The first thing the broker is associated is with the well known Cryptocurrency Exchange, Coinex. The name is used probably to get digital marketing upper hand although there are similarities as this broker deals only with the cryptocurrency accounts. Coinexx is a smaller group of a dozen employees that changed the orientation after acquisition or rebranding of FinproTrading.com to an exclusive crypto model. As for the regulation, there is none. They are located in Kingstown, Saint Vincent and the Grenadines, one of the favorite locations for an easy entry into the brokerage business, some of which are not honest.

Also, the broker is from Seychelles, as the support staff told us, making things very confusing. Coinexx is very obscured about its location, it is nowhere to be mentioned on their website or in the legal documents. There is a considerable risk when dealing with a broker with crypto accounts, without regulation or verifiable location. Still, Coinexx has some solid ratings on the benchmark sites, probably the only way traders can put trust in. The broker recognized the need and the potential dealing with cryptocurrencies, an area where none of the heavily regulated brokers can get involved. On top, Coinexx offers some very competitive trading conditions and services. We will evaluate if the inherent risk this broker carries is worth your while.

Account Types

There is only one account type offered. The logic behind this is that there is no need to make selections, one account for all trader’s needs. This may be only temporary although traders can have a sense of simple, pure, and professional approach to trading without marketing or gimmicks. This is a good sign and a marketing strategy to show honest intentions and no reasons to hide behind flashy statements. As stated, the Pro ECN Account will be appropriate for scalpers, news traders, EAs, crypto lovers and the rest of fast strategy traders.

The main features are instant withdrawals, (apparently using the crypto technology), Secure and private Wallets, Crypto based accounts in BTC, BCC, LTC, ETH and USD, and negative balance protection. The Account is protected by Two Factor Authorization (2FA) method and it is also stated that Coinexx wallets are cut off from the internet, so-called cold wallets, that keep hacking impossible. In addition to account security, End to End encryption is in place. All trading styles are allowed. Commissions exist but they are one of the smallest in the industry. Spreads from 0.0 pips are promoted and also a bonus, whether this is true or just marketing will be evaluated in respective sections.

Platforms

Coinexx has two platforms offered, MetaTrader 4 and 5. All of the versions exist, For PC, Mac, iOS, and Android. The web MT4/5 is also available from the Client Portal that does not require any installation. The server scan showed two Coinexx servers, Demo and Live, with almost the same ping of 51ms. Log In was very quick giving a feeling the servers are not loaded and ready for fast executions.

The MT4 client is updated to the latest version with all the settings by default and visible One-Click trading buttons. The four classic charts show major Forex pairs with basic, included indicators. The execution times are just a bit over 150ms including the server latency, which is considered top tier in the industry.

The assets symbols are grouped although not very user-friendly, for example, Forex crosses and exotics have just a dot suffix to set it apart from the major currency pairs. Trade Terminal will account for the commissions and the swaps for each trade and instrument specifications are filled with enough information. The MT4 though does not show Cryptocurrencies available for trading, only MT5 does.

The MT5 has a bit different symbols layout and traders may need adaptation if their account nominated in BTC. Interestingly, we have noticed another Coinexx location in the About window. This time the broker is in Edinburgh, UK. Anyways, the execution is even faster than with MT4, with an average of 55ms, a figure that can rarely get better.

Coinexx stated that the liquidity is arranged with 20 tier 1 banks. The only drawback with MT5 is the lack of abundance of EAs and custom indicators. The base currencies available for MT5 are USD, BTC LTC, BCC, ETH, and XRP. We have noticed that the commission in MT5 is not displayed it the Trade terminal by default, it has to be enabled. The specification window states $1 per lot and this is per side.

Coinexx features a free VPS service. This VPS is located near their servers in Amsterdam. Coinexx also has servers in Chicago and London as stated by their staff. The VPS service is available for $5000 deposits or, if the trader does not meet the requirement, it is still available for $25 per month. The VPS service can be requested within the Client Portal or via chat.

Leverage

The leverage can be set up to 1:500. From the Client Portal, it is easy to change, the minimum one can set is 1:100, which may be too high for some traders. The maximum leverage is 1:500 for all major Forex pairs, while the exotics have between 1.6 to 10 times lower leverage. For example, USD/CHN has 1:50 leverage or GBP/TRY with 1:200. Indexes do not have any change while cryptocurrencies are all fixed to 1:5 maximum. Metals and Oil types retain a maximum of 1:500. Only Natural gas is reduced to 1:300.

Trade Sizes

Coinexx trade sizes are in micro-lots or 0.01 lot. The minimum trade size is set to 0.01 while the steps volume is also 0.01 lots. The maximum trade volume for Forex currency pairs is 100 lots. The same trade size setup is across all the offered instruments except for Indices where the minimum trade volume is 1 lot. The standard micro-lot trade sizes are convenient for precision trading and Money Management used in high-frequency trading.

Coinexx has somewhat higher Stop Out and Margins Call than usual. Stop Out is set at 50% margin level, a mark where most of the brokers set their Margin Calls. In the case of Coinexx, Margin Call is at 70%.

Coinexx is very friendly when it comes to Stops levels. We have not found an asset in their offer that does not have zero Stop level, meaning absolute freedom where to put your Stop Loss or Take Profit pending orders.

Trading Costs

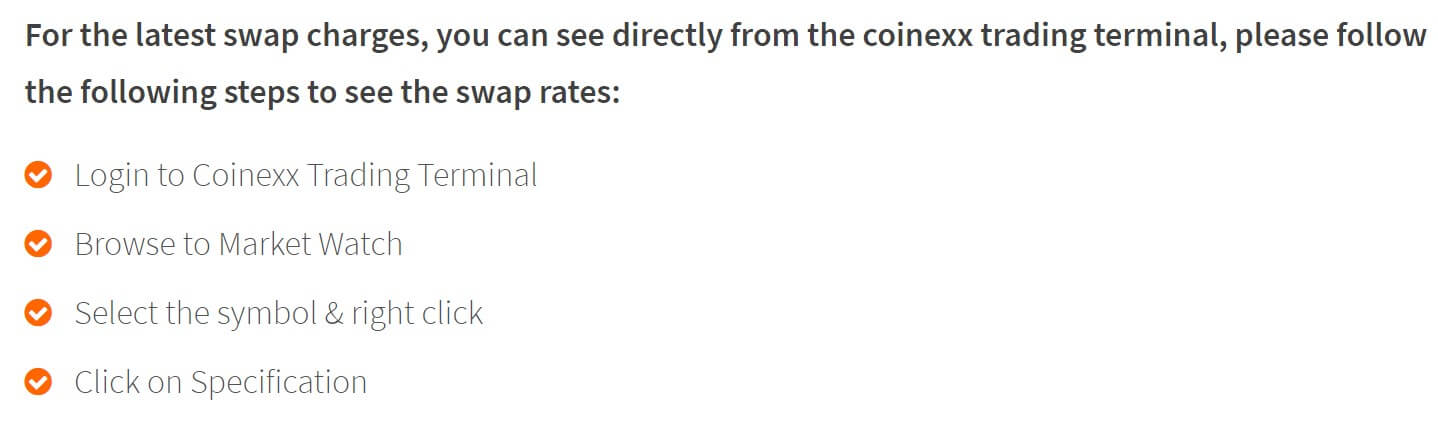

There is a $2 commission charged for every lot traded. This is one of the lowest commissions in the industry as it is usually integrated if the broker uses raw, tight spreads. The swaps are a bit higher than usual, but under normal levels, calculated in points and tripled on Fridays. There are positive swap figures but know that the negative always overweight the positive swap.

For a better picture, the most traded currency pair, EUR/USD the swap is 1.86 for short and -8.92 for long. If you trade crosses, AUD/NZD has -3.9 long and -3.2 short position swap, EUR/CHF -2.5 long and -8.16 short, GBP/CAD -3.6 long and -5.32 short, etc. And in the exotic pairs area, some have very low swaps like GBP/MXN with -12.3 points long swap and -8.6 short, USD/PLN has -37.5 long and 1.5 short position swap. Of course, some are in the extremes like the USD/RUB with -430 long and 49.3 short. Precious metals do not have positive swaps. XAU/USD has -16.3 for long and -3.74 points for short position, while XAG/USD has -1.45 long and -0.55 on short.

Crypto swaps are calculated in USD, and in percentage terms, they are roughly 0.25% per day, depending on the crypto price. For example, BTC/USC has -$19.1 long and -$18.4 for short position, ETH/USD -$0.937 for long and -$0.475, Ripple -$0.0348 / -$0.0144, and so on. The commission is calculated in percentages, exactly 0.001% per side.

Coinexx does not charge any maintenance or inactivity fees, commission and the swaps are the only non-spread trading costs.

Assets

Coinexx does not have an impressive range of instruments apart for Forex. There are 5 categories if you trade with MT5 and 4 with MT4, where Cryptocurrencies are excluded. The forex range is great and will satisfy picky traders. We have counted a total of 68 currency pairs, far better than the average number other brokers offer. All the majors are present, lots of crosses and the exotics are under GBP and EUR too, not just the USD, hence the bigger Forex range. Coinexx covered exotic currencies like TRY, RUB, ZAR, SGD, HKG, MXN, HUF, CNH, PLN, CZK, and Scandinavian currencies.

Under the CFD group are Indices. The range is limited to the majors, a total of 11. Majors like FTSE, S&P, DAX and so on are mixed with some less popular like CAC 40, Hang Seng and IBEX 35.

Commodities range is limited to only energy assets, a total of 3. These are UK Oil, US Oil, and spot Natural Gas.

Metals are also limited, spot Gold and Silver are found, all denominated in USD.

Finally, Cryptocurrencies should be one of the best categories for a crypto broker, although to our surprise there are only 5 listed, and only in the MT5 platform. All of the coins are denominated in USD without any crosses. These are Bitcoin, Litecoin, Ethereum, Bitcoin Cash, and Ripple. Note that the trading session for Crypto is not 24/7, but 24/5 like the rest of the assets.

Spreads

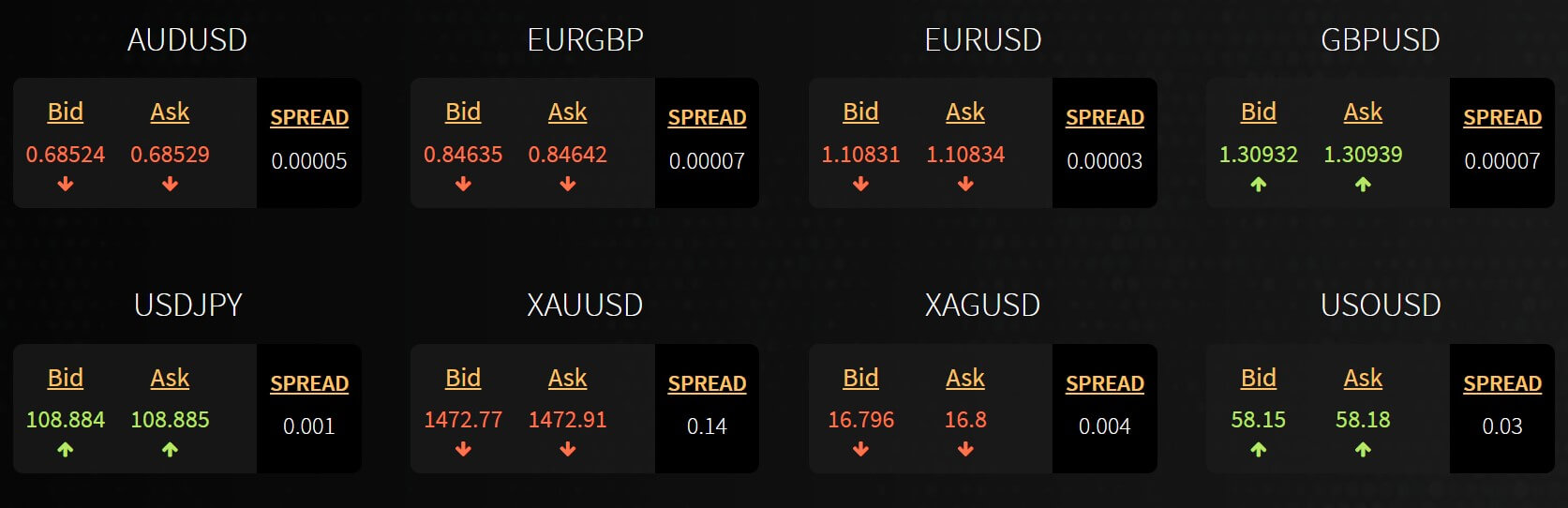

The spread is a floating type and were not 0.0 pips at any moment during our observation, still, they are close enough. Spreads presented on the Coinexx website are not the ones we see on the platform, as they are not updating. The EUR/USD showed 2-4 points spread and even lower is the USD/JPY in the range of 1-3 points during a stable environment.

Similar spreads have AUD/USD, EUR/JPY, CAD/JPY and to our surprise, an exotic, USD/CHN. Coinexx is probably the only broker that offers 2 points spread on USD/CNH pair. Crosses have 5 points wider spreads, for example, EUR/AUD has 5-12 points, AUD/NZD 9-14 points, and GBP/CAD 10-18 points. Exotics have some unexpectedly small spreads, like the GBP/CZK – 2 pips, EUR/CZK – 7 points, and USD/HKD – 25 points. Others have normal spreads for their volatility. USD/MXN – 325 points, USD/HUF – 91 points, USD/RUB – 1100 points, and so on.

Precious metals have also very competitive spreads. XAU/USD did not go over 20 pips while XAG/USD had 3-4 pips. Cryptocurrencies show spreads that vary a lot more than other assets. For, example, BTC/USD varies between 40 and 60 pips, BCC/USD from 100 to 120 pips and XRP/USD 70-80 pips.

Minimum Deposit

The minimum deposit I very small for the current price of Bitcoin ($7000) and is 0.001 BTC. This low minimum is convenient if you are interested to test their services and withdrawals without risking considerable sums.

The minimum deposit I very small for the current price of Bitcoin ($7000) and is 0.001 BTC. This low minimum is convenient if you are interested to test their services and withdrawals without risking considerable sums.

Deposit Methods & Costs

The deposits are possible by using many Cryptocurrencies. These will be converted to the base account currency you have selected at the broker rates if they differ. Deposit coins are Bitcoin, Litecoin, Ethereum, TrueUSD, Gemini USD, USDC, Bitcoin Cash, ZCASH, Monero, Binance Coin, OmiseGO, Lisk, Siacoin, NEM, Monaco, Stratis, Dash, Dogecoin, Ether Classic, NEO, BlackCoin, NXT, and Pot Coin. The transfer fees do not exist. For those unaware, any deposits made in crypto are permanent, the investor is not protected by chargeback by any financial institution.

Withdrawal Methods & Costs

Withdrawals are the same as deposits, using the cryptocurrency of choice, regardless of deposit coin. The minimum withdrawal amount is 0.001 BTC or $5 and there are no fees. Note that incorrect wallet address may result in permanently lost funds. Coinexx encourages small transfers before large sums to secure correct usage.

Withdrawal Processing & Wait Time

One of the selling points if Coinexx is the withdrawals. By using digital assets technology, they claim to have 48 hrs policy before the funds are reflected in the client’s e-wallet. By user reports, this processing time is correct.

Bonuses & Promotions

Coinexx offers a 100% bonus on first-time deposits with the maximum leverage of up to 1:200, requested within the Client’s Portal. The requirements are only $100 minimum deposit, no trading volume required. The bonus cannot be withdrawn and serves just like the fund’s extension. Any withdrawals that exceed the original deposit amount will reduce the bonus proportionally, but profits withdrawals will not affect the bonus. This kind of bonus does not have any purpose as it has the same function as the leverage, except in this case the leverage maximum is reduced to 1:200. Based on the bonus conditions, it is better to open an account with 1:500 leverage without the 100% bonus.

Coinexx also has PAMM/MAM accounts and Introducing Brokers (IB) programs.

Educational & Trading Tools

Educational & Trading Tools

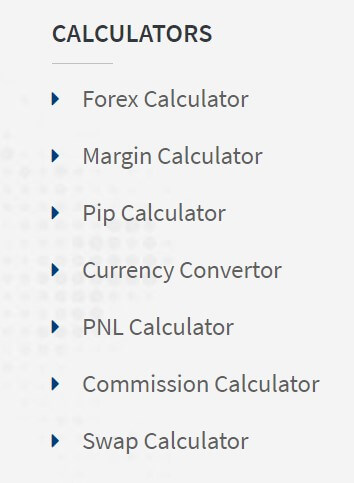

Coinexx does not have any educational material has calculators. They are presenting 7 calculators on their website. Forex, Margin, Pip, PNL, Commission and Swap calculator with the addition of currency convertor. In essence, it is one calculator that shows different figures. Forex calculator contains all of the calculations mentioned, Profit/Loss, Margin, Pip value, Commission, and the swap amount. It is well designed and useful.

Customer Service

What we have noticed is that the support is 24/7 and they respond quickly, in 1-minute for chat service. The staff is knowledgeable but may avoid direct answers on touchy questions like for example for their location. You may wait for half a minute for every new question and the response may not be in full, with additional relevant information that may interest you. There is also email contact but no phone lines. The website does not feature any FAQ so visitors will have to rely on the support for any questions.

Demo Account

The demo account has no limits and is opened only within the Client Portal. This means visitors need to register first. The phone number is required for this and is later used for OTP security, in addition to the optional 2FA. The demo will reflect the live account trading environment without any differences and the information provided.

Countries Accepted

Taking into account that this is now an exclusive cryptocurrency broker, there are no restrictions, as confirmed by the Coinexx staff.

Conclusion

The main issue Coinexx has is intricately connected to the nature of cryptocurrencies. There are multiple clone sites like coinexx.net, coinexx.org and similar, that are used by scammers so unwary visitors will deposit their crypto to addresses not owned by the broker. The reason the broker is attractive for such practices is hard to track owners of cryptocurrency wallets.

Coinexx is a popular choice for many US traders, as it allows much more leverage, good trading conditions, and the option to use cryptocurrencies in a way other brokers cannot. Definitely, the main drawback is the risk of having a broker that can get closed one day, without a trace and all the funds will probably be lost. There is no security here, even if Coinexx is legit. On the other hand, smaller accounts could be a great choice or for a quick in and out methods that will not allow exposure to such risks for too long. The broker location issue is better to leave aside, this obscurity is probably to avoid legal pressures by the governments that would like to put the cryptocurrencies in control.

As per user ratings, Coinexx is a solid broker and most of the complaints are met with the Coinexx staff response. We have not found any serious negatives in reading user experiences.