Dominant gold association with wealth and security is going to be even more hyped after the next economic downturn most economists expect to be more dramatic than what we have used to see in the last two decades. Also, cryptocurrency is another market type, Bitcoin also gets perceived characteristics of precious metals by people, even though they are very different in many ways. It comes down to what we perceive as valuable, but we will not go into theories just to pin down silver is more scarce than gold, contrary to what most people think.

Before we move on to XAG/USD trading, readers need to understand the basics of Supply and Demand forces, general characteristics of precious metals, and also know what we do with gold trading. All of these topics are already covered before. Similar to gold, silver carries the inherent value property, it was also exchangeable for silver dollar banknotes before the gold standard abandonment and is traded on the markets worldwide. If we go deeper into silver fundamentals, similarities stop. Traders that follow a procedure will explore forex trading the right way, the same applies to meals trading. This is why we start with the fundamentals even though currencies’ knowledge alone will not get you to the prop trader level.

Silver is a less popular trading asset than gold and therefore you will have a harder time finding a broker that offers XAG/EUR, XAG/JPY, or any other currency against silver except the USD. Although, like with spot gold trading, this will not be an issue. Liquidity is lower though it is good enough to retain trading conditions we like to have, with a few trading drawbacks in the technical area.

Bitcoin and Litecoin comparison can be like gold and silver if we compare their fundamental similarities. Obviously one is worth less than the other and they also move in tandem, in a positive price action correlation. Silver is considered to be a more risky asset than gold, however, opportunities or possible gains are higher than with gold. According to some professional traders’ opinion, the silver upside is larger in proportion to the risk. This opinion is based on technical and fundamental analysis and experience that puts silver in a special basket. Let’s first start with the fundamentals.

Silver has about 3.5 billion troy ounces available right now when we count all holders, total supply. Roughly estimated, it is about half an ounce per person. Now, the demand is certainly made more aggressive when you have some people having more than others, it creates scarcity which can be a primary driver for the bullish sentiment. Interestingly, silver is more scarce than gold which has 6 billion ounces in total supply, but gold is more expensive, trading around $1900 per Oz right before the 2020 US presidential elections. Amateur investors will probably just take gold anytime before silver, yet the scarcity of silver might get on top of the gold bullish sentiment according to plain fundamental numbers.

If you remember the article about increasing the odds in your favor, by accounting for the scarcity of silver and the fact it is a lot cheaper than gold, it is easy to understand silver is a better prospect for the average investor. On top of this supply scarcity, know silver is used in production a lot more than gold. To be more precise, 50% of it is used for various industrial needs, not just jewelry and silverware. The latter is not consumed, it still has the same weight while in production it is consumed and hard to recycle again. Silver is used in batteries, nuclear tech, medicine, solar panels, and electric cars all of which are getting exponentially popular nowadays. One more argument for the silver future value jump is the fact the supply is getting lower too.

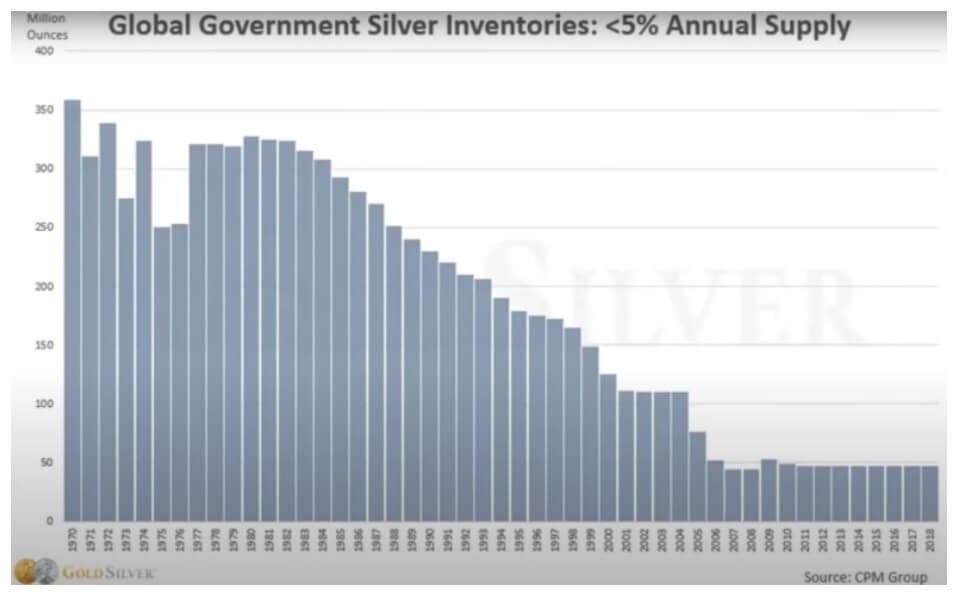

Traders and investors still need to pay attention here, just because the scarcity and demand are increasing it does not mean it will necessarily increase the silver value in an economic downturn. A bearish argument comes from the fact a big part of the silver industry consumers will bust or cease production when a large scale crisis emerges. Central banks seem not to care about silver, according to statistics, their supply is getting lower sharply after the gold standard abandonment.

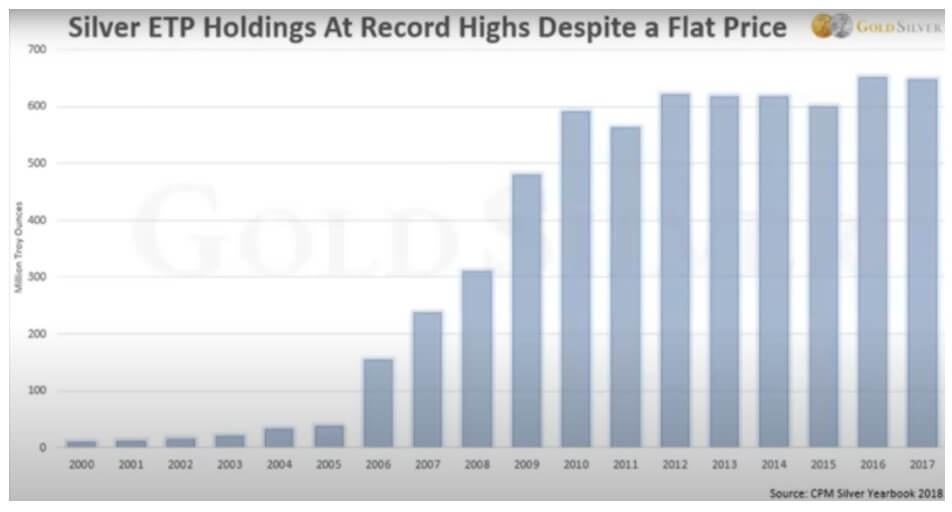

Governments do not want silver and do not have a long-term investment plan with it most likely because silver value concentration is not as high as gold. Contrary to this, silver holdings with individual investors are booming.

So people want silver as well in their portfolio and this is what matters for traders that come from forex. The chart above does not show the last 2019 result but it was pretty high after the India craze for silver. If the demand is going higher and the supply is the same or getting lower it is easy to conclude a bullish silver outlook. In our previous article, you could see the gold supply is starting to go down and expected to do so sharply in the next few years, even with the new technology around. That chart has a projection that it will go down but silver is already in a downtrend.

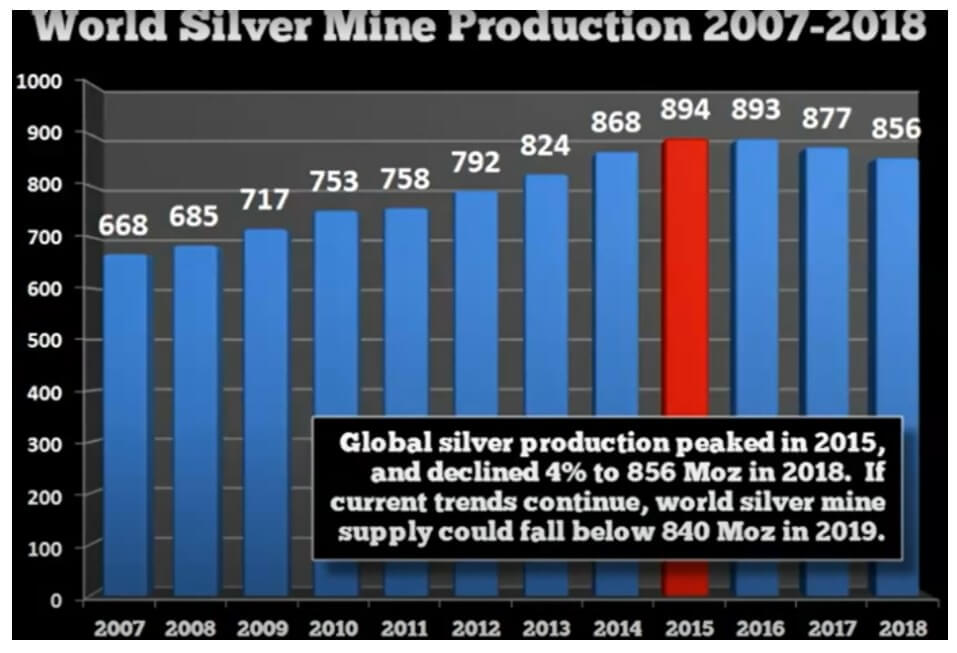

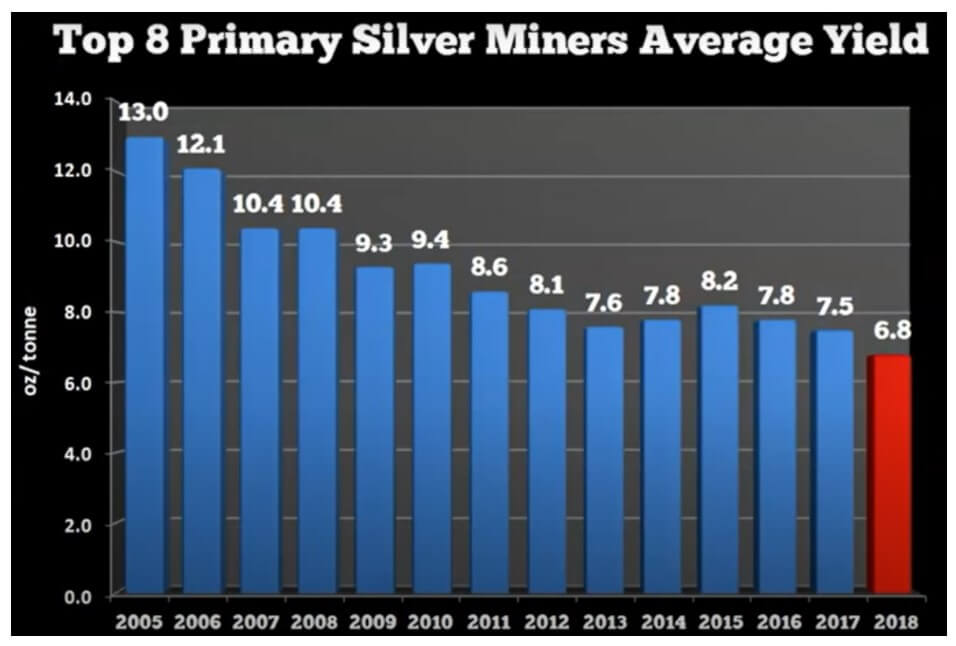

Now the world silver mine production chart above displays what they produce, the silver ore. The ore does not have the same quality as when the mine was new, it has a lower yield. This yield chart is very bullish for silver.

So the mines have peaked in production and the ore is getting diluted and now even the production is down trending. These fundamental charts are the unpopular backstage few traders want to see. It is good to know this if we want to invest long term, however, for daily traders, it may just mean a bit bigger positions on the long silver positions.

All points traders should apply to buy and hold strategies explained in our previous article, now when silver is booming and is not as expensive as gold, you can buy more of it. The potential upside is even more amplified compared to gold. Gold runup from the low to high pivot point for the last decade is about 768%. Silver for that exact period went 1147%. Last year, during the summer of 2019, silver run outperformed gold by two times. So to some basic upside/downside assessment, this might be a good point to hold silver instead. Throughout history, silver mostly outperformed gold when big correlated trends occur and it is likely silver will do it again for the coming downturn, which is going to be amplified because of the COVID-19 implications. Of course, an even better proposition is to diversify and hold both, precious metals are a hedge against everything, when all goes south you will get richer.

From a technical analysis standpoint, silver is different too when we get into the details. Firstly, the ATR is different, and it is logical since silver is much cheaper per ounce than the other precious metals (copper is a commodity metal). On a daily chart, silver is also more volatile, candle wicks are longer, and this is not what we want to see. Conditions like this need to be tamed with different risk management levels than for forex and gold – for which the daily chart is mostly smooth. Silver moves in tandem with gold, they do correlate to some extent although the application of this info is not a good trading proposition. Simply, correlation trades are hard to realize, this correlation between assets may serve as additional info but not a dominant decision-making point. You will always find a moment when they look correlated and then when they are not, but make similarly looking charts.

Positive gold – silver correlation can commonly produce signals from the same system on both assets. The daily chart we like to use is especially prone to have tandem signals. If silver is a bit riskier asset and you have a signal to trade but not quite yet on the gold, you might be asking if the wait for the gold signal tomorrow is a good choice. Not all brokers will provide the same price chart, they should be almost identical yet different liquidity providers and broker setups might cause some differences. This difference should not be an issue when we use the same system with different brokers. In some instances, you may have one set of winners and losers and different entry points with others, however, at the end of the day, the bottom line is the same. Some brokers also have 3 digits quotes after the comma so your ATR value is also one digit too long. Mostly it is like with the JPY pairs with two decimals. Silver charts have wicks and tails you may associate with stop loss hunting. Well, silver moves like this, it is not manipulation, just the nature of silver movements.

Back to the trading decision question. When you have signals on both gold and silver at the same time, platinum and palladium are unlikely to follow, and this is good, you can trade and have better diversification in the metals category. Trade both gold and silver in this situation, but split the risk you normally take. We trade 2% per position with a 50% scale-out at 1xATR range, but you can use whatever structure you like. If gold is the first to produce a signal yet silver is about to come second tomorrow, just go on full risk with the gold. You do not have crazy price action with gold and less likely to be stopped out by the wick. Lastly, when you have a silver signal while gold is probably triggering the entry signal tomorrow at the next candle, our prop trader group suggest to split the risk once again and wait for the gold and get in with the other half. This is the plan of how we manage silver movement risk, with a simple position size cut. According to the prop trader’s experience, when you get that first signal on silver, this metal’s volatility can trigger take profit even though both trends reversed, ending with one loss and one small win. All these suggestions are just a personal preference, so traders can use it as they see fit, make their own rule. Whatever plan you set up, do not keep changing things. You will not know it works or not if you keep changing, so stay consistent.

To close this article, know the future of this metal and that long-term holding it is a good idea as with gold. The stats presented here strongly confirm the opportunities are almost guaranteed. When we trade silver, adapt to its movements, volatility, and understand the correlation with gold. Lastly, you may use other indicators for metals than in forex but know what to do when you have tandem signals to enter and stick to the plan. A quick reminder, 4 precious metals trading is likely going to be at least as good as trading forex 28 major pairs and crosses, but with additional benefits of long term buy and hold strategies you can combine.