Orbex webpage itself is easy to navigate, with a handy FAQ page with a search feature, enabling clients or prospective clients, to efficiently pinpoint information. Orbex is regulated under CySec, FCA, and other regulatory agencies as shown in the photo below.

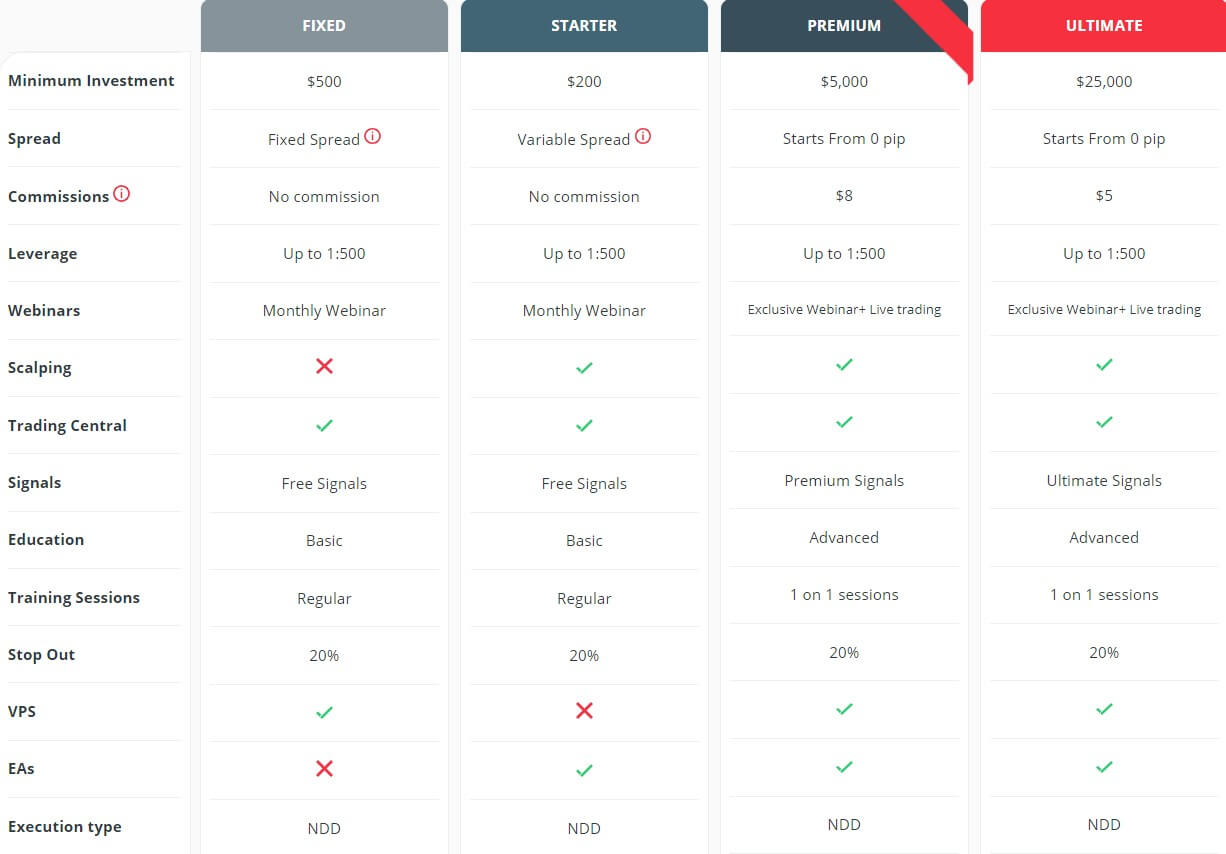

Account Types

Orbex offers 3 types of trading accounts to choose from Universal Mini, Universal/ECN Standard, and Universal/ECN Advanced. Islamic accounts are also available. However, when you click on another link within the ‘account types’ link, you are then advised that there are in fact 4 account types: Fixed, Started, Premium and Ultimate. This is incredibly confusing. Perhaps there was a change in account types, but it is not clear which ones are actually currently available, especially when the FAQ page mentions all 7, and the live chat is not often responsive.

Platforms

Orbex offers MetaTrader 4 which is always a positive attribute, and most clients are satisfied with this. Desktop and mobile versions are all available.

Leverage

Due to regulation and ESMA policies, the leverage caps are as follows, excluding ‘professional trader clients’ who can make use of up to 1:500 leverage:

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs, gold and major indices

- 10:1 for commodities other than gold and non-major equity indices

- 5:1 for individual equities and other reference values; (e.g.: Shares CFDs)

Trade Sizes

With Orbex, the minimum trade size allowed is 0.01 lots and the maximum being 50 lots.

Trading Costs

Commission fees are only applied to two accounts; Premium ($8) and Ultimate ($5), both amounts round turn. For swaps, you can calculate them with a tool found on their website.

Assets

Orbex offers Forex, Energies, Precious Metals, and Cash Indices. A full list of all assets available is found on the website, which is handy as this saves opening a demo first.

Spreads

The spreads vary between floating and fixed, and depend upon the account that you choose.

- Fixed – fixed spreads

- Starter – variable spreads

- Premium – spreads start from 0 pip

- Ultimate – spreads start from 0 pip

Minimum Deposit

The minimum deposit requirements with Orbex are as follows:

- Fixed $500

- Starter $200

- Premium $5,000

- Ultimate $25,000

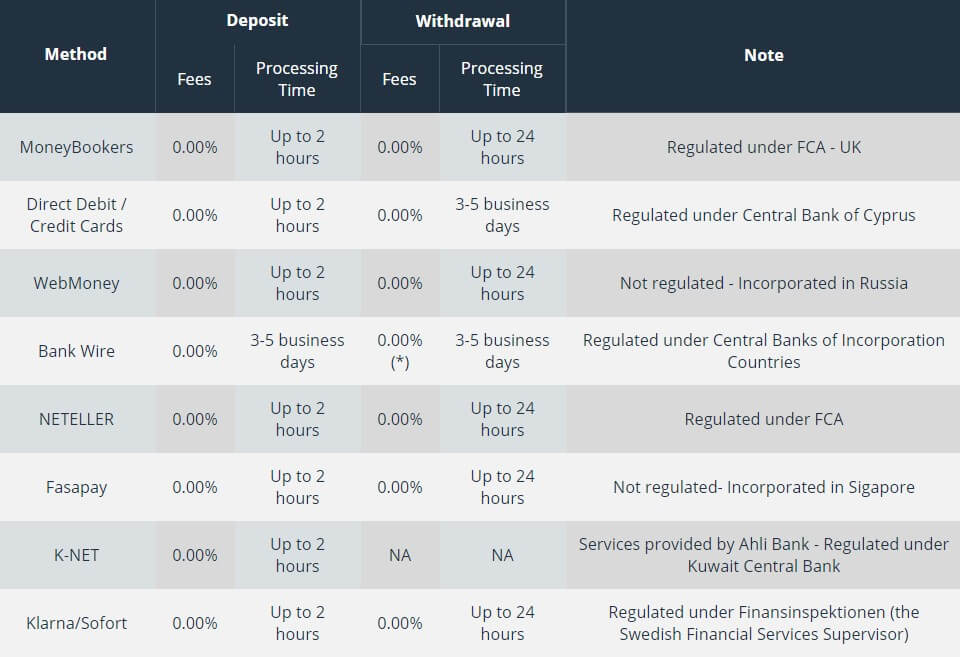

Deposit Methods & Costs

The website sets out all deposit methods you may use to fund your account, and there is a fair variety: Credit/Debit Card, Skrill, Neteller, Web Money, Wire transfer, Fasapay, K-net, and Sofortüberweisung. No fees are charged by Orbex.

Withdrawal Methods & Costs

Withdrawal methods with Orbex are the same as deposits, and you can only withdraw your funds via the same way you deposited (Credit/Debit Card, Skrill, Neteller, Web Money, Wire transfer, Fasapay, K-net, and Sofortüberweisung). No fees are applied however for bank wire transfers, your bank may apply a fee, so be sure to check with your provider before requesting a withdrawal.

Withdrawal Processing & Wait Time

It is very useful to note that Orbex has a table on the website clearly setting out all deposit and withdrawal methods, fees and timescales. For withdrawals, the timescales to process are as follows:

- Moneybookers: up to 24 hours

- Credit/Debit Card: 3-5 business days

- Neteller: up to 24 hours

- Web Money: up to 24 hours

- Wire transfer: 3-5 business days

- Fasapay: up to 24 hours

- K-net: ‘n/a’ so assumably instant

- Sofortüberweisung: up to 24 hours

Bonuses & Promotions

Orbex does not currently offer any deposit bonus schemes or promotions.

Educational & Trading Tools

Orbex does offer a very wide variety of trading tips, tools, and analysis which can be found directly on the website, which could assist you in your everyday trading.

Customer Service

You may reach out to Orbex customer service via email, live chat, and telephone on a 24/5 basis (GMT + 3).

Demo Account

Demo accounts are available for those who wish to backtest Orbex services prior to trading with them live.

Countries Accepted

One must note that due to CySEC regulation, Orbex does not offer services to residents of certain jurisdictions such as the USA, Cuba, Sudan, Syria, and North Korea.

Conclusion

Although this broker was a little confusing to understand the account types at first, the customer support was overall friendly and helpful to explain and clarify any queries we had. The minimum deposit requirements may not be ideal for beginner traders, but for the more experienced, we think this broker offers a fair variety of instruments to trade, a good amount of deposit/withdrawal methods, and fair trading conditions.