Financial traders follow many charts, patterns, and trading strategies. Each one has its own advantages and disadvantages. Nevertheless, there is a saying, ‘the simpler, the better.’ In the financial markets, especially in the Forex market, a trader cannot deny this truth.

Let us demonstrate an example of this.

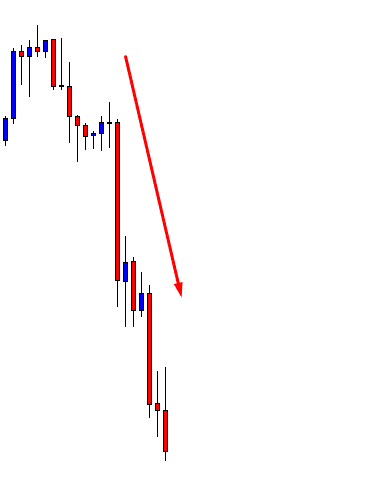

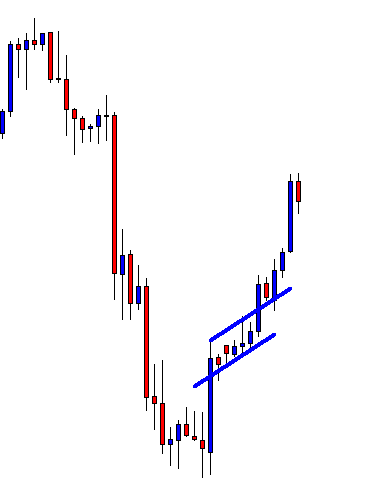

The price heads down with strong bearish momentum. The sellers are to wait for an upside correction and a breakout at the support to make it more bearish. Let us proceed with what happens next.

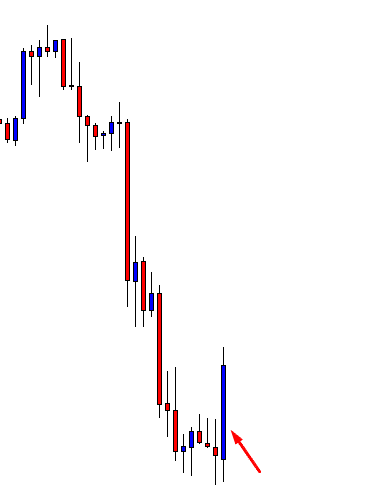

The price has an upside correction, but it did not make a breakout at the support. It instead produces a huge bullish engulfing candle at Double Bottom support. Things are different now. Traders are to look for a long opportunity on the chart.

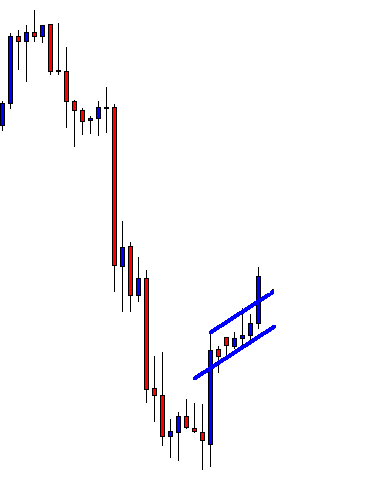

The price is bullish, but it gets caught within an ascending channel. A breakout at either side attracts traders to trade in this chart. The chart shows that the price makes an explicit breakout towards the upside. Ideally, the buyers shall flip over to their trigger chart to find a long entry. Let us find out whether they find any on the next candle.

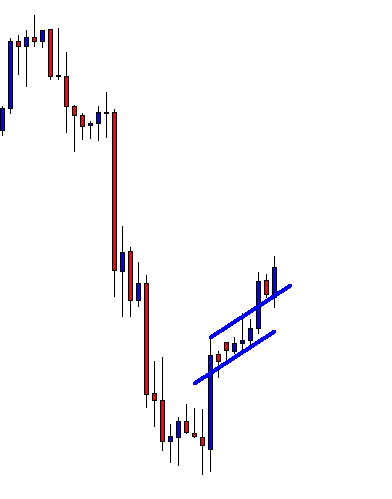

The price does not make a breakout at the highest high of the breakout candle. Thus, the traders do not find an entry on the triggered chart. However, see the second candle (bullish candle). It makes a breakout (horizontally) at the highest high of those two candles. The buyers are to flip over the trigger chart again to find an entry. Do they see an entry this time? Let us find out.

Yes, they do. The price heads towards the North with good bullish momentum, and it does not come down to the support of the breakout candle. By flipping over to the trigger chart for an upside breakout to trigger an entry, a trader makes some green pips.

In this chart, the price makes a breakout at ascending channel’s resistance just a candle earlier. That breakout does not create bullish momentum. However, when it makes a breakout at the horizontal resistance, it creates the momentum that the buyers look for. I am not saying a breakout at ascending channel’s support/resistance does not offer entry at all. It does. A breakout at horizontal support/resistance offers more entries than the channel’s support/resistance breakout. It is because; it is simple and easy to be noticed by most of the traders.

In this chart, the price makes a breakout at ascending channel’s resistance just a candle earlier. That breakout does not create bullish momentum. However, when it makes a breakout at the horizontal resistance, it creates the momentum that the buyers look for. I am not saying a breakout at ascending channel’s support/resistance does not offer entry at all. It does. A breakout at horizontal support/resistance offers more entries than the channel’s support/resistance breakout. It is because; it is simple and easy to be noticed by most of the traders.

The Bottom Line

Does that mean we stop looking entries on a channel or other pattern breakout? No, we shall eye on those breakouts; flip over to the trigger chart and trigger an entry if the trigger candle makes a new higher high or lower low. It is just the probability that a breakout at horizontal support/resistance offers more than any other chart pattern. After all, it is simple, and we know “the simpler, the better’.