Uniglobe Markets is a foreign exchange broker based in the Marshal Islands and says that they offer safe regulatory environments, lowest spreads, fast execution with no re-quotes, no trading restrictions, swap-free accounts, low minimum deposits, free personalized training, confidentiality, and unrivaled customer service. In this review, we will be looking into the services being offered to see if they live up to the expectations they have put on themselves.

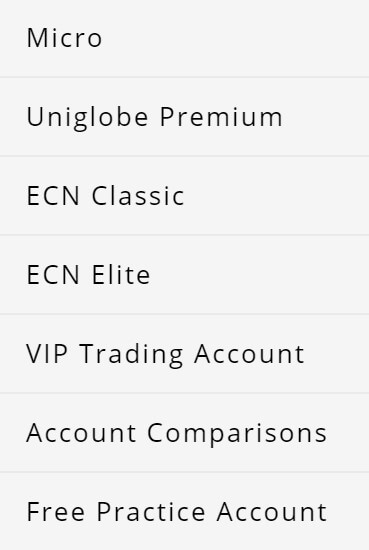

Account Types

There are 5 different accounts available from Uniglobe Markets, each one having a different entry requirement and trading conditions, so let’s see what is on offer.

Micro Account: The minimum requirement to open this account is $100, it has a spread starting from 1.5 pips and there is no added commission. The leverage can be up to 1:500 and trade sizes are starting from 0.01 lots. Hedging, Scalping and Expert Advisors are all allowed and there is an account manager available 24/5. Forex training is also available with this account.

Micro Account: The minimum requirement to open this account is $100, it has a spread starting from 1.5 pips and there is no added commission. The leverage can be up to 1:500 and trade sizes are starting from 0.01 lots. Hedging, Scalping and Expert Advisors are all allowed and there is an account manager available 24/5. Forex training is also available with this account.

Uniglobe Premium Account: The Uniglobe Premium account increases the minimum deposit up to $1,000, this account comes with a slightly lower spread starting at 1.3 pips and also a slightly reduced leverage as the nex maximum is now 1:300. Trade sizes now start at 0.1 lots and just like the Micro account, Hedging, Scalping, and Expert Advisors are allowed and so is the forex training and 24/5 account manager.

ECN Classic Account: The ECN Classic account sticks with the $1,000 required deposit, spread on this account are as low as 0 pips due to there now being a $10 per lot commission added to the account. Leverage is further reduced and now has a maximum level of 1:200. Trades start from 0.1 lots and just like the other accounts, Hedging, Scalping, and Expert Advisors are allowed along with the 24/5 account manager. Along with the forex training, there are now technical training available as well as free trading signals.

ECN Elite: This account further increases the minimum deposit requirement which now sits at $10,000. Spreads are as low as 0 pips and there is a $7 commission per round lot traded on the account. Leverage is further reduced and now has a maximum value of 1:100. Minimum trade sizes have increased up to 1 lot and all other features remain the same as the ECN Classic account including, the training availability, Hedging, Scalping, Expert Advisors and the account manager being available 24/5.

Uniglobe VIP: This is the top-level account, it requires a minimum deposit of $50,000 which could price out a lot of retail traders. It has spreads as low as 0 pips and a low commission of $2 per round lot traded. Leverage remains at 1:100 as a maximum and trade sizes start from 1 lot. Hedging, Scalping, and Expert Advisors are allowed and now the account manager is available 24/7 instead of 24/5. All training is available along with the free signals, and this account can be used as a corporate account.

Platforms

Uniglobe Markets offer MetaTrader 4 as their only trading platform, so let’s take a look and see what it offers.

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. Millions of people use MT4 for its interactive charts, multiple timeframes, one-click trading, trade copying and more. In terms of accessibility, MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Leverage

The maximum leverage that you can get depends on the account type that you are using, if you are using the Micro account your maximum leverage is 1:500, for the Uniglobe Premium account it is 1:300, the ECN classic has a maximum of 1:200 and the ECN Elite and Uniglobe VIP accounts both have a maximum leverage of 1:100.

You can select the leverage when opening up an account and if you wish to change your leverage once it is already open, we would recommend getting in contact with the customer service team to do so.

Trade Sizes

Different accounts have different minimum trade sizes. The Micro account has a minimum trade size of 0.01 (known as micro-lots) lots and goes up in increments of 0.01 lots so the next trade will be 0.02 lots and then 0.03 lots. The Uniglobe Premium and ECN Classic accounts have starting sizes of 0.1 lots (known as mini lots) and go up in increments of 0.1 lots so the next trade would be 0.2 lots and then 0.3 lots. The ECN Elite and Uniglobe VIP have starting trade sizes of 1 lot, it is known what the increment is on these accounts.

There is no mention of what the max trade size of each account is, however, no matter what it is we would not recommend trading trades larger than 50 lots as the bigger the trade becomes the harder it is for the markets and liquidity providers to execute the trades quickly and without any slippage.

Trading Costs

The Micro and Uniglobe accounts use a spread based system that we will look at later in this review and so do not have any added commissions.

The other three accounts have a commission added to them, we have listed them below so you can see which accounts have what commissions.

- ECN Classic: $10 per round turn lot

- ECN Elite: $7 per round turn lot

- Uniglobe VIP: $2 per round turn lot

Swap charges are also present, these are a charge for holding a trade overnight, they can be either positive or negative and can be viewed directly within the MetaTrader 4 trading platform.

Assets

Uniglobe Markets have broken down their assets into five different categories, we have outlined them below with a few examples from each.

Forex: There isn’t a full breakdown of which forex pairs are available, the site simply states that there are major and minor pairs, a couple of examples are EUR/USD, GBP/USD and AUD/USD.

Spot Metals: Just the two metals are available and these are the regular metals of Gold and Silver, tradable against the US Dollar.

Commodities: Commodities are available in the form of energies and also soft commodities, a few examples are Brent Oil, Crude Oil, Coffee, Corn, and Sugar.

Indices: Indices are also available if you are interested in trading them, some examples are FTSE 100, Nikkei 225, Dow Jones and S&P 500.

Shares: The final category offers shares, there is not a full breakdown but they indicate a few of the available shares as Amazon, Google, McDonald’s, eBay, Alibaba, and Facebook.

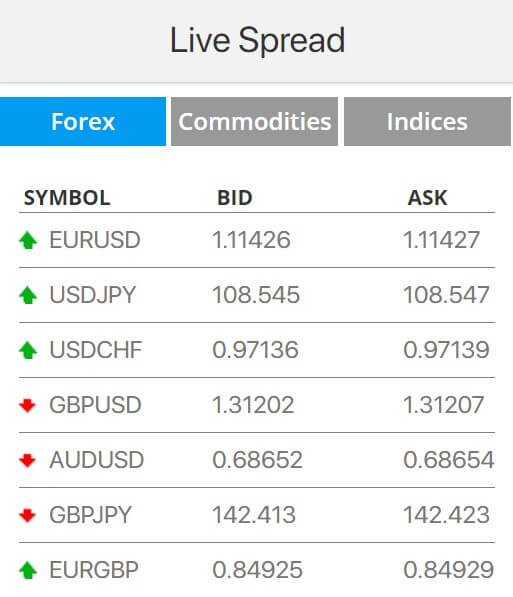

Spreads

As there is no specific breakdown of assets, there is also not one of the spreads. The account comparison page indicates that the Micro account has spreads starting from 1.5 pips, the Uniglobe Premium account has starting spreads of 1.3 pips and all other accounts can be as low as 0 pips. The spreads are variable (floating) which means they move with the markets when there is a lot of volatility the spreads often widen and will be seen higher than the stated amount.

It should also be noted that the spreads are different for different instruments, so while the starting spread for EUR/USD may be 1.5 pips, for another pair like AUD/NZD it will start slightly higher.

Minimum Deposit

The minimum deposit required to open up an account is $100 which will get you the Micro account, if you want a different account you will need to deposit at least $1,000. Once an account has been opened the minimum deposit for top-ups is reduced down to $50.

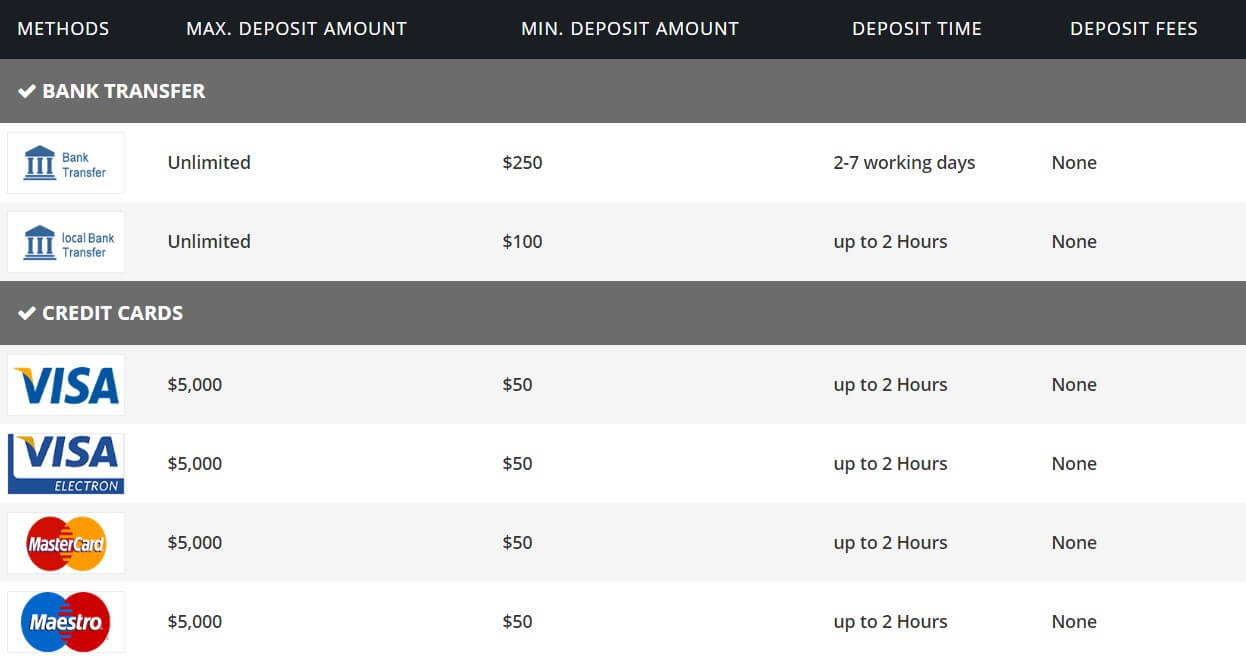

Deposit Methods & Costs

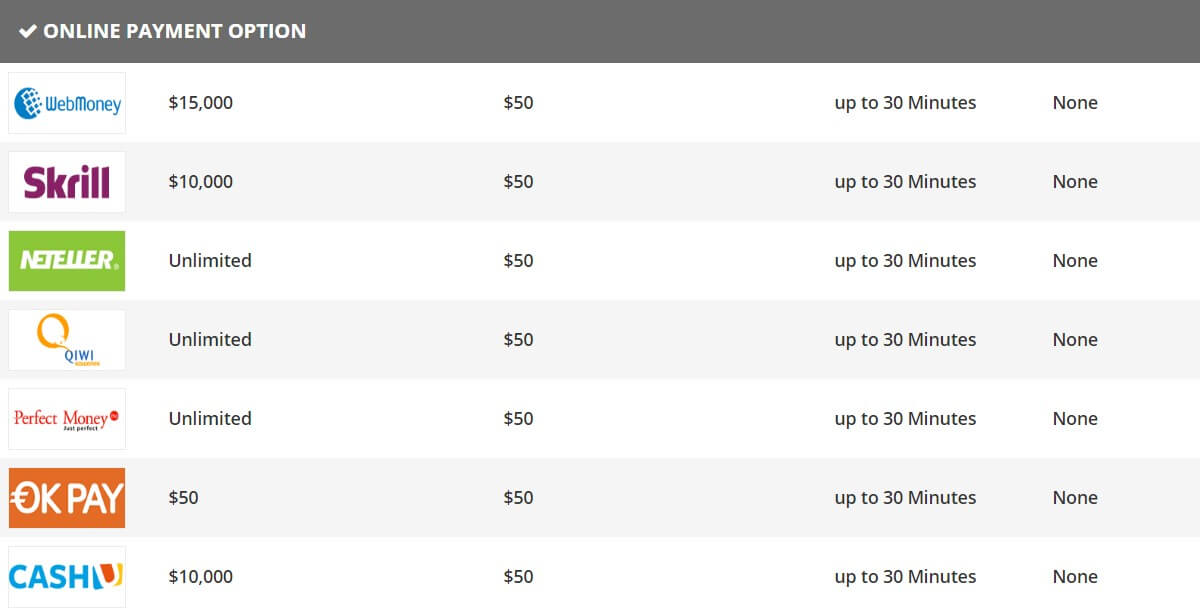

We have listed out the deposit methods below along with the minimum / maximum deposit amount.

- Bank Transfer – $250 / Unlimited

- Visa Debit / Credit – $50 / $5,000

- Visa Electron – $50 / $5,000

- MasterCard Debit / Credit – $50 / $5,000

- Maestro – $50 / $5,000

- WebMoney – $50 – $15,000

- Skrill – $50 – $10,000

- Neteller – $50 / Unlimited

- QIWI Wallet – $50 / Unlimited

- Perfect Money – $50 / Unlimited

- OK Pay – $50 / $50

- CashU – $50 – $10,000

The good news is that there are no added fees for any deposit method, however, be sure to check with the processor that you are using to see if they charge any fees of their own.

Withdrawal Methods & Costs

The same methods are available to withdraw with, Bank Wire Transfer has a minimum withdrawal of $150, while all other methods have a minimum withdrawal amount of $10. There are also no withdrawal fees added by Uniglobe Markets, however, just like when depositing be sure to check with the processor that you are using to see if they charge any fees of their own.

Withdrawal Processing & Wait Time

All deposits and withdrawals are processed the same business day between 7:00 am and 5:00 pm GMT. The following are the estimated time it will take to receive your money after processing.

2 – 10 Business Days:

Visa Credit / Debit, Visa Electron, MasterCard Debit / Credit, Maestro, Bank Wire Transfer.

2 – 24 Hour:

WebMoney, Skrill, Neteller, QIWI Wallet, Perfect Money, OK Pay, CashU.

Bonuses & Promotions

There are a number of different bonuses and promotions running, we will outline some basic info on them below:

Welcome Bonus: Get up to $6,000 with this 60% bonus. The bonus funds are not withdrawable and act as an extra margin, any profits made using the bonus can be withdrawn.

Cash Rebate: Receive up to $10 per lot as a cash rebate. The more you trade the more you receive, in order to receive $10 per lot you will need to trade over 700 lots in a month, 1 lot up to 199 lots gets you $4 USD per lot traded.

No Deposit Bonus: You can receive $100 as a no deposit bonus, in order to withdraw you need to trade at least 15 lots and the minimum amount to withdraw is $50, the bonus lasts for one month.

There are a couple of other bonuses but these are Christmas related and so may not be relevant when reading this review.

Educational & Trading Tools

There are a few different things when it comes to learning and trading tools, there is the standard economic calendar which gives you an idea of upcoming news events and which markets they may affect. There is also some basic training, going over very basic areas of trading and to get an understanding of what trading and analysis is, however it never goes into lots of depth. Finally, there is some technical and fundamental analysis which you can view to help you decide what to trade next.

It is nice to have all of this information, however, it is not as in-depth as a lot of other places on the internet.

Customer Service

Should you wish to get in contact with Uniglobe Markets there are a few different ways that you can do it, There is the standard online submission form where you can fill in your query and you should then receive a reply via email. There is also a telephone number should you wish to speak to someone directly. There are also Skype usernames for both Global and Arabic and finally a physical address for the UK and Marshall Islands.

It would have been nice to have an email address available to email directly, but the online webform is as much as we get.

Demo Account

Demo accounts are available from Uniglobe Markets, some benefits of a demo account include no initial payment, real-time conditions, learn to analyze and test new strategies, zero risks, and they are 100% free. When signing up you are able to select leverage up to 1:500 and a deposit between 1,000 and 100,000. There is no indication as to which account conditions it mimics or how long the account lasts for.

Countries Accepted

The following statement is on the Uniglobe Markets website: “Uniglobe Markets does not provide services to citizens of certain regions. It is advisable to check if your region is included in the services provided before entering into any legal agreement” This is not the most helpful statement so we would suggest getting in contact with the customer service team to see if you are eligible for an account or not.

Conclusion

Uniglobe Markets are pretty transparent when it comes to the information they have provided, the trading conditions are competitive and the deposit and withdrawal methods are clearly laid out and with no added fees they are a big plus. The main downside to the Uniglobe Markets website is the lack of information on instruments and assets, this information would be good to have as many potential clients would like to see what they can trade before signing up, it would also be nice to have an email address available to contact. If you are able to look past those two issues then Uniglobe Markets could be a decent broker to use.