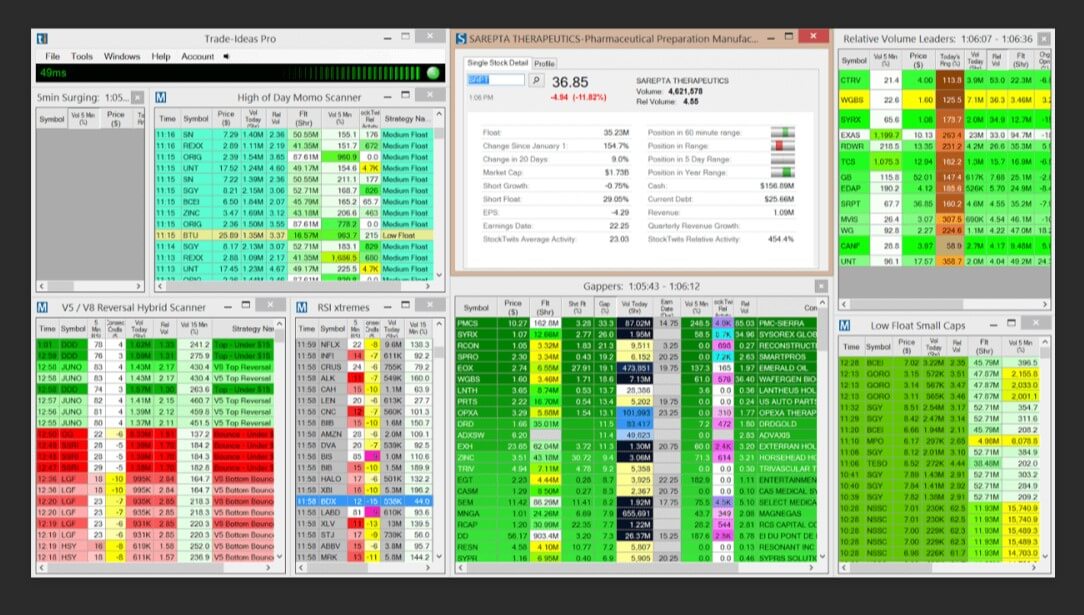

A vast majority of people keep using certain tools that a portion of successful forex traders describe as utterly futile. In this article, we are going to assess the basis of such opinions and possibly shed some new light on the topic of technical analysis tools in spot forex trading. More specifically, we are going to provide ways in which you can stop yourself from squandering any more money by offering some direct and practical advice. If you keep finding yourself in a precarious situation where you cannot seem to prosper or grow as a trader, learning about these 12 tools may provide you with new and innovative ideas and perspectives you can incorporate in your trading in this market.

Some references go as far as to say that the number of traders who are experiencing financial hardship, constantly spiraling downward, is as high as 99%, if not above. Some of the reasons behind such lamentable statistics may have a lot to do with one’s money management skills. At times traders have quite a good idea of which entries they should make, but they lack the investment mindset to back these skills up in a more sustainable manner. As one of the essential topics in the world of trading, this is unfortunately seldom discussed, along with today’s topic. Aside from possibly lacking an efficient system to support your intelligent investment and trading decisions, you may be also lacking the knowledge or experience regarding tools, often unfoundedly glorified by various people.

While educating yourself on tools, techniques, and strategies is key in this world, we may often come across information suggesting the use of some outdated tools and indicators, which can be even quite detrimental to your attempt to follow current trends. What is more, some of these were not even developed for forex trading in the first place as they are based on concepts used in trading equities and gold, among others. It is these basic concepts which forex market revolves around that you strive to grasp and apply intelligently and strategically: understanding the nature of fiat currencies, the impact of money management skills, the role of big banks, the importance of trend trading, and the detriment of trading reversals to a trader’s overall success. At this point, every trader must accept the need to eliminate the information which is not beneficial because no professional algorithm can overpower flawed thinking. You can now begin to grasp how disinformation and misinterpretation can impact your development and finances, which naturally involves the necessity to discriminate between different tools and indicators you can use in your chart.

Started in 1996, the spot market is only a little over one decade old, which is why we currently have approximately 10 thousand indicators and tools at our disposal. Nevertheless, we must be aware of the fact that most of these were not specifically invented for the needs of forex trading. Like with various other gadgets that lost their importance or were simply replaced by more modern versions (e.g. pager vs. cell phone), we can logically conclude how even the world of trading requires modernization to be able to produce realistic results. A tool designed in the 70s for the stock market can possibly render some success, but you know that an innovative tool can lead you to a much better, and much more secure, outcome. Therefore, let us see which 12 indicators fall under this category and why we should consider turning to some other tools at this time.

ADX Indicator

The average directional index (ADX) was developed in 1978 and the reason why traders use it is twofold. People mostly use it for the purpose of measuring volume, which is absolutely understandable and needed in forex trading; however, the volume meter is simply too slow and, even if you try to make it work faster, the information it provides can become severely inaccurate. Another important component of this indicator, Directional Index (DI) which tells traders whether their currency pair is bullish or bearish, has such a major lagging issue that it affects the whole process. Therefore, due to using this indicator, you are not only at risk of making entries based on false data, but you also enter the market too late, which together make this indicator increasingly unreliable.

Trend Lines

As there is no one correct way to draw trend lines, which involves a great degree of imprecision, this approach may easily be least worthy of your time. Differences between the way trend lines are drawn can be so vast that a trader may not know how to surpass this seemingly unsurmountable problem – show the focus on price tops or where the price closed and what should they do if a price has broken the trend line? Everyone seems to have their own idea of what to do in this case, but these opinions differ to the extent that forming a uniform approach seems impossible. Furthermore, with such a great number of possible options, we may be able to draw several trend lines in any chart. Unfortunately, most trends are already over by the time we discover them. If you experienced a situation where a price did not align with your trend line, it is because the notion of diagonal support or resistance is entirely nonexistent, which supports the belief that trend lines should not be used in charts to gain any relevant information.

Stochastics

Developed way back in the 1950s, this tool is based on terms such as overbought and oversold that meaningfully and essentially have no relevance to trading fiat currencies, which alone is a proof strong enough for you to opt for another indicator. Moreover, it is highly unreliable in trading stocks too because the majority of signals it gives are false even in case of range-bound prices. What is more, traders inevitably face disappointing results whenever the prices are trending because, with a commonly vast number of reversal traders, stochastics will simply keep giving inaccurate information. This further implies that all the money traders make during the range-bound periods will go to waste once the prices start trending. Therefore, regardless of whether you are using the slow or the fast version of this indicator, there is a high chance that your investment will not go as planned.

Price Levels

Although this is not a tool per se, a number of traders believe that they should place special attention on trading when they come across a round number (e.g. 1.2000 EUR/USD or 1.5000 NZD/USD). Because the same happens when a price ends in this way, traders must understand the vastness of options this standpoint entails. Moreover, price levels are commonly interpreted as psychological levels, which some professional traders consider downright false. Another reason why this may not be your best approach is the fact that the big banks will always show interest in a surge of activity in the trading market, and should they any of these catch their attention, they may decide to step in. Traders simply cannot predict how the price will go from this point onwards, which is why putting your faith in price levels may be unwise.

CCI Indicator

The Commodity Channel Index (CCI) is commonly used for both trends and reversals. Built in 1980, this indicator is mostly criticized for its tendency to push traders into making a move too early. A number of traders claim to have attempted to make use of this indicator and failed because of its mechanics. As this market does not react well to any untimely activity, entrusting your financials to an imprecise indicator may take a toll on your trading and possibly your future prospects of succeeding in forex trading.

Support/Resistance Lines

Despite this indicator being so frequently used by spot forex traders, we need to address the fact that it leaves room for too many possibilities. Unlike trend lines, these lines are quite easy to draw and, at the same time, almost every trader can have access to the exact same information. Such ability diverts a lot of attention in a very narrow direction and this immediately sparks big banks’ interest. The moment this happens, the price is redirected the opposite way and everyone using this indicator ends up losing a lot of money.

Japanese Candlesticks

One of the oldest indicators dating back to the 18th century, Japanese Candlesticks, is also one of the easiest to see and thus used by large numbers of traders. Once they are noticed, everyone decides to react to the same signals and, quite naturally, big banks interfere once again. Due to the fact that a price reversed, you may even find a hammer you believe functions well, but so did other participants in the market. Many traders find themselves very excited at this point that they cannot seem to notice several points in the chart where other hammers previously failed. To keep traders motivated, the big banks will always allow them an occasional victory, but this only further instills casino mentality in traders intended to maintain a constant surge of individuals hungry for another win.

Chart Patterns

Chart patterns, which function similarly to the previously mentioned indicator, can be quite useful in trading stocks because it focuses on traders’ sentiment. Forex trading does not favor this approach unless we decide to go against the flow, because traders in this market are by default bereft of the information where the money is actually going as the big banks are the only ones entitled to possess this kind of knowledge. In addition, chart patterns are quite easy to see and, as we have seen with the other indicators above, big banks take traders’ orders, trigger them, and whipsaw the price. Only once these traders exit the trade will the banks actually decide on the price’s direction, and the vast number of people who use this indicator allows for this perpetual motion to keep happening over and over again.

Bollinger Bands

This indicator created by John Bollinger in the early 80s is another tool largely dependent on the subject of overbought and oversold, the trap which reversal traders keep getting themselves into. As discussed above, this approach is not viable in trading currencies although some individuals make use of them in calling trends. Unfortunately, this again has its drawbacks because you may be pushed out too early. Successful forex traders commonly look for long runs where they can get a great number of pips, which is why this indicator often does not make their algorithm.

Fibonacci

Similar to support/resistance lines, with any given timeframe, any trader can draw several Fibonacci retracements on any chart. Having several lines on one chart entails that there are too many possibilities, especially considering the fact that we cannot know which line the price is going bounce off of. As Fibonacci revolves around the patterns which occur in nature, the spot forex market naturally cannot make use of this indicator.

RSI

The Relative Strength Index (RSI) was created in 1978 for the purpose of trading stocks, which implies that concepts of overbought and oversold are again used extensively with this indicator. Considering the fact that a number of stock traders do not find it to be useful in reality, we can wonder why traders would even attempt to use them in trading currencies. As RSI is one of the most researched and widely used indicators, traders now have access to a great quantity of data which can save them from experiencing failure while trading currencies.

Moving Average Crossovers

Despite the fact that this indicator proved to be useful at times, it still does not give you an exclusive insight into any market activity. Even if you can draw an SMA (simple moving average) of 50, 100, or 200, you become one of many who focus on the price nearing one of these levels or on the two moving averages crossing. Moreover, as the spot forex market requires traders to be alert and timely with their decision-making, this indicator is probably not the best choice because it simply gets you in too late.

Whichever indicator you want to use, make sure that you do not lose sight of the need to enter the market and start trading just on time, which some of the tools discussed today evidently cannot grant you. If you want to become a successful trader, explore whatever available information you can and work on your trading toolbox understanding what trading currencies essentially means. Last but not least, think of the percentage of people doomed to fail just because they have not invested time and effort in researching and analyzing the indicators they entrust their financial stability with.