Introduction

The sales tax rate usually comes as an afterthought to many. But for forex traders, understanding how the rarely-talked about sales tax rate could prove useful in the long-run. This article defines what sales tax rate is and further shows how they impact a country’s economic development and, by extension, its currency.

Understanding the Sales Tax Rate

A sales tax rate is the percentage of the total cost of the goods or services being sold. Sales tax is a consumption tax that is imposed by governments or local authorities on the sale of goods and services. The sales tax rate is calculated as a percentage then added on the cost. These taxes are usually collected at the retail point of sale on behalf of the imposing authority.

As structured, any business that is offering goods or services is liable for the payment of the sales tax in a given jurisdiction. Depending on the laws, this occurs is they have a physical location within the jurisdiction, an official employee, or an affiliate.

How Sales Tax Work?

The sales tax is collected at the end of the supply chain, only after resale to the consumer has occurred. Since consumers are the ones paying the tax, businesses receive a resale certificate to show that the sales tax is not yet due. The purpose of this certificate to the resellers is to ensure that no sales tax is paid on purchases of items to be resold.

The administration for the sales tax is triggered by whether or not a particular business has a presence within the tax jurisdiction. To be eligible to collect sales tax from its customers, the business has to apply for a sales tax permit from the relevant authorities.

Depending on the jurisdiction, the goods and services that are eligible for a sales tax vary. Groceries and medications are exempt from sales tax, as are goods and services purchased by nonprofit organizations.

Sales Tax Rate as an Economic Indicator

The sales tax rate can serve as a leading indicator for the shifts in demand and supply within the economy. Higher sales tax rates reduce the purchasing power and, with it, the aggregate demand and aggregate supply. The lowered demand and supply within the economy result in reduced economic activities, which could have an unintended ripple effect throughout the economy. With lowered demand and supply, unemployment as a result of job cuts in the affected sectors is another unintended consequence of a higher sales tax rate.

On the other hand, lowering sales tax increases the purchasing power of consumers, which in turn increases the aggregate demand and aggregate supply. These increases lead to job creation in various sectors and boost a flourishing economy. With a lower sales tax rate, the GDP growth within the country is guaranteed to bring about a strengthening currency as a result of improved economic conditions.

How the Sales Tax Rate Affects the Economy

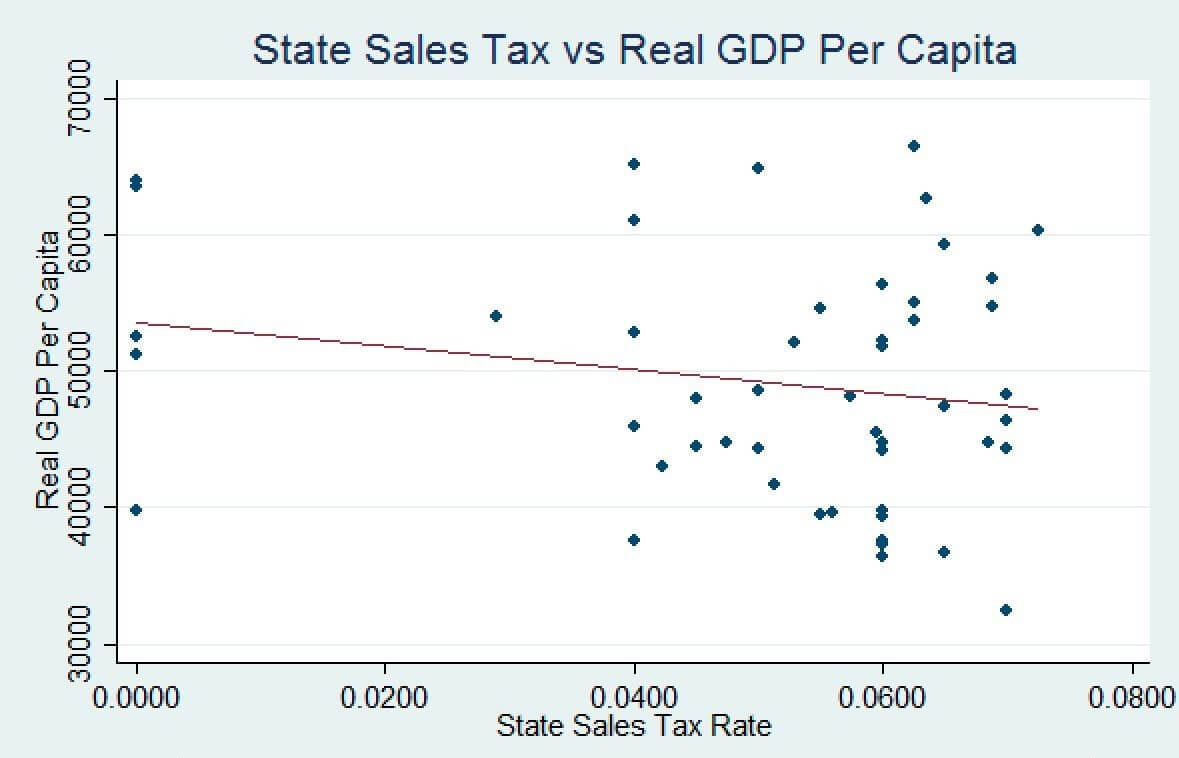

In general, the sales tax rate has a negative correlation with the GDP. This negative relationship is shown in the scatterplot graph below of the US state sales tax rate against the GDP.

Source: Georgia Tech Library

At its core, sales tax is a revenue stream for the government. Thus, it can be said that a higher sales tax rate increases government revenues. The increase in government revenues increases government expenditure, hence higher GDP. In this scenario, a conflict arises. This conflicts because sales tax is an extra cost passed on to the consumer.

Thus, in general, the sales tax rate reduces the purchasing power of the consumers. The reduced purchasing power leads to lesser sales taxes collected by the government, hence lower GDP. As a result of the diminished purchasing power, the consumers will spend less, resulting in a reduction in the aggregate demand within the economy. This reduction in demand leads to a reduction in the economic output hence lower GDP.

On the other hand, a lower sales tax rate returns some of the purchasing power to the consumers. They will spend more of their disposable income hence increasing the aggregate demand and supply within the economy. The increase in demand and supply increase the economic output. Furthermore, spending more implies that the government is bound to collect more revenue in the form of the applicable sales tax. An increase in revenue will increase the government expenditure within the economy, thus increasing the GDP.

How Sales Tax Rate Impacts Currency

The strength of any currency is usually seen as a direct reflection of its economic performance. As already discussed, the sales tax rate is considered to be leading indicators of aggregate demand and aggregate supply within an economy, and by extension, the unemployment levels. An increase in the sales tax rate will result in a drop in the aggregate demand and aggregate supply. This drop leads to increased unemployment levels and consequently reduced GDP. Long term currency traders can take their cue from an increased sales tax rate as an impending loss of strength in the country’s currency.

This loss in the currency’s strength can be brought by the expectations that, in the long run, central banks and the government will employ the use of expansionary fiscal and monetary policies to stimulate a stagnating economy. These policies harm the currency.

On the other hand, lowering the sales tax rate signifies that in the long run, the economy will be stimulated to grow. This growth is brought about by increased demand and supply. For forex traders, a country that is lowering the sales tax rate or entirely removing the sales tax can expect its currency to strengthen. The currency strength is because the traders can anticipate that in the long run, the government and the central banks may be forced to employ deflationary monetary and fiscal policies to avoid an overheating economy. These contractionary policies are good for the country’s currency.

Therefore, it can be expected that an increase in sales tax corresponds to a weakened currency against other pairs while a decrease in the sales tax rate corresponds to the strengthening of the currency.

How Sales Tax Rate News Release Affects The Forex Price Charts

The sales tax rate is not an indicator forex traders consider when placing their trades because it is a low-impact leading indicator. However, it is useful for forex traders to know just how much the impact of this low-level indicator is on the price charts.

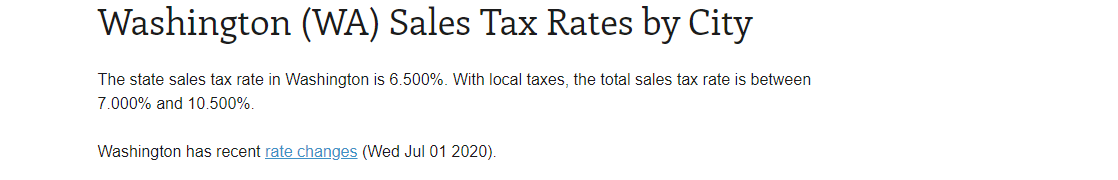

In the US, the national government does now impose the sales tax. However, the various local governments set their own local sales tax rates. The detailed list of the US states and the sales tax rate applicable in each state can be found on the Sales Tax Institute website. The data on annual GDP growth can be accessed from the World Bank website. A forecast of the sales tax rate through to 2020 can be found on the Trading Economics website.

Below is a screengrab of the Sales Tax Institute showing the most recent changes sales tax rate in Washington.

In the latest release, Washington state lowered the sales tax rate applicable from 8.0 % to 6.5% in an attempt to alleviate the strain on consumers as a result of the Coronavirus pandemic.

Now, let’s see how this news release made an impact on the Forex price charts.

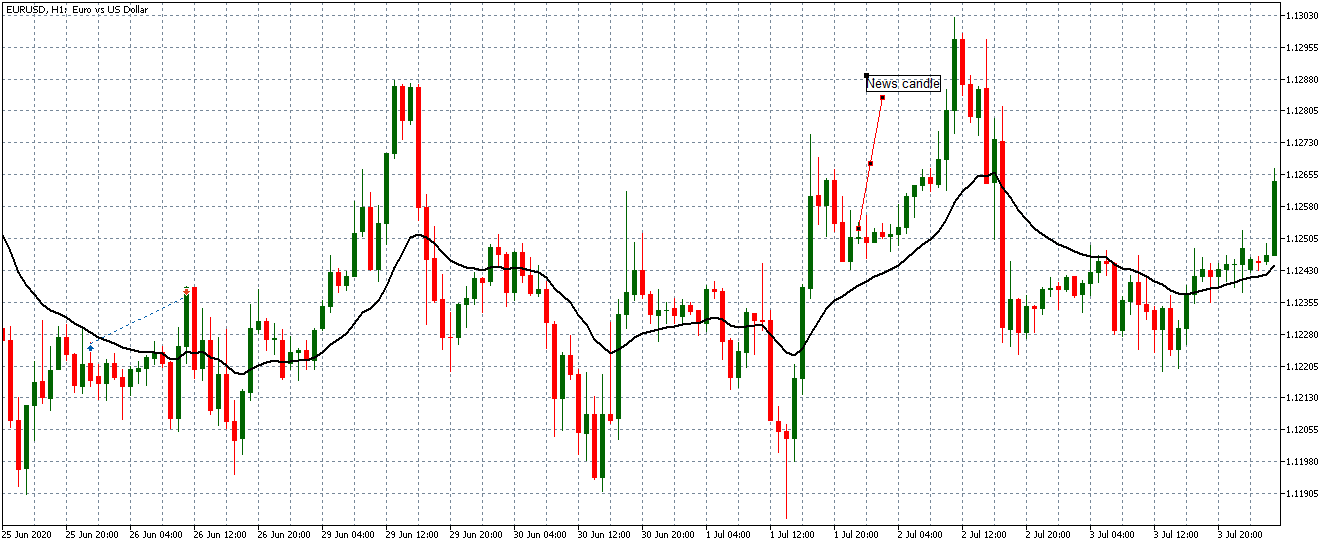

EUR/USD: Before Washington Sales tax rate release July 1, 2020

As can be seen in the chart above, we have plotted a 20-period Moving Average on a one-hour EUR/USD chart. From the chart, the pair is one a steady uptrend, represented by the candlesticks forming above the Moving Average. Before the news release at 1730GMT, the pair can be seen to be on a recovering uptrend. This uptrend can also be observed in the AUD/USD pair, as shown by the chart below.

AUD/USD: Before Washington Sales tax rate release July 1, 2020

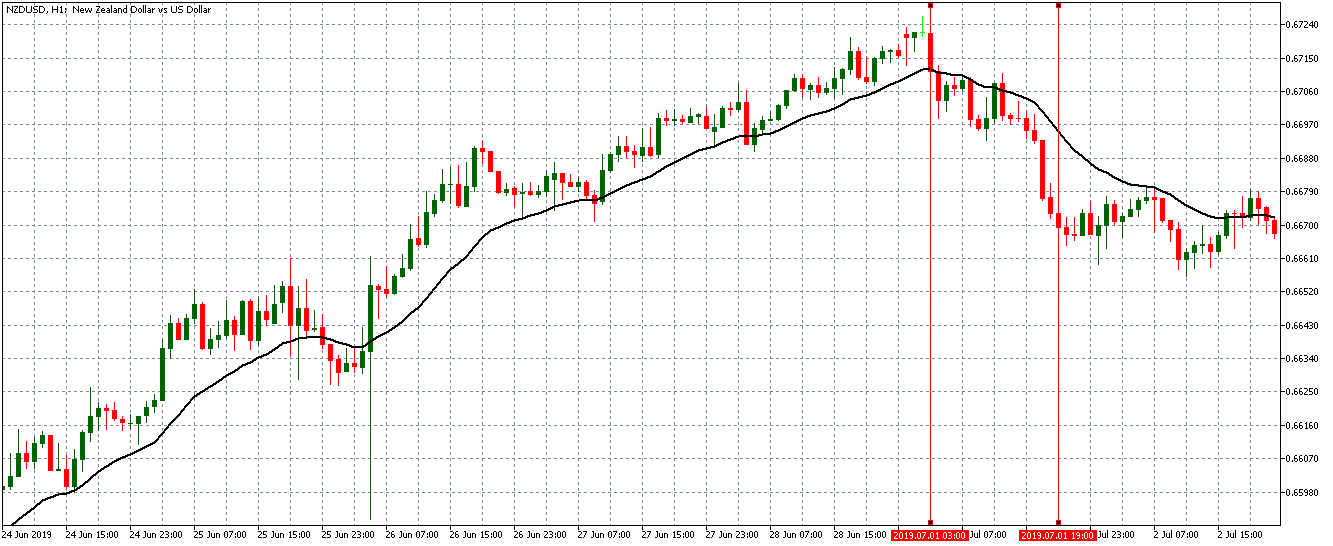

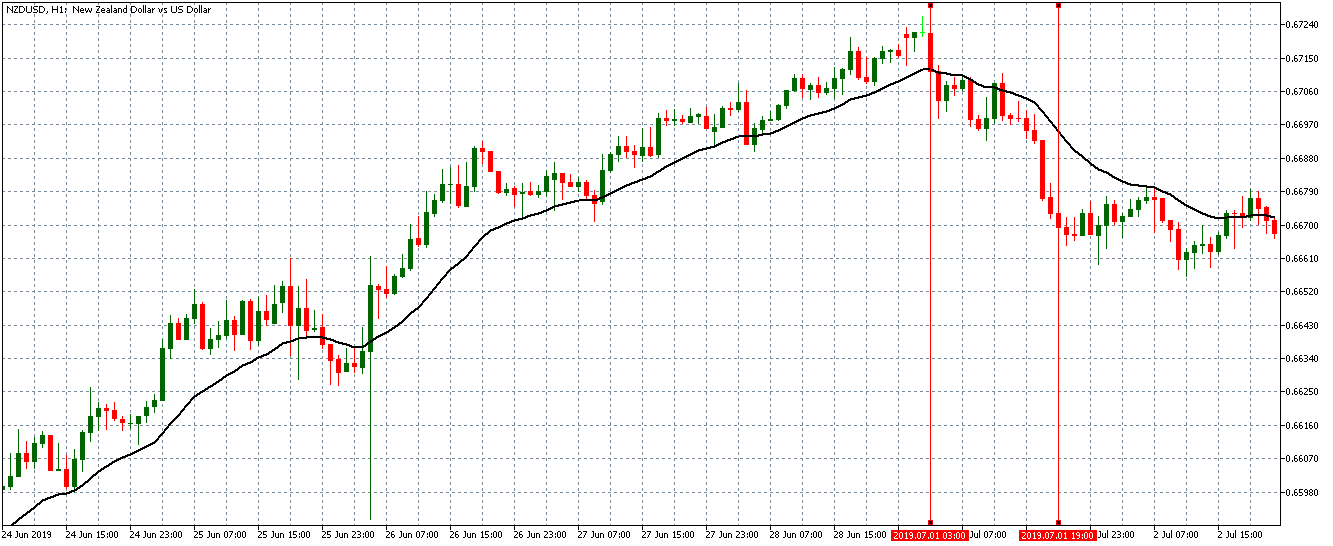

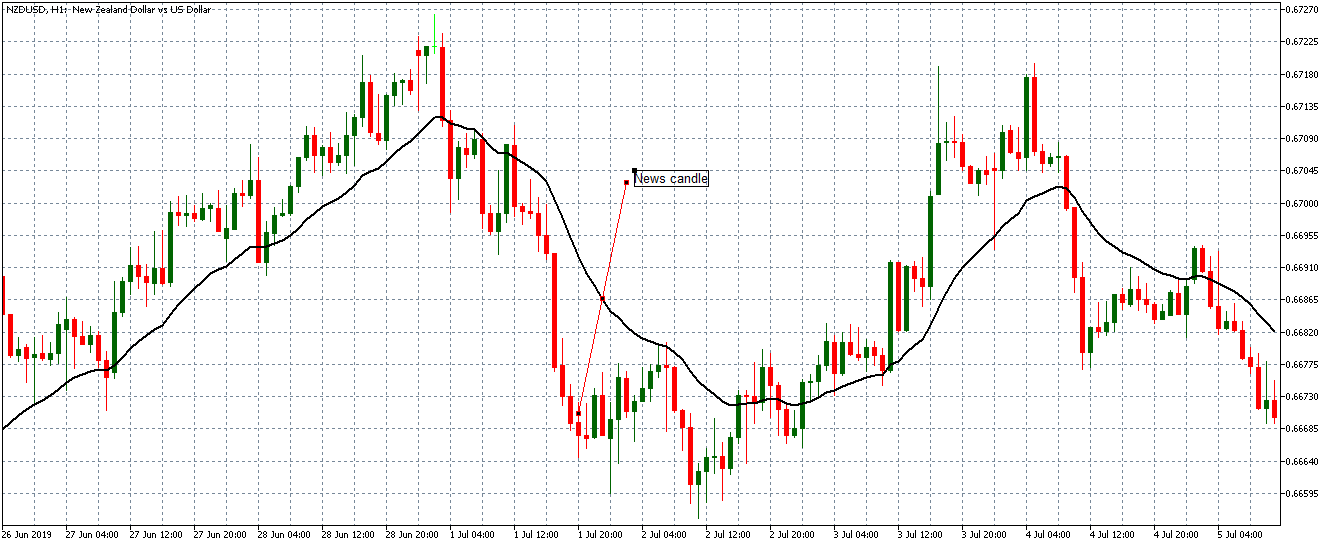

For the NZ/USD, the pair is on a steady downtrend for hours preceding the news release. This trend is shown in the chart below.

NZD/USD: Before Washington Sales tax rate release July 1, 2020

For long-term forex traders, the pattern offers an excellent opportunity to go long on the EUR/USD and AUD/USD pairs while short on NZD/USD, since the prevailing market trends would favor them. Let us now see how the price action responded to the release of the sales tax rate in Washington State.

EUR/USD: After the sales tax rate release July 1, 2020

Lowering the sales tax rate should have a strengthening effect on the USD. However, as shown in the chart above, the news release of the sales tax rate had no impact on the EUR/USD since the uptrend continued with the same magnitude as before. The same trend can be observed on the AUD/USD and NZD/USD pairs since the previous trends were no reversed. This trend is shown in the charts below.

NZD/USD: After the sales tax rate release July 1, 2020

AUD/USD: After the sales tax rate release July 1, 2020

It is evident from the after-news charts that the release of the sales tax rate does not have any impact on the price action. Although it is has a significant impact on the GDP, it is a low-level economic indicator in the forex market. Cheers!