We’ve compiled this handy guide to give traders more insight into the most common funding methods available with brokers today: bank wire transfer, cards, cryptocurrency, and e-wallets. Choosing a good deposit/withdrawal method through your broker is essential for several reasons. Fees, processing times, security, and other factors all need to be considered, otherwise one might find themselves paying ridiculous fees or running into issues down the road.

Keep in mind that anti-money laundering laws and broker policies usually require funds to be withdrawn back to the original deposit method, so you’ll want to consider the factors that affect deposits AND withdrawals with any certain method.

Bank Wire Transfer

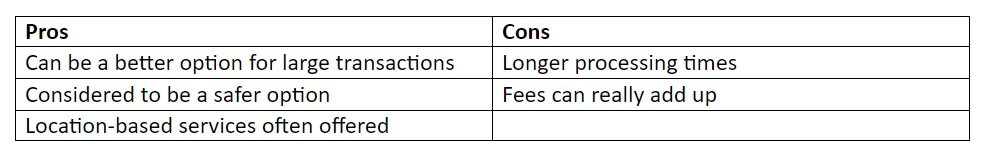

Wire transfer to/from the client’s bank account is the most traditional method for depositing and withdrawing funds that is offered among brokers. Depositing this way can be somewhat outdated, considering that there are longer wait times for the funds to be credited and withdrawals are also subject to bank processing times. This can be frustrating if you’re in a hurry to have your account funded, or if you need your withdrawal quickly for any reason. Fees are usually unavoidable as well and usually fall within the ballpark of $30 to $50 USD. Intermediary bank charges and/or conversion fees can also apply. Those making a large transaction may do better with this method if the chosen brokerage has funding restrictions with other methods. Bank wire usually allows for larger sums of money to be deposited/withdrawn.

Credit/Debit Card

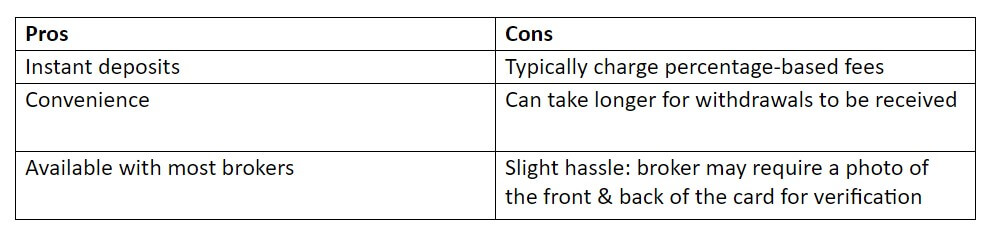

Making a deposit via card is one of the quickest and most convenient ways to deposit funds into your trading account. These funds are often credited instantly, making this a great way to replenish your trading account in a hurry. Withdrawals do tend to take a bit longer than with cryptocurrency or e-wallets, as you’ll need to factor in the broker’s processing times along with the banks. Fees vary with this method – many brokers offer fee-free deposits, but there may be percentage-based fees (around 3-7%) charged on withdrawals. Others offer fee-free depositing both ways.

Cryptocurrency

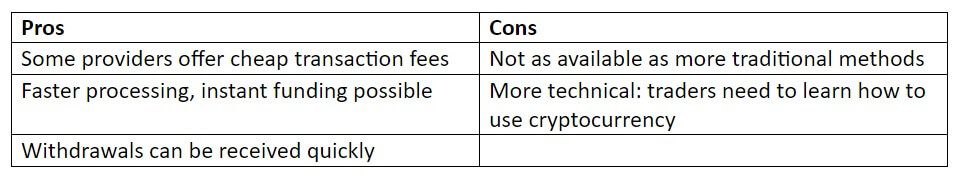

Cryptocurrency has become a popular modern method for transferring funds quickly to and from trading accounts. Here are some of the most popular cryptocurrencies out there:

- Bitcoin (BTC)

- Litecoin (LTC)

- Ethereum (ETH)

- Ripple (XRP)

- Bitcoin Cash (BCH)

- Tether (USDT)

Keep in mind that some brokers offer all these options (possibly more), while others may only offer a few of them or only the most-popular Bitcoin. Others out there have not jumped onto the cryptocurrency bandwagon and do not allow cryptocurrency-based funding. Funding your account through one of these methods comes with several advantages, although you’ll want to consider the fact that the value of this money is ever-changing. Still, Bitcoin or any other cryptocurrency can always be converted to cash and withdrawn to one’s bank account if that is preferred.

Cryptocurrency’s changing value falls in the middle of being a pro and a con – you may lose money, or gain some, depending on when you make transactions.

E-Wallets

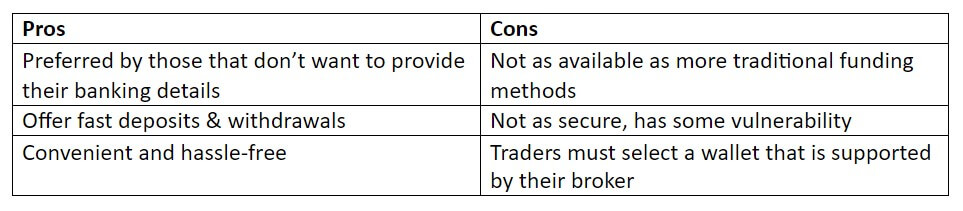

E-wallets have joined cryptocurrency as one of the newer, quicker methods for funding brokerage accounts, among other things. They work like pre-paid wallets (like bank accounts), however, funding through an e-wallet is much quicker than more traditional methods. There are tons of e-wallets out there to choose from, but brokerages tend to limit the options that can be used to fund on their sites. Here are some of the most commonly available e-wallets offered by brokerages:

- Skrill

- Neteller

- QIWI

- Przelewy24

- PayPal

Broker-to-Broker Transfer

In order to fund your account this way, you would need an existing trading account with another brokerage that is already funded. Many traders with secondary accounts choose to fund this way; however, both of your brokers would need to support the funding method. Fees may apply with this method, but this varies.

Miscellaneous Methods

While we’ve covered the major funding methods most used by brokerages, do keep in mind that there are hundreds of payment options out there, so you may find an option that isn’t listed here. Know that some methods are also restricted to clients in certain locations as well. For example, GiroPay is for German residents. If you do see something you’ve never heard of, be sure to use Google to conduct further research.

Conclusion

Here are a few key tips for depositing/withdrawing with any broker:

- Be sure that the broker offers at least one or two payment methods that appeal to you.

- Check for any ridiculous fees with any broker and avoid using those funding methods.

- Look for a withdrawal minimum requirement. If the broker requires withdrawals to be made for minimum amounts of $50, $100, etc., then some of your money may get stuck in limbo if you decide to pull everything out of the trading account due to bad luck or because you’d like to switch to another broker. Reputable brokers do not usually set a limit, or the limit is low (around $5).

- Also, check to see if there is a withdrawal minimum for any particular funding method. For example, bank wire is sometimes subject to a $100 requirement per withdrawal.

- Does the broker’s website have a detailed page related to funding? Transparency is key here. A lack of information or detail about fees can typically result in higher than expected charges or hidden ones.

- Remember to factor in all pros and cons for any given method and decide which works best for you. Some traders may not mind paying higher fees if it means they will receive funds faster, while others would prefer a longer wait in return for fee-free withdrawals. This comes down to personal preference.