FX Choice is a Forex broker that is based in Belize and is regulated by the IFSC. The firm has actually been in the FX business since 2010 and for that very reason is viewed as being a veteran brokerage. In the FX Choice review below, you’ll not only learn exactly what this broker offers, but also learn how they differ from other brokers. The goal? To provide you with more than enough information to decide whether or not FXC is worthy of an even closer look.

Account Types

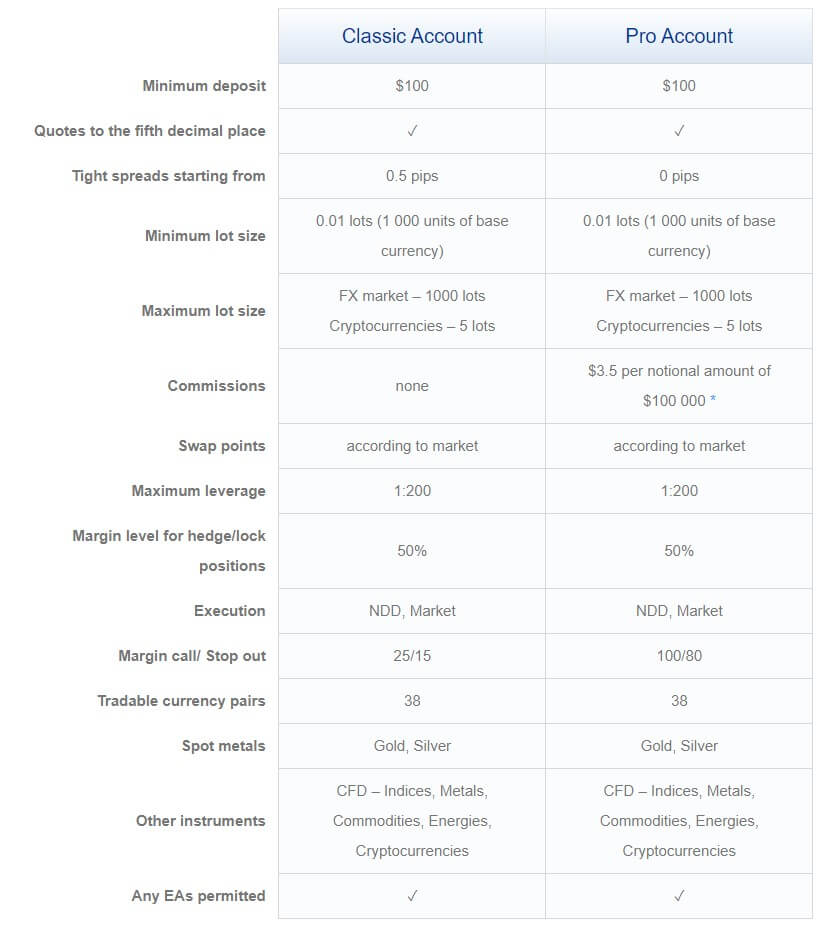

There are two account types offered, with these being Classic and Pro. With both types, the minimum required deposit amount is $100. Both also have the same leverage ratios, same lot size requirements, and most of the same assets. There are, however, some important differences that you’ll want to take note of. One being that the Pro account provides access to ten additional FX pairs. There are no commission charges on the Classic account, but the spreads are higher. On the Pro account, there are commission charges, but the spreads are tighter.

Classic Account:

- Minimum Deposit: $100

- Spreads: starting from 0.5 pips

- Commission: None

Pro Account:

- Minimum Deposit: $100

- Spreads: starting at 0 pips

- Commission: $3.5 per $100,000

Platforms

FX Choice offers both the MetaTrader 4 and MetaTrader 5 platforms. MT4 has been the preferred platform of most Forex traders for quite some time now. Even so, some traders are now making the move to MT5 and will be happy to see it as a platform option. Do note, however, that the MT5 platform is only made available to those who open a Pro level account. So, if you opt for the Classic account level, you’ll only be able to use MT4.

Both platforms are available as a download for Windows and can be accessed within any major browser using WebTrader. Both are also available in app formats and are available for download within the Apple Store or Google Play.

Leverage

The maximum leverage setting on both account types is 1:200, a ratio which some who trade Forex will consider less than optimal. If you’re looking for higher ratios of 1:500 or even higher, you’ll need to look to one of the offshore firms to provide it. The lowest allowed leverage setting is 1:25, which may also be viewed as a problem by those who wish to trade with no leverage whatsoever. On the Classic account, margin call is set to 25% and stop out at 15%. On the Pro account, margin call will take place at 100%, while stop out is set to 80%.

Trade Sizes

The smallest trade size is 0.01 micro lot and this goes for both account types. The maximum on both is 1,000 lots on all assets other than cryptocurrencies. On digital assets, the maximum trade size is capped at 5 lots. The ability to trade in micro-lots is a nice one to have. However, some may feel restricted by the maximum position size on cryptocurrencies.

Trading Costs

As mentioned previously, one will need to pay commission with a Pro account, but not on the Classic account. Essentially, you’ll be paying the broker by way of higher spreads on the Classic account. Swap, or rollover, fees are charged on both account types. Since these costs vary by the asset, you may want to create a demo account or contact the FX Choice support team for more information. The broker does keep a detailed rollover policy posted on its website.

Assets

FX choice offers six different asset groups, including:

- Currency Pairs

- Indices

- Metals

- Commodities

- Energies

- Cryptocurrencies

In total, here are 28 currency pairs available to Classic account holders, while Pro account holders have access to 38. Aside from this one difference, it appears that all other assets are available on both account levels.

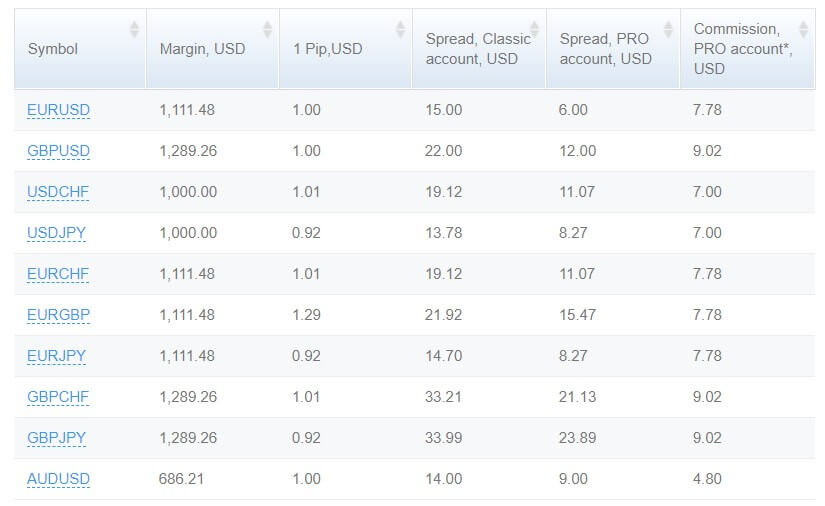

Spreads

On the Classic account, spreads start as low as 0.5 pips. This is actually quite impressive, considering the fact that there is no commission charged on this account type. With the Pro level, spreads start as low as 0.0 pips. Spreads, of course, vary by the asset, so you may want to spend some time comparing the spreads on your preferred assets on both accounts.

Minimum Deposit

There is a $100 minimum deposit requirement across the board. This is relatively standard within the industry and certainly no cause for concern. With that being said, there are FX brokers that do ask for less. Commonly, brokers will ask for larger amounts on higher-level account tiers, but here, the minimum is the same for both.

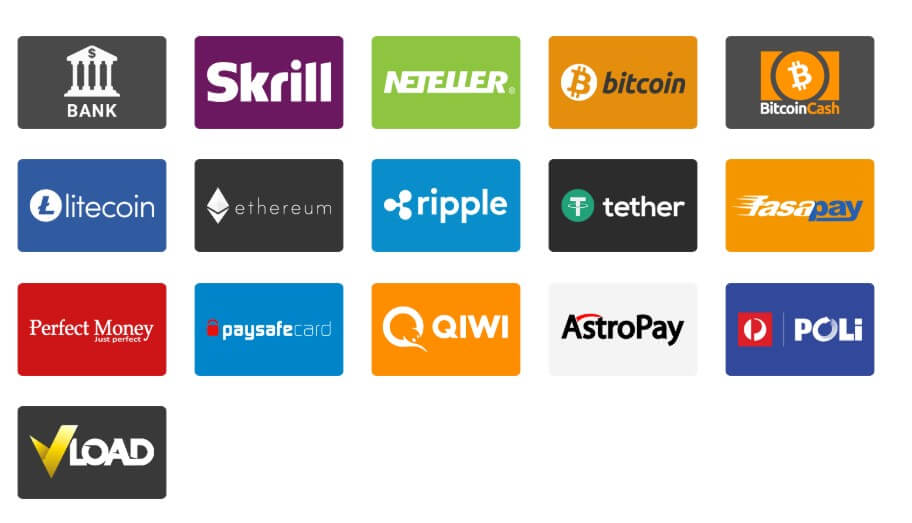

Deposit Methods & Costs

FX Choice has done an excellent job of setting itself up to accept a broad range of incoming payments. The following list includes all of the payment methods that can be selected for deposits and withdrawals.

- Wire Transfer

- Bitcoin/Bitcoin Cash

- Skrill

- Neteller

- Litecoin

- Ethereum

- Ripple

- Tether

- FasaPay

- Perfect Money

- PaySafeCard

- Trustly

- Qiwi

- AstroPay

- POLi

- UPayCard

- ePayments

- Vload

Did you notice what is missing from this list? That’s right, credit and debit cards. Even so, cards can be used to purchase e-funds which can then be used to make a deposit. FX Choice does charge deposit fees on most of these payment methods. The fees vary by method, ranging from 0.5% to as high as 10%.

Withdrawal Methods & Costs

PaySafeCard, Trustly, QIWI, AstroPay, and POLi cannot be used for withdrawals, but all other payment methods can. With most methods there is a nominal withdrawal fee. However, Neteller and ePayments withdrawals are free. FX Choice provides complete details on all deposit and withdrawal fees on their website.

Withdrawal Processing & Wait Time

Same-day withdrawals are a possibility during the business week (Monday through Friday). The actual wait time for a payment to arrive will be determined by the payment method. Bank wires, for example, tend to take the longest time to post. Whereas payment methods such as Bitcoin can arrive in an hour or less.

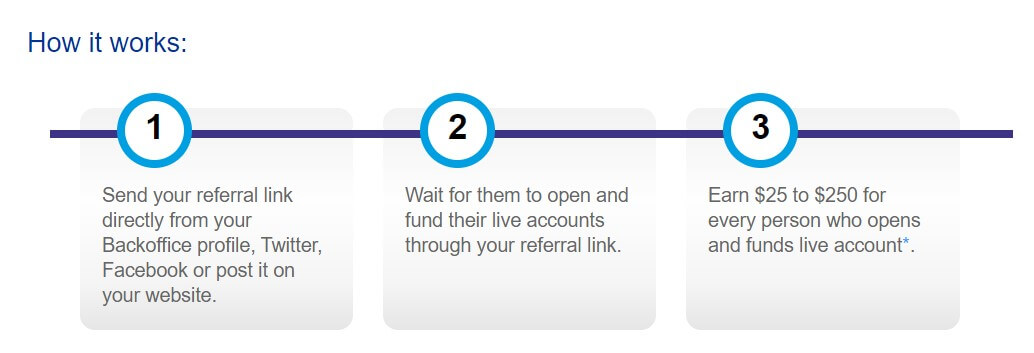

Bonuses & Promotions

There are no trading contests offered by FX Choice at the moment. They do, however, offer a referral program. To profit from the referral program, one will need to share their own personal referral link (found in your account back office) with friends, family, or acquaintances. When someone uses the referral link to create a new account and deposit with FXC, the referrer (you) would earn $25 for each $100 deposited. The earnings are capped at $250 per new trader referred. A one-time deposit bonus in the amount of 15% of the total deposit is also offered.

Educational & Trading Tools

There are no educational resources provided, aside from a Knowledge Base. The only trading tools are those which are already built into the MetaTrader platforms. There are extra services available though, including Forex signals, Autotrading service, EAs, VPS, and more. The firm has also rolled out a program titled, “Pips+” which is targeted at Pro account holders who wish to reduce their commission charges. Visit the FX Choice website to learn more.

Customer Service

Customer Service

The FXC customer support team is available 24/5 and can be reached via live chat, phone, and email. It is possible to request a callback, which should be completed within 24 hours or less. Multilingual support is offered, which is excellent. Whether your native language is English, Spanish, Italian, Farsi, Mandarin, or Thai, help is available. The primary contact number for client support is +52 558 526 80 32, whereas the contact number for general inquiries is + 501 227 27 32.

Demo Account

Not only does FX Choice offer demo accounts, but they also offer them in ‘real account’ format. This means that their demo accounts offer trading conditions and pricing which is the same as what is seen within real accounts. Their demo accounts allow you to choose a leverage setting ranging from 1:25 up to 1:200. A demo account can be created on the FXC website by providing just some basic personal information.

Countries Accepted

Residents of Afghanistan, Belize, Iraq, Italy, North Korea, Spain, Sudan, and the Syrian Arab Republic are not allowed to create an account with this broker. As of now, they are allowing residents of the United States and China to trade with them, which is interesting, since many brokers ban these two countries from their platform. Obviously, this could change, so check with the support team should you have any questions regarding acceptance for your country.

Conclusion

The positives of FX Choice are pretty clear. They offer two solid platforms, accept plenty of payment methods, have good spreads, and do not ask for a crazy-high minimum deposit. There is the option to trade commission-free and withdrawal requests are reviewed and paid out quickly. As for the negatives, there are fees on most payment methods, there is no weekend support, and some may find the 1:200 leverage maximum too low. Overall, the final determination of this FX Choice review is that this Forex broker is reliable and worthy of at least some consideration by those in search of a brokerage.