Most traders initially rely on what they hear, read, or otherwise find to be useful and informative, especially due to the enabling nature of this age of information exchange and media saturation. More often than not, these pieces of data prove to be half-truths, if not worse, and such a lack of skills and knowledge is then easily transferred across the global forex market. Due to the unrestricted access to partial, non-factual information, traders absorb too many fallacies, especially when these are related to indicators and strategies to earn a bigger profit. The same goes for the widely praised Bollinger Bands and Fibonacci, among others, which are some of the oldest and the most outdated tools that numerous sources still glorify despite their age and poor performance.

Some other tools and topics are simply copied from one source to another without much creativity and personal input. Nowadays we have heaps of materials with no innovative additions, which may not necessarily involve any new creation except for an original perspective. In this article, we will attempt to provide a fresh outlook on another popular topic from the world of forex trading – Heikin Ashi trading strategy. Also, this is just one example and opinion based on one group of professional technical swing traders, you can interpret the information the way you see fit.

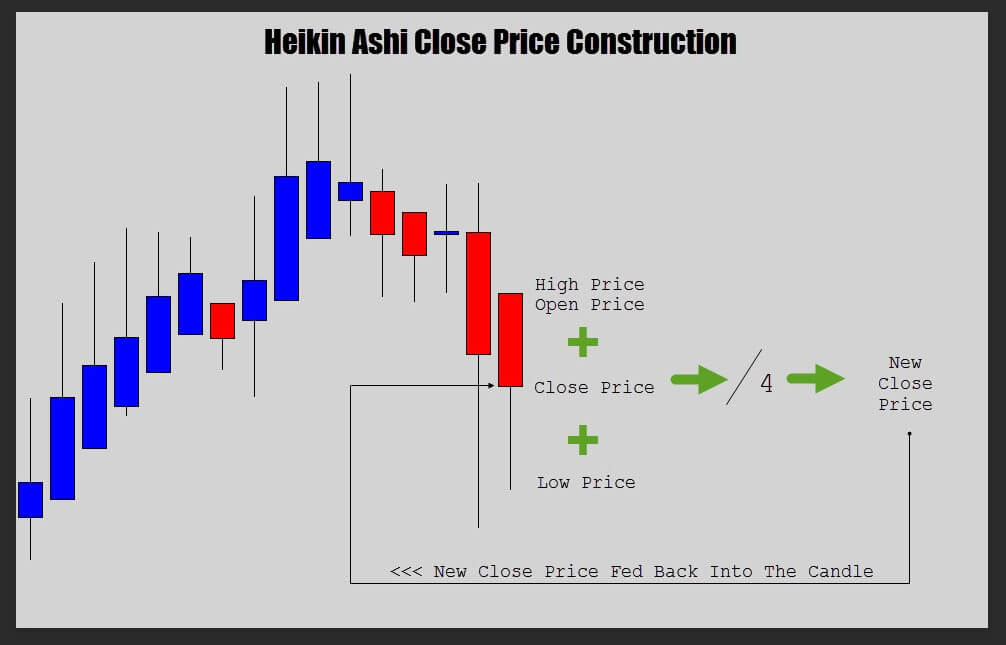

Heikin Ashi is often perceived as one of the most basic indicators under the MT4 group, which another reason why some professional traders question its quality. In addition to being similar to another well-known indicator, Japanese Candlesticks, its name actually originates from Japanese and it translates as an average bar. Beginners mostly find it extremely useful because it makes finding the trade entry considerably easier. However, most available sources provide an insufficient amount of data as well as to abound in the lack of the right tips that can help traders earn a profit. It is common knowledge that, as with other similar indicators, Heikin Ashi offers two distinct candles, where the white candle suggests that a trader should go long, while the red one implies the opposite. Despite its simplicity, traders are not given an opportunity to make any settings adjustments, which additionally reduces the quality of this tool.

Furthermore, this indicator is so easy to see that everyone can see the same signals at any location on the planet, thus stripping you of the exclusivity that naturally comes with using a good indicator. Bearing all these facts in mind, any individual at any point in their forex trading carrier must be aware that simplicity and popularity do not necessarily equal supreme quality.

Regardless of this tool’s shortcomings, we should strive to be objective and provide a clear list of actions which traders should avoid if they decide to use Heikin Ashi. Firstly, traders should not use this indicator to enter trades because the number of losses is almost always higher than the number of gains. As we already said that Heikin Ashi is generally favored for its ease of use, beginners, as well as all other traders, should attempt to do a demo trade and see this for themselves. It is extremely easy to get excited while using this indicator early on, but using it to enter or even exit a trade will only make you feel more frustrated and incompetent at trading in this market. Moreover, Heikin Ashi’s candles function in an entirely different way from the regular forex candles we are used to seeing.

If you take a look at the image below, you will surely see a few prominent reversals in the chart (marked grey). These inviting points are precisely the places where you should remain focused just because most people fail to grasp the severity of entering a trade in between the grey areas (marked yellow). By measuring how trading, in this case, would turn out in advance, you could in fact understand that your price would probably never reach your take profit. What is more, before you could even see any profit from such a trade, you would probably need to go through more than a few losses, and no success afterward would be able to compensate for the degree of loss you previously experienced. Therefore, if you only allow yourself to see the surface and feel compelled to enter a trade only because of some superficial positives, you may lose all your confidence and severely endanger your financial stability as a result.

While we owe it to ourselves to call a spade a spade, this indicator can still offer some value, which other sources do not seem to be interested in. To be able to extract any such benefits from Heikin Ashi, you primarily need to be a trend trader using your own system. To manage a win, you will take half of your trade off after a certain number of pips and your move stop loss to the break-even. In case you have yet to discover an exit indicator you would prefer to use, Heikin Ashi can temporarily assist you with the rest of your trade. Simply put, if a trader is already going short, they will have to wait for the candle to become white to exit and vice versa. This indicator is not the best tool you could use to finalize a trade, but it certainly can be of great assistance if a trader has not decided on a specific exit indicator yet.

In comparison to not using an indicator to end a trade, Heikin Ashi can definitely render more pips and thus bring you more money than the other way would. However, if you already have an exit indicator you like or you are exploring your options, you can always use Heikin Ashi to compare the results it gives you to the ones your indicator of choice produces. It this comparison demonstrates any advantage of Heikin Ashi over the other indicator, you will know to continue looking for a better tool. This approach will save you much time and help you develop a safe and functional system you can rely on.

We know how important having a good algorithm is and Heikin Ashi can not only help you discover a good exit indicator, but it can also yield a great number of pips, even to beginners. Nevertheless, earning a few coins here should not stop you from looking further for an excellent tool that can bring even more success to your account. Keep searching for trend indicators and do not give in to passing compulsions that this indicator entails on the surface level. Avoid reversal trading and strive to see the entire chart as a whole measuring possible wins and losses and demo trading to compare. You can truly stand out from the crowd by learning how to differentiate between acting upon a feeling and making decisions based on some tangible data.

Do not be misguided by a vast number of sources promoting price levels, support/resistance lines, and other ineffective strategies that will not get you in or out of a trade on time or without losing a substantial amount of money. With a clear strategy, a trading mindset, and an effective exit indicator, you can get to wherever you want to be and Heikin Ashi can serve as a transitioning step on the way to reaching your goals. Finally, understand that all the time you invest in learning about Heikin Ashi and other indicators, testing, and making necessary comparisons will only help you grow as a trader for these are the skills you will always be able to call upon in the future.