Fortrade is a forex broker located and regulated in the UK by the Finance Conduct Authority (FCA). Fortrade states that it is providing state of the art trading platforms and services in favor of clients. With great support, every day market analysis, efficient informational network, they are trying to be at your service all the time. In this review, we will be looking into the service being provided to see if they live up to the expectations that they have put on themselves and to help you decide if they are the right broker for you.

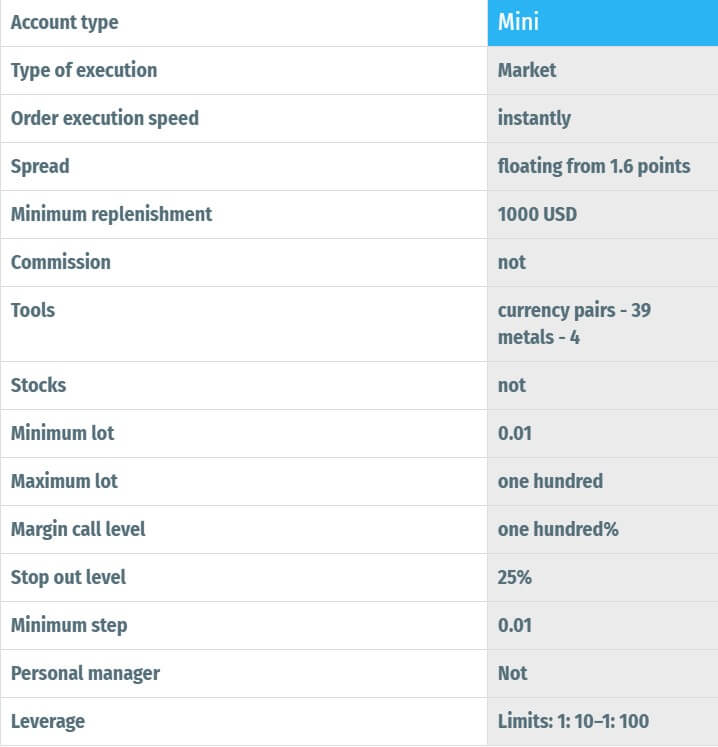

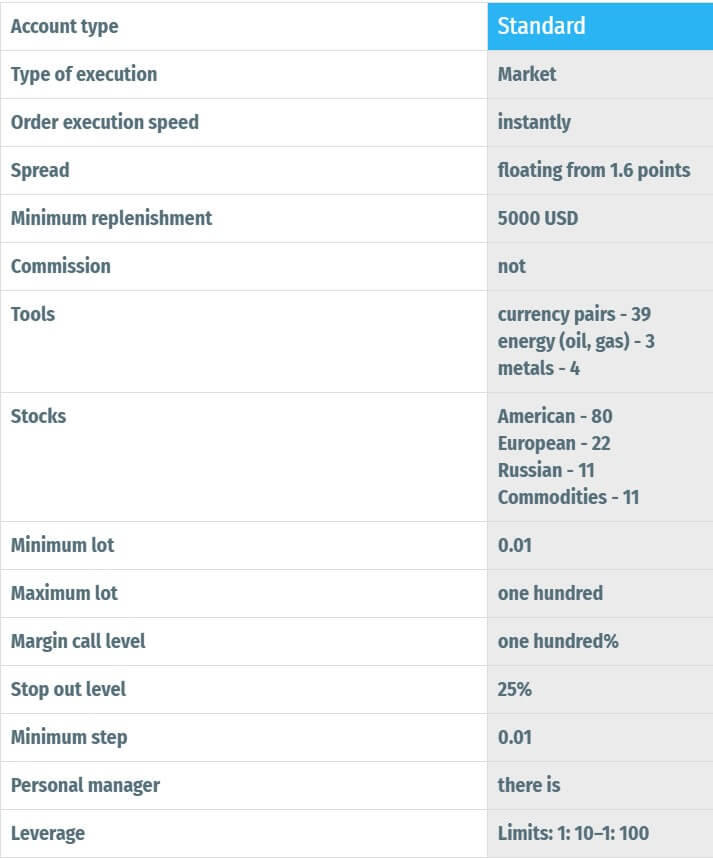

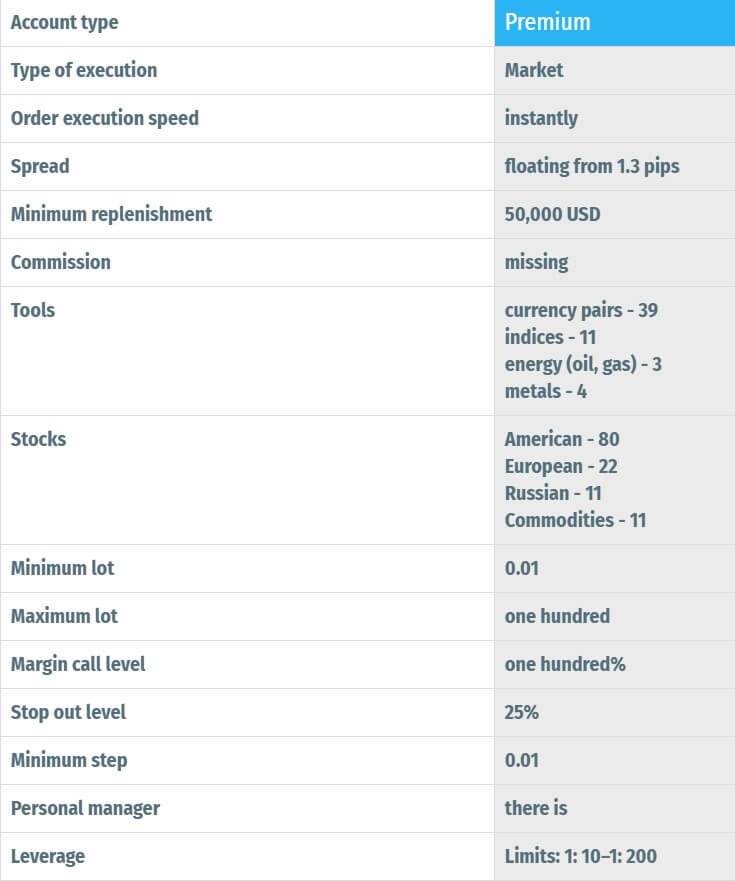

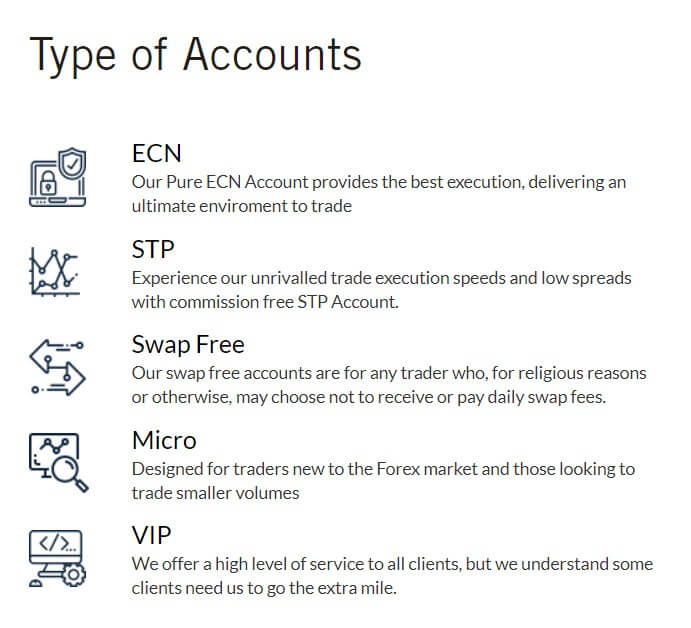

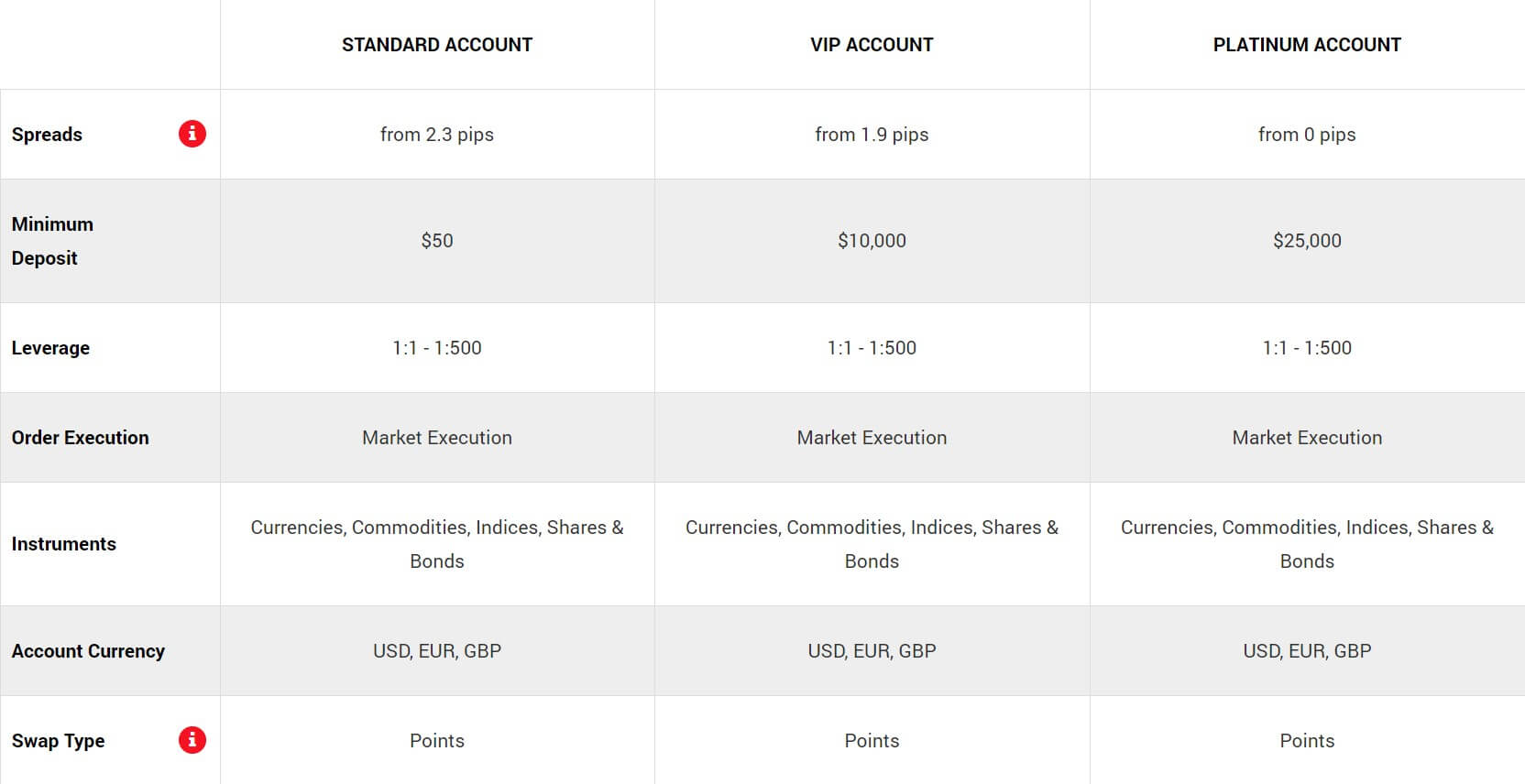

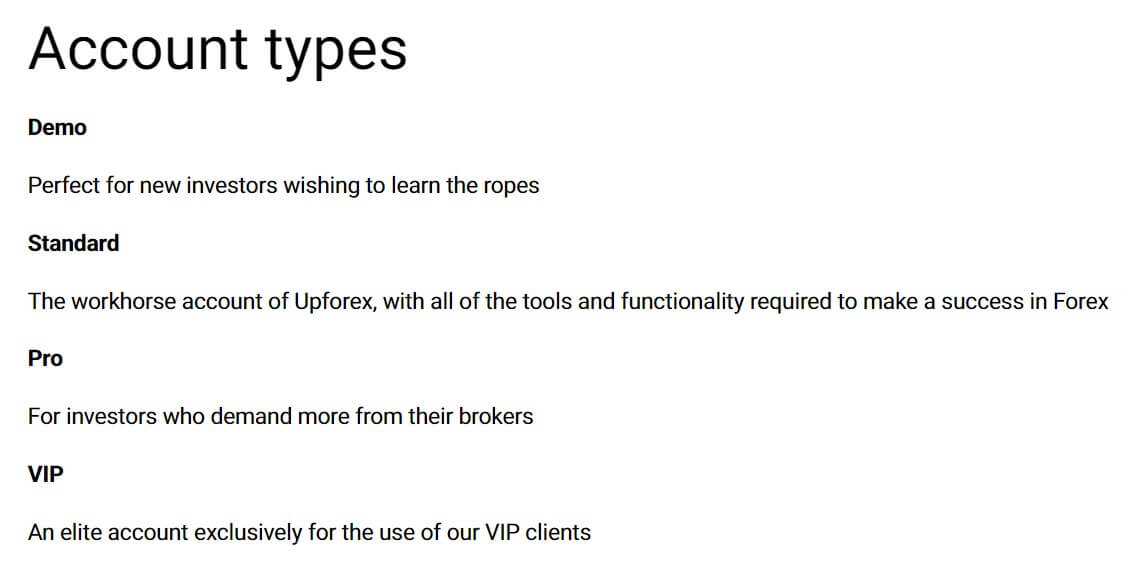

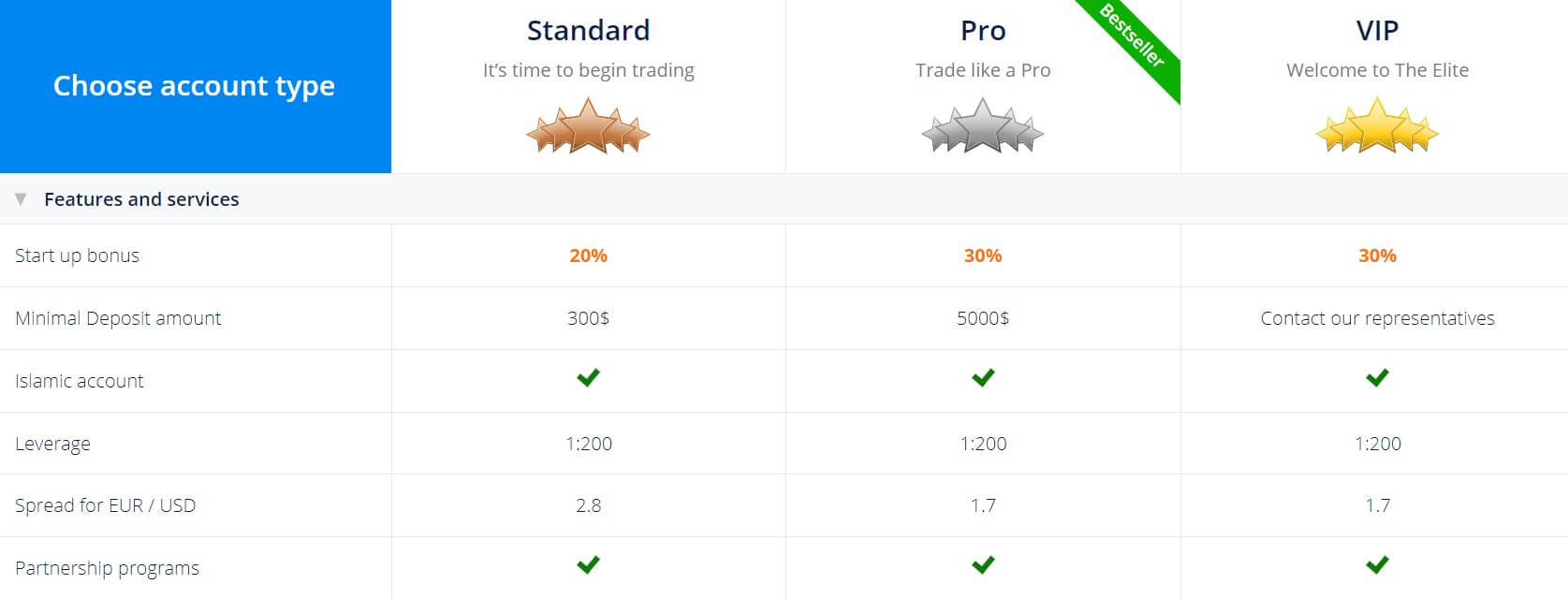

Account Types

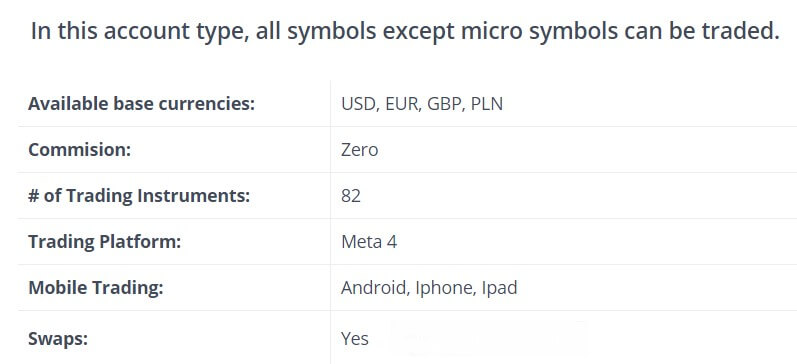

When it comes to accounts, Fortrade makes it very simple, there is just one account called “Real Account”. This account comes with the following stated features:

- No provision and additional expenses

- Up to € 2500 bonus

- Free Forex book

- Fixed spreads

- Deposit and withdraw your funds with ease

- Fortrade Meta Trader 4, WebTrader & MobileTrader

- 12 hours a day support

- Daily market analysis

- Personal account manager

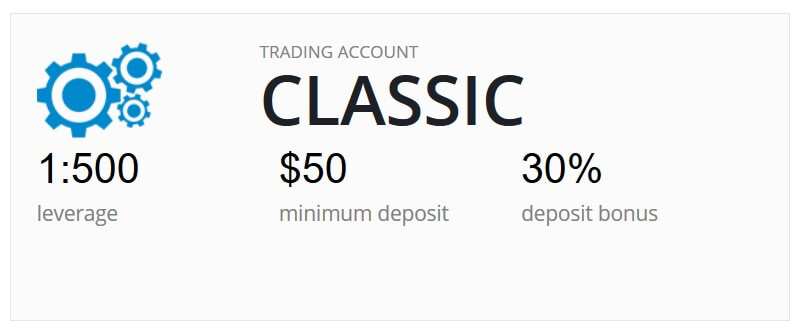

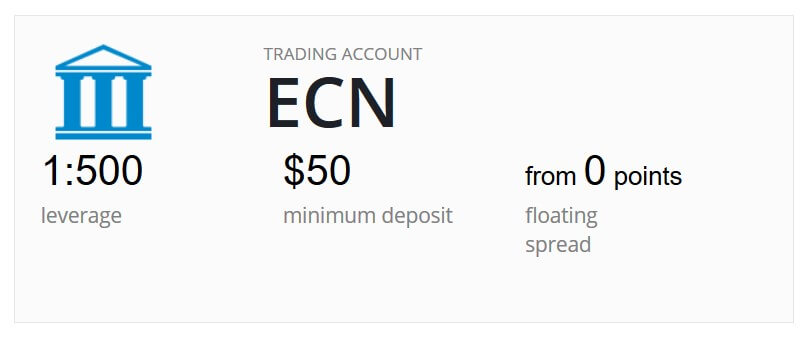

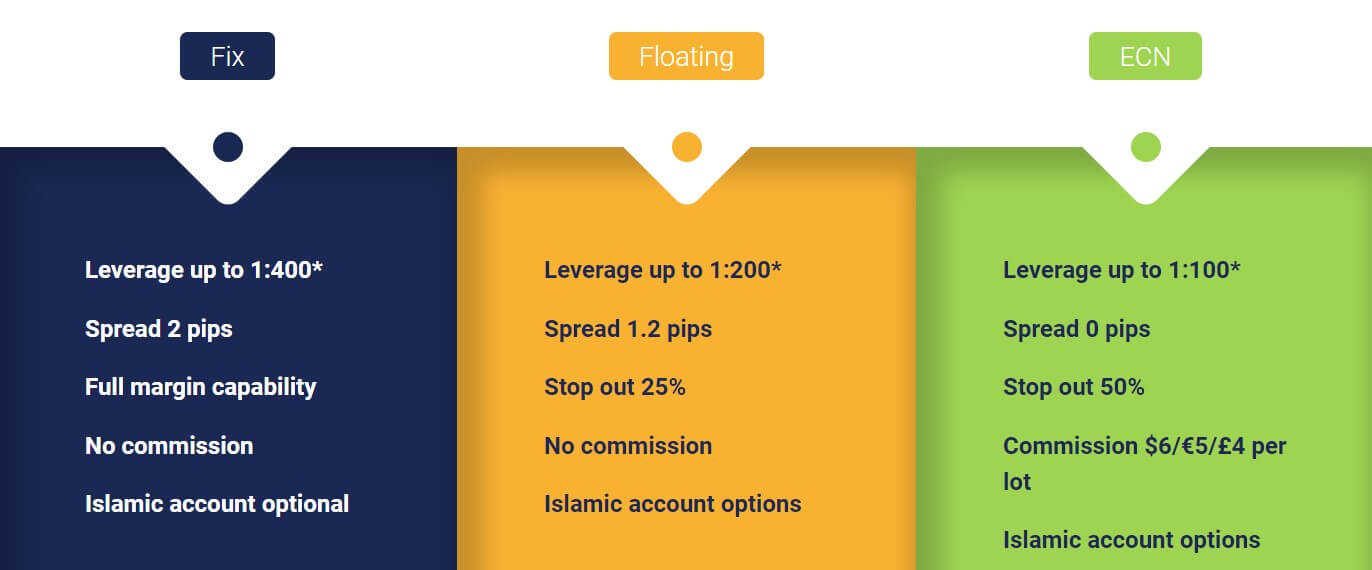

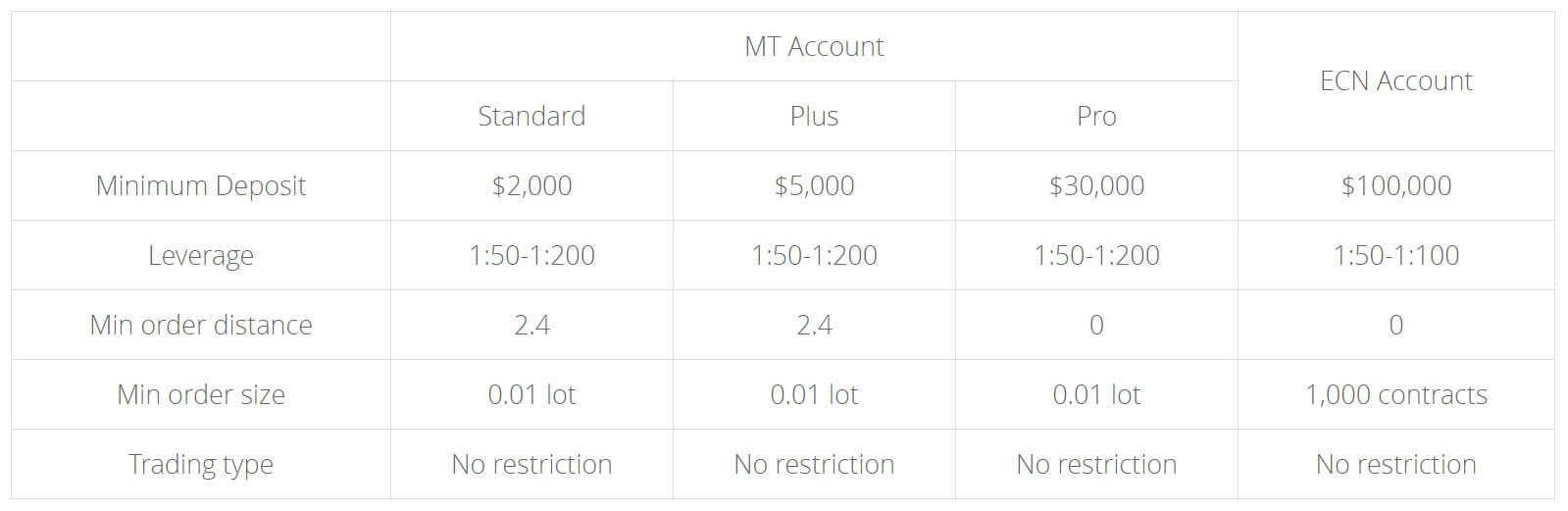

There is mention of an ECN account in the trading conditions part of the website, however, there is no indication that you can open this account rather than the standard account, so we are unsure if this account is still valid or not.

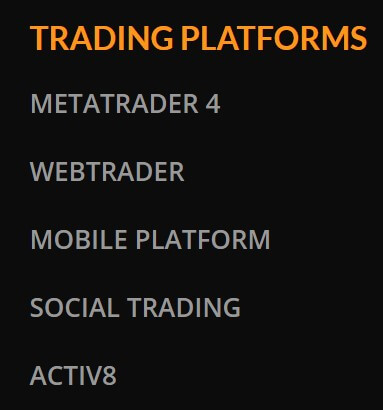

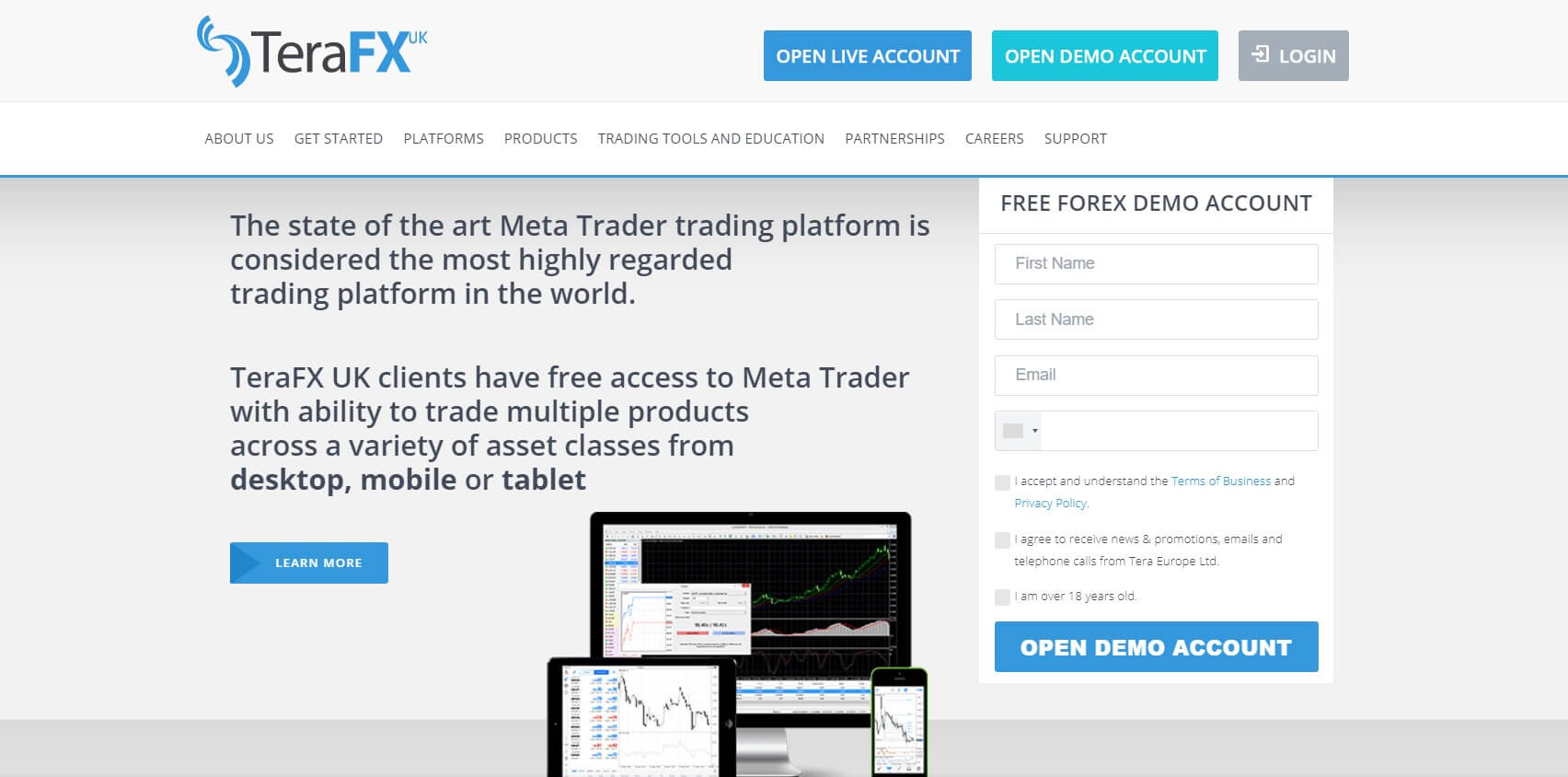

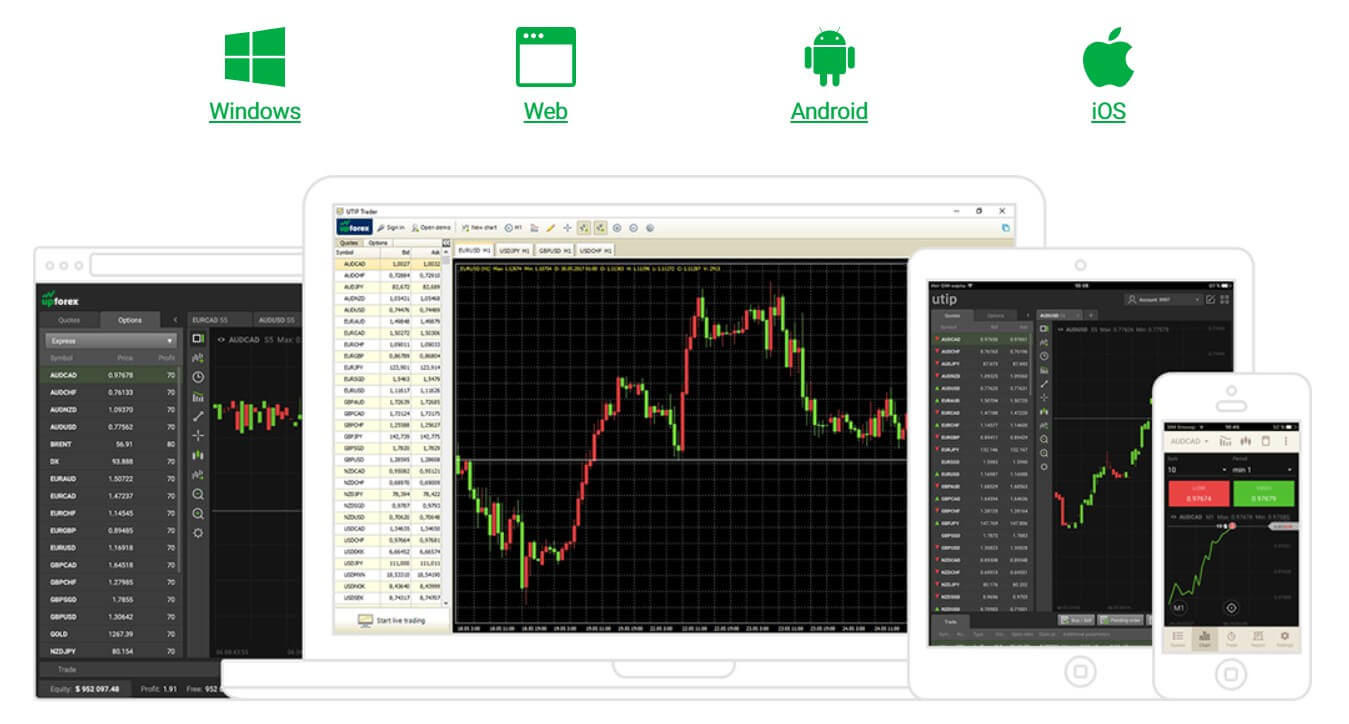

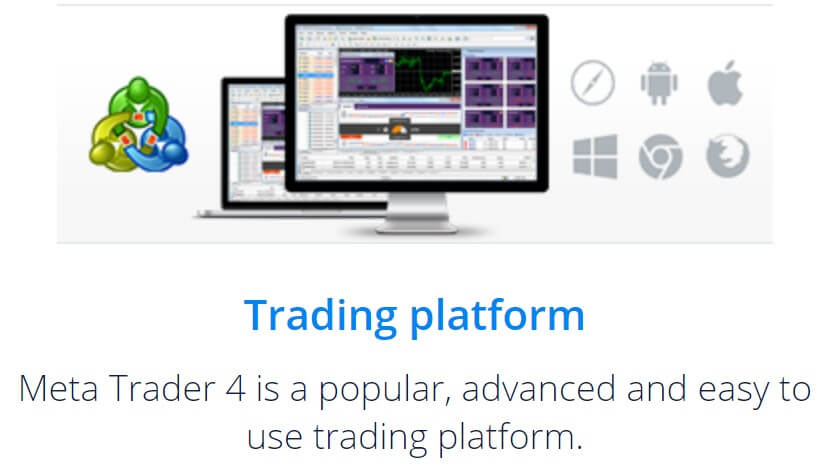

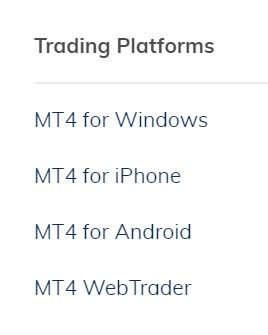

Platforms

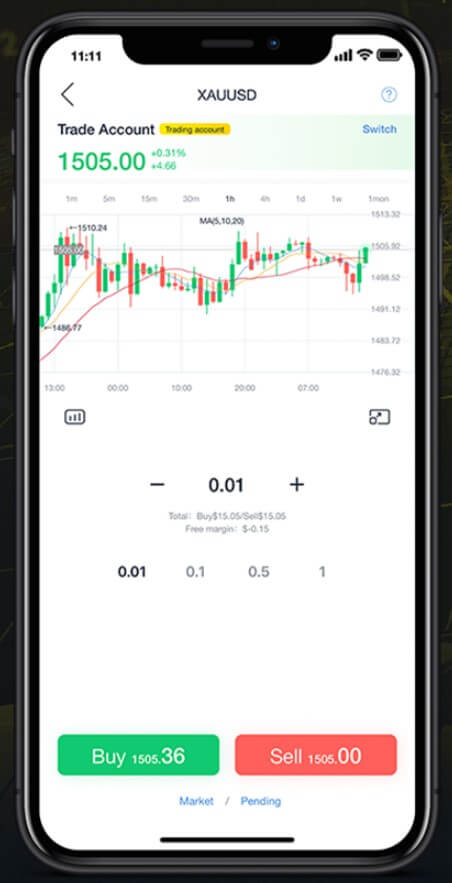

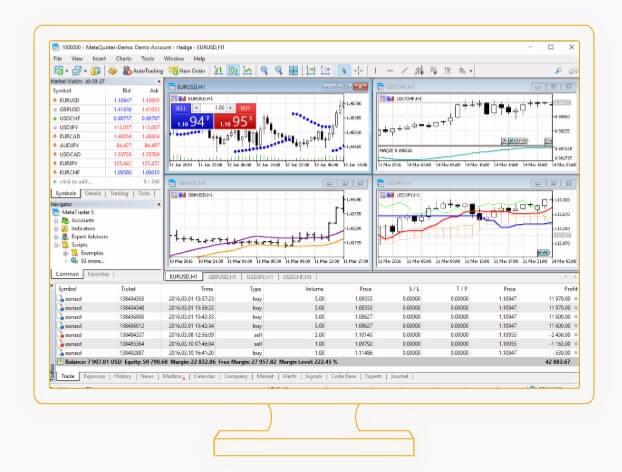

Fairtrade offers two different platforms, one multi-purpose platform in the form of MetaTrader 4 and one custom made a mobile app called Fortrade Trader.

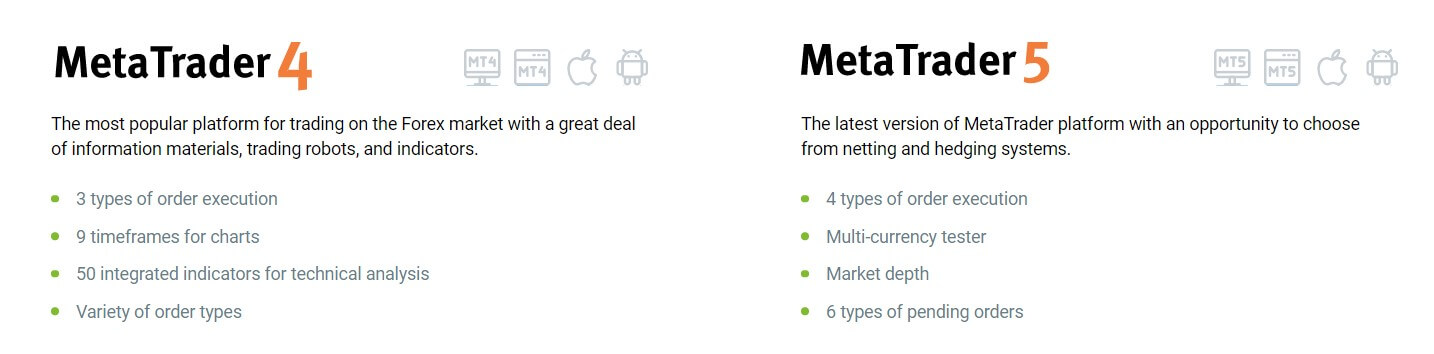

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. Millions of people use MT4 for its interactive charts, multiple timeframes, one-click trading, trade copying and more. In terms of accessibility, MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Foretrade Trader: The Foretrade trader is a custom-made mobile app for their clients. It has over 100 different instruments and gives you complete control over your trading. Some of the features include: Create a new trading account, switch from one to another trading account, change the password and personal details directly in the application, deposit funds, send requests to withdraw your funds, use the unique “Double Tap trading” option, close all open positions with a single click, receive information and news directly to your phone in the form of notification, get in touch with Fortrade support directly through the application, full control of your positions and access to the complete trading history, use indicators on charts, change the look of the chart to fit your needs, having access to the latest news from the market and the economic calendar and much more,

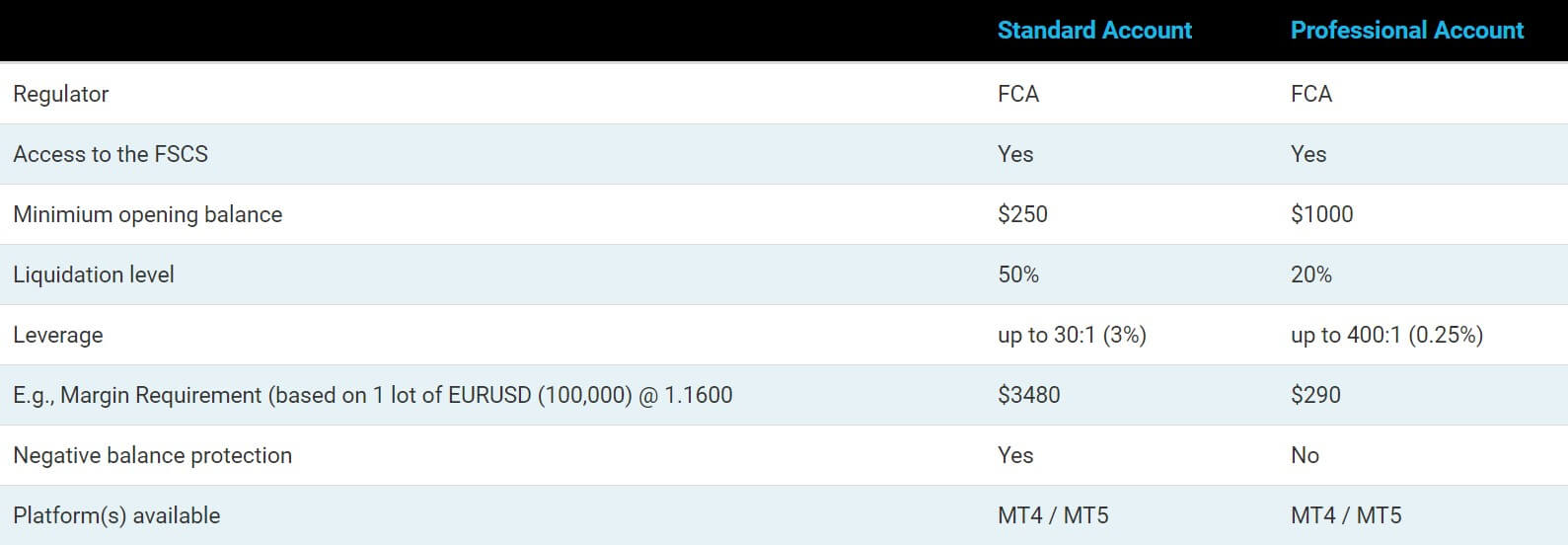

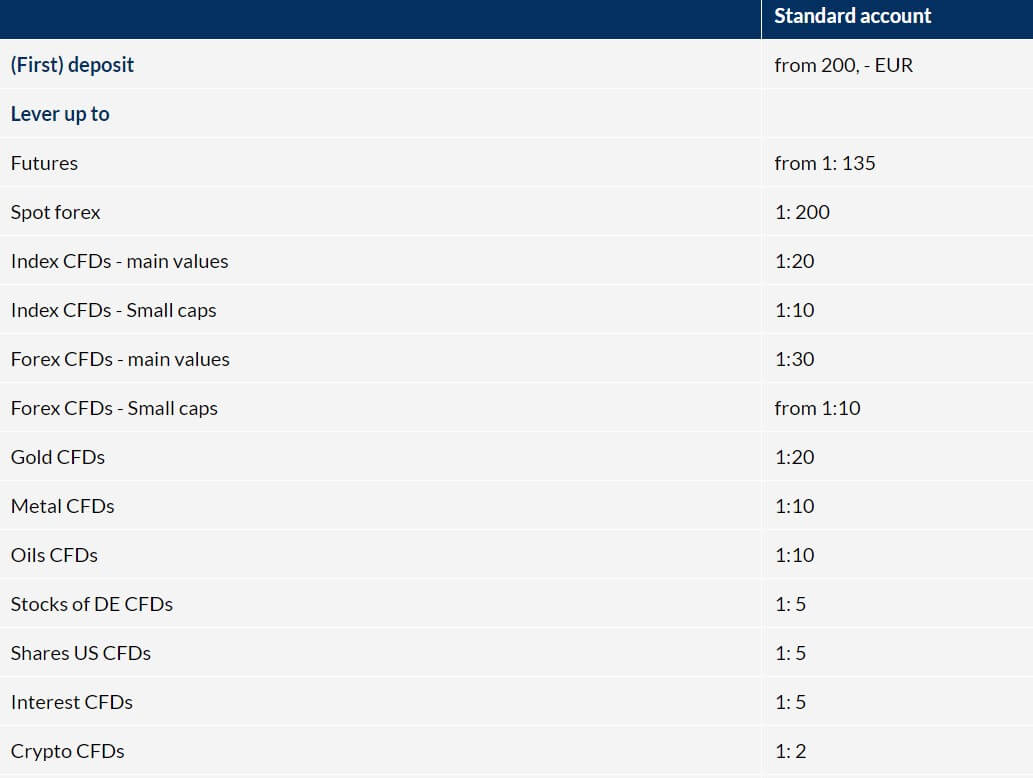

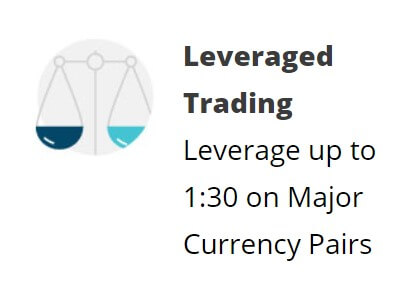

Leverage

Leverage with Fortrade is fixed and can not be changed so the account comes with a single leverage which varies by the instrument that you are trading. Some currency pairs are set at 1:20 while others are 1:30. Indicies and some stocks are also 1:20 while indices are at 1:10. If you are able to open up an ECN account then the maximum leverage is stated as 1:200 but we could not find a way to open this type of account.

Trade Sizes

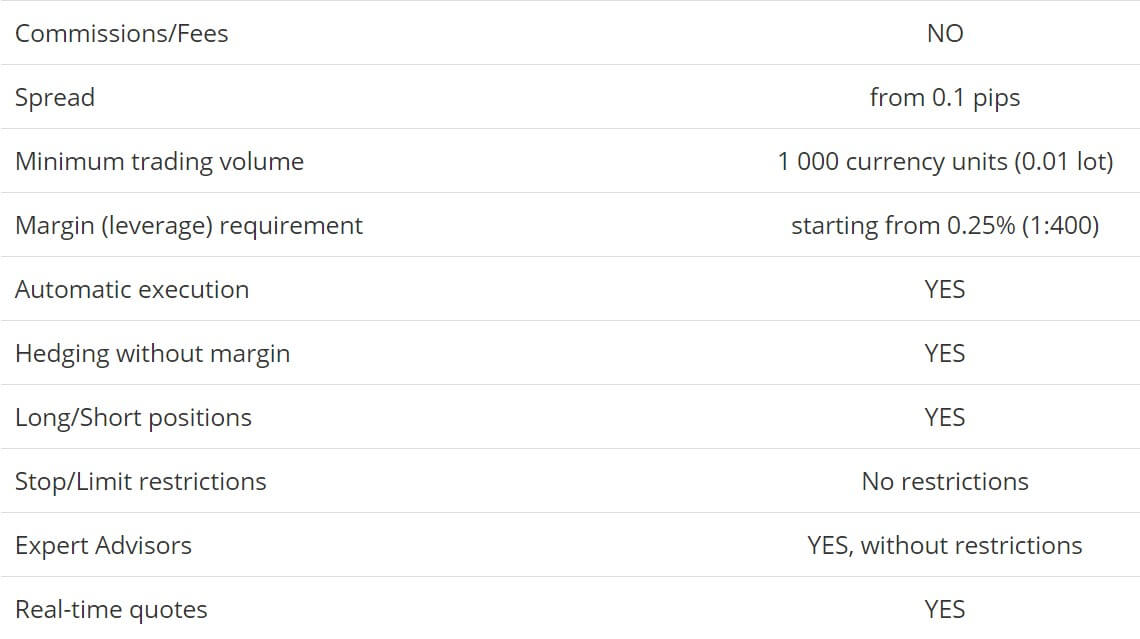

Trade sizes for currency pairs start at 0.01 lots which are also known as a micro lot, they then go up in increments of 0.01 lots so the next available trade will be 0.02 lots and then 0.03 lots. We could not locate information on the maximum trade size, however, no matter what it is we would not suggest trading over 50 lots in a single trade as it becomes increasingly harder for the markets and liquidity providers to execute trades quickly and without any slippage the bigger they get. For other instruments such as commodities the minium trade sizes start at 0.1 lots (known as a mini lot).

Trading Costs

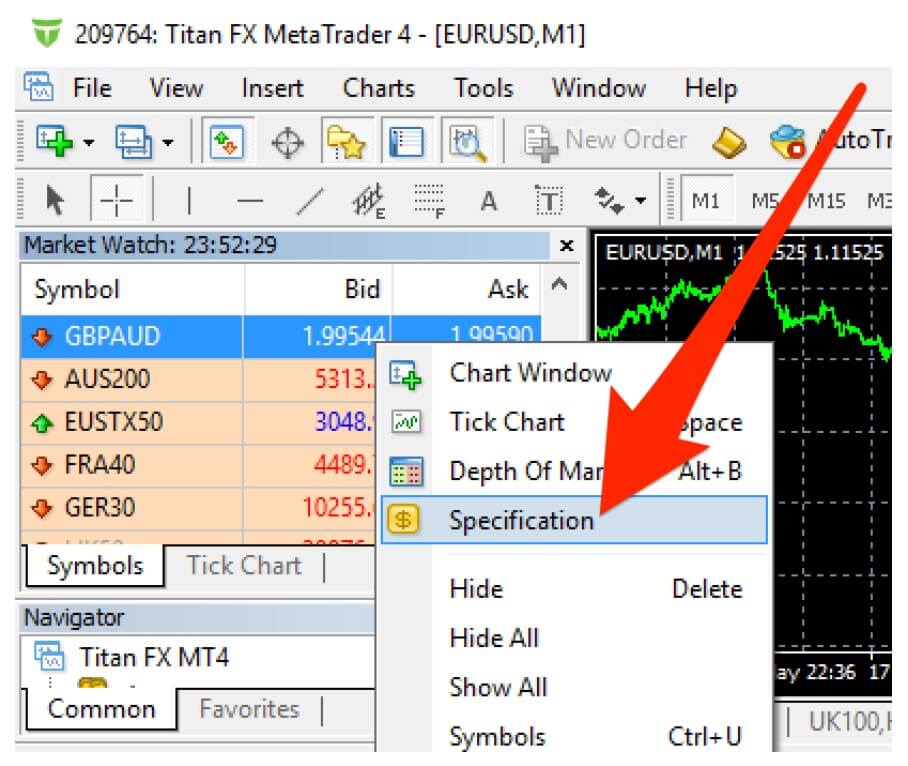

As far as we could tell all trading costs come from spreads and no commission so we will be looking at them later in this review. Swap charges are present though, they can be both positive or negative and are charged for holding trades overnight, these can be viewed directly within the MT4 trading platform.

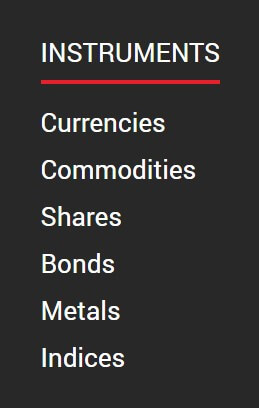

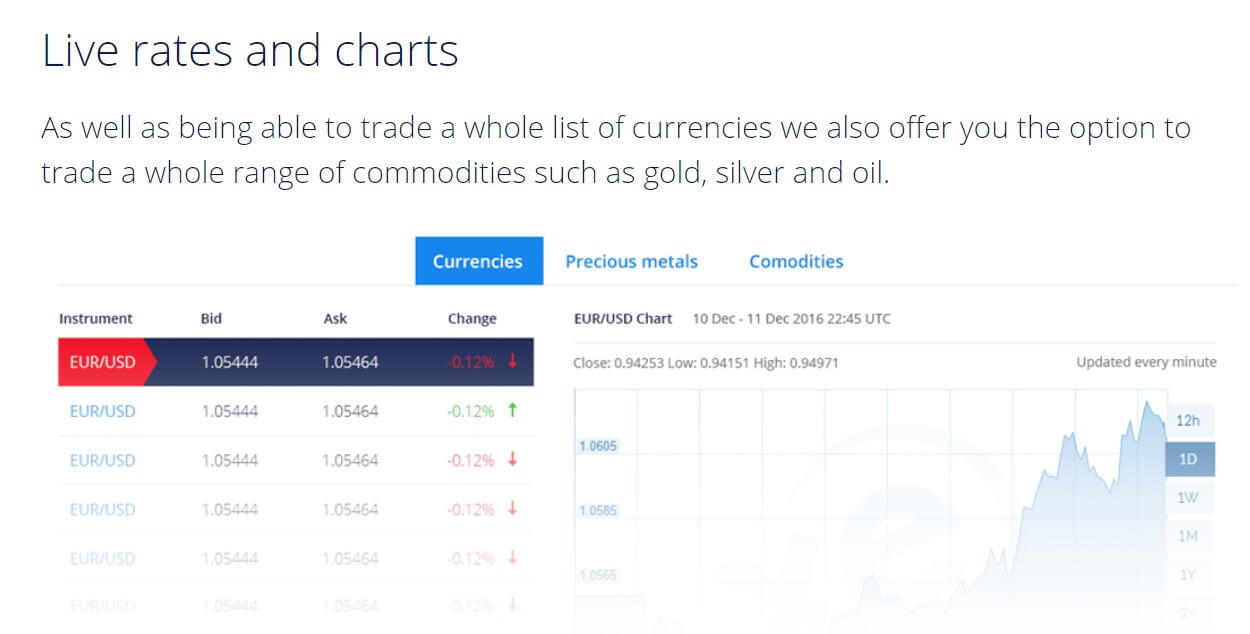

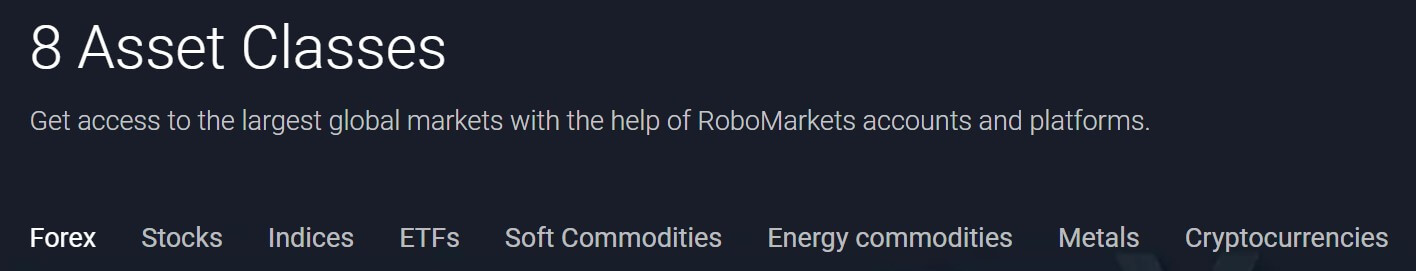

Assets

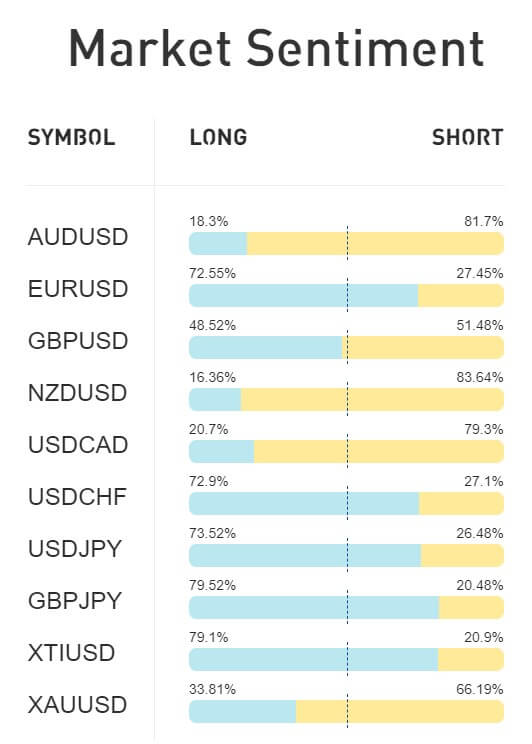

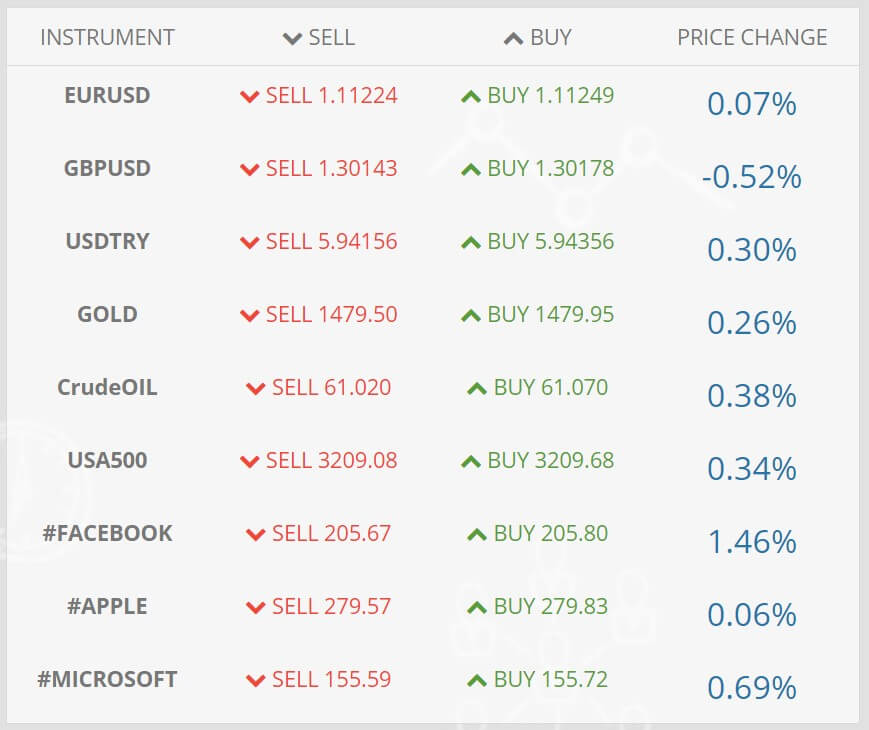

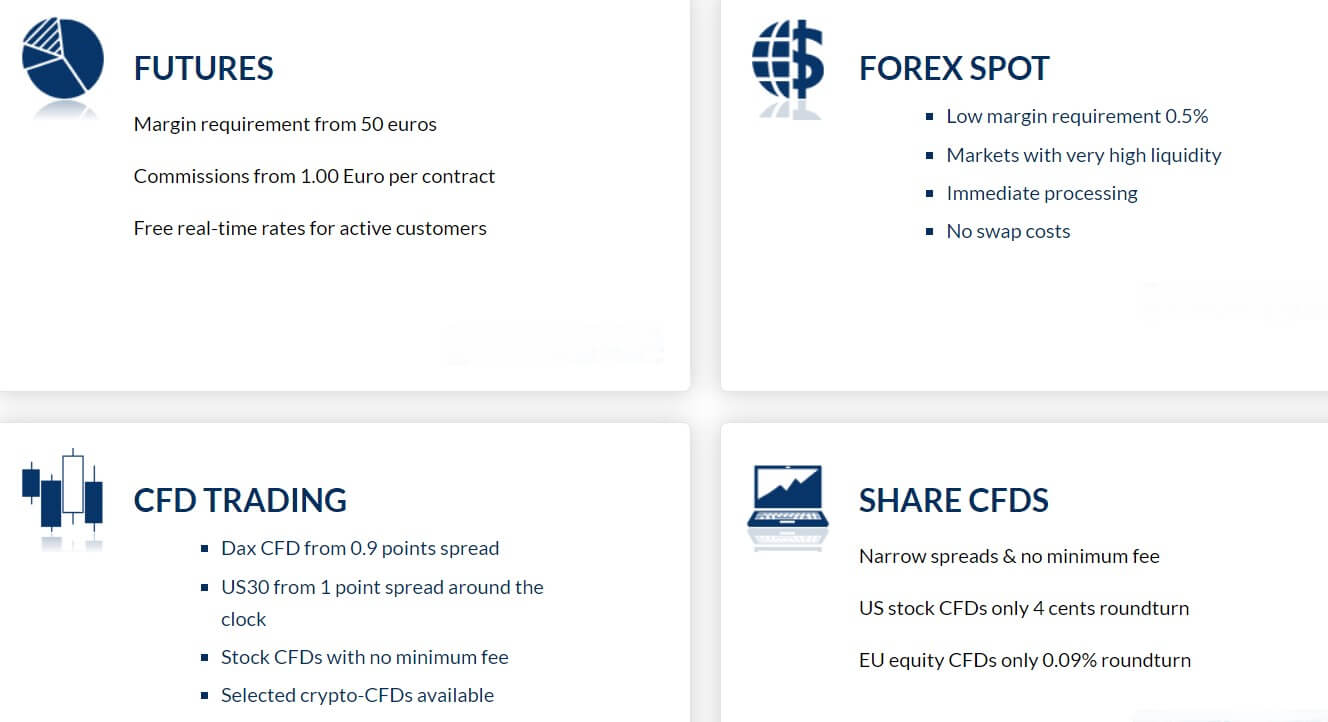

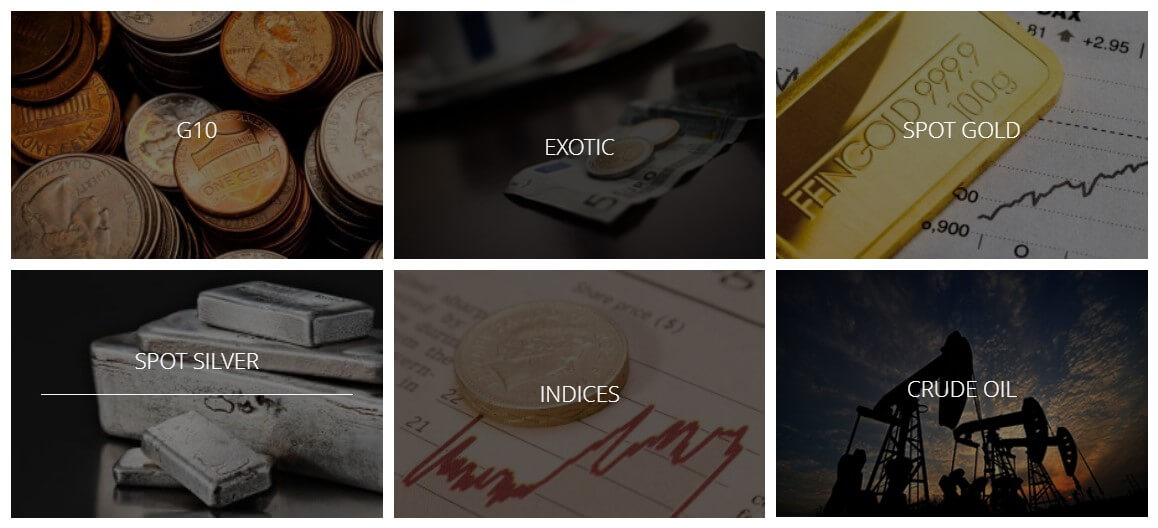

Fortrade breaks down its assets into a number of different product categories. There isn’t a full list of what assets are available in each category, instead, they offer a simple overview which is not the most informative way of showing off your assets.

Forex pairs are available, there are only 5 listed, those being EURUSD, GBPUSD, USDJPY, USDCHF and AUDUSD, Fortrade state that there are more but they are not listed on the website. Their next category is called Gold CFDs however, in reality, this involves all metals and not just Gold, Silver, Copper and Platinum are also available to trade. Oils are also present with Crude Oil, Brent Oil, Gasoline, Heating Oil and Natural gas all being mentioned on the website.

We then move on to Agriculture CFDs, this includes the likes of Corn, Wheat, Cotton, Soy Bean, and Sugar. Index CFDs are next up, again there is not a full breakdown, instead just a number are listed including USA 500, USA 100, GER 30, USA 30, UK 100. Finally, we move onto stock CFDs, stocks such as Google, Microsoft, Facebook, Twitter, and Apple are all available.

Note: We have now managed to locate PDFs on the website with all tradable assets listed, these can be found in the “Trading conditions” part of the website.

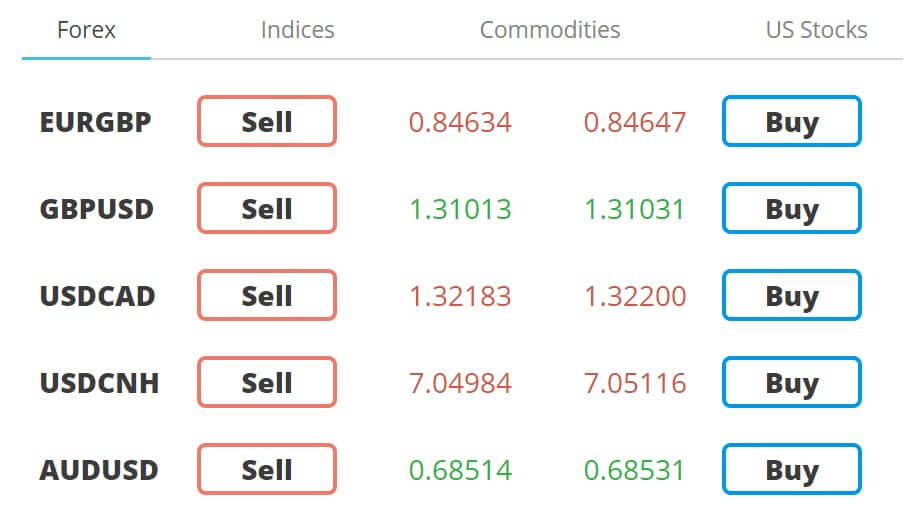

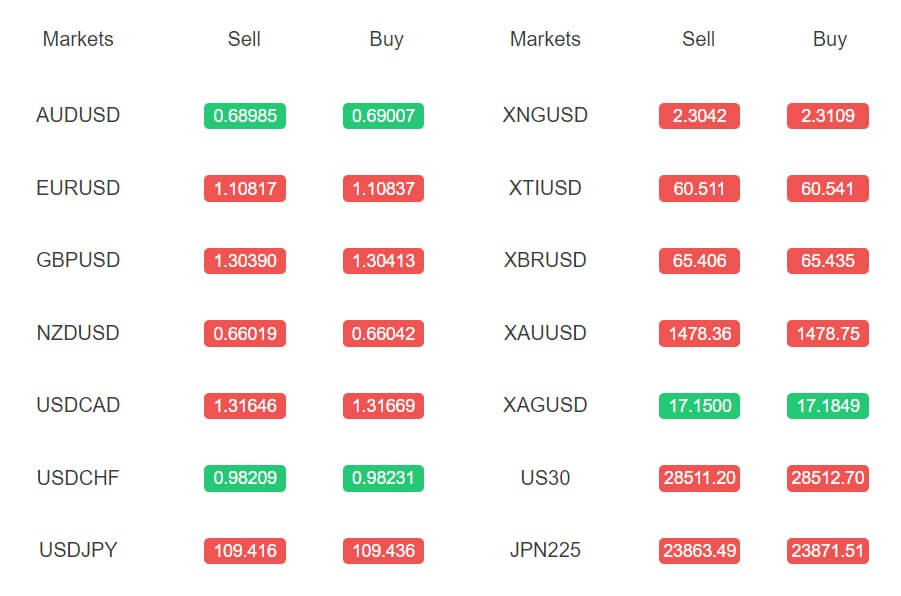

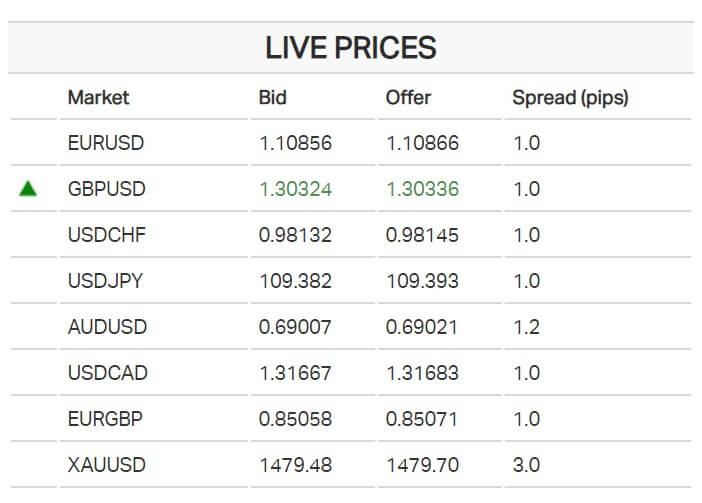

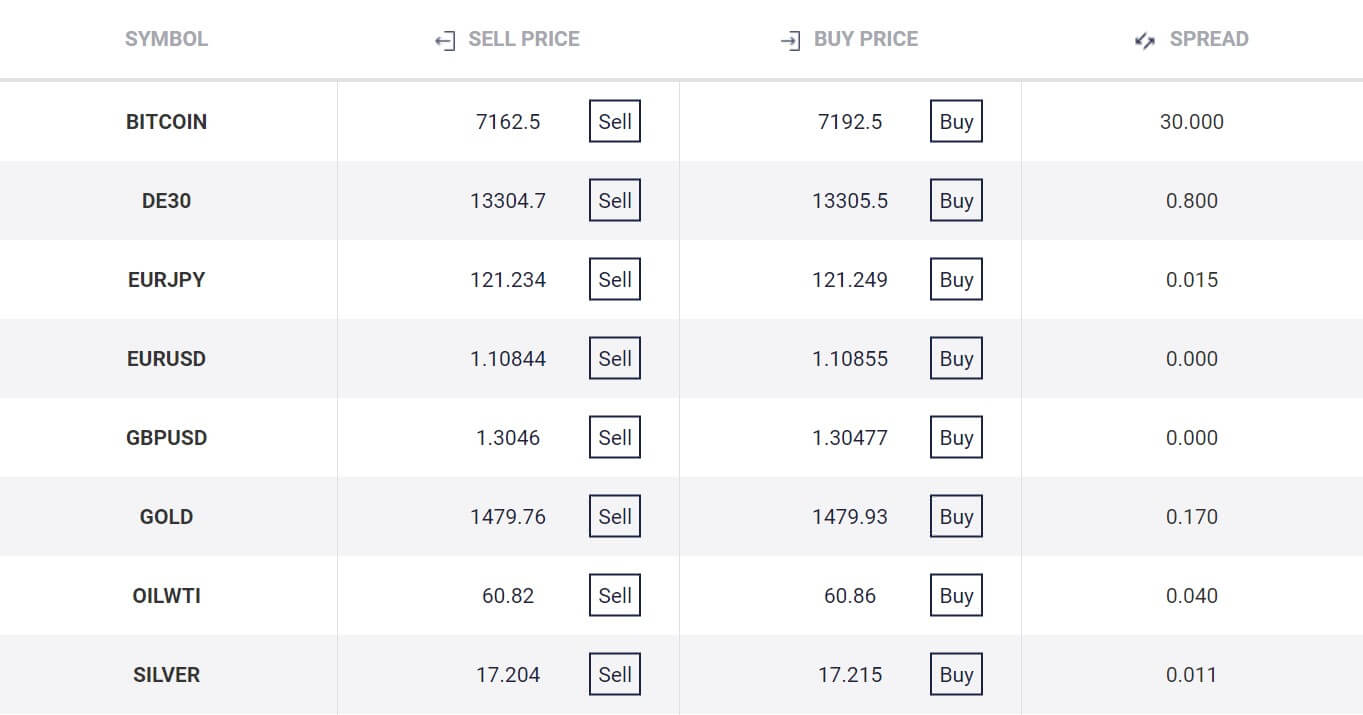

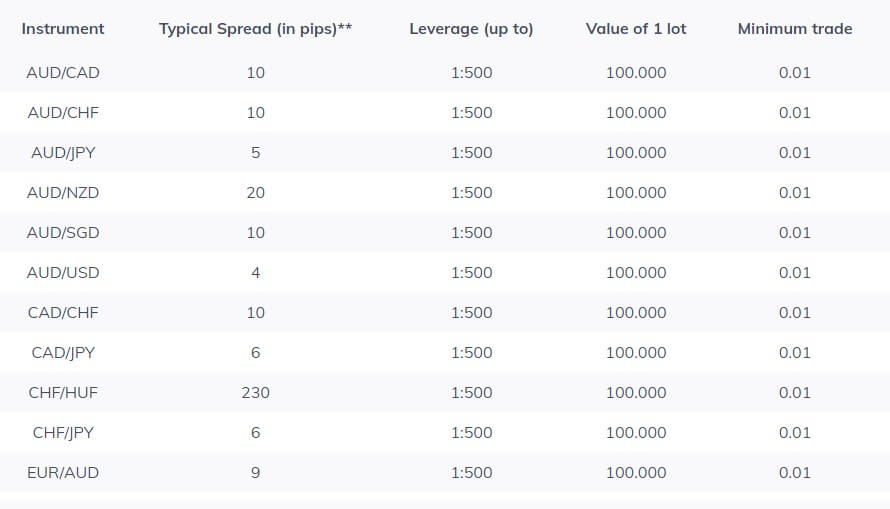

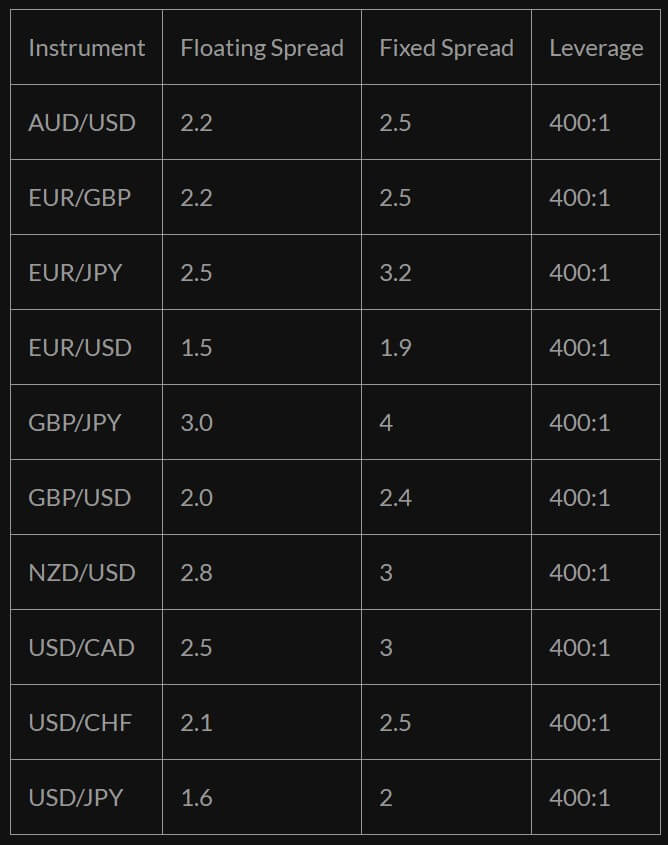

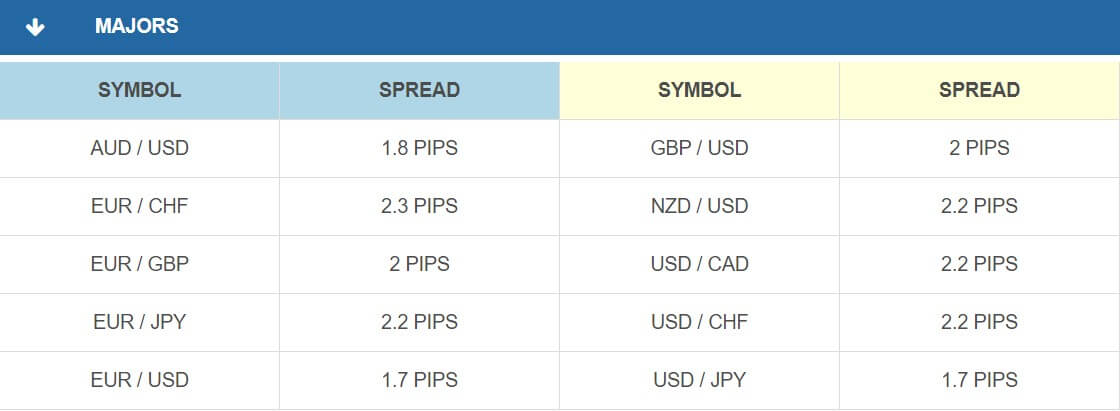

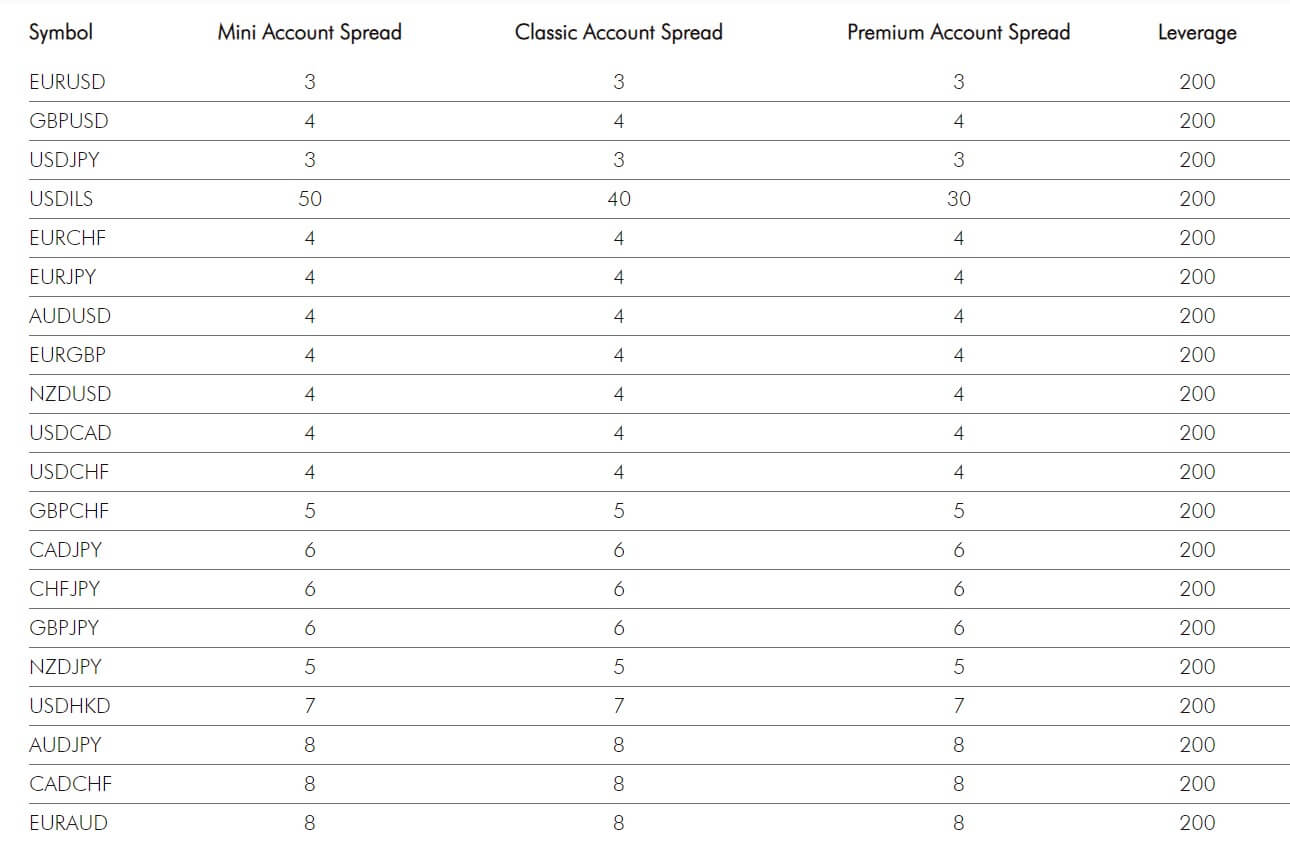

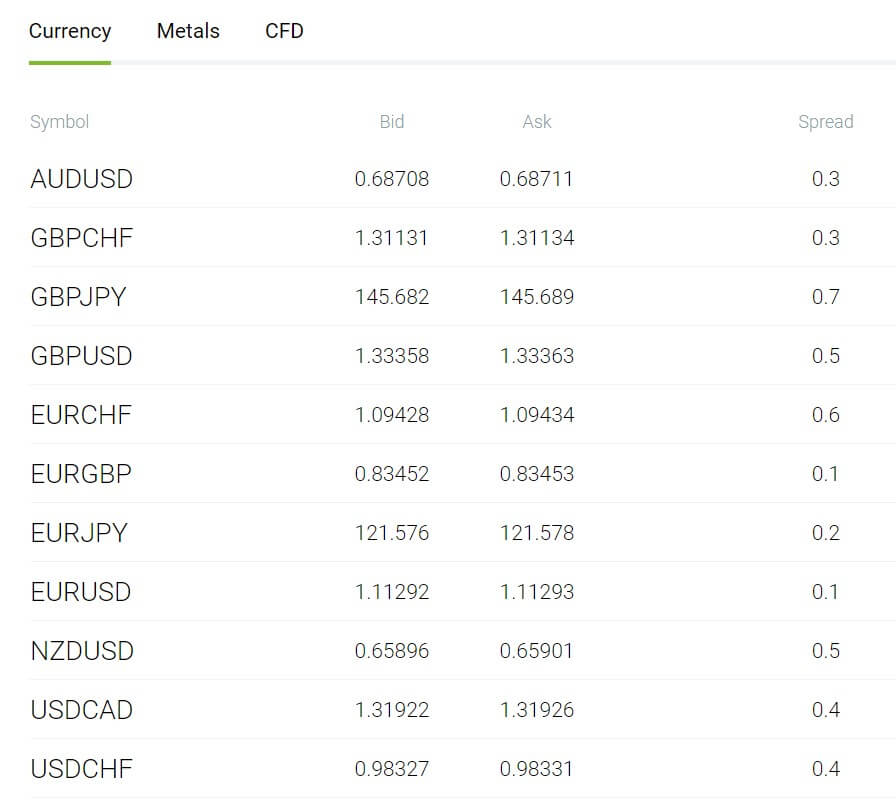

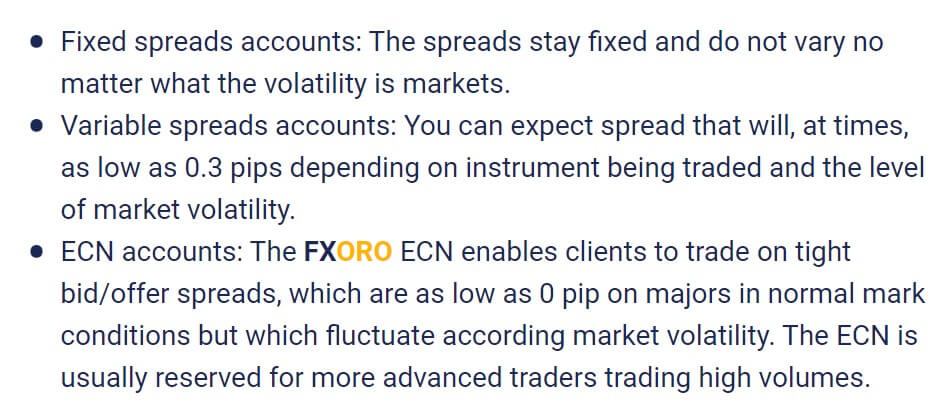

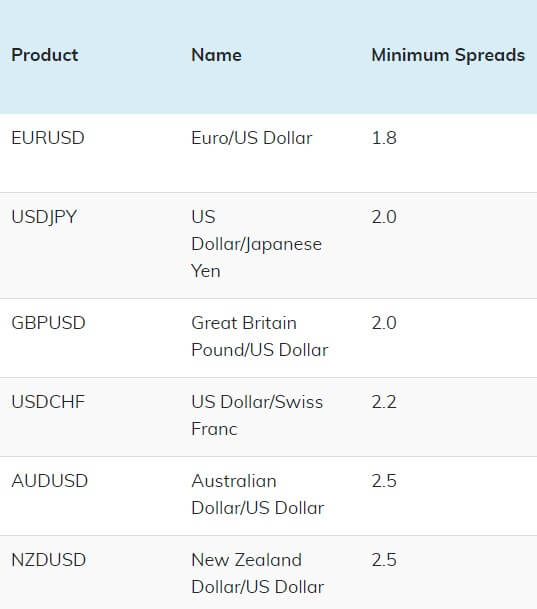

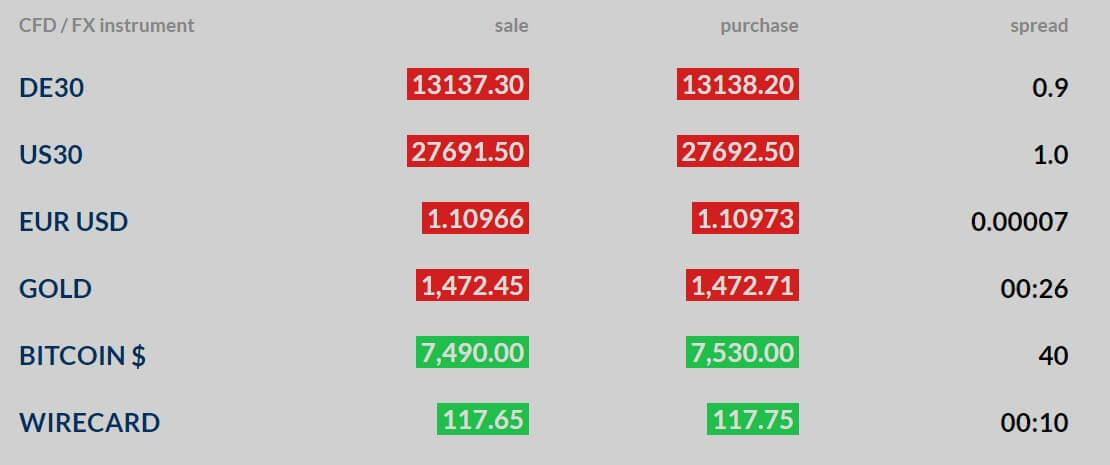

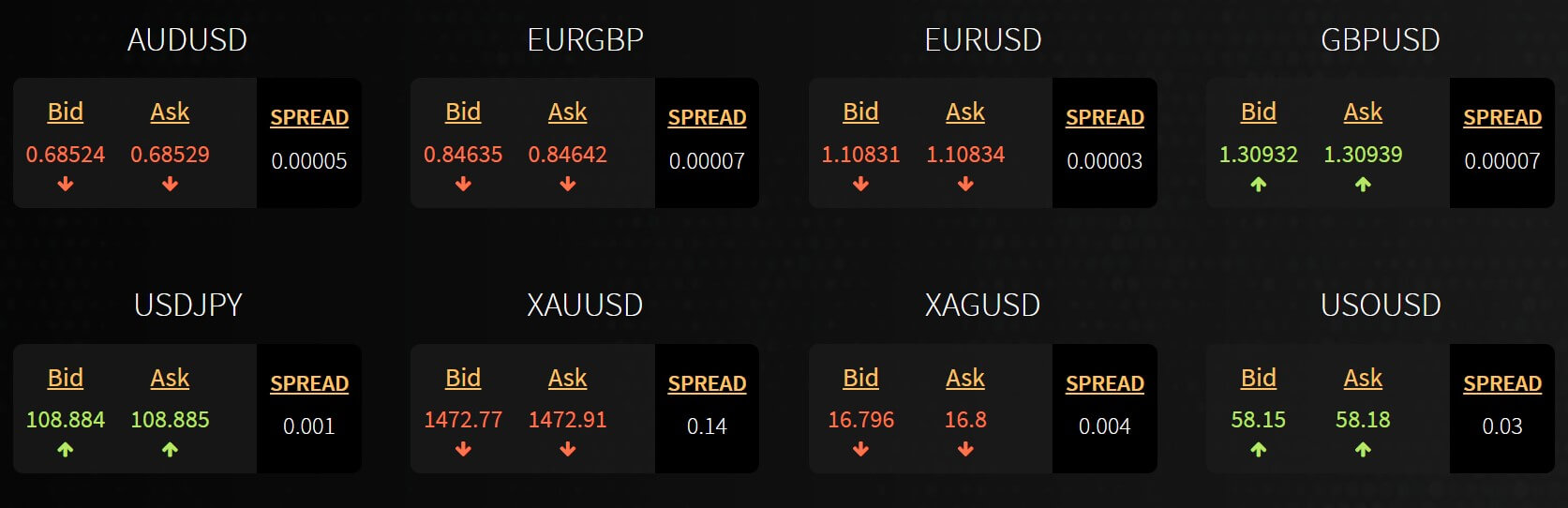

Spreads

Foretrade offers an average spread on its website indicating what different instruments spreads will be. All spreads are variable which means that while they state 3 pips as an example, they will often be seen higher than this as it is simply the starting point, during times of high volatility the spreads will be much higher.

It is also worth noting that different instruments have different natural spreads, while on the Standard account EUR/USD may have a starting spread of 3 pips, USD/CAD will have a starting spread of 4 pips.

Minimum Deposit

The minimum deposit is not actually stated on the website, however, from scouring the internet it seems that the standard consensus is that you require $100 in order to open up an account with Fortrade.

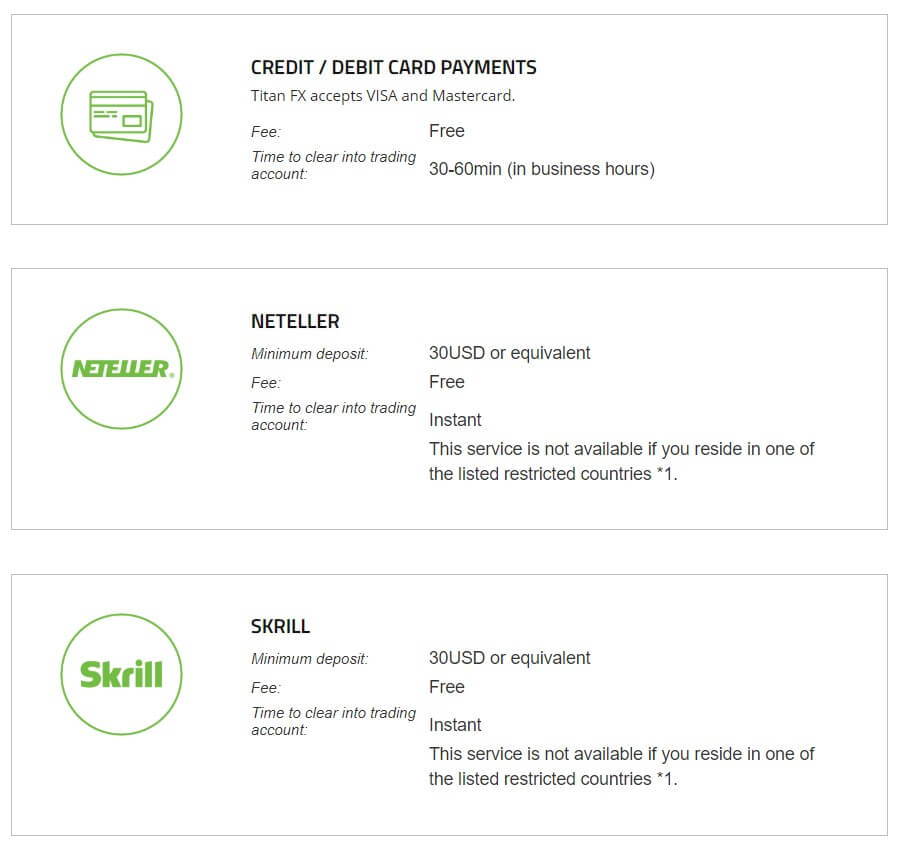

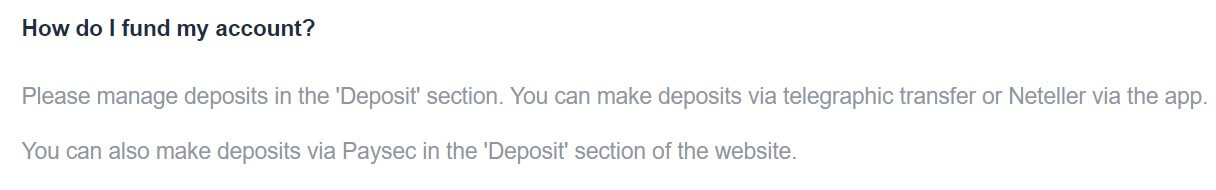

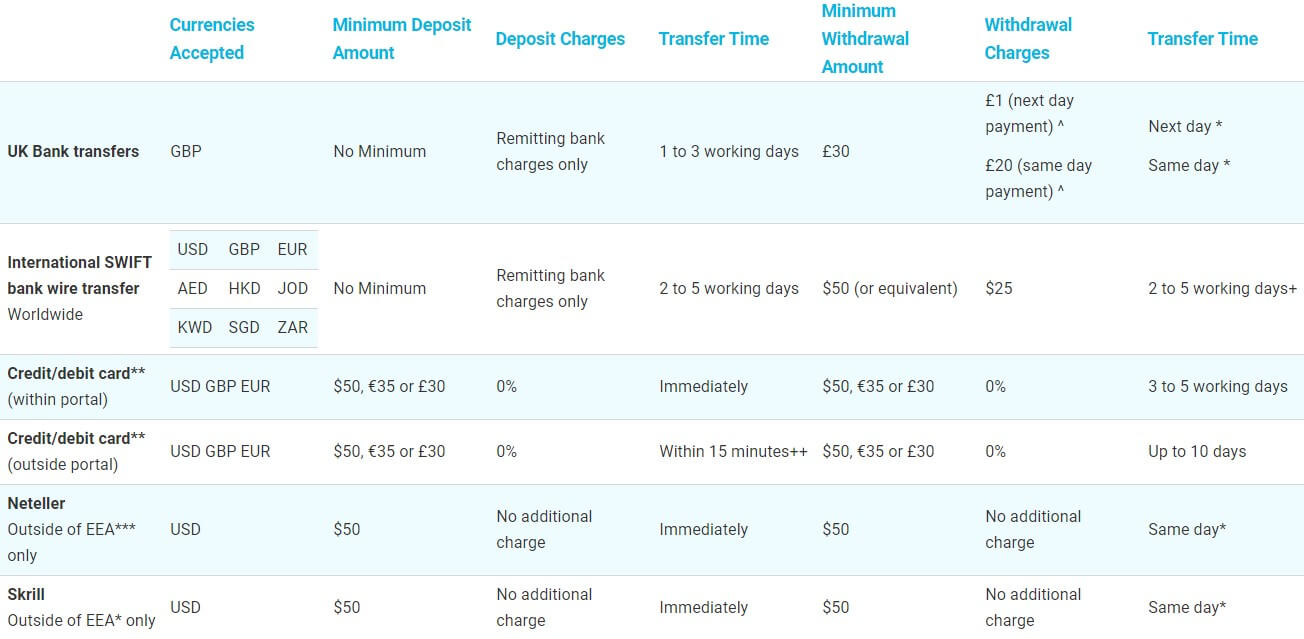

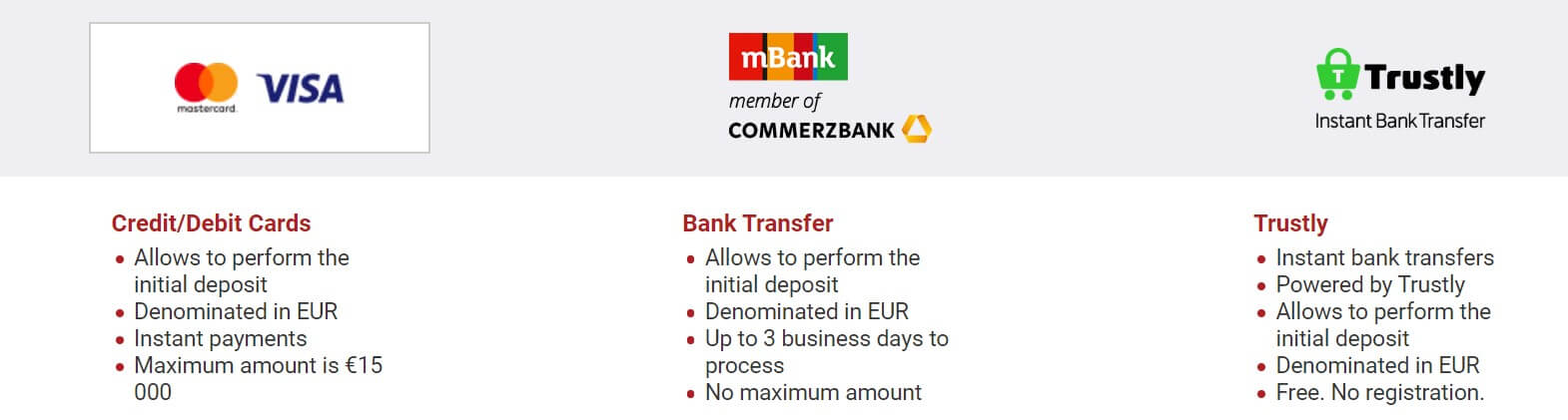

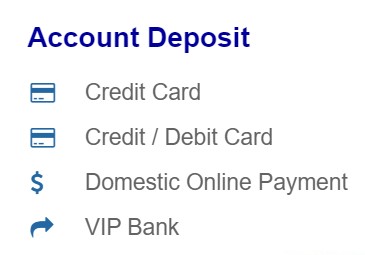

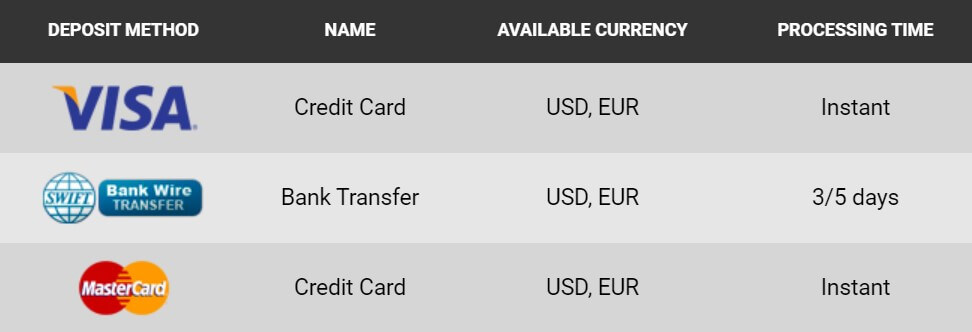

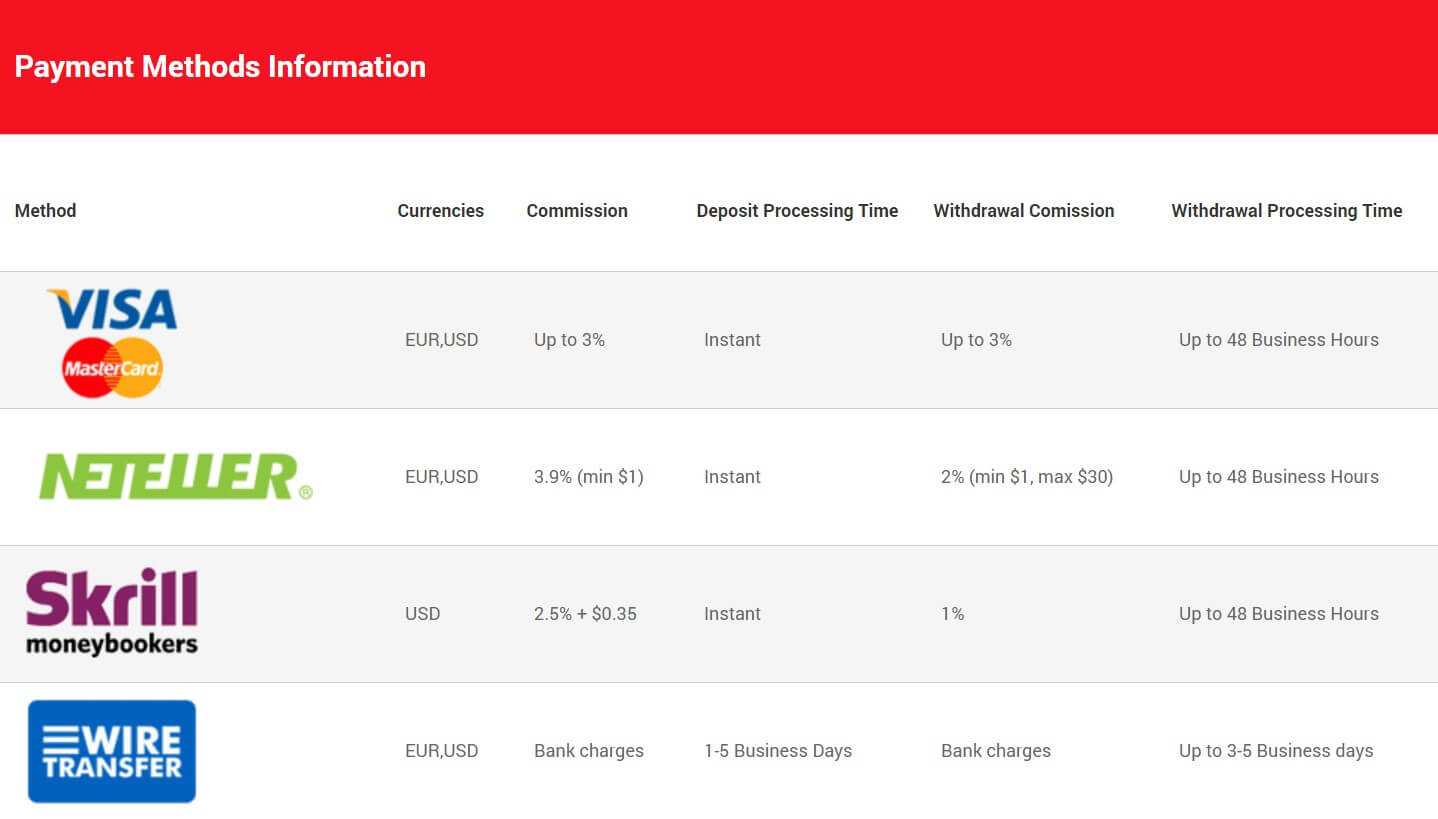

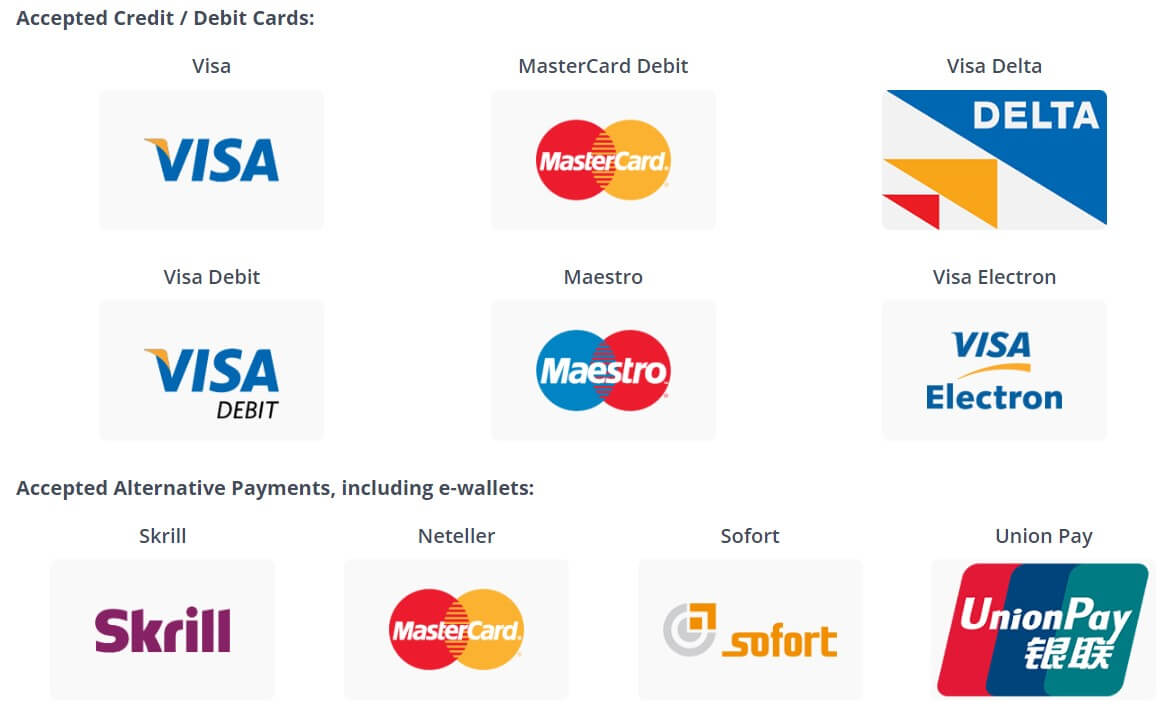

Deposit Methods & Costs

There isn’t clear information on the methods available to deposit, there are mentions of Bank Transfer, Credit Cards and E-wallets including Neteller and Skrill. No other method is available so we would be expecting that these are the only ones available. There is also no information on any deposit fees but be sure to check with your own processor just in case they add their own processing/transfer fees.

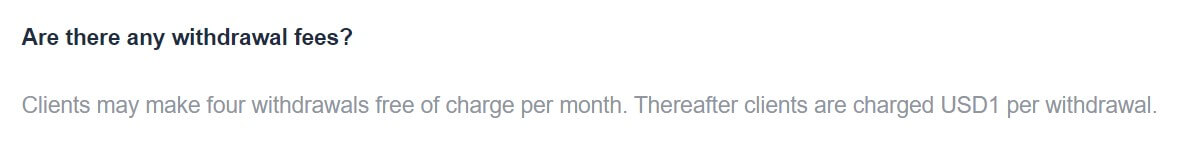

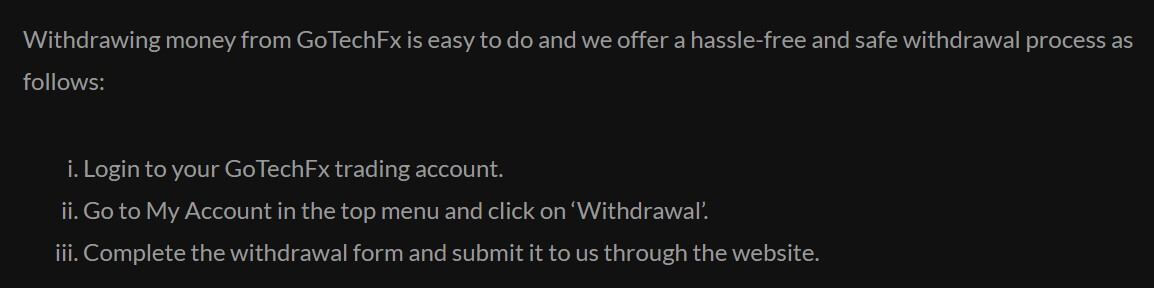

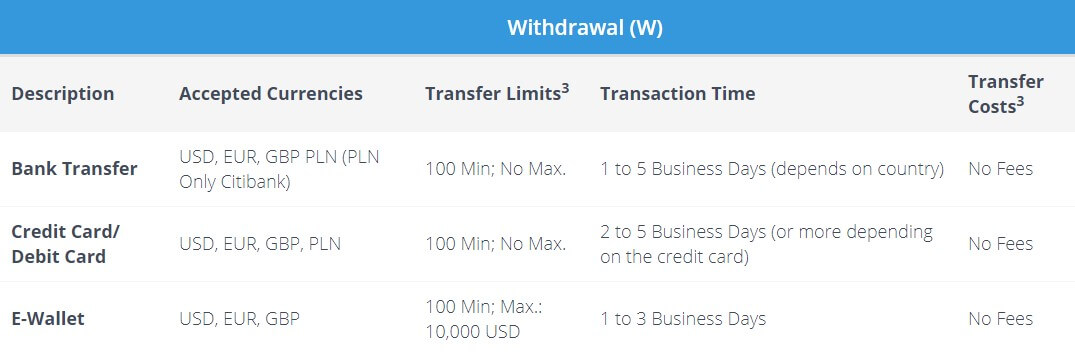

Withdrawal Methods & Costs

The same methods are mentioned as withdrawal methods, the following information is valid for all withdrawals.

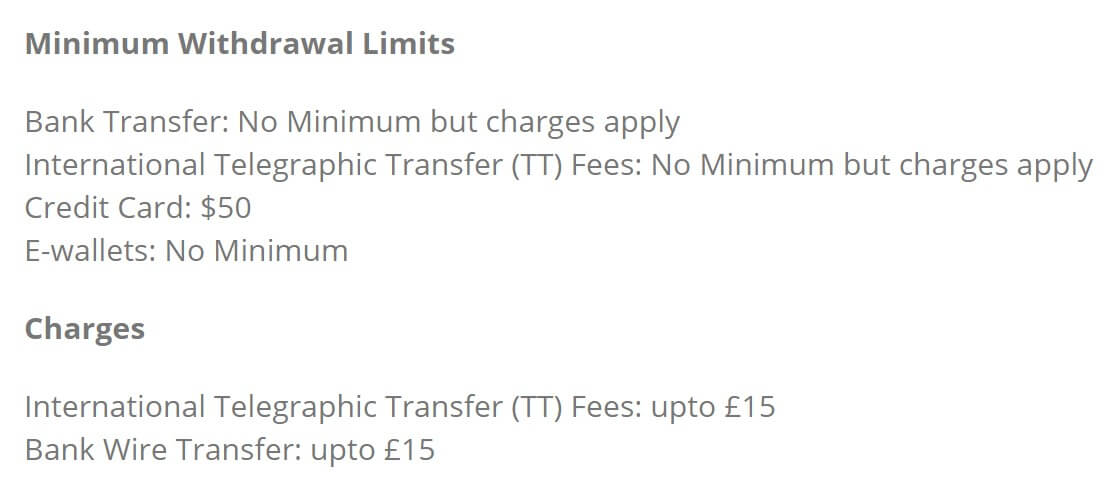

Minimum Withdrawals:

Bank Transfer: No Minimum but charges apply

International Telegraphic Transfer (TT) Fees: No Minimum but charges apply

Credit Card: $50

E-wallets: No Minimum

Charges:

International Telegraphic Transfer (TT) Fees: up to £15

Bank Wire Transfer: up to £15

Withdrawal Processing & Wait Time

Fortrade states that all withdrawal requests will take up to three business days to be processed which is longer than what most brokers are looking at now. They also state that it could take up to 15 days for clients to receive their funds when using a credit card or payment processors.

Bonuses & Promotions

The account page states that there is a bonus up to €2,500, however, there is no indication on the website what the terms are like or what you need to do in order to convert bonus funds into real funds (if you can at all). So we can not say if this is a good bonus to take or not. There does not appear to be any other bonuses or promotions active, but be sure to check back regularly just in case any new ones come up.

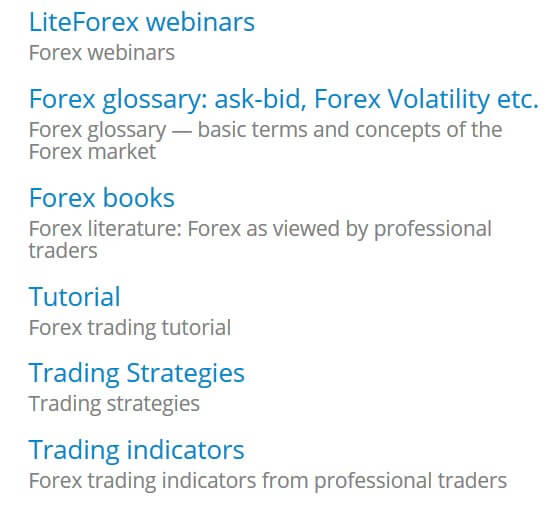

Educational & Trading Tools

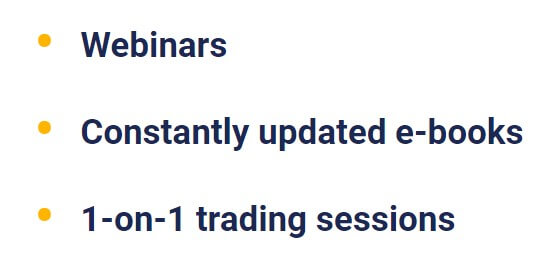

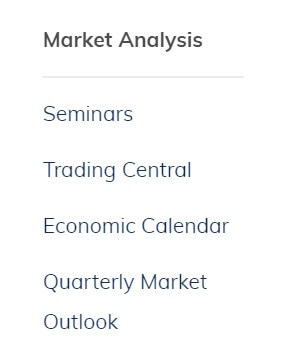

There are two different sections of the website based on education and trading tools.

There are two different sections of the website based on education and trading tools.

Education: The education section offers some basic information surrounding different aspects of trading, it gives some simple answers to questions like “What are CFDs” and other basic info like that. There are also webinars available, however clicking on this link brings up a 404 error page, there are also one-day seminars that you can sign up to, however clicking the sign-up button doesn’t work either and simply reloads the page, there is also no information regarding what the seminars go over so their benefits are currently unknown. E-books are stated to be available but just like the other sections, these are not currently available either.

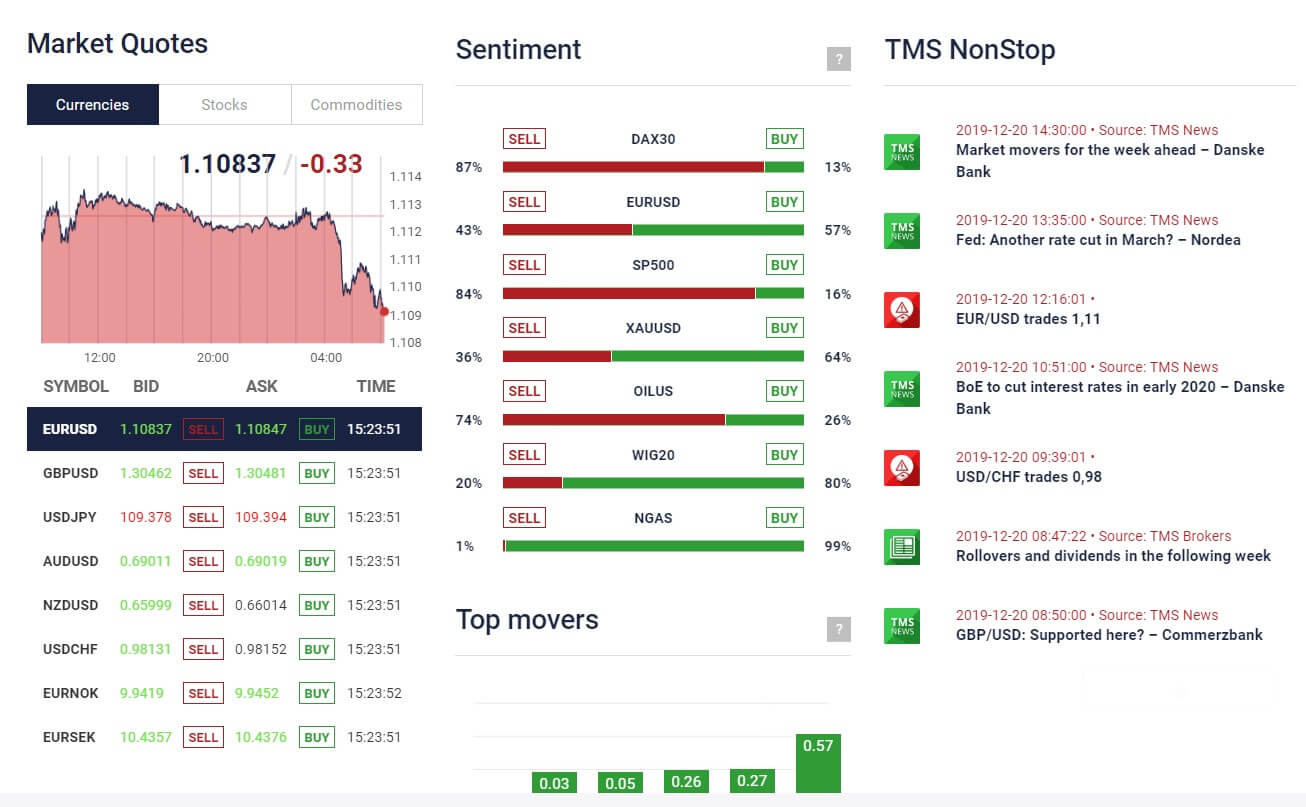

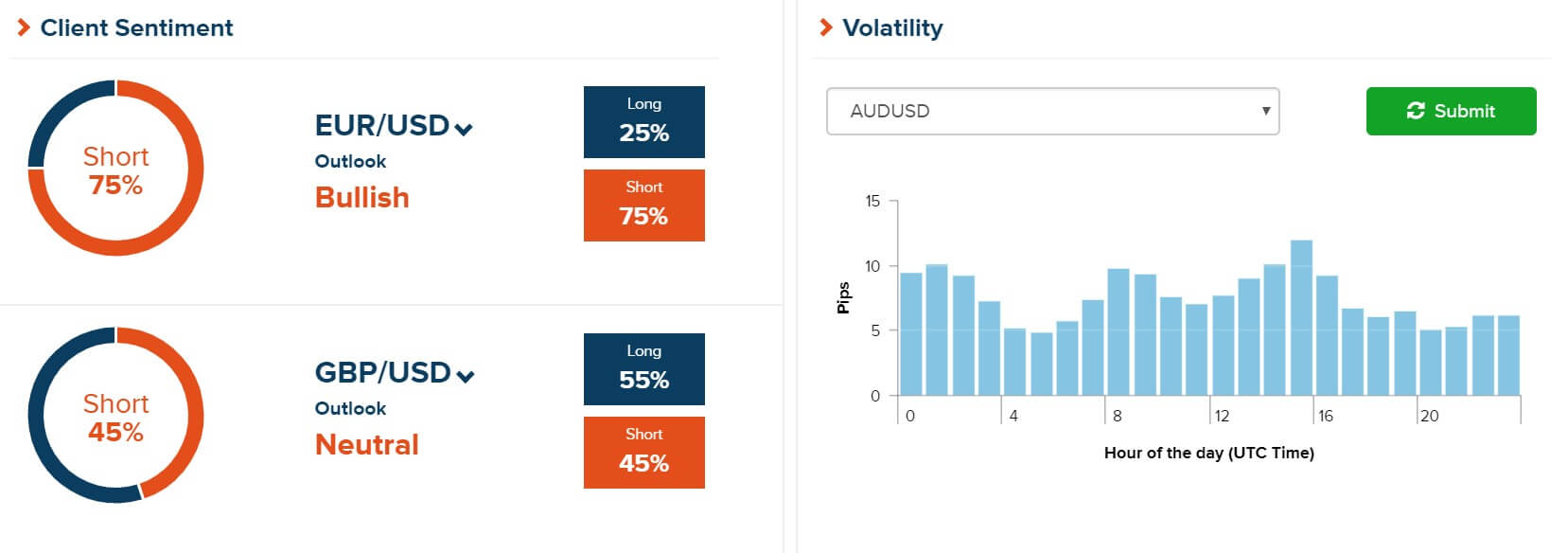

Market News and Analysis: This section focuses on news and analysis, there is a simple economic calendar which tells you of any upcoming news events and what markets they may affect. There is also daily analysis on a number of different pairs which is a more in-depth analysis of what is happening in the markets, along with daily analysis there is also weekly and microanalysis which looks at a broader and more specific view respectively.

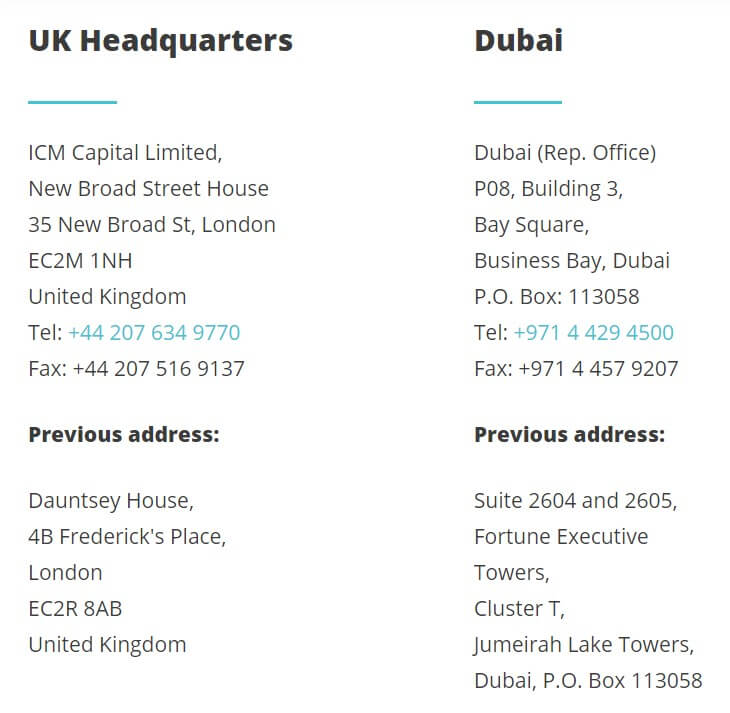

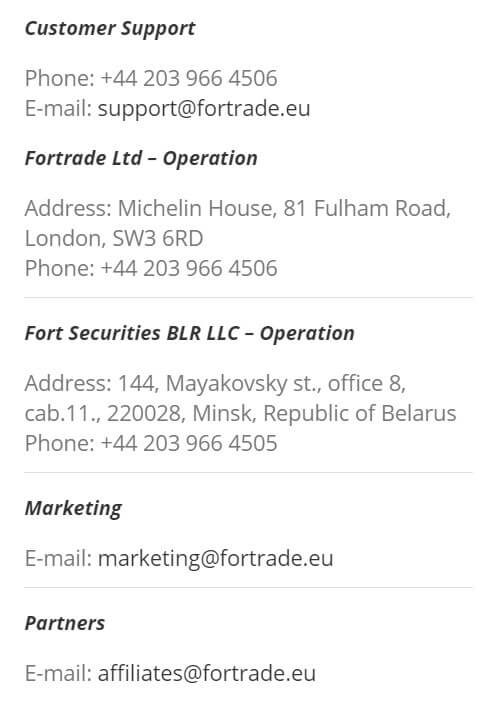

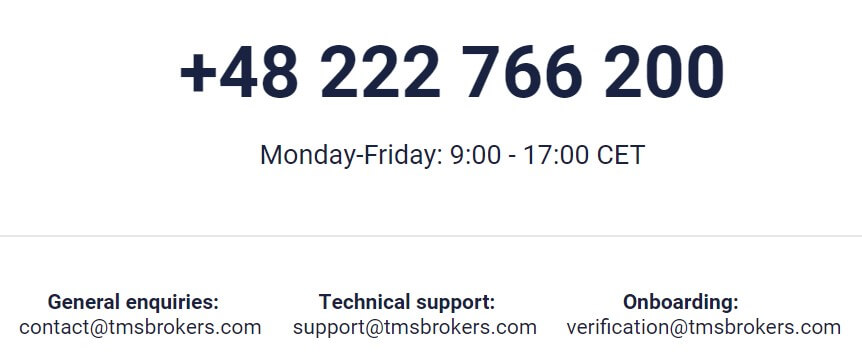

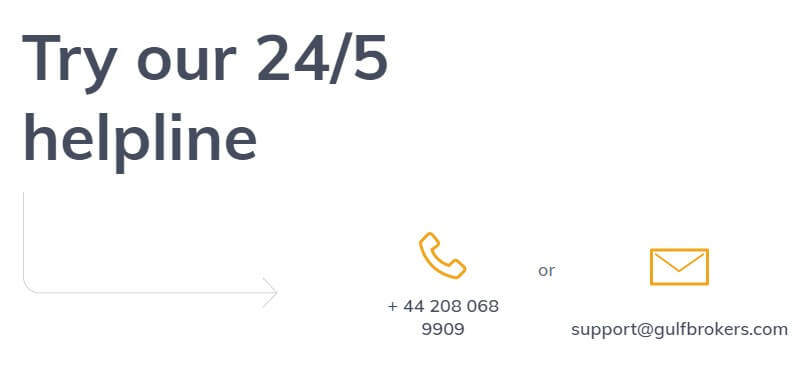

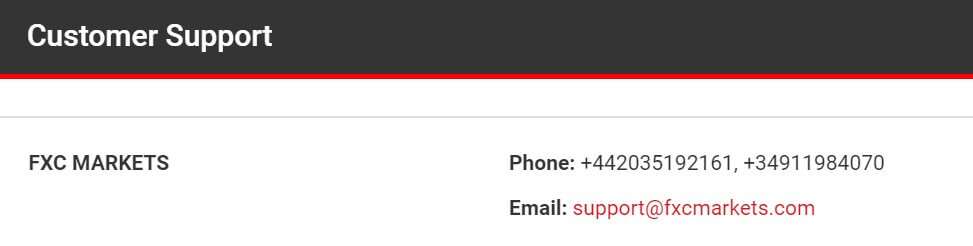

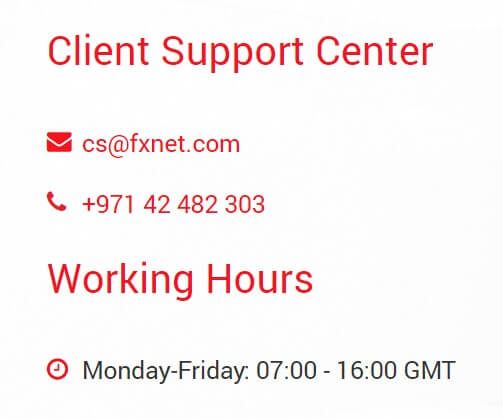

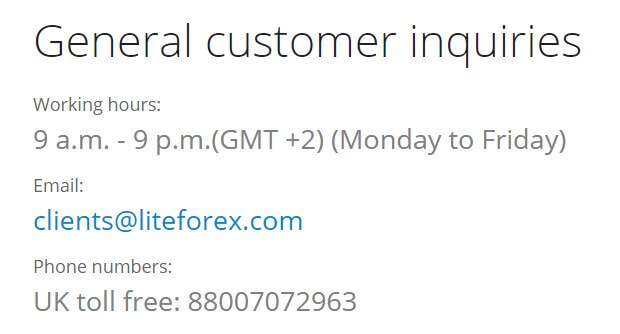

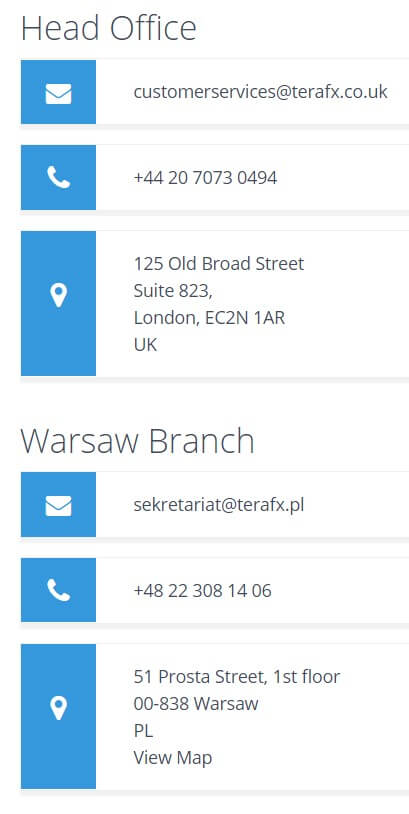

Customer Service

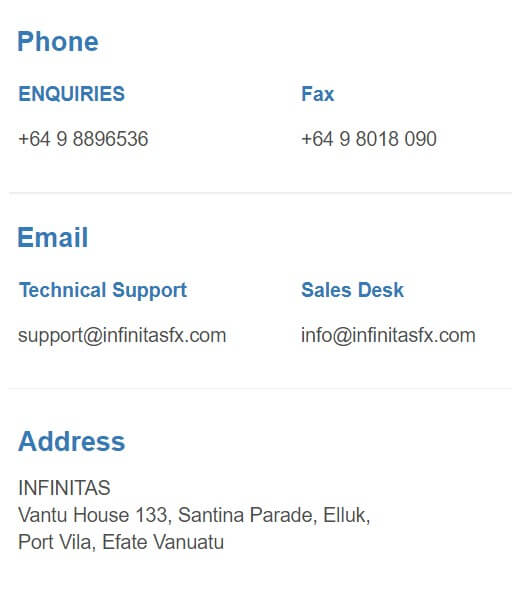

If you want to get in touch with Fortrade you can do so but using the online contact form, simply fill in your query and you should get a response back via email. The customer support section also has an email address and phone number available should you wish to get in touch directly. There is also an email address available for marketing and partners along with an address and phone number for two different departments for operations. So plenty of ways to get in touch should you need to.

If you want to get in touch with Fortrade you can do so but using the online contact form, simply fill in your query and you should get a response back via email. The customer support section also has an email address and phone number available should you wish to get in touch directly. There is also an email address available for marketing and partners along with an address and phone number for two different departments for operations. So plenty of ways to get in touch should you need to.

The website states that the support team is open 12 hours a day and closes at the weekends when the markets are closed, we are not sure what these 12 hours are though.

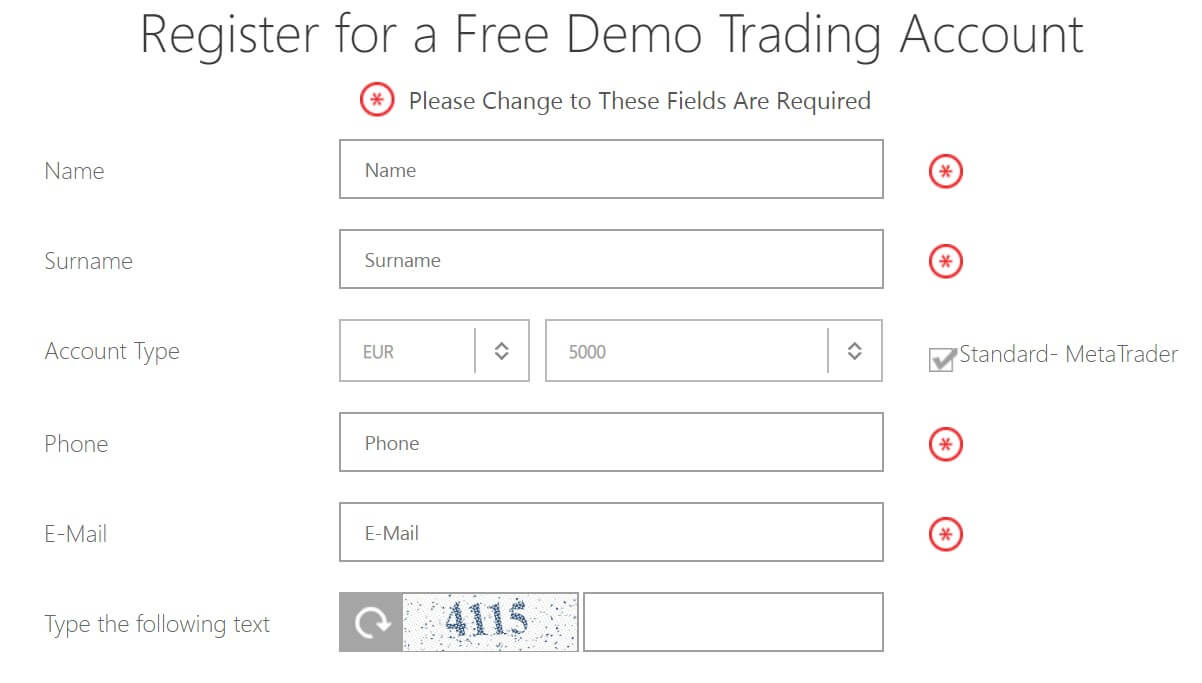

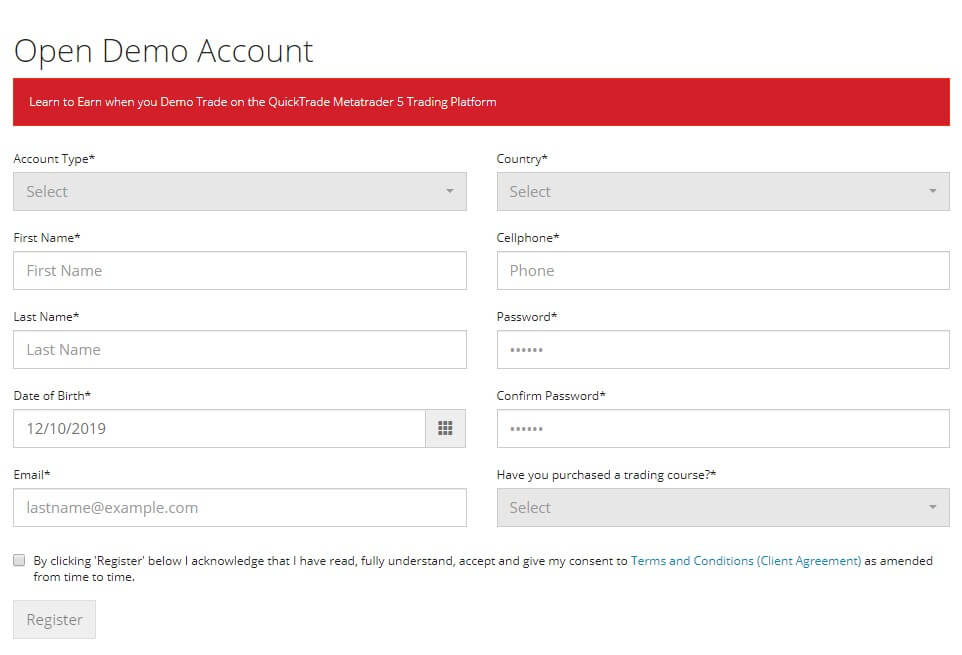

Demo Account

Demo accounts are available, the exact trading conditions are unknown but we will be assuming that it will match the conditions that we have mentioned in this review. You can have a balance up to €100,000, and get the same support as you do on a real account. It would be nice if there was more information such as how long the accounts last, just in case they have an expiration time.

Countries Accepted

The following statement is present on the Fortrade website: “The information on this site is not directed at residents of the United States or Belgium and is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.” As always if you are unsure whether you are eligible for an account or not, get in contact with eh customer service team to find out.

Conclusion

It is hard to recommend Fortrade when there is so much missing information, without a full breakdown and easy to access information on deposit and withdrawal methods it is not somewhere that we would want to put ur money, not to mention the confusion around account types and what the trading conditions on the accounts actually are. While Fortrade may well be a great broker, without this vital information it is hard for us to justify recommending them as a broker.

We hope you like this Fortrade.eu review. If you did, please be sure to check out some of the other reviews on the site to help find the broker that is right for you.

Forex: There isn’t an actual breakdown of each currency pair, there is just a simple overview, majors, minors, and exotics are available including pairs like EUR/USD, GBP/AUD and AUD/NZD. Spreads on currency pairs go up to 1:100 and trades start at 0.01 lots.,

Forex: There isn’t an actual breakdown of each currency pair, there is just a simple overview, majors, minors, and exotics are available including pairs like EUR/USD, GBP/AUD and AUD/NZD. Spreads on currency pairs go up to 1:100 and trades start at 0.01 lots.,

Assets

Assets

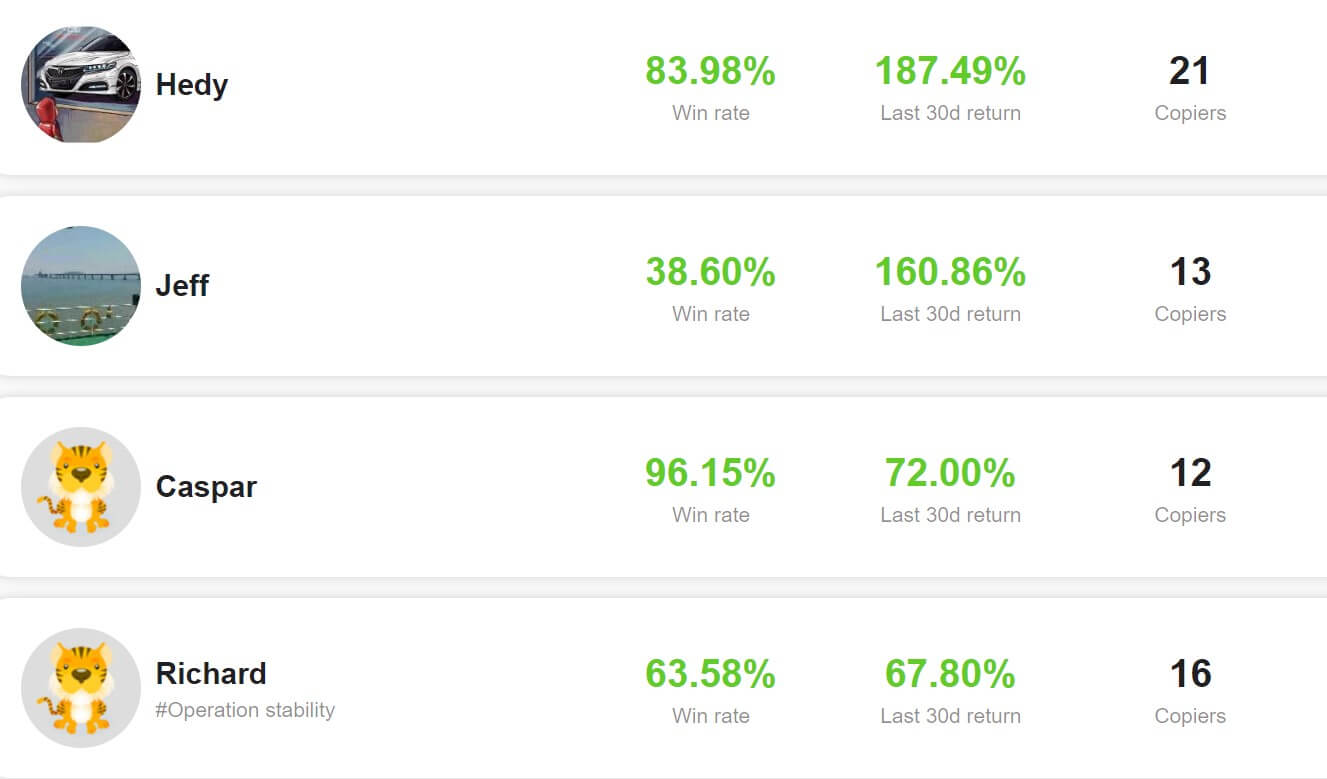

TigerWit offers one live account called the ‘Experience account’ and one type of live account, SCB of FCA regulated, depending on your residency. The live account requires a minimum deposit which is reasonable set at £50, gives

TigerWit offers one live account called the ‘Experience account’ and one type of live account, SCB of FCA regulated, depending on your residency. The live account requires a minimum deposit which is reasonable set at £50, gives  As a result of complying with regulation policies, the maximum leverage allowed for TigerWit clients is 1:30. Depending on specific pairs,

As a result of complying with regulation policies, the maximum leverage allowed for TigerWit clients is 1:30. Depending on specific pairs,

Bonuses & Promotions

Bonuses & Promotions Customer Service

Customer Service

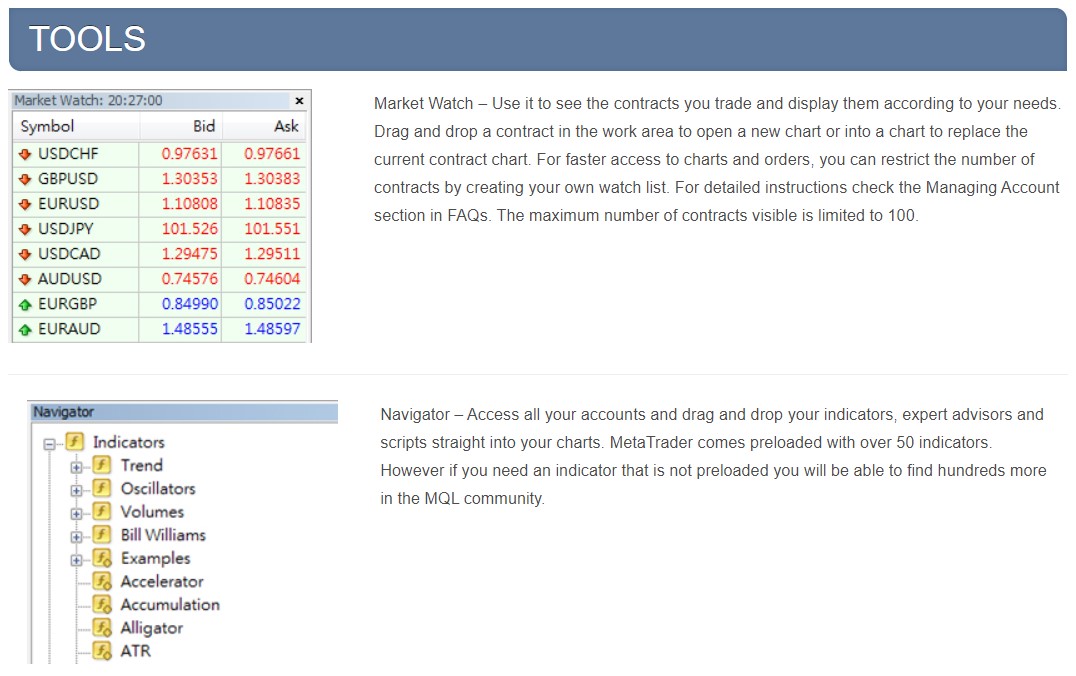

One of the main benefits that come with using MT4 is that traders can work with professional advisors who will actively guide them through the platform’s features and help users manage their accounts. Given that MT4 is one of

One of the main benefits that come with using MT4 is that traders can work with professional advisors who will actively guide them through the platform’s features and help users manage their accounts. Given that MT4 is one of

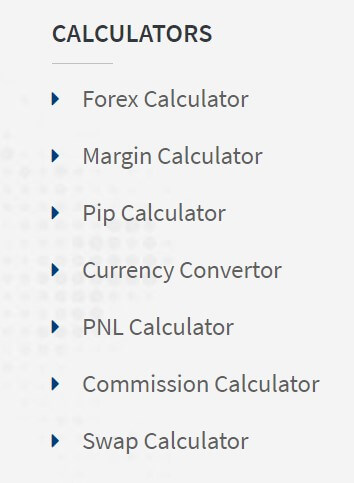

Lastly, the ‘Sharp Trader’ program is an entire website that is dedicated to educating readers about day trading. More specifically, its wide range of video content covers the details that are related to analyzing daily fundamental events, reading short-term technical charts, and utilizing different practical tools (economic calendars, calculators, …etc.). In fact, GoTechFX offers these exact resources to its account holders.

Lastly, the ‘Sharp Trader’ program is an entire website that is dedicated to educating readers about day trading. More specifically, its wide range of video content covers the details that are related to analyzing daily fundamental events, reading short-term technical charts, and utilizing different practical tools (economic calendars, calculators, …etc.). In fact, GoTechFX offers these exact resources to its account holders.

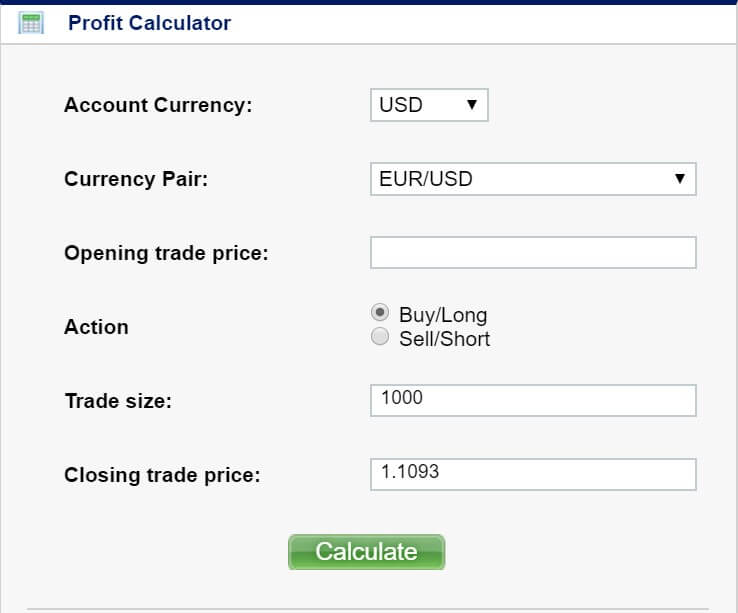

Other advantageous features the GoTechFX account holders enjoy include a relatively large number of forex pairs (over 60), a generous 400:1 leverage, and a very low 3% stop-out level. In addition, only a few firms in the industry can match this broker’s highly resourceful and cost-efficient trade calculator. If used the right way, you can identify and limit otherwise unnoticed expenses, including interest fees on overnight positions and undesirable wide spreads.

Other advantageous features the GoTechFX account holders enjoy include a relatively large number of forex pairs (over 60), a generous 400:1 leverage, and a very low 3% stop-out level. In addition, only a few firms in the industry can match this broker’s highly resourceful and cost-efficient trade calculator. If used the right way, you can identify and limit otherwise unnoticed expenses, including interest fees on overnight positions and undesirable wide spreads.

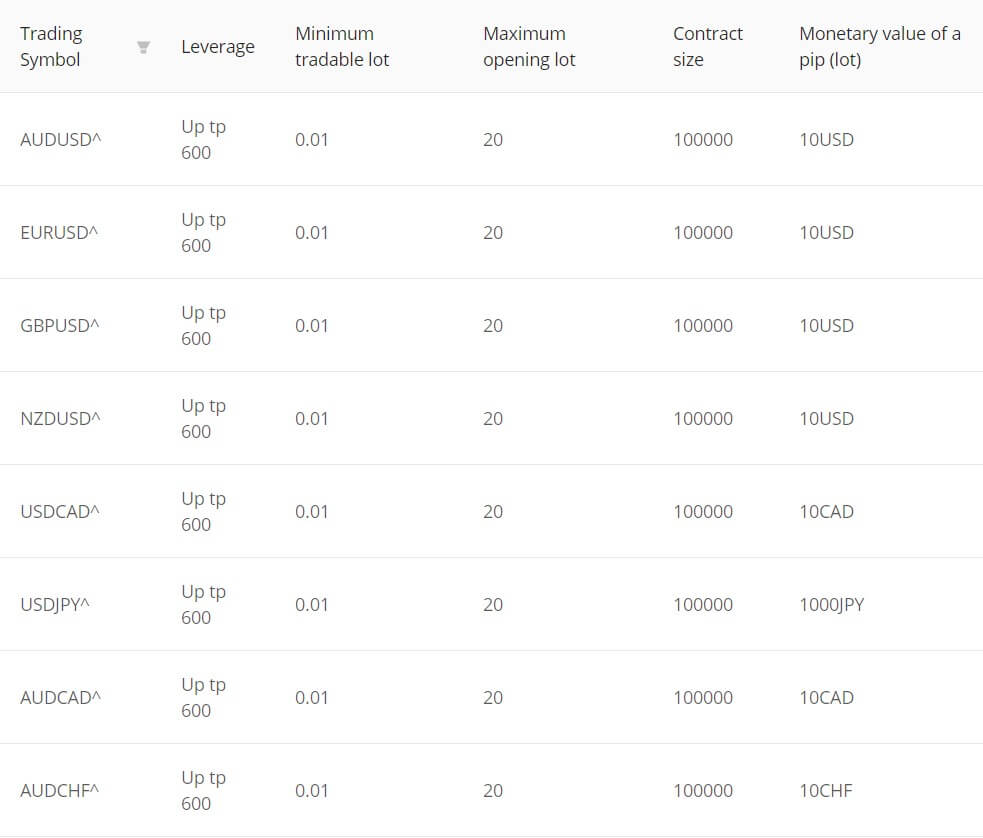

MetaTrader 4 (MT4) is arguably the most popular forex trading platform on the market. You can place orders, open or close positions, and transfer funds from any device, whether it’s a desktop or a smartphone. Windows users can download the app directly from CJC Markets’s website, the same applies if you have an iPhone and Android. Those with a Mac computer, on the other hand, may need to install special software (usually for free) before downloading MT4’s app. Moreover, they have to do so directly from the platform’s website, rather than CJC Markets’s. However, there is a browser version, WebTrader, that is compatible with different browsers (such as Chrome, Safari, Firefox, ..etc.) and accessible on desktop devices (both MacBooks and Windows).

MetaTrader 4 (MT4) is arguably the most popular forex trading platform on the market. You can place orders, open or close positions, and transfer funds from any device, whether it’s a desktop or a smartphone. Windows users can download the app directly from CJC Markets’s website, the same applies if you have an iPhone and Android. Those with a Mac computer, on the other hand, may need to install special software (usually for free) before downloading MT4’s app. Moreover, they have to do so directly from the platform’s website, rather than CJC Markets’s. However, there is a browser version, WebTrader, that is compatible with different browsers (such as Chrome, Safari, Firefox, ..etc.) and accessible on desktop devices (both MacBooks and Windows).

Assets

Assets

Bonuses & Promotions

Bonuses & Promotions

Assets

Assets

Assets

Assets

Sadly, the broker remains vague when it comes to the costs for withdrawals. It does seem that all of the available deposit methods can be used for withdrawals, although it is unclear if the broker has any special rules surrounding the methods one can use. For example, there may be a condition that requires withdrawals to be made back to the same source that was used to fund the account. Some brokers also require profits to be withdrawn through a certain method, like Wire Transfer. Of course, it is possible that there are no conditions on withdrawals; however, the lack of provided details for this section definitely makes us apprehensive about any potential conditions or fees.

Sadly, the broker remains vague when it comes to the costs for withdrawals. It does seem that all of the available deposit methods can be used for withdrawals, although it is unclear if the broker has any special rules surrounding the methods one can use. For example, there may be a condition that requires withdrawals to be made back to the same source that was used to fund the account. Some brokers also require profits to be withdrawn through a certain method, like Wire Transfer. Of course, it is possible that there are no conditions on withdrawals; however, the lack of provided details for this section definitely makes us apprehensive about any potential conditions or fees.

Assets

Assets

Currency Pairs: There are plenty of forex currency pairs from major pairs, minor pairs, and exotic pairs. A few examples include EURUSD,

Currency Pairs: There are plenty of forex currency pairs from major pairs, minor pairs, and exotic pairs. A few examples include EURUSD,

Educational & Trading Tools

Educational & Trading Tools

Currency: These are your most popular trading assets, within the currency category there are both major pairs, and minor pairs. Some examples are EUR/USD, USD/CHF and EURTRY. There is plenty to choose from when it comes to currency trading.

Currency: These are your most popular trading assets, within the currency category there are both major pairs, and minor pairs. Some examples are EUR/USD, USD/CHF and EURTRY. There is plenty to choose from when it comes to currency trading.

There is an economic calendar that tells you of any upcoming news events and also which markets they will potentially effect, along with the calendar is some analysis, they look at and review different events and markets to help give you an idea of some potential trades. There is also some analysis from a company called Claws and Horns which is an independent company giving analysis.

There is an economic calendar that tells you of any upcoming news events and also which markets they will potentially effect, along with the calendar is some analysis, they look at and review different events and markets to help give you an idea of some potential trades. There is also some analysis from a company called Claws and Horns which is an independent company giving analysis.

Customer Service

Customer Service

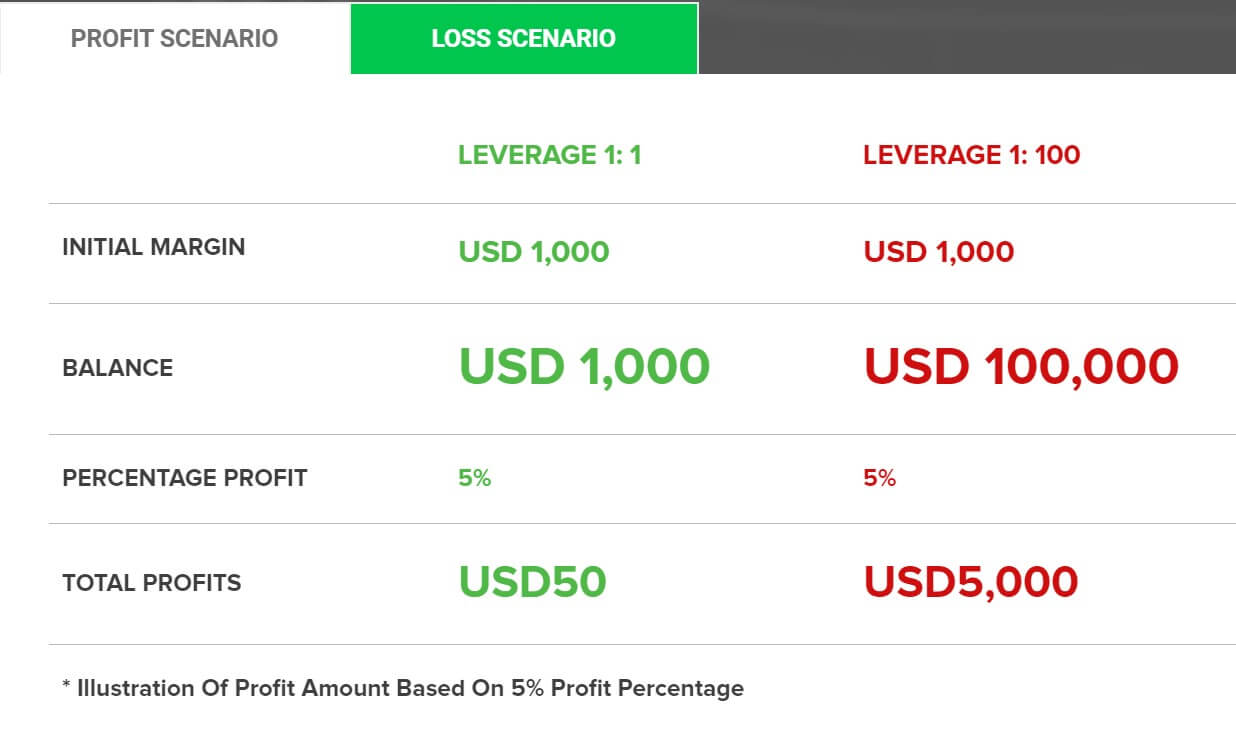

All accounts allow for maximum leverage of up to 1:100, without restrictions based on account equity or other means. Most will be satisfied with this option, especially considering that many professional traders prefer to trade with the cap that is offered by this company. Beginners may even want to stick with lower leverage, in an attempt to avoid the risks that are associated with trading with higher leverage. On the other side of things, it is possible to find brokers out there with higher leverage caps, if this is something you’re definitely looking for.

All accounts allow for maximum leverage of up to 1:100, without restrictions based on account equity or other means. Most will be satisfied with this option, especially considering that many professional traders prefer to trade with the cap that is offered by this company. Beginners may even want to stick with lower leverage, in an attempt to avoid the risks that are associated with trading with higher leverage. On the other side of things, it is possible to find brokers out there with higher leverage caps, if this is something you’re definitely looking for.

If you want to get in touch with IFA-FX you can in a few different ways, you can get in contact via email, phone, submit your query to receive an email response or request a callback. There is also an online chat that we tested and got through to someone after about 8 minutes of waiting, they responded quickly to questions but weren’t able to answer a lot of our questions, simply pointing up to different sections of the site that either did or didn’t answer the question, this was a little disappointing.

If you want to get in touch with IFA-FX you can in a few different ways, you can get in contact via email, phone, submit your query to receive an email response or request a callback. There is also an online chat that we tested and got through to someone after about 8 minutes of waiting, they responded quickly to questions but weren’t able to answer a lot of our questions, simply pointing up to different sections of the site that either did or didn’t answer the question, this was a little disappointing.

Assets

Assets

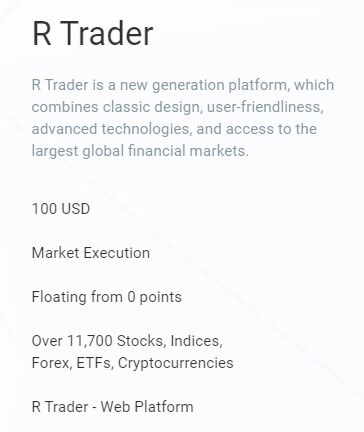

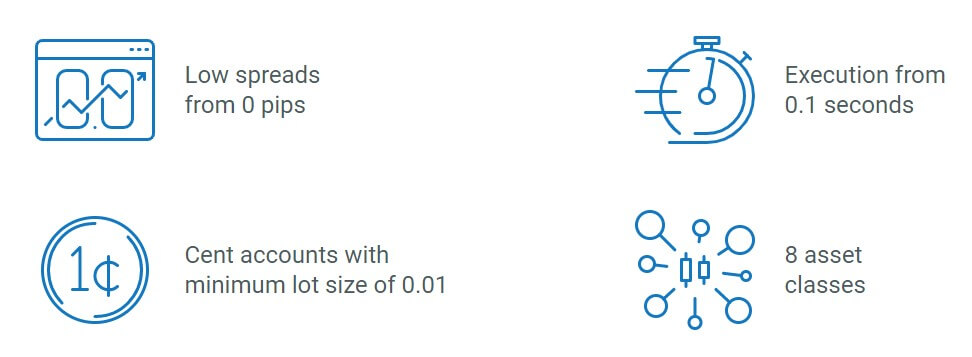

R Trader Account:

R Trader Account:

Amongst the 12 exotics are the Swedish Krona (SEK), Norwegian Krone (NOK), Mexican Peso (MXN), and Polish Zloty (PLN). However, the two pairs involving the zloty (USD.PLN and EUR.PLN) can only be traded through the MT5 platform. Similarly, exchanging the five cryptocurrencies on BenchMark requires you to install MT5. All crypto CFDs are paired against the dollar (Bitcoin (BTC.USD), Bitcoin Cash (BCH.USD), Ether (ETH.USD), …etc.).

Amongst the 12 exotics are the Swedish Krona (SEK), Norwegian Krone (NOK), Mexican Peso (MXN), and Polish Zloty (PLN). However, the two pairs involving the zloty (USD.PLN and EUR.PLN) can only be traded through the MT5 platform. Similarly, exchanging the five cryptocurrencies on BenchMark requires you to install MT5. All crypto CFDs are paired against the dollar (Bitcoin (BTC.USD), Bitcoin Cash (BCH.USD), Ether (ETH.USD), …etc.).

Demo Account

Demo Account

Spreads

Spreads

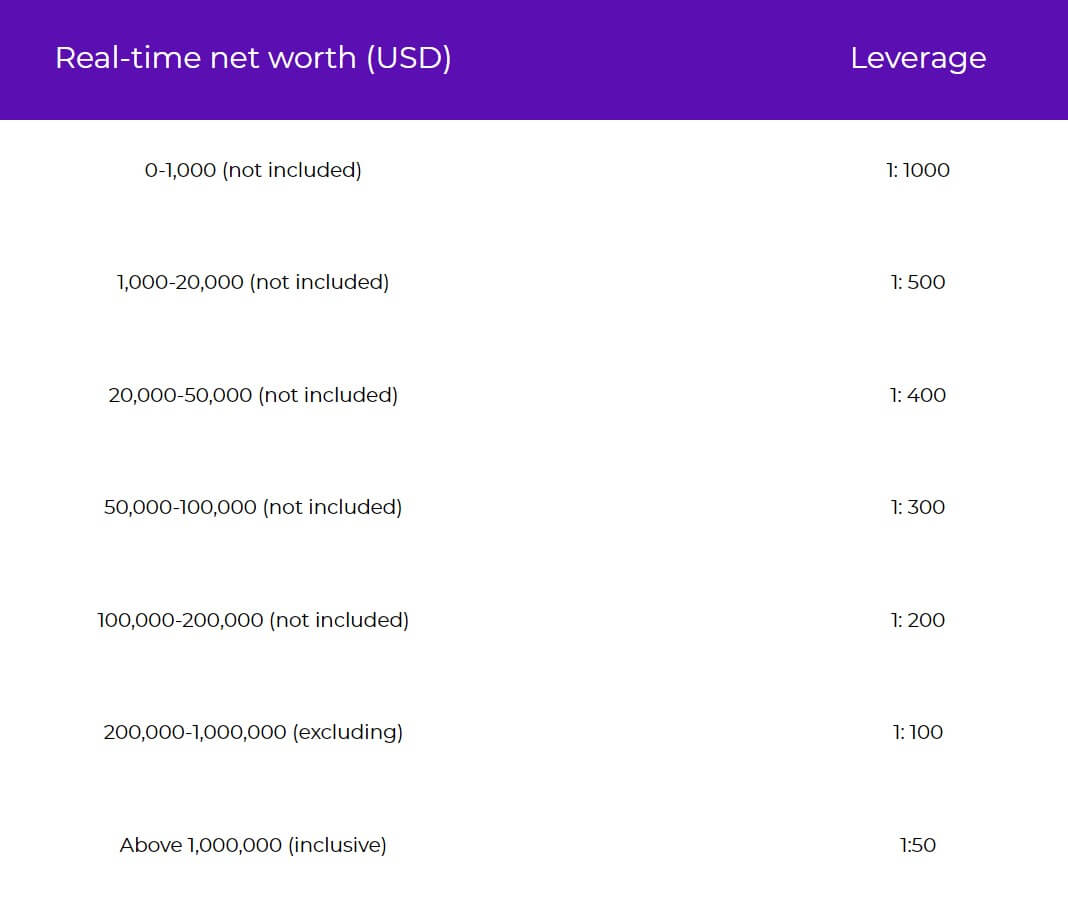

The larger your account’s balance is, the less buying power that FXB will give you. For the most part, this is done to minimize risks. Using a large amount of leverage can cause traders to lose their entire balance or even more than that within seconds. The Basic Account has up to 1:500, which is among the higher end in comparison to the overall brokerage industry. From there, the Standard, VIP, and Premium have 1:300, 1:200, and 1:100 in leverage, respectively.

The larger your account’s balance is, the less buying power that FXB will give you. For the most part, this is done to minimize risks. Using a large amount of leverage can cause traders to lose their entire balance or even more than that within seconds. The Basic Account has up to 1:500, which is among the higher end in comparison to the overall brokerage industry. From there, the Standard, VIP, and Premium have 1:300, 1:200, and 1:100 in leverage, respectively.

Deposit Methods & Costs

Deposit Methods & Costs

Account holders have access to plenty of educational articles, written courses, and video classes. In addition, the

Account holders have access to plenty of educational articles, written courses, and video classes. In addition, the

Yet, just as with any other broker, there are certain downsides to using FXB. First, they charge a commission per trade, which is a con in itself. FXB also doesn’t mention anything about what the amount is on the website. High-frequency traders should make sure that the commission is within their desired range before proceeding with this broker. Second, the way that transfers are handled may make it difficult to manage cashflow. Lastly, the number of forex pairs on FXB is limited in comparison to other brokers.

Yet, just as with any other broker, there are certain downsides to using FXB. First, they charge a commission per trade, which is a con in itself. FXB also doesn’t mention anything about what the amount is on the website. High-frequency traders should make sure that the commission is within their desired range before proceeding with this broker. Second, the way that transfers are handled may make it difficult to manage cashflow. Lastly, the number of forex pairs on FXB is limited in comparison to other brokers.

Autochartist is available and is one of the world’s most advanced tools that aims to supply the automatic identification of both chart and Fibonacci patterns. Additionally, its technology permits users to monitor thousands of Forex financial instruments 24 hours a day automatically, exposing trading opportunities as soon as they occur. There is also an economic calendar and a new section to give you an idea of what news is coming and what impact it may have, however, there are more in-depth resources already available on the internet. There is a basic signals page too where they give buy and sell signals but they are not incredibly in-depth and the accuracy has not been tested by us.

Autochartist is available and is one of the world’s most advanced tools that aims to supply the automatic identification of both chart and Fibonacci patterns. Additionally, its technology permits users to monitor thousands of Forex financial instruments 24 hours a day automatically, exposing trading opportunities as soon as they occur. There is also an economic calendar and a new section to give you an idea of what news is coming and what impact it may have, however, there are more in-depth resources already available on the internet. There is a basic signals page too where they give buy and sell signals but they are not incredibly in-depth and the accuracy has not been tested by us. In terms of education, there are some basic courses as well as some separate in-depth courses on different aspects of trading and how to use different platforms and analysis techniques. There are also a couple of ebooks to download as well as a glossary of forex based terms.

In terms of education, there are some basic courses as well as some separate in-depth courses on different aspects of trading and how to use different platforms and analysis techniques. There are also a couple of ebooks to download as well as a glossary of forex based terms.

Only one platform available from Capitaria, luckily it is a very well established platform. MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

Only one platform available from Capitaria, luckily it is a very well established platform. MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

Leverage

Leverage Assets

Assets

If you decide to open an account through this broker, you’ll be trading through the world’s most popular trading platform, MetaTrader 4. Even with further advancements in the time since the program was released, MT4 still remains the best-suited platform on the market, due to its wide array of features, including the ability to tailor indicators by customizing scripts, libraries, and even EAs, 31 chart analysis tools and 30 different indicators, support for a wide variety of trading instruments, market diversity, and more.

If you decide to open an account through this broker, you’ll be trading through the world’s most popular trading platform, MetaTrader 4. Even with further advancements in the time since the program was released, MT4 still remains the best-suited platform on the market, due to its wide array of features, including the ability to tailor indicators by customizing scripts, libraries, and even EAs, 31 chart analysis tools and 30 different indicators, support for a wide variety of trading instruments, market diversity, and more.

Educational & Trading Tools

Educational & Trading Tools

Just one platform on offer, the good news is that it is the ever-popular MetaTrader 4 which is always a good option to have.

Just one platform on offer, the good news is that it is the ever-popular MetaTrader 4 which is always a good option to have. Currency Pairs: In terms of forex pairs, there are currently 43 different pairs on offer, these are across the major pairs, minor pairs, and exotic pairs. Some examples of what is available as EUR/USD, AUD/CAD and

Currency Pairs: In terms of forex pairs, there are currently 43 different pairs on offer, these are across the major pairs, minor pairs, and exotic pairs. Some examples of what is available as EUR/USD, AUD/CAD and

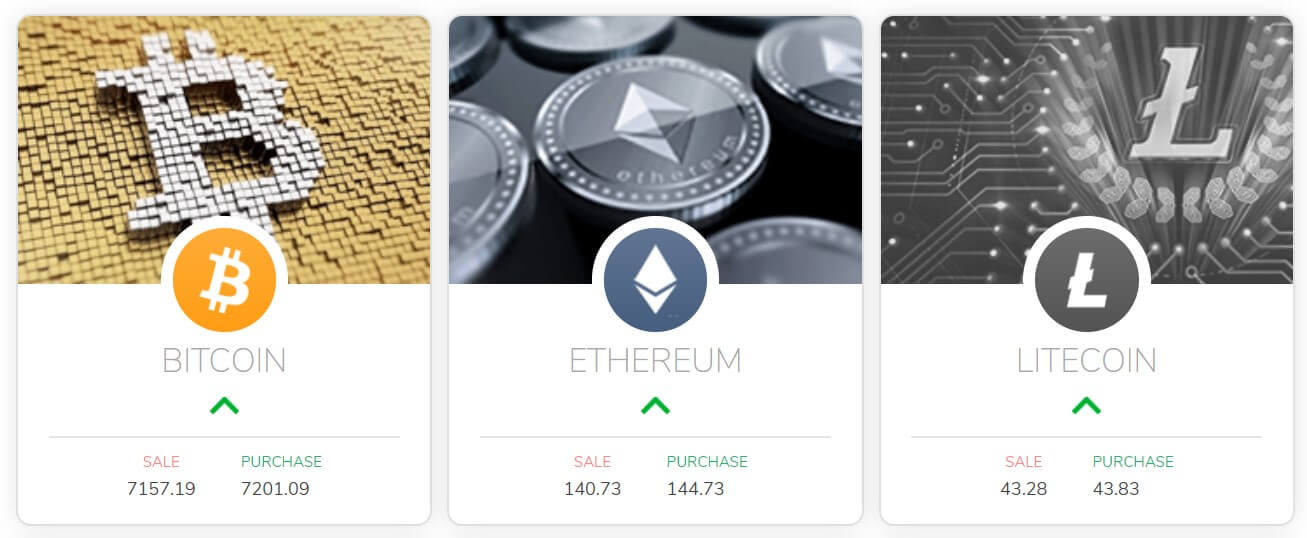

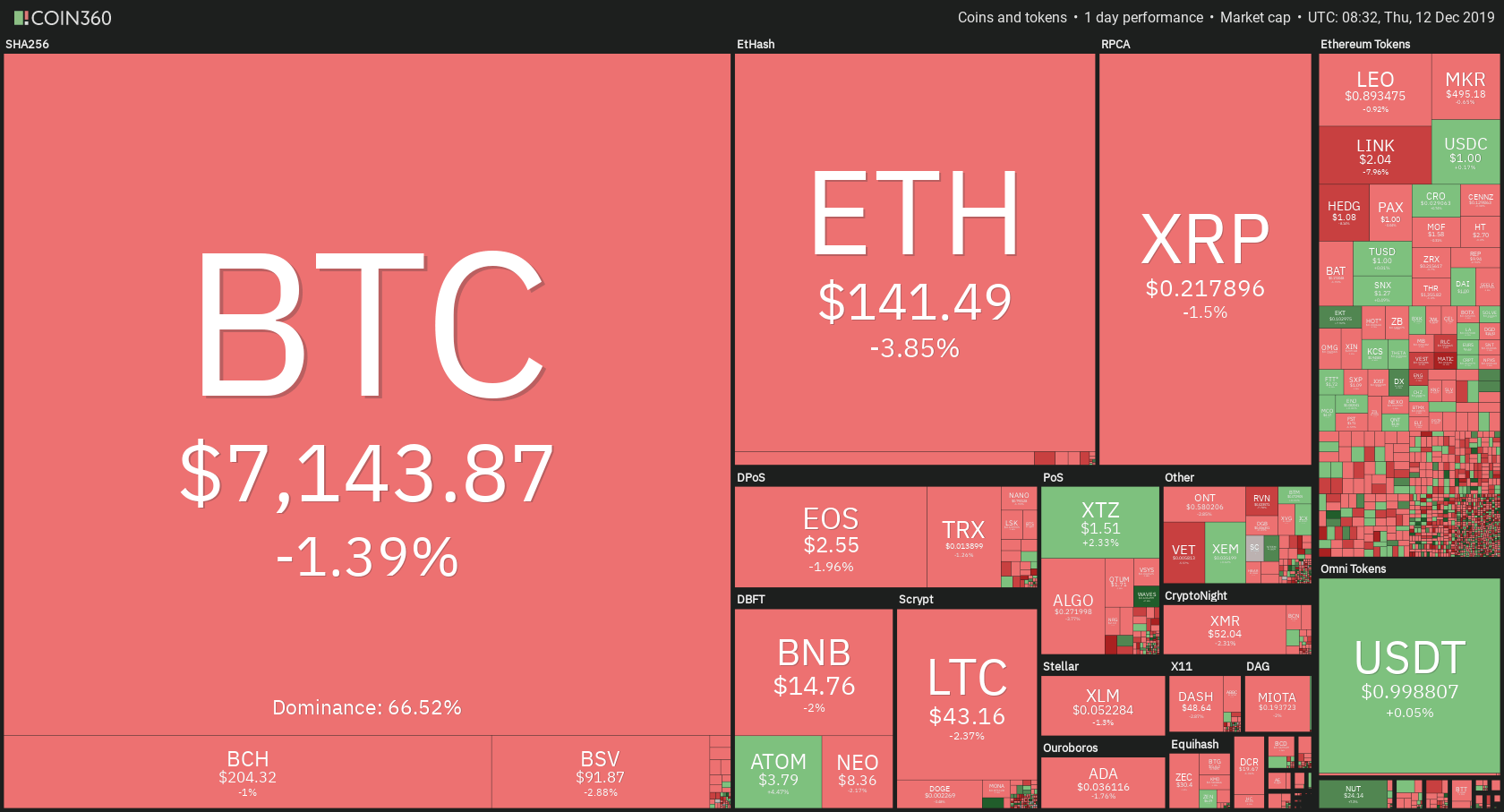

The minimum deposit I very small for the current price of Bitcoin ($7000) and is 0.001 BTC. This low minimum is convenient if you are interested to test their services and withdrawals without risking considerable sums.

The minimum deposit I very small for the current price of Bitcoin ($7000) and is 0.001 BTC. This low minimum is convenient if you are interested to test their services and withdrawals without risking considerable sums. Educational & Trading Tools

Educational & Trading Tools

Customer Service

Customer Service

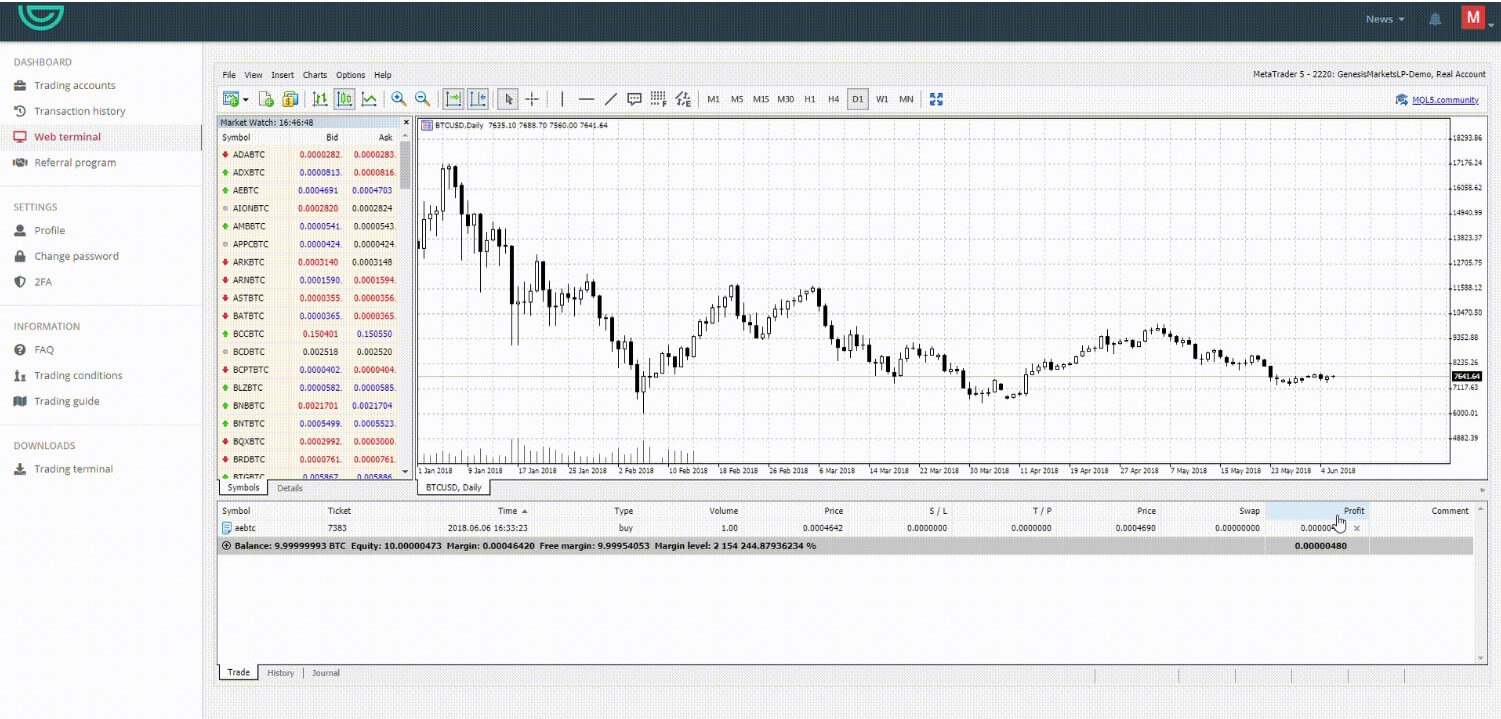

MetaTrader 5 offers the built-in Market of trading robots, the Freelance database of strategy developers, Copy Trading and the Virtual Hosting service (Forex VPS). Use all these services from one place, and access new trading opportunities. MetaTrader 5 is also highly accessible with it being available as a desktop download, application for iOS and Android devices and even as a WebTrader where you can trade from within your internet browser.

MetaTrader 5 offers the built-in Market of trading robots, the Freelance database of strategy developers, Copy Trading and the Virtual Hosting service (Forex VPS). Use all these services from one place, and access new trading opportunities. MetaTrader 5 is also highly accessible with it being available as a desktop download, application for iOS and Android devices and even as a WebTrader where you can trade from within your internet browser.

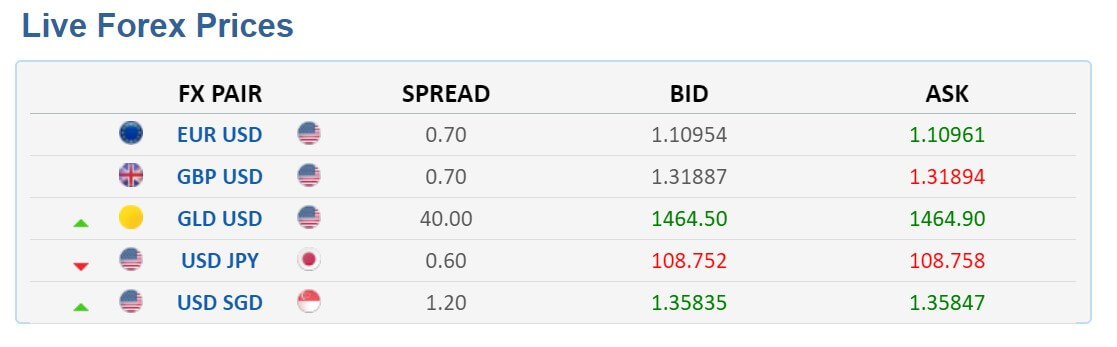

Phillip Futures is primarily a futures-based broker, so that is where the majority of their assets lie, they do have a number of others which we will briefly look at now. There are

Phillip Futures is primarily a futures-based broker, so that is where the majority of their assets lie, they do have a number of others which we will briefly look at now. There are

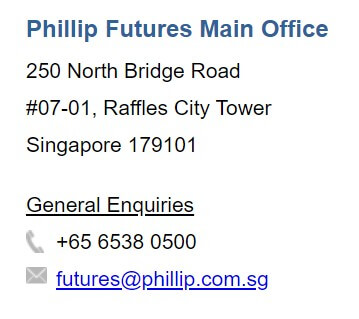

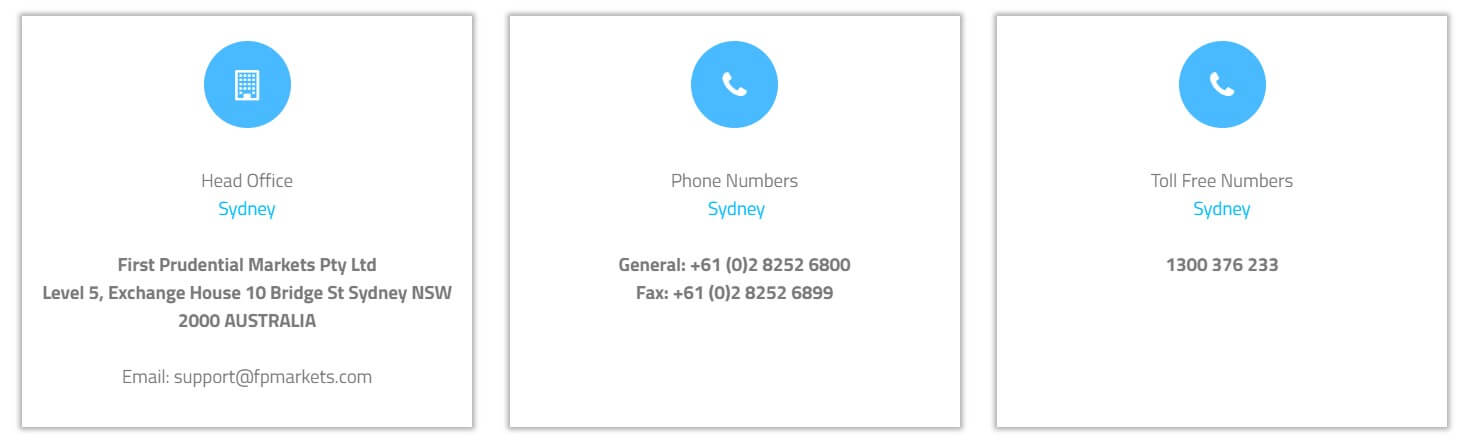

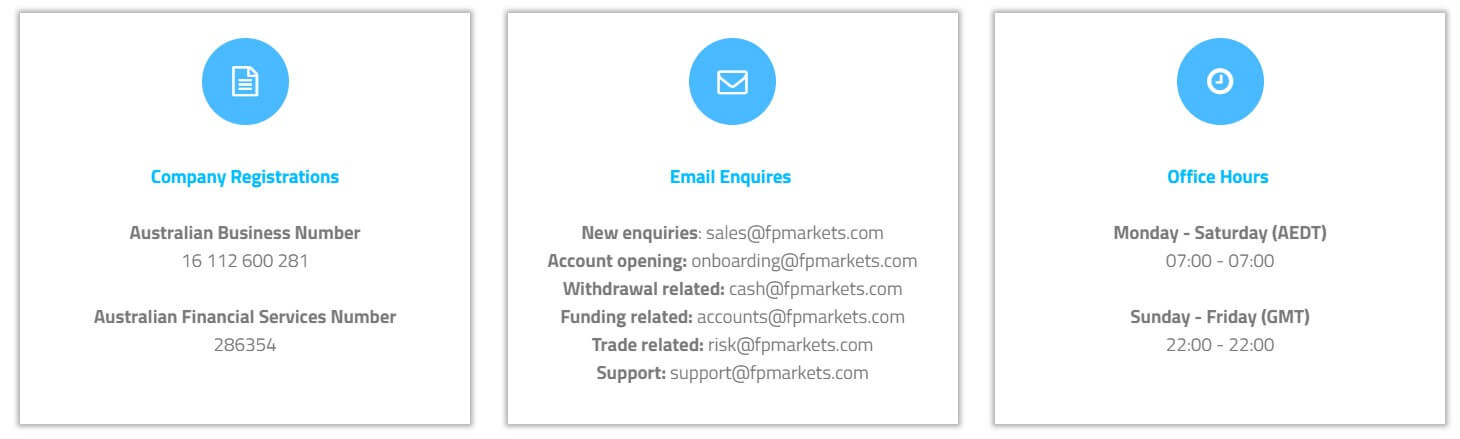

There are plenty of options when it comes to getting in touch with Phillip Futures, there are multiple different departments including general enquiries, it supports, gold enquiries, futures dealing desk, bullion/forex desk, commodities/energies/metals desk, feedback and complaints, trading member enquiries and personal data protection. Each department has its own telephone number and email address to get in touch directly with them.

There are plenty of options when it comes to getting in touch with Phillip Futures, there are multiple different departments including general enquiries, it supports, gold enquiries, futures dealing desk, bullion/forex desk, commodities/energies/metals desk, feedback and complaints, trading member enquiries and personal data protection. Each department has its own telephone number and email address to get in touch directly with them.

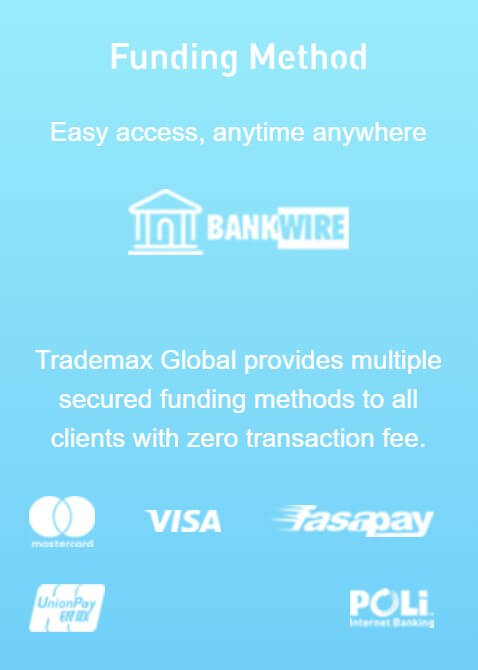

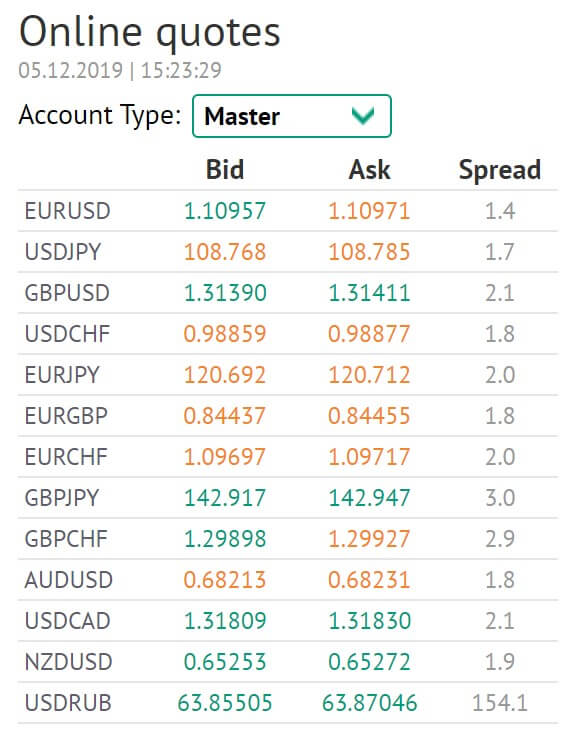

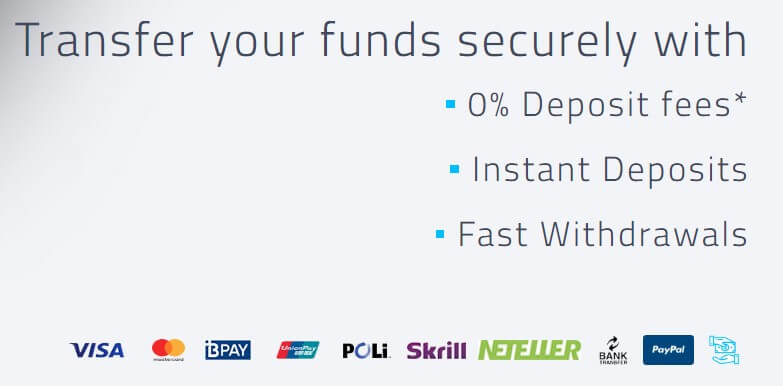

The website is very clearly set out and outlines deposit methods available very clearly. The deposit methods offered by NBPFX are Skrill, Neteller, Bank Wire (a very large variety of which you can see on the website) and also Visa/Master Card. Bank Cards, local bank transfer, and Wire Transfers are the only ones that come with a fee by the bank, while all other methods do not incur any fees from the broker.

The website is very clearly set out and outlines deposit methods available very clearly. The deposit methods offered by NBPFX are Skrill, Neteller, Bank Wire (a very large variety of which you can see on the website) and also Visa/Master Card. Bank Cards, local bank transfer, and Wire Transfers are the only ones that come with a fee by the bank, while all other methods do not incur any fees from the broker.

Standard Account:

Standard Account:

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

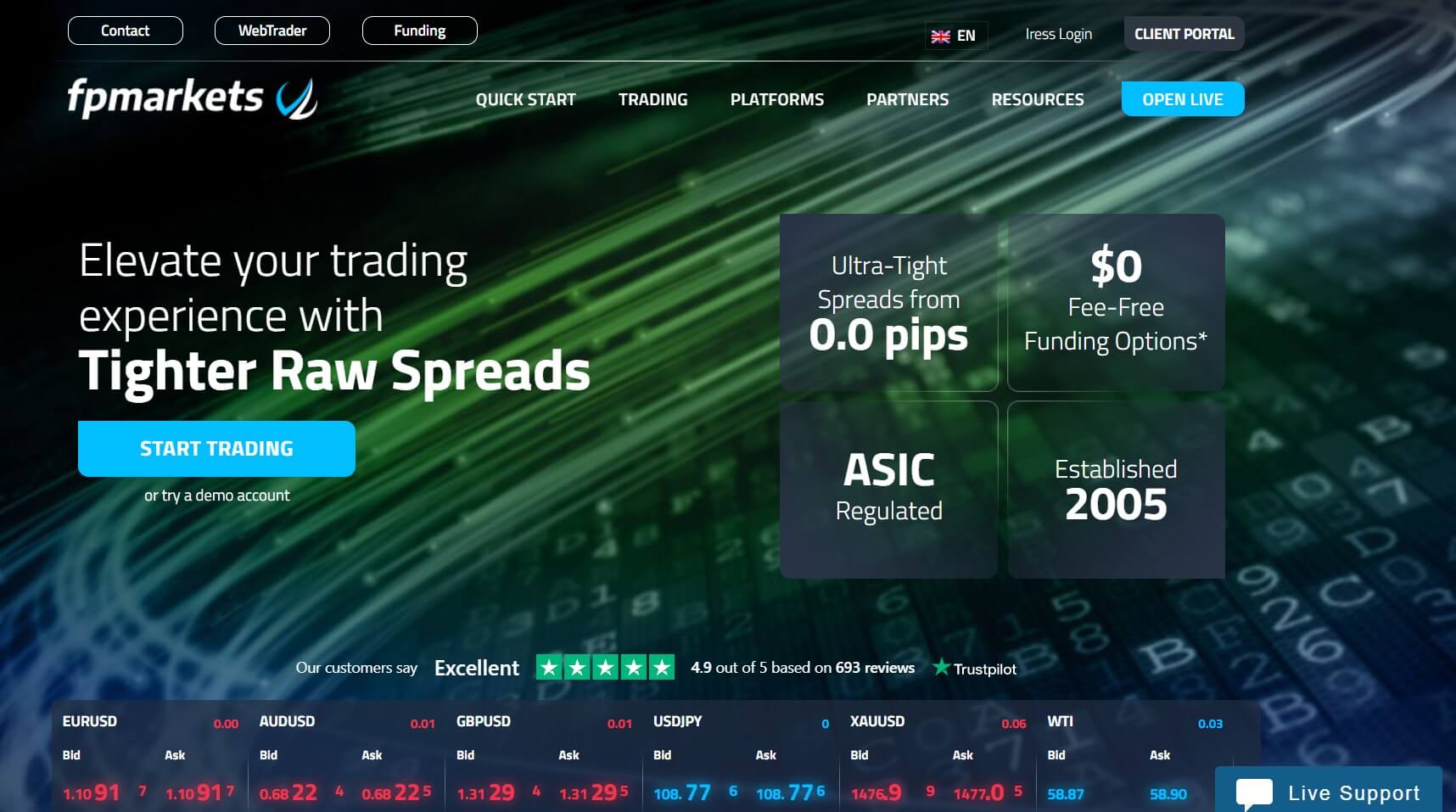

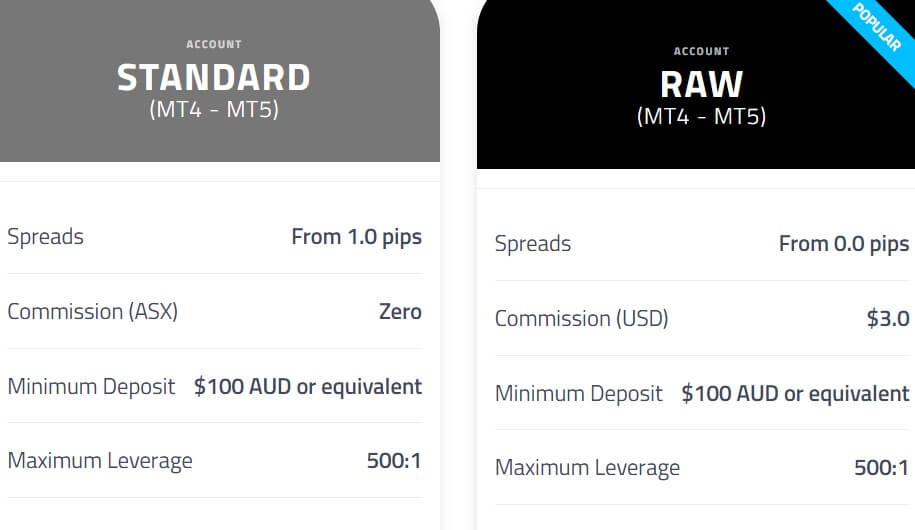

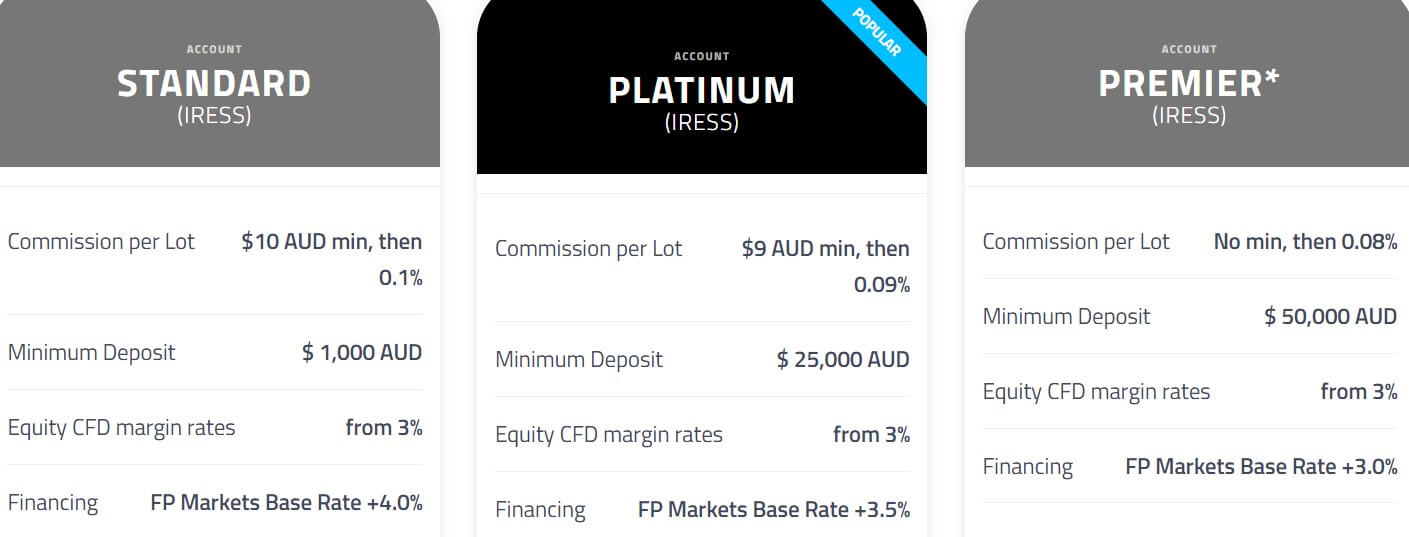

MT5 builds on its predecessor’s features and adds more pending order types, an improved strategy tester for EAs, a built-in economic calendar, and greater flexibility for different trading styles. Both MT4 and MT5 are highly accessible, available through download on PC, Mac, Android, or through Google Play for iPhone/iPad. These platforms can also be accessed through the browser-based WebTrader. Moving on, we were interested to get more of an in-depth look at the Iress platform, since this broker markets three account types around this trading platform.

MT5 builds on its predecessor’s features and adds more pending order types, an improved strategy tester for EAs, a built-in economic calendar, and greater flexibility for different trading styles. Both MT4 and MT5 are highly accessible, available through download on PC, Mac, Android, or through Google Play for iPhone/iPad. These platforms can also be accessed through the browser-based WebTrader. Moving on, we were interested to get more of an in-depth look at the Iress platform, since this broker markets three account types around this trading platform.

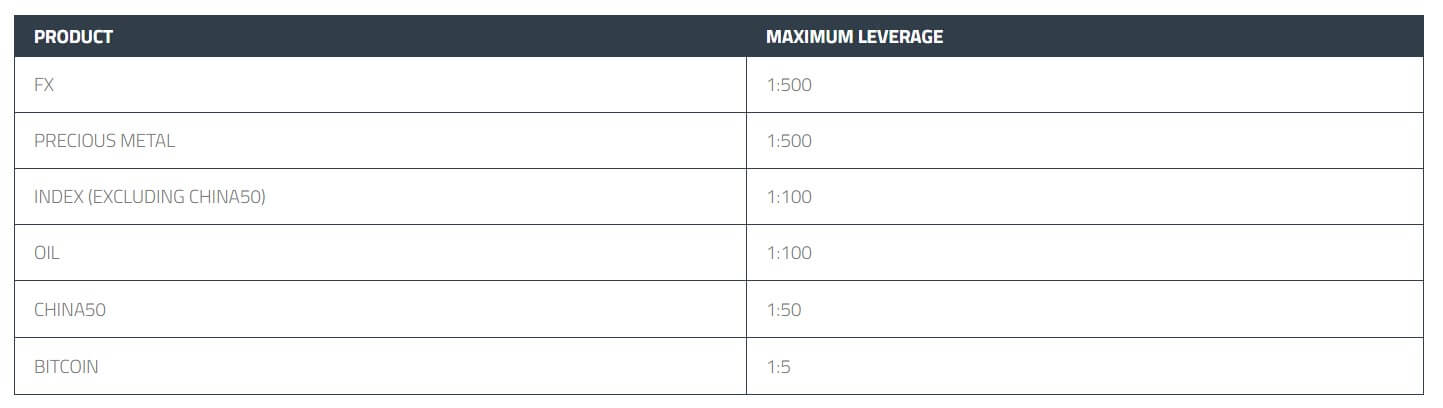

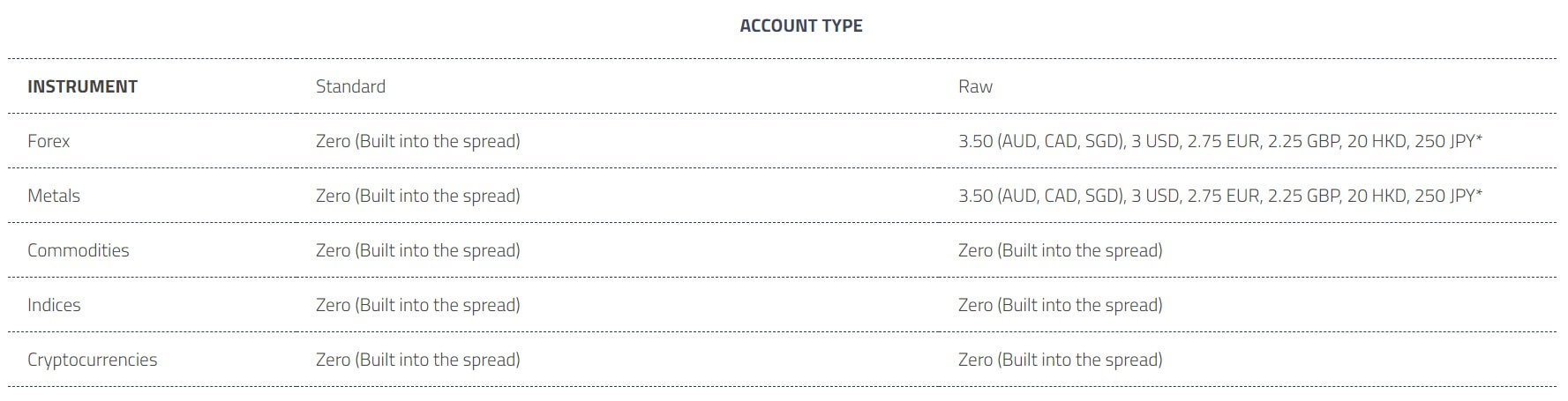

Available markets include Forex, Equities, Metals, Commodities, Indices, and Cryptocurrency CFDs. All options are available on Iress accounts, while both MT4/MT5 centered accounts limit the options to FX pairs, Metals, Indices, and Commodities. The broker advertises 70 currency pairs as being available; however, we only counted 52 available instruments ourselves, all of which were made up of majors, minors, and exotics. Trading Metals is available with leverage of up to 500:1 on

Available markets include Forex, Equities, Metals, Commodities, Indices, and Cryptocurrency CFDs. All options are available on Iress accounts, while both MT4/MT5 centered accounts limit the options to FX pairs, Metals, Indices, and Commodities. The broker advertises 70 currency pairs as being available; however, we only counted 52 available instruments ourselves, all of which were made up of majors, minors, and exotics. Trading Metals is available with leverage of up to 500:1 on

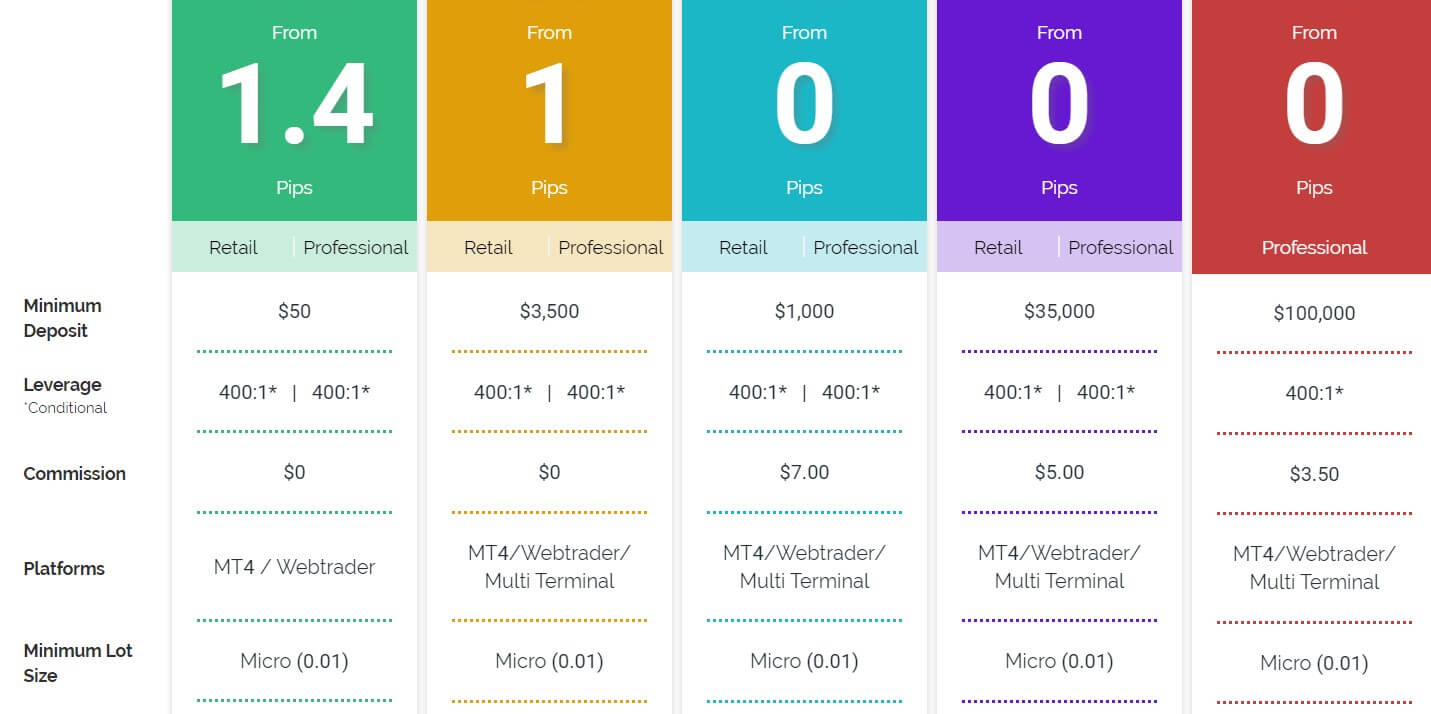

Royal Financial Trading offers both the well known and trusted MetaTrader 4 as well as ZuluTrade PLatform which gives clients access to smaller spreads. Both platforms are amicable but bear in mind that the Classic account is limited to the use of MT4 and web trader only.

Royal Financial Trading offers both the well known and trusted MetaTrader 4 as well as ZuluTrade PLatform which gives clients access to smaller spreads. Both platforms are amicable but bear in mind that the Classic account is limited to the use of MT4 and web trader only.

Royal Financial Trading offers the following methods to their clients for withdrawals: Bank Card, Bank Wire, Skrill or Neteller. Royal Financial Trading covers the fee for the client if the withdrawal is less than $50. Above that, you could be subject to a 2.5% conversion fee in addition to any transaction fee while Neteller and Skrill charge 2% to return funds to your Skrill/Neteller account. Lastly, Bank Card/ Wire (Domestic AUD transfers) do not incur any fees. All other international transfers and currencies will attract fees that are charged by the bank, so ensure you speak with your bank first to understand what you may be charged.

Royal Financial Trading offers the following methods to their clients for withdrawals: Bank Card, Bank Wire, Skrill or Neteller. Royal Financial Trading covers the fee for the client if the withdrawal is less than $50. Above that, you could be subject to a 2.5% conversion fee in addition to any transaction fee while Neteller and Skrill charge 2% to return funds to your Skrill/Neteller account. Lastly, Bank Card/ Wire (Domestic AUD transfers) do not incur any fees. All other international transfers and currencies will attract fees that are charged by the bank, so ensure you speak with your bank first to understand what you may be charged.

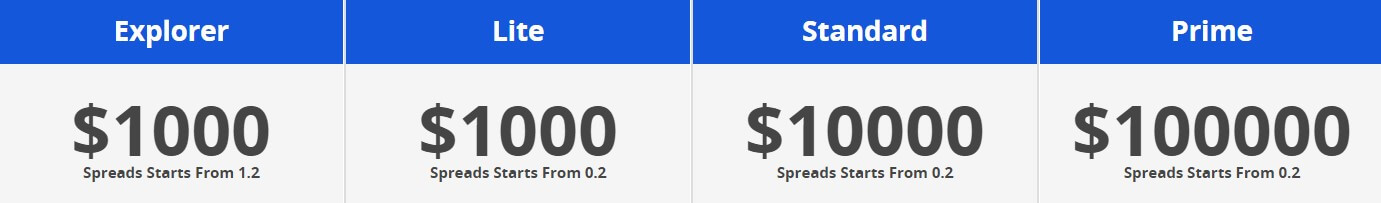

Lite Account has increased deposit requirement and it is different from the Explorer Account by tighter spreads and the included commission. As we go to the next tier, Standard Account has further increased deposit requirement, lower commission but the spread is the same. The leverage is reduced and also the trading sizes are bigger. The final, Prime Account has a very big deposit requirement and the smallest commission of them all. Trade sizes are increased and the leverage is further reduced.

Lite Account has increased deposit requirement and it is different from the Explorer Account by tighter spreads and the included commission. As we go to the next tier, Standard Account has further increased deposit requirement, lower commission but the spread is the same. The leverage is reduced and also the trading sizes are bigger. The final, Prime Account has a very big deposit requirement and the smallest commission of them all. Trade sizes are increased and the leverage is further reduced.

BlueMax has a few deposit methods, one of which is via Bitcoin and Ethereum. Bank Transfer fees depend on the depositor’s bank, the deposit process will take 3 to 5 days. Card deposits will induce a 3% transaction fee and will take 1 to 2 days to be completed. Netteler deposits should be faster but the broker will need 1 day to process the funds. A fee of 2.5% will apply. Skrill is similar to Netteler but with an increased fee to 2.8%.

BlueMax has a few deposit methods, one of which is via Bitcoin and Ethereum. Bank Transfer fees depend on the depositor’s bank, the deposit process will take 3 to 5 days. Card deposits will induce a 3% transaction fee and will take 1 to 2 days to be completed. Netteler deposits should be faster but the broker will need 1 day to process the funds. A fee of 2.5% will apply. Skrill is similar to Netteler but with an increased fee to 2.8%.

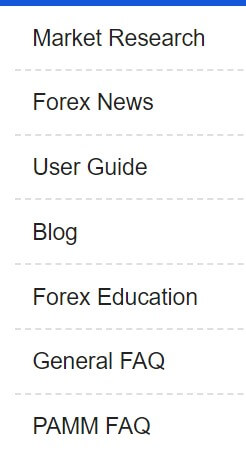

The User Guide is an addition on how to use the MT4 platform, PAMM features and guides, IB program introduction, how to deposit and withdraw and some other articles that are mostly marketing content.

The User Guide is an addition on how to use the MT4 platform, PAMM features and guides, IB program introduction, how to deposit and withdraw and some other articles that are mostly marketing content.

Conclusion

Conclusion

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors,

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors,

Credit / Debit Card (Visa and MasterCard): Deposits over $100 there will be a fee of 2% + EUR 0.24 (or equivalent) and for international cards there will be a fee of 2.5% + EUR 0.24 (or equivalent). For deposits under $100, there will be an additional service charge of $10 (or equivalent). The maximum daily deposit limit is $15,000 (or equivalent).

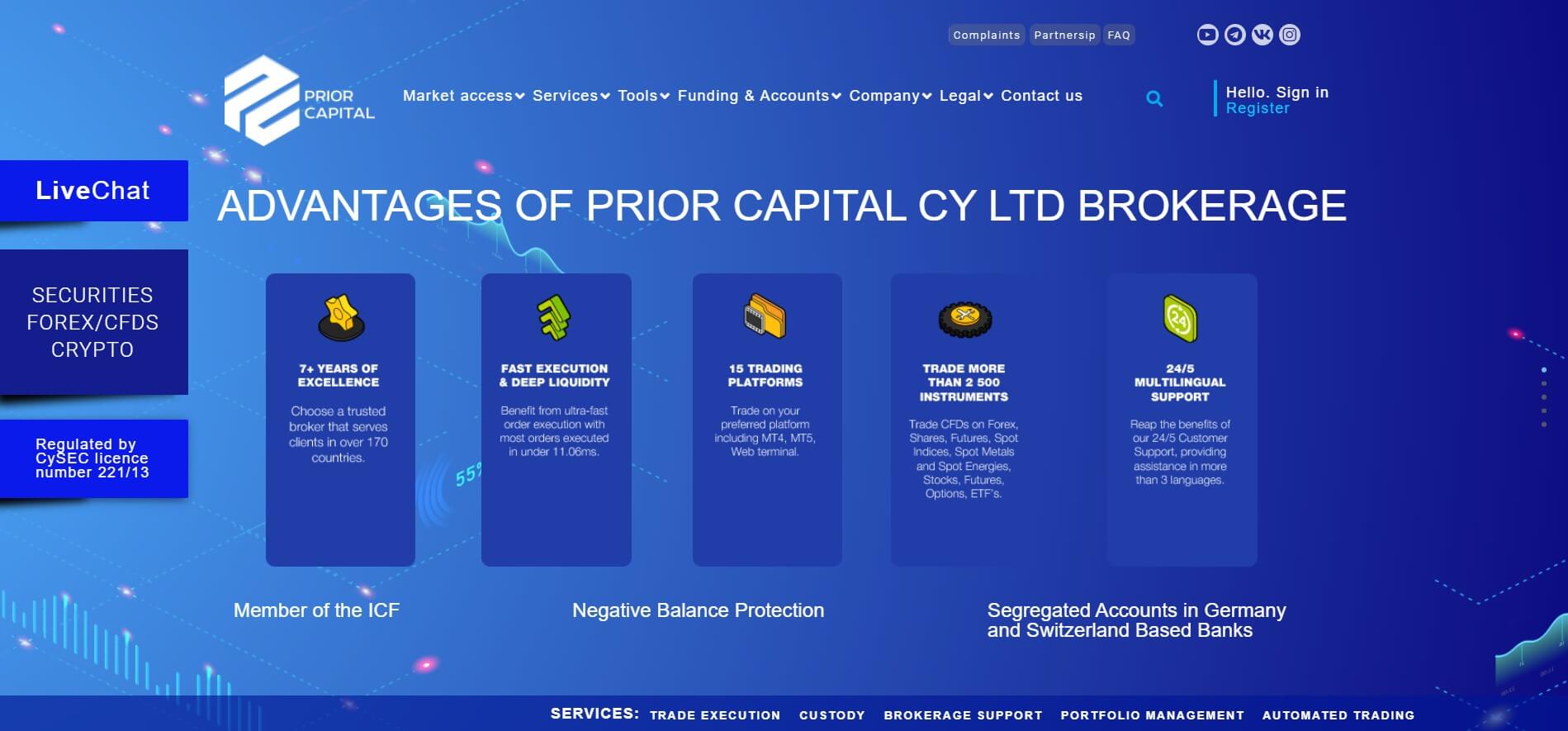

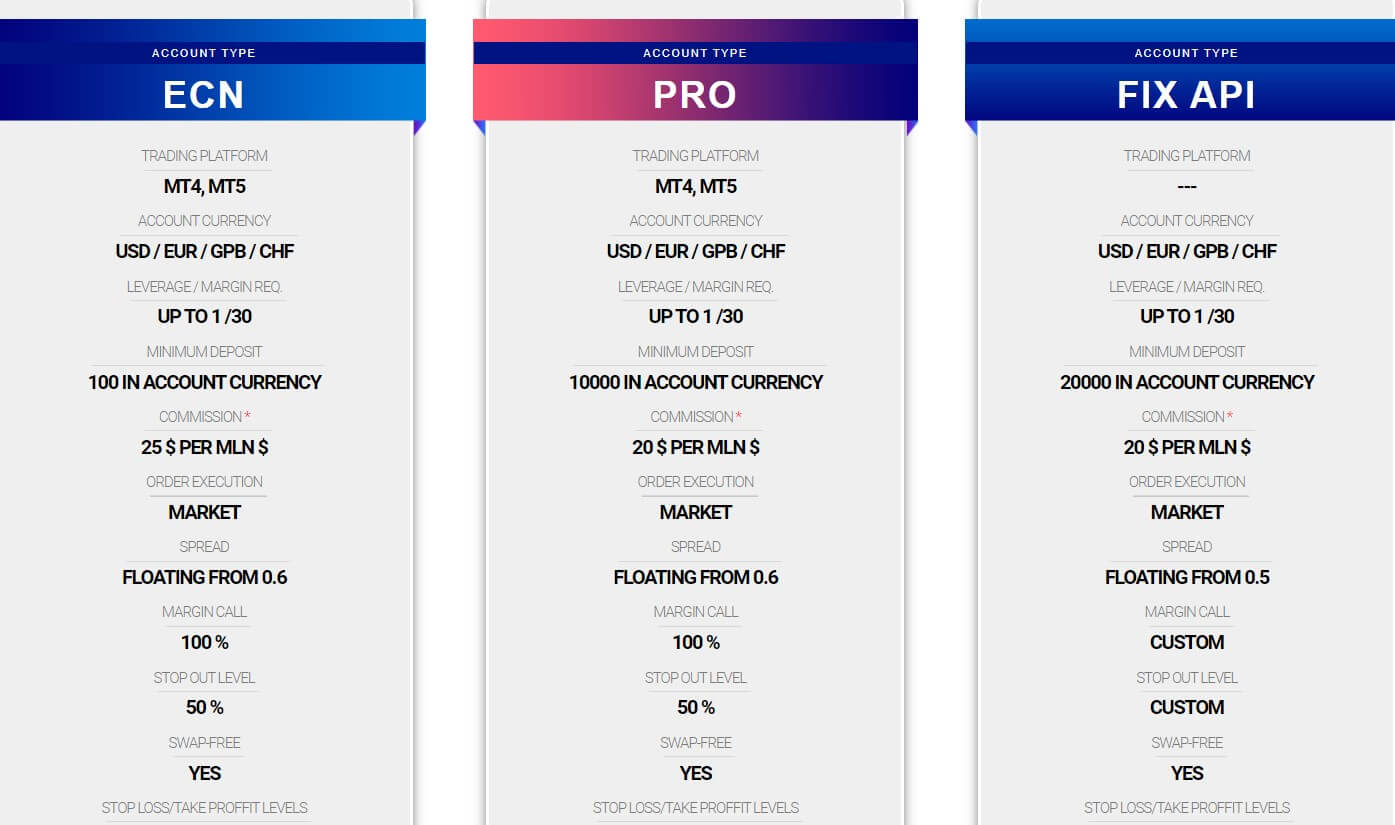

Credit / Debit Card (Visa and MasterCard): Deposits over $100 there will be a fee of 2% + EUR 0.24 (or equivalent) and for international cards there will be a fee of 2.5% + EUR 0.24 (or equivalent). For deposits under $100, there will be an additional service charge of $10 (or equivalent). The maximum daily deposit limit is $15,000 (or equivalent). There are a few basic tools on offer to help with your trading, there is some market analysis that is very basic showing a chart of various currencies but not much more information than that. You can contact Prior Capital though to help create a personalized report. Market data is also available but this much the same thing as the market analysis. The economic calendar on offer gives you information about any upcoming news events that may affect the pairs you are trading ut there are more detailed ones available for free on the internet. Finally, there is a

There are a few basic tools on offer to help with your trading, there is some market analysis that is very basic showing a chart of various currencies but not much more information than that. You can contact Prior Capital though to help create a personalized report. Market data is also available but this much the same thing as the market analysis. The economic calendar on offer gives you information about any upcoming news events that may affect the pairs you are trading ut there are more detailed ones available for free on the internet. Finally, there is a

The available leverage caps for your account can vary depending on the price volatility of the underlying instrument. The leverage cap is set at 30:1 on major Indices, 10:1 on Commodities other than Gold and non-major Equity Indices, and 5:1 on individual Equities and other reference values. On another note, the broker offers a slight advantage in this category for Pro account holders by setting the

The available leverage caps for your account can vary depending on the price volatility of the underlying instrument. The leverage cap is set at 30:1 on major Indices, 10:1 on Commodities other than Gold and non-major Equity Indices, and 5:1 on individual Equities and other reference values. On another note, the broker offers a slight advantage in this category for Pro account holders by setting the  The Direct account offers access to Forex, Metals, Futures, Shares, and Cash CFDs and would be the best choice if you’re looking for more variety. The Zero account limits tradable instruments to Forex, Energies, and Metals. FX options are made up of majors and minors and include 34 options. Precious Metals include Gold and Silver. Energies include Light Sweet Crude Oil, Brent Crude Oil, and Natural Gas. Note that this would be the extent of what is offered on the Zero account type. There are 45 total options available under US stocks and major brands like Apple, Citigroup Inc., Google, Microsoft, Disney, and more are available. The broker also lists 6 Index Futures and 11 Cash CFDs.

The Direct account offers access to Forex, Metals, Futures, Shares, and Cash CFDs and would be the best choice if you’re looking for more variety. The Zero account limits tradable instruments to Forex, Energies, and Metals. FX options are made up of majors and minors and include 34 options. Precious Metals include Gold and Silver. Energies include Light Sweet Crude Oil, Brent Crude Oil, and Natural Gas. Note that this would be the extent of what is offered on the Zero account type. There are 45 total options available under US stocks and major brands like Apple, Citigroup Inc., Google, Microsoft, Disney, and more are available. The broker also lists 6 Index Futures and 11 Cash CFDs. On the Account Type Table, we see spreads on the Zero account listed as starting from 0 pips. However, reading the fine print reveals that this is only on the EUR/USD pair. The broker is vague when it comes to describing the spreads on the Direct account type and suggests potential clients check out the Contract Specifications for themselves in order to view them. Upon checking the spreads for ourselves, we weren’t exactly surprised that the broker wasn’t boasting about their offers.

On the Account Type Table, we see spreads on the Zero account listed as starting from 0 pips. However, reading the fine print reveals that this is only on the EUR/USD pair. The broker is vague when it comes to describing the spreads on the Direct account type and suggests potential clients check out the Contract Specifications for themselves in order to view them. Upon checking the spreads for ourselves, we weren’t exactly surprised that the broker wasn’t boasting about their offers.