JFD Bank has offices located in Cyprus, Germany, Spain, Bulgaria, and Vanuatu and is regulated by the CySEC, BaFin, and VFSC. This broker offers three different platforms and multiple types of trading instruments and has won multiple awards every single year since 2013. If you like the way this broker’s profile sounds so far, you’ll definitely want to keep reading to find out more.

Account Types

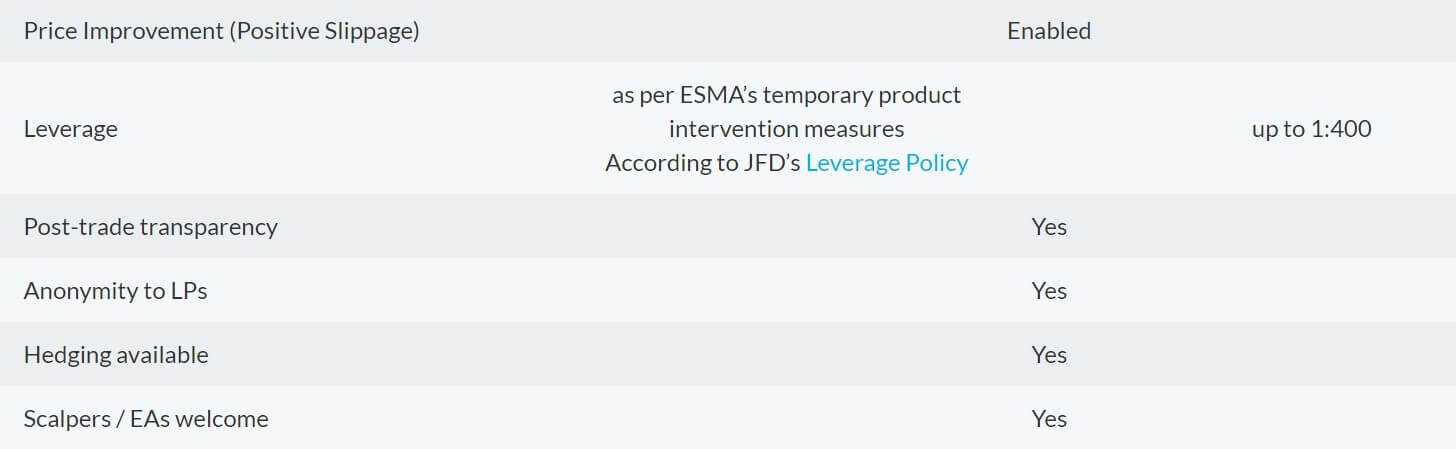

JFD provides the same account type to all of its clients. The company explains that they believe this is the most transparent option, and that each trader deserves the best market access, so there was no need to feature several different accounts. This can certainly provide an advantage to some traders, but we wonder if the lack of specialization could have any negative effects. Rather than offering better spreads or trading costs to some, the company aims to reward higher volume traders through rebates and other types of promotions. The company can get technical when it comes to commission fees and deposit fees, so you’ll need to read through the rest of our review to find more specific information on these sections. Below, you can find a quick overview of this company’s account specifications.

Standard Account

Minimum Deposit: 500 USD/GBP/EUR/CHF

Leverage: Depends on Asset (more on this later)

Commissions: Charged on FX, CFDs, Metals. (more on this later)

Platforms: MT4 & MT5, Guidance

Note that there is a difference between JFD Group LTD and JFD Overseas LTD. The difference only seems to affect transaction fees, and clients in different locations are handled by one certain branch of the company. You’ll be able to pinpoint which branch you’d be dealing with later on in this review. Personal ID and address documents must be submitted and approved before traders can use their account for trading. Once documents have been submitted, it takes 1-2 working days for approval.

Platform

This broker offers the ability to choose from the MetaTrader 4 or MetaTrader 5 platforms, in addition to a platform of their own. We will provide some information on MT4 and MT5, the most popular trading platforms in the world, first. Starting with similarities, both platforms are equally accessible through Webtrader, mobile, or PC, offer add on widgets and tools, technical analysis tools, and 1-click trading, among many other features. MT5 offers access to more markets, supports ten more languages, and provides a few more pending order types, etc.

MT4 is most commonly offered by Forex brokers since it is favored above the newer version. The company’s third-party platform, Guidance, offers many of the same advantages, with some key differences. Webinars are embedded in the platform, as well as built-in social tools. You can compare all of the platforms in more detail by choosing ‘Trading’ > ‘Platform Comparison’. This program is offered through the web or via download on PC.

Leverage

The company’s leverage limits are based on the type of asset that is being traded. Major CFDs have a leverage cap of up to 1:30, while minor CFDs set the limit at 1:20. Commodities and other non-major Equity Indices, such as Crude Oil and Hong Kong 50 Index are capped at 1:10, while individual Equities are capped at 1:5, and Cryptocurrencies offer leveraged trading of up to 1:2. Sadly, this is much lower than the advertised 1:400 leverage ratio. That number is reserved for what the company considers to be ‘professional’ clients. The company runs a program in the background whenever clients are signing up that automatically decides whether they are deserving of the highest leverage offer, based on experience and so forth. It’s possible that you may qualify for the better leverage option if you have experience in the field.

Trade Sizes

The minimum order size in Forex trading is 0.01 lot or 1 micro lot. For CFDs on indices, and commodities is 1 lot (= 1 CFD). The minimum order size for DMA equity CFDs is 1 lot (= 1 stock share). However, there is an exception to some instruments where the mini lot size (0.1 CFD) is enabled. Margin call is set at 100% and stop out levels are set at 50%.

Trading Costs

Trading costs are applicable to all of the following: Commissions, overnight financing, inactivity fees, and for currency conversions. It isn’t surprising to see commission fees and overnight financing charges on this list, but we do wish this broker didn’t charge inactivity fees. These fees are likely charged to help close out abandoned accounts, however, it can be frustrating to find that your account has been charged if you take a break from trading for a few months. Below, we have listed all of the exact fees in detail.

Commissions: CFDs, FX, and metals are all subject to commission fees. These fees differ slightly, although they are very similar, so we will provide the USD fees as examples. The fees are 0.03 on FX, 3.0 USD on precious metals, 0.05% of order volume/minimum charge of 5 EUR on CFDs on stocks from France, Germany, the Netherlands, Spain, Turkey, or the UK. There is a 2cps /5USD minimum charge on CFDs on stocks from the US and a 2.5cps/5USD charge on ETFs. CFDs on indices and commodities are subject to a 0.10 USD charge. Note that zero commission fees are charged when cryptocurrencies and physical stocks of France, the US, Germany, Dutch, and Spanish stocks, however, the company does maintain the right to charge a preset limit at their discretion. If you’d like to view the exact charges in EUR, GBP, or CHF, you can do so under ‘Trading’ > ‘Account Specifications’. The website states that there are different charges for traders of high volume (10 million USD per month).

Overnight Financing: 3.25% +/- Libor, excluding CFDs on Futures Contracts. Swap fees may be subject to fluctuations in the market.

Inactivity Fees: After three calendar months with no activity, accounts will begin to be charged inactivity fees of $20 per month. If there are no funds in the account, these charges will not be applicable, and these fees will not be charged on accounts that have never been funded.

Currency Conversions: 1% fee

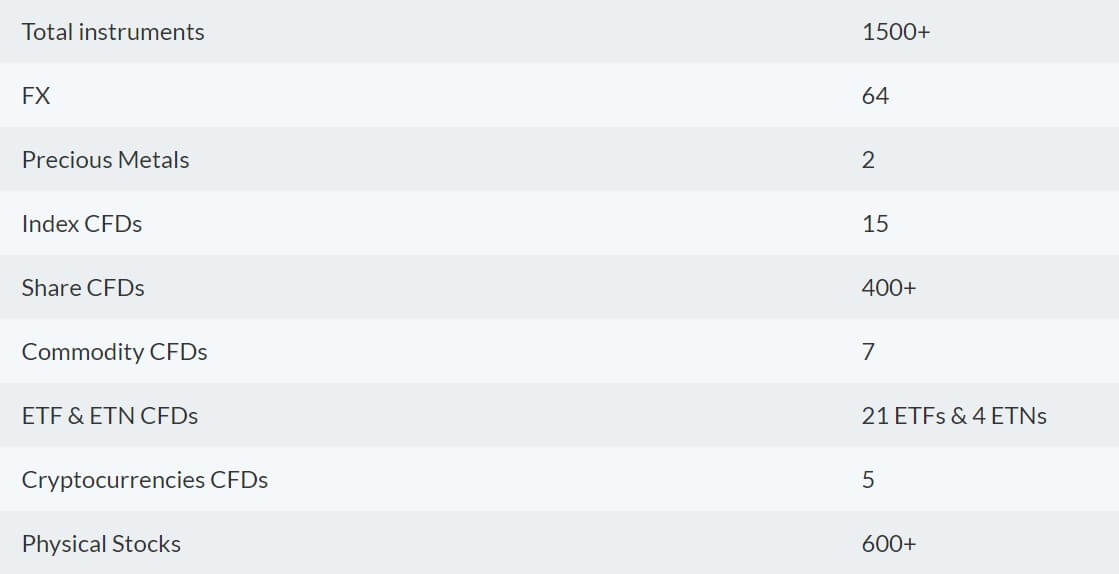

Assets

This broker offers 1500 plus instruments over 8 asset classics. The bulk is made up of more than 600 physical stocks, 64 currency pairs, and 400 plus shares. The company also offers 2 precious metals, 15 Index CFDs, 7 Commodities, 21 ETFs, 4 ETNs, and 5 cryptocurrencies. The sheer number and variety of trading instruments set this broker apart from the crowd, and everyone should be satisfied with options that are available here. This certainly makes JFD Bank worth consideration, if you are interested in trading more than just standard options.

Spreads

The website was very vague about what type of spreads one should expect to see, so we reached out to support to gain some clarity. Our support agent assured us that the company uses Inner-Banking Core Spreads from 0 pips for FX. Support also stated that there are no minimum spreads and that the company provides the best possible spreads available from the bank, with no manipulation. Spreads can be monitored from within the trading platform, so you may want to take a look, just to make sure that these options are as low as support makes them out to be.

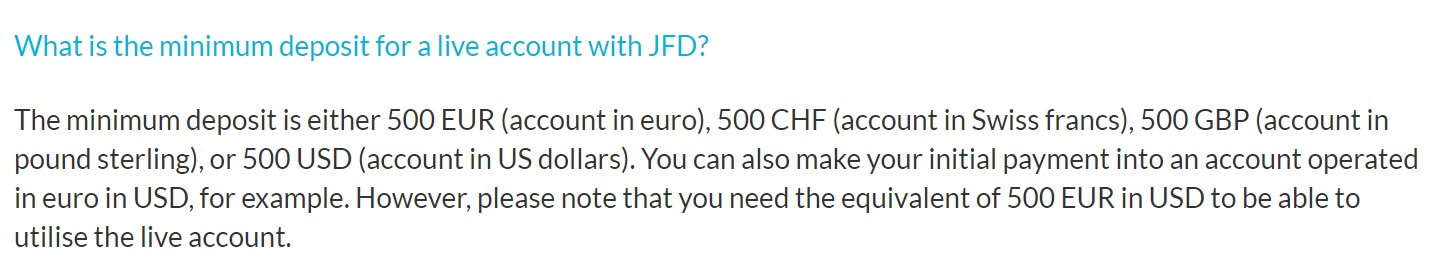

Minimum Deposit

There is an initial minimum deposit requirement of $500 USD. Once that requirement has been met, there are no further minimums one must meet when making future deposits. If you compare this amount with the competition, you’ll find that several other brokers do offer much lower deposit minimums, more in the range of $100. Some don’t even require minimums at all. On the other hand, the fact that there is only one account type means that the broker is likely offering some better conditions, most likely resulting in the larger deposit with them. Fortunately, this amount is realistic, even if one may have to save up for a moment to afford an account.

Deposit Methods & Costs

Deposit Methods & Costs

Deposits can be made through the following methods: Bank Wire Transfer, SafeCharge (Visa, Maestro, & MasterCard), Skrill, Neteller, and SOFORT (if available in your country). Note that deposits must be made through bank accounts that match the name on the client’s account. Transaction fees and percentage fees are applicable on all deposits and vary based on the currency used. Transaction fees are different for every payment method, currency, and whether it is through JFD Group or the Overseas group. You can view exact transaction costs online, but note that most of them are around .25 cents USD. Below, we have listed all fees associated with depositing.

SafeCharge (Visa, Maestro, & MasterCard)

EUR & GBP: 1.9% Percentage Fee + Transaction Fee

USD & CHF: 2.95% Percentage Fee + Transaction Fee

Skrill & Neteller

2.90% Percentage Fee + Transaction Fee

SOFORT

1.8% Percentage Fee + Transaction Fee

Withdrawal Methods & Costs

All deposit methods are available for withdrawal. The company processes withdrawals back to the original form of deposit, so you may want to consider withdrawal fees when choosing a deposit method. When it comes to SafeCharge withdrawals, note that Standard Credit would be any amount previously deposited, while Credit Extra would refer to any extra profits. We have listed the associated costs below.

- Bank Wire: No fees charged on behalf of JCB. (Fees may be charged on bank’s side)

- SafeCharge (Visa, Maestro, MasterCard): 0.88 units on Standard Credit/7.38 units on Credit Extra

- Skrill: 1% of withdrawal amount, maximum of 10EUR/11USD/8GBP/11CHF

- Neteller: 2% of withdrawal amount, a maximum of 30 USD

Withdrawal Processing & Wait Time

Skrill and Neteller would be the fastest withdrawal methods, due to the fact that both are processed within 24 hours of the time the request was made. SafeCharge can take 2-3 processing days for Standard Credit and 3-10 days for Credit Extra, meaning that it will take longer for the company to process any profit back to the client. SOFORT is returned within 1-3 business days. Bank Wire varies based on the bank’s location. German Banks typically take 2-3 working days to credit funds, European banks can take 3-5 working days, and banks outside of Europe can take 4-7 working days to credit funds.

Bonuses & Promotions

At this time, there do not seem to be any promotional opportunities. It’s always nice to see these offered since it can be a great way to earn a little extra on an initial investment or through some other type of opportunity. This shouldn’t stop one from choosing this broker since this isn’t something that is always offered. Check back in the future to see if anything has changed.

Educational & Trading Tools

Educational & Trading Tools

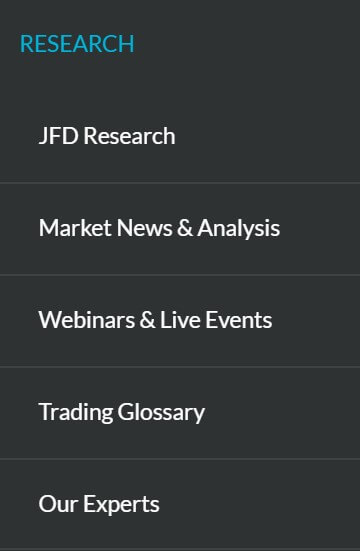

This broker focuses more on providing educational tools, rather than offering trading tools, like calculators, an economic calendar, etc. (Although an Economic Calendar is available within the Guidance platform). The company does have a section devoted to Market Analysis, however, where you’ll find some helpful articles that point out trends in the market and relevant news. The most important educational opportunity we found was under the Webinars section, where the company live streams different subjects periodically. Some of the titles of past streams included ‘Pair Trading’ and ‘DAX: Long or Short?’. The company seems to live stream every day and the schedule can be viewed under ‘Research’ > ‘Webinars and Live Events’. Finally, traders will find a Forex Glossary located under this section.

Demo Account

JFD provides the ability to open free demo accounts that mimic the conditions offered on their real accounts. This is a great way to test out the broker before making the decision to sign-up, and demo accounts can be an excellent learning tool for beginner traders. The demo accounts are supported on MT4 and MT5, but you won’t be able to practice on the Guidance platform. In order to open the demo, you’ll need to select a platform and enter details like your name, telephone number, email, and country. You’ll also choose what currency you’d like to use for your practice account and select a deposit that ranges from $500 (The company’s minimum deposit limit), up to a maximum of $5,000,000. You may want to choose more of a realistic deposit minimum to ensure that you’re making realistic trades.

Customer Service

Support is available 24 hours a day, 5 days a week over LiveChat. To be more specific, exact support hours for LiveChat are from 23:00 CET Sunday through 23:00 CET Friday, while all other departments are available from 8:00-17:00 CET Monday thru Friday, aside from banking holidays. In addition to the instant contact option LiveChat, support can be reached through phone or email. This broker is also active on Twitter, Facebook, YouTube, and LinkedIn. The contact information has been listed below.

- Phone: +49 (0) 69175374271

- Email: [email protected]

Countries Accepted

JFD Group LTD is only authorized to serve clients located in the EEA or in other countries where it is legal to do so, including Belarus, China, Switzerland, Turkey, UAE, and Ukraine. JFD Overseas Ltd serves clients that are located in another third country. Restrictions apply to offering services to clients of the United States of America, Russia, and to any clients located in countries where it would be illegal. Note that you can select the US on the account sign-up page and open account from that location, so there may be no issues trading from there.

Conclusion

JFD Bank offers trading on 8 different asset classes, including crypto options, and provides three different trading platforms to choose from. The company offers one account type with a $500 minimum deposit. Spreads seem to be competitive, based on what we learned from support, but the company does charge fees for deposits and withdrawals. Leverage options are lower than average unless you qualify as a ‘professional’ client. Support seems to be easy to reach, although they are not available on the weekend. Overall, the trader needs to decide whether the larger deposit minimum, low leverage options, and funding fees are made up for by the huge variety of trading instruments and the low trading costs.