Whenever you see marketing product bundling schemes they are commonly named by precious metals, starting from “silver package” up to gold and platinum as the top, most expensive offer. However, platinum is not the most expensive metal you can trade on the market, it is cheaper than gold and palladium. The price of an asset is not important to traders, they look into other important factors such as volatility, supply and demand, fundamentals, and policies.

We will approach palladium trading the same way we have described in previous articles. Note traders should be familiar with the system we use, although the analysis and opinion presented here can be useful for everyone interested in widening their opportunities and skills from forex to the precious metals market. All the adjustments we have made to our technical trading system for precious metals is already described, therefore, we will focus on the specifics of platinum.

Platinum crossed paths with gold in 2011, to the point platinum is currently trading at $860 and gold at $1900 per troy ounce, it took only 9 years for gold to double. Before platinum was a more expensive metal. This shift has more to do with demand than with the supply of platinum. South Africa is the place where platinum is mined but actually, platinum can be considered as a by-product of gold, nickel, and some other metals mining process. It is like a metal that comes along with them, not primarily the goal of the mine opening, except in South Africa. The total platinum supply is extremely scarce compared to gold and silver, by far. A total of 8 million ounces are currently mined out from the earth, gold has 6 billion, and silver 3.5. If you are interested in investing in platinum, you will be a minority investor by choice.

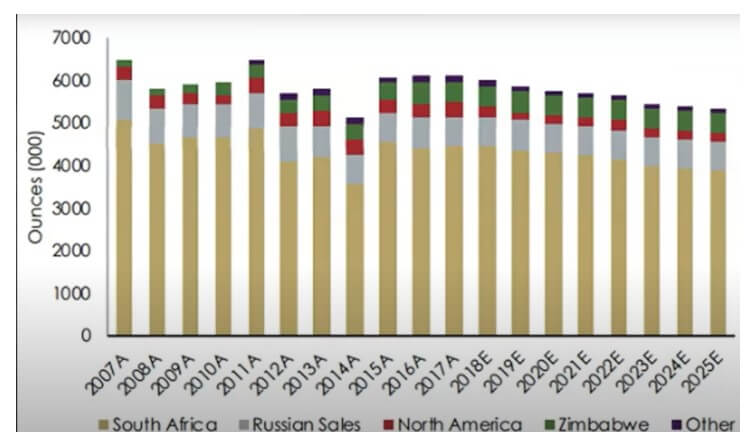

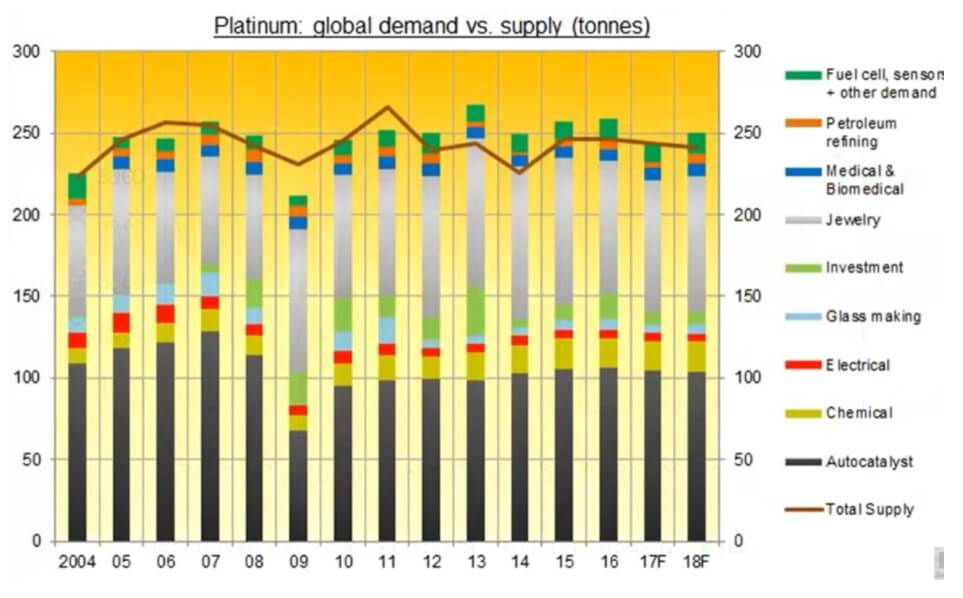

When we turn to demand, platinum is used in the industry, automotive, dental, medical appliances, and jewelry for making white gold alloy, even though pure platinum jewelry is not common. The primary platinum supply and projection for the next few years is in the picture below.

As with gold and silver, platinum is also having a decreasing supply projection, creating a bullish sentiment. However, there is a twist to it. Platinum at the moment cannot be your ultimate hedge asset as gold and silver can be, despite its scarcity and decreasing supply. The fact that offsets platinum ability to be a metal to go in an economic crisis is the demand for it. In the picture below we can see the composition of platinum demand by sectors and the total demand.

Note the actual investing part of the demand, it was not present before 2007. Since inception as an investment metal platinum is not seen as the metal traders would choose, although long term investments are now held. Also, demand levels remain the same more or less, the automotive industry can be a factor, we have an increasing need for electric cars that also require platinum yet that also counters the need to make catalysts for combustion engines. Platinum is not bearish nor bullish here. It is extremely unlikely platinum is about to become a metal of choice before silver or gold, therefore the price does not move up or down dramatically as silver and gold. Can platinum be a hedge against other precious metals? Probably, diversification is an investor’s friend. Is it good to hold it long term? It is hard to know, there are no trends that could increase its demand.

The demand is the major factor of platinum price, supply is low and mining platinum is hardly going to get up, thus even a small demand increase will amplify the price move because of scarcity. If this ever happens because of the industry shift or a different perception of platinum, its price will catch up with silver and gold very quickly. An interesting fact about platinum is that there was almost no physical coins and bars to buy, gold and silver were dominant. Only in the last decade, you could see platinum coins and bars offered for investors, today they are not a rarity. Does this mean platinum needs more time before it is perceived as a good alternative to gold is yet to see. So the sentiment is neutral to bullish, we haven’t seen anything with platinum in the last decade as we have with gold and silver.

Now, by looking at the technical analysis, gold, silver, and platinum charts have nothing in common. However, they could move in tandem or positive correlation.

Gold (orange line), silver (gray line), and platinum (blue line) manifest similar patterns but platinum did it in its own way. The dips are more extreme and the tops are flatter. If we trade on a daily chart, you may not see the same price action. In the long term, you can with moderate precision tells platinum will follow gold and silver. A similar phenomenon is with cryptocurrencies. Still, platinum does not have a positive correlation on a daily and any other time frame where we invest for short-term trades. This is a great feature.

We do not have to worry about what gold and silver are doing. Platinum has its own vibe where it will move but will follow the major precious metals trend when zoomed out. Take any trend from gold or silver for the last month and you will see entry points are completely different and there might even be a counter-trend not present on the gold or silver chart. Go to the weekly chart and observe the same thing. Having a variation in the precious metals asset range benefits you so you can trade one when the other is consolidating and vice versa. Days, when the USD is driving the bus, will be manifested with positively correlated moves across all metals against the USD. Luckily, metals have their own way and they drive the bus most of the time.

If you remember that we manage risk differently for gold and silver when we have the same trade signals not too far between, platinum does not need this measure. Trade full position sizes regardless of what gold and silver are doing. In some cases, you will even have opposite trend trades. Taking about pros, gold has its smooth movements, silver has its dramatic trends and platinum does not really care what the others are doing, you can trade it without fear even when signals are conflicting. According to some technical traders, platinum is performing better than the other two metals using the same system. So platinum may be an easy-going but faster performer, consequently, you will need to cope with somewhat erratic trends, they can appear out of nowhere and end suddenly.

Wrapping it all up, platinum has unattached movements with the other precious metals but will correct at some point when we zoom out to see the bigger picture. Does this mean you can use this and buy or sell at a better price? Not really, you may often find platinum went the opposite way and trigger your stop loss before it is corrected. If you are an investor you could wait out for the correction, however, the price may not be any better. You may find it was simply better to trade platinum without any regard for correlations.

When the USD starts moving hard, you will see a positive correlation just by sheer dominance of the USD move, but metals are independent movers. Be aware of the interest rate events for the USD. A change will likely impact precious metals in the same direction. Your forex knowledge of how to manage trades before news events can be carried over here without any changes. Just be sure to follow fundamental changes for platinum and all other precious metals, especially if you are investing and applying a buy and hold (for a long time) strategy. The major shift from forex trading is this fundamental information, still, we use the same technical trading system.