There are a lot of blunders and mistakes that you can make as a new trader and also as an experienced trader. What we need to remember is that mistakes happen, both small ones and large ones, sometimes it can be our own fault and sometimes it is completely out of our control. What is important is that we learn from those that we have done, and try to avoid those that we have not, so we have come up with a list of some quite common mistakes that traders make, but also ones that you should keep an eye out to try and avoid.

Not having a trading plan:

You are probably bored of hearing this now, but a trading plan is wanted, in fact, it is needed. If you are trading without a trading plan, you are putting your trades and your account in danger. When first starting out, you won’t have a full trading plan created, but it is important to get one started, as you continue down your trading journey and learn more you can add to it and adapt it to the new things that you have learned. What is important is that you have one, it will detail the requirements to get into a trade and how to get out, as well as everything in between. Without it, you will be trading blind and this will only lead to ruin.

Chasing results:

Please don’t do this, chasing results leads to overtrading which leads to loss. If you start to chase results, you won’t be taking the very specific rules that you have created into account, you will begin to start making bad trades or even completely guessing your trades, this will only lead to losses as you cannot predict the markets. You need to stick to your trading plan, do not chase results, they will come in time and in a controlled manner as long as you continue to follow your trading plan.

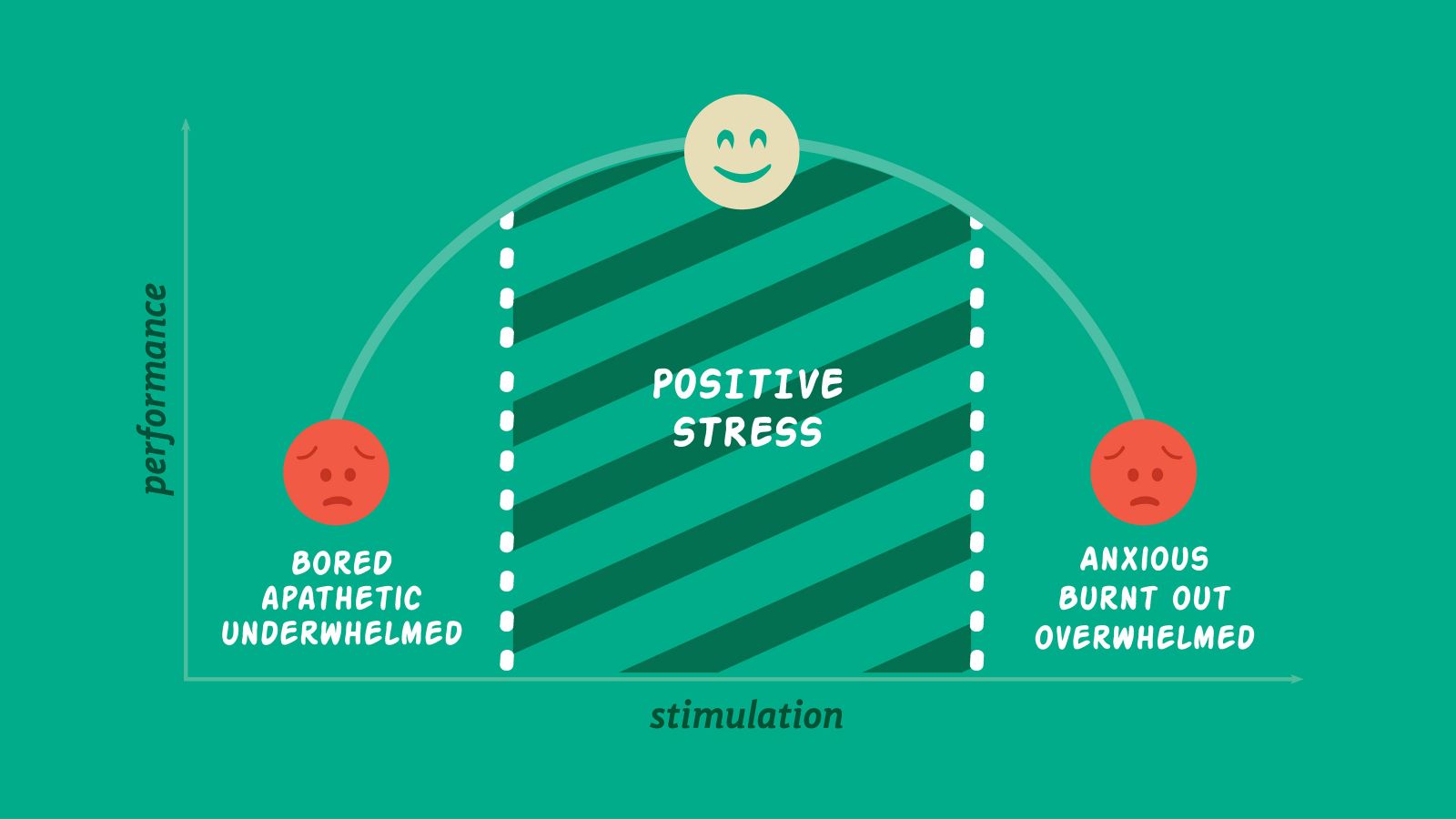

Forgetting your risk tolerance:

Every single person in the world has a set risk tolerance, this is how much they are willing to risk or how much they can risk without it consuming every thought that they have that day. You need to remember yourself, pushing yourself too hard will begin to cause unnecessary stress that you really do not need. When you created your trading plan, you should have taken your risk tolerance into account so that you always remain around it or below it. If you go too high, you will begin to hate trading and it will feel far more like gambling, which is not a good route to go down.

Forgetting the time:

This is more about getting obsessed with the markets, they can be exciting and then can be boring, but one thing we can be sure of is that once you are in them, you don’t always want to get out. What you do not want to do is to get obsessed, you need to be treating trading like a job, you would not want to sit at your job 14 hours a day, so do not do it with trading, be sure that you have set times, especially when starting out and things generally take longer to do. It’s not healthy for you or your relationships if you are spending too much time by yourself on the computer.

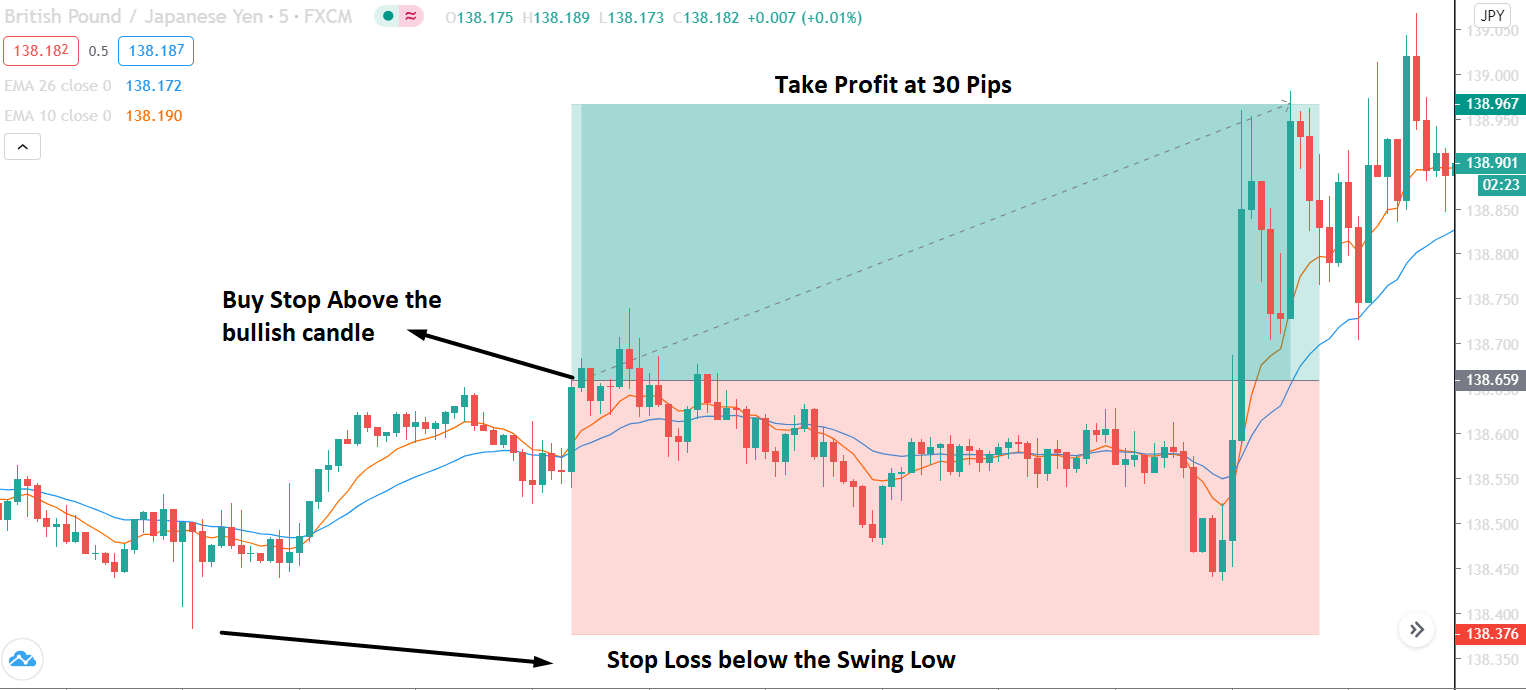

Not using stop losses or take profits:

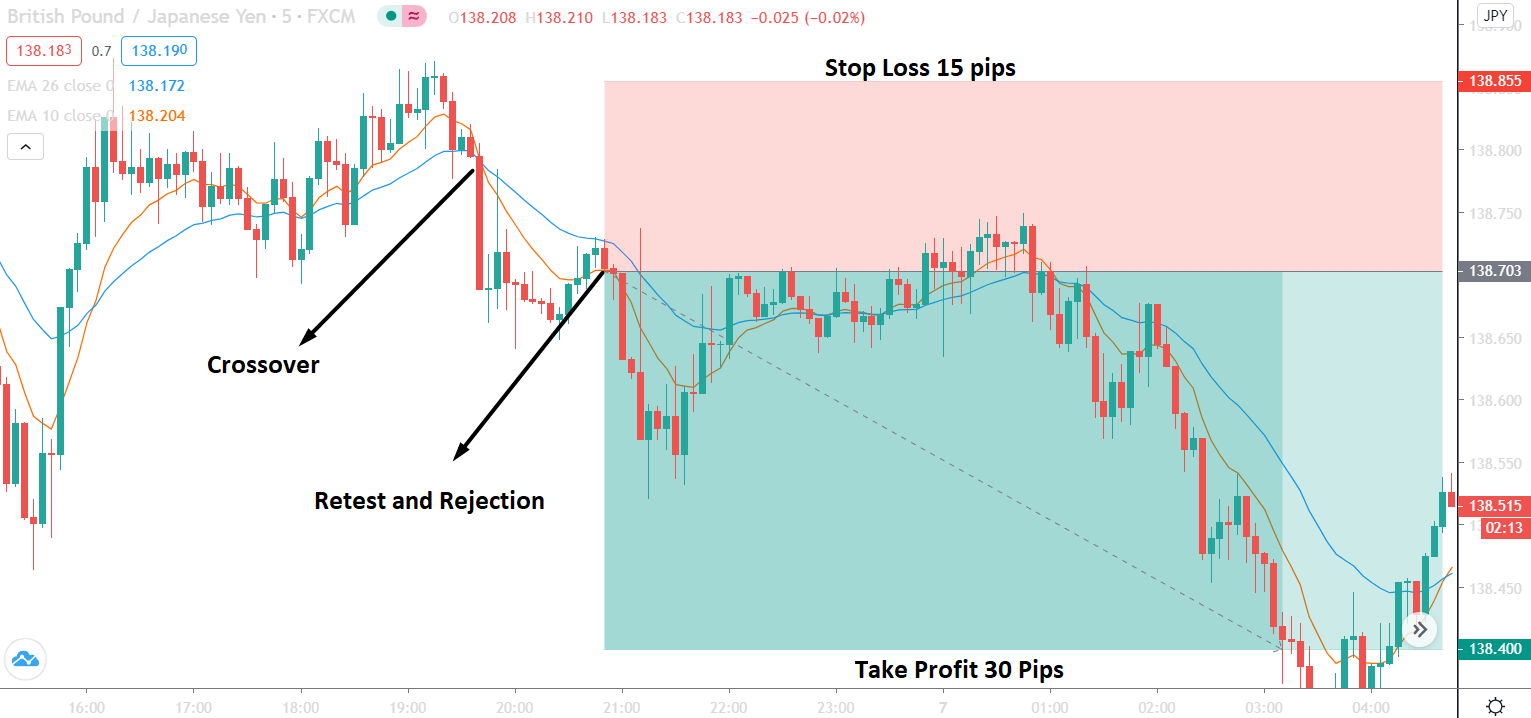

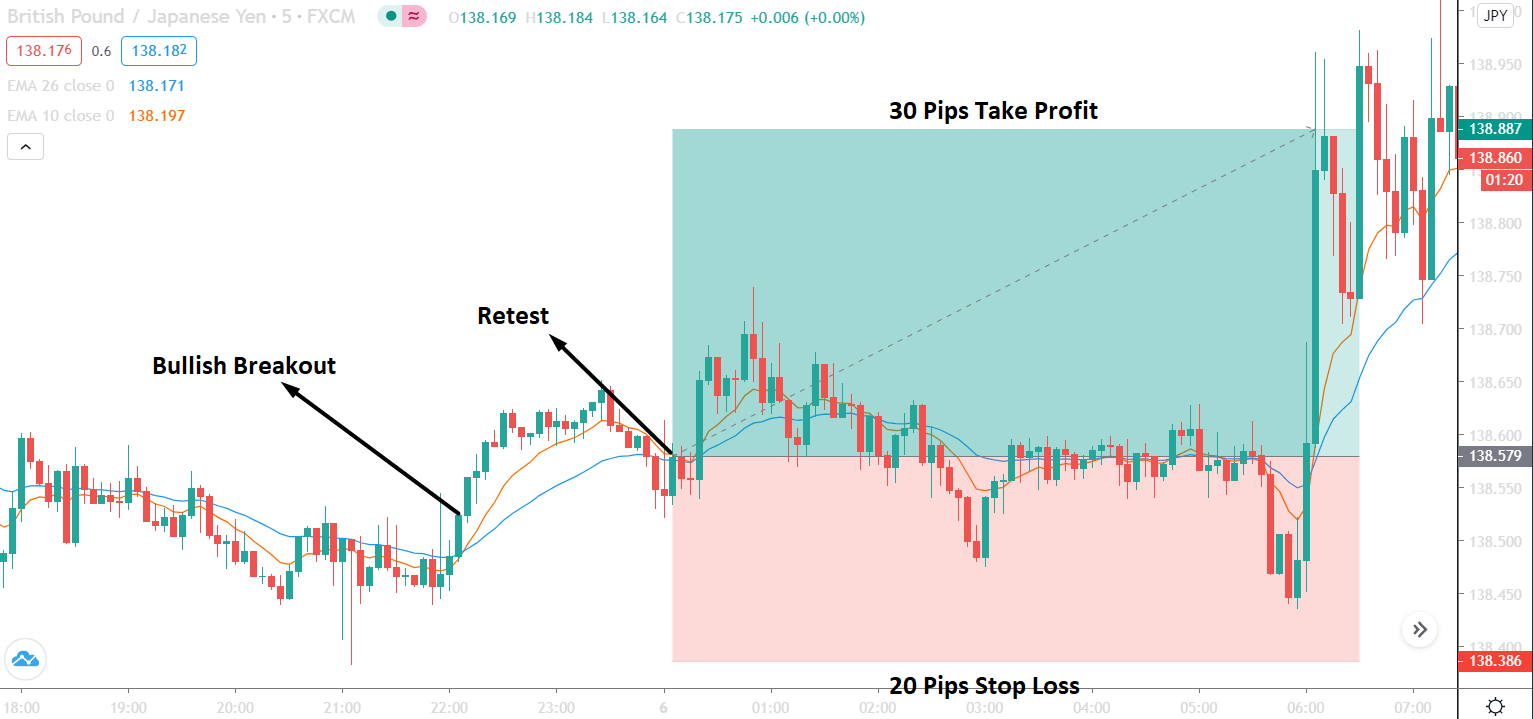

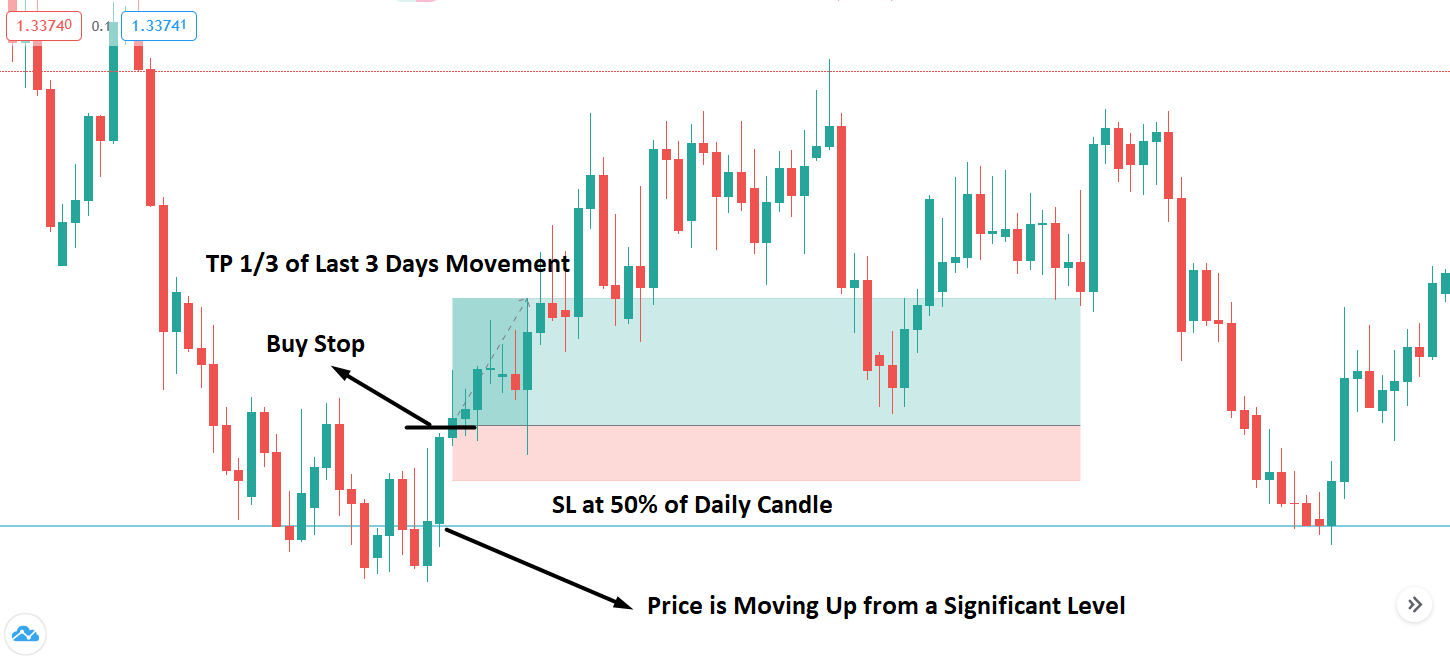

You most likely have been told by someone that you should be using stop losses, you should be using them to help limit the amount that you can lose, and they are right. Stop losses are essential, they limit the amount of risk that you are putting on each individual trade. They are also there to save your account. Not setting stool losses basically allows a single trade to potentially blow your entire account should it go too far. Always use stop losses, they should be cemented into your trading plan, if not, go and put them in right now.

A similar thing can be said about take profits, while not as potentially devastating to your account, not using take profits can cause you to lose out of profits, some may argue that they can actually reduce profits, but a take profit used is that money banked. If you created a risk/reward plan within your trading plan then there should be take profit levels taken into consideration, others may refer to use a trailing stop instead, but that still acts as a form of take profit, be sure to use one, especially when starting out.

Not cutting losses:

This goes along with not using stop losses, but let’s imagine that you do not have the set and your trades have now gone into negatives. What do you do? Do you hold them and hope that they will turn around or do you cut the loss and move on? Knowing when to cut is vital and also a very important thing to understand. You do not want to let your losses start to run and control your account. In your head, you should have a percentage that you are willing to cut, once it gets there cut it, regardless of what you think. That is your set target and it is to protect your account, so cut it, do not let it run or you will be risking your entire account instead.

Using grid or martingale strategies:

One of the easiest strategies to learn is the grid strategy or the martingale strategy, mainly because there is very little strategy to it, they are also the ones that you see the most around the internet. So if it’s so easy, and so popular, why don’t we all use them? Simply because they are also the riskiest strategies around. The strategy is simple if a trade goes against you, you simply open up a trade going in the same direction as your original, now you have two, trades, it continues further, you open up a third, you continue doing this until either your account blows or it reverses and you close everything once the overall position is profitable. The only real difference between grid and martingale is that with martingale you increase the lot size each time and with grid you keep it stable.

You can probably see how dangerous it is, as soon as you start adding positions or lot sizes, the drawdown starts to grow exponentially, not a safe thing to do at all and it has blown hundreds and thousands of accounts in the post and they will continue to how many more in the future.

Being influenced by others:

You have your strategy all setup, it is working for you, so why would you suddenly listen to a random person on a forum somewhere that the analysis that you have done or even that your overall strategy is wrong? What do they know? They don’t know how your strategy works or how you can do the result of your analysis. Your strategy has been working so why would you second guess it because someone else said something. Stick to your guns, do not change things just because someone loses things differently. You are here to trade your plan, not someone else’s.

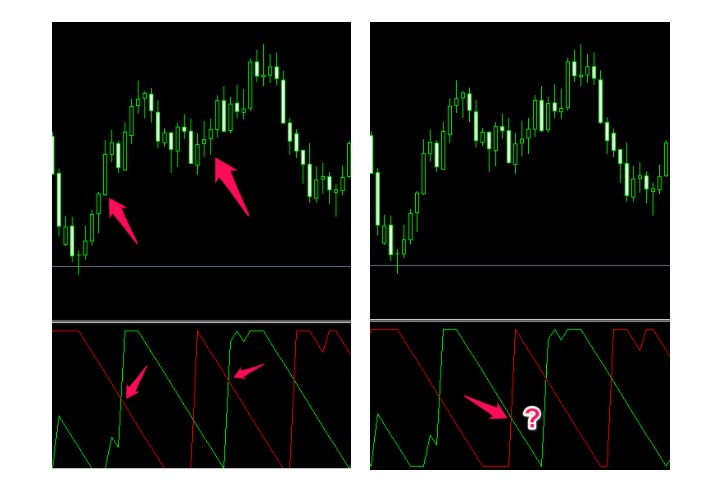

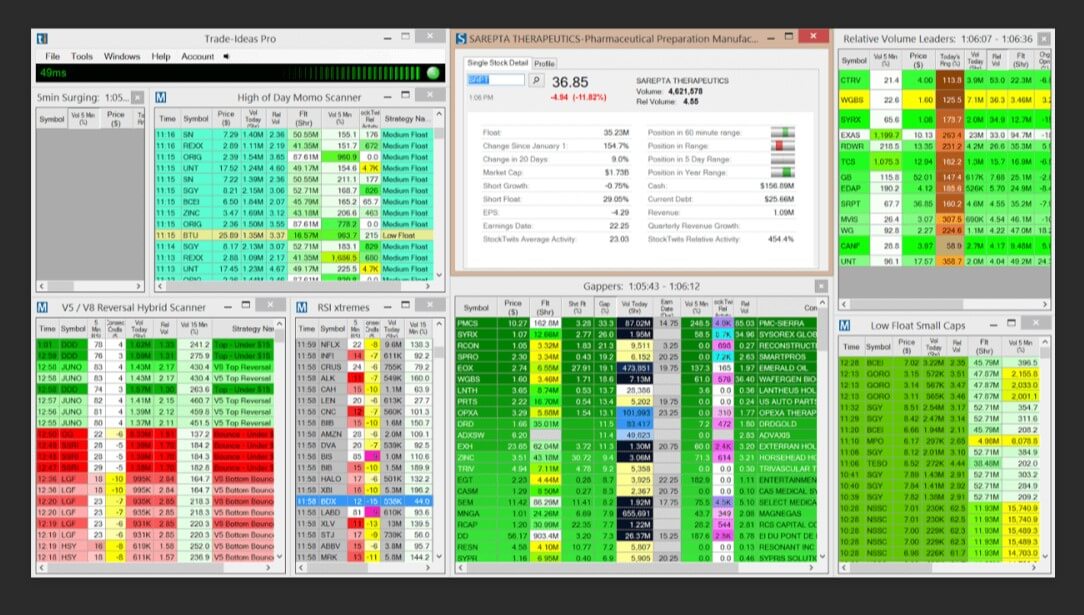

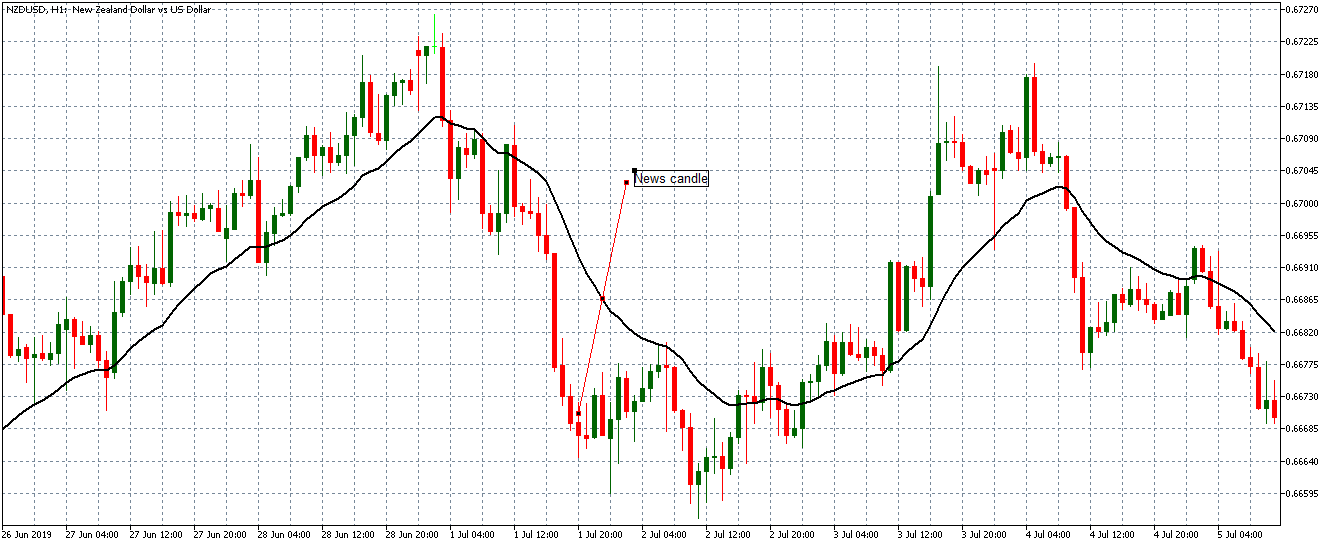

Blindly following signals:

Sometimes signals can be a godsend, it is a way to put on trades that someone else has done all the analysis for and so you just need to place it a reap the regards. Unfortunately, it isn’t quite as simple as that, placing trades from signals completely blind means that you have no idea why it was placed.would you give your money to someone to place on the horses? Probably not, as far as you know, they are just posting random trades, if you are going to follow signals, be sure that you understand the reasons behind the trades and how they came to those conclusions. This will allow you to do some of your own analysis to help confirm a signal before putting one on, allowing for far greater accuracy and confirmation of each signal.

Too much risk per trade:

Your trading plan should cover this, it should have a risk management plan and get into it also, this will detail exactly how much you are willing to risk with each trade. Depending on your strategy this could be between 0.1% per trade up to 2% per trade. Of course, some can go higher, but that is putting a lot of risk on your account, and the higher you go, the more likely you are to blow the account. If you have not got anything set, then you are risking the entire account with each trade, make sure that you limit the risk that each trade takes, this is one of the primary ways of keeping your account safe and alive.

Too much emotion:

Motions are extremely powerful, they are powerful enough to take over your entire mindset and to alter the way that you trade. Emotions like greed and overconfidence can cause you to through your trading plan completely out of the window. They can cause you to trade outside the plan on what you think will happen, you need to remember that the markets do not care what you think. You need to be able to control your emotions, when things are going well, remember that it is your plan giving success, not you when things are going wrong, the plan works and will turn things around to give an overall profit. Always trade with the plan and not with your emotions.

Following the herd:

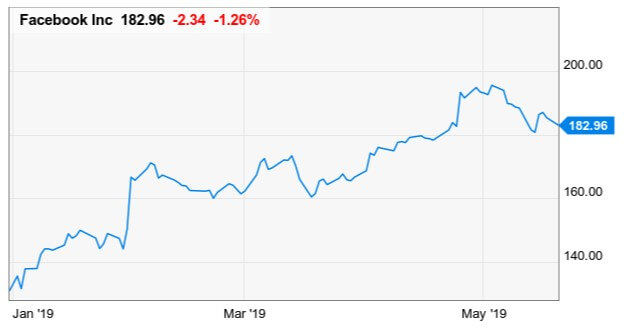

Many new traders will pretty much blindly follow what other traders are doing, if they see a lot of people going long on EURUSD then they most likely will too, why? Simply because others do, they have no knowledge behind whey they are going long or what other people see in the markets as to why they have gone long. You need to be able to do our own analysis and to come to your own conclusions. Do not just do things because others are doing it, in anything in life, make up your own decisions and then own those decisions that you do make.

Not continuing to learn:

One thing that a lot of traders do is that they learn their first strategy, once they understand it they stop at that. They have their strategy and so that is all that they need. However the markets are an ever-changing thing, you always need to be able to adapt and the only way to do this is to continue to learn. As soon as you stop, you are being left behind, there are always more things to learn, from new strategies, risk management, various elements of the markets, it is a never-ending course and one that you should not take for granted, you can never learn everything there is to it, but a continuous learning plan is the best way forward.

Losing track of your goals:

When you started trading you would have set yourself a set goal, something that you want to aim for. You need to keep that in mind and in perspective. If things going well, do not suddenly move your goal ten steps ahead, if things are going well, use that goal to remember why you are here and what you want out of it. That goes needs to stay at the forefront, write it on your wall if you need to, that is your source of motivation and why you are here, so do not lose sight of that and keep working towards it, no matter how hard things are at that point in time.

Diversifying too much:

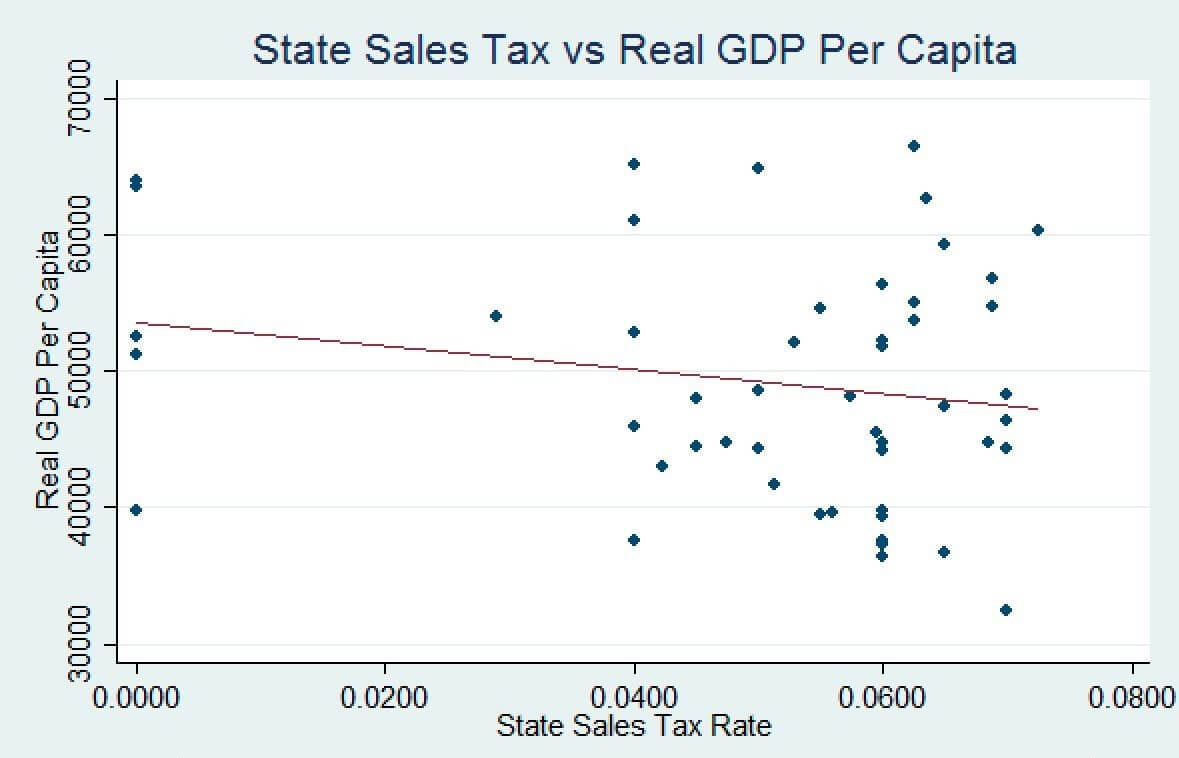

A lot of strategies that you see out there say that they can work with any currency pair or asset available, those sorts of strategies are just hitting and hoping, instead, when creating a strategy, you need to focus on one or two currency pairs or assets. This way you can ensure that your strategy works with those pairs and that it will be able to deal with its movements and changes. Every single asset and currency pair moves differently and is influenced by different things, so a single strategy cannot work for all of them, instead, focus on learning a few of them and make them your bread and butter.

Not asking for help or advice:

We mentioned earlier that blindly listening to others is a bad thing, of course it is, but so is not asking for help when you need it. Sitting in front of the screen and markets not knowing what you should be doing or not knowing why something went wrong is not a good position to be in, instead ask for help, others may be able to give you an insight into what went wrong and reasons why your strategy may not be working. So not just kindly do what they suggest, instead use the knowledge and information that they have given you to look deeper into what you did so you can know exactly what went wrong. Do not sit there by yourself wondering forever.

Not asking for support:

The last point that we will point out can actually be one of the most important, trading can be stressful and it can be lonely. If you ever feel that you are becoming overstressed, frustrated, or lonely, get out and ask for help. The most important thing in life is your health and your well-being, do not let that suffer for your trading. Friends and family are important, so keep them close and keep in touch with them, do not lose them over trading Look after yourself. A lot of traders let trading take over their lives, do not let that happen to you.

There are of course more things that a lot of traders get wrong, but we don’t want to give a list of 10,000 different things that makes it sound like you can’t actually do anything when trading without doing things wrong. You will make mistakes, that is the course of life and anything that we do, what is important is that when you make one of those mistakes, you are there to make it better again and to learn from the mistake that you have made. Do not fear that you have done any of these, as soon as you have realised that you have done something that you should not have, or that something didn’t go your way, that is the time to make the change and improve. Of course, some things here may actually suit your style, so it is up to you to decide what is actually good or bad and what you need to change, but change is the catalyst for success, so do not stick with something that isn’t working as well as it used to.

Self-doubt: The strange thing about self-doubt is that it often comes when we are doing the best that we have. A few wins in a row and you may begin to wonder why you are doing so well, it must just be luck, it won’t continue, these sorts of thoughts are more common than you may think. The problem with these thoughts is that they will take away all of your motivation to continue, it will make you want to stop as you are ahead and you won’t be able to continue. If you are following a strategy, just remember that you made that strategy, you are doing well and you certainly do deserve it.

Self-doubt: The strange thing about self-doubt is that it often comes when we are doing the best that we have. A few wins in a row and you may begin to wonder why you are doing so well, it must just be luck, it won’t continue, these sorts of thoughts are more common than you may think. The problem with these thoughts is that they will take away all of your motivation to continue, it will make you want to stop as you are ahead and you won’t be able to continue. If you are following a strategy, just remember that you made that strategy, you are doing well and you certainly do deserve it.