ATFX is an online FX and CFD broker that is located in St. Vincent & the Grenadines and regulated by the Financial Services Authority (FSA). This particular broker is managed by AT Global Markets Limited and is part of the AT group, with sister companies that have been regulated by the FCA and CySEC. The company was founded in 2014, giving them a few years to become more established. Considering the success of the overall brand, it seems that this broker will be up and running for many years to come. If you’re interested in a commission-free, spread only account type, then this broker may very well be a suitable option.

Account Types

Traders registering through ATFX will be limited to one main account type. We do enjoy seeing diversity, although there should be no issues with this limitation, should one find the conditions to be advantageous. Tradable instruments are made up for Forex majors, minors, and exotics, Precious Metals, Crude Oil, Indices, and Share CFDs. It costs $100 to open an account and leverage options are based on the type of asset that it being traded, with a maximum cap of 1:200. Trade sizes are also based on the type of asset that is being traded. Trading costs are built directly into the spreads, meaning traders will not have to worry about commissions at all with this broker. Conditions have been outlined below.

ATFX Account:

Minimum Deposit: $100 USD

Leverage: Up to 1:200

Spreads: 0.6 pips on EUR/USD

Commissions: None

The broker requires a form of ID (Identity card, Driver’s License, Passport) to be uploaded before the registration process can be completed.

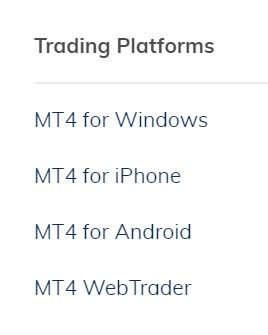

Platform

If you decide to open an account through this broker, you’ll be trading through the world’s most popular trading platform, MetaTrader 4. Even with further advancements in the time since the program was released, MT4 still remains the best-suited platform on the market, due to its wide array of features, including the ability to tailor indicators by customizing scripts, libraries, and even EAs, 31 chart analysis tools and 30 different indicators, support for a wide variety of trading instruments, market diversity, and more.

If you decide to open an account through this broker, you’ll be trading through the world’s most popular trading platform, MetaTrader 4. Even with further advancements in the time since the program was released, MT4 still remains the best-suited platform on the market, due to its wide array of features, including the ability to tailor indicators by customizing scripts, libraries, and even EAs, 31 chart analysis tools and 30 different indicators, support for a wide variety of trading instruments, market diversity, and more.

Another important factor that adds to the platform’s success would be how easily it can be accessed by downloading on PC, Mac, or Mobile devices. MT4 can be downloaded on any device that supports the App Store or Google Play, including iPhone, iPad, Android, etc. Those that don’t wish to download the platform can also access MT4 via WebTrader, which provides the same experience in a browser-based version.

Leverage

Leverage options are dependent on the asset class that is being traded and caps are as follows: 1:20 on Shares CFDs, 1:50 on USDX and FX exotics, 1:100 on Oil and Indices (not including USDX), 1:200 on FX majors and minors, Gold, and Silver. Overall, the maximum cap here is slightly lower than what one may typically see with the competition. It is worth noting that beginners, or even more advanced traders, likely won’t even notice the cap, since many prefer to trade with a leverage of 1:100 or lower. If you’re just getting into trading, you’ll definitely want to stick with lower leverage than the 1:200 option. If you prefer the high-risk experience that comes with trading higher leverages, this broker may not be a good fit.

Trade Sizes

The minimum trade size is 0.01 lot, or one micro lot, on all asset types. There is a maximum trade size of 20 lots on FX majors, minors, and exotics, Metals, Oil, and Indices. The maximum trade size for Share CFDs is 500 lots. The broker does not detail any margin call or stop out levels on the website.

Trading Costs

This broker profits through spreads, swaps, and withdrawal fees in special cases. The trading cost has been built-into the spread on the broker’s sole account type, making it simpler to calculate how much it really costs to place a trade. Of course, some would prefer to pay commissions in exchange for lower spreads; however, we can say that the spreads with this broker are fairly competitive, especially considering that commissions are not applicable.

Swaps are applied to positions that are held overnight, with triple charges on Wednesdays. Traders can only view applicable swap fees from within the trading platform. If a withdrawal is made with no trading activity in the client’s account since the previous deposit, the broker will charge a fee of 5%, applied on the amount of the previous deposit. This charge will be applied to the credited amount of the withdrawal.

Assets

Asset classes include FX, Precious Metals, Crude Oil, Indices, and Shares CFDs. FX options are made up of 43 currency pairs, including majors, minors, and exotics. Precious metal options are limited to Gold and Silver. Crude Oil options include WTI Oil and Brent Oil. 15 types of Share Indices are offered from the US, Europe, and Asia. The broker also offers 50 major US and German shares from famous enterprises like Apple, Amazon, etc. Altogether, the broker is offering 110+ tradable instruments.

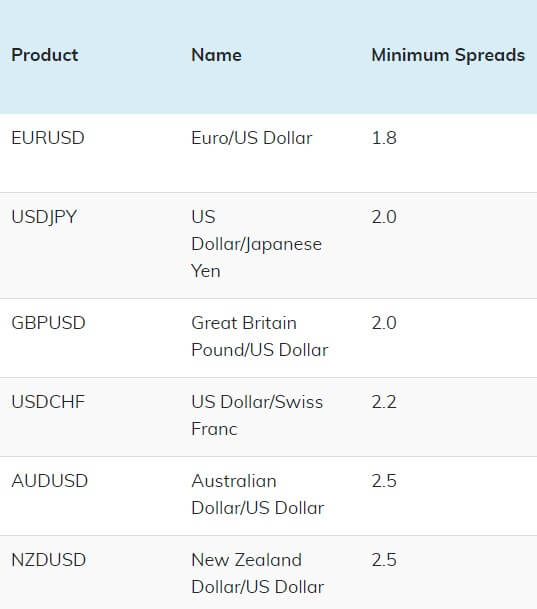

Spreads

Due to the No Dealing Desk (NDD) policy adopted by the broker, traders can expect to see transparent spreads with no intervention from the company. This works well and leaves us with spreads that are fairly competitive. For example, we see spreads as low as 0.6 pips on the pair EUR/USD. On Share CFDs, we see spreads that can be as low as 0.5 pips, according to the broker. On the downside, it can be difficult to find a lot of examples on the spread through the broker’s website, so we can’t provide further examples of the typical spreads on other instruments.

Minimum Deposit

The broker requires a standard $100 minimum deposit when opening an account. Even in situations where a deposit amount is not required, it’s always going to cost something to maintain some trading activity. Therefore, we feel that $100 is a sturdy deposit amount that still manages to fall slightly below the industry average. Traders should be able to maintain their balance long enough without having to make another deposit immediately.

Deposit Methods & Costs

ATFX allows traders to fund their accounts with cards, electronic payment methods, and bank transfers. All of the available deposit methods are as follows: Visa, MasterCard, Neteller, Skrill, Ngan Luong, Local Bank transfer, and Bank Wire Transfer. As long as the client has provided necessary documents and completed the verification process, the broker will be able to process and credit deposits instantly. In the case of Bank Transfers, it can take 3-7 business days for funds to be processed. There are 0 fees charged on all deposit methods, aside from Bank Wire Transfers. Bank fees will be applied on funded amounts less than $1,000, while the broker will cover any fees upon proof of receipt for deposit amounts of more than $1,000.

Withdrawal Methods & Costs

Due to the broker’s anti-money-laundering policy, funded amounts must be withdrawn via the same payment method used to deposit. Fees are only applied to Bank Wire withdrawals. The first withdrawal via this method per month will be fee-free and the company will charge administration fees on subsequent withdrawals. A $5 USD fee will be charged on withdrawals equal to or less than $100. If the amount of a single withdrawal is more than $200, the withdrawal will be free of charge. For the second Wire withdrawal request of the month, a $40 fee will be charged on the bank’s behalf.

Withdrawal Processing & Wait Time

It takes the company 1-2 days to process each withdrawal application. All electronic payment methods (Neteller, Skrill, Ngan Luong) are available instantly once processed. Wait times for Visa/MasterCard withdrawals are subject to bank processing times and exact time frames are not listed. It can take 2 business days to receive Local Bank Transfer after processing and it can take between 3-7 business days to receive Bank Wire Transfers once processed. The exact timeframe would depend on the individual bank.

Bonuses & Promotions

The broker is currently offering a $100 Welcome Credit and a Rebate Promotion. In order to claim the $100 bonus, traders would need to deposit at least $200 USD. The amount becomes fully withdrawable once the client has traded 6 Standard Lots. This promotion is only valid in the Philippines, Malaysia, Thailand, and Indonesia. As for the Rebate Promotion, cashback is paid back per Standard Lot traded.

The higher the net deposit, the higher the amount the trader will earn per lot. The maximum payout is also dependent on the net amount. For example, a net deposit from $1.00 to $1,000 will earn a $1 rebate per lot, with a maximum payout of $100. A net deposit of more than $10,000 would earn $5 per lot, with a maximum payout of $2,500.

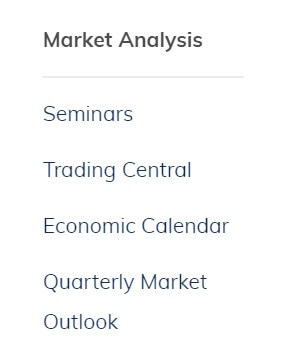

Educational & Trading Tools

Educational & Trading Tools

All offers in this category are located under the “Market Analysis” section of the website. As far as educational resources go, options are limited to seminars. This section of the website is laid-out conveniently and the broker lists the title and date of any upcoming seminars. Sadly, this just won’t be enough to help a beginner trader get on their feet. Tools are limited to an economic calendar, quarterly market outlook, and Trading Central.

Demo Account

This broker offers demo accounts for any trader that would like to use one. Since this service is provided free of charge for any potential or existing client, this would be an excellent opportunity if you need more practice, or if you’d like to test out this broker before opening a real account. Demo accounts can be funded with between $1,000 USD and $5,000,000 USD in virtual currency by selecting a predetermined amount from a drop-down list. The broker only requires a few personal details, including name, phone, email, and country when signing up for a demo, so you’ll be able to get straight to trading.

Customer Service

Support is available 24 hours a day, Monday through Friday and is provided in 13 languages, including English, Cantonese, Mandarin, Spanish, Italian, German, Arabic, Thai, Uyghur, etc. In order to get in touch with an agent, one can use LiveChat (available directly on the website), phone, or email. The broker is also active on Facebook, Instagram, Twitter, LinkedIn, and YouTube.

All inquiries will be directed to the same email address, while phone calls will need to be made to the office corresponding with one’s location. Response time is typically one day through email or social media. As usual, we did attempt to try out the LiveChat feature; however, we were greeted with a message stating that agents were not available at the time. Considering that this was within business hours, we were disappointed with the service and it made the instant contact option seem less convenient.

On a positive note, we did manage to get in touch with an agent immediately on our next attempt, so this somewhat made up for the previous experience. All listed contact information is included below.

Email: [email protected]

Phone:

China: +84 284 458 1666

Taiwan: (2) 231 2153

Malaysia: 400-1200-143

Philippines: 1800 813 690

Thailand: 0080 112 7901

Vietnam: 180012752

Countries Accepted

On their website, the broker claims that service is not provided to residents of Canada, the Democratic People’s Republic of Korea, Iran, and the United States of America. On the sign-up page, we did find Canada and Iran listed, so it seems that it would still be possible to open an account from one of those locations. The other two options are missing from the list entirely, so it seems that residents of the US and DPRK won’t be able to register.

Conclusion

ATFX is a regulated broker that offers leveraged trading on more than 110 tradable instruments. The broker is best for traders that prefer for all trading costs to be charged through the spreads, with no commissions. Since only one account type is available, this is the only pricing option. The spreads with this broker do seem to be below average, although the website could provide more details. Leverage caps are dependent on the asset category, although the maximum cap is not entirely impressive, at 1:200 on FX majors and minors, and Gold and Silver.

Aside from Bank Wire, all deposits and withdrawals are completely free. Multilingual support is available 24/5 via LiveChat, phone, email, or social media, although there were no agents online when we first attempted to test out LiveChat. Sadly, educational resources are not sufficient enough for beginners and there are only a couple of tools available on the website. There are a couple of ongoing promotions, including a $100 Welcome Credit that would be advantageous to anyone opening a new account.