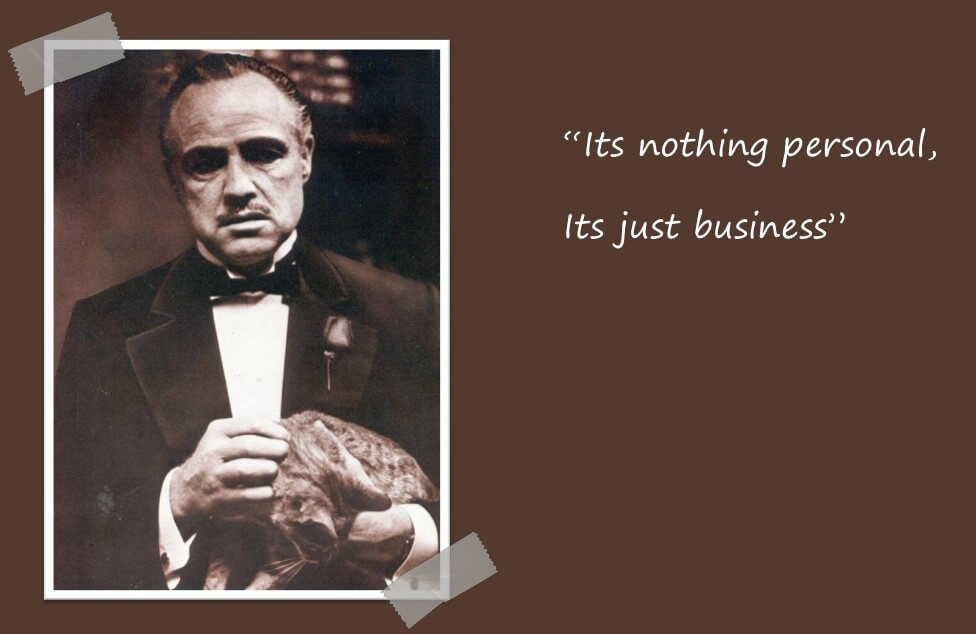

Let’s get this out of the way straight away, the markets do not care about you, when you take a loss, they are not doing anything against you, in fact, they do not even know that you exist. When you take the loss personally, it is only putting the rest of your balance, money and psychological well being at risk of collapsing.

It sounds a little extreme to call it a psychological collapse right? Well, the fact of the matter is that that is exactly what it is. When you take a loss and then take it personally, you are going to want to do whatever you can to get it back and to get even, but you are doing this against something that doesn’t even know you are there. If this was a football match, the opposition scored, it is perfectly normal and fine to want to get even, in fact, that would be the entire aim for the rest of the match until you do. However, for trading, this is not the case, if you make a loss, your main aim is not to simply win that money back. It is to continue with your current strategy and not to let that loss get the better of you.

You need to be able to separate the feeling of a loss and the fact that someone did it against you with the idea that it is simply part of your strategy. Losses should have been built into it and so they should not be taken personally, as soon as you look at it in a way that the markets purposely hurt you, things will only begin to go downhill.

Trading can be hard and you will make losses, a lot of them, there are no traders that do not make losses, what is important is that you do not see them as a failure, they are not personal failures and you should not treat them like they are. A single loss means very little in the long run, by following your trading plan you will be able to make back the money lost very quickly. These feelings of things being personal only really come from a loss when you win, the strategy is working and that is it, but when you lose, you must have done something wrong, which is a long way from the truth. You will feel frustrated, you will feel like it was your fault and that can lead to some very bad decisions on your next few trades, decisions that could potentially put the rest of you account in danger.

Some that knee jerk reaction is always the wrong one, but what should you be doing? Your reaction to a loss should simply be that you want to find out why it lost, there is often a logical explanation (although at times the market can be a little crazy). Review what happened, find what went wrong so you can try to avoid it in the future. As soon as you make rash decisions you will make further losses, then more and more until you are done, analyse and look at things calmly and you will be able to work out and avoid similar losses, of course, that is often easier said than done when you have just lost some of your money.

When you experience your first loss it can be hard when you experience your first consecutive loose sit can be even harder, but you need to be able to look at them as learning experiences. Someone who has the experience of losses will be able to look back at what they die after the losses, was their ration right and do they resolve anything, looking back and using past experiences can allow you to better overcome any future ones. Did you manage to recover? The fact that you are still trading tells us and you that you did, so you will be able to again. Use past experiences to help you get over current ones.

We have mentioned how regular losses will be, everything one should be helping you to improve the way that you are able to cope with them, making it easier for you to get past them. Again, losses will happen, it is important that you are able to deal with them without letting your emotions and feelings get the better of you.

If things are getting a little tense, take a step back, move away from the markets in order to clear your mind. Come back with a clear head and then do not just start trading again, instead look back to the loss and try and work out why it happened, with a clear mind you will be able to look at it without feeling that it was personal and so it will be easier for you to work out how you can deal with it in the future and how to avoid getting caught up emotionally in the losses.

Remember, the markets are not there to hurt you, they are not there to take your money, there will be wins and there will be losses, working out how to deal with the losses is a vital part of trading, just remember that the markets are not targeting you and your losses are not personal, they are just part of what trading really is.