Introduction

There is a lot of buzz in the Forex industry about the ten-pip a day strategy. We have seen both experienced and novice traders getting excited about this strategy. So we decided to talk in detail about this topic in today’s article. Some expert traders believe that it’s not possible to make ten-pip consistently in the market, while many others say it is possible.

In reality, it entirely depends on the person’s trading skills, mindset, and experience. Traders need to adapt themselves to the market situations to be successful. Making ten-pip a day is a great way to accumulate wealth in the Forex market, and it is easily possible. All we need is to master our skills to the point where we exactly know when to take a trade and when not to.

Statistics say that it’s not easy to make consistent money in the Forex market, and the losses are a part of the game. This is true to an extent, but if we practice this strategy enough on a simulator, we can easily make ten pips a day no matter what. In this article, let’s understand how to make ten pips per day in the Forex market by using five different buy and sell examples of five trading days in a week.

Trading Strategy For Making 10 Pips A Day

’10 Pips A Day’ – The idea behind this term is to stop trading for the day right after making ten pips that day. Also, it is up to you to follow this idea or not. You can stop trading after making ten pips, or you can ignore that and go for 20, 30, or even 100 pips a day according to the market situation.

But only go ahead if you are 100% confident about the markets. In case of any tiny bit of uncertainty, make sure to exit right after you make ten pips. One critical aspect of this strategy is selecting the currency pairs. One must be professional enough to understand the market situations and pick the pairs where there is a minimum potential of making ten pip profits.

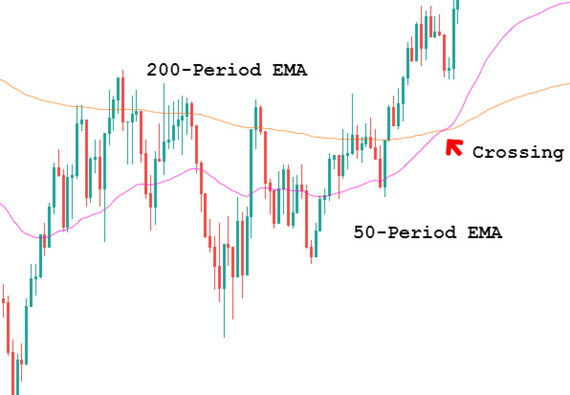

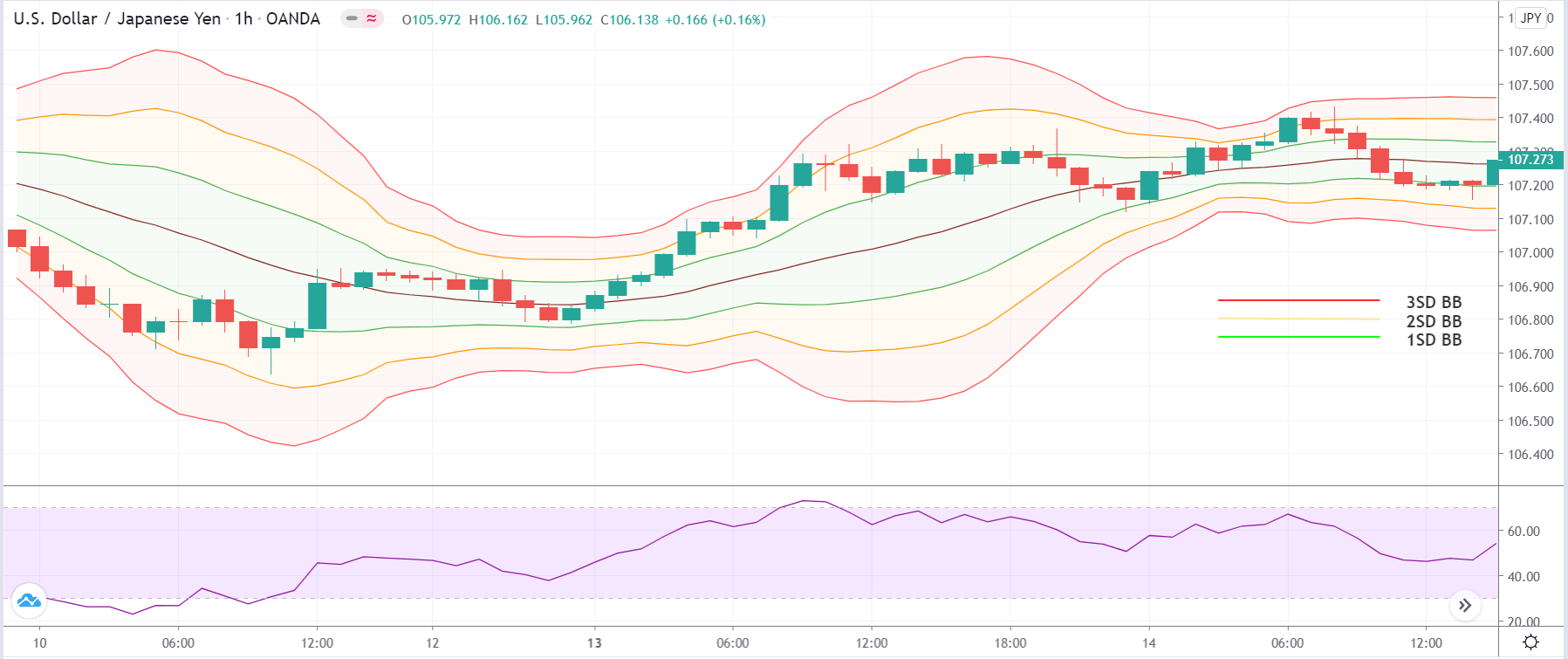

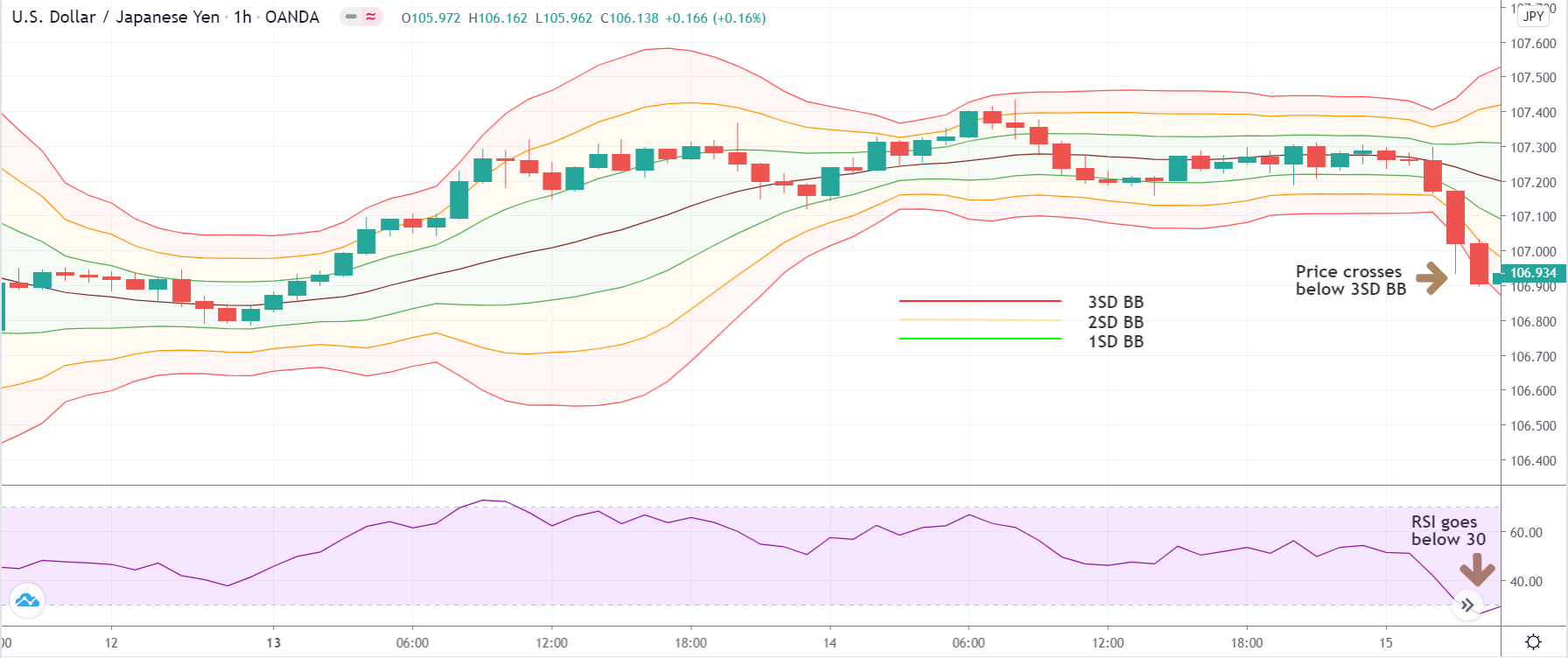

Pairing The Bollinger Bands With The Stochastic Indicator

Rules For Going Long

- The market must be in a strong uptrend.

- Wait for the price action to slowdown at the lower Bollinger Band.

- Let the Stochastic Indicator reverse at the oversold area.

- Only go long if the above two rules are satisfied. Also, consider the momentum of the price.

- Place the stop-loss just below the lower Bollinger Bands.

Now, to understand how this works, we have taken five different trades for five trading days in the last week of Feb 2020 and have generated 10, 20, and 30 pips in the market successfully. According to this strategy, conservative traders must stop trading after making ten pips for that trading day. But, if you are an aggressive trader, go ahead for bigger targets. Let’s get into the examples.

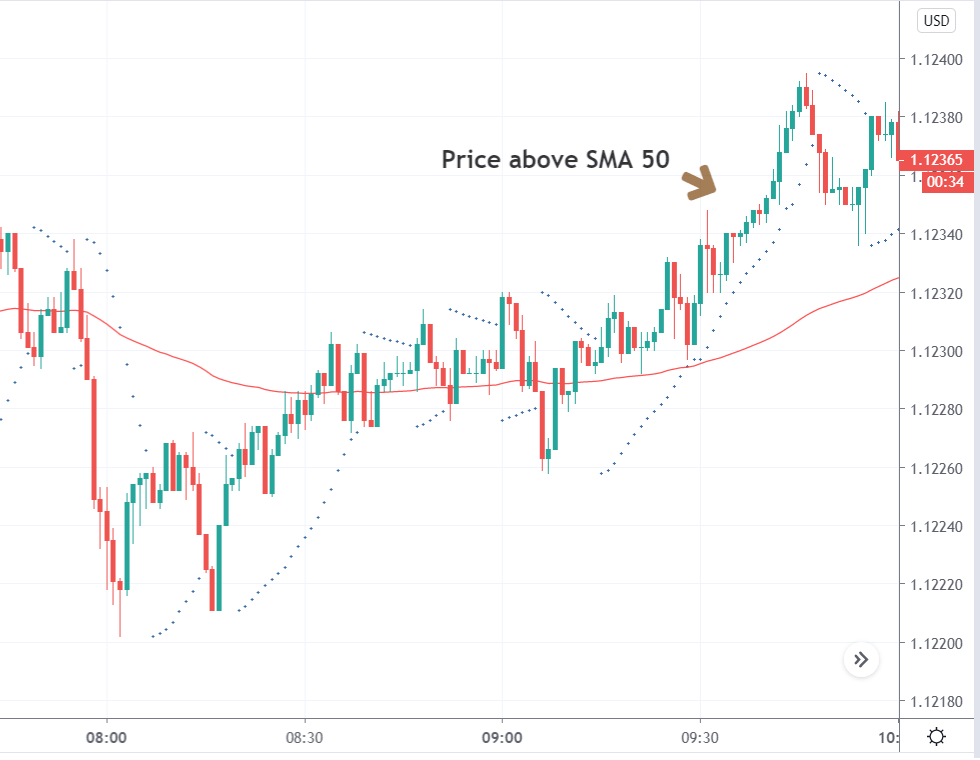

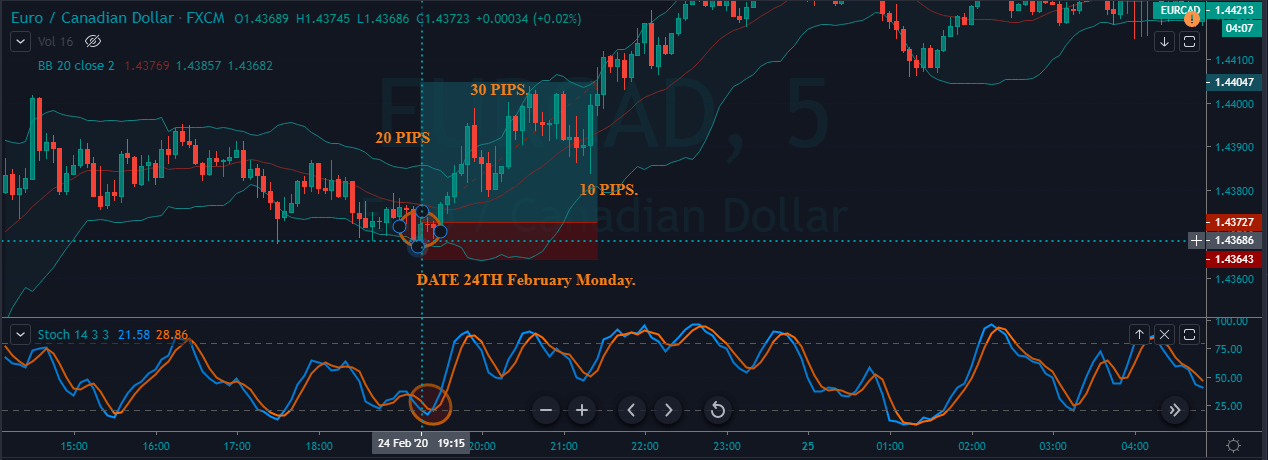

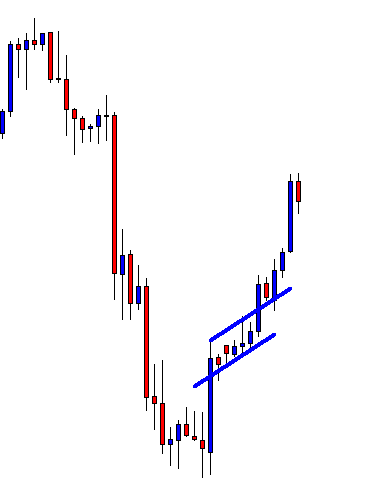

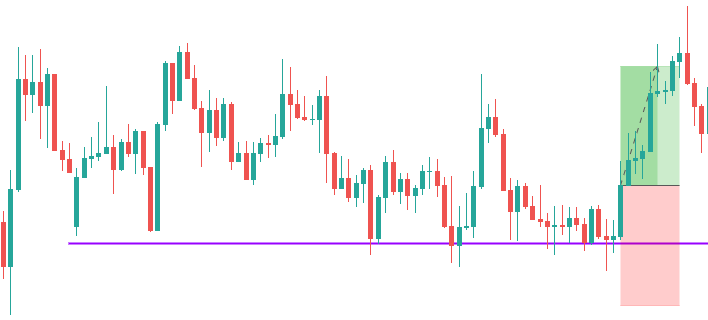

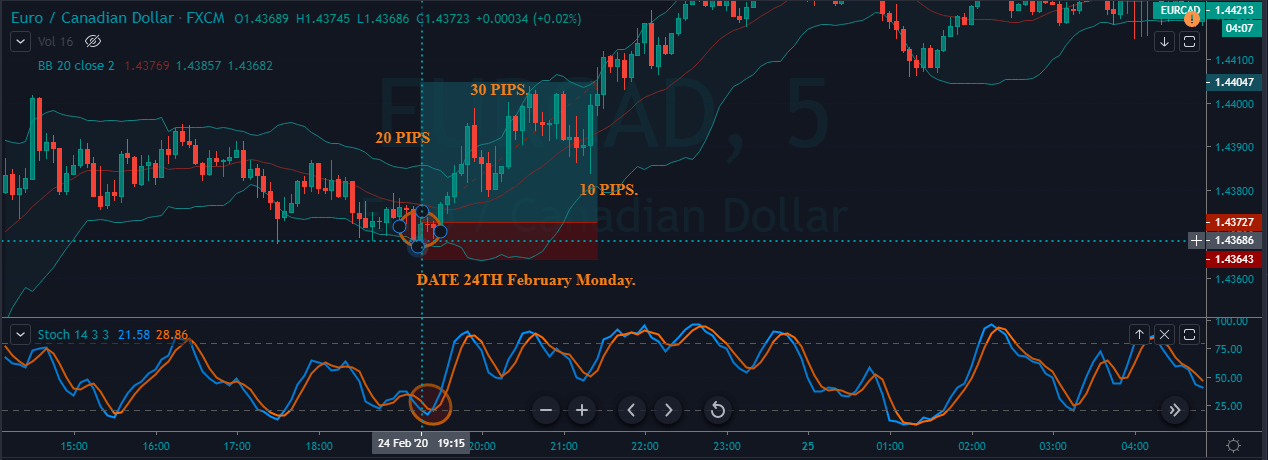

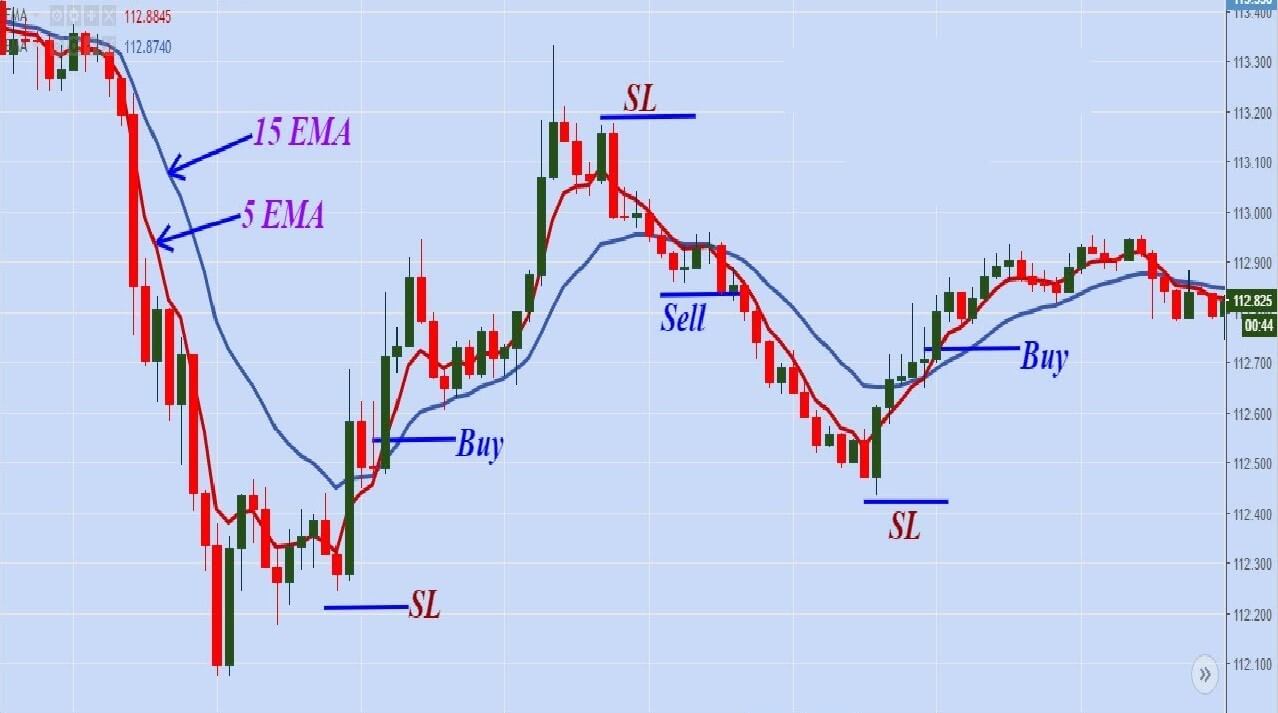

Monday Trade

The below chart represents a buy trade in EUR/CAD Forex pair. When all the rules mentioned above are met, we took a long position in the New York Session on 24th Feb 2020. Our stop-loss is placed right below the lower Bollinger Band.

We have gone for three different targets according to the market situations and predominant S&R levels. As mentioned, exit the trade as soon as you make ten pips if you are a conservative trader.

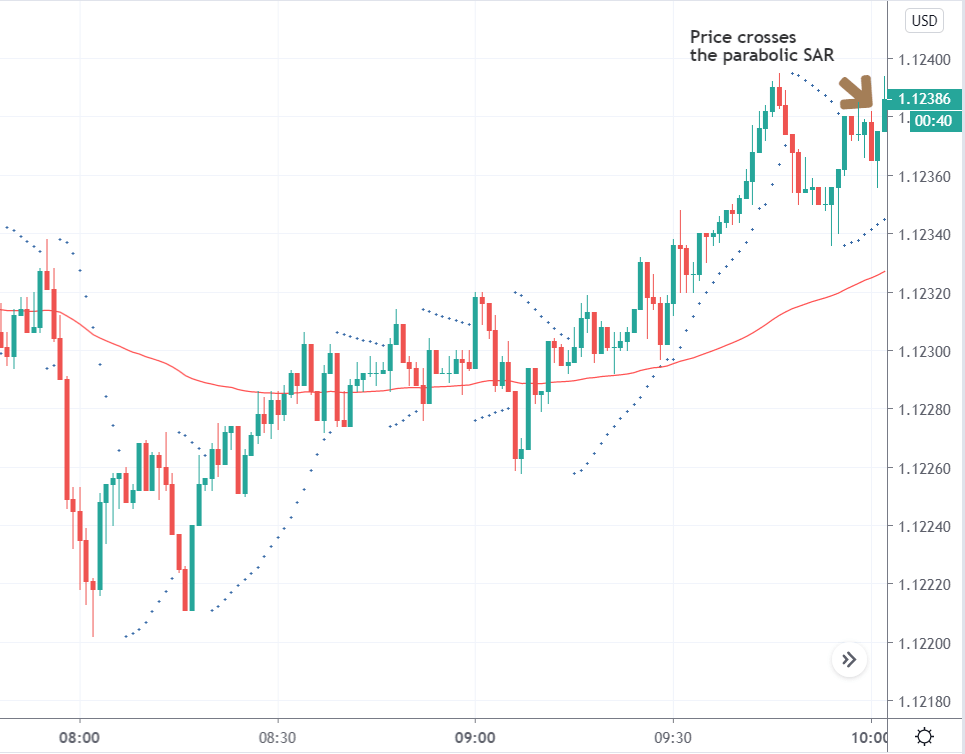

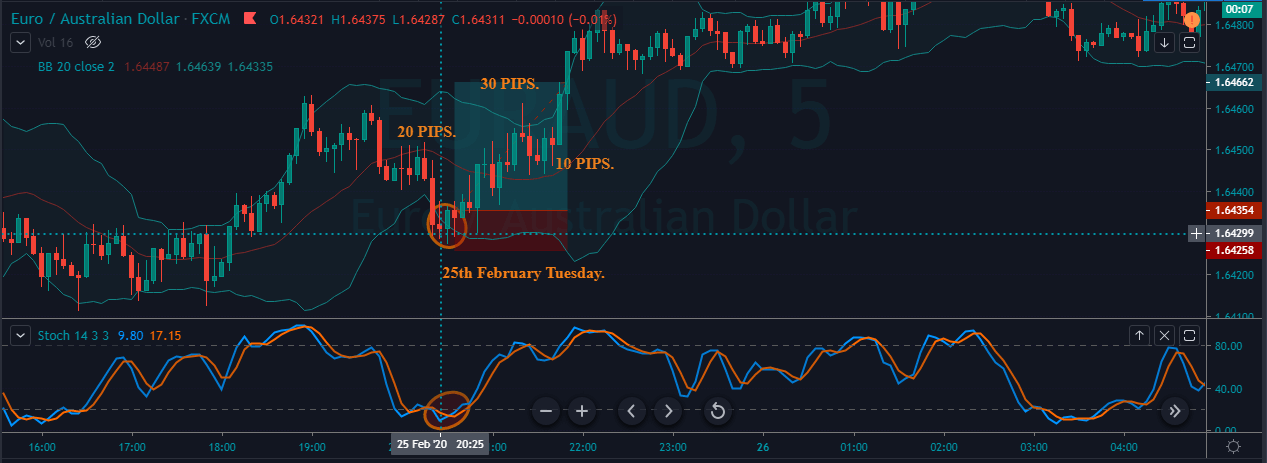

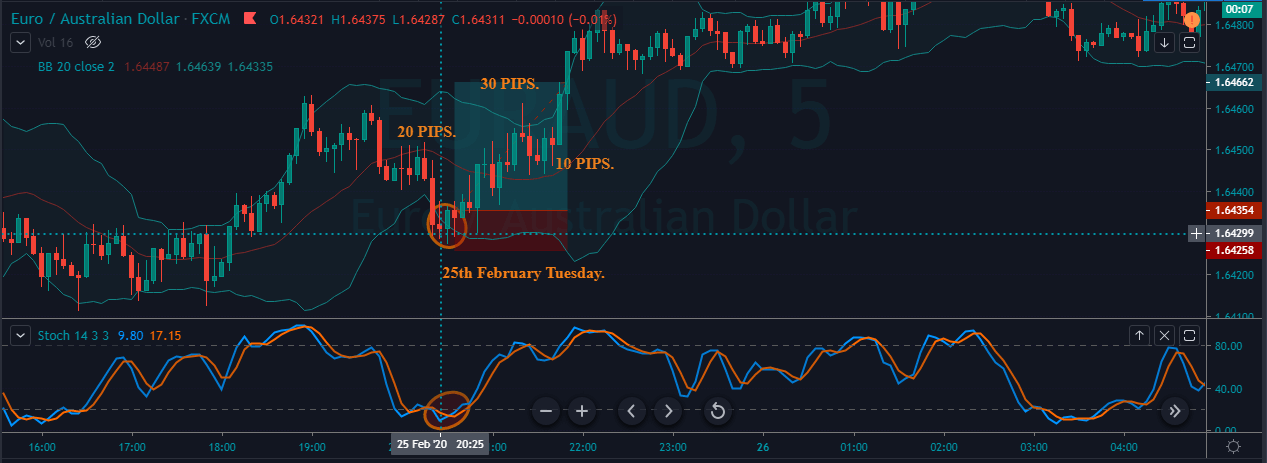

Tuesday Trade

For the second day, we have picked the EUR/AUD Forex pair as we identified some potential market moves. We have gone long on this pair in the New York session on 25TH Feb 2020. We can clearly see both the indicators indicating a clear buy signal.

Here, we have gone for the third target and exited the trade as soon as we made 30 pips.

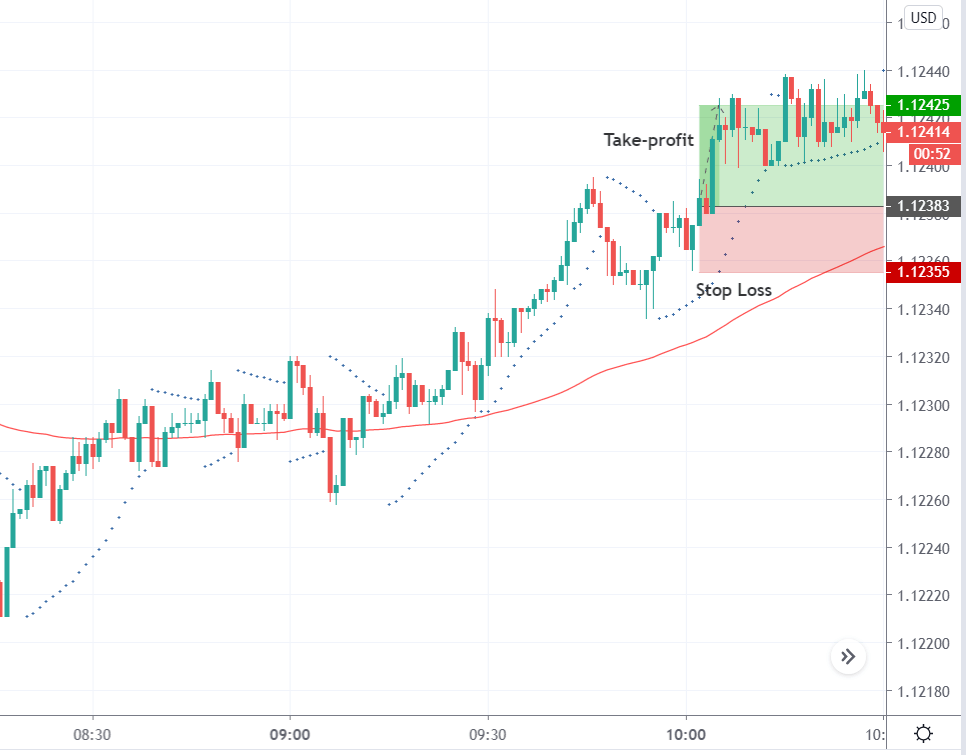

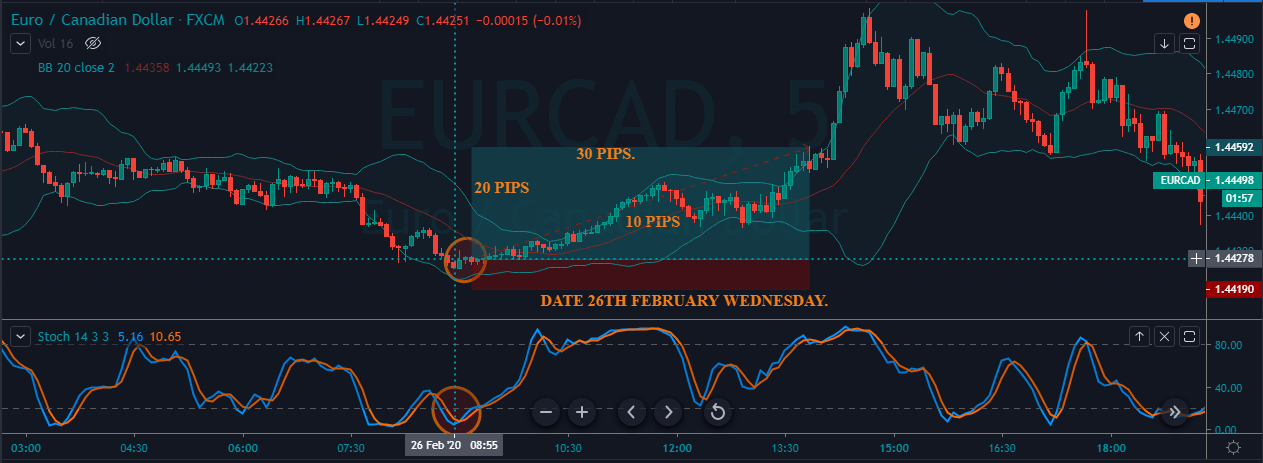

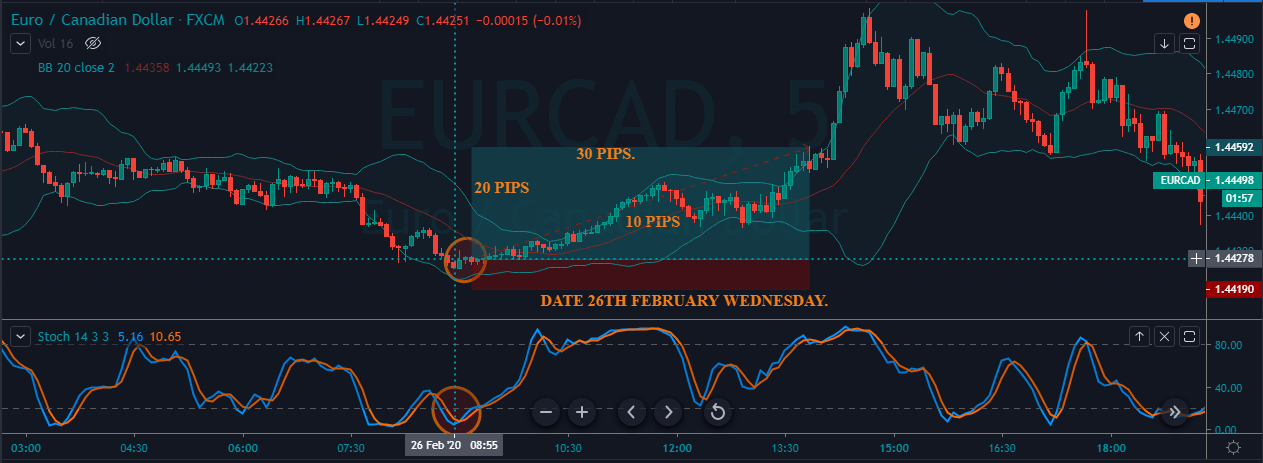

Wednesday Trade

Our third trade was in the EUR/CAD Forex currency pair in the Asian session on 26th Feb 2020. When prices hit the lower Bollinger bands, and the Stochastic indicated the oversold market conditions, we went long on this currency pair.

We would have exited the trade at ten pips, but the market started printing continuous bullish candles, which made us wait for the prices to hit the third target.

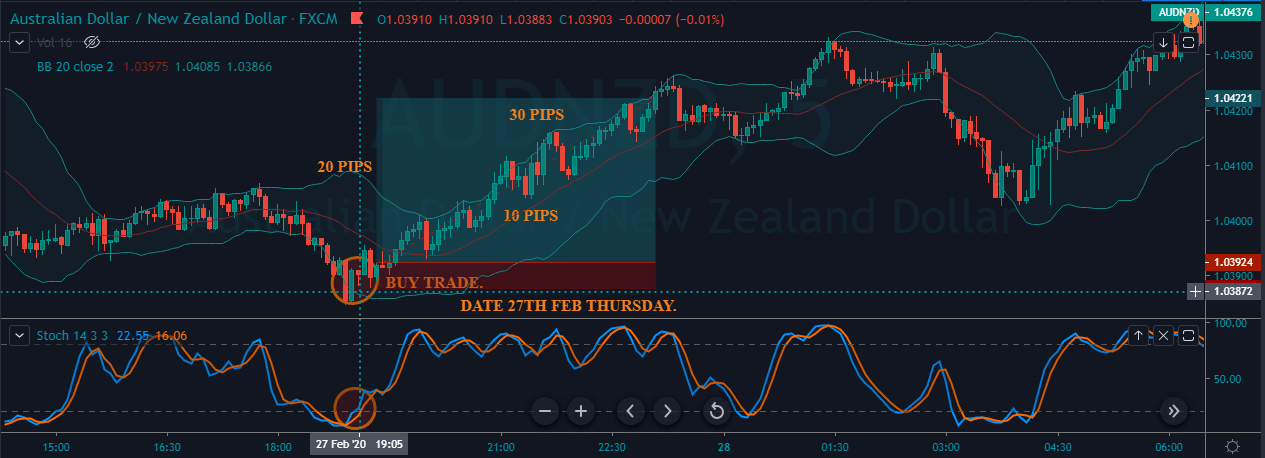

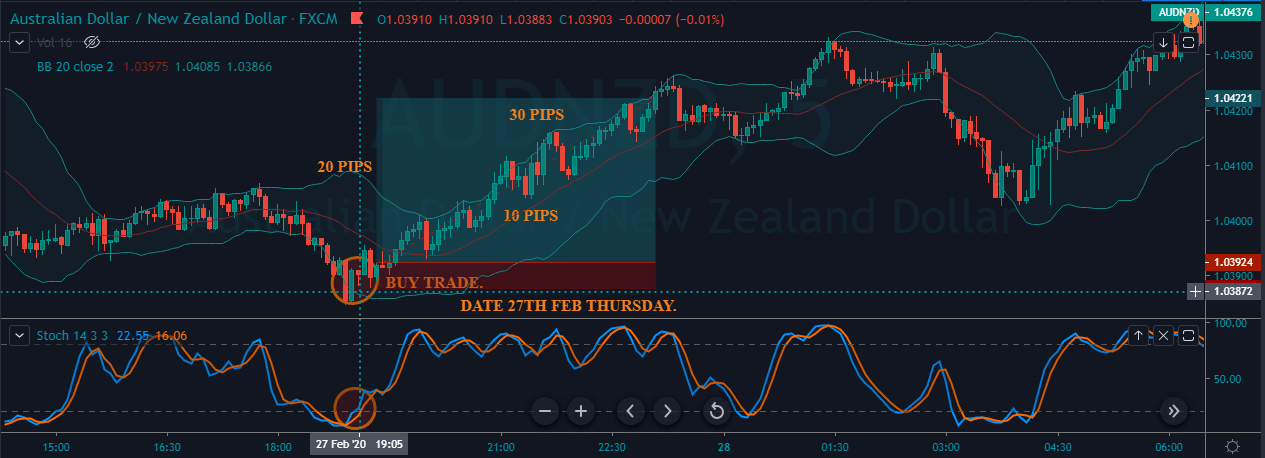

Thursday Trade

On the 4th day (27th Feb 2020), we took a long position in the AUD/NZD Forex pair. The entry was at the point where the prices touched the lower Bollinger Band, and the stop-loss is placed just below the recent low.

Since the higher highs were getting continuously printed, we went for the third target and exited the trade as soon as we made 30 pips.

Friday Trade

For the Friday trade, we chose the AUD/NZD Forex pair. We went long in the Asian session on 28th Feb 2020. When both the indicators lined up in one direction, it is a clear indication that the sellers have given up, and now it’s time for buyers to lead the market.

We had exited at the third target even when the market was moving up north.

Rules For Going Short

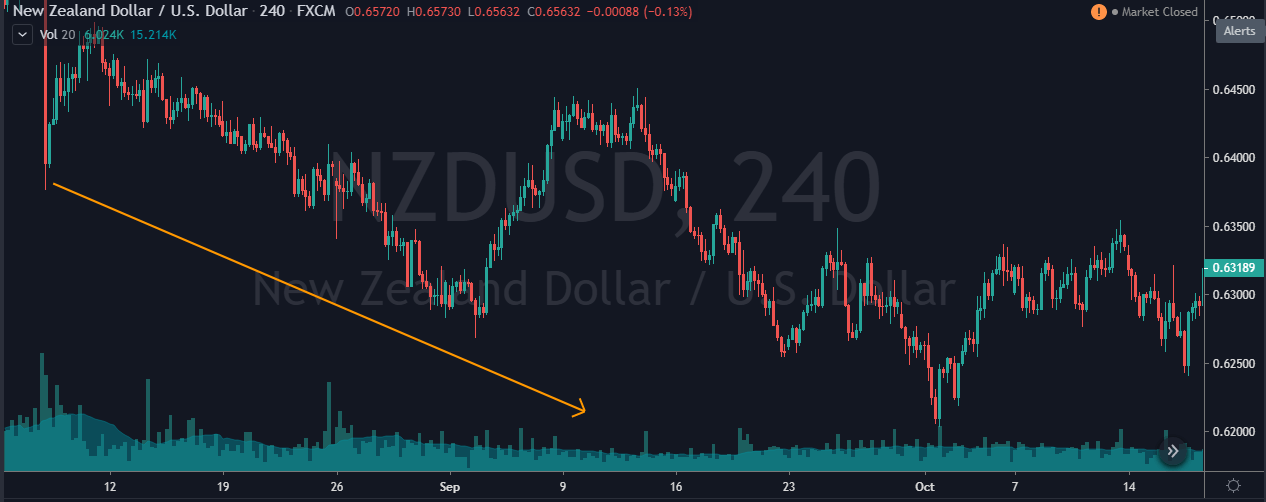

- The market must be in a strong downtrend.

- Wait for the price action to slowdown at the upper Bollinger Band.

- Let the Stochastic Indicator reverse at the overbought area.

- Only go short if the above two rules are satisfied. Also, consider the momentum of the price.

- Place the stop-loss just above the upper Bollinger Band.

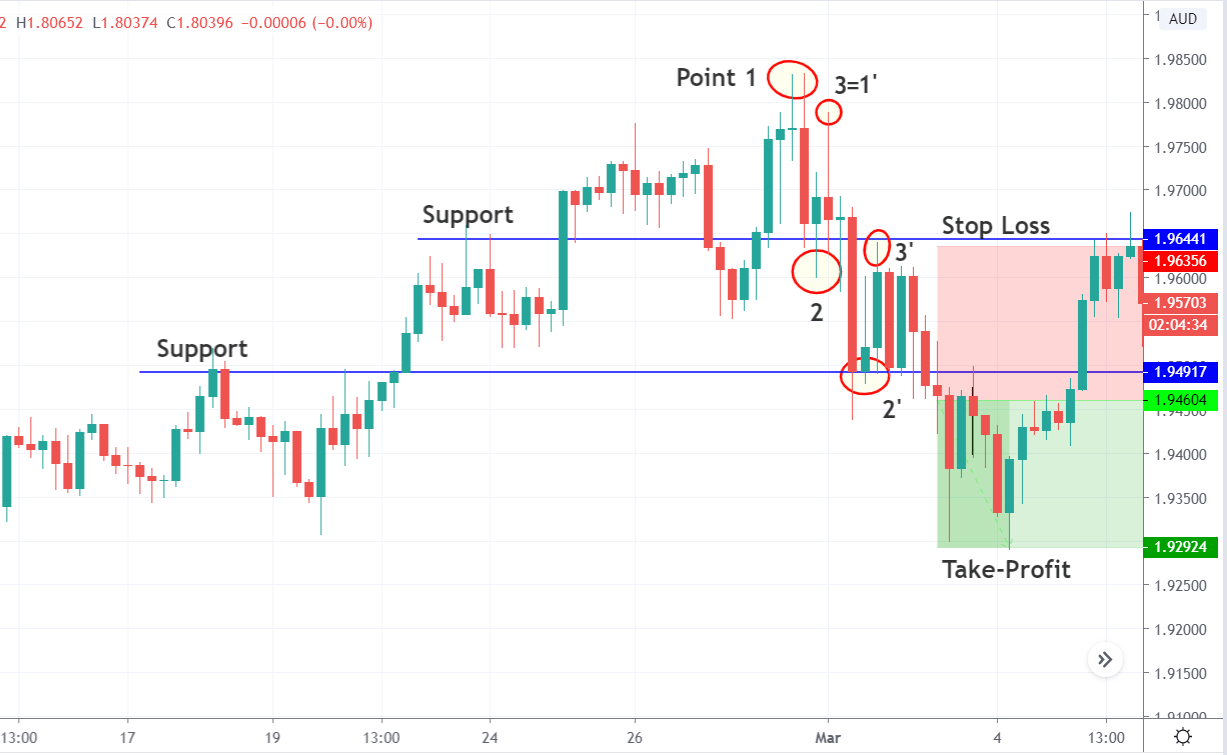

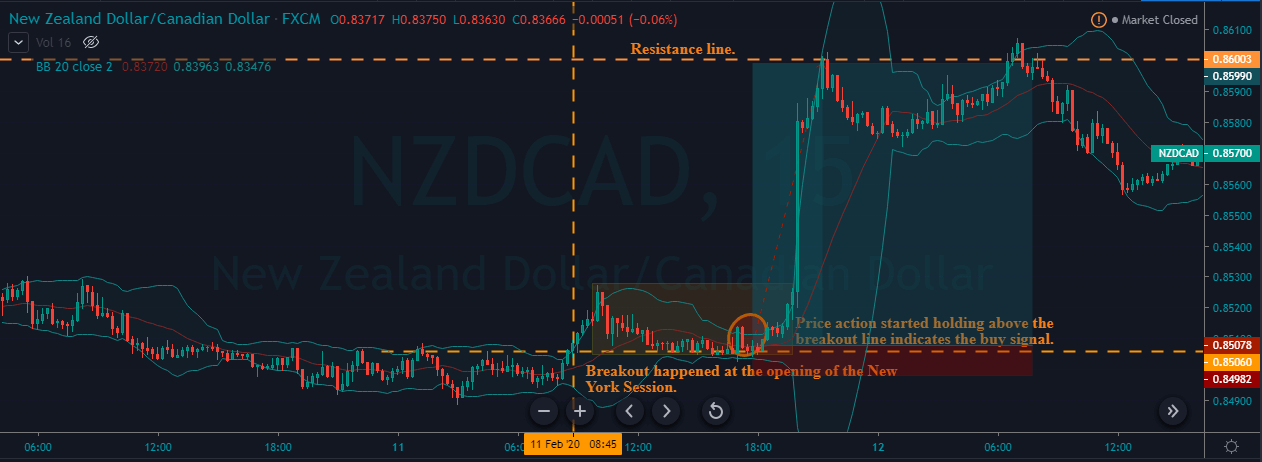

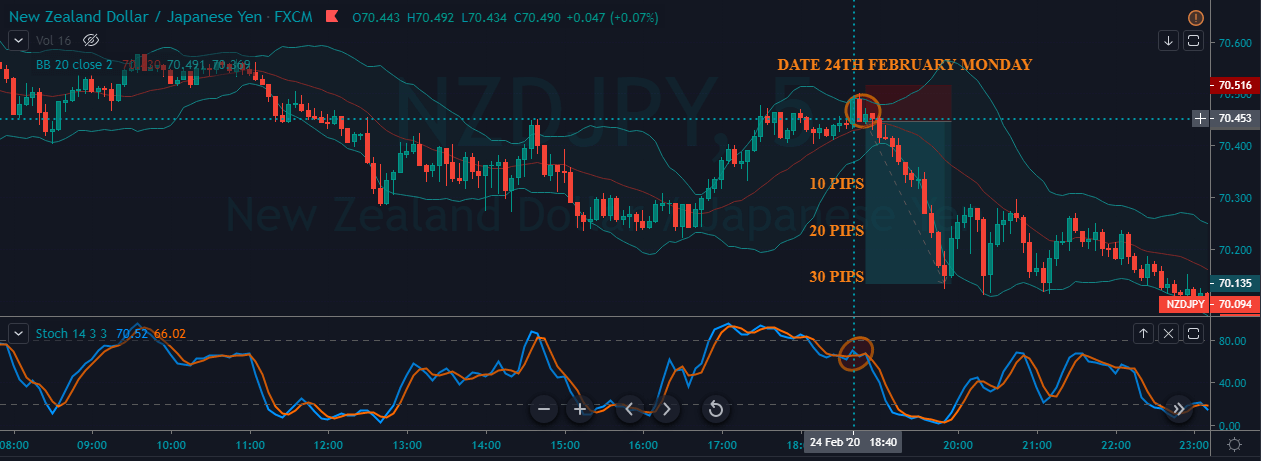

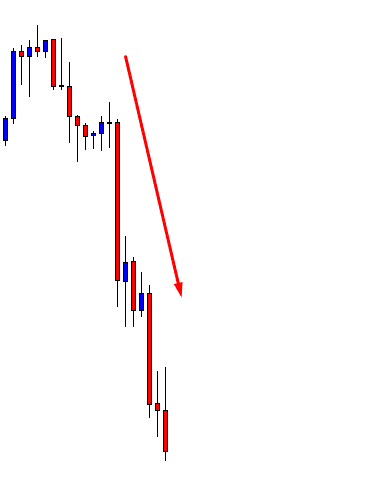

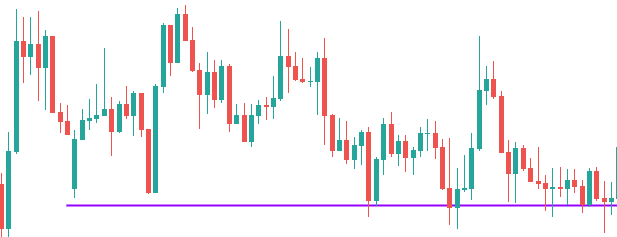

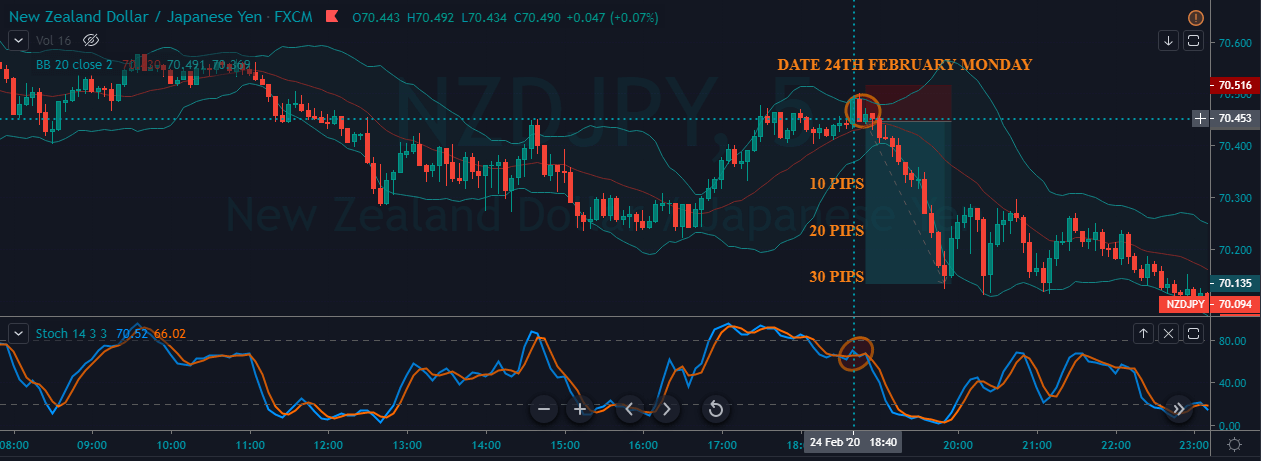

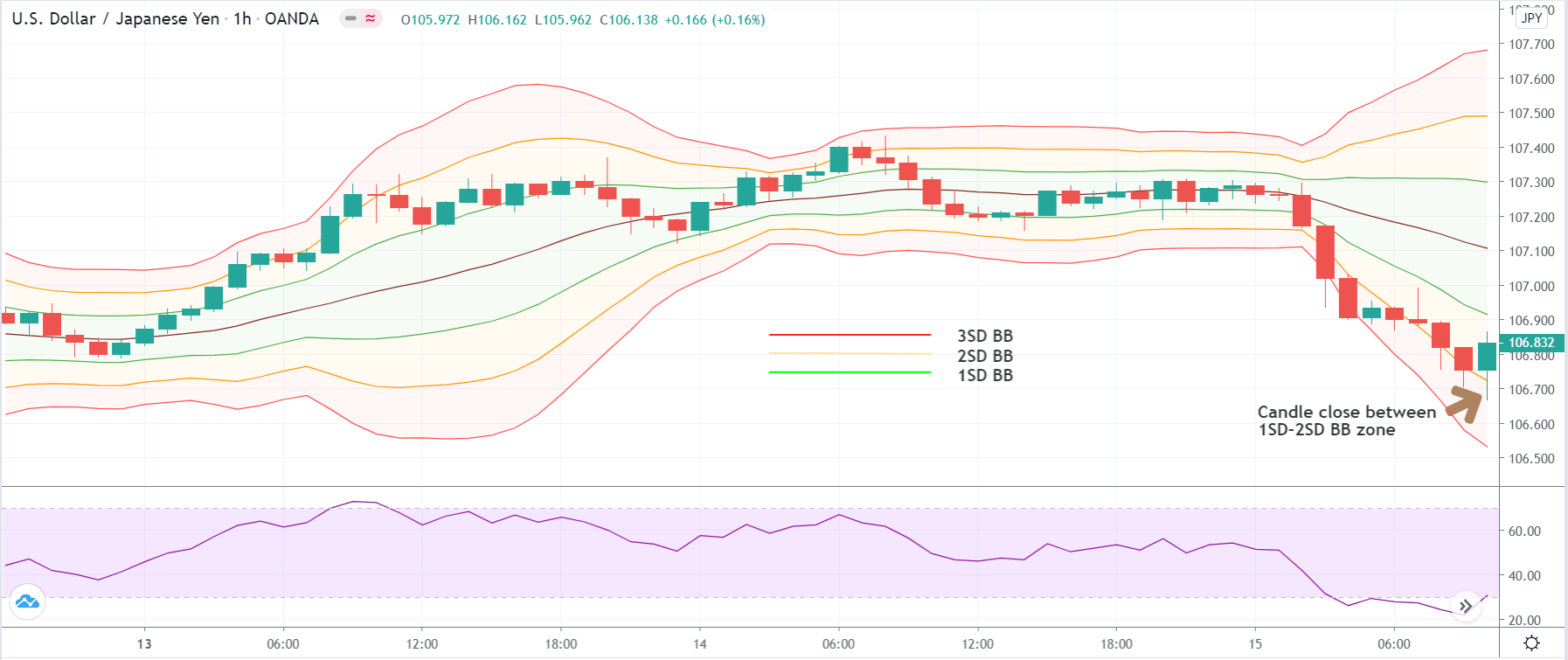

Monday Trade

The below chart represents the first sell trade we took in the NZD/JPY Forex pair on the 24th Feb 2020. We went short when the price action hit the upper Bollinger band, and the Stochastic indicated the overbought conditions.

The stop-loss is placed just above the upper Bollinger Band. We have gone for the third target, and the market printed a brand new lower low.

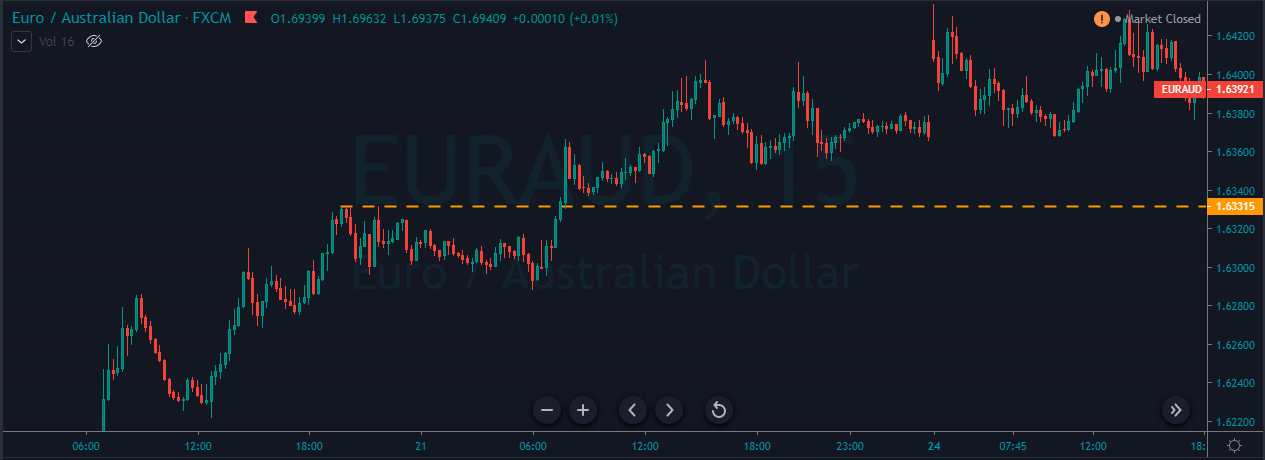

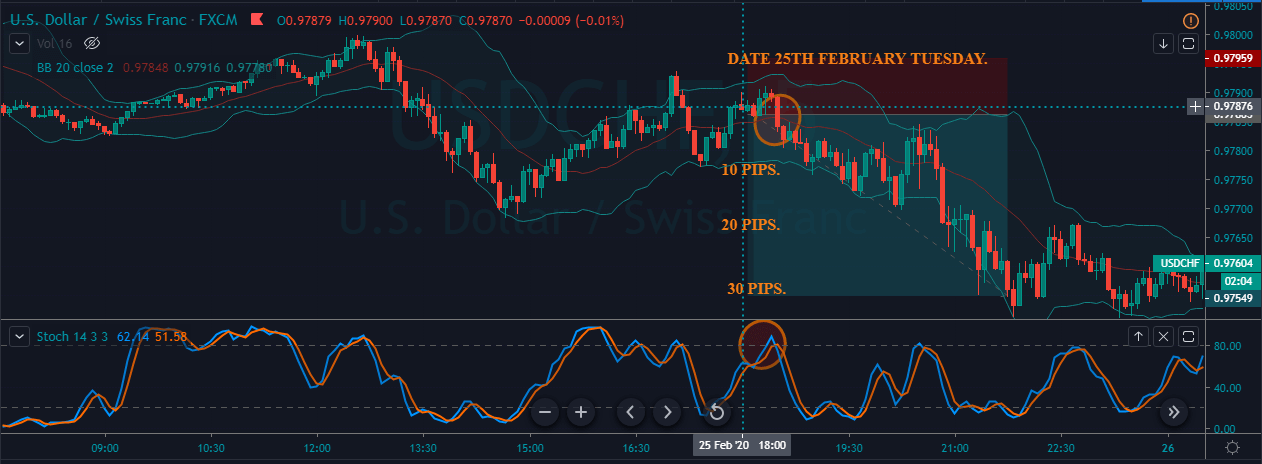

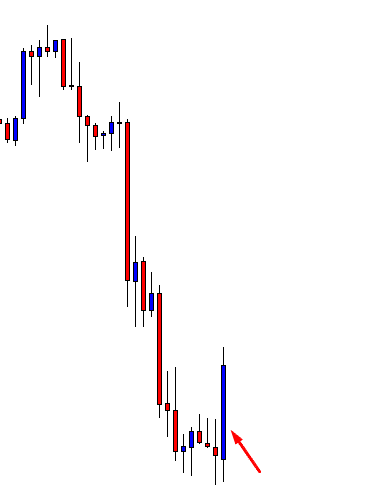

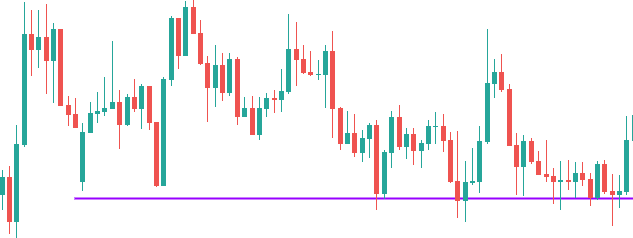

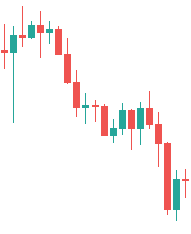

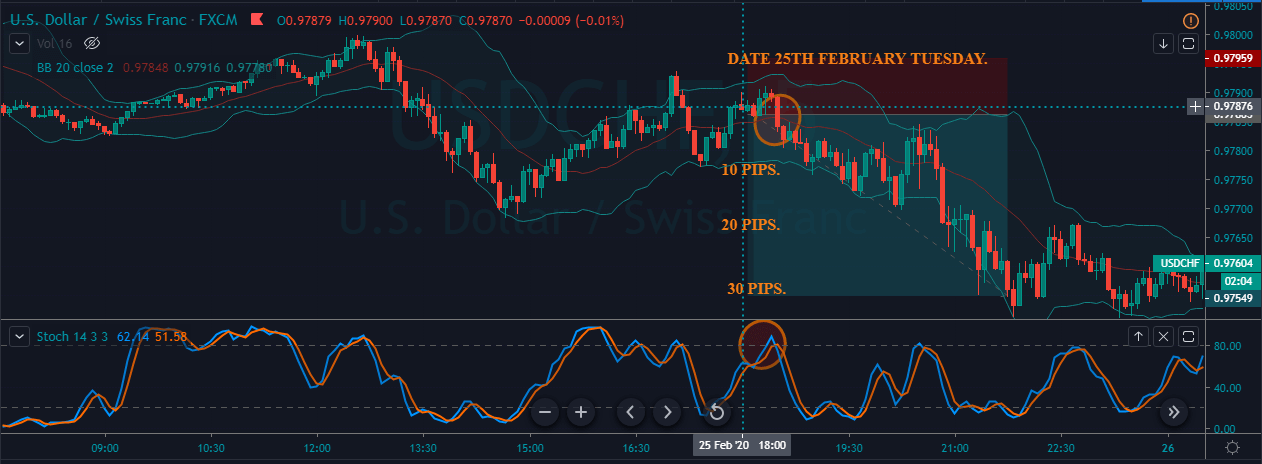

Tuesday Trade

The below image represents the USD/CHF Forex pair. This pair was in an overall downtrend, and on 25th Feb 2020, we have activated the sell trade right after our sell criteria is met.

We can see the market reaching all of our targets in just a couple of hours.

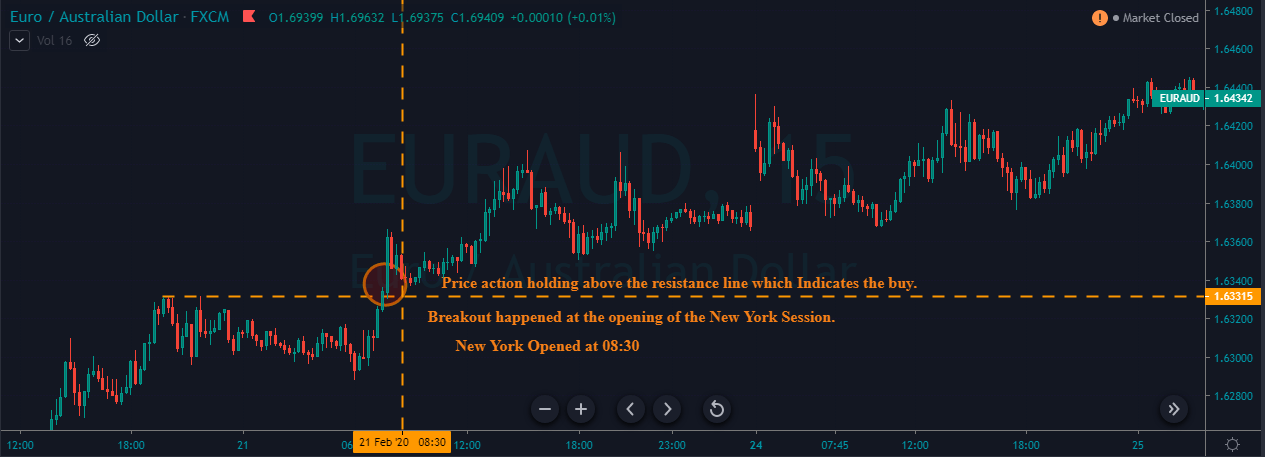

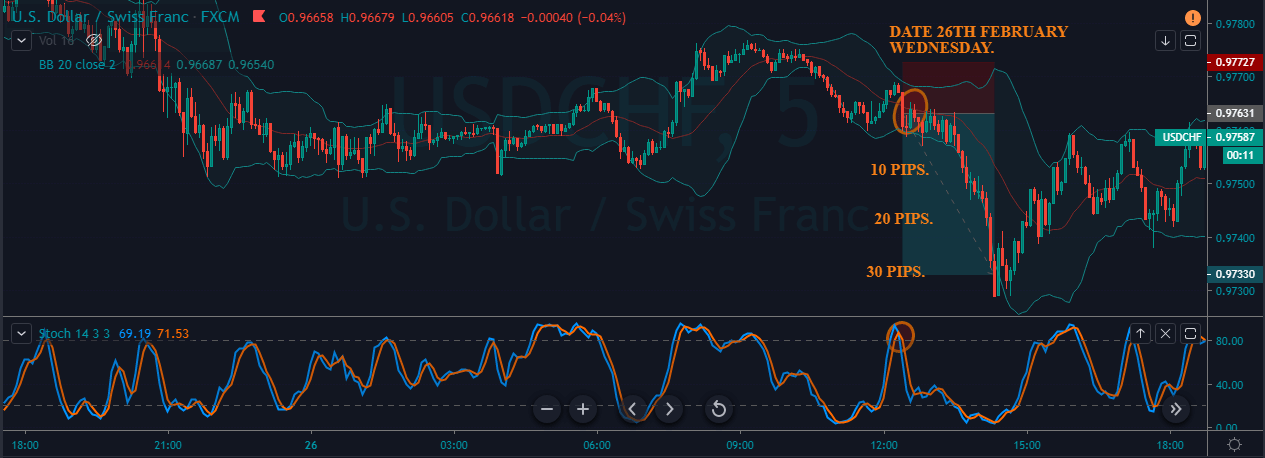

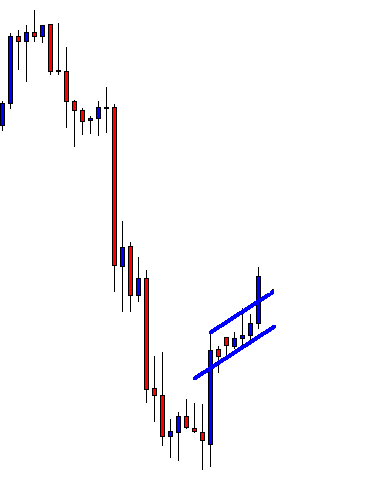

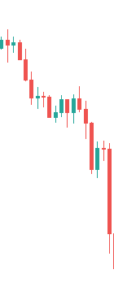

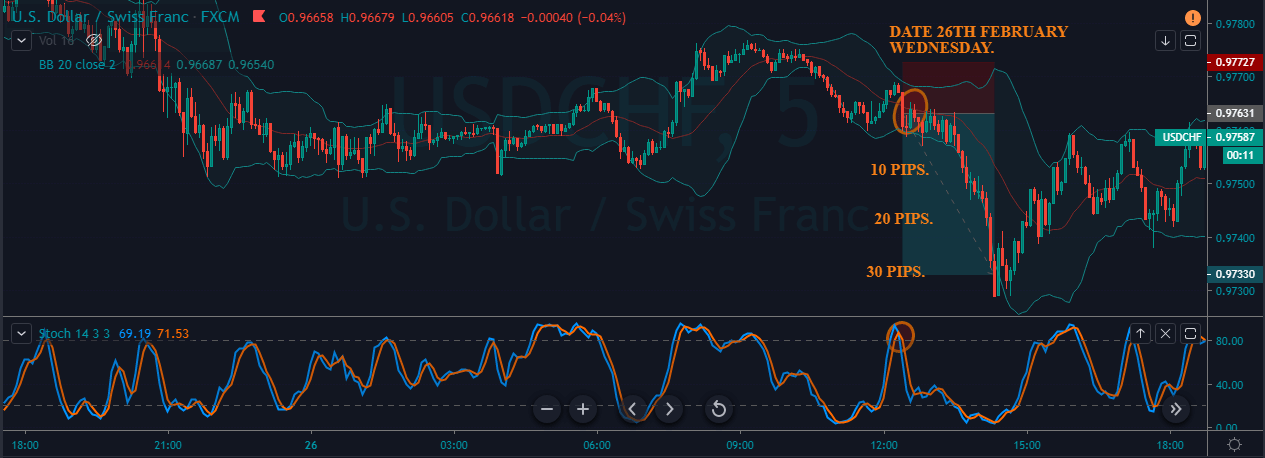

Wednesday Trade

For the third day, we have chosen the USD/CHF Forex pair to identify the sell opportunities on 26th Feb 2020. The entry was at the point where the price action touched the upper Bollinger band, and the stop-loss was just above the upper band.

The reason we place the stop-loss there is because of the bands of the indicator act as a dynamic support resistance level to the price action.

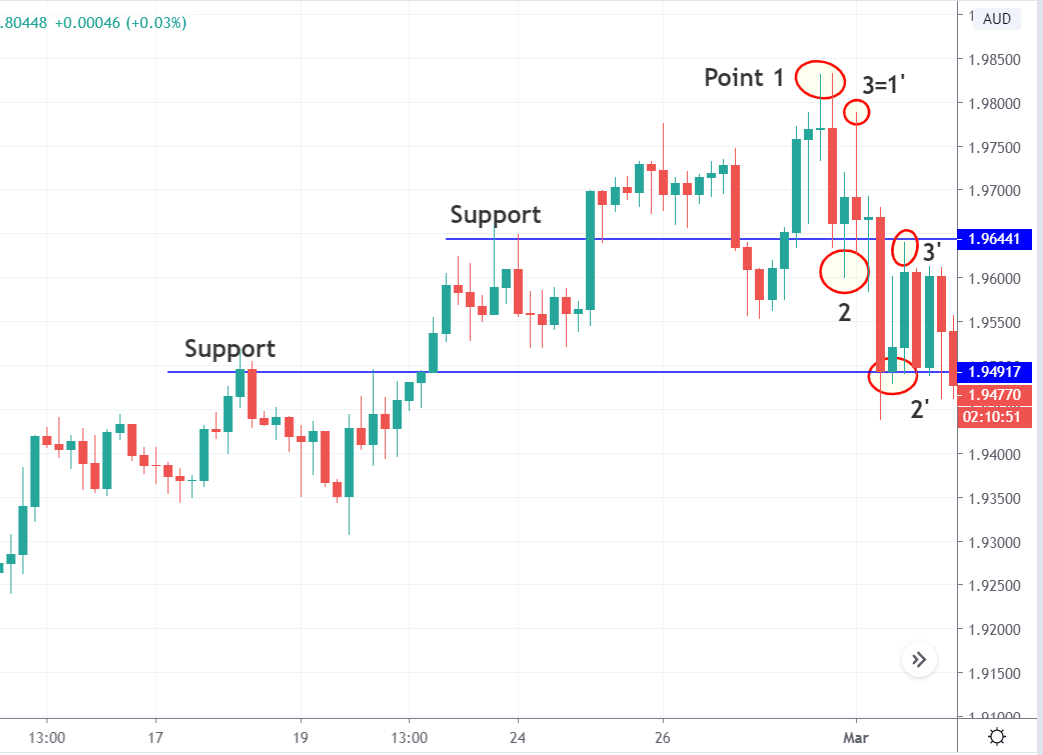

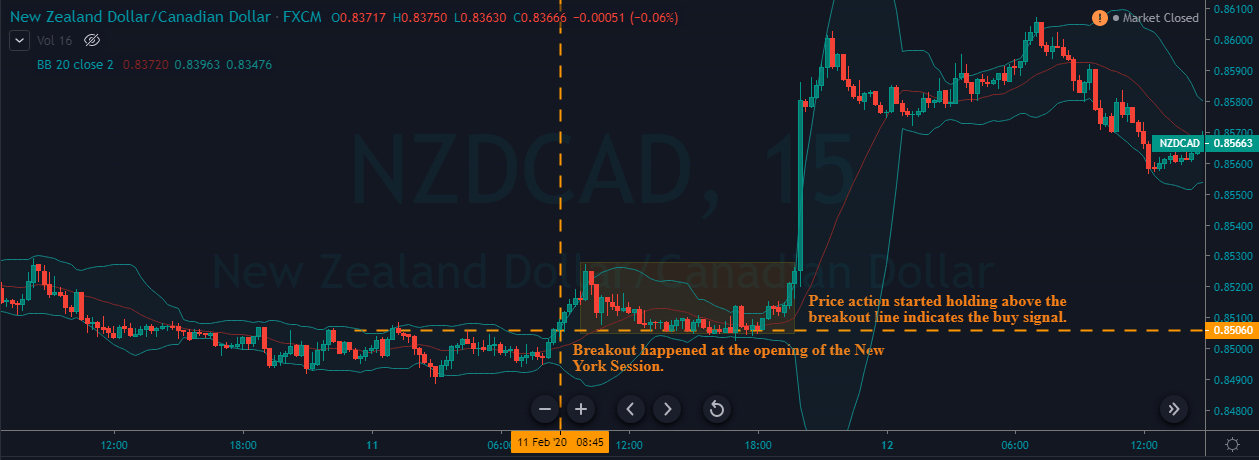

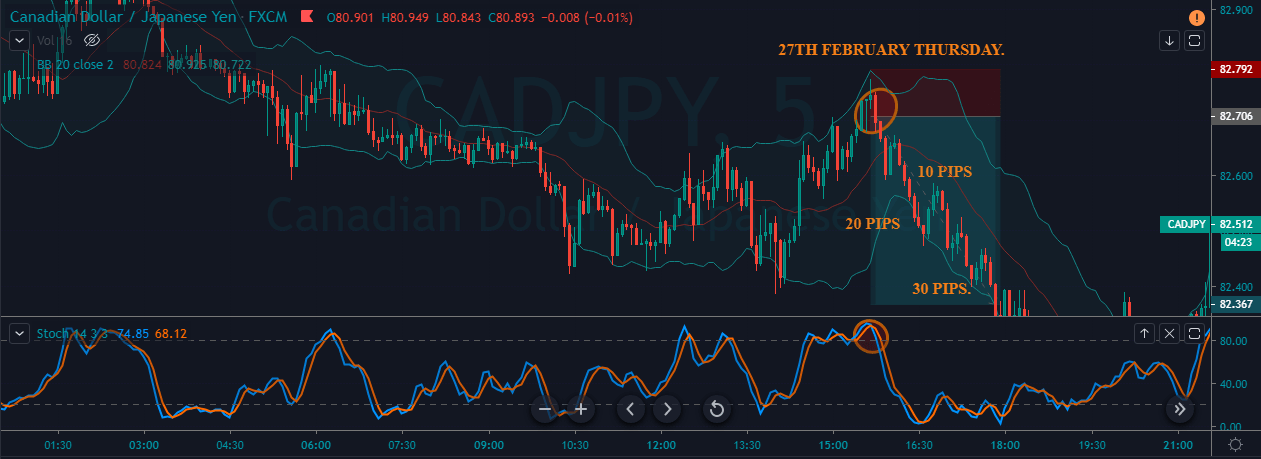

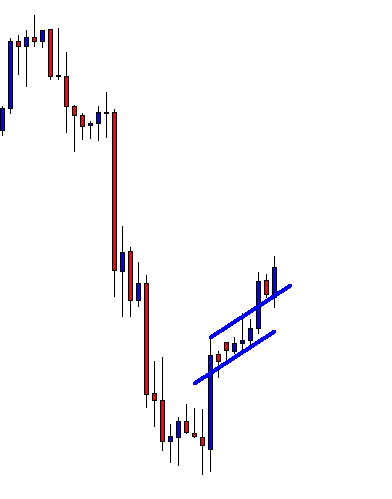

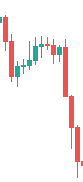

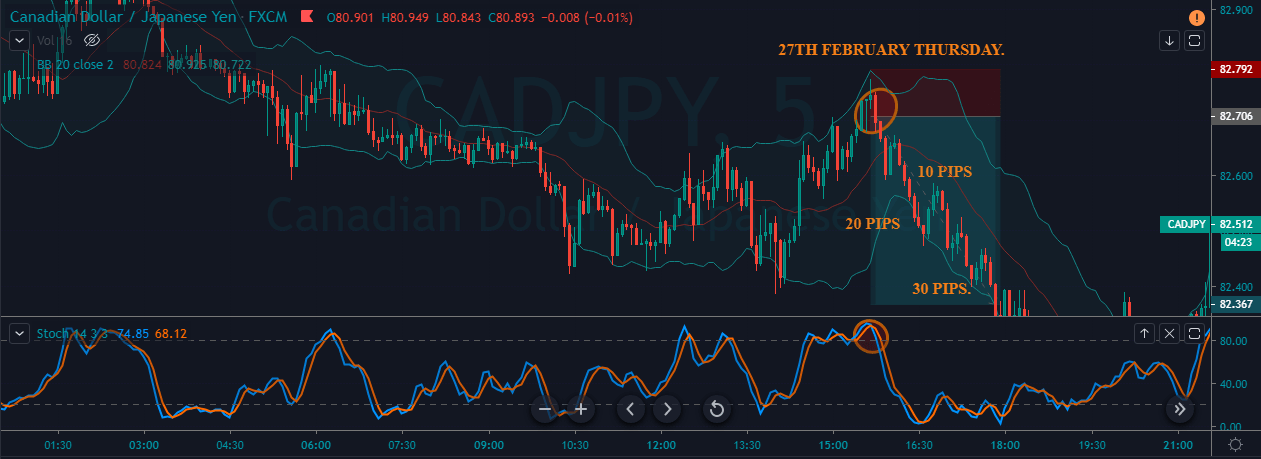

Thursday Trade

The 4th trade belongs to the CAD/JPY Forex pair, and we have activated our sell trades on 27th Feb 2020. We took sell when both of the indicators lined up in one direction, and we booked profit at the third target.

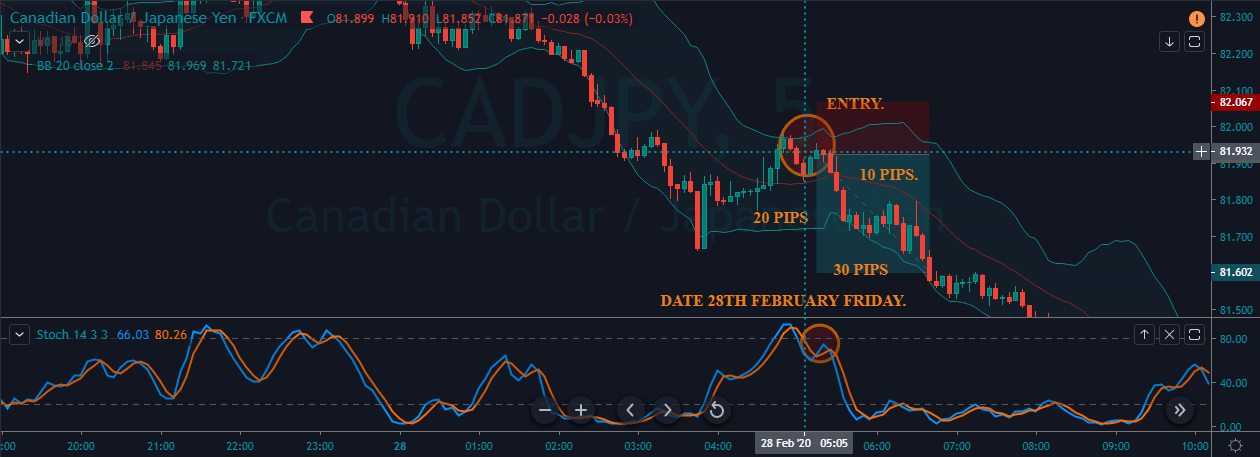

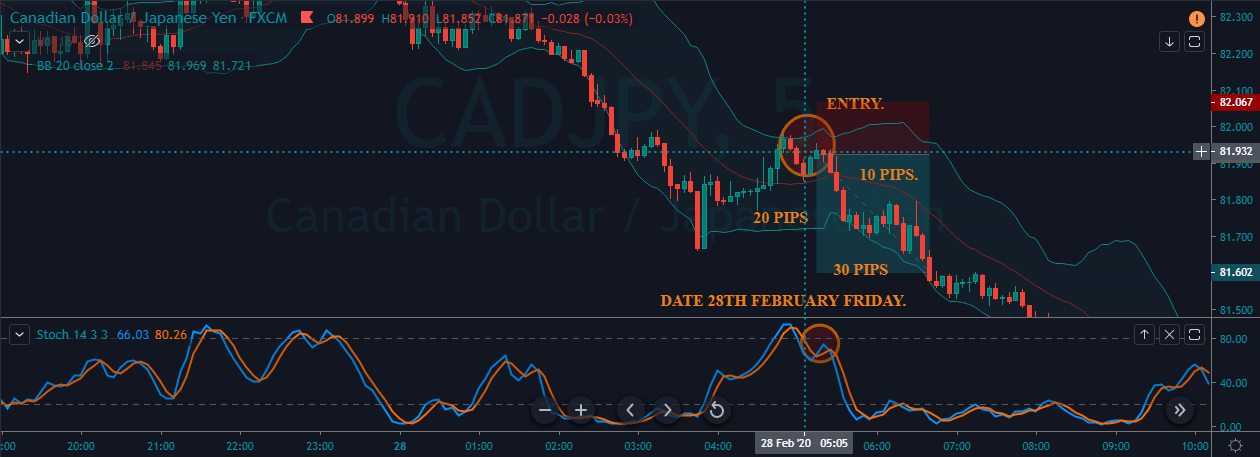

Friday Trade

For the last sell trade, we chose CAD/JPY currency pair. Sell trade was activated on Friday, 28th Feb, in the Asian session. When the Stochastic reached the overbought area and gave a sharp reversal, we saw the price action hitting the upper Bollinger band. This essentially means that the market is ready to go down.

Bottom Line

In almost all of the cases, we have gone for the third target only and make 30 pips profits. The reason behind this is to show you how reliable is the Bollinger Band and Stochastic combination. We are saying this time, and again, please stop trading after making ten pips per day if you are a conservative novice trader. But if you are experienced enough to predict the market, milk as much as you can depending on the market conditions. All the best.

Similarly to the point above, you need to be using a demo account, and you need to be using it for quite a while before you even think about making any money. The demo account is there for you to test out your strategies and to ensure that you have got them working properly before actually risking any of your actual capital. It is vital that you use these accounts properly and use them to ensure that you are ready for live trading.

Similarly to the point above, you need to be using a demo account, and you need to be using it for quite a while before you even think about making any money. The demo account is there for you to test out your strategies and to ensure that you have got them working properly before actually risking any of your actual capital. It is vital that you use these accounts properly and use them to ensure that you are ready for live trading.

A lot of people like a good gamble, but you should stick to sports or the casino, forex, and trading really is not the place that you should be making those bets. If you are only interested in throwing your money at a certain outcome without any regard for anything else going on, then it would be better to avoid trading altogether. Trading is all about working out the probabilities and then seeing which side has the most and so which way the markets are more likely to move. Just randomly choosing a direction without knowing them is the same randomly betting on a football team while not knowing the players. The moral of the story is to simply not gamble, do not trade in this way, it will only lead to losing your account,

A lot of people like a good gamble, but you should stick to sports or the casino, forex, and trading really is not the place that you should be making those bets. If you are only interested in throwing your money at a certain outcome without any regard for anything else going on, then it would be better to avoid trading altogether. Trading is all about working out the probabilities and then seeing which side has the most and so which way the markets are more likely to move. Just randomly choosing a direction without knowing them is the same randomly betting on a football team while not knowing the players. The moral of the story is to simply not gamble, do not trade in this way, it will only lead to losing your account,

No confidence in the trading plan: If someone has created a trading plan but does not actually have any confidence in it, this can cause them to double guess the choices that have been made and the levels that have been set, this can cause them to cut their profits just to get out of a trade. You should not be trading on a plan that you are not confident in, if you are not confident then work on it, work out why you are not and then fix that issue before reading on a live account. Only trade a system that you know you are confident and that you can leave alone to do its thing.

No confidence in the trading plan: If someone has created a trading plan but does not actually have any confidence in it, this can cause them to double guess the choices that have been made and the levels that have been set, this can cause them to cut their profits just to get out of a trade. You should not be trading on a plan that you are not confident in, if you are not confident then work on it, work out why you are not and then fix that issue before reading on a live account. Only trade a system that you know you are confident and that you can leave alone to do its thing.

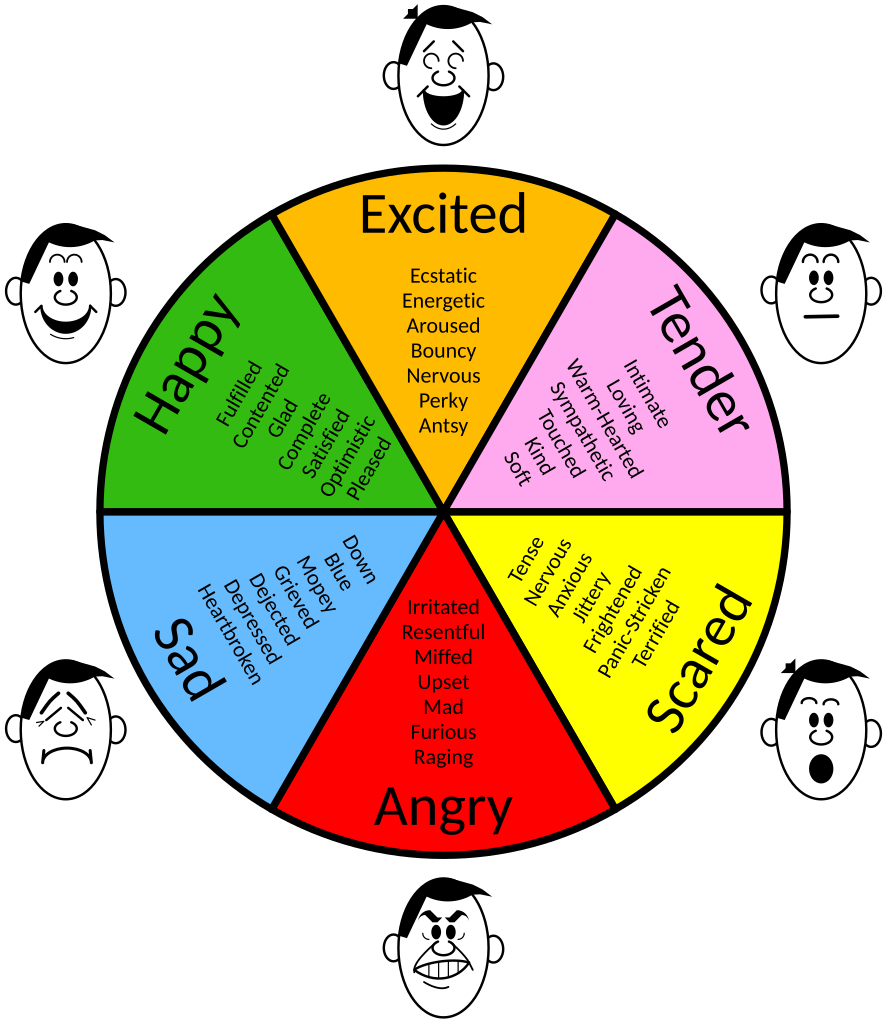

Out in the real world, telling someone that your losses are a blessing might get you a few funny looks. However, in many walks to life, a loss can be one of your greatest tools, it can teach you far more about yourself and the performance than a win ever could.

Out in the real world, telling someone that your losses are a blessing might get you a few funny looks. However, in many walks to life, a loss can be one of your greatest tools, it can teach you far more about yourself and the performance than a win ever could.

So, if you happened to be wondering if your investment strategy is the right one, just ask yourself the question of what is more important – being right or being profitable. While this is often easier said than done, we should first put effort into understanding which skills can help you begin or jump-start your career as a cryptocurrency trader. If you are a successful crypto trader or a

So, if you happened to be wondering if your investment strategy is the right one, just ask yourself the question of what is more important – being right or being profitable. While this is often easier said than done, we should first put effort into understanding which skills can help you begin or jump-start your career as a cryptocurrency trader. If you are a successful crypto trader or a

How many times we heard: “These are the results I’ve got trading forex in the past year so I can logically expect to get at least the same results this year”? Sentences like, “I pulled 10% out of a dead market in 2019 therefore, I should reasonably be able to get 15% this year”, or “I just got a 75% yearly return in my back-testing, then I should probably get 75% when I forward-test too which it seems logical, right?” If we had a good day or good week trading forex and we think that we can replicate that, what an awesome lifestyle that would be?

How many times we heard: “These are the results I’ve got trading forex in the past year so I can logically expect to get at least the same results this year”? Sentences like, “I pulled 10% out of a dead market in 2019 therefore, I should reasonably be able to get 15% this year”, or “I just got a 75% yearly return in my back-testing, then I should probably get 75% when I forward-test too which it seems logical, right?” If we had a good day or good week trading forex and we think that we can replicate that, what an awesome lifestyle that would be?