If you are a novice in the Forex market and you don’t know exactly what a lot on Forex is and what this is all about, in this article I will show you what it is and how to know what amount you should use or what amount in lots you should use in your case to trade on Forex.

What are Pips and Lots?

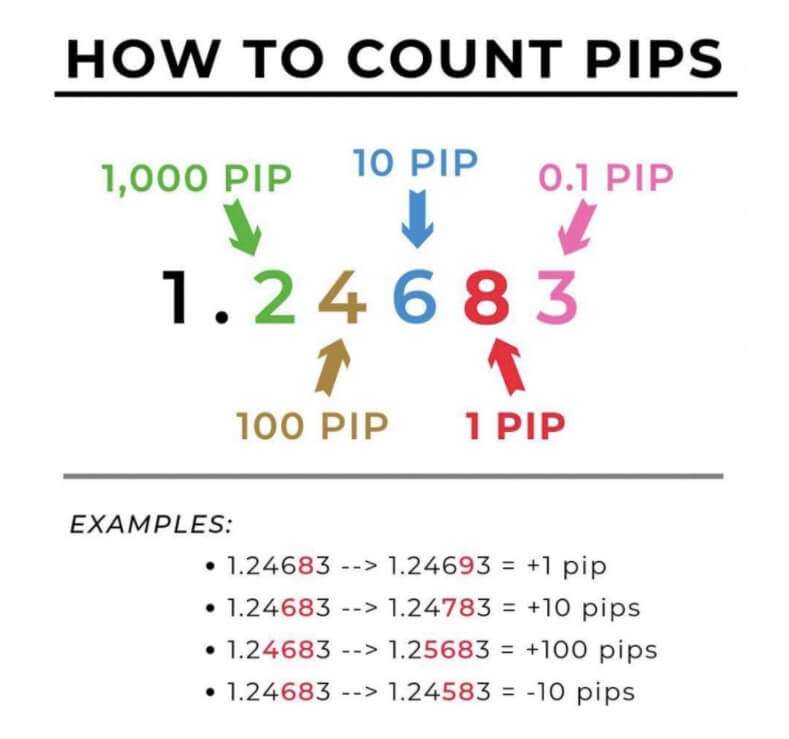

The first thing to understand is that pips and lots are two concepts in the currency market that are related when calculating gains or losses in a move that can make a quote for a currency pair.

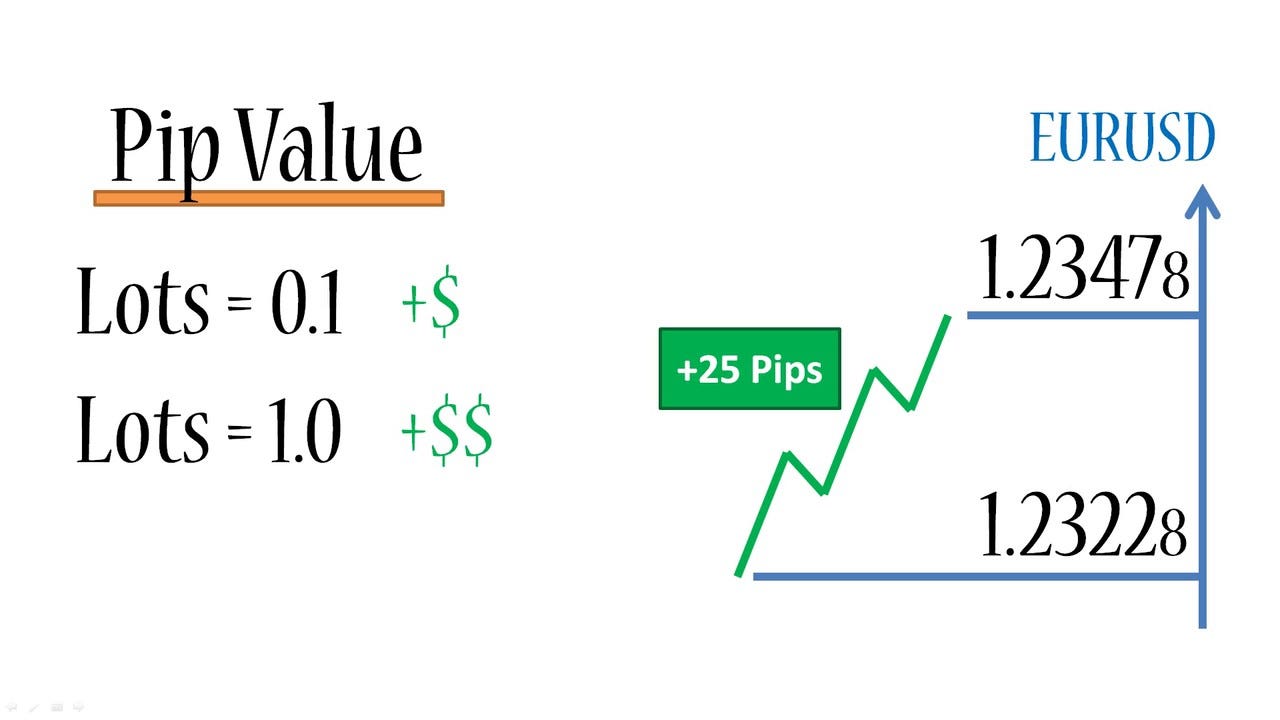

The pips measure how much the currency varies and the lots measure how much you buy or sell from that currency crossing. That’s why the more you flow in pips and the greater what you’ve bought or sold the more it will affect your account.

How many units make up a Forex lot

When you trade in the currency market you do it as if it were in a pack. What does this really mean? A lot is 100,000 units, so if for example, you make a purchase in the pair EUR/USD of a lot, you are performing an operation worth 100,000 dollars. This type of trading can be done even with much less money in your account, as brokers offer leverage for it.

What is a Micro Lot and a Mini Lot?

You must be thinking that leverage and $100,000 doesn’t sound very good to start with. Definitely not. Therefore, it is possible to do it for the minimum possible and that is where the mini lots and micro-lots come in.

Mini lots are one-tenth of a lot, so if a lot is equal to 100,000 units, when you operate a mini lot in EUR/USD you do it for $10,000. Okay, this is something else, but what if I want to do it for less? Is it possible? Indeed, there is also the possibility of a micro lot, that is 1,000 units. Following the example above, 1,000 dollars.

How to Calculate the Value of a Forex Lot

Understood all these now I will explain how you can know the value of a lot in a currency and how it will affect your account every change that occurs in the price.

Step 1: Choose the currency pair. GBP/JPY.

Step 2: Calculate how much a pip is worth. In most cases, the pip at a crossover is the fourth decimal. In the crossings with JPY is the second (yes, I have put it on purpose for you to learn it well).

GBP/JPY is currently listed at 175,150

If GBP/JPY moves and its price goes to 175.170 there will be two pips varied (175.170 – 175.150).

How much is this variation in my account with a micro-lot?

1000 units * 0.02 = 20 yen.

Step 3: Calculation in your currency. How much does this mean if your account materialized in dollars? We just need to do a conversion by looking at the USD/JPY rate, which currently stands at 107,750. Thus, if one dollar is equivalent to 107,750 yen, 20 yen is equivalent to 0.18 euro.

That is, the change of two pips in our account implies a variation of 18 cents.

Can we give another example for the classic EUR/USD?

Step 1: we have it, EUR/USD.

Step 2: Suppose EUR/USD varies from 1.12500 to 1.2490.

We have mentioned above that in most pairs a pip supposes the minimum variation in the fourth decimal place. This is the case, a drop in the price of the pair of 10 pips or 1 pip.

If in this case, you have bought a mini lot (10,000 units):

0.0001* 10,000 =1 dollar per pip.

You’d be missing a dollar more commissions in this scenario.

Step 3: What if your account is in euros?

1/1.12500 = 0.88 euros. It would vary instead of one euro, 88 cents.

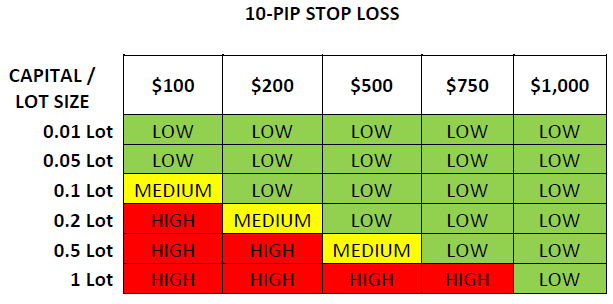

Just as we have calculated the value of one pip in this last case or two in the previous one, we can do it for 100 or 200 and so depending on the entry price and stop calculate what is the maximum you can lose or win in each operation. Easy, isn’t it?

Online Calculator

All right, Ruben. I have understood everything, but I find it a drag to have to be doing these calculations to be able to calculate the potential gains and losses in each operation. Relax, I have a solution for you, here you have a calculator where to do all this in a simple way.

Just choose the currency of account, the balance (use equity), the percentage that you are willing to risk, and stop-loss in the currency crossing you have chosen. From here the rest calculates as you will see automatically.

Commission Per Lot on Forex

You know how lots and pips work in the currency market. I have previously told you that brokers allow leverage so in Forex you will be able to move more amounts than you have in your account.

First, you should be very careful with all this talk. Leverage generates greater potential gains, but also potential losses that can end your account. Now, leveraging here in a controlled manner is another matter. Why does the broker allow you to beat yourself up and move more money than you actually have? Because he’s interested, that means more commissions for him. At times when there is more volume on the market, the more money you will receive for it. Even with all this, I have to tell you that competitive brokers allow you to move up to $100,000 by paying only $7 in commissions. The cost is relatively low for financing the operation.

I recommend that you practice all this in a demo account so that you do not have any doubts. The above calculation can help you do your calculations, but it’s OK to start doing it yourself manually and then check if it’s OK. Also, as you learn and progress my advice is that you can automate all this so there is no miscalculation. Remember that every failure here costs money.

In the end, you have already seen that this pips and lots is not at all complex, everything is in standing with attention to understanding how it works and making a couple of practical examples like these.