Infinitas FX is an FX and CFD broker that offers leveraged trading of up to 1:400 on 70+ currency pairs, Precious Metals, Indices, Bonds, Commodities, and Securities. The company is primarily located in Vanuatu and is regulated by the Vanuatu Financial Services Commission (VFSC), with additional offices located in the United States, Canada, Africa, Italy, Russia, and Asia. On their website, Infinitas lists their category of tradable instruments, starting spreads from 0.5 pips, and use of the MetaTrader 4 trading platform as some of their key strengths. Of course, one can’t go on the broker’s word alone, so we decided to dive deeper into the website to find out the real truth. Stay with us to find out what we learned.

Account Types

This broker separates their account types into two options – the Standard account, for less experienced traders, and the Premium account, for more experienced traders that can afford the $100k deposit requirement. The highest leverage options are available on the Standard account, so long as one has equity of less than $50k in their account. Another one of the key differences between the accounts would be the spreads, which start from 1.7 pips on the Standard account and from 0.5 pips on the Premium account. The broker is vague about commission costs, although it does seem that the same charges apply on both accounts. As for trade sizes, tradable instruments, and supported platforms, the accounts share conditions as well. Details for each account type can be viewed below.

Standard Account

Minimum Deposit: $500

Leverage: Up to 1:400

Commissions: See “Trading Costs”

Spreads: From 1.7 pips on FX Majors

Premium Account

Minimum Deposit: $100,000

Leverage: Up to 1:100

Commissions: See “Trading Costs”

Spreads: From 0.5 pips on FX Majors

Note that the broker doesn’t mention whether Islamic accounts are available, although we do see demo and IB accounts on the list. The website is also vague about any documents that may be required to open an account.

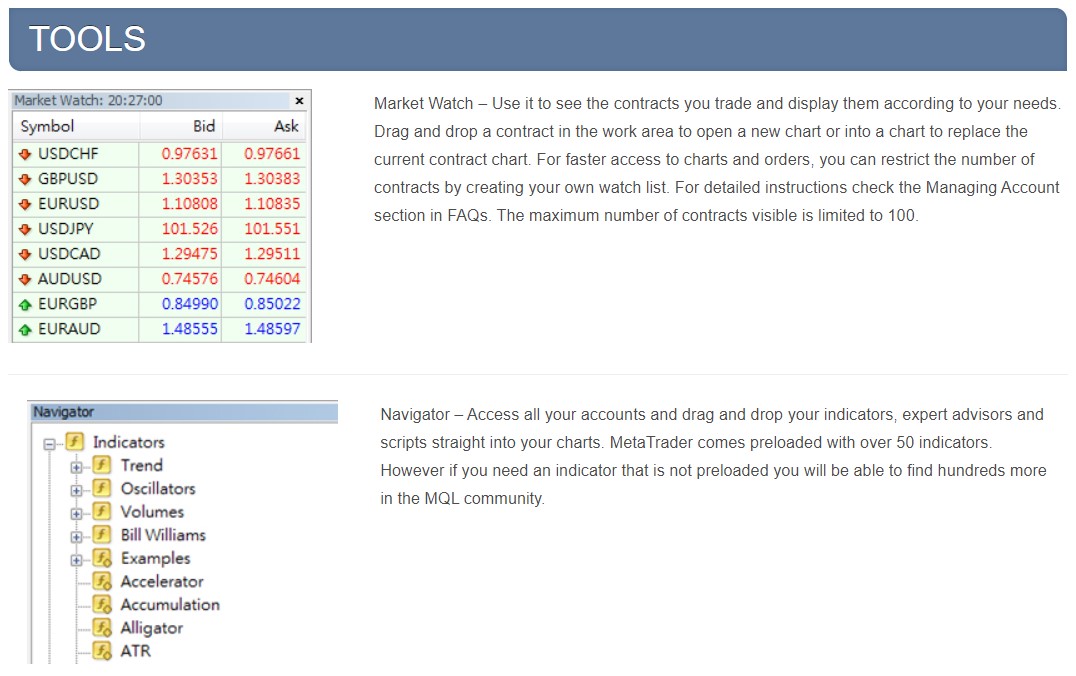

Platform

Most have already heard of this broker’s supported trading platform – MetaTrader 4. If not, one should know that developers created the platform as an easy to learn and customizable option that even novice traders will be able to master. When it comes to features, we see one-click trading, unlimited charts, real-time quotes, market orders and pending orders for long and short positions, economic news headlines, strategy backtesting, price alerts, trailing stops, and more. One shouldn’t have any problems accessing MT4, considering that the platform comes in multiple languages and can be downloaded on PC or Mac, through the App Store or Google Play, or accessed through the browser-based WebTrader.

Leverage

On FX options, the leverage cap is 1:400 on Standard accounts and 1:100 on Premium accounts, with the lower limit likely set to limit losses for clients that have made larger deposits. As for the other categories, leverage options depend on the instrument category and the amount of equity within the client’s account. Note that any limit above 1:100 would only be applicable to the Standard account type. When trading Indices & Financials, the broker allows leverage of 1:400 for clients with a balance of less than $50k, 1:200 for clients with a balance between $50,001 and $100k, or 1:100 for clients with a balance above $50k. On Commodities, the cap is set at 1:400 for account equity of less than or equal to $25k, 1:200 for balance between $25,001 and $50k, or 1:100 for any balance that is higher than $50k. When trading Securities, leverage of 1:1 is the only option.

Trade Sizes

At times, Infinitas’ website can be vague when it comes to important information and their customer support team can be slow with responses, which creates a delay in getting that necessary information. We do know that the broker allows for the trading of mini and micro-lots, although maximum trade sizes are not listed anywhere on the website. This is one reason we wish the broker would include an FAQ page that actually provides more details about the broker’s conditions. Due to the lack of information, we cannot provide margin call or stop-loss levels at this time.

Trading Costs

This broker profits through spreads, overnight charges, otherwise known as swaps, and some commission charges. Spreads tend to average 1.6 pips on FX options on the Standard account and start from 0.5 pips on the Premium account type. As for commissions, the broker can be vague when describing terms. The website does mention that commissions are not charged when trading forex, while another section of the website lists a charge of $1 per side when trading Indices.

It is unclear whether these charges are applicable on both accounts. CFD contracts on Indices and fixed incomes have expiry dates and no overnight fees. Swaps, or rollovers, are the interest rate calculations that determine the cost or reward of holding an open position overnight. Rollover takes place for all positions that are opened before 00:00 that are still open after 00:00 CET. When you roll over an open position from Wednesday to Thursday, the settlement date is Monday.

Assets

This broker’s instrument portfolio is made up of FX, Precious Metals, Indices, Bonds, Commodities, and Securities. FX options are made up of 10 majors, 17 minors, and 20 exotics. Precious Metals include Gold and Silver, and we don’t see Pallidum or Platinum options, or others offered. In total, seven options are available under the Indices and Bonds categories. Commodities include Crude Oil, Natural Gas, Corn, Soybeans, Wheat, Cocoa, Coffee, and Sugar. The Securities category includes 6 options. Overall, the broker does seem to be offering a variety of different asset classes, although their total number of tradable instruments is limited to 70 total options.

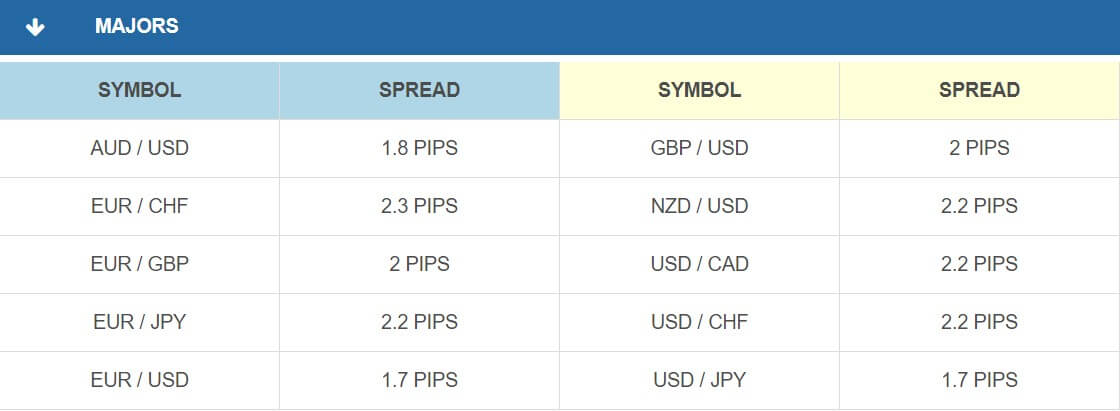

Spreads

On the Standard account, we see spreads that range from between 1.7 and 2.2 pips on FX majors. Spreads can be as high as 4 pips on minors and fluctuate to higher amounts on exotics and Gold. On the Premium account type, we such much lower spreads that range from 0.5 pips to 1.1 pips on majors. On minors, the spreads range from 1 pip to 2.9 pips. When trading major FX currency options, the spreads on this account type certainly fall below the industry average. Note that the aforementioned spreads are related to normal market conditions and the spreads may spike in times of volatility.

Minimum Deposit

This broker is asking for a minimum $500 deposit in order to open one of their Standard account types. Considering the fact that several brokers don’t even ask for a minimum, or ask of amounts of $100 or less for the same account type, one could argue that this broker is expensive. If the broker would add a Cent or Mini account to the list, then we would certainly see these costs go down for at least that one account type. For the Premium account type, a minimum deposit of $100,000 is required. This amount may force many of the broker’s potential clients to stick with the cheaper Standard account or to choose another broker altogether.

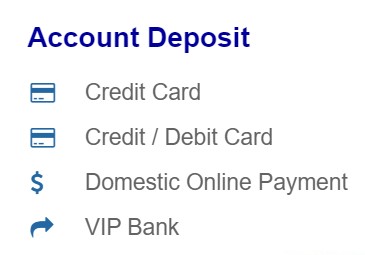

Deposit Methods & Costs

Accounts can be funded through Bank Wire Transfer, Visa, MasterCard, Maestro, Neteller, Skrill, Sofort, and UnionPay. Unfortunately, the broker doesn’t provide us with any further information about fees or processing times. Typically, banks do charge some sort of fee from their side for Wire Transfers, so it would be wise to check with your particular bank. One should also expect longer wait times to see Wire transfers credited to their account, while electronic payment methods are often credited instantly.

Withdrawal Methods & Costs

Sadly, the broker remains vague when it comes to the costs for withdrawals. It does seem that all of the available deposit methods can be used for withdrawals, although it is unclear if the broker has any special rules surrounding the methods one can use. For example, there may be a condition that requires withdrawals to be made back to the same source that was used to fund the account. Some brokers also require profits to be withdrawn through a certain method, like Wire Transfer. Of course, it is possible that there are no conditions on withdrawals; however, the lack of provided details for this section definitely makes us apprehensive about any potential conditions or fees.

Sadly, the broker remains vague when it comes to the costs for withdrawals. It does seem that all of the available deposit methods can be used for withdrawals, although it is unclear if the broker has any special rules surrounding the methods one can use. For example, there may be a condition that requires withdrawals to be made back to the same source that was used to fund the account. Some brokers also require profits to be withdrawn through a certain method, like Wire Transfer. Of course, it is possible that there are no conditions on withdrawals; however, the lack of provided details for this section definitely makes us apprehensive about any potential conditions or fees.

Withdrawal Processing & Wait Time

This is another category where the broker fails to provide any information. Once again, we can make guesses about how long it may take for withdrawals to be processed or received, although we cannot be completely sure. Processing times will likely take between 1-2 business days, or 3 business days if the broker is slower than the majority of their competitors. Wire Transfers will likely take longer to be received, considering that one would need to wait for their funds to be processed on the bank’s side. Neteller and Skrill typically tend to be available quickly with other brokers, while we see varying time-frames for withdrawals back to cards.

Bonuses & Promotions

This broker does not seem to be offering any bonus opportunities at this time. While this is disappointing, we aren’t surprised to see a lack of offers with any broker, since this is something that we would consider to be an extra perk that isn’t necessary. Still, one may be able to earn a small deposit bonus or take part in a contest through another broker, so this does take away from the company’s attractiveness. Remember that it is never a good idea to choose a broker based on this section alone.

Educational & Trading Tools

While we do see the website lacking in some departments, we were happy to find that the broker has made the time to include educational material for their clients. This information covers Trading Basics, Types of Orders, Understanding Forex, Techniques, Fundamental and Technical Analysis, and a Forex Glossary. The broker also offers a FAQ that answers simple questions about trading. We do wish that the broker would incorporate video tutorials or e-books into the mix and that the range of information would be widened, although it is still nice to see some beginner level introductory information. Sadly, the website is missing trading tools, such as calculators, an economic calendar, market news, etc.

Demo Account

Risk-free demo accounts are offered as a way for traders to evaluate their trading methodology, practice holding trades for different amounts of time, establish exit plans, become more familiarized with the supported trading platform, and more. These accounts can provide amazing learning opportunities and are made available to everyone, even those that aren’t clients of the company. The website doesn’t detail whether demo accounts will expire and it is unclear whether there is a certain amount of virtual funds that will be applied, or if clients will be able to choose any amount for their account balance.

Customer Service

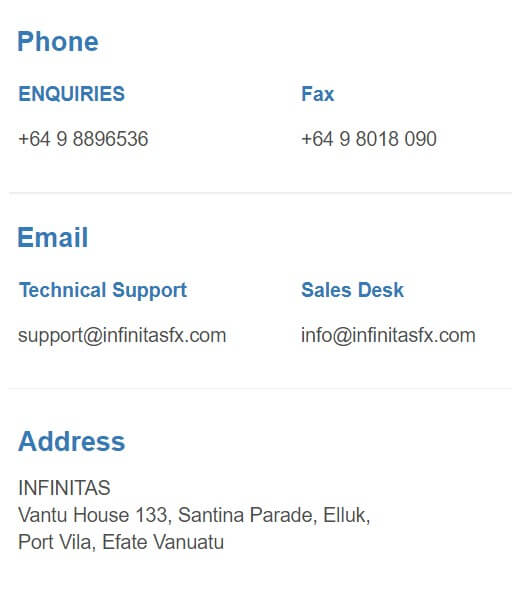

Support is available from 09:00 – 21:00, Monday through Friday. Traders can reach out through LiveChat, phone, email, fax, by filling out a form on the “Contact” page, or by filling out a callback form. Based on our experience, one shouldn’t always expect an agent to be online on LiveChat at all times, even during business hours. After multiple attempts to contact support at different times of the day, we were met with the same message informing us that an agent was not online.

Finally, we gave up on this contact method altogether and settled for email instead. More than 24 hours later, we were still waiting for a response, so we can’t give this broker much credit for their response times. If you’re in a hurry and an agent isn’t available on LiveChat, a direct phone call would probably the fastest option. All listed contact information has been detailed below.

Phone: +64 9 8896536

Fax: +64 9 8018 090

Email

Technical Support: [email protected]

Sales Desk: [email protected]

Countries Accepted

We couldn’t find a specific list of restricted countries on the broker’s website. This, coupled with the fact that the broker has locations in the US and several other countries, made us hopeful that clients from all countries would be welcome. To be sure, we did attempt to check out the registration page to check for any missing options. Unfortunately, the website seemed to be experiencing difficulties and we were unable to load the available registration options. Our final opinion would be that all countries do seem to be accepted, although you’ll want to reach out to support if your country does seem to be missing.

Conclusion

Infinitas FX is an international broker with an investment portfolio that includes 70 total instruments, made up of FX, Precious Metals, Indices, Bonds, Securities, and Commodities. One can trade with a maximum leverage cap of up to 1:400 through this broker and the popular MetaTrader 4 platform is supported. It costs at least $500 to open an account, both of which offer commission-free trading on forex instruments. The broker’s website can be vague in some important categories – including processing times, deposit and withdrawal fees, maximum trade sizes, and stop-loss levels.

Infinitas has provided several different ways to reach out to an agent, although support hours are limited and we couldn’t get in touch with an agent on LiveChat, despite multiple tries. Sadly, the broker is lacking any bonus opportunities and demo accounts. Educational resources are available, with the information being limited to articles that are targeted towards novice traders exclusively. Overall, the broker does seem to be offering some attractive trading conditions, although one would need to get past their vague website and the fact that extra options are missing.