Relative Weakness or Relative Strength? The RSI is a popular indicator but it is not without its detractors. If you go online to learn more about technical forex trading – and who these days doesn’t? – then you will surely encounter a lot of people recommending the RSI. Indeed, most people you see on social media or YouTube who talk about the RSI will talk about it in glowing terms. This is why we think it’s important to bring you to the other side of the story. There is a growing number of technical forex traders out there who dismiss or outright criticize the RSI and this article is here to bring you their side of the story and the arguments they deploy to highlight the major problems with the RSI.

Popularity Contest

If you go online and do a search for all of the most popular indicators out there, you will likely find that you’ll get more hits for the RSI and just about any other indicator. You’ll hear about it all over social media whenever you’re trying to learn from others about forex and you’ll see video tutorials mentioning it or even promoting it. More than that, you’ll see it on your TV screens when you turn over to see the financial news and you will have heard about it from the very people you relied upon to teach you forex trading in the first place. Already here there are several serious problems to point out but we’ll come back to those further on in the article. First thing’s first, what is RSI?

Brass Tacks

The Relative Strength Index is an oscillating indicator that measures the velocity and magnitude of price movements. What you need to know though, is that it ultimately tells you if something is over-bought or over-sold. “Wait a minute, what do you mean over-bought or over-sold?”, you cry at your screen. Indeed, that’s one of the things about the RSI you should know. It was invented by a guy who is the father of a number of technical indicators, J. Welles Wilder. But the thing is, he invented it primarily for equities trading, where knowing if a stock is overbought or over-sold is pretty useful information because stocks – and commodities, where it is also heavily used – have an intrinsic value, while forex does not.

That isn’t to say that a currency pair can go as high or low as it wants, there are limits because governments or national financial institutions will eventually step in and rein things in. But that can happen thousands of pips down the line and there’s no guaranteed or even foreseeable limit where that kind of institutional intervention is going to kick in. Moreover, there is another issue with the RSI’s history, beyond it being invented for trading stocks, and that’s that it was invented back in the 1970s – literal decades before the kind of retail forex trading we are all doing was even a thing.

How Does It Work?

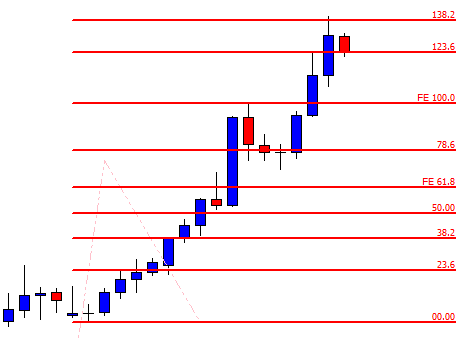

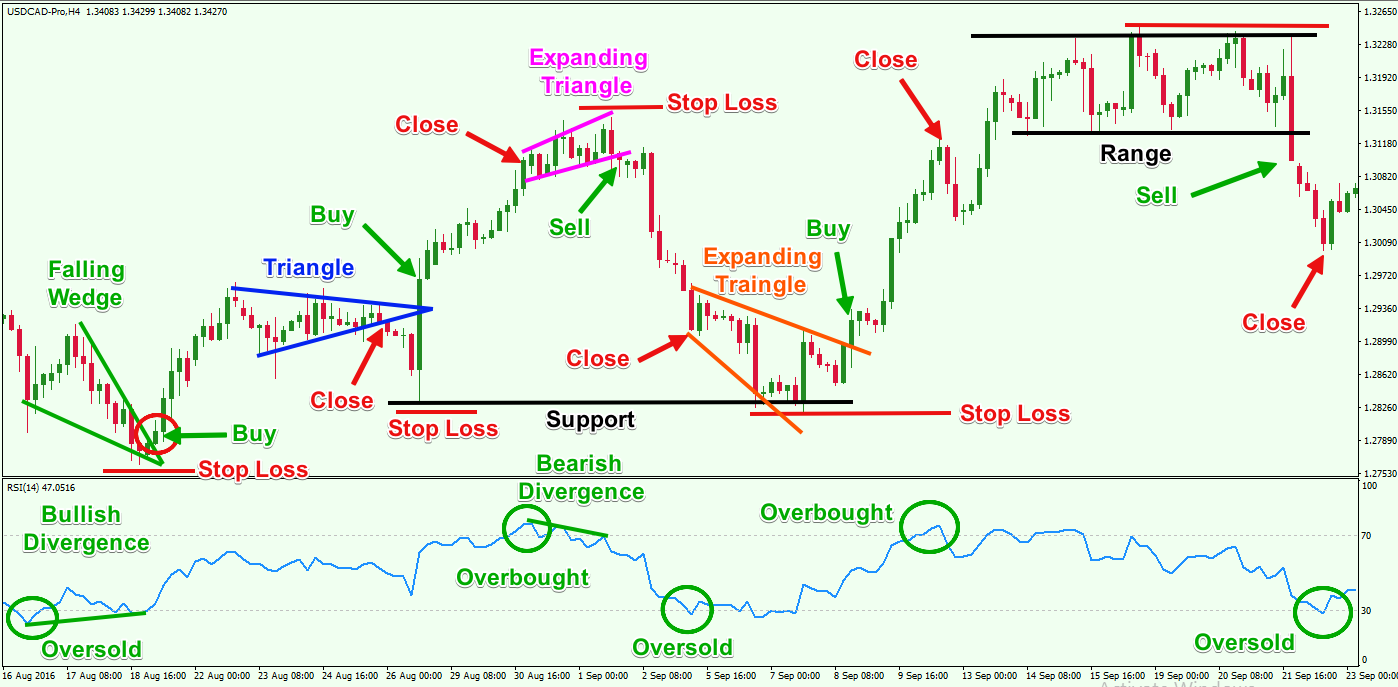

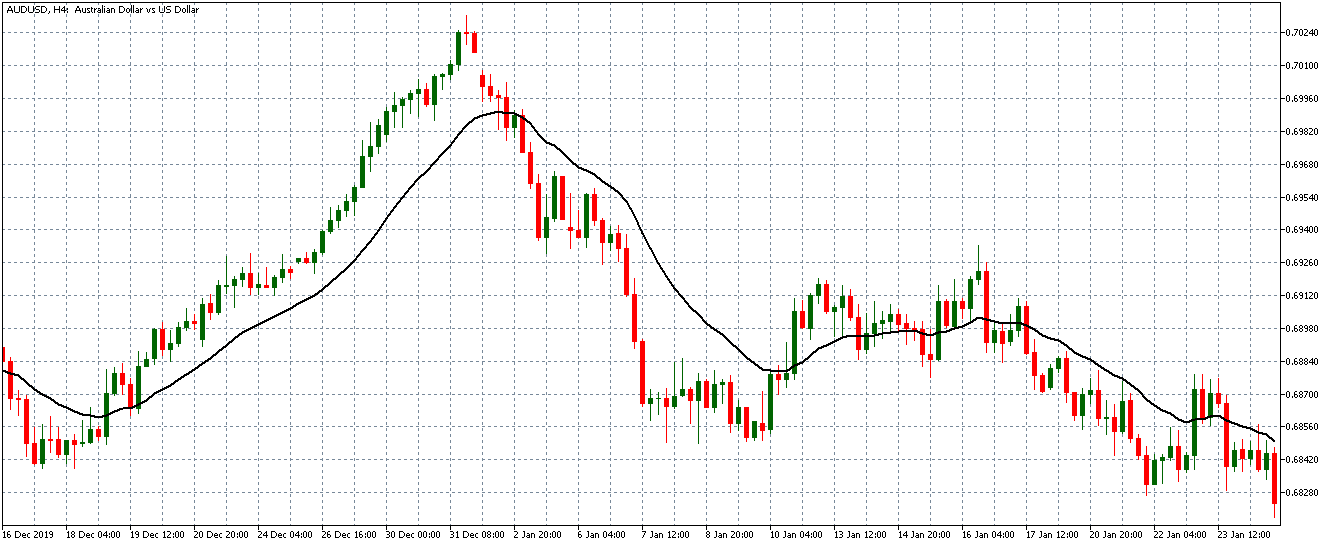

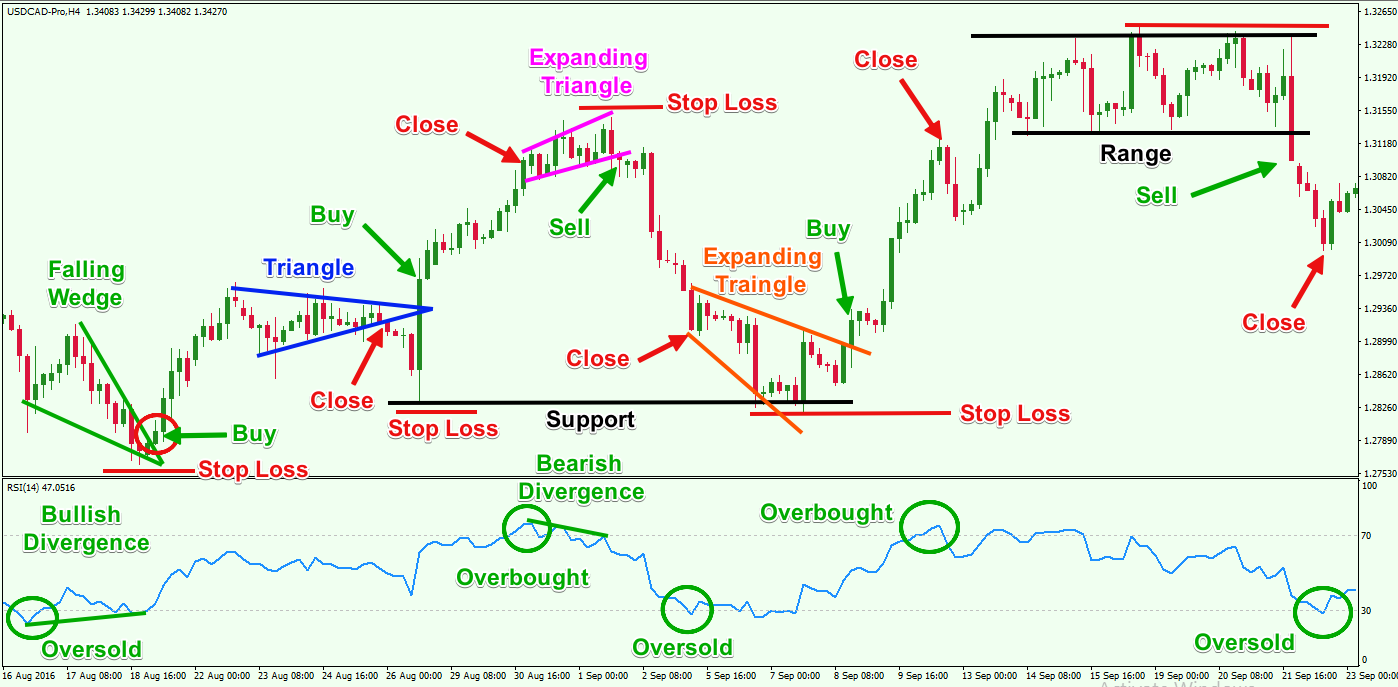

In its basic configuration, the RSI measures values from 0 to 100, where you will typically have lines at 30 and 70. When the reading goes below the 30 line, this indicates that a security or currency is oversold or undervalued and when the reading goes above the 70 line, this indicates that it is overbought or overvalued. As a default, the RSI will cover the previous 14-day period and is supposed to be overlaid against your chart to provide you with trade signals.

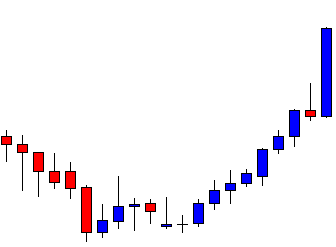

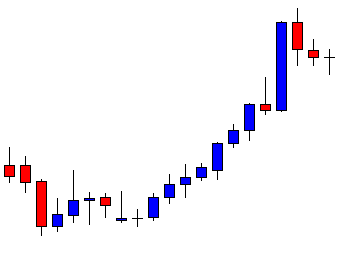

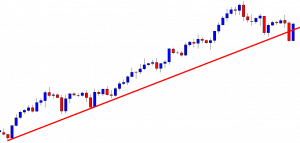

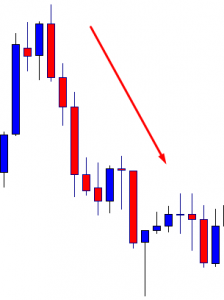

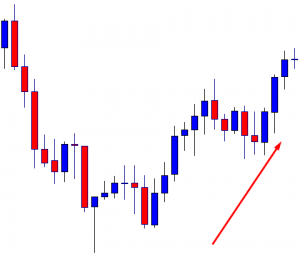

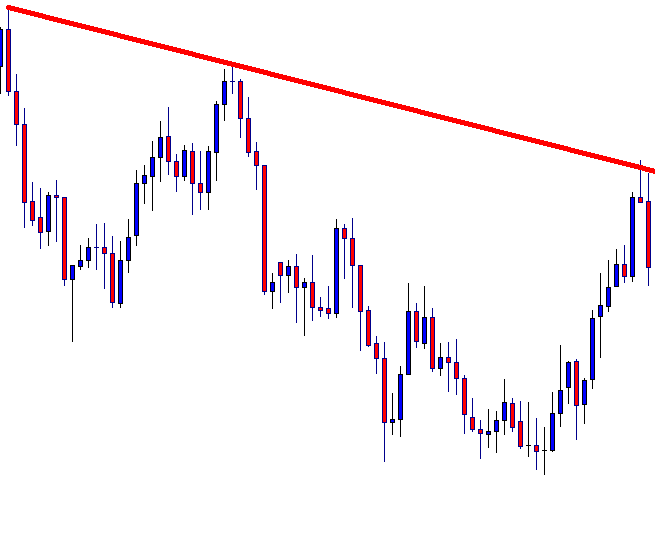

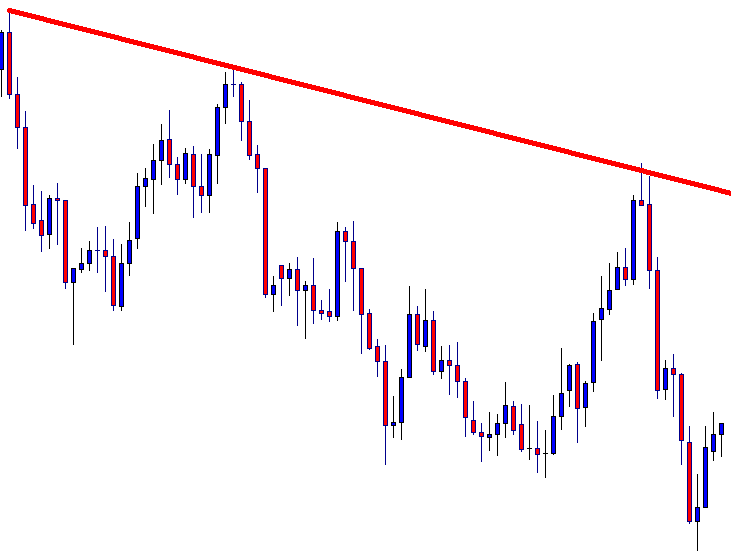

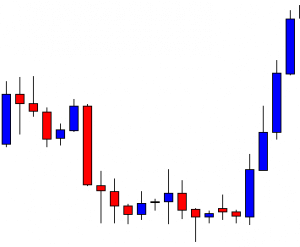

For example, if the RSI verges off into overbought territory and then drops down below 70 again, this should indicate that there is about to be a downward trend and you should go short. Conversely, if the inverse is happening with the RSI crossing into oversold territory and then rising back above the 30 line, this should indicate a reversal and the signal will be telling you to go long. That is how it’s supposed to work but – as many traders are increasingly keen to point out – there are several problems with that so let’s look at some of those.

The Problem of Popularity

As any high school prom king or queen will tell you, being popular is not always all that it’s cut out to be. In terms of the RSI, for us, it is important to understand why it’s so popular in the first place. Firstly – and this is pretty understandable actually, especially for traders who are just starting out – it is dead simple to use. Even if you’ve never encountered it before, just the short explanation above will tell you a huge chunk of what there is to know about using the RSI.

There isn’t a problem with simplicity per se – something being simple should not be a reason to avoid it. If there is a simple and easy to use indicator out there and it works, then just go ahead and use it. The problem comes from people who expect to be able to find one indicator and use it to consistently make money by trading on the back of that one indicator. But you should know by now – regardless of where you are in your trading career – that there are no silver bullets. In fact, if you think you’ve found a silver bullet that’s easy to use and is simple and everyone else is using it, you’re in big trouble.

But that isn’t the real problem with the RSI’s popularity. The real problem with the RSI’s popularity is that it is popular. If that sounds like a tautology, it is. But in forex trading there is a big problem when everybody is doing the same thing so when something’s popular, it’s time to start hearing those alarm bells. If you’re doing something in forex trading that is popular, something everyone else is doing, you’re running with the herd. And if you’re running with the herd, there are big players out there, who have way more influence in the way the market behaves, who is going to notice that the herd are all moving in a particular direction. The herd as a whole are going to be on the radar of the big players who will manipulate the mechanics of the market to take advantage of that big clump of traders who are all doing the same thing and sending their money in the same direction.

Of course, you’ll eke out a win every now and then – that is, the big players will let you have a win from time to time – because this keeps you in the game and lets them pick you off the very next time the herd gets going together. This doesn’t work the same way in the equities trade, so if you’re used to that, get ready for something different. In forex trading, you want to steer clear of the herd and stay away from what’s popular as much as possible. If that were the only problem with RSI, it would be enough to make smart traders drop it immediately. But there are other problems lurking in there and if you are still clinging on and conjuring up counterarguments in your head right now, you should be aware of the other problems some traders are keen to highlight.

The Problem of Credibility

The RSI is not only one of the most popular indices out there, but it has also been given the weight of credibility by television. You will have noticed that financial news anchors will often pull up a chart of a given currency pair and show it on your screen referenced against its RSI. Now, why do they do this and why is it a problem?

The simple answer to why they do this is that they don’t know any better. Most financial analysts on television are not traders and certainly not technical traders. They make their living by being smart and credible and being extremely good at talking about the financial markets. They do not need to spend their time trading, researching, testing, and backtesting indicators. Moreover, they know full well that their audience is also not, for the most part (like 99%), technical traders. So neither are they in a good position to properly present and explain indices more complex than the RSI nor would their audience appreciate it because they would struggle to follow along.

So why is this a problem of the RSI and not just a problem of how the financial news treat forex trading? Well because if you are just starting out trading or have been trading using the RSI (with mixed results), seeing these prestigious financial news shows flashing that very same indicator up on the screen will probably mean you will give the RSI more weight than it deserves. If it deserves any at all. You might use it and lose money or you might continue using it beyond the time when you actually become aware that it isn’t working. All because it has been lent this credibility by being on television and being discussed by smart people in suits.

The Problem of Teaching

Speaking of smart people in suits, another reason why people continue to use the RSI and why it is so popular is that it is taught to people learning how to trade in just about every forex trading course out there. When you’re just starting out and you don’t know any better – and crucially, you haven’t built up any of your own trading experience in a meaningful way – RSI looks pretty valid. It is kind of exciting because you are taught this indicator that tells you to wait for certain conditions and when you see them, it gives you a signal to trade.

It’s really easy to learn and you pick it up with no effort at all (are those alarm bells ringing yet?) – all you have to do is look at your chart and identify when the RSI is giving you a signal to trade and just take it. If you’ve learned anything about forex trading by now, you should hear how unrealistic all of that sounds. What’s more, the RSI really easy to teach, which is why it has found its way onto all those courses and video tutorials. It doesn’t take a rocket scientist to teach it and you don’t have to have a foundation course in brain surgery to learn it.

But that’s where you have to question who it is that’s teaching you to trade. Is the person you’re learning from an actual trader? Chances are they are not. If they are making their money by teaching forex trading or by making forex tutorials and courses and then selling them on, there’s a good chance they don’t have to trade for a living. They just want to teach this stuff and, if you’re starting out, you’re hungry for knowledge and just want to learn. As a result, they will show you easy-to-teach indicators, like RSI, that fit neatly into their course material and are easy to back up with simple examples that will make them look like they’re teaching you something important.

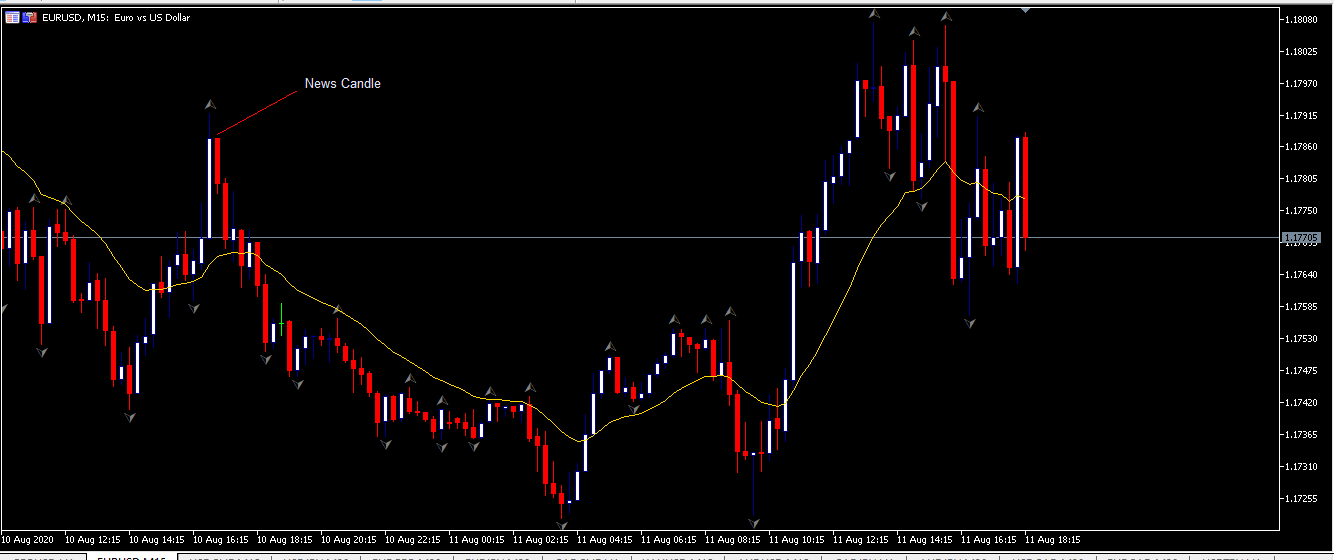

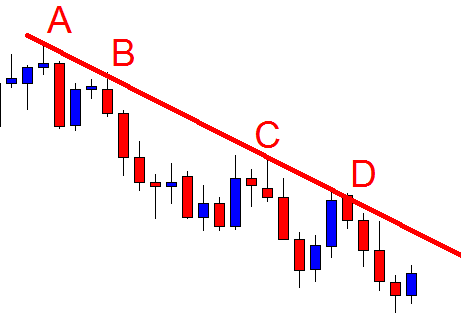

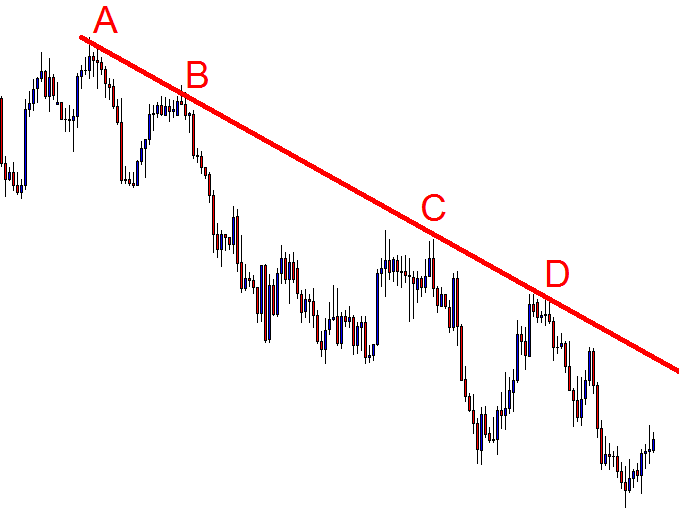

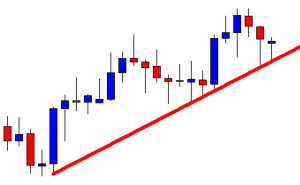

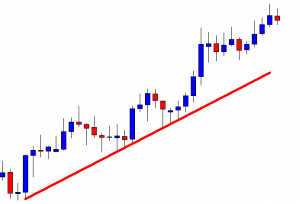

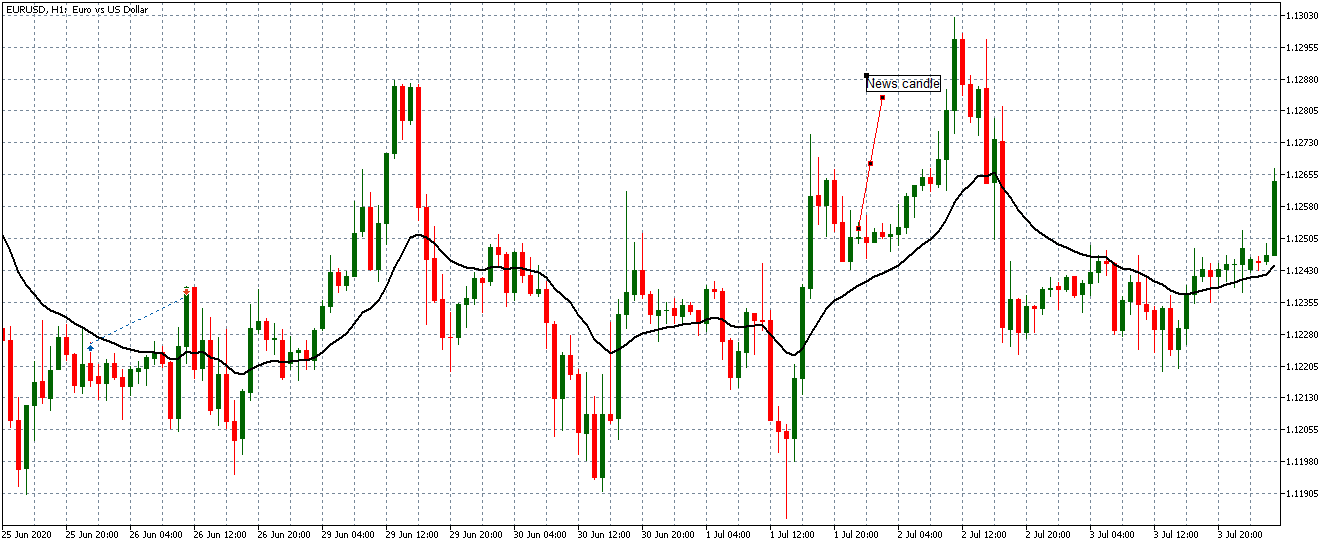

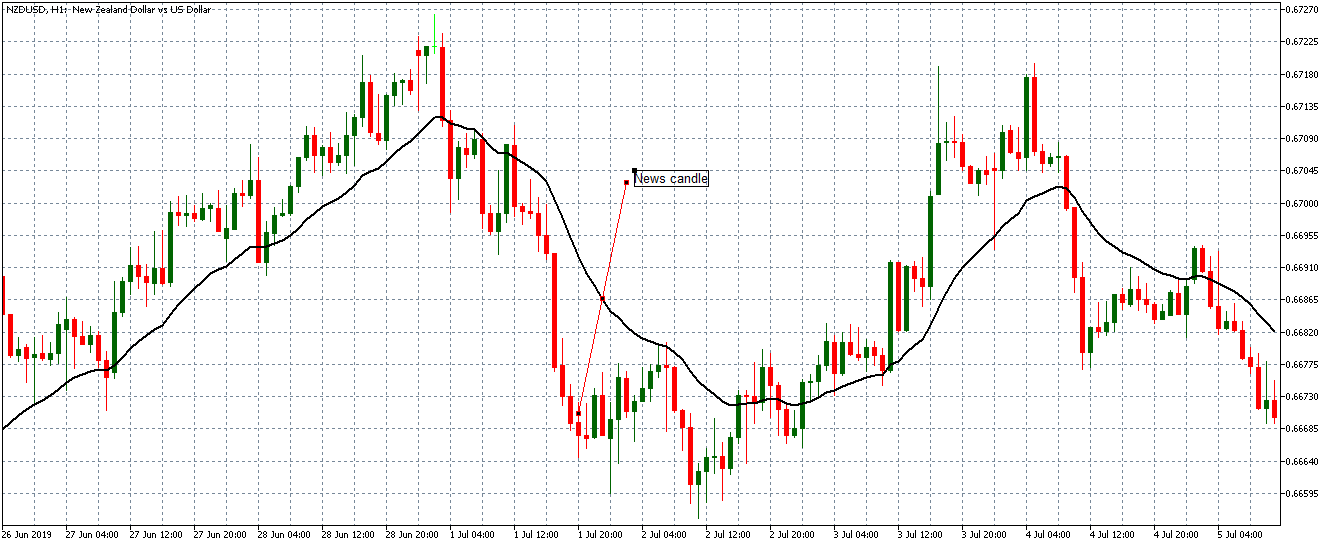

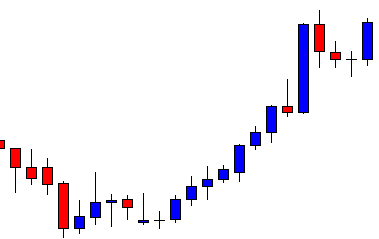

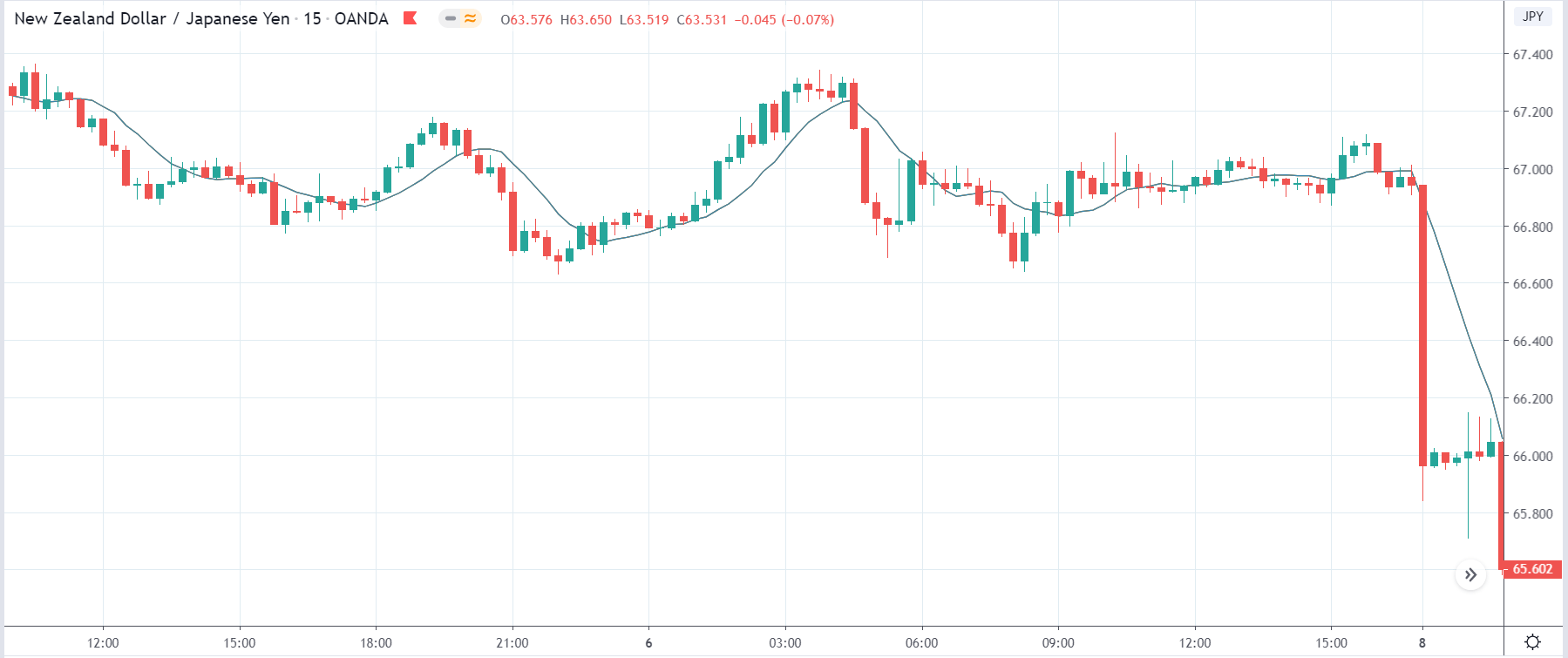

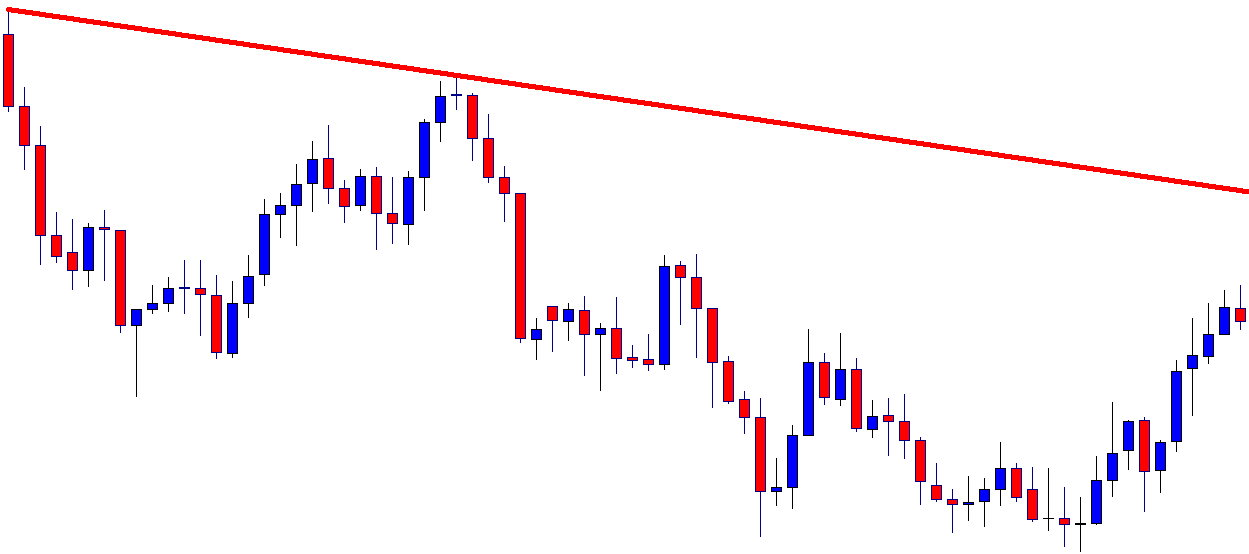

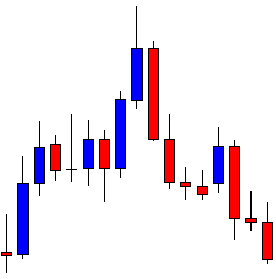

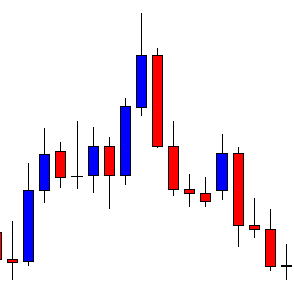

There’s a problem with those examples, however. In almost all cases, when somebody is showing you an example of how RSI works, they’re showing you a cherry-picked example. They’ll go out and find the perfect moment, on a chart of the perfect currency combination and set it to the perfect timeframe and then they’ll say, “see here where the RSI crosses back down under 70, that’s an indication that the price is about to trend downwards and here you can see that that is what’s happening”. But even in these best-case scenarios, if you look at the chart, you’ll probably be able to see a couple of cases of the RSI telling you to trade one way but the price going the other way or stagnating. You can try it now, go to YouTube or on social media and find somebody singing the RSI’s praises – there’s a 90% chance that you’ll be able to see for yourself that the example (the one that they chose) is full of holes.

Ultimately, the reason RSI gets taught so much to just about every last living soul who wants to learn about forex trading, is that the teachers themselves don’t know any better. As we said, they are almost certainly not traders themselves, and, more to the point, there are thousands of indicators out there to choose from. A great many of these are more difficult to teach than the RSI, less likely to throw up what appear to be sure-thing examples and more likely to work in conjunction with other indicators in a trading system that’s adapted to the needs and habits of the individual trader. Well, how do you teach that? Surely it’s just simpler to show people the RSI. It is and that’s why they do it.

The Problem of Success

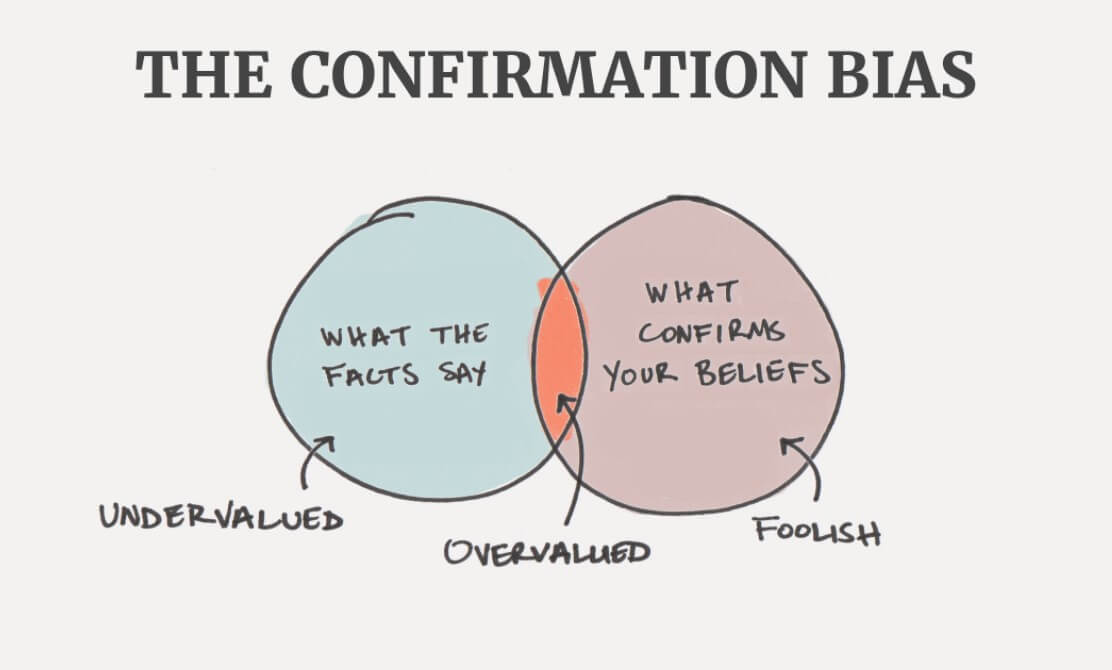

With all of its popularity and credibility and the fact that it was taught to you when you first started trading, the RSI gets used a whole lot. Now, if everyone was learning the RSI and using it and it failed every time, people would simply drop it immediately and it would be resigned to the ash heap of history. But it doesn’t work that way. In fact, it’s much more insidious and sinister than that. The main reason people continue to persevere with the RSI is that even though it is probably losing them money in the long term, they have occasional successes with it, which reinforces all those cognitive biases generated by everything we’ve already covered in this article. It’s called gambler’s ruin or casino theory.

If you went to a casino in Las Vegas and you and everybody around you was just constantly losing money – never winning, not even 0.001% of the time – nobody would ever go to a casino again. The way the house keeps you coming back for more is that you do occasionally get that blackjack or the roulette ball does sometimes land on your number. It doesn’t happen nearly as often as the house wins but it happens often enough that it gives you that kick of adrenaline and clouds your judgment so you keep gambling.

Do not underestimate the power of that rush from winning. It will keep you in a casino for ten hands beyond the one at which you should have stopped or keep you using an indicator that you have seen doesn’t work consistently but that brought you that one win a few months ago and boy didn’t that feel good. The big players in the forex market understand the power of that thrill and will use it as mercilessly as the casinos in Vegas or Macau or anywhere else in the world. They reel out a little slack and the herd lap that up and comes back for more.

The Final Nail in the Coffin

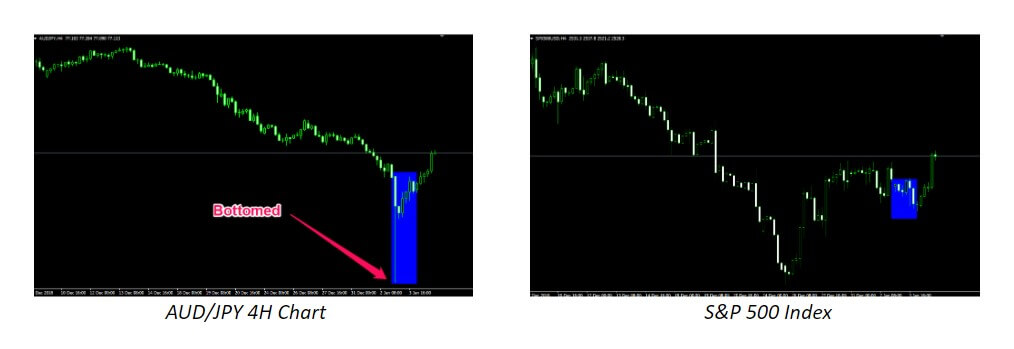

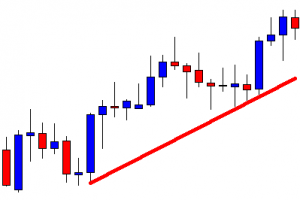

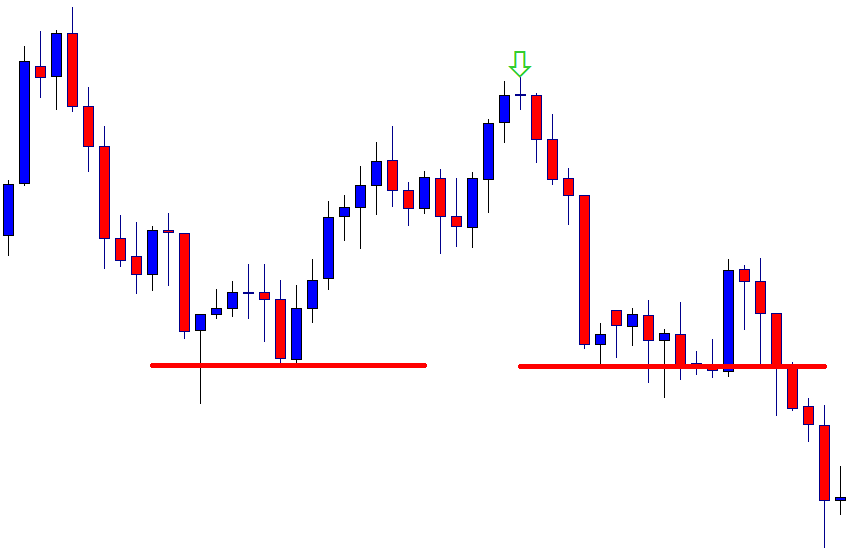

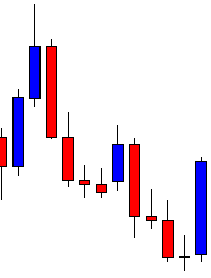

There is a counterargument to much of this and if you use and like the RSI, you’ve probably been reading through this like a coiled spring, waiting to counter with: “But the RSI does work in range-bound markets!” Well, there are a lot of seasoned technical traders out there that would respond like this: If you’re seeing a ranging market, it’s probably already over. Forex markets don’t range forever and identifying a ranging phase in the market is not as simple as textbooks will have you believe. You won’t know when it’s coming and when you see it forming it will likely be too late to take advantage of it using the RSI.

The problem is that there is a glut of reversal traders out there relying on the RSI to call out reversals for them and they outnumber the people who are trying to follow a trend when it does break out. It’s the very reason the price trends as long as it does sometimes. When it does, it sucks the life out of those reversal traders over and over again – erasing any gains they made when the price was consolidating.

Try It and See

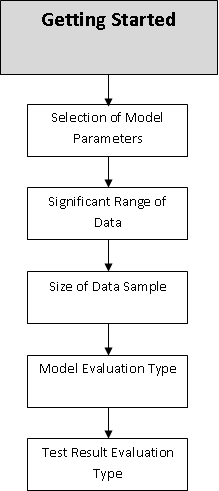

Of course, the best way to be really sure that the RSI is flawed is not to listen to an endless to-and-fro of well-thought-out arguments. The best way to be sure is to take the thing to the testing range and see if it falls apart. One good way of doing that is to open a demo account and trade it using the RSI exclusively. Use this account to track the wins and losses over a meaningful period (anything less than a couple of months is too short) to see where it gets you. Sadly, most traders are not sufficiently disciplined to go through all of that and will not benefit from that learning experience but demo-testing an indicator like that does reveal a whole lot about it.

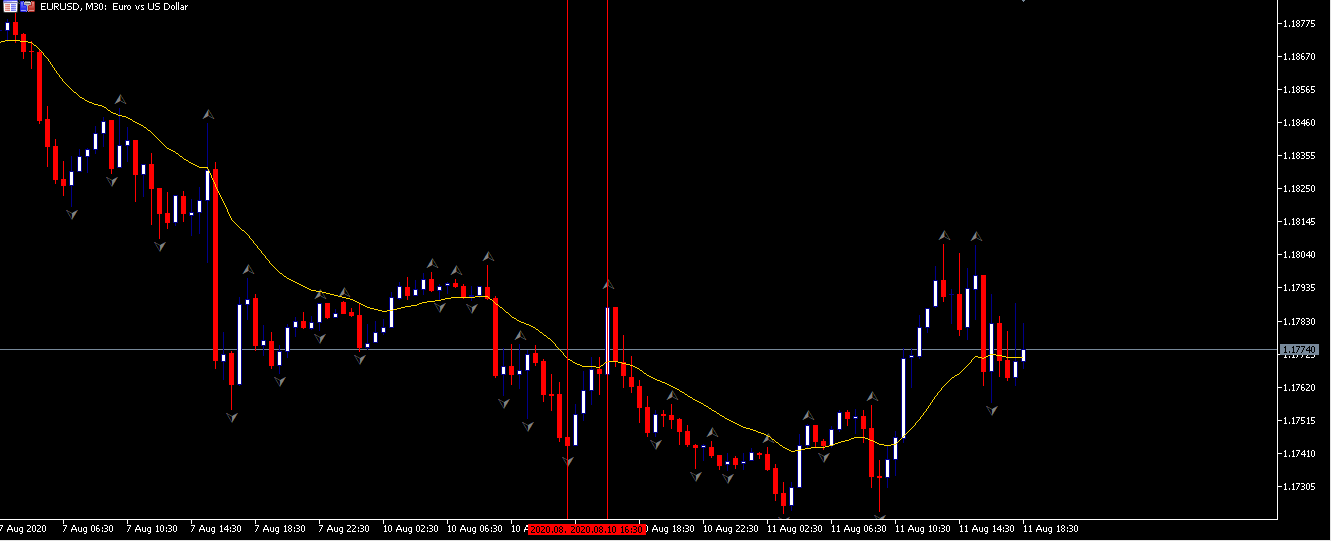

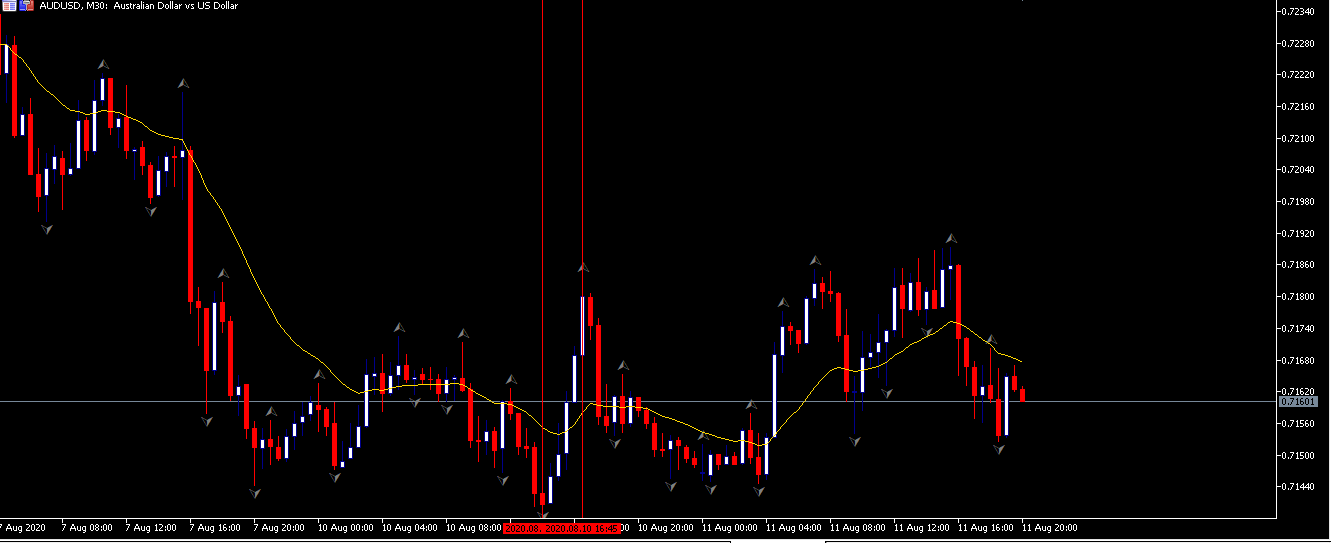

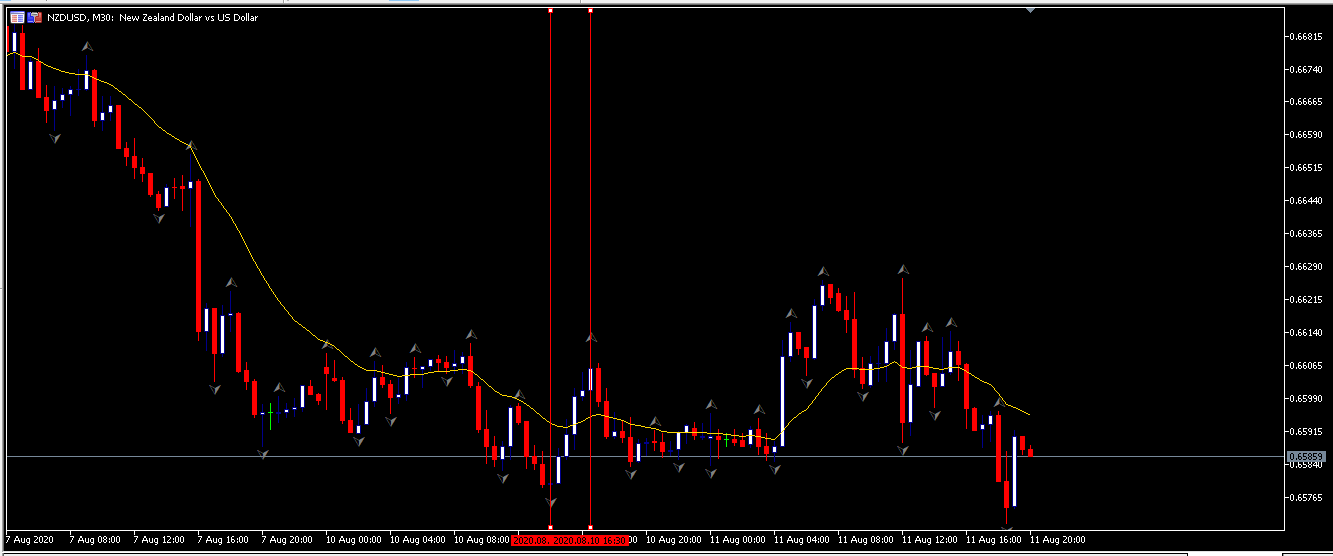

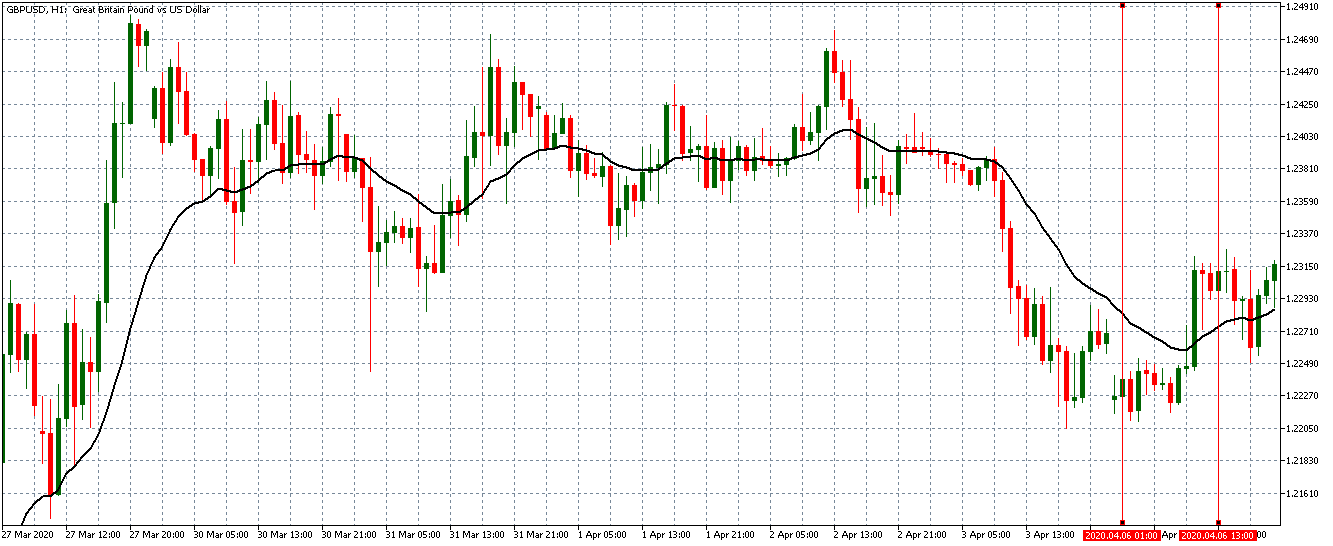

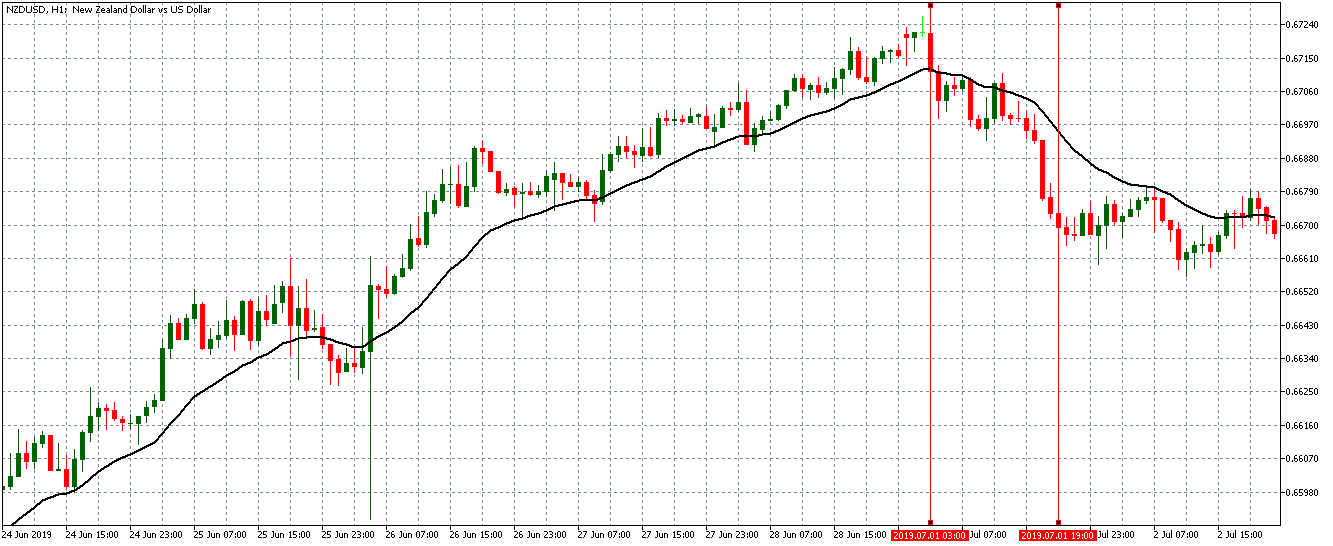

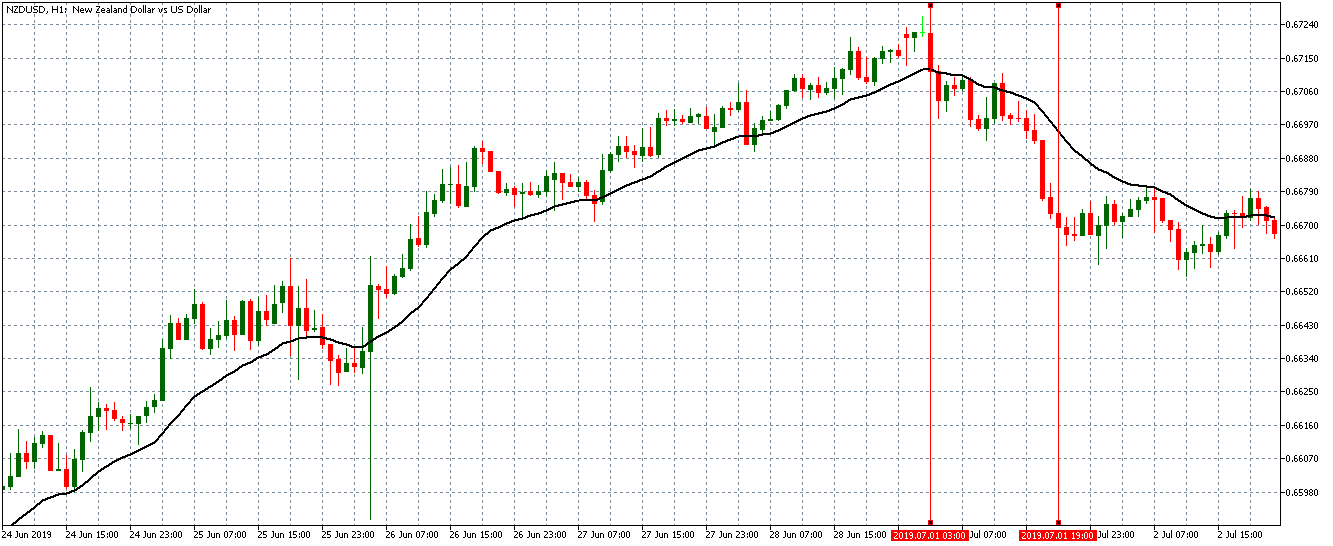

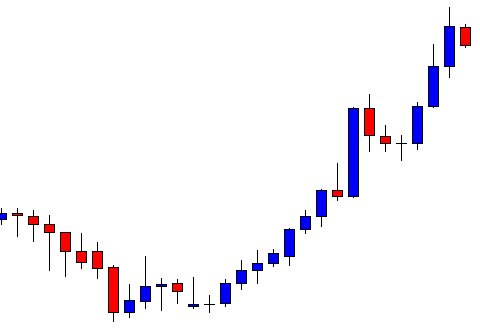

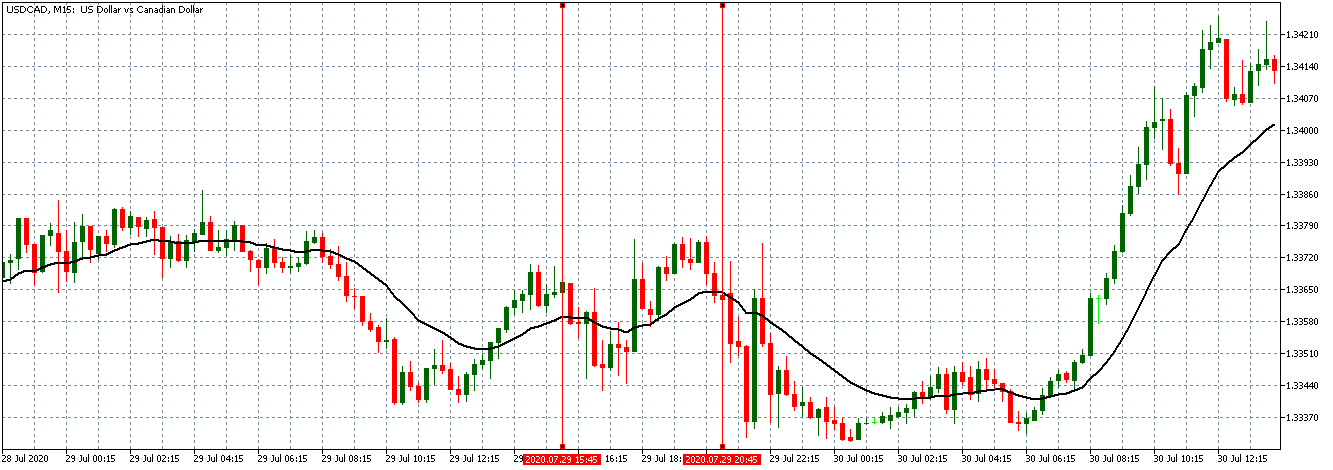

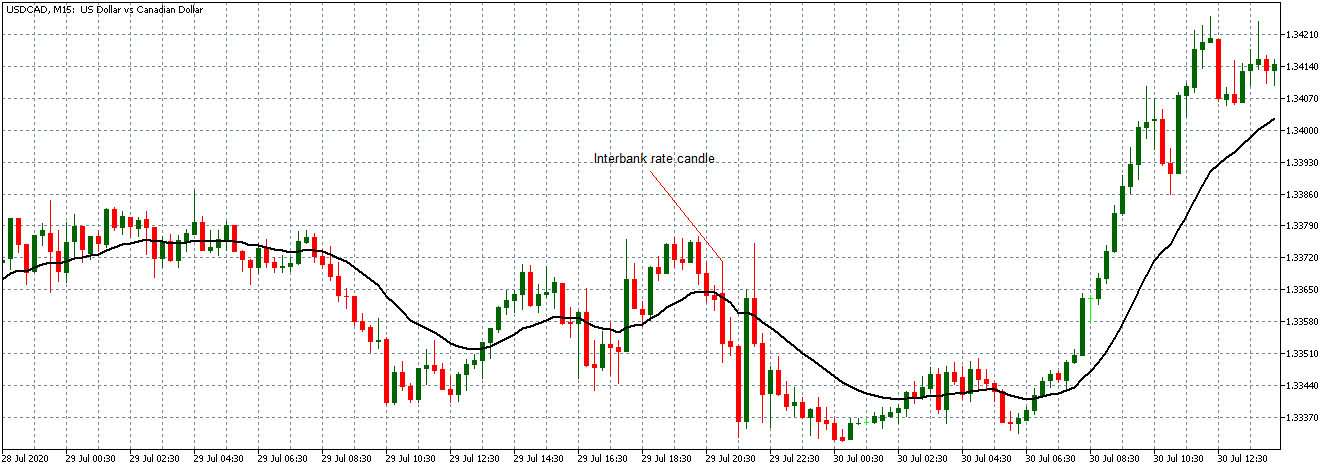

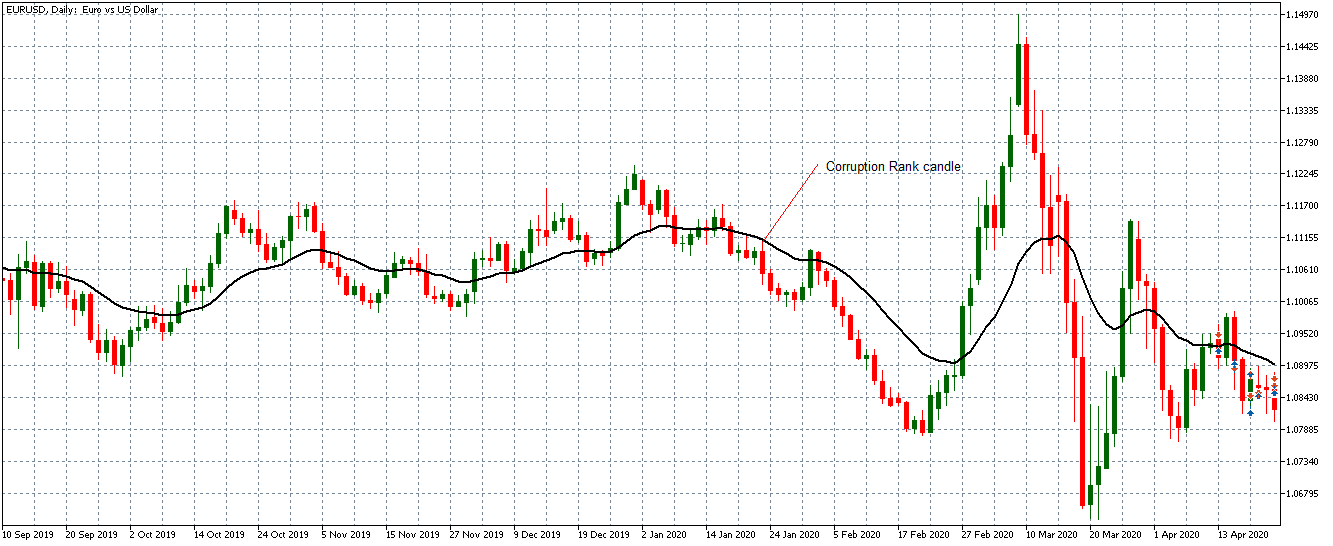

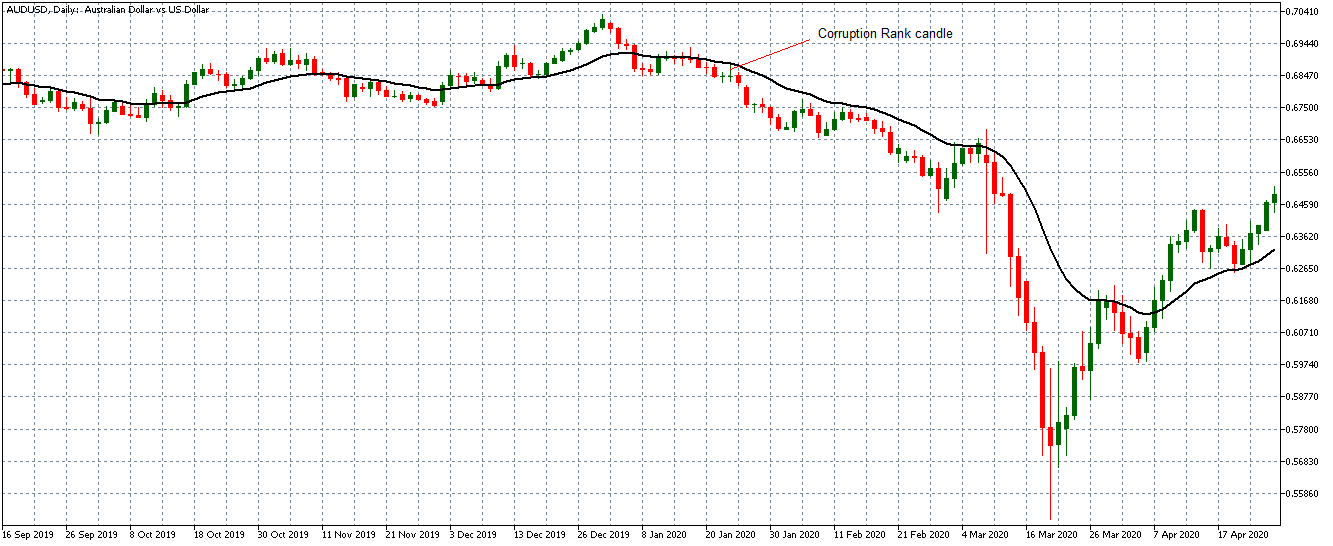

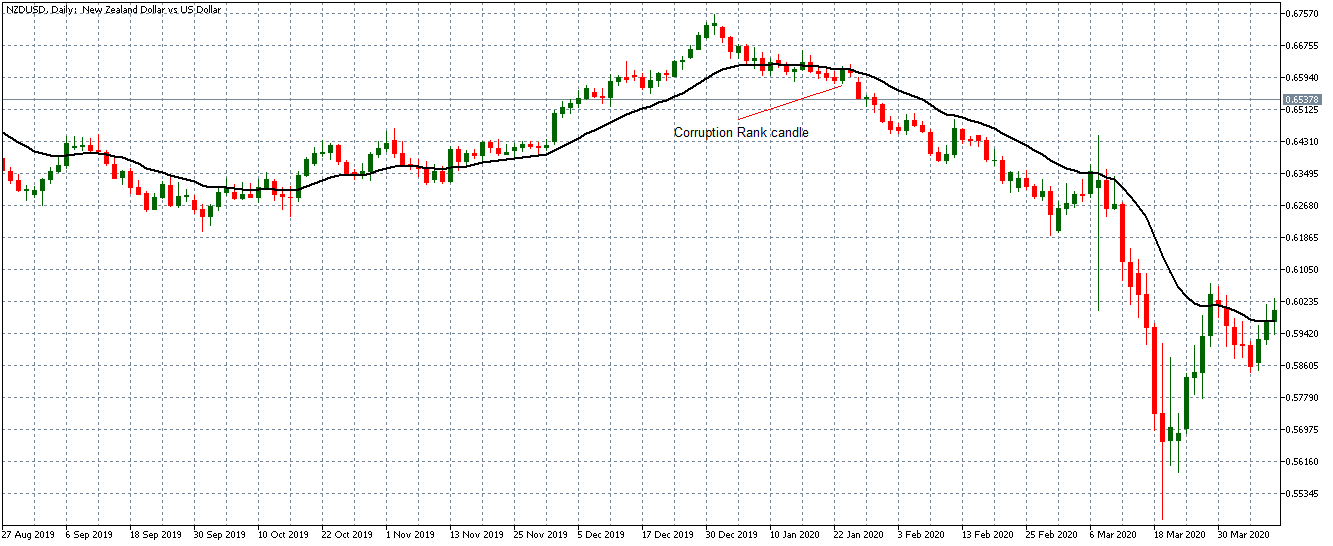

The alternative is to look at a historical example and analyse those moments where the RSI was giving a trade signal. Chances are you would see very few examples where the signal would actually have paid off. The way to do this is to take a popular currency pair or a pair that you actually trade and look back over a year’s worth of data. Pull up the RSI indicator, compare it against the price chart, and go through each and every time the RSI pinged a trade signal. Check forward from that point to see whether following that signal would have paid off but be honest with yourself about where you would have set your stop/loss and take profit limits.

You will find that, in most instances, following the RSI will completely kill you. That’s not to say it never throws up a win. It will give you a win from time to time but the losses will outweigh these infrequent wins over time. And not only that but the wins will more often than not be pretty mediocre and the losses will not. To sum up, there are a lot of traders out there who are very disparaging about the RSI and now you know why. If you feel like this is sound advice, don’t take their word for it, test it out for yourself in a demo account and see if it really lives up to any of its hype.

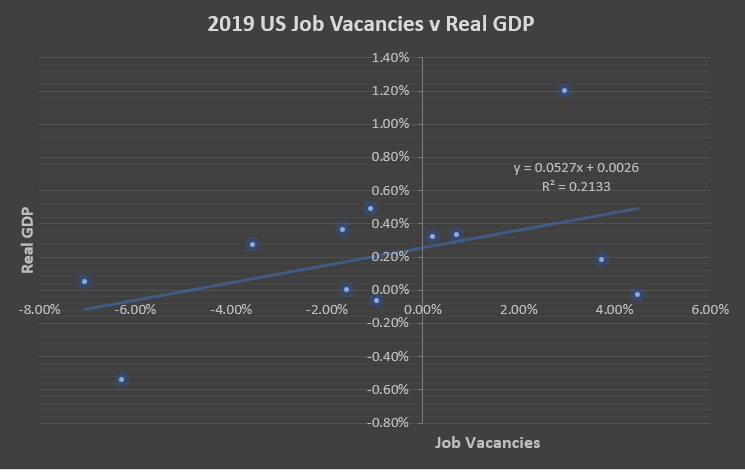

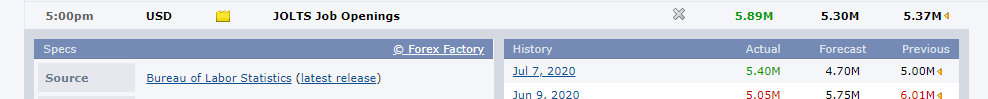

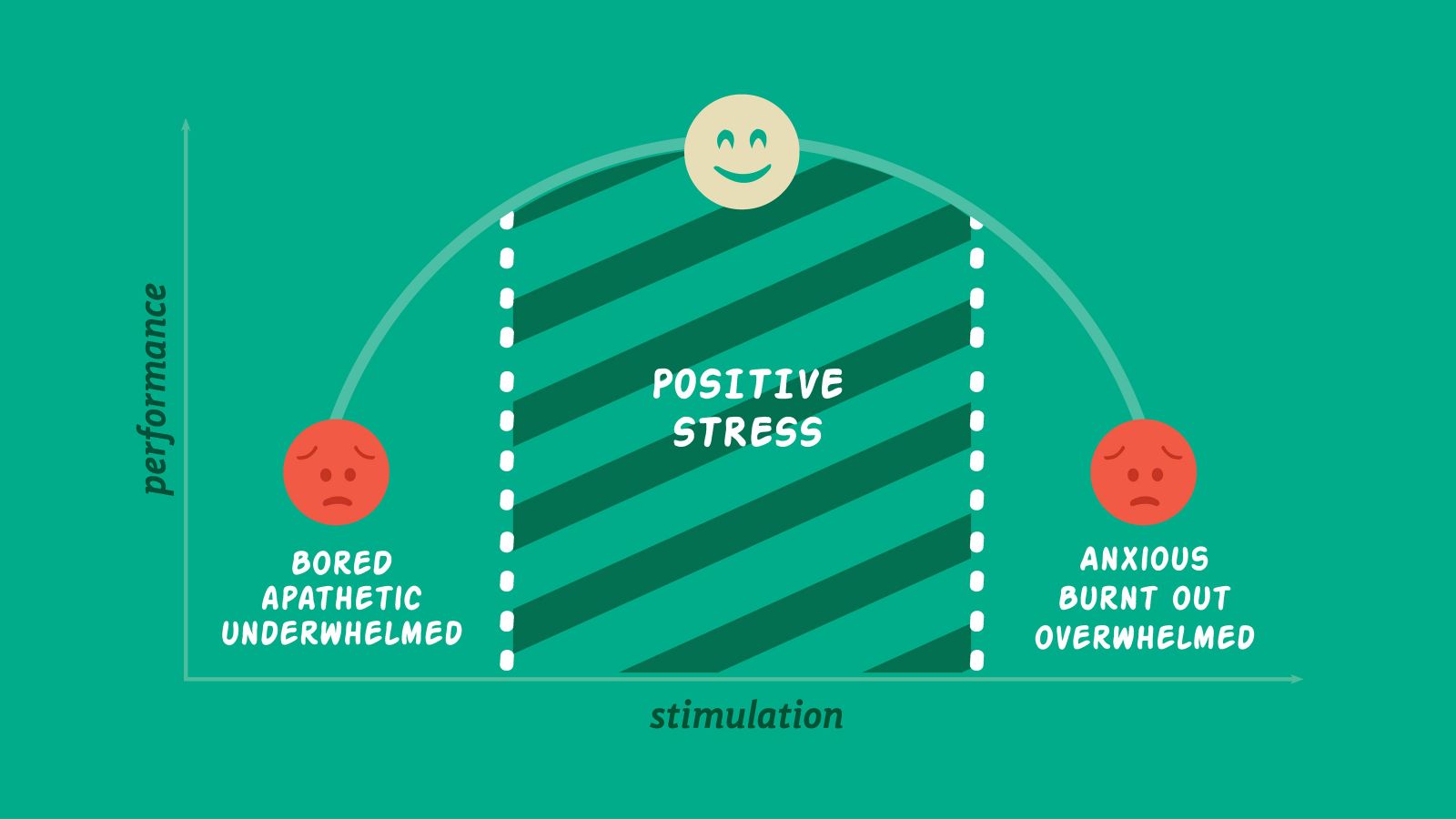

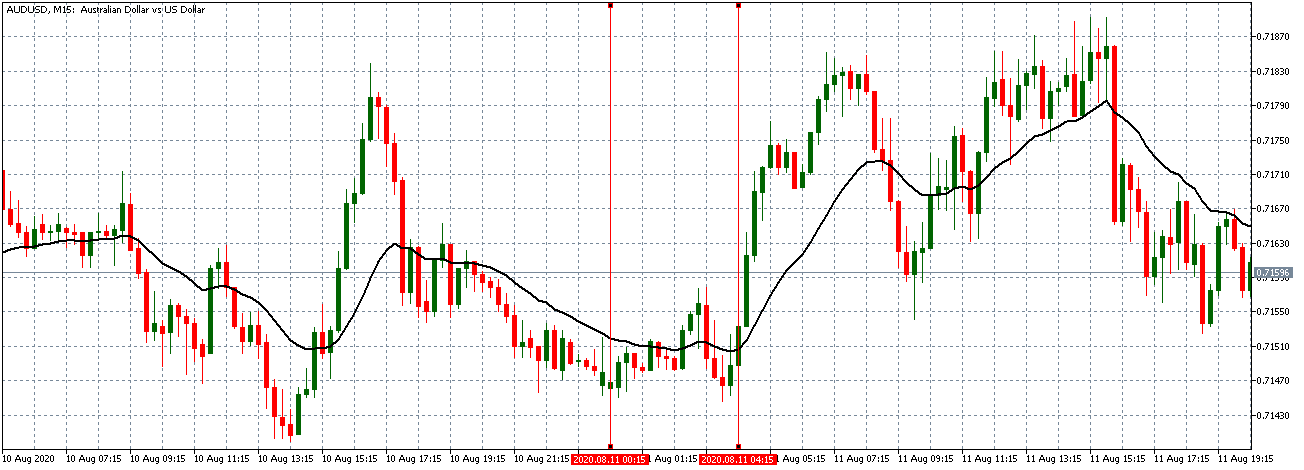

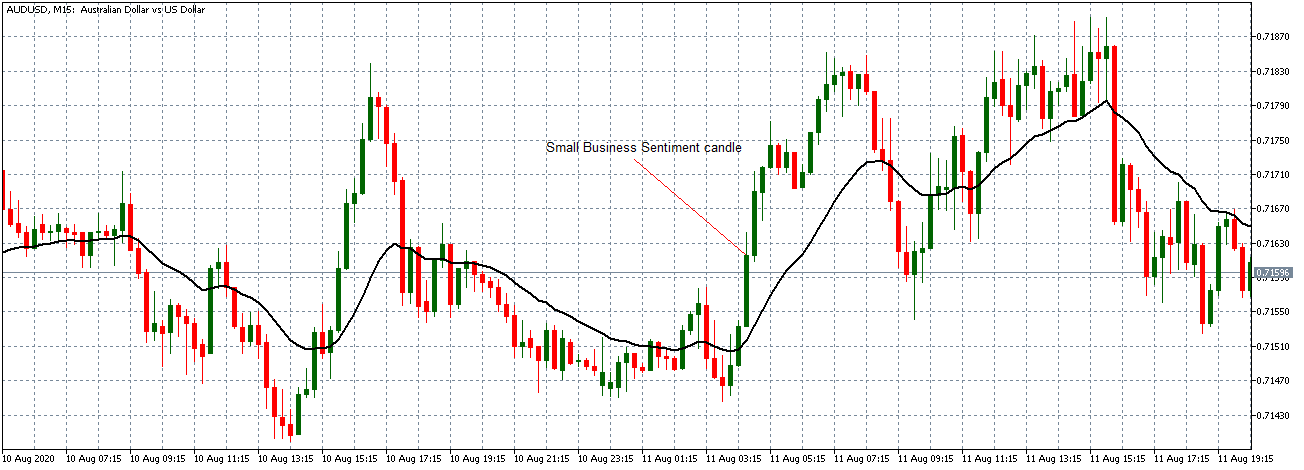

In the meantime, another possible reason people don’t enter a trade, when they otherwise think they should, is over-analysis. This is a bit counter-intuitive since analyzing the technical parameters that lead to a trade is pretty much the bread and butter of most traders. That said, there is such a thing as overthinking it. Some of us love nothing more than to get deep into understanding what causes a given currency pair to move the way it does and, for the most part, that makes us stronger traders. But there’s a flip side to doing too much research because the deeper you get and the more information you try to include, the greater the likelihood that some of that information is going to start contradicting itself. Sometimes you’ll have filled your head with so much reading about news events and looked at so many indicators that some of that begins to cause you to doubt yourself. And not only will you begin to doubt yourself, but you will also – just through the sheer act of spending so much time thinking and analyzing one trade – become too invested in it emotionally.

In the meantime, another possible reason people don’t enter a trade, when they otherwise think they should, is over-analysis. This is a bit counter-intuitive since analyzing the technical parameters that lead to a trade is pretty much the bread and butter of most traders. That said, there is such a thing as overthinking it. Some of us love nothing more than to get deep into understanding what causes a given currency pair to move the way it does and, for the most part, that makes us stronger traders. But there’s a flip side to doing too much research because the deeper you get and the more information you try to include, the greater the likelihood that some of that information is going to start contradicting itself. Sometimes you’ll have filled your head with so much reading about news events and looked at so many indicators that some of that begins to cause you to doubt yourself. And not only will you begin to doubt yourself, but you will also – just through the sheer act of spending so much time thinking and analyzing one trade – become too invested in it emotionally.