The issue of the balance sheet has been discussed by a number of analysts since there is no consensus on what the appropriate size for the assets of the bank should be, and how positive it is to have a very large balance as that acquired by the main banks in the world. Some analysts believe that at present the balance sheet of the main banks in the United States, the United Kingdom and the European bank has expanded sufficiently, and the committees of these banks have wanted to materialise a change in asset acquisition policies.

Many people believe that the purchase of assets increases the balance sheet unnecessarily due to the limited scope of this measure in the real economy in terms of job creation and economic growth.

After the 2008 crisis, the Federal Reserve and the Bank of England, among others, multiplied their balance sheets several times through a quantitative easing program which consisted in the issuance of money to finance the purchase of government bonds and corporate debts. The long-term objective of this measure was to keep interest rates low in the medium and long-term in order to support the financial system and demand for loans, which would reactivate the economy.

Many analysts believe that the decision to modify the balance sheet was made due to the limited response of the economy in the short term to reductions in the interest rate after the financial crisis.

When the authorities of the main banks issued their intentions in 2014 to normalise their policy and begin to reduce their balance sheet, financial markets became more volatile due to the change in expectations of investors who expected higher interest rates in the long term. But it is not clear yet how much the balance sheets would be reduced or what the possible consequences of this policy change would be, so in the next part of the article, it will expose the main findings of Charles A. Goodhart in his paper, A Central Bank’s Optimal Balance Sheet?

The paper criticises the centralisation of monetary policy studies since it is well known what the effects are of the intervention on the interest rate, but not the study on the normalisation of the balance sheets of banks. The conjuncture of the paper was given at the moment that the FED was announcing the reduction of the size of its balance sheet by not reinvesting its internal cash flows of interest payments and the maturation of the principal.

It was expected that the announcement would come out between September and October 2017 and that some banks such as the European Central Bank (ECB) and the Bank of England would follow in the footsteps of the FED soon after. What the market had discounted is that the reduction of the balance sheet would be gradual, to be only the non-reinvestment of its cash flow instead of selling the portfolio of banks directly. But for Goodhart, what had not been discussed was what the final objectives of normalisation were and what the equilibrium balance of the banks would be.

Quantitative easing involves not only public debt assets but also the purchase of financial and corporate assets in some countries to support credit flows in weak markets. But with the normalisation of the balance sheet, the direction of the credit as its supply and demand should be determined by the market, and the assets held by the banks in equilibrium should be only public debt assets.

Although the banks have already expressed their desire to normalise their balance sheet, there are still different points of view on what the result of the normalisation policy should be. That is why the author exposes two different points of view about the people who defend the permanence of the expanded balance sheet and those who are against it.

Those in favour of a larger balance sheet mention that the payment of interest on excess reserves or offering Reverse Repos (RRPs), central banks can continue to control the official short-term rate and thus fulfil the mandate of monetary policy without having to import the size of the reserves of commercial banks and their own balance sheet.

Furthermore, according to the defenders of a large balance sheet, central banks can create additional liquidity for the benefit of the public sector since their assets generally have a higher rate of return than their liabilities, so this positive dynamic can be followed with large balances that end up contributing to the public sector.

The truth is that the optimal size of a balance sheet is unknown, and consensus may never be reached. The only thing that is not proposed is to continue increasing these balances but to maintain the current levels that, as already mentioned, would not have negative effects according to these people.

Analysts who are against the big balance sheet criticise the fact that the people who make the analysis of the quantitative easing and balance sheets of the central banks come from the central banks themselves, so they are not the most suitable and objective people to perform this work. In addition, they could be under political pressure, so it would be best for people outside the institutions to do the analysis on what is best for the banks and the economy.

It is also clear to them that with normalisation, it is likely that short-term interests will increase which would lead to higher payments on their liabilities, while the increase in the rates that are paid to their assets would increase more slowly, which would go against the argument in favour of having a large balance. It would be the opposite because it would reduce the central bank’s liquidity by generating losses, although the magnitude of this will depend on how the bank’s balance sheet is made up.

It is clear that there will always be a continuing concern about financial stability and according to Goodhart, there is a consensus on the need to continue satisfying the demand for liquidity of the financial system in general. But that could be achieved with a great variety of assets in the system and not necessarily everything has to be done through the massive holdings of commercial bank reserves in the central bank.

Another problem that is generated by the maintenance of satiety of liquidity is that the desired level of liquidity can be altered over time, so it would not be possible to differentiate if the economy is in a stage of growth or a crisis, so an imbalance in the sizes of the balance sheets would be generated in the long term.

Perhaps the biggest problem with an excessively high balance is that the disadvantages outweigh the advantages according to Charles A. Goodhart. This is generated because the long-term interest rates remain excessively low, so it is best to reduce the size of the balance in a gradual manner. In addition, the size of the balance sheets has become so large and debt levels are generally so widespread, which implies greater sensitivity in the future to increases in interest rates so that monetary policy could face some restriction.

In conclusion, the objective of monetary policy, in general, is to provide economic stability. But with excessive quantitative easing, the opposite can happen, since in the short term this generates a monetary stimulus, but in the long term, imbalances can be created. For example, in the long term, excessive QE and a stable economy could trigger high inflation beyond what is desirable by central banks.

In addition, this excess liquidity can generate a bubble in assets due to the fact that short-term interest rates are low, which encourages the valuations of some assets to exceed their fair value. This is an issue addressed by the monetary policy committee of the Bank of England which found that in the last year many assets have excessively increased their value which can be risky in the medium and long term, as a vertiginous decrease in the values of shares and other assets could be transferred to the real sector, affecting the growth path of the economies.

There are also critics since quantitative easing may be guilty in the long run of the creation of economic cycles since this policy created liquidity to get out of the financial crisis which kept interest rates low. But this was not necessarily positive because access to credit was facilitated and it may have generated the obtaining of credits to people who are not able to pay, so if this policy is followed, it is possible that the Financial system would suffer in the future, but for the moment what generated this large amount of liquidity was an economic boom.

The opposite can happen when that large amount of money is removed in the economy because as mentioned by the writer of the paper, an excessively large balance could have generated an imbalance in the economy without certainty of what could be the point of equilibrium of the economy. It is possible that a counter-cycle of the boom is generated because the long-term rates will increase with the reduction of the balance sheets, generating a narrower credit market affecting the main motor of many economies in the world, the consumption. It is clear that this reduction in the balance will be moderate to not have a major impact on the economy, but there is no certainty as to how this will turn out.

In the case of the Bank of England, you can see the progress of the balance sheet from 2015 to the third quarter of 2015. As is evident, there has not been a decrease in the value of the balance, although in the last three instalments it has not increased drastically, although its value continues to rise. The US Federal Reserve and the European Central Bank have already given some clues as to how they will reduce the excess liquidity, but the British bank has not yet commented on this.

Graph 66. The stock of APF HOLDINGS. Data Taken from

https://www.bankofengland.co.uk/asset-purchase-facility/2017/2017-q3

Graph 67. Gilts. Data Taken from

https://www.bankofengland.co.uk/asset-purchase-facility/2017/2017-q3

Graph 68.Term Funding Scheme. Data Taken from

https://www.bankofengland.co.uk/asset-purchase-facility/2017/2017-q3

Graph 69. Corporate Bonds. Data Taken from

https://www.bankofengland.co.uk/asset-purchase-facility/2017/2017-q3

Although there is no defined route by the English bank of how it will normalise the liquidity it is evident that a large part of the assets are the Gilts that are bonds issued by the British government, so if it is taken as true the central idea of the paper A Central Bank’s Optimal Balance Sheet?, the English bank can start its reduction with corporate bonds and other assets that do not represent a large percentage of its balance. After the bank reduces or eliminates those assets, the credit market will respond to supply and demand forces as stipulated that it should be.

With the measure taken by the MPC in November 2017 to raise the interest rate, this may be the beginning of the normalisation of the balance sheet, as the meaning of this measure was to keep interest rates low to inject dynamics into the economy. But the current conjuncture of the British economy is different from the one that existed after the 2008 crisis because of the Brexit elections.

Inflation is at very high levels, so the Bank of England has decided to start raising its rates which could be complemented with the normalisation of the balance sheet since it is expected that a smaller balance will generate a reduction in the inflation indexes.

In addition, the global context is favourable to observe higher inflation rates since the world economy is growing at higher rates than expected, which may lead to higher inflation rates. The Federal Reserve has already begun its normalisation since October and it is expected that the European Central Bank will start soon, as will the Bank of England for the latest monetary policy decisions.

According to the main newspapers of the world, more aggressive increases in interest rates are expected in the United Kingdom due to the good performance of the economy in the world and in this territory. Logically, the United Kingdom has not shown the same dynamics as other countries such as the United States due to the risk associated with the United Kingdom until it is clarified how negotiations with the European Union will end.

It is likely that with a more aggressive rate hike the normalisation will also be faster, but we will wait for the next quarterly reports of the bank’s balance to observe what the pace of normalisation will be like. The composition of the assets is a determining factor since a large part of it is made up of public debt and if what is stated in the paper serves as the guidelines that banks will follow, it is first expected that banks will dispose of corporate debt and other assets, which is a small part as seen in the graphs above.

In conclusion, the Bank of England has a good profile on its balance sheet since almost all of its assets are public debt, which means that the possible effect and noise that standardisation will generate may be small. With the increase in rates, the first step towards normalisation was taken for the medium and long-term, as mentioned several times, central banks will do everything possible to reduce their balance sheets very slowly, avoiding possible undesired effects. In 2018, a more aggressive rate hike is projected due to the behaviour of inflation in the United Kingdom, although no statement has been issued such as that issued by the FED which mentions an exact date to begin normalisation.

When this process begins, it is not known to what extent an equilibrium level will be considered, as there is no consensus on how much the indicated level of liquidity in the economy is, and the level chosen by each central bank may be different. The European Central Bank has also issued statements, although it has not initiated this process. We will have to be alert to the possible effects that this will generate in the market and what decisions the Bank of England will make during the following years since by the middle of 2019 it is expected to conclude negotiations with the European Union so that normalisation could be affected if the financial system presents a marked weakness. The evolution of the balance since 2009 can be seen in the article Asset Purchase Facility Quarterly Report 2009-2017 where there have been two important moments of increases in assets and the composition of the sheet has also changed over time.

The current sentiment for Bitcoin is slightly positive, meaning only 69,89% of total 356 mentions on the web are positive.

The current sentiment for Bitcoin is slightly positive, meaning only 69,89% of total 356 mentions on the web are positive.

The current market sentiment for this cryptocurrency is positive, meaning 71.3% positive mentions on the web out of a total of 115.

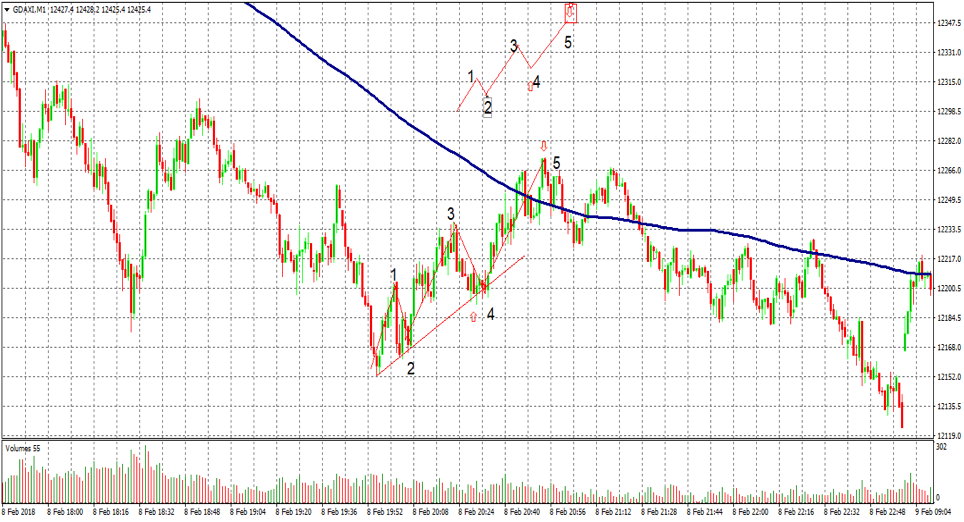

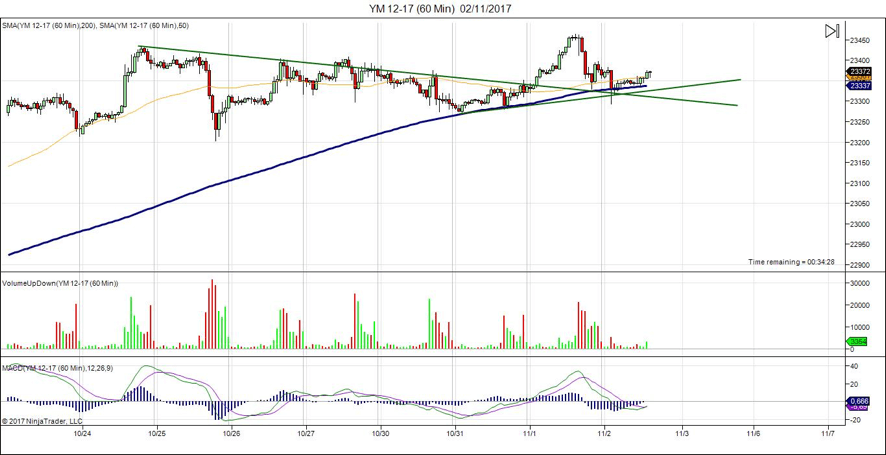

The current market sentiment for this cryptocurrency is positive, meaning 71.3% positive mentions on the web out of a total of 115. Looking at the hourly chart, we can note that price has formed two bull flags on the way of forming a cup and handle. That is an extremely bullish sign, and if you look back at the daily chart, this formation was also the bottom last time the price surged all the way up to above 1000$

Looking at the hourly chart, we can note that price has formed two bull flags on the way of forming a cup and handle. That is an extremely bullish sign, and if you look back at the daily chart, this formation was also the bottom last time the price surged all the way up to above 1000$ Overall the hourly chart signals a buy.

Overall the hourly chart signals a buy.

Zooming into its hourly chart we can see that price formed two bullish flags after the cup-and-handle was completed, and after price tested the 0.38 Fibonacci level for support.

Zooming into its hourly chart we can see that price formed two bullish flags after the cup-and-handle was completed, and after price tested the 0.38 Fibonacci level for support. Overall the hourly chart signals a buy.

Overall the hourly chart signals a buy.

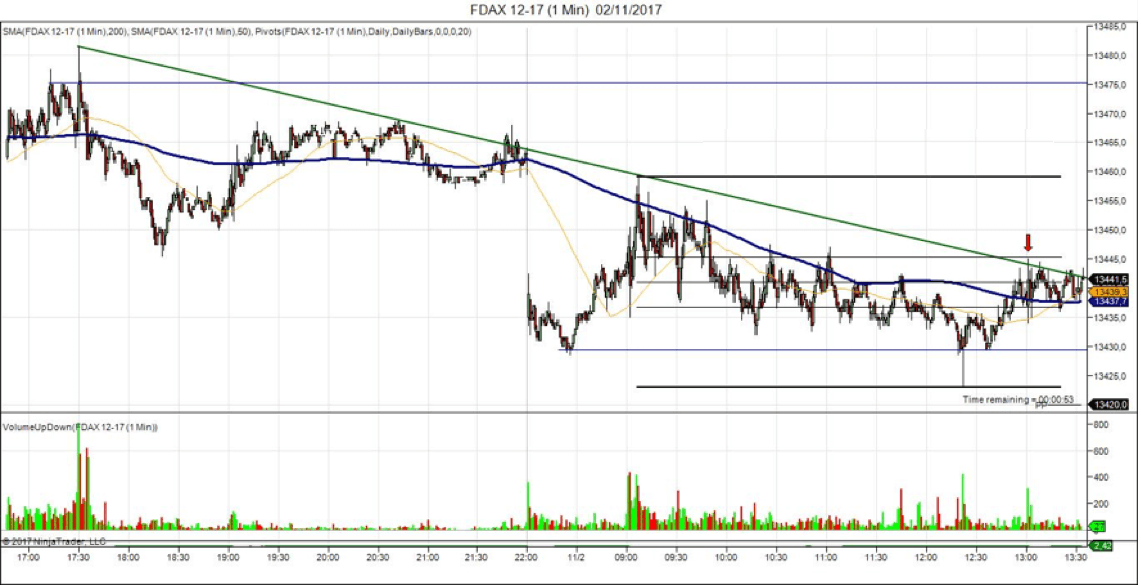

The daily chart is looking bearish as the Bitcoins price failed to create a higher high and is now 6823$. Not much has changed since yesterday, expect that the price slightly rose by 1,84%.

The daily chart is looking bearish as the Bitcoins price failed to create a higher high and is now 6823$. Not much has changed since yesterday, expect that the price slightly rose by 1,84%.

The main drawback of the SMA is its abrupt change in value if a significant price move is cut off, particularly if a short period has been chosen.

The main drawback of the SMA is its abrupt change in value if a significant price move is cut off, particularly if a short period has been chosen.