At the moment of writing this article, we see a lot of turbulence involving the COVID-19 mixed in with the dramatic US elections aftermath. The pandemic presents a unique environment, one which cannot be categorized into a recession cycle or anything we have experienced before. We see the first large scale pandemic in modern history. Does this mean some assets are going to be better performing?

It is hard to predict future movements, you can ask any serious investor such a question. They are bombarded with them and what most say is that they do not know. But they can rely on some data that points to some expectations. It’s logical to see certain commodities and precious metals tied to economic activity level, still, it is not known exactly when oil is going to spike with the activity coming back to normal. Nor we may expect the same spike will happen with metals related to industrial activity. Entering any reversal trade based on a hunch is a great way to lose, but we can stay in certain safe heavens until it is time to slowly go into risk-off assets after clear indications the worst is over.

Let’s see what happened since March, once the pandemic went viral and global. We will first analyze risk-off currencies such as NZD, CAD, AUD, then the neutrals, GBP, EUR, and lastly safe heavens USD, JPY, and CHF. The NZD did not endure any special selloff. According to the picture below which represents the NZD basket against other major pairs, we see the exact opposite. Is this because New Zealand fared well in the fight against the pandemic than other countries? Unlikely. The correlation between the COVID-19 patient numbers and the currency directions is random in most countries, therefore trading based on these statistics is a bad idea.

The AUD followed a strong positive correlation with the equities or indexes. It is almost copied price action. The vertical red line marks the March pandemic breakout. Before the breakout, AUD was in a downtrend that looks like it just amplified a bit before it went long again. This price action seems it does not care about the pandemic at all. If we want to pick a currency to trade in 2021, COVID-19 impact on a single economy should not be our criteria. However, some other assets as mentioned above are directly affected.

Canadian Dollar is considered correlated to oil. Most of the informed traders know about the oil price shock once the pandemic forced lockdowns in most of the world, especially developed economies, except China. From the CAD basket chart below, we see extreme whipsaws and price action that spells trouble for trend followers. We cannot say this chart is positively correlated to oil, we also do not see a small correction as with oil. How price action is going to look like in 2021 based on this info is completely unknown. At this point, CAD seems to be the worst currency to trade unless you have some special range-effective strategy.

So what we see in risk-on currencies is that AUD and NZD do not care about COVID-19 but are somewhat in-line with indexes. NZD is not the same copy, although it tends to move like the AUD. New Zealand was one of the best countries to cope with the pandemic, but this is not the criteria you should rely on. One should know Australasia currencies are very tied to China’s economy, a country that seems to know how to control the spread of this virus. However, China relies on export and inevitably depends on importers such as the USA and EU.

Great Britain Pound has a lot of major fundamentals affecting its economy. Brexit, internal political struggles, COVID-19, and discouraging economic indications. GBP price action chart shows a strong bearish move than almost as strong pullback after the pandemic had started getting global. Chart analysts will easily spot three strong support points after the initial shock. Similarly to the CAD, GBP is extremely unpredictable by any means, probably only partially good for range-bound trading strategies.

Euro and GBP seem to be in the same boat. EU countries took catastrophic hits to their economy and health systems. Has this affected the EUR? It is, but not in a negative way. By looking at the price action below, we see a strong uptrend after the pandemic start and then calm consolidation that lasts for months. Is the EUR the best currency to trade with? Depending on your strategy, range-bound reversals with channel indicators are probably the best way to go here, pairing the EUR with another ranging currency such as the GBP. In 2021 it is hard to predict what will happen to the Eurozone, but for now, it seems not much can shake this market.

Swissy is copying the EUR. According to the price action below it is not behaving as the safe-haven currency, more like the EUR clone. Does it mean it lost its reputation? Unlikely, it just means it is not a safe haven in situations when the whole world shuts down. Similar to the above range-bound currencies, it is not a good pick for trend following strategies.

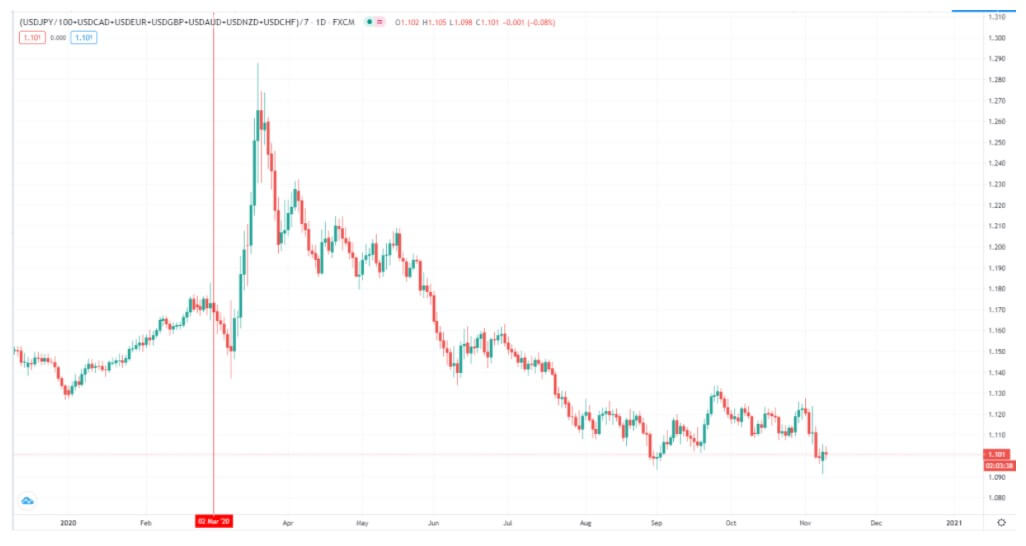

JPY is not regarded as a safe haven apparently once COVID-19 went global and serious. It is just more volatile than the CHF but after the 2020 US elections and the recent vaccine announcement, it is testing its major support level before the pandemic. It is yet to see if this is just another spike before the real economic downturn is about to start.

Finally, the USD went sharply up but investors soon realized the US economy does not have that safe haven characteristic, what’s more, the pandemic has a strong impact on the ideals of this country, pushing the USD down more than any other currency.

All this can provide us with some results which are the best pairs to trade until now during the COVID-19 since March 2020. The biggest difference index or pairs that moved the most are AUD/USD, NZD/USD, AUD/JPY, NZD/JPY, and to a lesser extent EUR/USD and GBP/AUD. Therefore, these pairs are the best for trend followers. Range bound strategies would probably like EUR/CHF, EUR/CAD, CAD/CHF, and AUD/NZD. Is the same going to continue in 2021? If vaccines prove to be effective we can probably see risk on sentiment again, however, the pandemic might have pushed the economic cycle off the cliff, causing another economic crisis on steroids.

Recently, after the US elections, we have witnessed interesting events. Pfizer and its partner, BioNTech announced the vaccine after the US elections, spiking equities up. Gold went sharply down back to the pandemic showup rally support. Gold futures experienced a single day decline not seen in seven years. However, some assets enjoy a real safe-haven personality – cryptocurrencies. Bitcoin is back to $15k levels at the moment of writing of this article, resembling the famous rally from 2017. So, gold is not really going to be a pick for 2021 unless we are into recession, Bitcoin on the other hand is on a good track to be both, pandemic safe heaven and also a recession safe haven.

Cryptocurrencies are volatile and require adapted strategies to trade. They are still considered risky assets and should be only traded with also good risk management. If we had to pick an asset to trade, it would not be currencies unless we see the end of the pandemic. In that case, going back to risk-on currencies seems a reasonable choice. If an economic downturn is about later, it is going to be global so precious metals and crypto could be the right choice.