Mahatma Gandhi said that when you try to change the world first they don’t notice you, later they laugh at you, and then they attack you, and finally, your enemies embrace the new world you have created. When you try to change the world first they ignore you, then they laugh at you, then they attack you, and finally, your enemies embrace the new world you have created.

This pattern is repeated in revolutionaries who have transformed entire industries, like Henry Ford did with automotive or Steve Jobs with telephony and music. Similarly, Jack Bogle transformed and democratized over four decades one of the most elitist and restrictive industries in history, that of asset management. Over the course of four decades, Jack Bogle transformed and democratized one of the most elitist and restrictive industries in history, that of asset management.

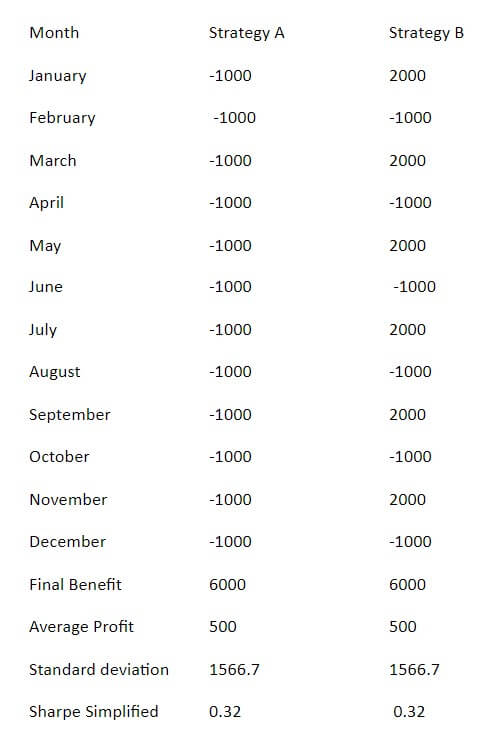

On January 16, John Clifton Bogle died at the age of 89. Jack, so was he called, was little known outside the investment industry. However, its impact on savers around the world has been far greater than that of any other private or public initiative: The revolution that Bogle started 40 years ago means saving some $155.75 billion a year to investors around the world (see Annex 1 at end of the article).

Saving around $155.75 billion a year to investors around the world.

Throughout his unexpectedly long and rugged life, Bogle managed to democratize the exclusive asset management industry, dominated by large banks and high barriers to entry, to make it a service available to everyone regardless of the size of their heritage.

Epiphany

Bogle didn’t have it easy from the start. His family was ruined during the Great Depression of the 1930s, shortly after his birth in 1929. The lack of opportunities during the Great Economic Depression of the 1930s caused his father to fall into alcoholism, which eventually led to his parents’ divorce. But despite the difficulties he had as a young man, he managed to get into Princeton University on a scholarship.

When he remembers how hard his youth years were -combining temporary jobs with studies-, Jack joked that he felt a certain “pity” for his wealthy and carefree Princeton classmates, for they had not been given the opportunity that he interpreted as his great advantage: to learn to face real problems and to overcome serious difficulties from a very small age. He was unaware at the time, but this ability and attitude to the problems would reveal, two decades later, crucial when the time came.

Its great advantage: learn to face real problems and overcome serious difficulties.

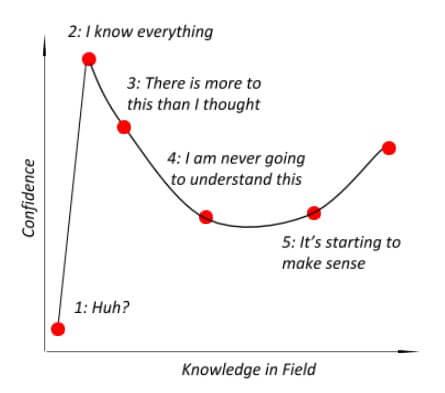

Its first and successful stage in fund management -within the Wellington Fund- coincided with “the go-go era”: the big bullish market of the 1950s and 1960s, in which the stock market rose by an average of 14.5% a year. The years passed and his «skills» as a fund manager began to be recognized, becoming President of Wellington in 1970. It is then that motivated overconfidence as he himself confessed to his great previous success led him to realize a good number of unfortunate decisions. Later, Jack would refer ironically to his “Wellington years” in these terms:

“It was a time when it was easy to seem intelligent.” – Jack Bogle

Indeed, seeking to further increase the profitability of the fund, he incorporated an external manager who excessively concentrated his positions on a few very speculative stocks. Thus, when the first of the two major recessions that would hit the United States in the 1970s hit, the fund lost more than 50% of its value. And when the same scheme was repeated in the next recession of 1973-74, Jack was definitely fired.

It wasn’t a good time to lose your job. In the midst of an economic recession, with 44 years and six children to feed, Bogle lost his job but also became seriously ill. Several heart attacks brought him to the hospital frequently. A doctor who treated him said him in 1974 that he had “little time” left, and that the best thing was to retire to spend «the few years of life that remained» in peace to say goodbye to his family.

With 44 years and six children to feed, Bogle had not only lost his job but also became seriously ill. Several heart attacks brought him to the hospital frequently. However, Jack did not retire, but it was in those extreme circumstances of uncertainty and apparent failure, during 1974, that Bogle had what we might call an epiphany that would eventually change the world of investment in the coming decades.

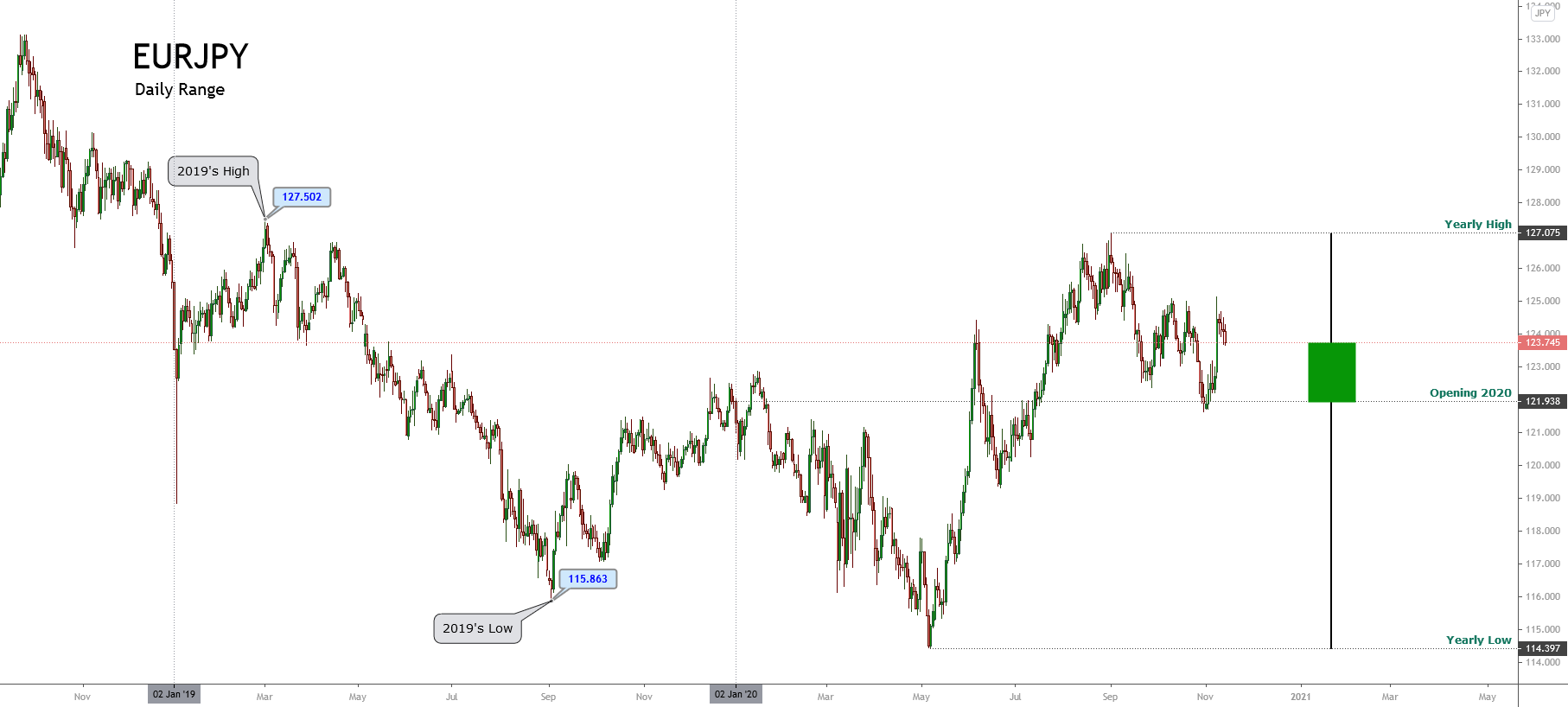

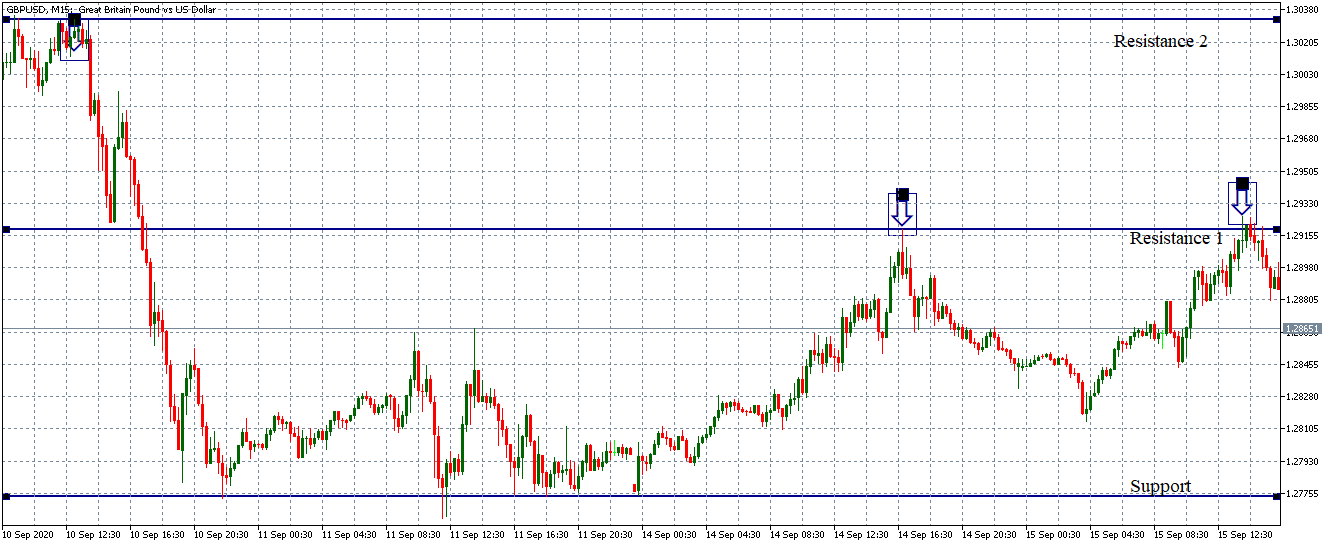

Influenced both by the ideas of the Nobel Prize winner Paul Samuelson on the impossibility of beating the markets in the long term and by his experience in the damage that produce in the investor the accumulation of commissions in the long term [see Annex 3 below], in 1975 it occurred to him to take advantage of the well-oiled back-office of the manager Wellington -together with the saving of not having to pay this time any manager to select the «best» actions-, to convince the new managers of the manager of his idea; and launch the first investment fund that would replicate the behavior of the market as a whole. Thus, on December 31, 1975, the first index fund with an initial capital of $11 million was born.

First, They Ignore You and Laugh at You

Like Jack, the first index fund didn’t have it easy at first either. The press and the rest of the professional industry considered it either nonsense that did not deserve the slightest attention, or directly a blatant business error that would be studied in business schools as an example of what never needs to be done.

Paul Samuelson was one of the few who appreciated him and recommended him within a few months of his birth (he too received criticism for it, more would be lacking). Indeed, despite the efforts made to market it during its launch, within a few years the refunds began. The fact that the next bullish stock market did not start until the second half of 1982 did not help, again underlining the weight of chance in timing when it comes to launching a business idea, however good it is in itself and well-executed it is.

About to be liquidated for lack of subscriptions in the early 1980s, Wall Street was known at the bottom of Bogle as “Jack’s madness” or “guaranteed mediocrity fund”. Practically no one believed then that a simple rule of stock selection based basically on weighting the index companies according to their market capitalization -as most indices do-, be able to outperform in profitability the sophisticated stock selection strategies of thousands of highly intelligent and prepared managers, dedicated every day of the year to seek and select the best stocks from the thousands available.

Then They Attack You

But as the 1980s progressed, the facts slowly began to prove Bogle right. Private jokes and jokes against him turned into surprise and disbelief on the part of his colleagues. After a decade and a half, its index fund began to rise in the ranking, revealing itself as one of the most profitable among all the funds and investment vehicles available in the United States. Bogle was attacked as anti-American (!) for not promoting the search for excellence in the active selection of the best actions.

Colleagues who made fun of him behind his back couldn’t believe it. What initially began as a footnote anecdote in the economy and investment books, was escalating in impact to generate a heated debate in the management industry during the 1990s. The most benevolent attributed their success to sheer luck. Others directly attacked Bogle as anti-American (!) for not promoting the pursuit of excellence in the active selection of the best actions. Many industry analysts began to say that passive or indexed management was a cancer not only for the financial markets but also for the country’s economy; because by ignoring the process of discovering anomalies in prices by investing in indices, the market would eventually stagnate and lead to a static price for all the shares (an argument which has, incidentally, been rescued again recently). These attacks have continued to be repeated cyclically since then and even today, almost three decades later, there is still debate within the industry about how “bad” indexation is or is not (especially for the interests of the industry, of course).

Many industry analysts began to say that passive or indexed management was a cancer not only for the financial markets, but also for the country’s economy.

In the midst of a debate about whether indexation was good or bad, whether it would continue to work or not in the future, his health problems returned with greater intensity in the early 1990s, forcing him finally to undergo a heart transplant in 1996.

Shortly before the operation and with little chance of survival (again the doctors did not give him much hope), he gave up command of the manager he had created, Vanguard, to his second-in-command then, John J. Brennan. After surviving the operation, not knowing how long he had to live and encountering unexpected friction with the new CEO, he left the Vanguard management. He then created and took over the management of the Market Research Centre that had been named after him since 2000.

Finally, You Win

But his seed had already taken deep roots and the tree, the forest, was already unstoppable. More than four decades after its launch, Jack’s first “fund-madness” (now the Vanguard Total Stock Market Index Fund), which started with just $11 million and was about to disappear, has reached more than $800 billion in assets under management (higher than the GDP of Switzerland and similar to that of the Netherlands). Along with the rest of the funds launched afterward, Vanguard is the second-largest manager in the world (just behind BlackRock) with $5.3 billion (Anglo-Saxon trillions) in assets under management; In the United States, 50% of all funds marketed are index funds (while in Spain they only represent a surprising 1%).

The “Vanguard Total Stock Index Fund”, which started with just $11 million and was about to disappear, has reached more than $800 billion in assets under management (higher than Switzerland’s GDP and similar to that of the Netherlands).

The superiority of indexation when it comes to investing has become incontestable, and fewer and fewer choose to pay more commissions in exchange for a slim probability of surpassing the profitability that the market itself will give you in the long term. Or as he said, why strive to find the needle, being able to buy all the haystack much cheaper.

The Legacy of Bogle

Jack leaves us two big contributions to the investment world and a reminder. He first applied the common sense that any entrepreneur with his feet on the ground applies in his business: the future benefits are hypothetical and unknown, but the costs are known and real (see Annex 3).

“Investment is the only industry in which the more you pay for what you want, the less likely you are to get it.” – Jack Bogle

If we recall that the long-term profitability of the stock market is limited to about twice the average GDP of developed countries, then opting for a low-cost index investment can double our long-term equity compared to the more expensive options offered by the management industry. Private banking clients, for example, feeling special thanks to the treatment they receive and the exclusivity of the products offered to them, would be paying with half of their potential future wealth to buy products that are better for us, but they are wrapped in a more attractive and expensive “wrapping paper”. This is the immense impact that the commissions have when it comes to investing and that Bogle never tired of repeating for 40 years.

Bogle’s second legacy is far less evident to the naked eye. If active management pales in results against index-linked investment, it is not only because of the difference in total costs. It is because indexing, as an investment strategy, is better adapted to the nature of financial markets than most of the strategies used by active managers. (Central theme of the previous post «The hidden message of indices»).

Indexation, as an investment strategy, is better adapted to the nature of financial markets than most strategies used by active managers.

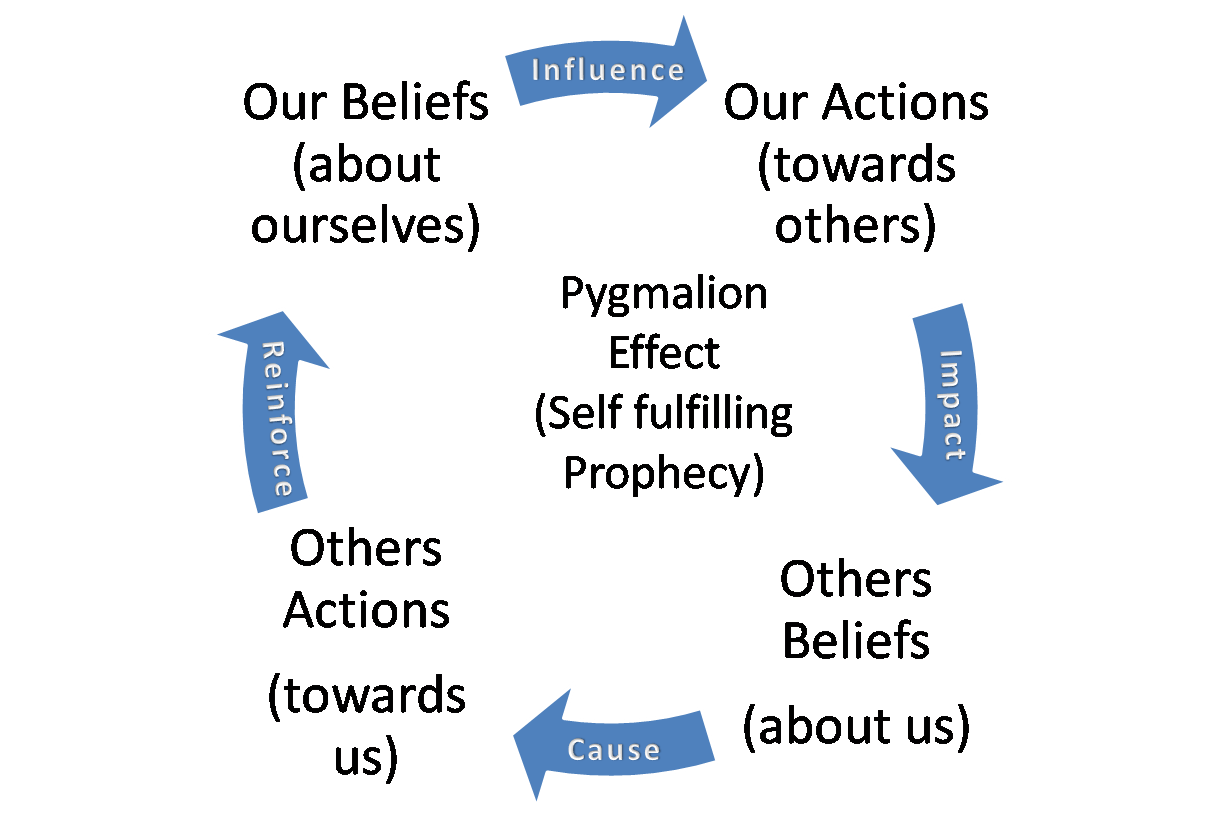

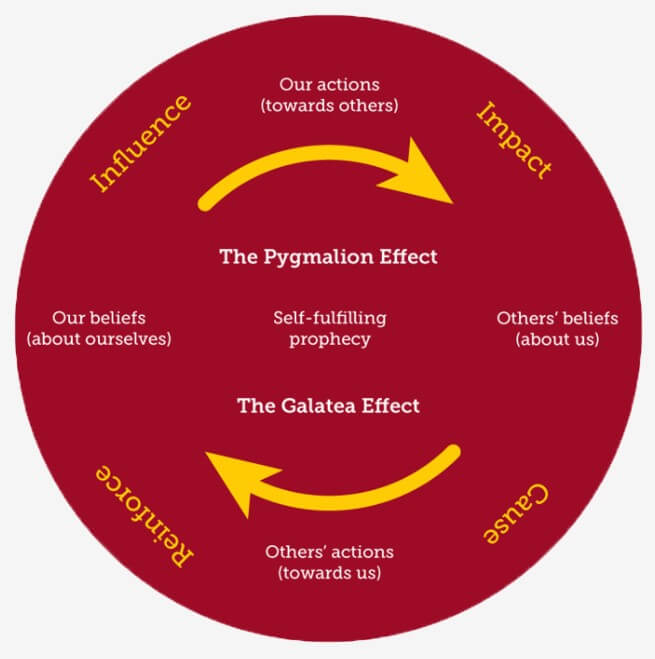

Indeed, if financial markets were to some extent predictable, those capable of exploiting such predictability would consistently and persistently succeed in outperforming indices by a sufficient margin that could justify higher fees. However, empirical evidence shows that surpassing the indices is a transient and not persistent phenomenon (in fact, those that have surpassed the index in recent years are the funds that most likely will not get it in the future!). So if markets are unpredictable, what kind of strategies are best suited to that nature?

Bogle had a clear answer from the start. Concave strategies (see Annex 2) work best the more predictable the dynamics of the environment in which they operate. Conversely, the more convex a strategy is, the better results you can achieve in unpredictable environments. Bogle’s vision was to realize, albeit intuitively in 1974, that if markets are unpredictable, then convex strategies will have a more favorable chance to survive and «doing better» in the long run. And that indices are a cost-effective implementation of convex strategy. The more convex a strategy is, the better results you can get in unpredictable environments.

His big business idea was to package the convex indexation strategy (resistant to our blindness to the future), pull down the price of the product (incorporating the essential importance of costs in the long-term profitability), and make it available to everyone. Bogle knew that as long as the competition is dedicated to offering attractive, sophisticated, and especially expensive concave strategies; they will be able to win some sprints in the short term (there are many funds that exceed the index to a year), but not the marathon of the long term (just 5% get it at 10-15 years). And it is not because he was a genius, but because he knew how to accept and transform into a viable product the fact that we cannot predict the future of markets.

His big business idea was to package the convex indexation strategy (resistant to our blindness to the future), pull down the price of the product (incorporating the essential importance of costs in the long-term profitability), and make it available to everyone.

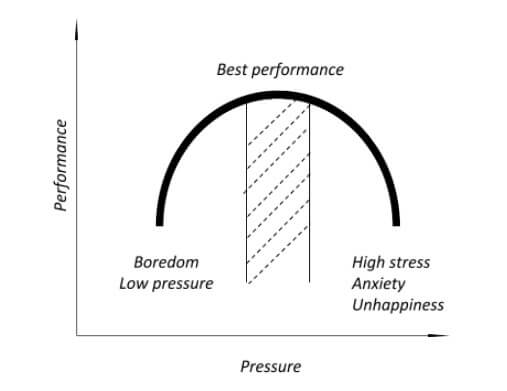

The Human Side of a Revolutionary

As for Bogle’s reminder, it’s about our tendency to overestimate what we can achieve in the short term and to underestimate what we can achieve in the long term. It is in the long term that the power of exponential capitalization can materialize. Perhaps walking, running, or lifting today 1% more than yesterday may seem an irrelevant and boring change, but in a few years, it can produce extraordinary changes in our state of form. The same as consistent investment in the long term. Anodyne in the short and medium-term, but explosive in the long term.

As for Bogle’s reminder, it’s about our tendency to overestimate what we can achieve in the short term, and not to take into account what can be achieved in longer periods of time.

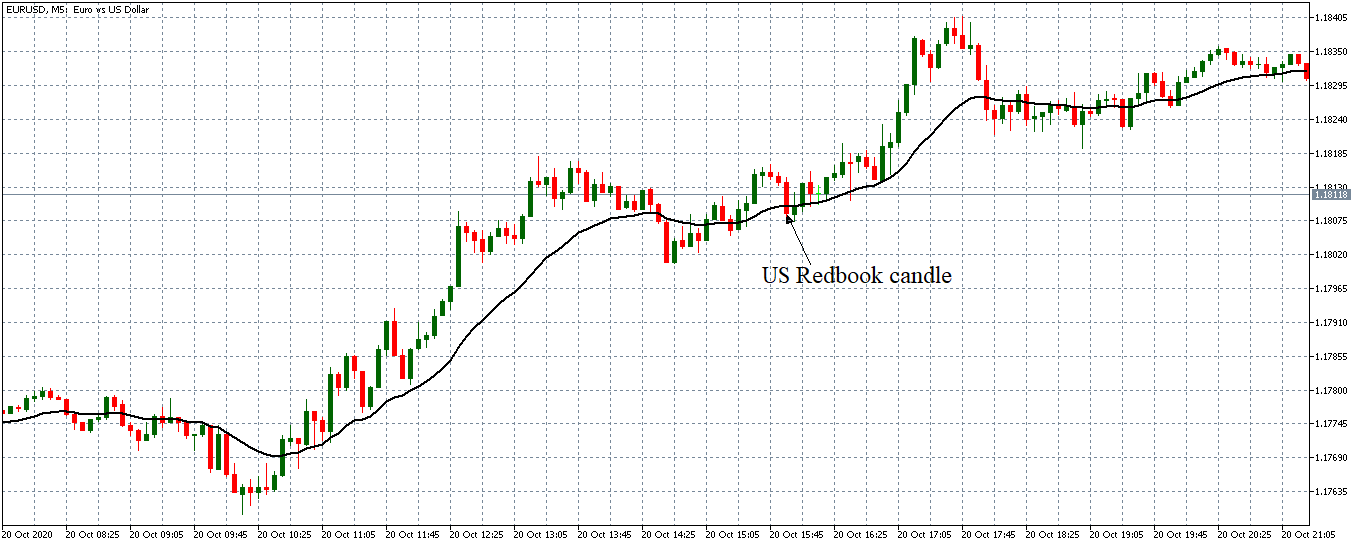

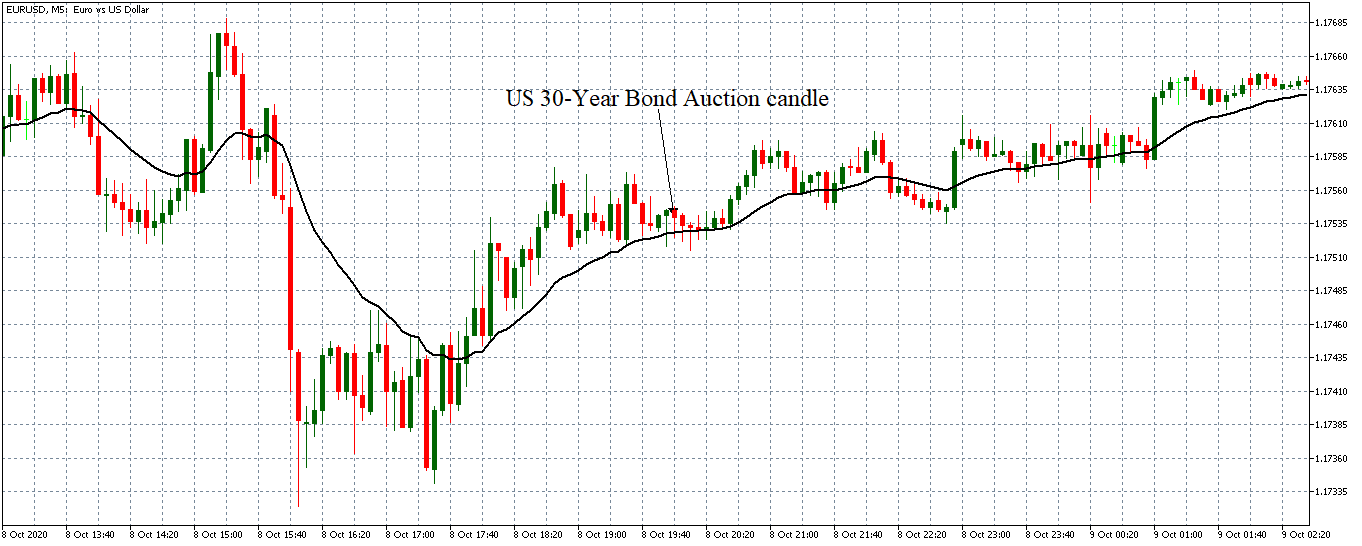

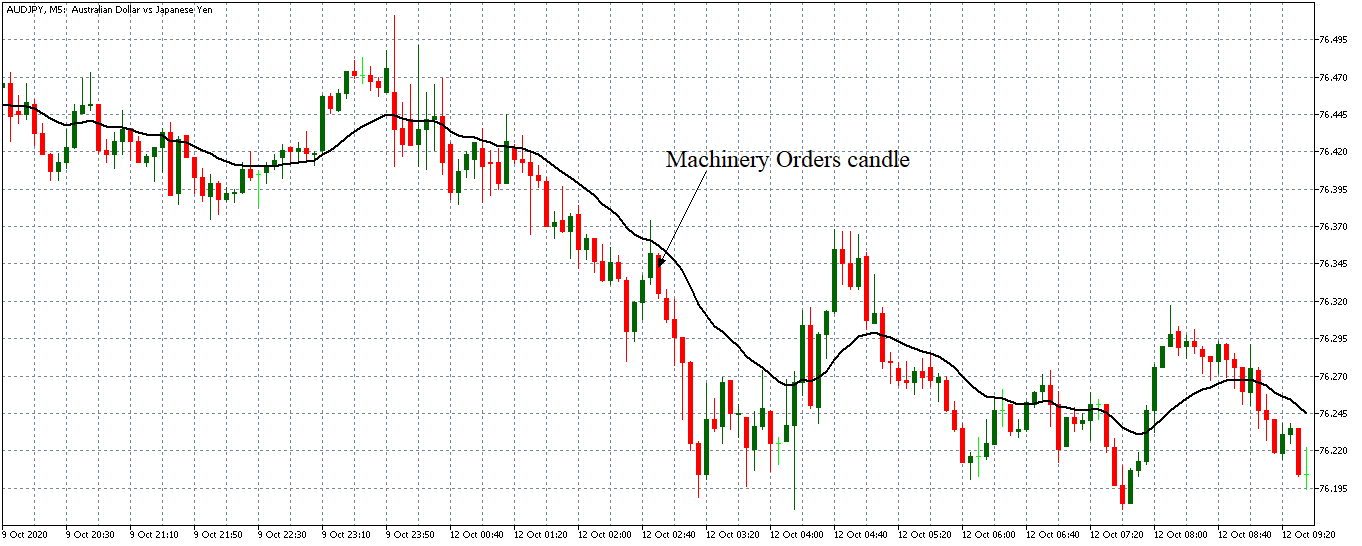

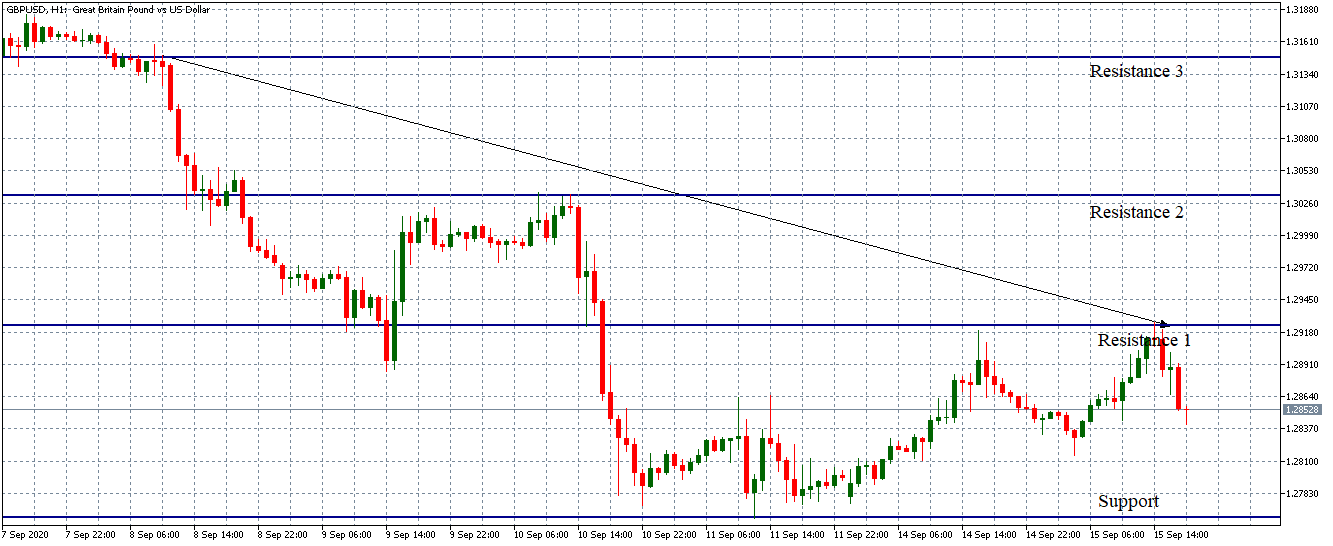

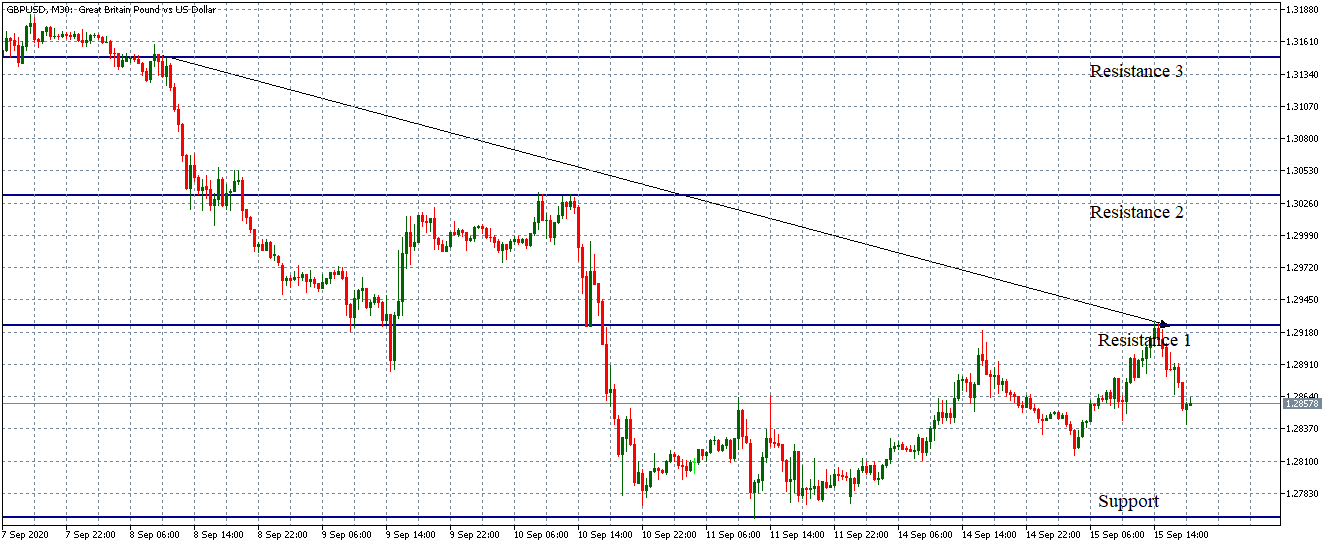

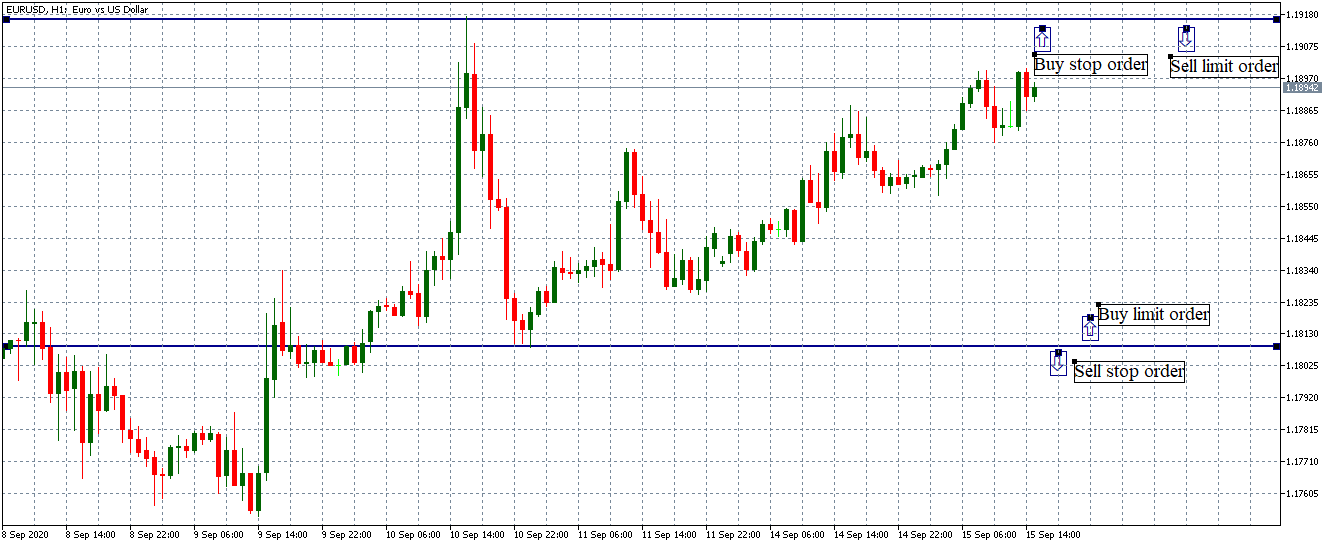

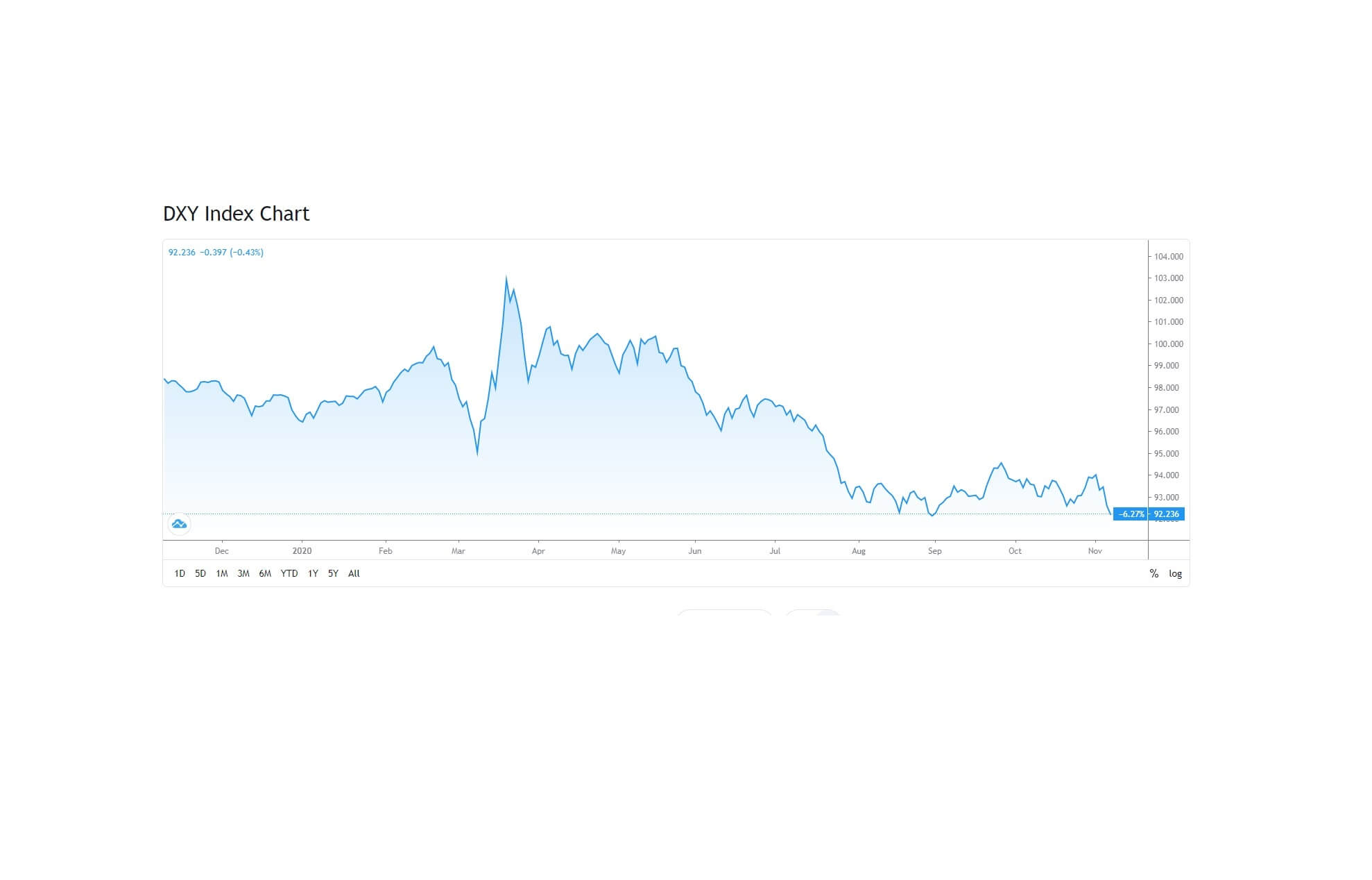

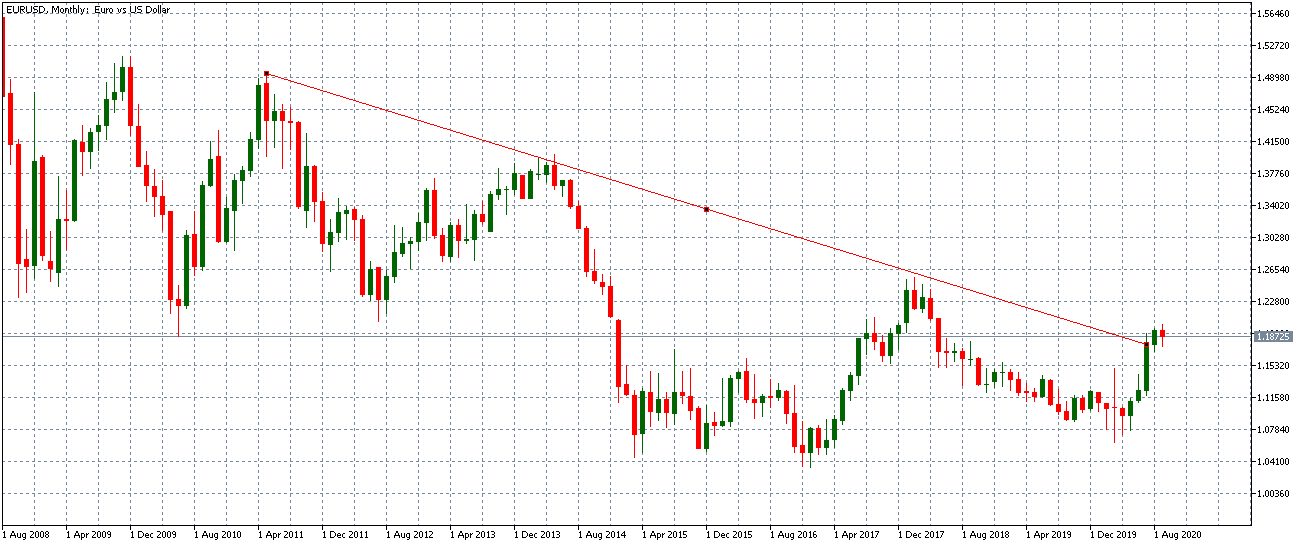

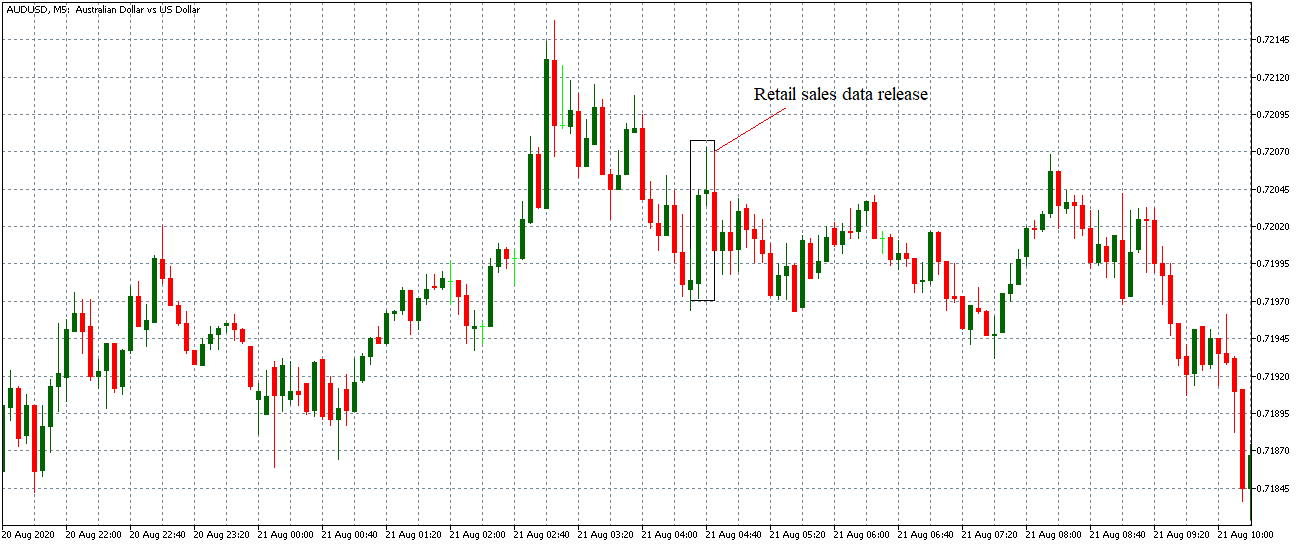

We tend to forget what we can achieve little by little; perhaps because of the growing need for immediate satisfaction that permeates our culture. And just focus on what we could get right away. In investment, it is much more popular a book or «trading course» on how to get 20 basis points a day on Forex, that others, such as those Bogle wrote, remind us that today is always the best time to plant the small seed of the tree that will give us shade in 20 years time.

Our expectations for the short term are usually inversely proportional to its possibility of realization. Meanwhile, we tend to dismiss the great achievements that only the long term can give us because today they seem an impossible task to achieve. Bogle did not start by trying to change the industry from one year to the next, but by planting a seed that would flourish decades later only if he endeavored to water and care for it daily. And he did it without even knowing if he’d still be alive the next month so he could keep taking care of the plant. If you want to move a mountain, one day you have to be the first to start digging-even with a spoon you can lose next month.

Jack Bogle’s life is one of those stories that moves and inspires us on various levels. When he could be considered unsuccessful and about to die, instead of giving up, he continued to struggle to start building what he considered most honest and valuable, without any guarantee of success or even the privilege of remaining alive. Without fear of recognizing that the first part of his life (for him then, his entire life) had been pursuing an illusion, striving in the wrong direction. Jack was always loyal to the search for the truth; he made a clean slate just as doctors gave him up and his family needed him the most.

Interestingly, despite Bogle’s enormous added value to society, his name will not be remembered for appearing on the Forbes list of millionaires. When he dies, he leaves his family an inheritance estimated at $80 million. Not a negligible amount, but it pales in comparison to the wealth that other giants in the industry have achieved. Like Warren Buffett ($83.5 billion) or his most direct competitor, Abigail Johnson, the CEO of fund manager Fidelity. Abigail, basically competing with Vanguard, has accumulated personal wealth of more than $17 billion in many fewer years than Jack.

But that didn’t matter to Jack. Of humble and friendly character, his personality never fit within an industry characterized by concentrating the greatest amount of pride per square meter known. When asked about the estate of his competitor Abigail, Jack replied laughing that he would not know what to do with so many “problems”. Bogle, generous even in his comments, reminded us with humility and humor that, beyond a reasonable threshold of personal wealth, increasing the wealth only leads to complicating our lives further.

Bogle, generous even in his comments, reminded us with humility and humor that, beyond a reasonable threshold of personal wealth, increasing the wealth only leads to complicating our lives further.

Jack never wanted to be the richest man in the cemetery. On the contrary, it was much more ambitious: It gradually transformed the most elitist and exclusive industry into an almost public service, helping millions of people achieve their economic goals, saving in the process $2 billion (Anglo-Saxon trillions) to millions of investors. With a sword of Damocles announcing his immediate death for most of his life, he preferred always to focus on building for the long term, continue watering the plant as long as life allowed, and leave a mark.

It was much more ambitious: It gradually transformed the most elitist and exclusive industry into an almost public service, helping millions of people achieve their economic goals, saving in the process $2 billion (Anglo-Saxon trillions) to millions of investors. And he sure did.

Annex 1: Bogle as Benefactor of HumanityVanguard

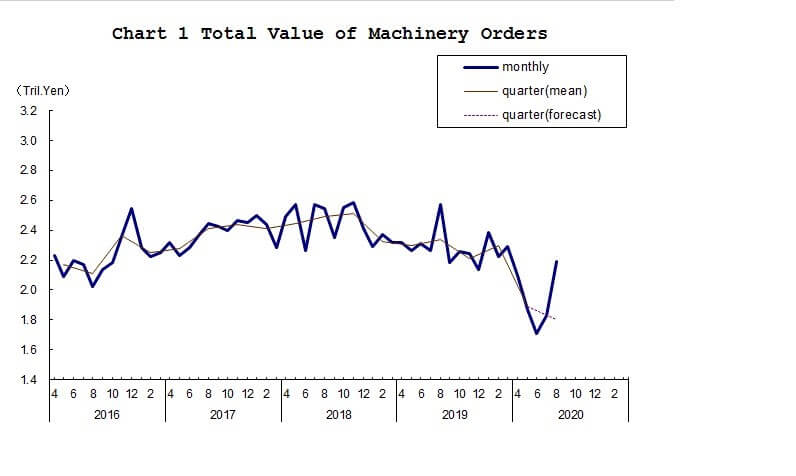

This has pushed the entire industry to lower its average commissions that it gained in popularity and volume of managed assets, leading it to a transformation today more profound than ever. This has been seen especially during the last two decades, growing each year and continuously, the percentage of assets managed passively through low-cost vehicles, mainly through index funds and ETFs.

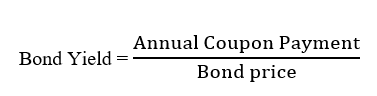

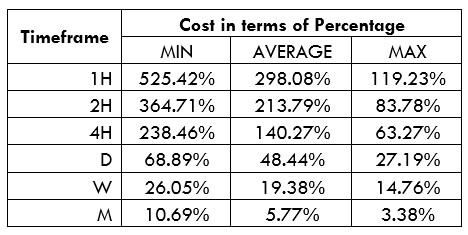

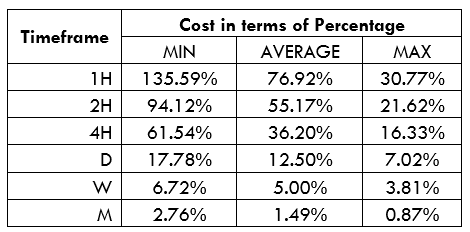

According to Willis Towers Watson, of the approximately $81 trillion (trillions) of managed financial assets in the world, 21.6% or about $17.5 trillions are currently invested in vehicles that give exposure to indices. Therefore, if you compare an average total management fee of 1% on traditional vehicles (including investment funds and hedge funds, much more expensive), with the total average costs around 0.11% charged by Vanguard and its low-cost competitors, concludes that the Bogle revolution is saving investors about $155.75 billion a year. Every year, year after year.

That is money that first stays in the pockets of millions of people who save more efficiently for their retirement, their children’s studies, or the house of their dreams. But it’s also money that the management industry stops earning, so in certain circles, Bogle is not exactly a highly admired or popular character (something he didn’t care about). If we add the cumulative growing impact of the shift from active to passive management over the past three decades, we could be talking about total savings for investors (or loss in profits for the industry) around the $2 trillions referred to in the title of this article; almost twice the GDP of Spain.

Annex 2: Concave and Convex Strategies

The philosopher and trader Nassim Taleb classified investment strategies into two large families; concave and convex. The former try to understand empirically what happens in the markets, assuming hypotheses about their behavior in order to develop investment models with a high probability of success. During the time when such models are in sync with the dynamics of the markets, they work very well, giving sustained returns that make the funds that market them very popular. Until the underlying dynamics change or some of these hypotheses fail unexpectedly and the fund fails; ruining its investors, but not its managers (remember the LTCM fund in 1998, for example).

Conversely, convex strategies assume that it is not possible to construct predictive models about the future of markets that are accurate enough to be persistent, So the most efficient strategies will be to limit to the maximum the very likely losses, while letting the benefits run as much as possible when they appear. This produces strategies with a low probability of success (many small losses), but with a large profit on the few successes (it is the basis of option theory in the Venture Capital funds, for example). As there are numerous small losses before a high return comes, they are less popular among investors than concave strategies because nobody likes to start losing money.

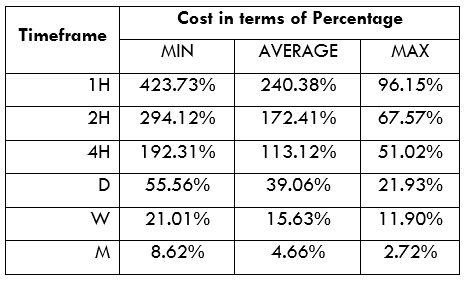

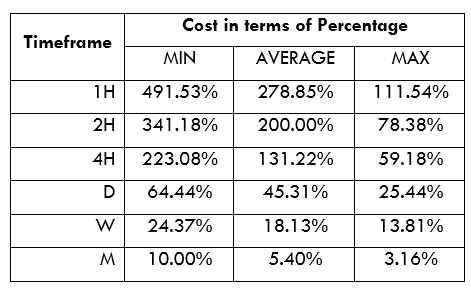

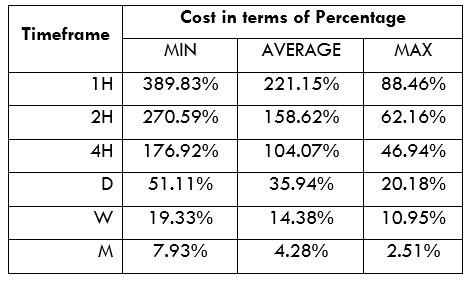

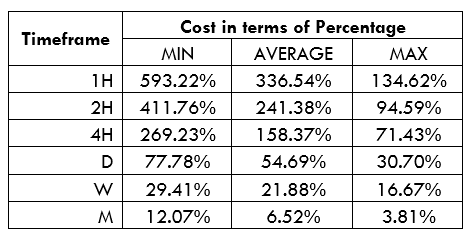

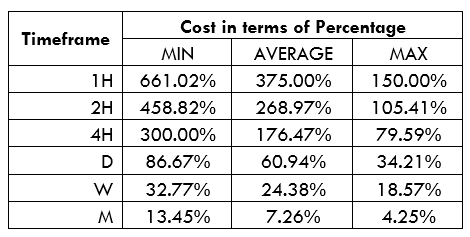

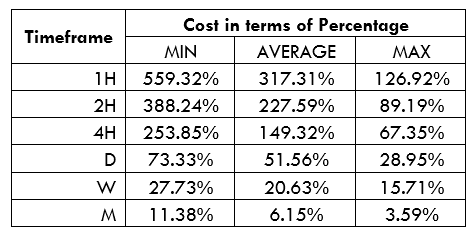

Annex 3: The Impact of Commissions

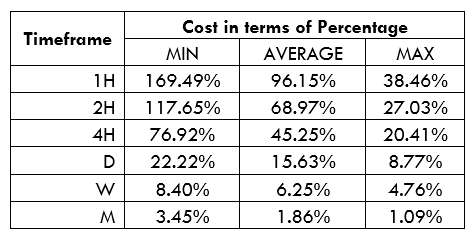

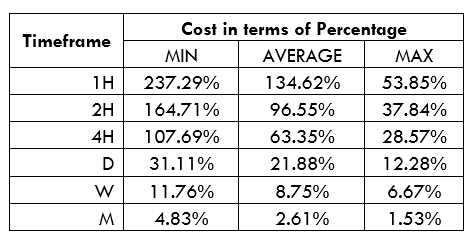

The industry underestimates the huge cost impact on its customers. In part thanks to the volatility of the markets, it allows us to easily believe that -2% a year hardly affects when the stock market moves (due to its natural volatility) double up or down in a week. In other words, it tacitly sells the false belief that that -2% per year is “easily compensated and recoverable” by the talent of managers, thanks to the apparent abundance of opportunities that the volatility of markets offers every day.

Just so you know what the importance of costs in long-term investment, suffice it to remember that an annual difference of 3% in total costs (which is normal if you choose to hire the services of a private bank when managing your assets, compared to a globally diversified portfolio of cheap index funds) means in 25 years a loss of half of the capital that could accumulate.

Mr. Buffett, in the last letter to the shareholders this year 2019, expressed this same idea recalling that if at the beginning of his career he had invested 1 million dollars in an index fund like Bogle’s, today he would have $5.3 billion (!). But if I had chosen an active fund with only a 1% extra management fee, that figure would have been halved.