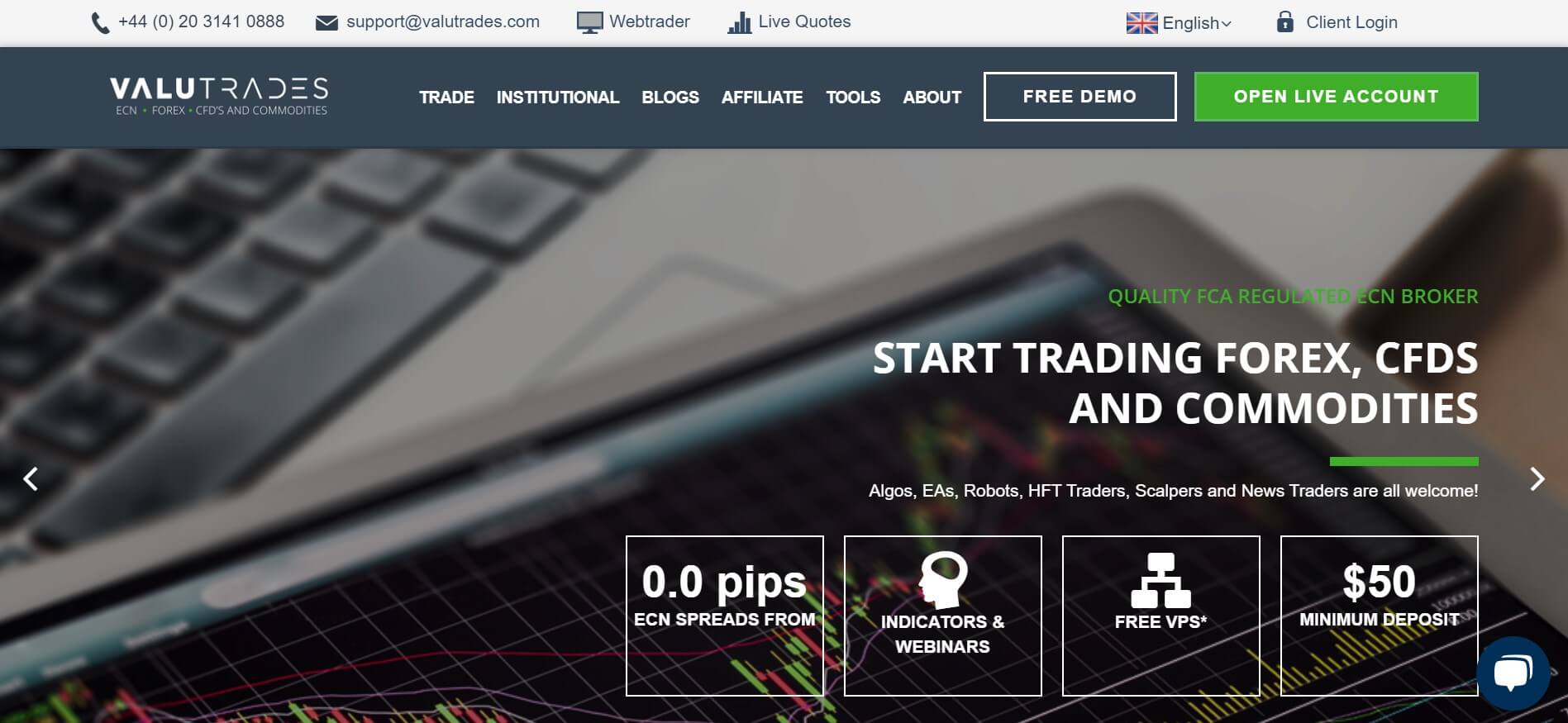

ValueTrades is an FX and CFD broker that is located in the United Kingdom and regulated by the Financial Conduct Authority (FCA). The company describes its mission as leveling the playing field, in order to give all clients complete access to the real financial markets. We certainly see the broker providing one advantage for the underdog, by allowing clients to open an account with no required deposit amount. If you’re located in London, it’s even possible to arrange an in-person meeting, something that many of the broker’s competitors would never consider offering. Stay with us to find out more.

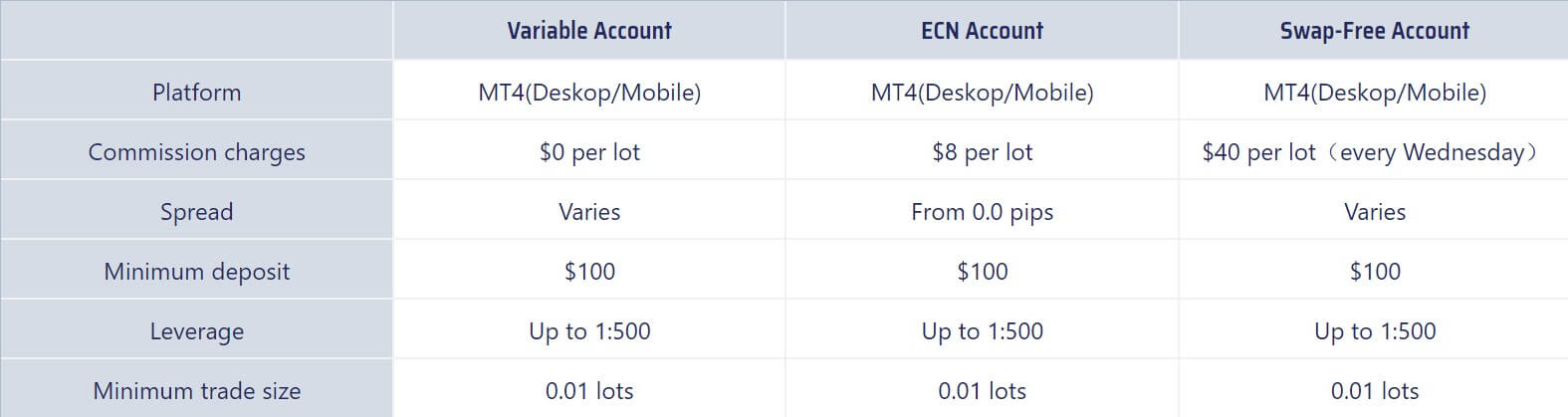

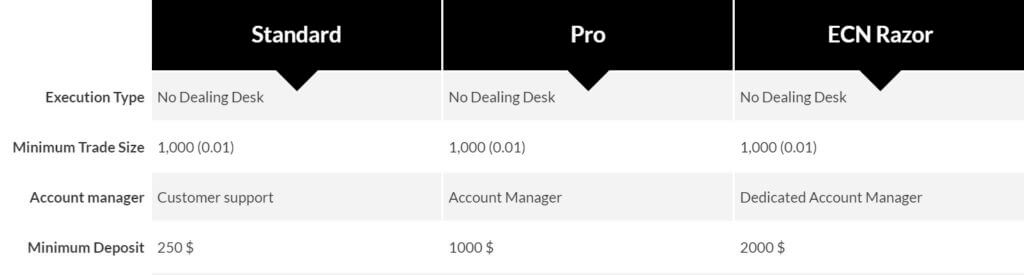

Account Types

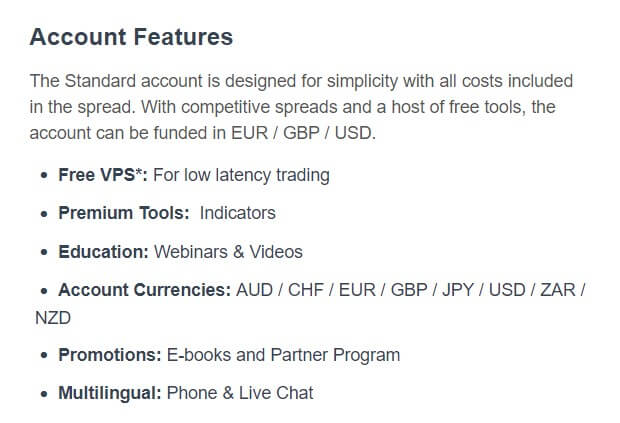

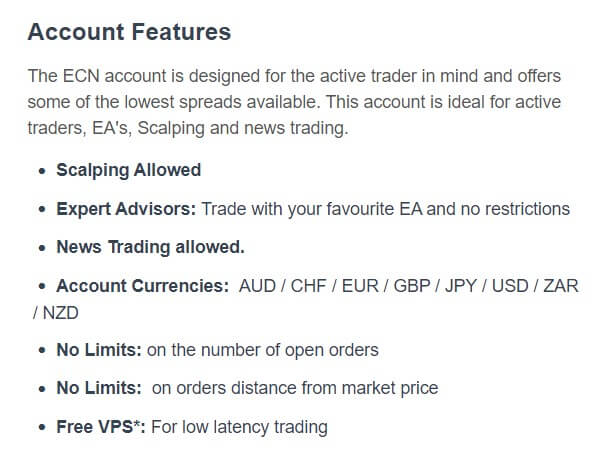

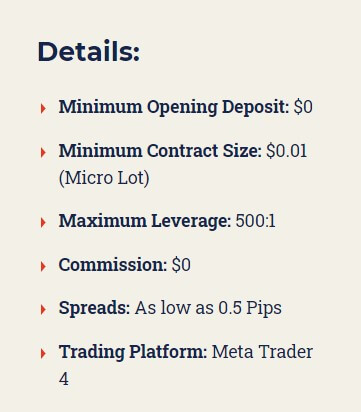

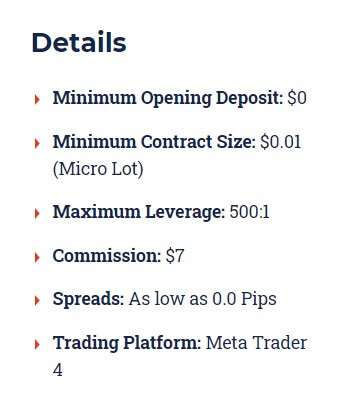

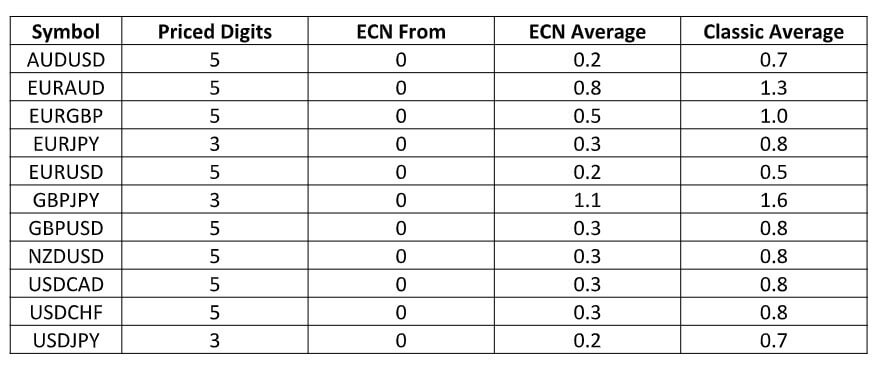

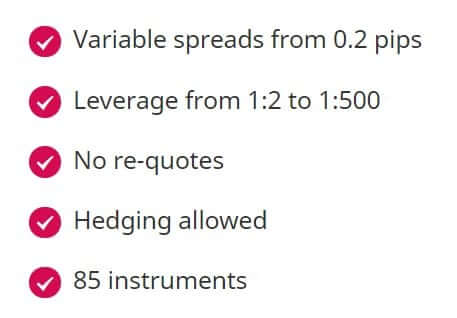

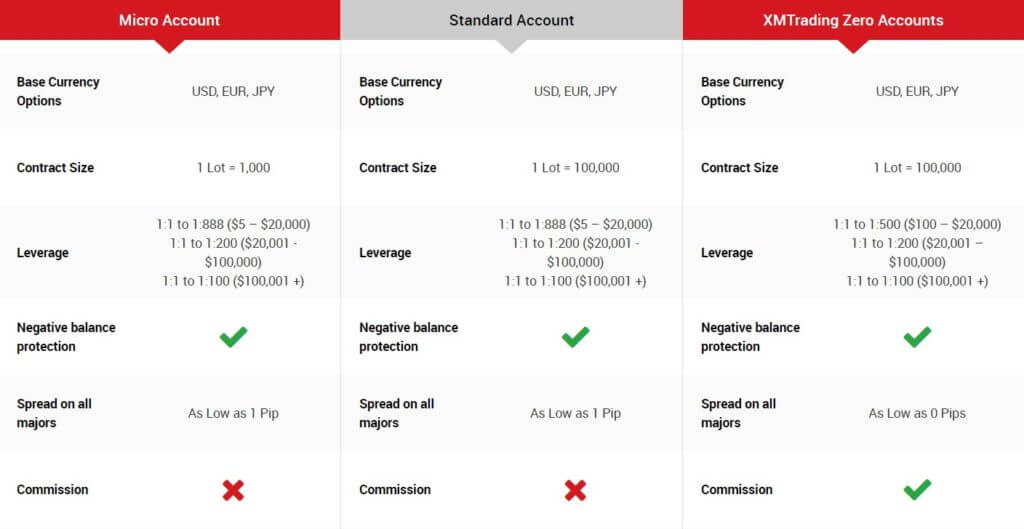

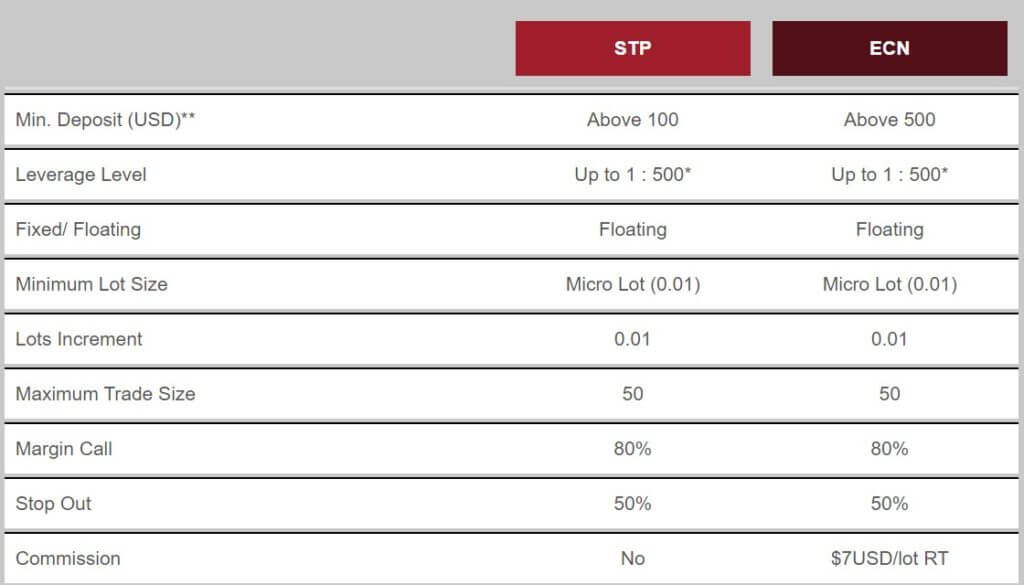

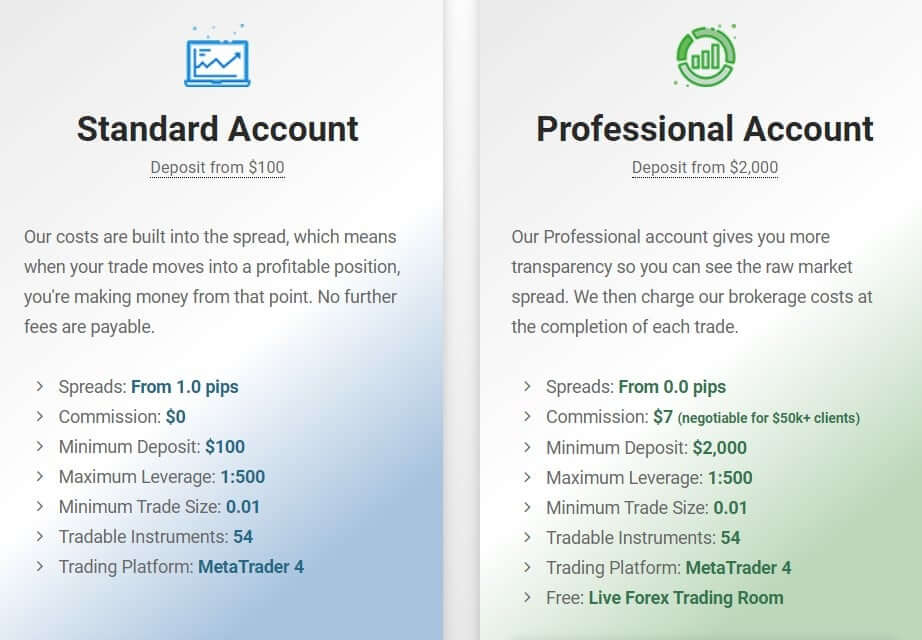

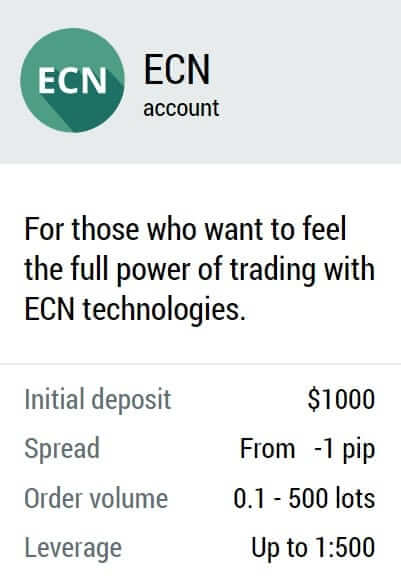

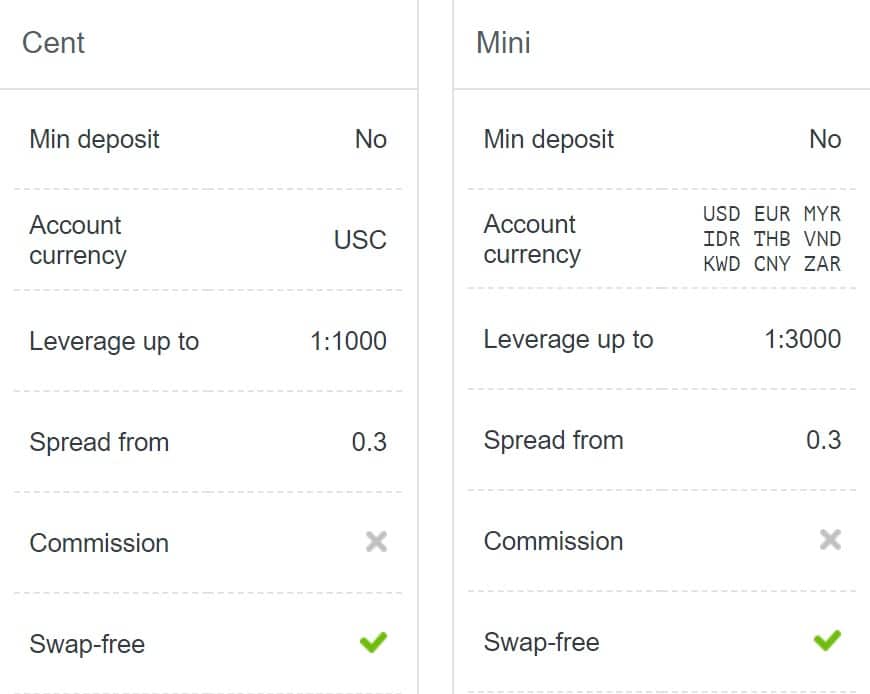

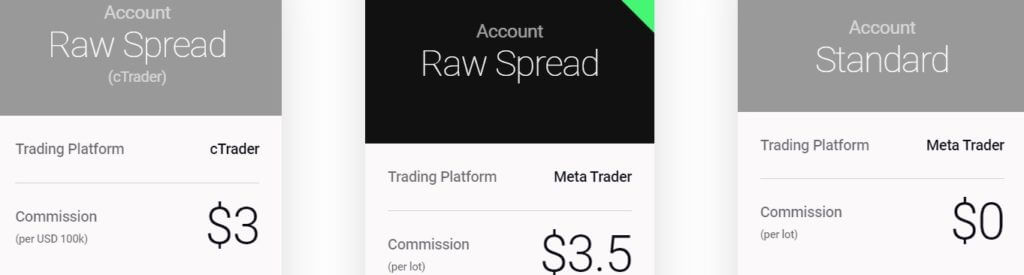

This broker offers two account types; Standard and ECN. Both accounts are extremely affordable, with no minimum deposit requirements. On Standard accounts, commissions are applied in the spread, meaning there are no separate commission entries. This setup type is ideal for beginners and long-term position takers. The ECN account offers the lowest spreads and is designed for active traders, EA’s, scalping, and news trading. Leverage options are based on the exact instrument that is being traded, in addition to the equity in the account. Platforms, trade sizes, and tradable instruments are also shared by both account types. We’ve provided a quick overview below.

Standard Account

Minimum Deposit: None

Leverage: Up to 1:500 on FX

Spread: From 1 pip

Commissions: None

ECN Account

Minimum Deposit: None

Leverage: Up to 1:500 on FX

Spread: From 0 pips

Commissions: $3 (Forex & CFD) (per Side)

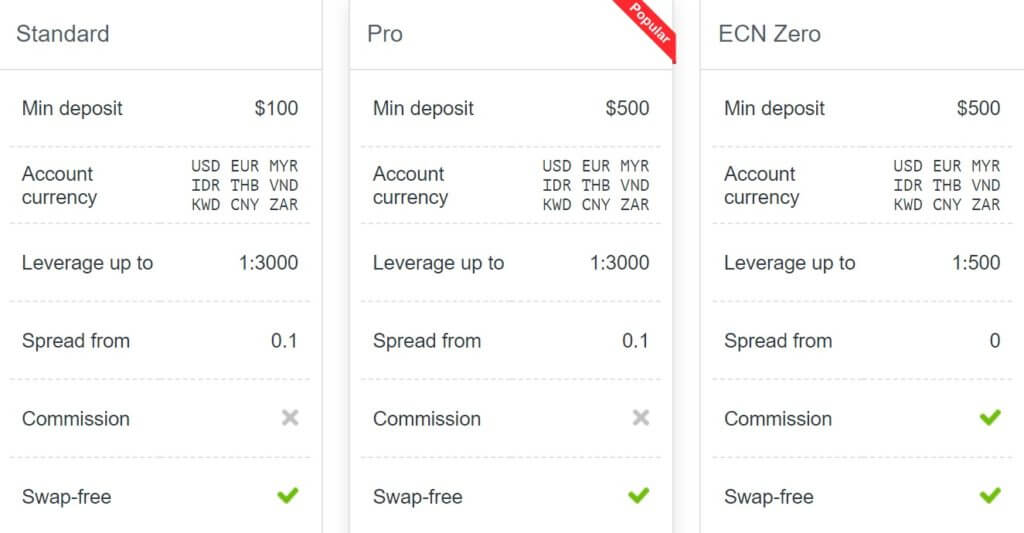

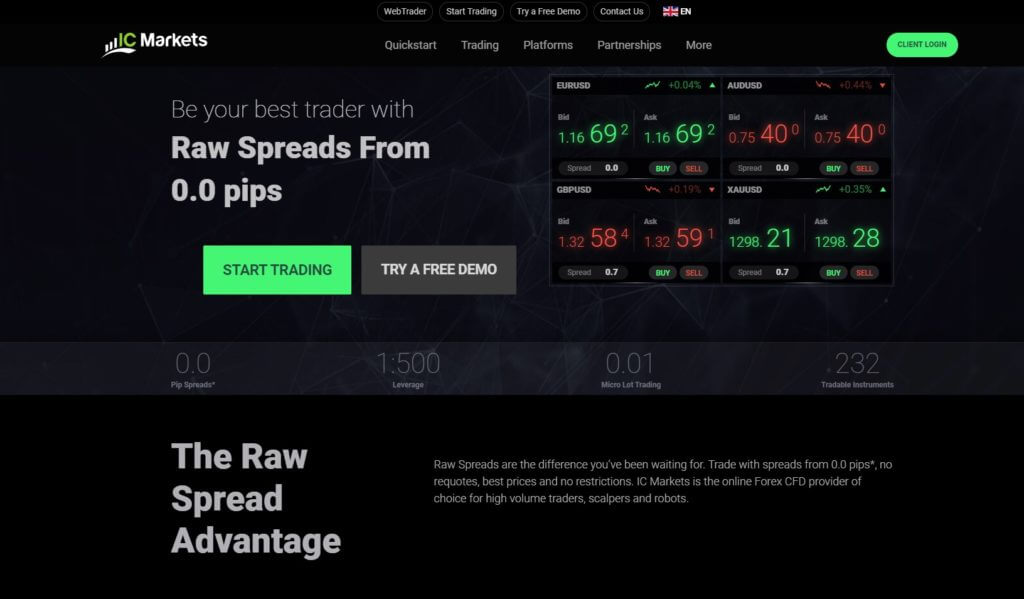

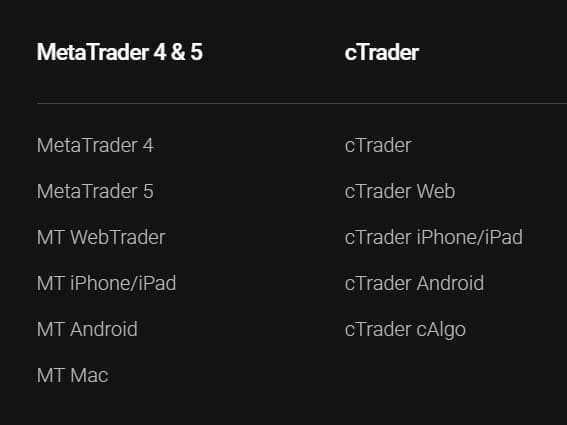

Platform

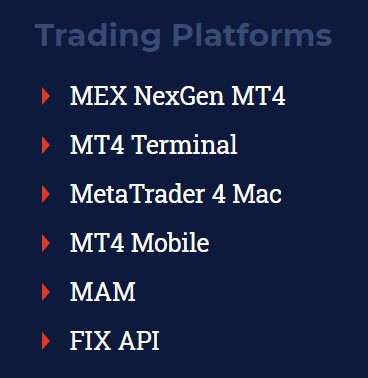

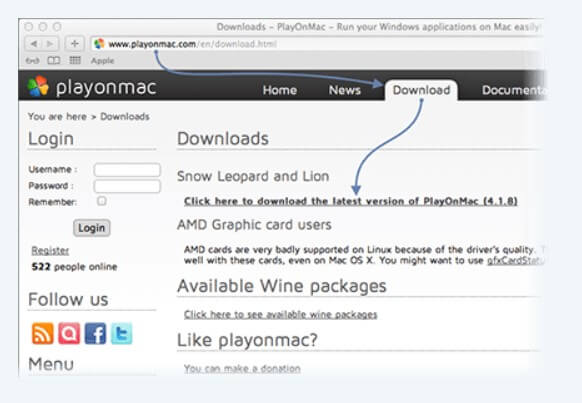

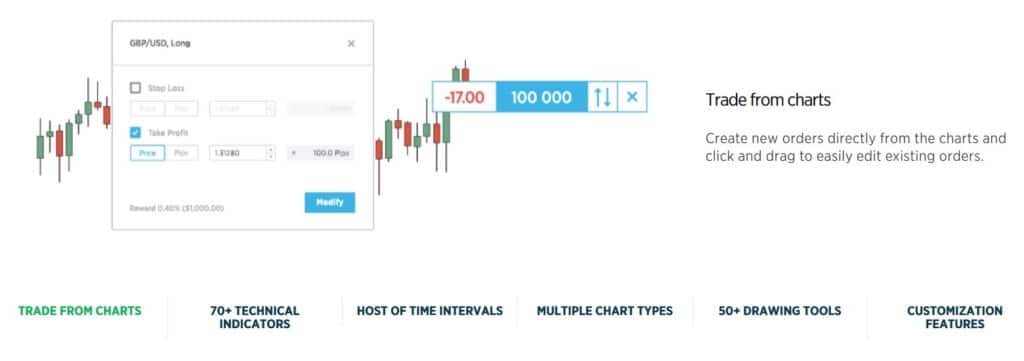

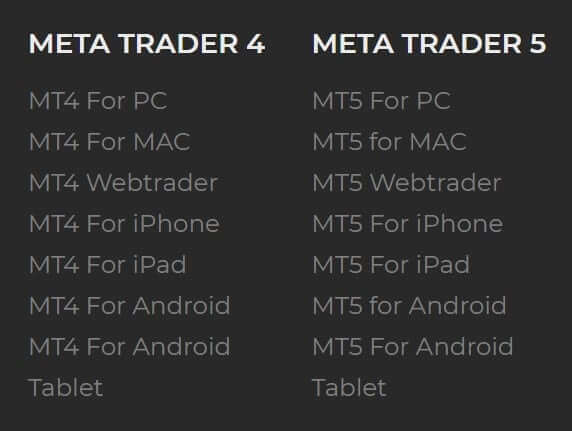

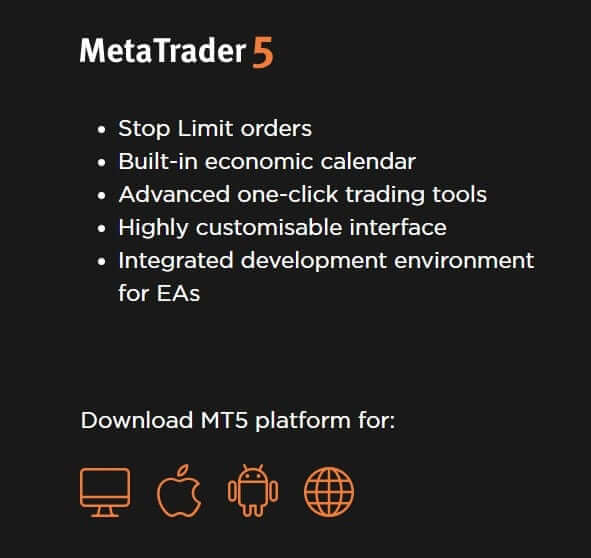

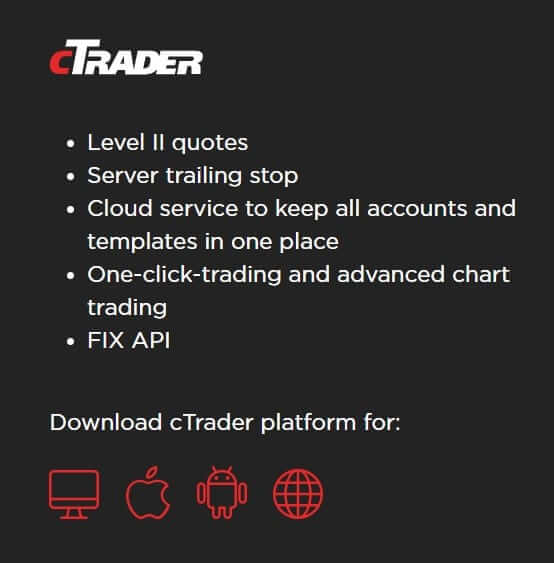

This broker offers three separate trading platforms; MetaTrader 4, MetaTrader 5, and Fix API. Chances are, many traders have already heard of the award-winning MT4 and MT5 trading platforms. Due to its wide range of trading resources, MT4 is preferred by all types of traders, including novices and investors. MT5 intends to build upon the success of MT4 and offers more pending order types and tools while providing a more powerful experience.

Both platforms can be downloaded on PC (Windows operating system 7 or better), Mac, or Mobile devices. The browser-based version, WebTrader, is also available for those that do not wish to download the program. Fix API is also offered as an alternative to the more traditional platforms and claims to focus on providing total control to traders. This platform provides direct market access and is applicable on all tradable instruments. The broker does not specify about device compatibility.

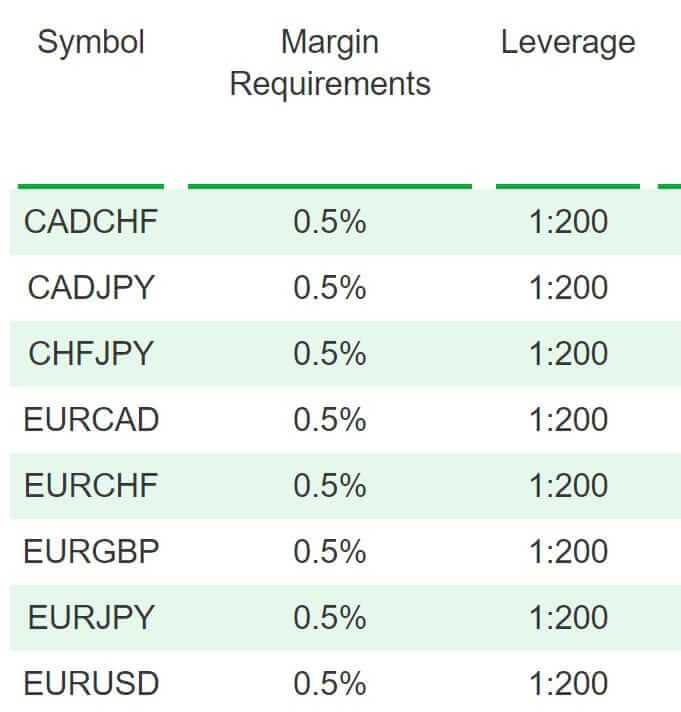

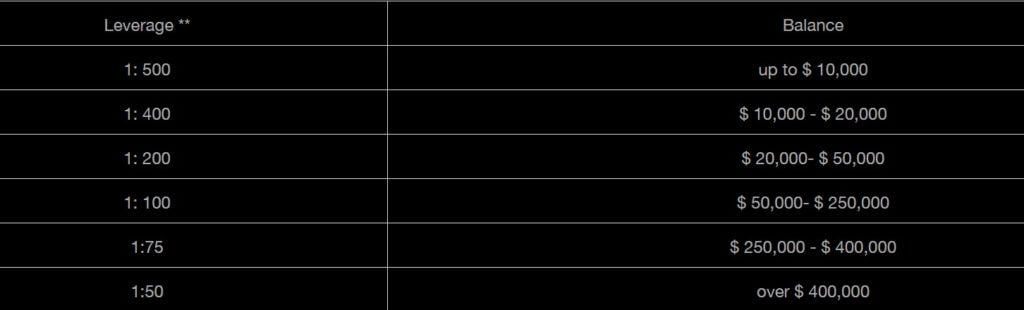

Leverage

Leverage options seem to be based on the equity within the account. All FX options offer a maximum leverage of either 1:125 or 1:500 on accounts that are funded with less than $20,000. The options are divided about half and half, so you’ll want to check the “Products” page to see which leverage is applicable on certain currency pairs.

For accounts that have equity between $20k – $100k, the broker also offers a mixture of leverages of either 1:50 or 1:200. Accounts with balances over $100,000 offer leverage up to 1:25 or 1:100 on FX options. On CFDs, the broker offers a leverage cap of 1:100 for all options.

Looking at Commodities, we see maximum leverage of 1:100 on US and UK Oil options, regardless of the account balance. The four remaining options offer a leverage cap of 1:500 for equities less than $20,000, a cap of 1:200 is offered for balances between $20k – $100k, and a cap of 1:100 is available for accounts holding more than $100k.

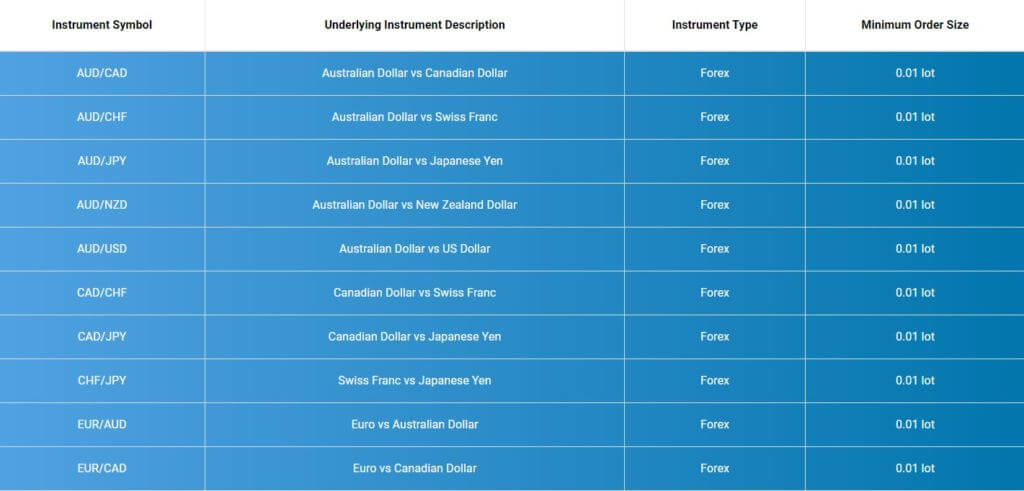

Trade Sizes

The minimum trade size is one micro lot across both account types. Maximum trade sizes differ based on the asset that is being traded. The maximum trade size on Forex options ranges from 10 to 50 lots, aside from on EURCZK, which has a higher maximum of 100 lots. The maximum trade size is 10 lots on all CFDs, with one exception, being a limit of 100 lots on AUS200. The maximum trade size is 30 lots on most Commodities, with a limit of 10 lots on Oil.

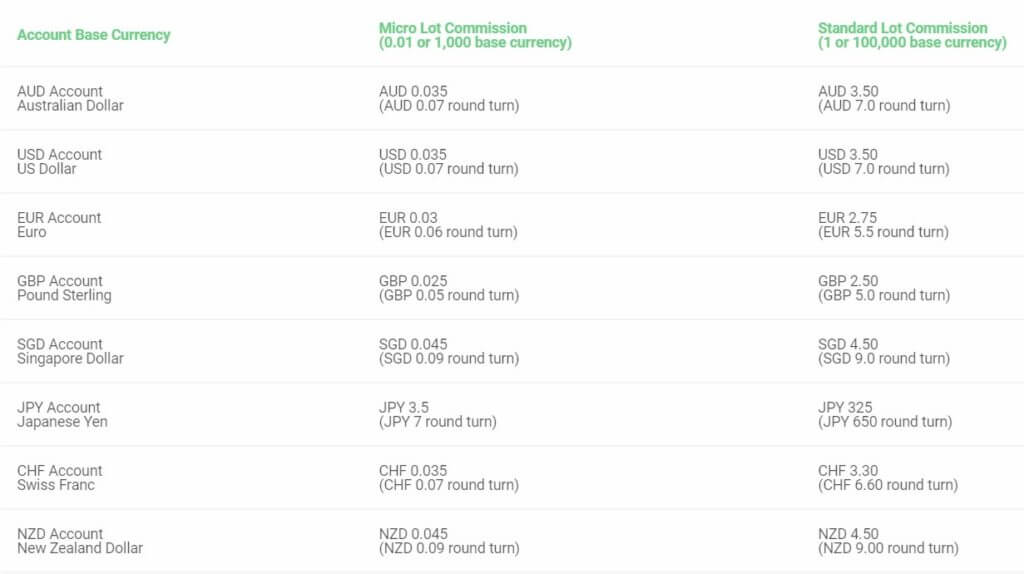

Trading Costs

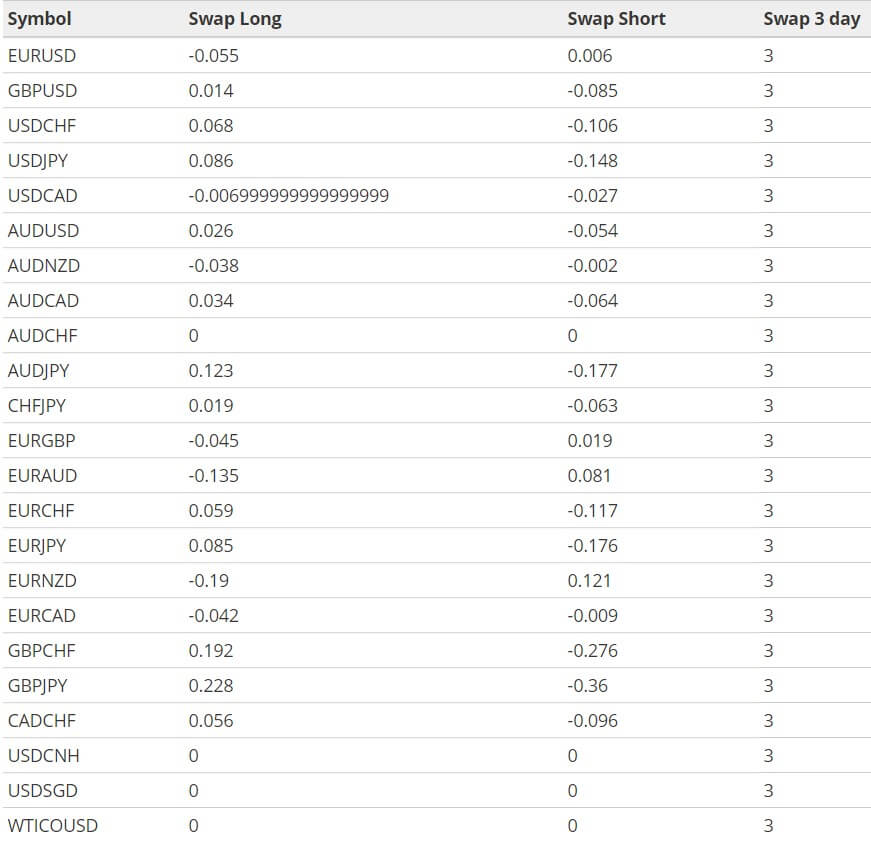

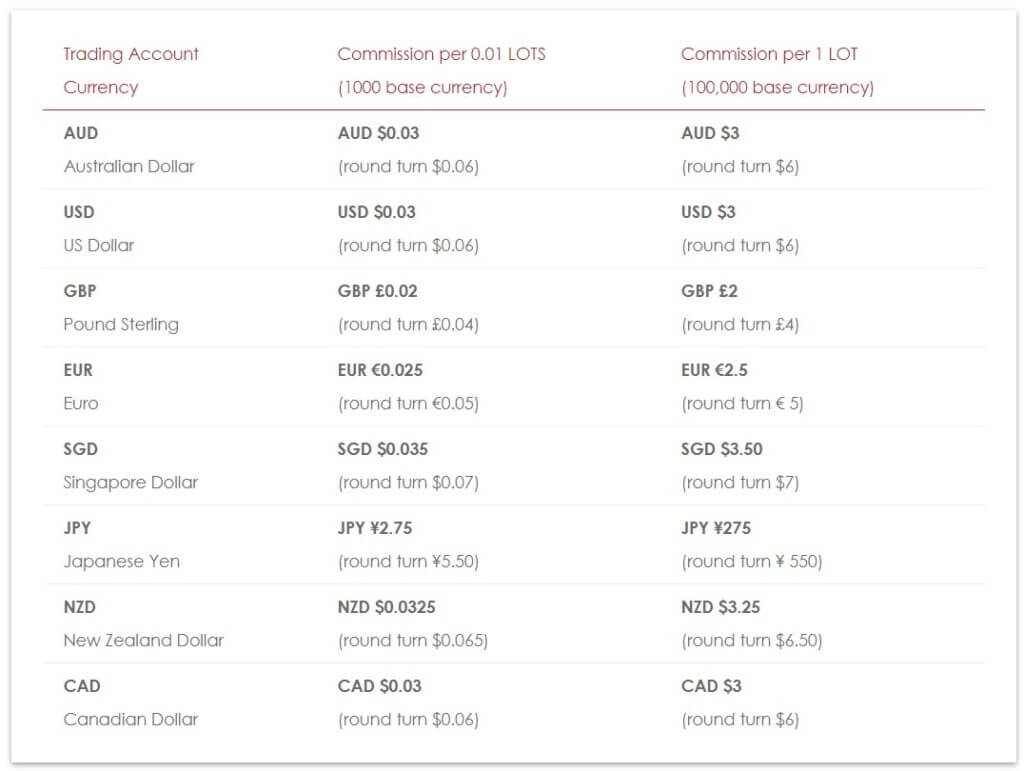

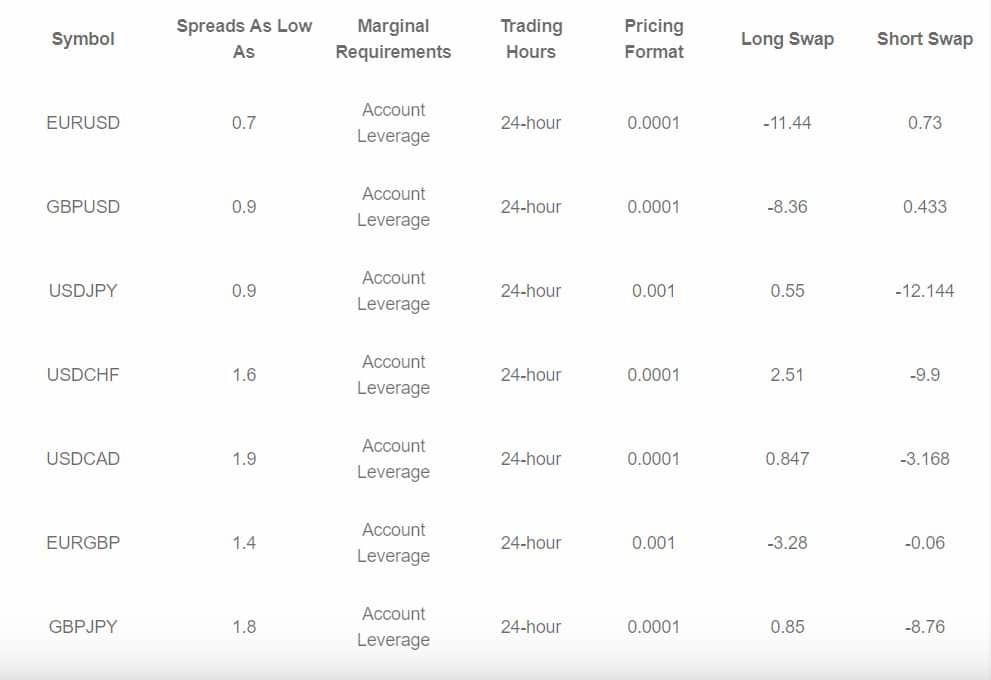

Traders will pay charges through commissions, swaps, and spreads. If you’re a Standard account holder, you’ll be able to avoid commission charges altogether, since this account type applies commissions to the spread. For ECN account holders, both commissions and spreads will apply, although spreads start from 0 pips. Commissions charged on this account type are $3 per Standard Lot per side, or $6 round turn. Any positions that are left open overnight will be subject to swaps and an interest rate that is credit or debit will be applied to swaps.

On FX, the value of the credit or debit is based on the difference between the interest rates of both currency pairs. Three times the swap is applied on Friday nights for CFDs. Oil behaves like a futures contract, where the settlement is a fixed date each month. You can find further information about swaps on the FAQ page and swap rates for any given day are published on the website daily; however, these rates can only be accessed by logging in through the client portal.

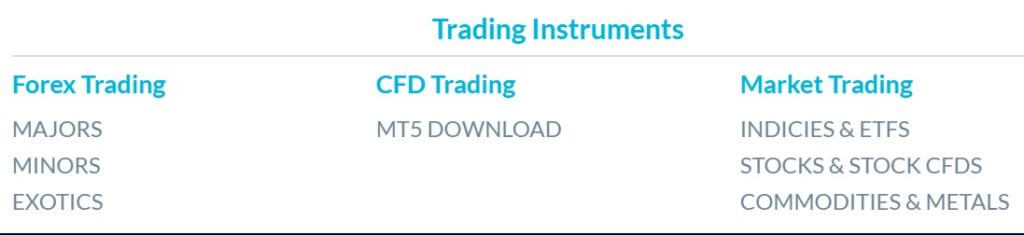

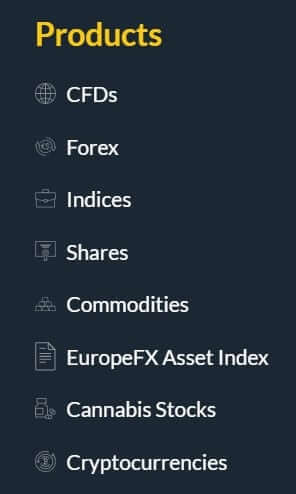

Assets

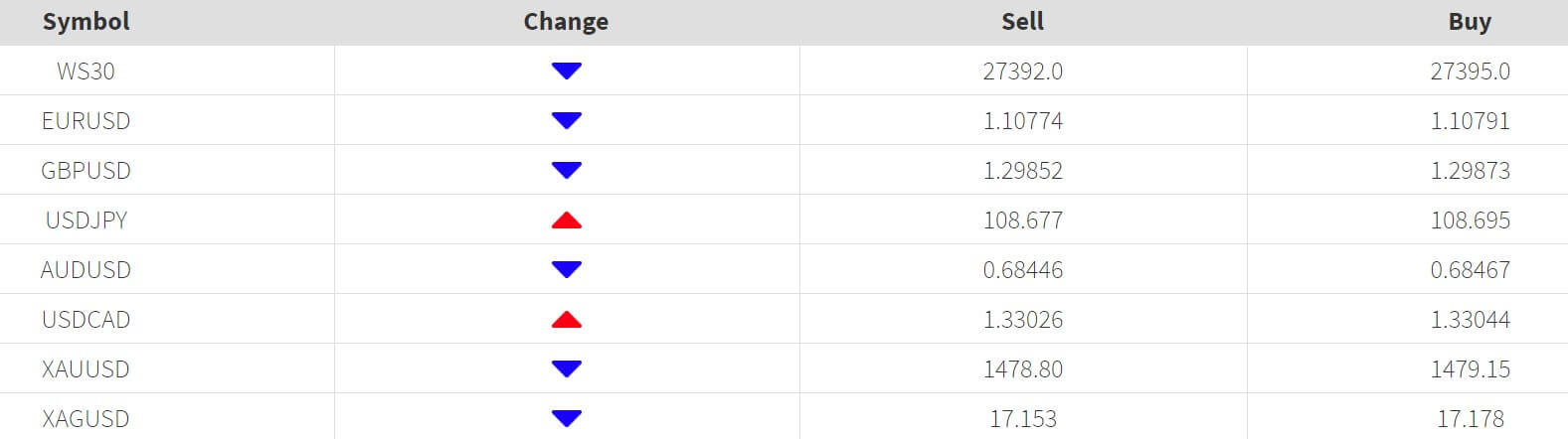

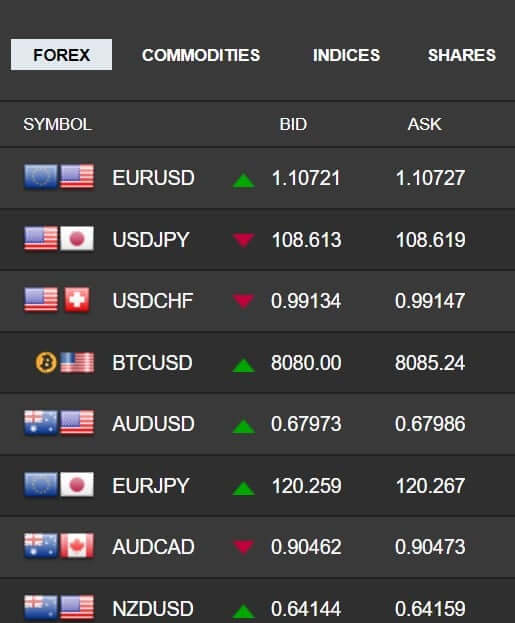

This broker advertises 100+ instruments, including FX, Precious Metals, Oils, and Indices. If you’re looking for Cryptocurrencies, you won’t find those options available with this broker. FX options are made up of 80 total products, including majors, minors, and exotics. In total, 11 CFDs and 7 Commodities are available. Taking everything into account, we can say that this broker is offering an excellent selection of currency pairs; however, the broker also seems to be focused on providing the most basic products. Some may feel satisfied with these options, while others may be looking for a larger variety.

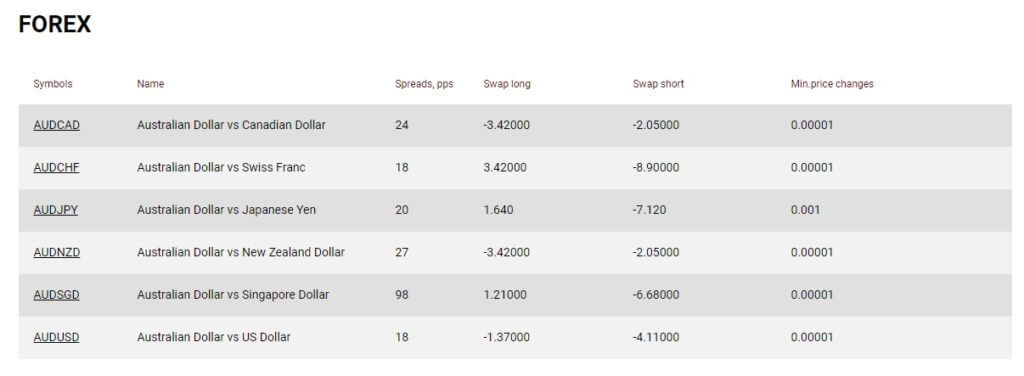

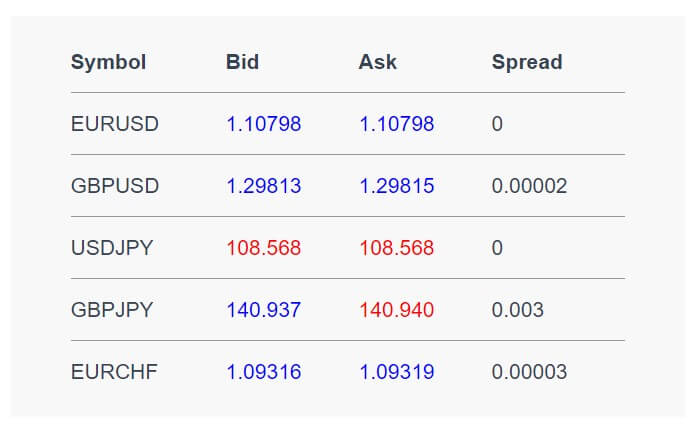

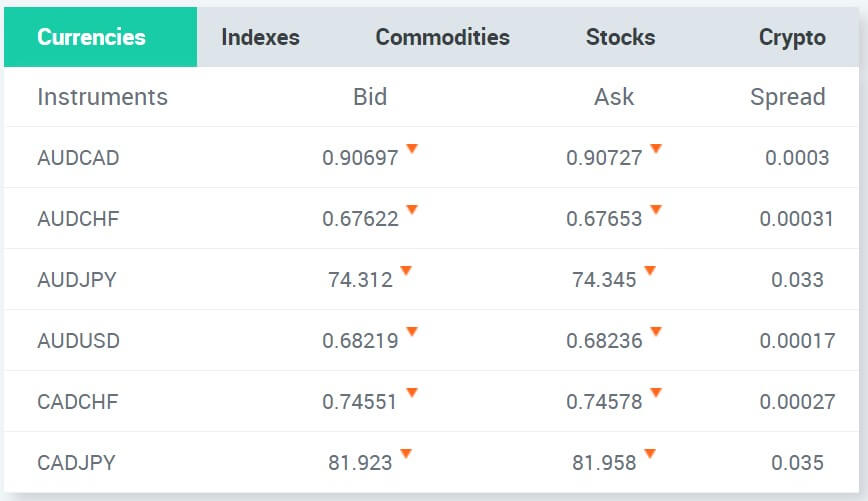

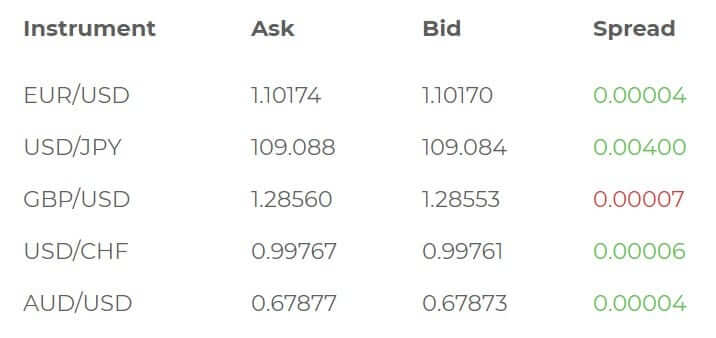

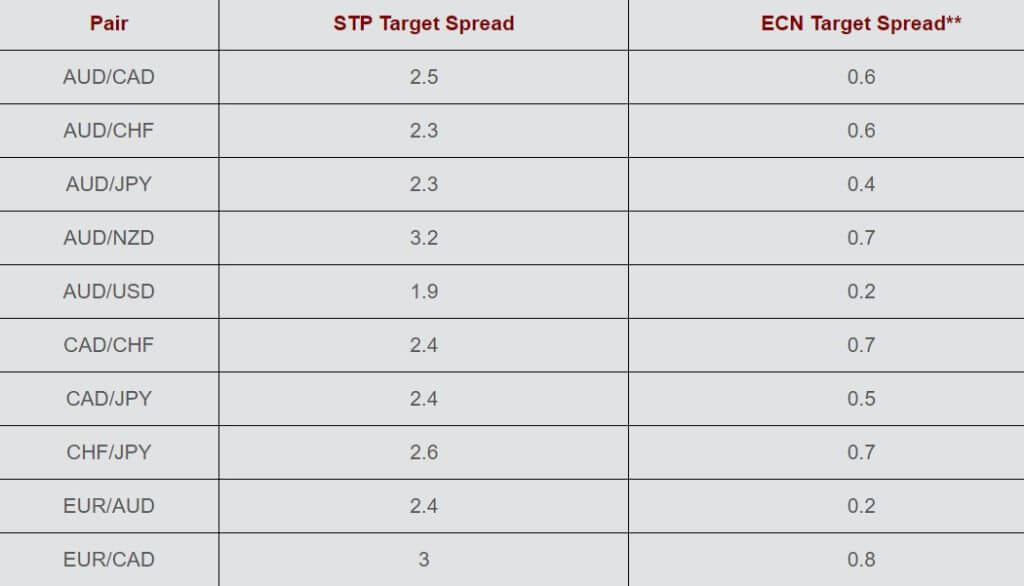

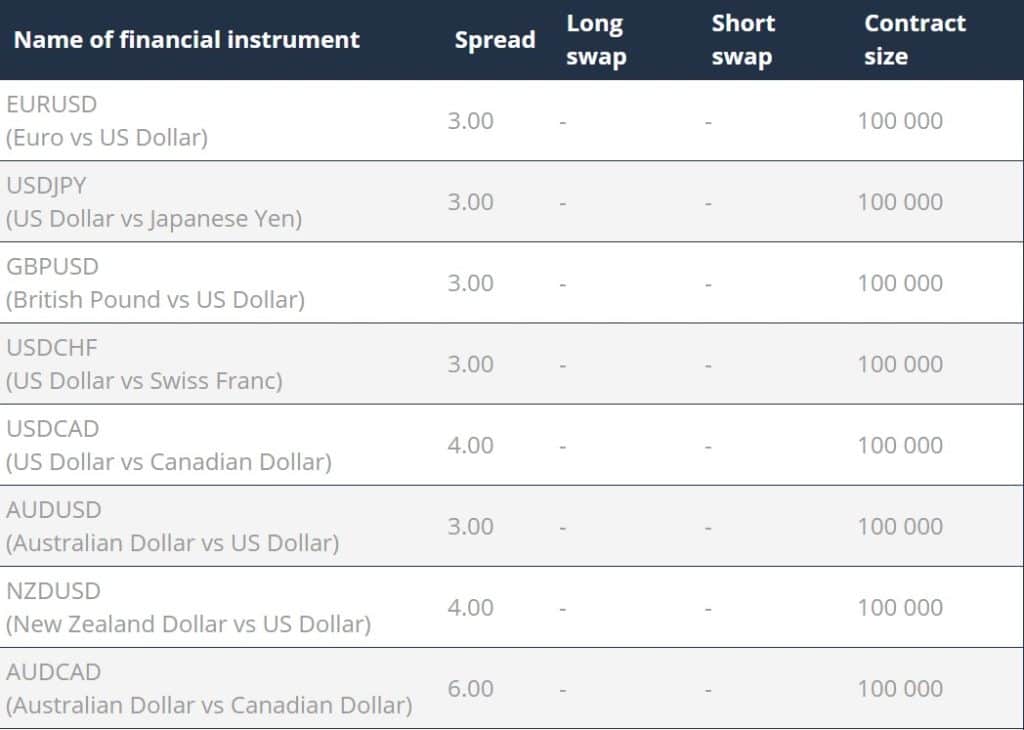

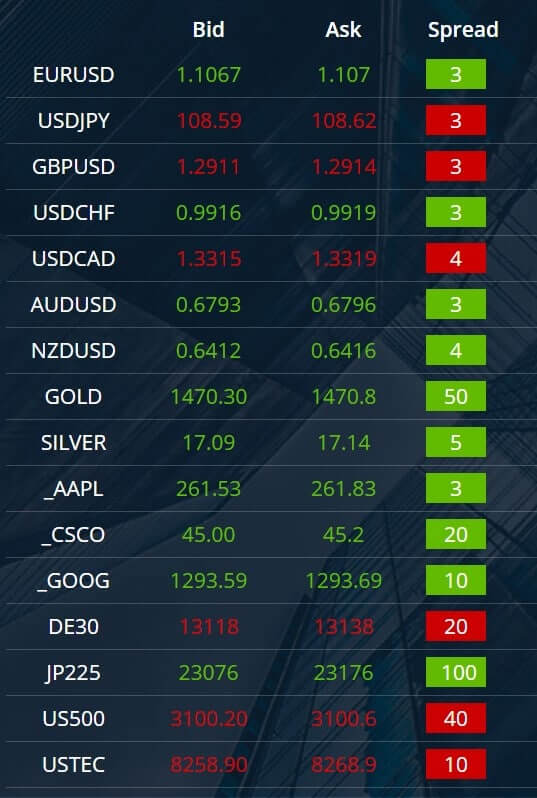

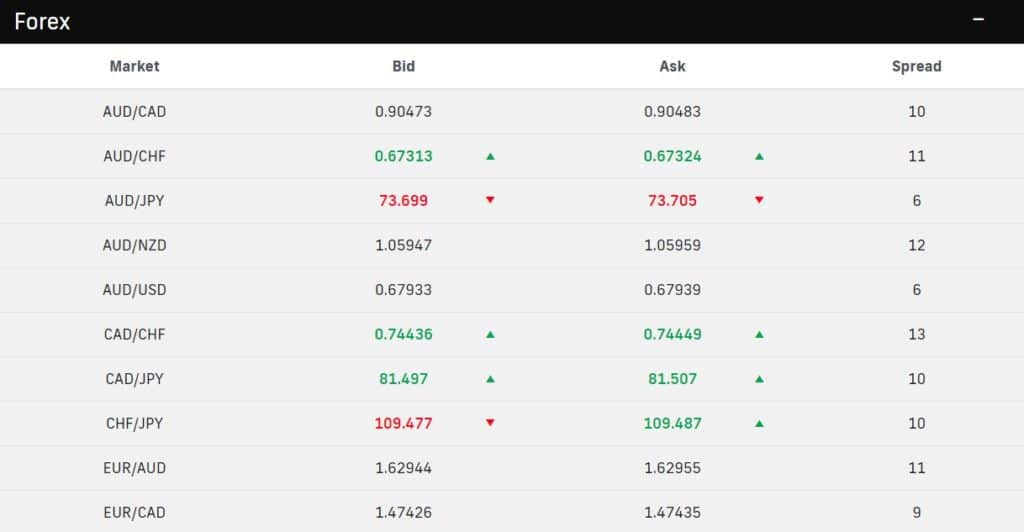

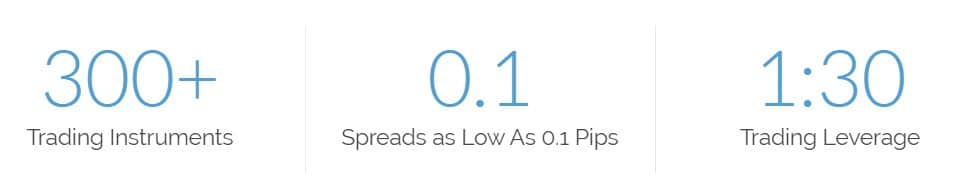

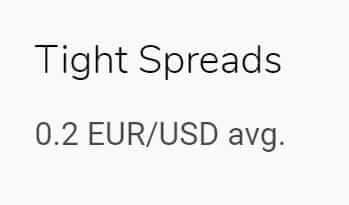

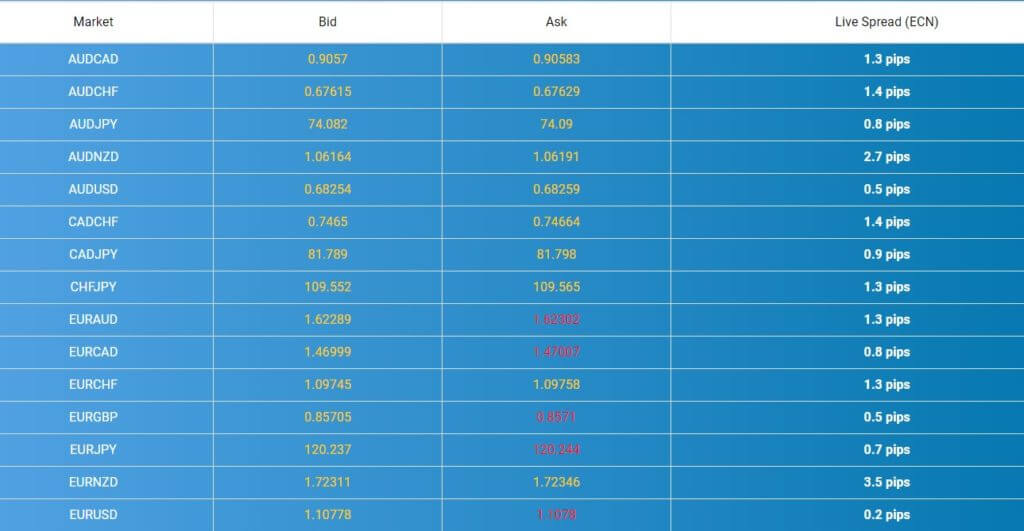

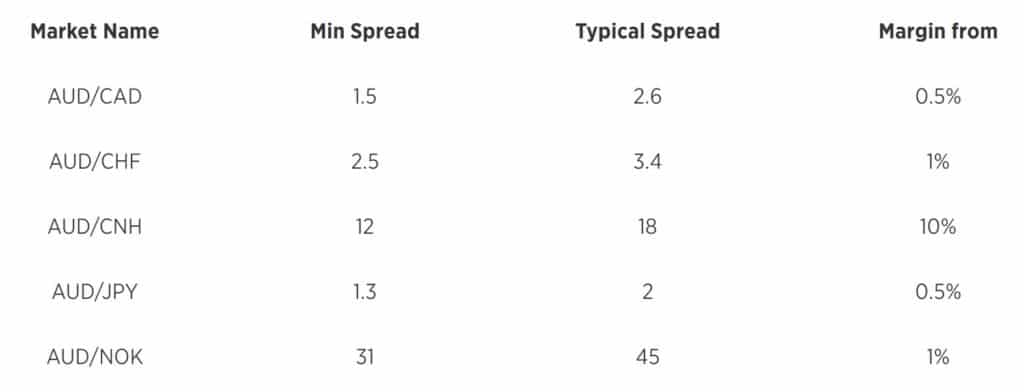

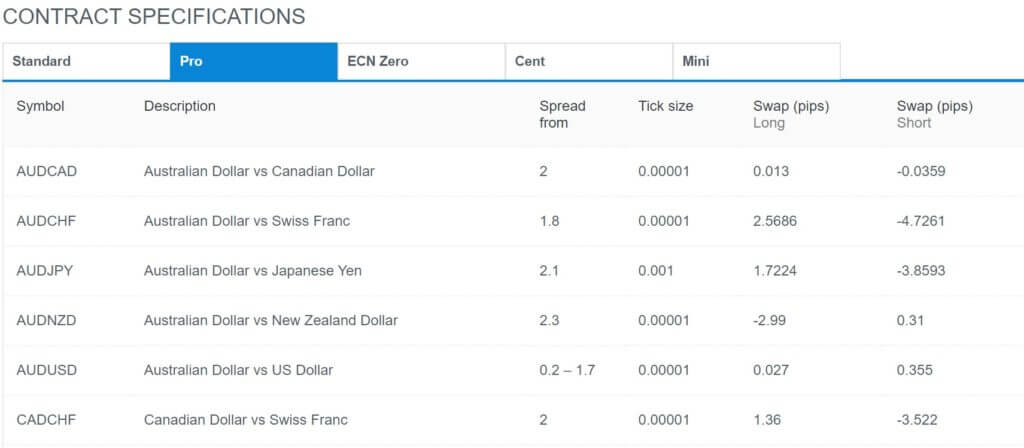

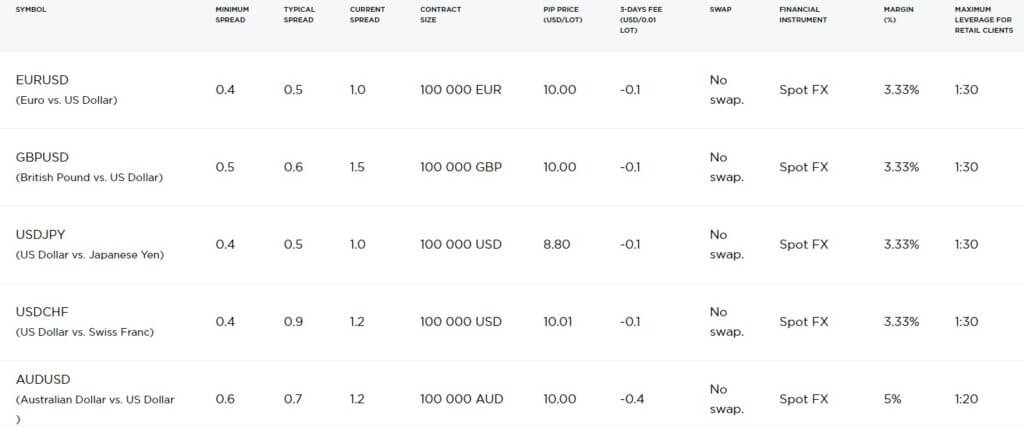

Spreads

Spreads with this broker are floating and start from 0 pips on ECN account types. On Standard accounts, the spreads start from 1 pip, which is significantly lower than the industry’s average 1.5 pips, especially considering this is not a more expensive account type. On the “Products” page, the broker offers complete transparency and lists live spreads for each instrument, so there is no need to worry whether spreads will appear much higher than advertised. Some brokers require deposits in the thousands of dollars to access these types of spreads, so we’re overly happy with the numbers here.

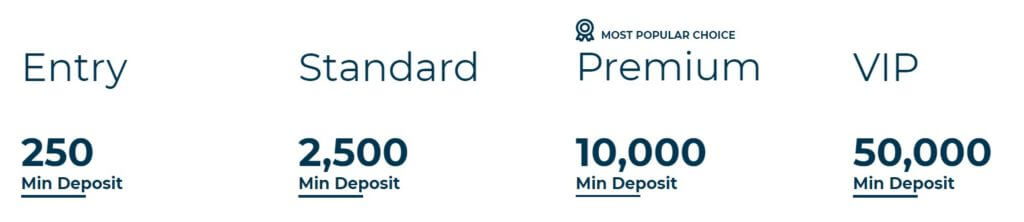

Minimum Deposit

One of the advantages of signing up for an account with this broker would seem to be the lack of minimum deposit requirements. Many other brokers tend to ask for deposits in the hundreds for Standard accounts, or in the thousands on other account types, which can often limit the account types one could realistically open. Fortunately, affordability will not be an issue with this broker and traders will be able to open either account of their choosing.

We do recommend making a deposit that is large enough to handle some trading activity, otherwise, you may find yourself making frequent deposits. However, we do want to point out one discrepancy. On the homepage, the broker mentions a $50 deposit requirement, although support assured us that there are no minimum deposit requirements set in place. We typically tend to listen to support, but we’d like to point this out, just in case this comes up when making a deposit.

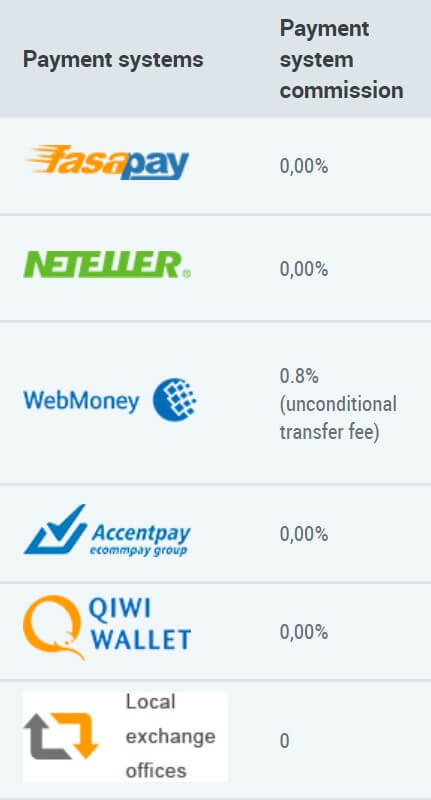

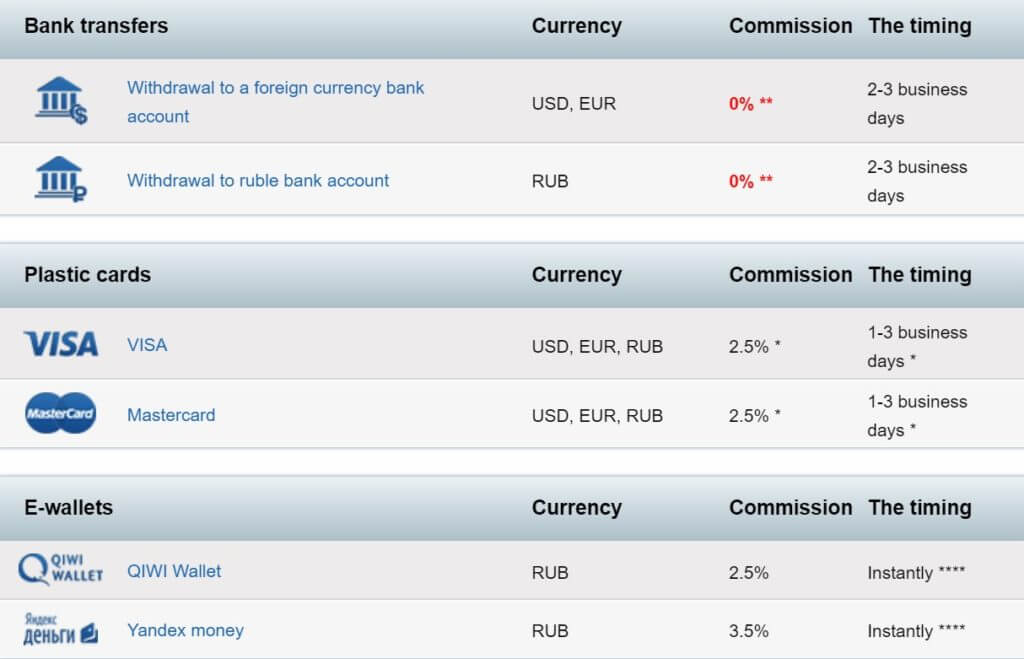

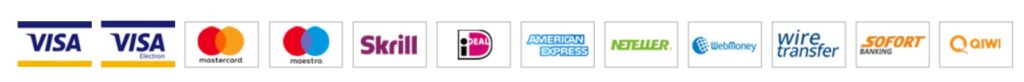

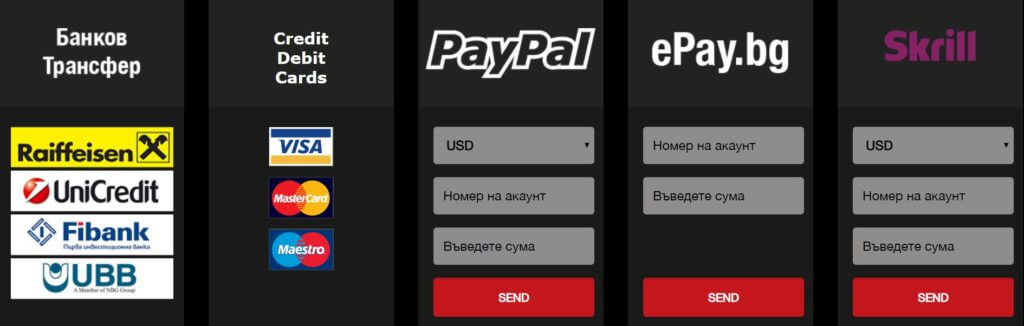

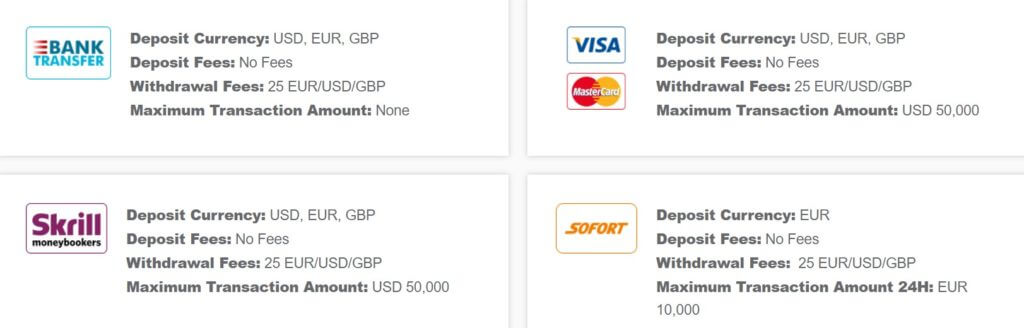

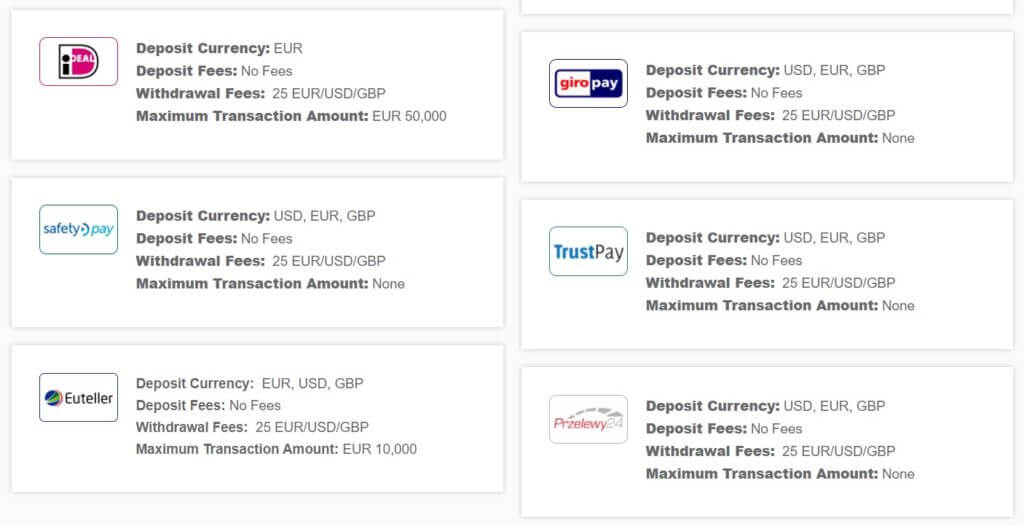

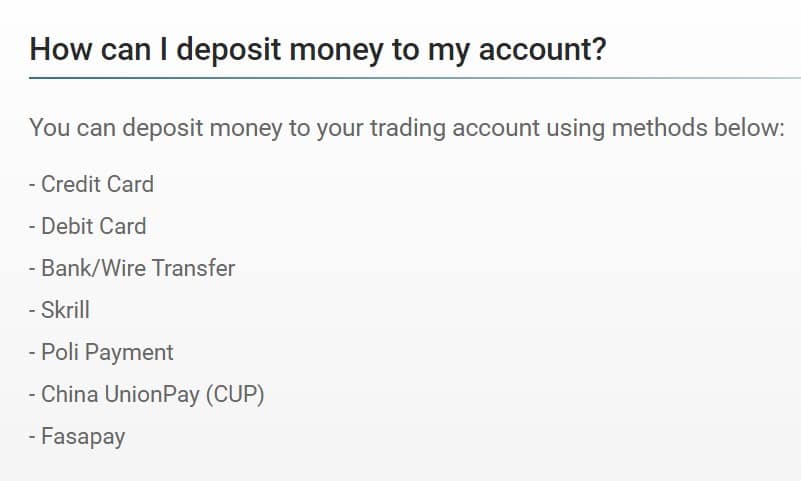

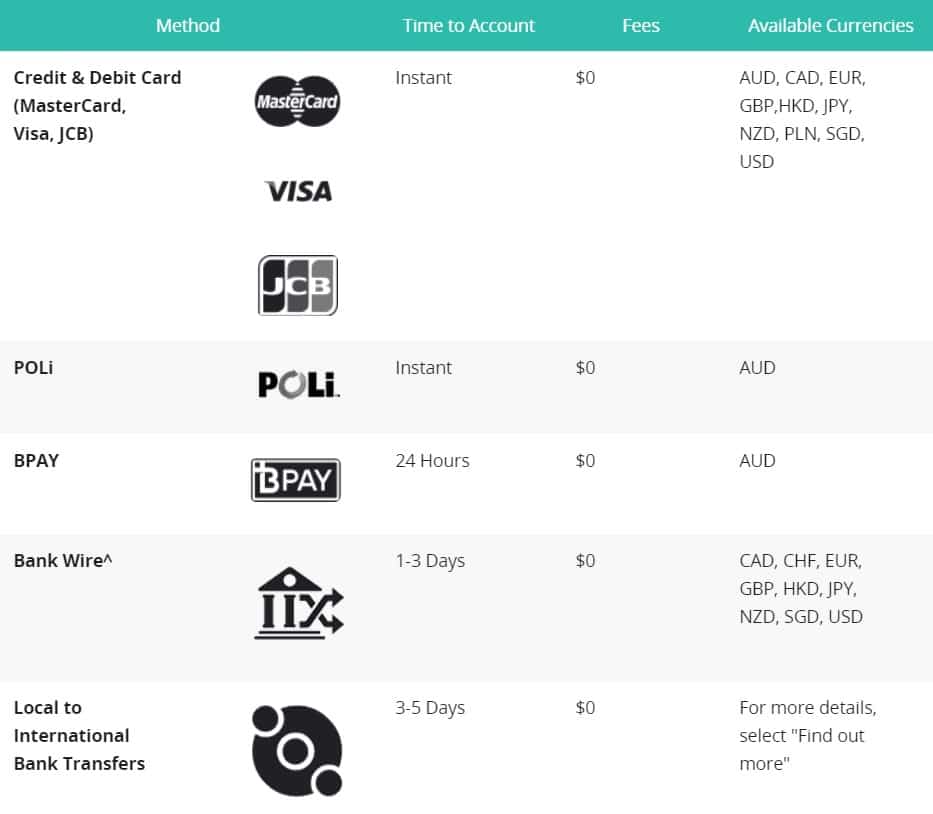

Deposit Methods & Costs

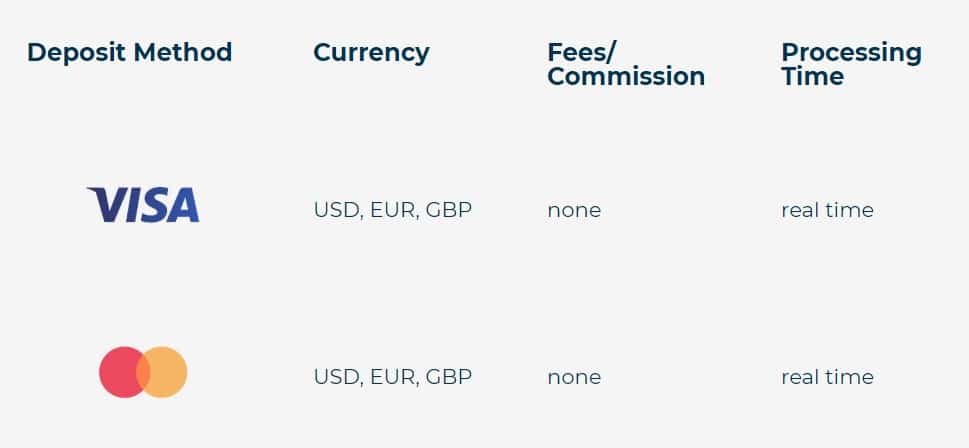

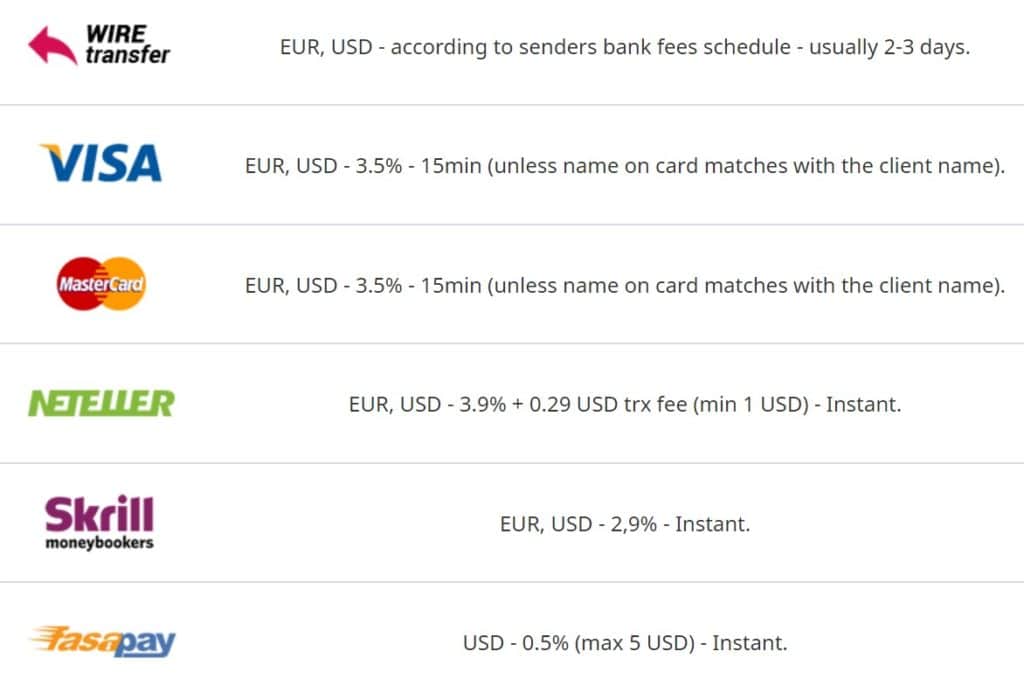

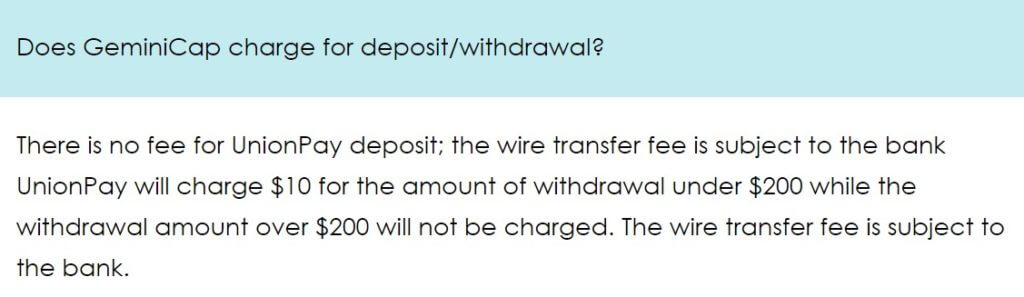

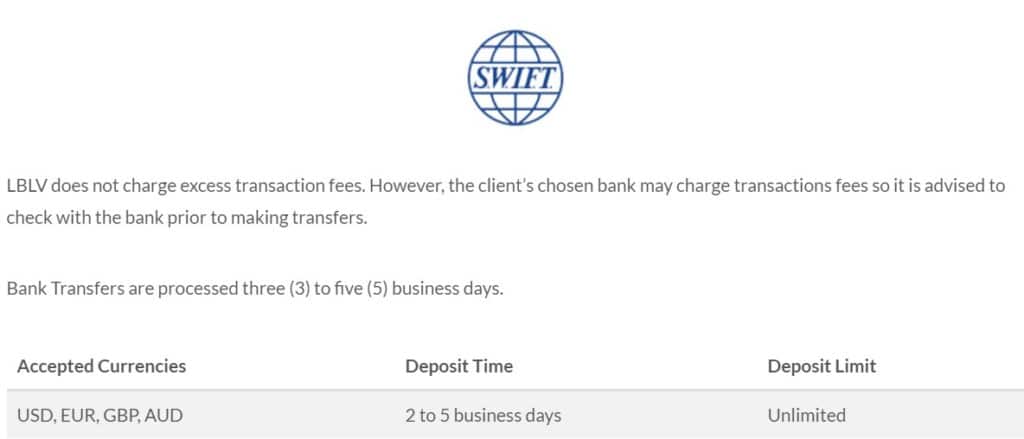

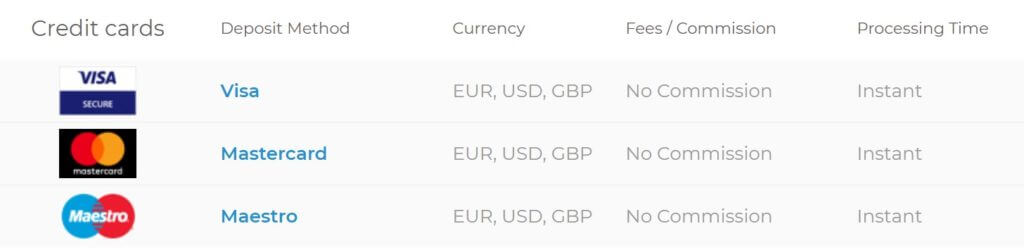

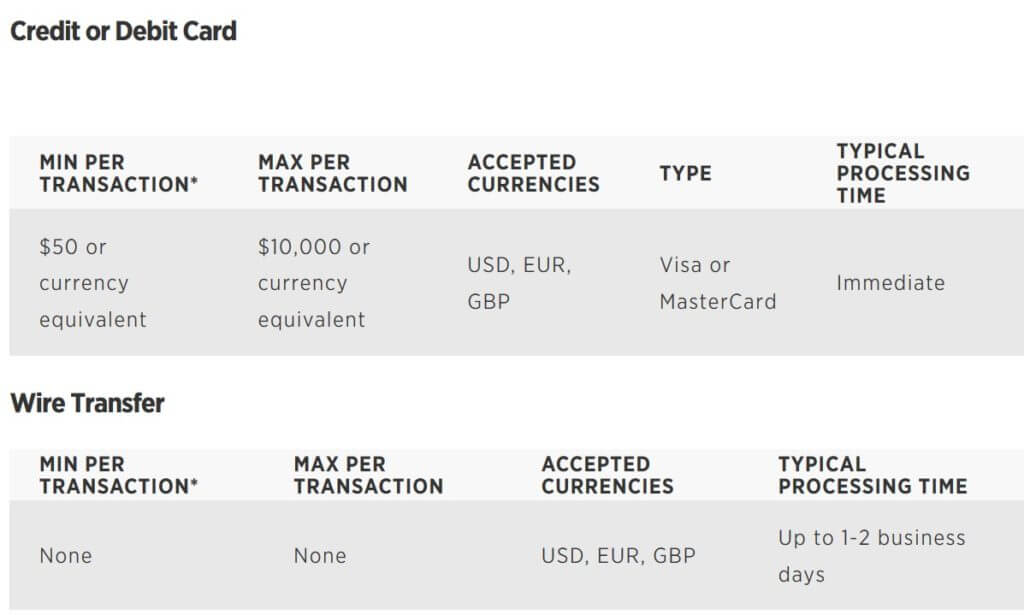

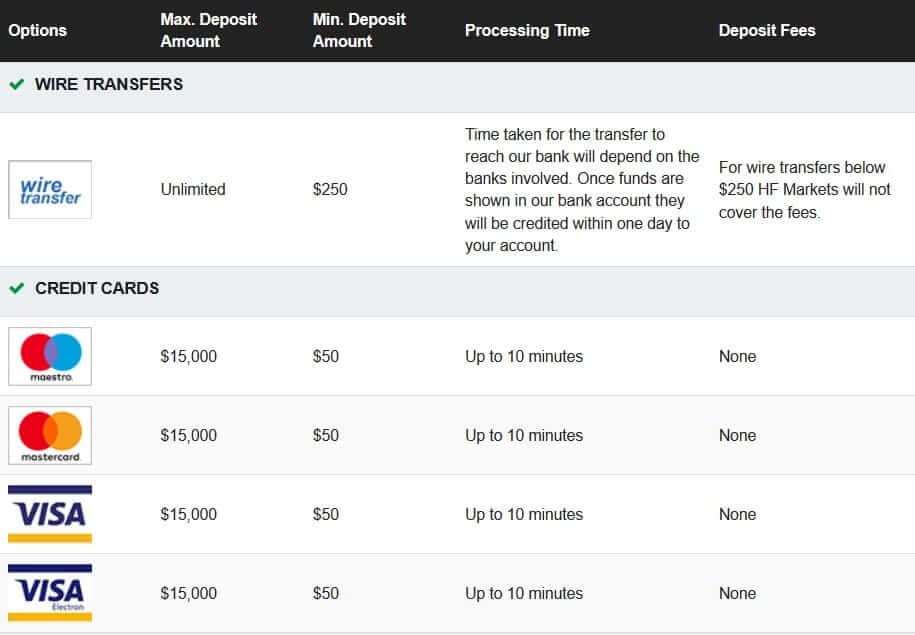

This broker accepts the following payment methods: Bank Wire Transfer, Visa, MasterCard, Neteller, Skrill, China UnionPay, Advanced Corretora, Boleto, and Remessa. This broker does not charge any fees on incoming deposits and credits the exact funded amount to the client’s trading account. The broker fails to mention how long it can take to see funds posted once sent.

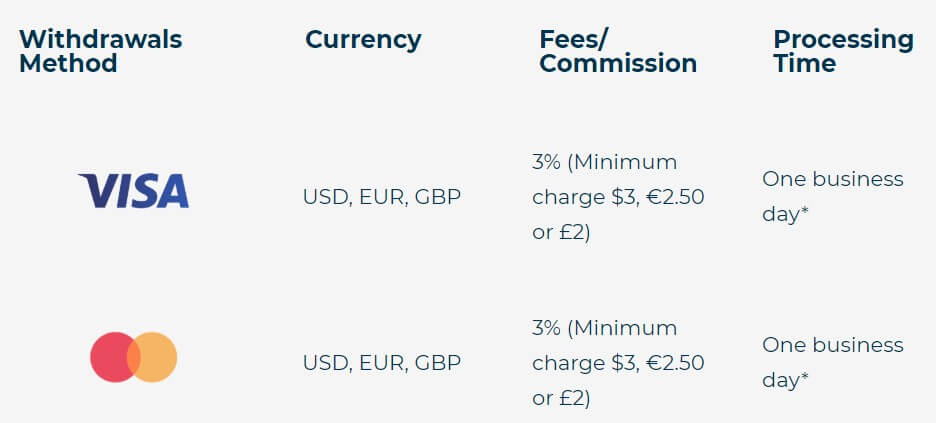

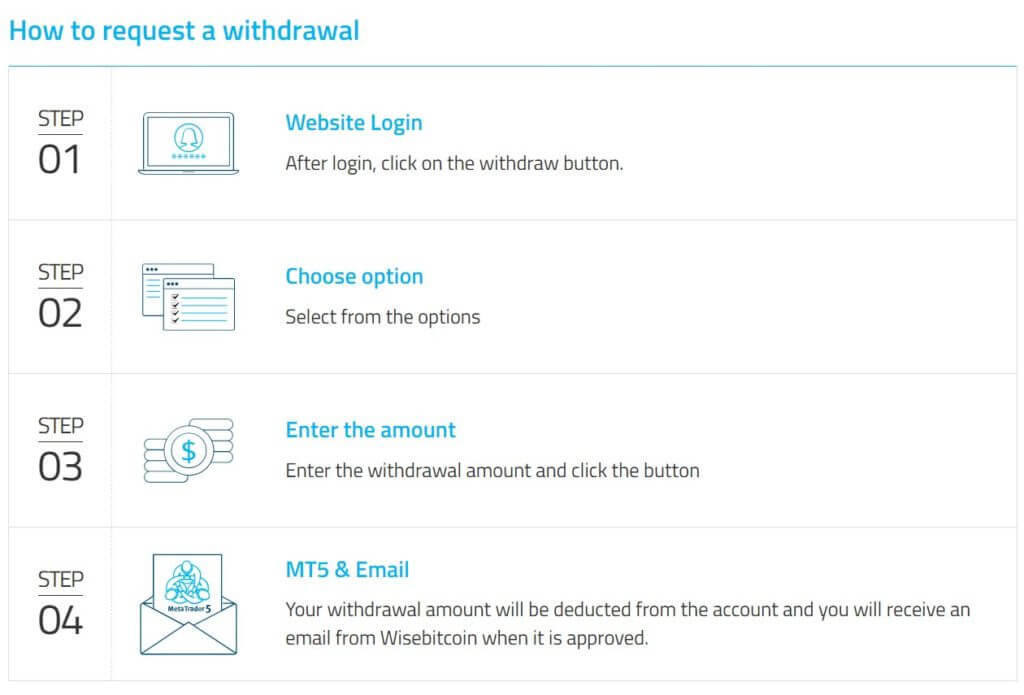

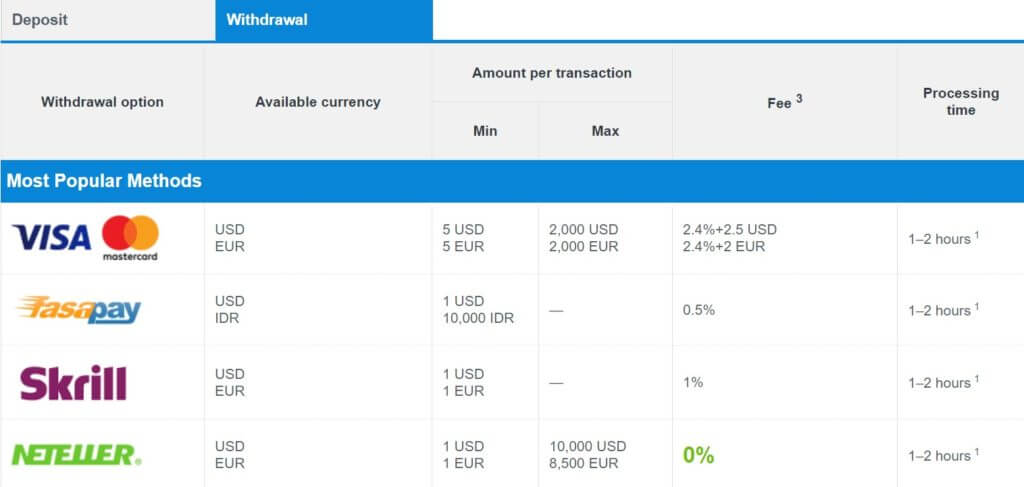

Withdrawal Methods & Costs

The broker doesn’t offer much information when it comes to withdrawals. We can hopefully assume that all available deposit methods can be used for withdrawals, although we can’t say for sure. Many brokers often have some type of policy in place that forces withdrawals to be treated as refunds and returned back to the payment source, so it is likely that there will be requirements with ValueTrades as well. We tried to reach out to support for more clarity on this policy; however, we did not receive a response.

We do know that withdrawals are marketed as being fee-free. A condition of the fee-free withdrawal policy would be that the broker doesn’t charge fees on the first three withdrawals each month; therefore, it would be in your interest to try to limit the number of outgoing withdrawals. The lack of clarity on information related to this section made us feel disappointed in this broker’s transparency, for the first time so far.

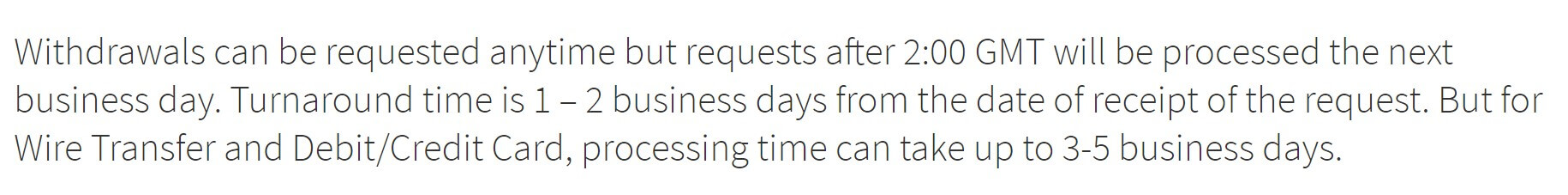

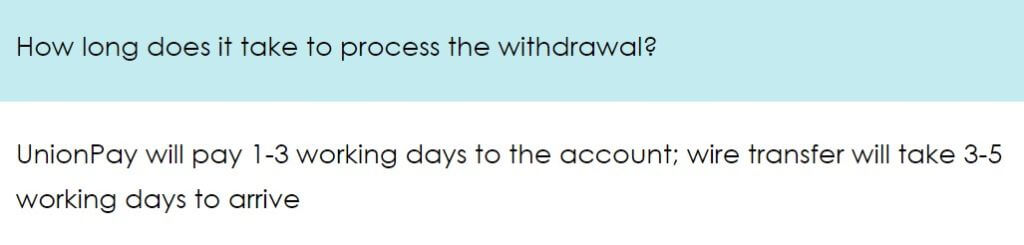

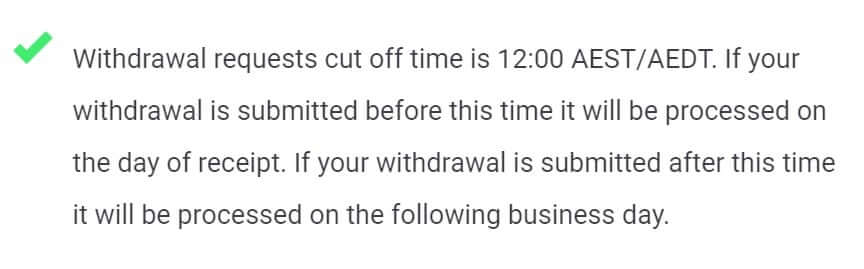

Withdrawal Processing & Wait Time

As we mentioned earlier, this broker is very vague about withdrawals, including the amount of time it can take to process them. This is very important for many traders to know since it would be crucial to know the timeframes in case a problem causes a delayed withdrawal. Sadly, the broker just doesn’t give us anything to go on here. From experience, we can definitely say that Bank Wire Transfer would likely take the longest to be received.

Bonuses & Promotions

Currently, the broker is not offering any special promotions or bonuses. Traders should never choose a broker based on special opportunities alone, although it’s always nice to have an opportunity to earn extra money. It’s possible that the broker could add some type of promotion in the future, so be sure to check from time to time if you sign-up.

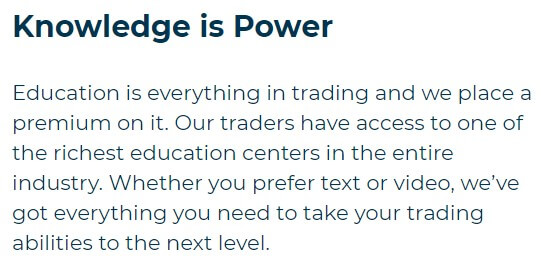

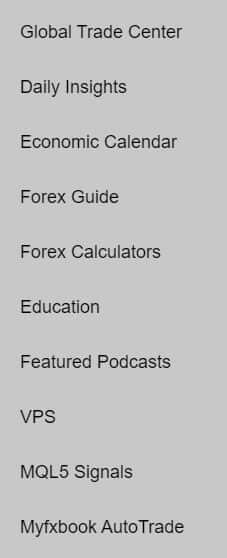

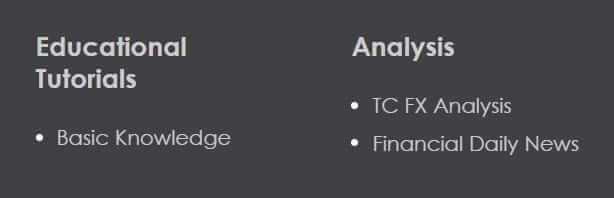

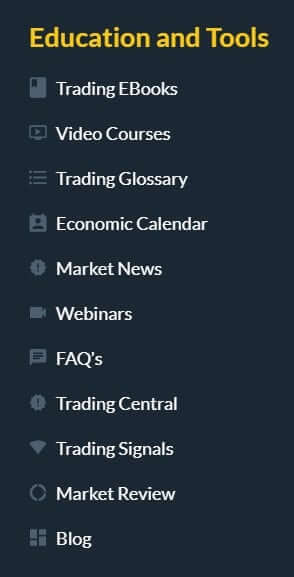

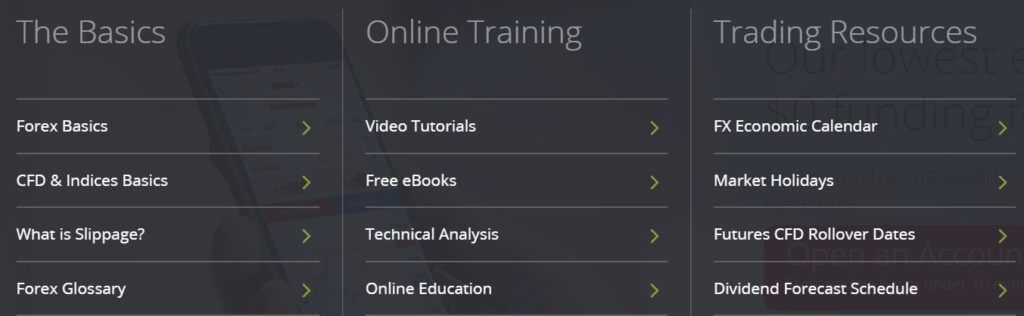

Educational & Trading Tools

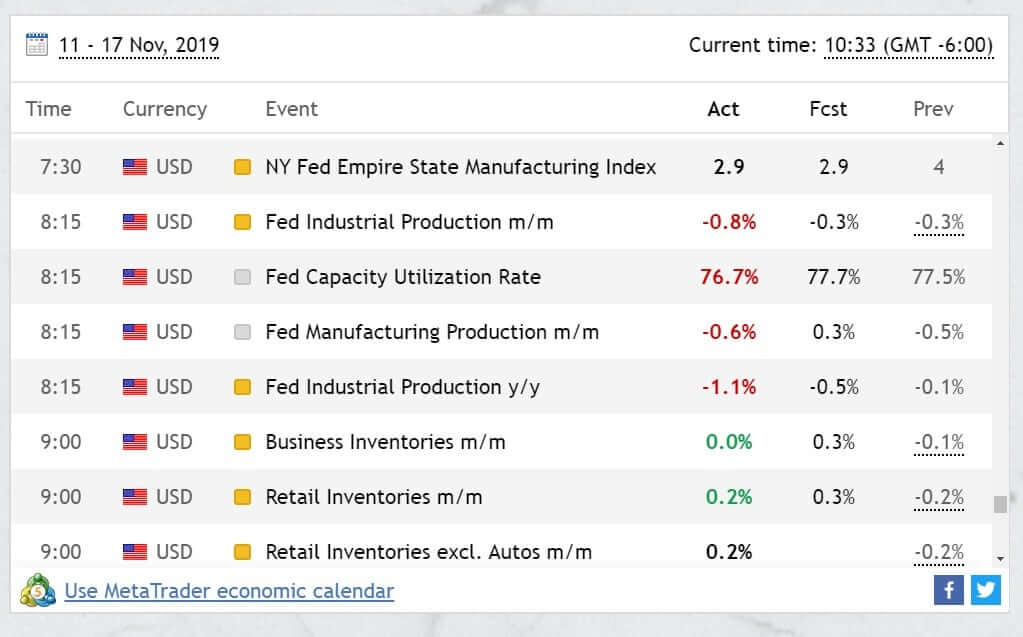

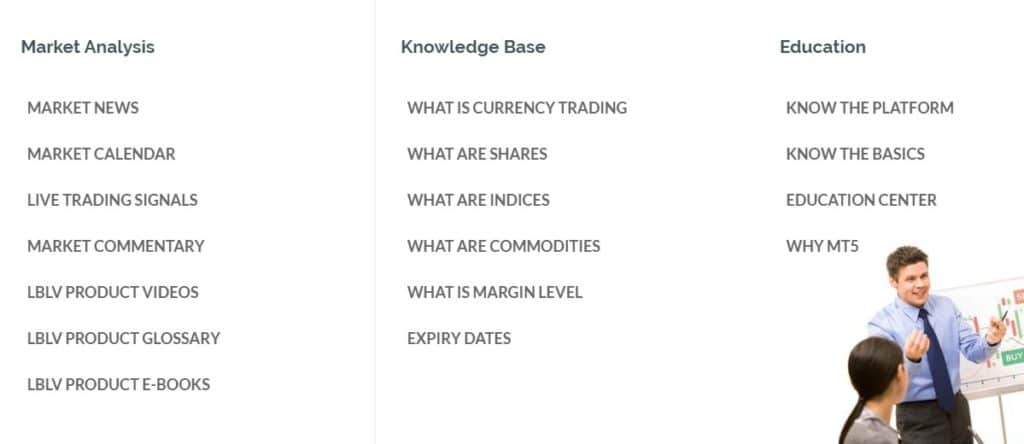

Most of the broker’s educational resources are located under the “Blog” > “Resources” section of the website. This section includes webinars related to operating MT4 and MT5, trading harmonic patterns, reading economic calendars, etc. Ebooks are also available and cover topics like effective forex trading strategies, risk management, and more. You’ll also find trading news, live quotes, an economic calendar, forex glossary, trading indicators, sentiment, and a FAQ.

Demo Account

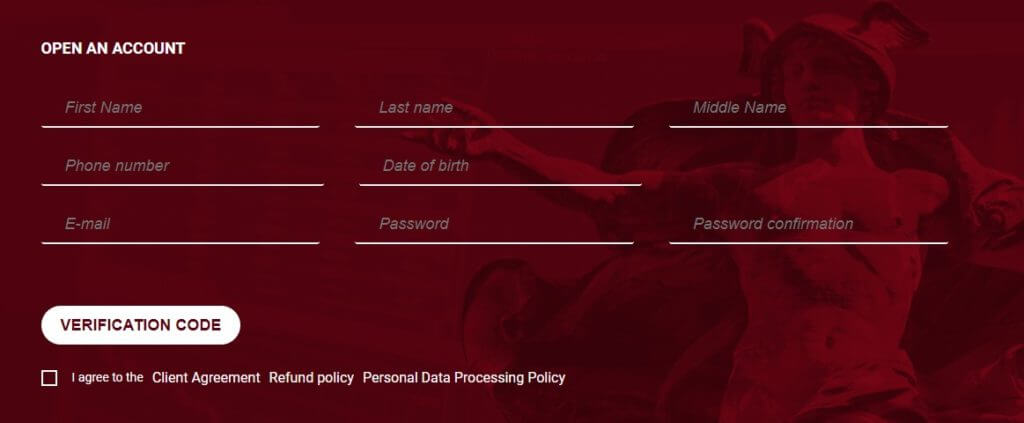

This broker labels their practice accounts as “Simulation Accounts”, although the concept is exactly the same as a demo account. Traders are able to sign-up for one of these accounts free of charge. In order to open a simulation account, you’ll need to fill in your name, country, phone number, email, and choose an account currency. The broker also offers the ability to choose between the two account types and MT4/MT5 trading platforms.

Another advantage would be the fact that the broker allows traders to type in any amount for their initial deposit, where many others choose a predetermined amount that may be unrealistic. Also, note that the US is missing from the country list, although there would be no reason one couldn’t select a different country for a training account. In addition, the broker offers simulation accounts, which are basically demo accounts.

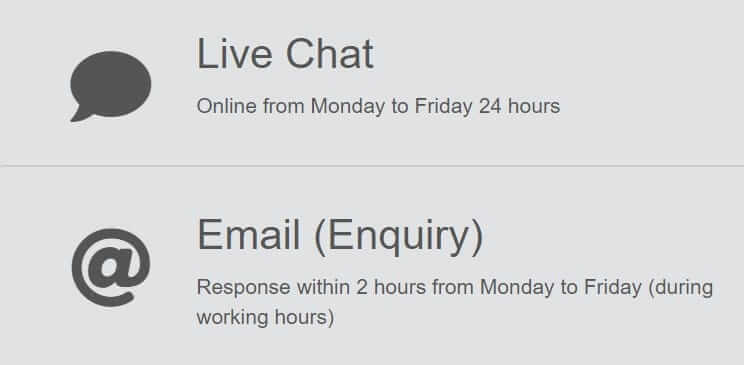

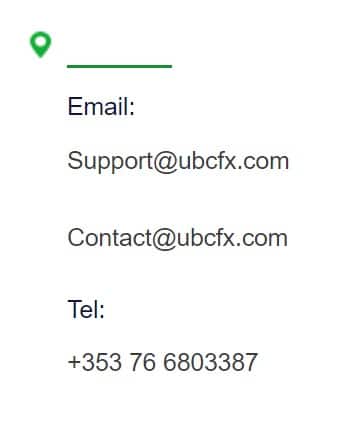

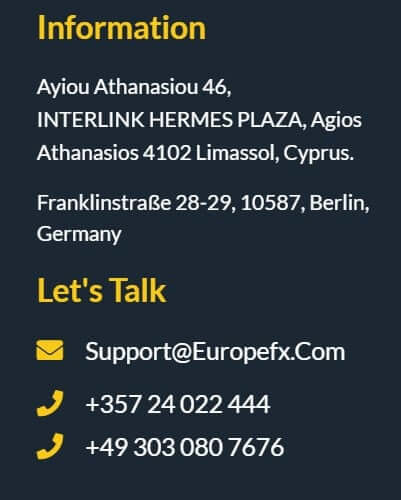

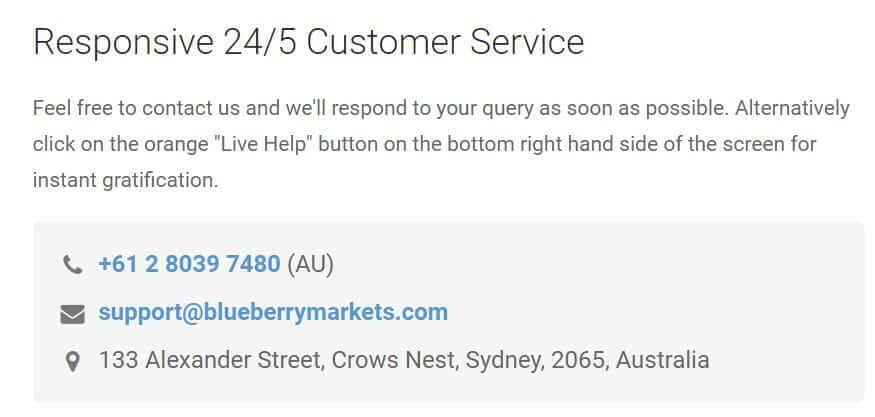

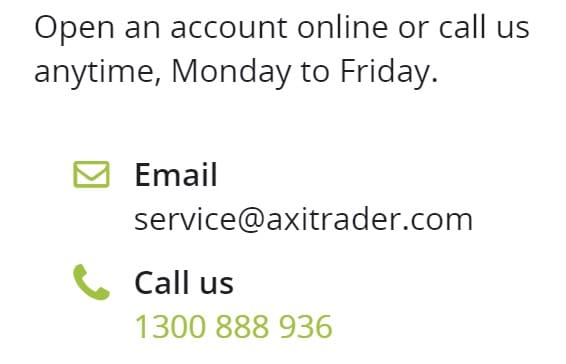

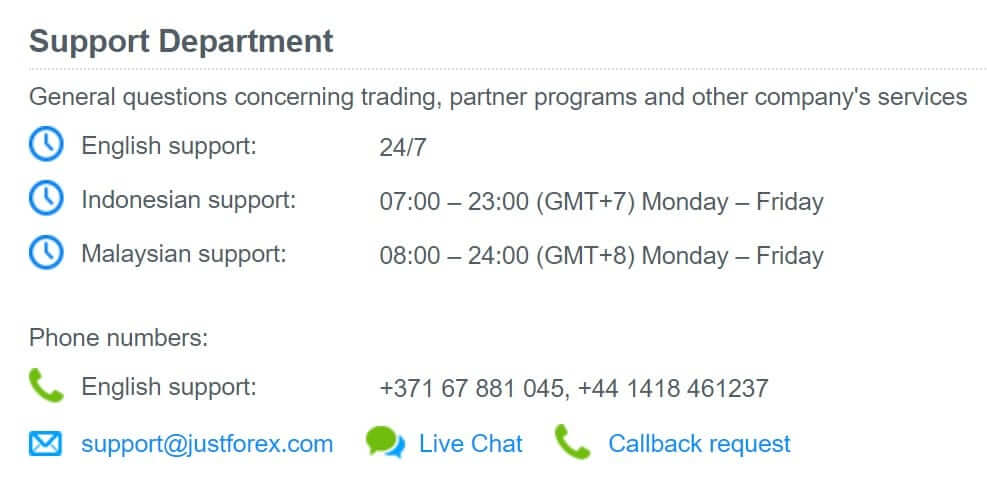

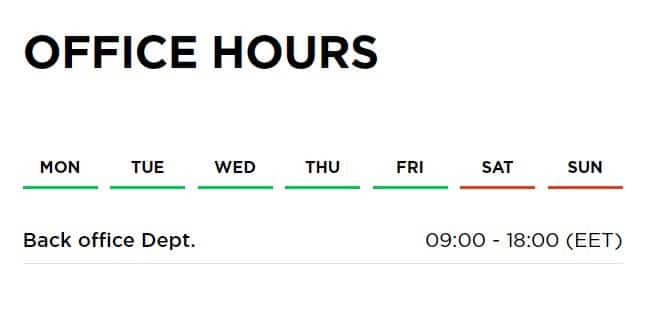

Customer Service

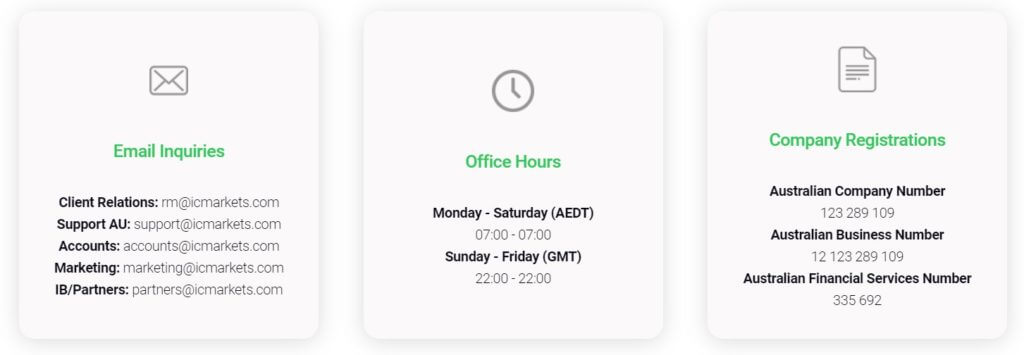

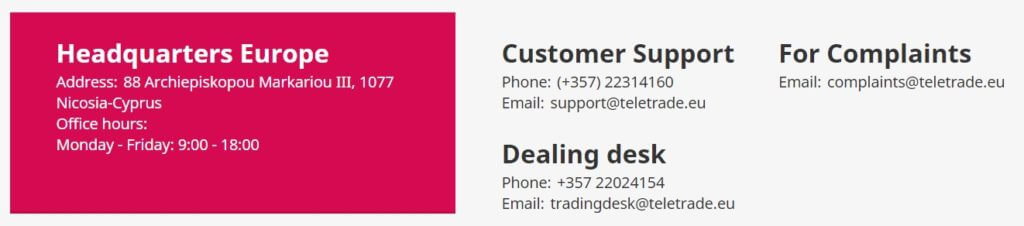

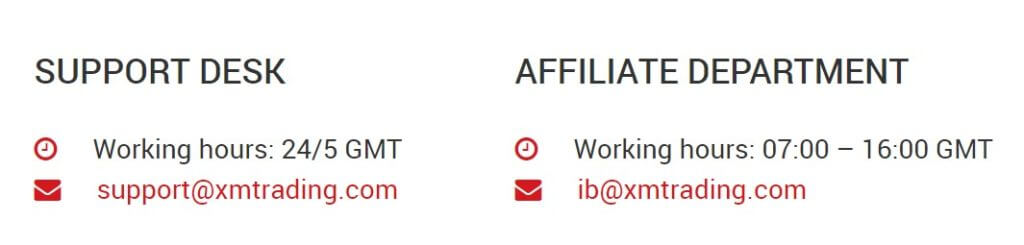

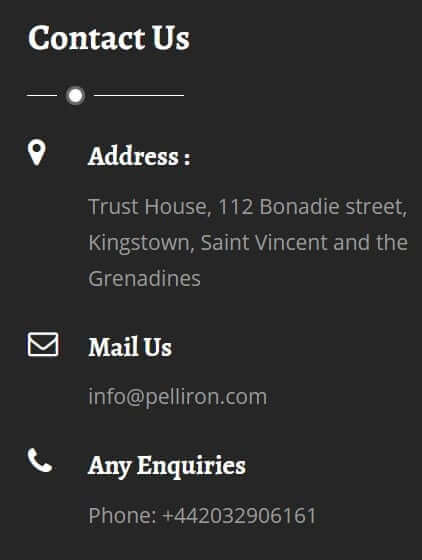

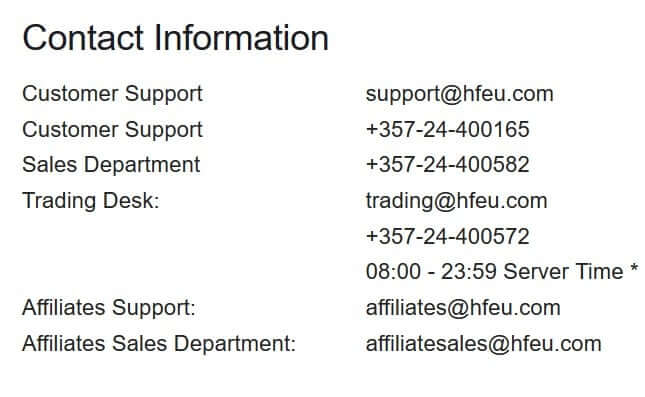

Support can be contacted via LiveChat, phone, email, or by filling out an online contact form. The broker is not clear about their working hours, although we did hear from support at a late hour. As usual, we made it a priority to test out the website’s LiveChat feature. Upon connecting in the chat, the broker displays a message stating that support typically replies within a few minutes. Not long after we joined the chat, the broker automatically asked for our email address and stated support would be in touch as soon as possible.

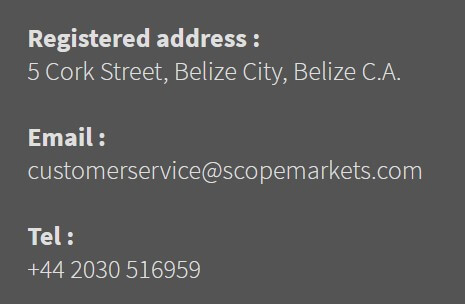

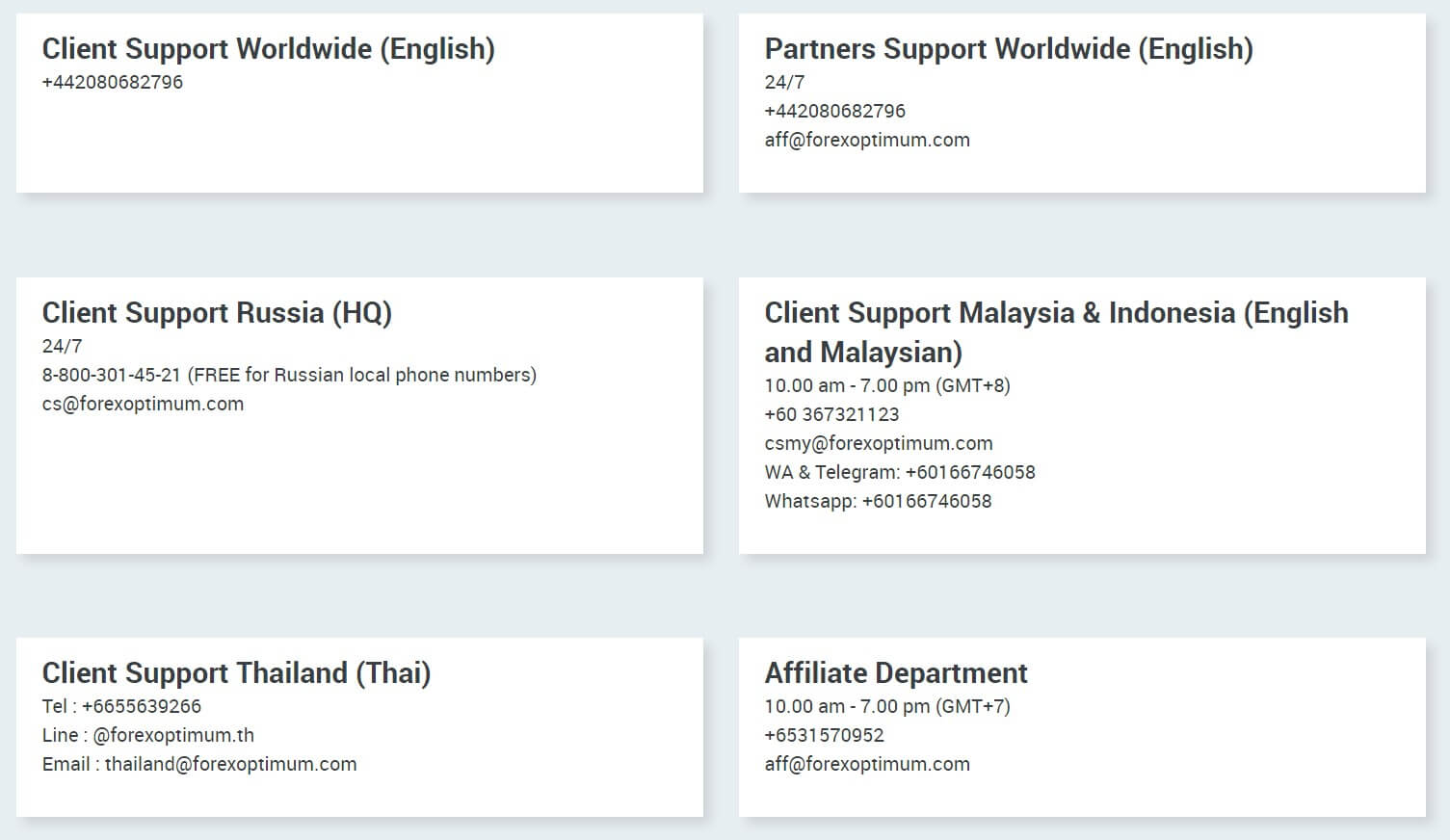

Hours later, support responded on the chat with an apology and an answer to our question. We were happy to receive a response, although we do feel that a support agent should have been online at the time we initially sent our message. On further attempts, support did not manage to respond at all. The contact form can be filled out on the website and all other listed contact information is included below.

Hours later, support responded on the chat with an apology and an answer to our question. We were happy to receive a response, although we do feel that a support agent should have been online at the time we initially sent our message. On further attempts, support did not manage to respond at all. The contact form can be filled out on the website and all other listed contact information is included below.

Phone: +44 (0) 20 3141 0888

Email: [email protected]

Address: 51 Eastcheap, London EC3M, 1JP, United Kingdom

Countries Accepted

The broker claims that the website is not intended for residents of the United States or any country where distribution would be contrary to local law or regulation. We still decided to attempt opening an account from our US-based offices, to see whether this restriction is upheld. Sadly, the US and all similar options are missing from the sign-up list, so there will be no way around this restriction. On the bright side, we did see that many other options that are often restricted are available.

Conclusion

ValueTrades is a regulated FX and CFD broker that offers several advantages, alongside a few disadvantages. There are no minimum deposit requirements for either of the available account types, spreads start from 0.0 or 1 pip, three trading platforms are offered, and leverage options go up to 1:500 for accounts that have equity of less than $20,000. Commission charges are only applicable on ECN accounts, so traders can choose between the lowest spreads with some commission charges, or having the commissions built-into the spread.

Some of the drawbacks would be lack of bonus opportunities, the fact that US residents cannot open accounts, and a limited variety of trading instruments, aside from currency pairs. Accounts can be funded through a variety of methods and there are no fees on deposits. The website is extremely vague when it comes to withdrawals, although we do know that the first three withdrawals each month are free.

We did find support to be available through a variety of methods, although it took a few hours for support to respond on LiveChat on our first attempt, and we received no response on further attempts. The website also provides a few educational resources in the form of eBooks and webinars. The conditions this broker offers can be advantageous; however, one must decide whether they can get past the vague information about withdrawals and other drawbacks before opening an account.

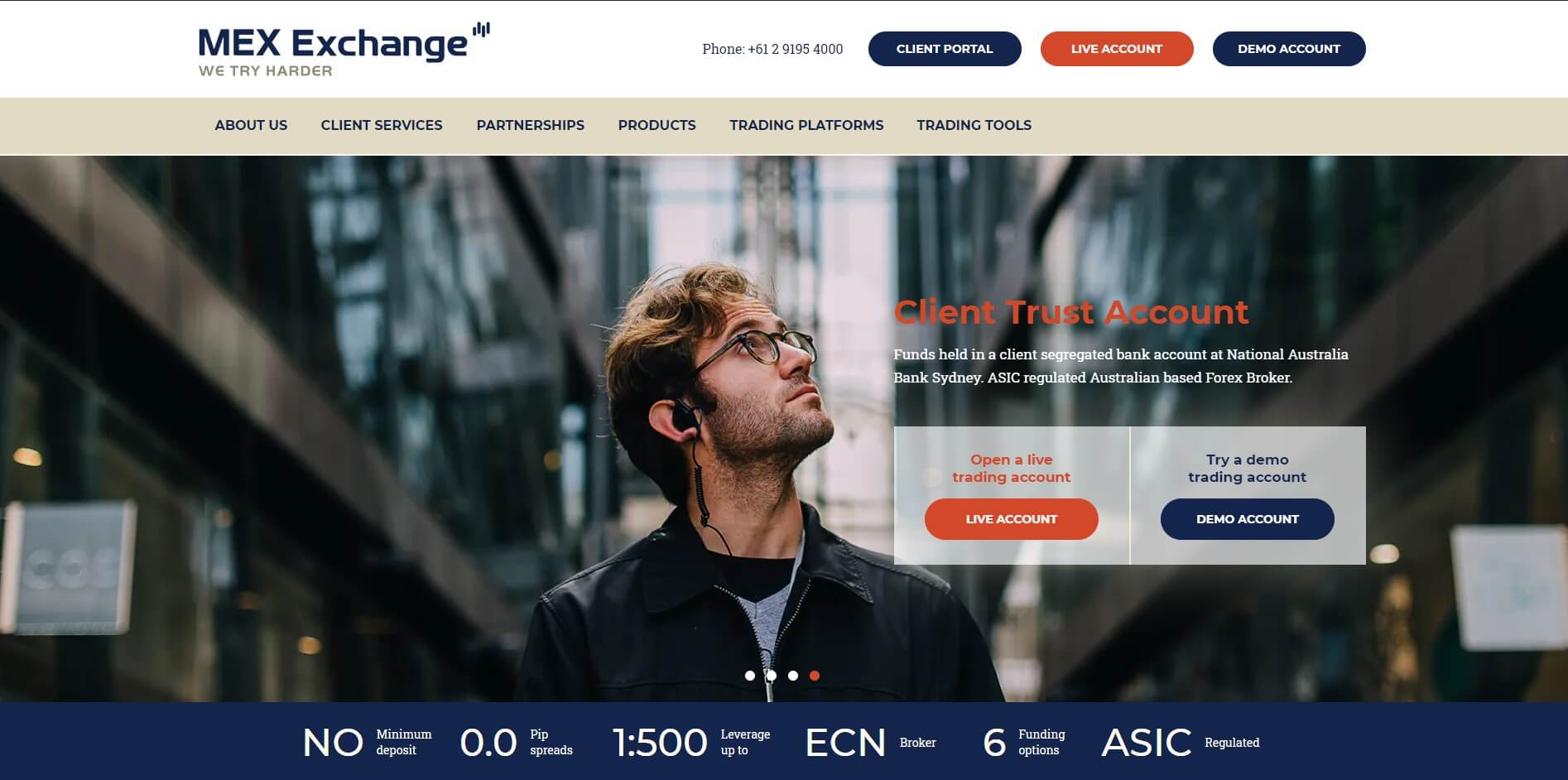

MEX NexGen MT4 – Provides traders with a clearer trading foresight through an additional 11 features on MT4. MEX NexGen MT4 is free to all traders who open a MEX Live or Demo trading account.

MEX NexGen MT4 – Provides traders with a clearer trading foresight through an additional 11 features on MT4. MEX NexGen MT4 is free to all traders who open a MEX Live or Demo trading account.

Emporio servers have an impressive 50ms average execution time like the server does not have any utilization. The same server is for Demo and Live accounts. Assets listing was very long and they are neatly categorized, for example, Forex pairs are grouped into 6 liquidity levels, where the most

Emporio servers have an impressive 50ms average execution time like the server does not have any utilization. The same server is for Demo and Live accounts. Assets listing was very long and they are neatly categorized, for example, Forex pairs are grouped into 6 liquidity levels, where the most

Emporio has a really impressive range of assets. Traders will enjoy great Forex offer, Metals, Stocks, Indices, Oil, and Cryptocurrencies. Starting with Forex, a plethora of exotics marks the broker. We counted a total of 56 currency pairs listed in the MT5. Apart from majors and major crosses, traders can find all of the Scandinavian currencies crossed with USD and EUR, Turkish Lira quoted with EUR, USD, and CHF. MXN, CHN, SGD, HUF also crossed with USD and EUR. The most

Emporio has a really impressive range of assets. Traders will enjoy great Forex offer, Metals, Stocks, Indices, Oil, and Cryptocurrencies. Starting with Forex, a plethora of exotics marks the broker. We counted a total of 56 currency pairs listed in the MT5. Apart from majors and major crosses, traders can find all of the Scandinavian currencies crossed with USD and EUR, Turkish Lira quoted with EUR, USD, and CHF. MXN, CHN, SGD, HUF also crossed with USD and EUR. The most

The broker states that maximum leverage is 1:500 for Forex and 1:50 for Cryptocurrencies. These levels were exactly what we found in both platforms. The only exception was the Tezos with the leverage of 1:2. Evolve Markets has a great overview of trading instruments online, with a filter that you can use if you seek a particular asset. The leverage of 1:500 on precious metals like Gold or Palladium is uncommon, but this broker can offer it as there are no restrictions by regulations. Also, this can be useful for low-risk Money Management to reduce the

The broker states that maximum leverage is 1:500 for Forex and 1:50 for Cryptocurrencies. These levels were exactly what we found in both platforms. The only exception was the Tezos with the leverage of 1:2. Evolve Markets has a great overview of trading instruments online, with a filter that you can use if you seek a particular asset. The leverage of 1:500 on precious metals like Gold or Palladium is uncommon, but this broker can offer it as there are no restrictions by regulations. Also, this can be useful for low-risk Money Management to reduce the

Evolve Markets has 5 categories, with each being deep enough to satisfy most traders. Starting with Forex, there are 50 total currency pairs. All majors are listed as well as the minors. To appeal to more demanding traders the list is expanded with exotics like the Scandinavian currencies with the EUR and USD and also NOK/SEK cross, USD/THB, TRY, SGD, RUB, PLN, MXN, HUF, HKD, and CNH, some of which have the EUR as the base.

Evolve Markets has 5 categories, with each being deep enough to satisfy most traders. Starting with Forex, there are 50 total currency pairs. All majors are listed as well as the minors. To appeal to more demanding traders the list is expanded with exotics like the Scandinavian currencies with the EUR and USD and also NOK/SEK cross, USD/THB, TRY, SGD, RUB, PLN, MXN, HUF, HKD, and CNH, some of which have the EUR as the base. Commodities range is minimal and only energies. Both Oil types, WTI and Brent are listed with the addition of Natural Gas. Other commodity assets are not very popular with the new age, younger traders, hence they are not listed.

Commodities range is minimal and only energies. Both Oil types, WTI and Brent are listed with the addition of Natural Gas. Other commodity assets are not very popular with the new age, younger traders, hence they are not listed.

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

Precious metals are limited to Spot Silver and Gold. Forex Optimum offers different currency quotes for these thus making a better selection even though the charts look very similar. A trader can find Spot Gold crossed with USD, GBP, CHF, EUR, and AUD. The same is with Silver making a total of 10 CFD on Metals.

Precious metals are limited to Spot Silver and Gold. Forex Optimum offers different currency quotes for these thus making a better selection even though the charts look very similar. A trader can find Spot Gold crossed with USD, GBP, CHF, EUR, and AUD. The same is with Silver making a total of 10 CFD on Metals.

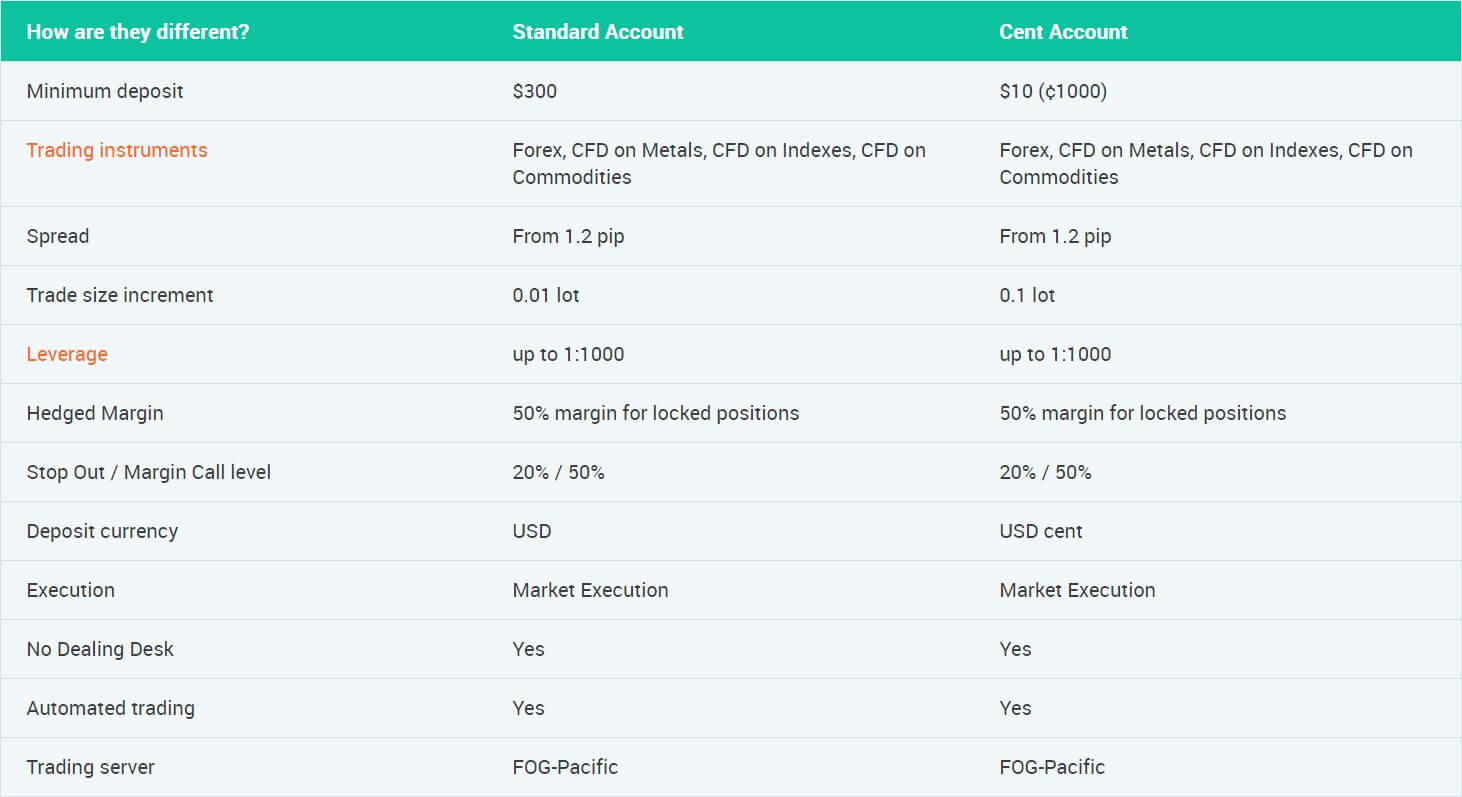

For the Cent Account, the minimum deposit is only $10. Traders that want to invest with Forex optimum can try their services, including the withdrawals and Signals with little risk. Scam brokers rarely have low-value deposit minimums. Standard Account requires a $300 deposit to be opened as well as the BTC (micro BTC) nominated. Mentioned

For the Cent Account, the minimum deposit is only $10. Traders that want to invest with Forex optimum can try their services, including the withdrawals and Signals with little risk. Scam brokers rarely have low-value deposit minimums. Standard Account requires a $300 deposit to be opened as well as the BTC (micro BTC) nominated. Mentioned

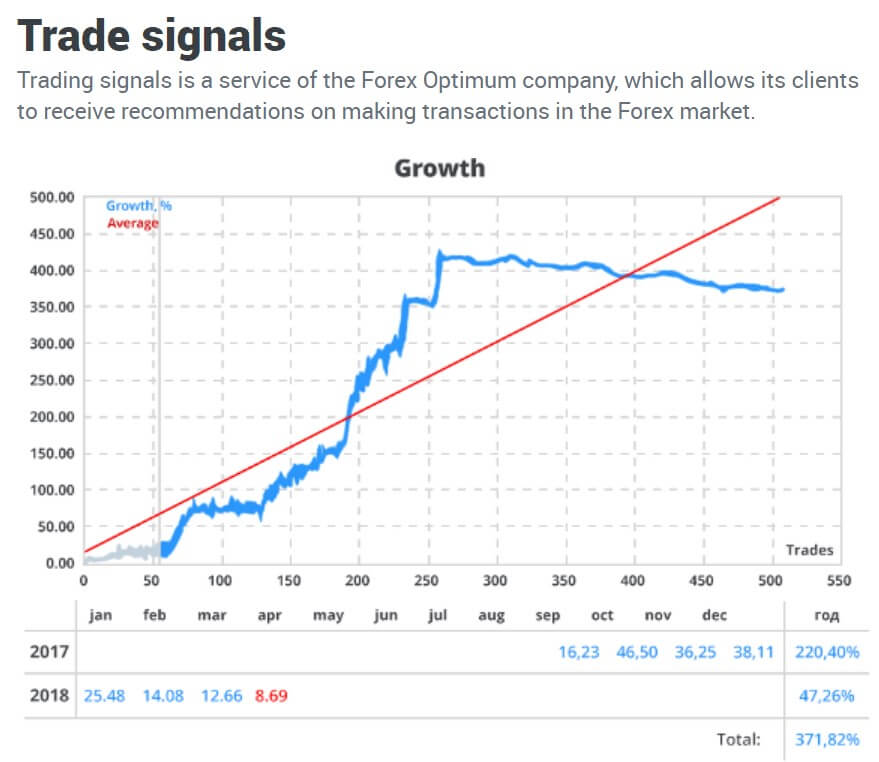

Trading Signal service is provided for registered accounts and has to be requested within the Client’s Portal. At first glance, the signals provided by the broker do not have a great depth and are based on Support/Resistance levels, basic trend indicators, channels, and

Trading Signal service is provided for registered accounts and has to be requested within the Client’s Portal. At first glance, the signals provided by the broker do not have a great depth and are based on Support/Resistance levels, basic trend indicators, channels, and

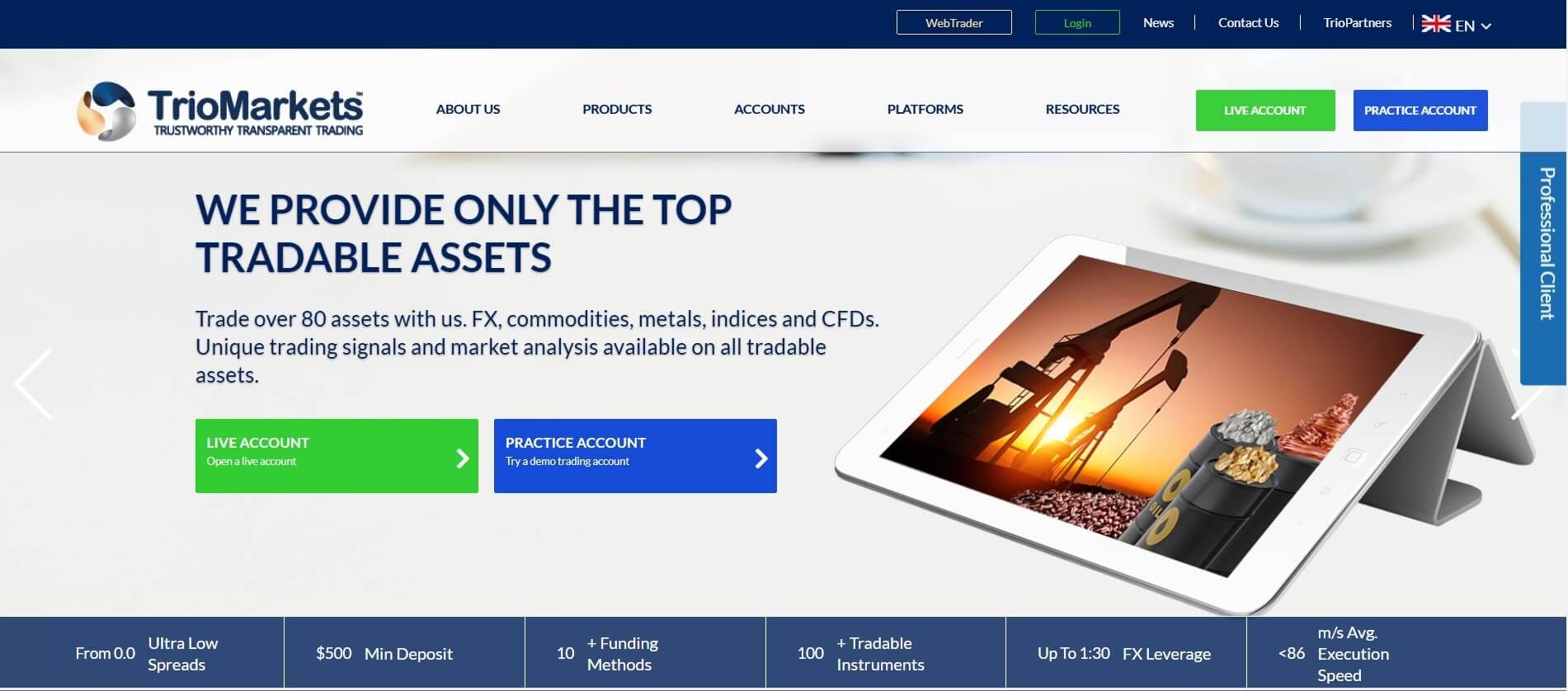

Traders Trust is not the best when it comes to variety and a wide selection of tradable assets, with only offering around 70 tradable instruments in total: Forex, Indices, and Commodities. Some traders may find this small selection satisfactory, while others may consider this limiting. We must note here that Traders Trust does not offer CFD crypto trading, which more and more brokers are not offering. This suggests that this broker is not particularly forward-thinking, and perhaps a little outdated with the provision of their trading services, in comparison to other brokers being added to the industry.

Traders Trust is not the best when it comes to variety and a wide selection of tradable assets, with only offering around 70 tradable instruments in total: Forex, Indices, and Commodities. Some traders may find this small selection satisfactory, while others may consider this limiting. We must note here that Traders Trust does not offer CFD crypto trading, which more and more brokers are not offering. This suggests that this broker is not particularly forward-thinking, and perhaps a little outdated with the provision of their trading services, in comparison to other brokers being added to the industry.

The only tools that you will find from Traders Trust are the standard: Economic calendar and a trading calculator, which is handy for both new and experienced traders alike. You will not, however, find any training or educational courses. Of course, these can be found online, anyhow, and for free.

The only tools that you will find from Traders Trust are the standard: Economic calendar and a trading calculator, which is handy for both new and experienced traders alike. You will not, however, find any training or educational courses. Of course, these can be found online, anyhow, and for free. Should you wish to get in touch with Traders Trust, you may contact them via Live Chat or email. For those that prefer telephone contact, unfortunately, you will be disappointed as this method of customer support is not available. Their customer support, however, operates on a 24/5 basis Monday to Friday on GMT+2 time zone. The response time is typically very prompt however the quality of response is not always consistent in reference to having to repeat oneself to get an answer.

Should you wish to get in touch with Traders Trust, you may contact them via Live Chat or email. For those that prefer telephone contact, unfortunately, you will be disappointed as this method of customer support is not available. Their customer support, however, operates on a 24/5 basis Monday to Friday on GMT+2 time zone. The response time is typically very prompt however the quality of response is not always consistent in reference to having to repeat oneself to get an answer.

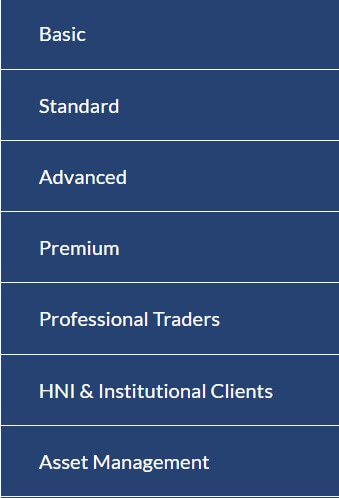

Basic: leverage of 1:30, minimum spread from 2.4 Pips and No commission charged

Basic: leverage of 1:30, minimum spread from 2.4 Pips and No commission charged

For all accounts (Basic, Standard, Advanced and Premium), clients can trade with a maximum leverage of 1:30, which is not particularly amicable for the majority of traders, but this is, of course, a result of regulatory policies that the broker must comply with. However, should you consider yourself a ‘professional’ trader, you can apply for the professional account, which entitles you to higher leverage, depending on how much you deposit. This information is not particularly clear until you submit the request for such an account.

For all accounts (Basic, Standard, Advanced and Premium), clients can trade with a maximum leverage of 1:30, which is not particularly amicable for the majority of traders, but this is, of course, a result of regulatory policies that the broker must comply with. However, should you consider yourself a ‘professional’ trader, you can apply for the professional account, which entitles you to higher leverage, depending on how much you deposit. This information is not particularly clear until you submit the request for such an account.

Educational & Trading Tools

Educational & Trading Tools

Trading Costs

Trading Costs

Educational & Trading Tools

Educational & Trading Tools LegacyFX provides a very satisfied customer support service via Telephone, Email and Live Chat. If you need to reach out to LegacyFX with any issues or queries, you may send your messages in between the hours of 8 AM-10 PM (UK time) Monday – Friday. Overall it should be noted that the quality of customer service is more than adequate, and responses are delivered efficiently. All answers received were comprehensive, polite and friendly, and live chat responds very promptly (a couple of minutes).

LegacyFX provides a very satisfied customer support service via Telephone, Email and Live Chat. If you need to reach out to LegacyFX with any issues or queries, you may send your messages in between the hours of 8 AM-10 PM (UK time) Monday – Friday. Overall it should be noted that the quality of customer service is more than adequate, and responses are delivered efficiently. All answers received were comprehensive, polite and friendly, and live chat responds very promptly (a couple of minutes).

The e-book has high quality and solid structure, it describes the basics very well and has some interesting unique content, with some company marketing mixed in. ACY e-book is genuine and good for any beginner, just do not expect to learn something if you know how to trade even the basic setups.

The e-book has high quality and solid structure, it describes the basics very well and has some interesting unique content, with some company marketing mixed in. ACY e-book is genuine and good for any beginner, just do not expect to learn something if you know how to trade even the basic setups.

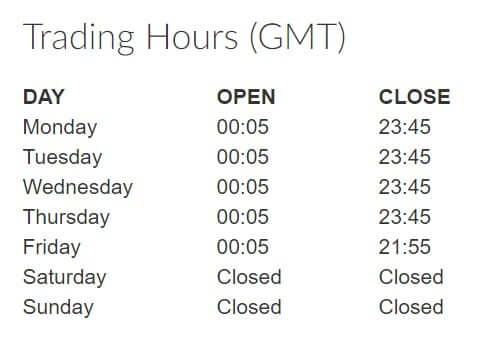

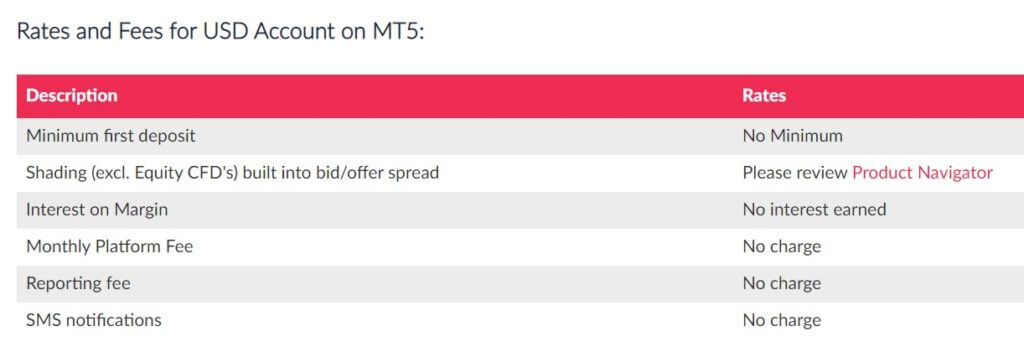

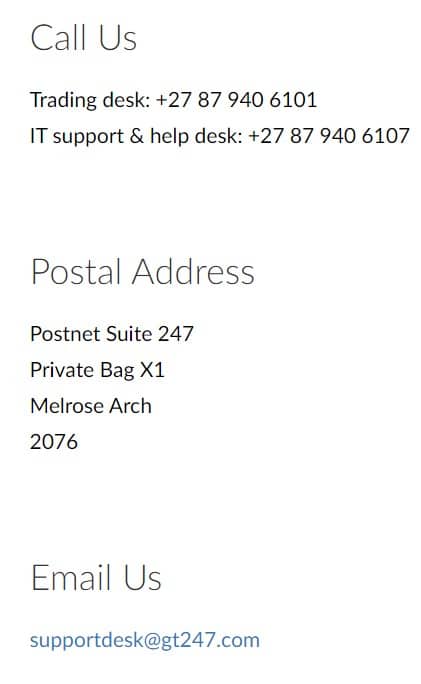

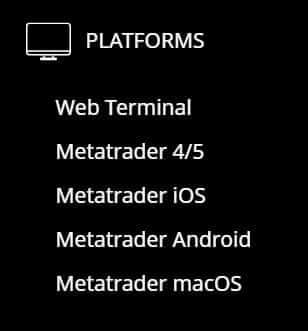

GT247 states that they offer 6 different platforms when in reality they offer a single platform (MetaTrader 5) which has multiple versions for different platforms such as desktop or iOS devices.

GT247 states that they offer 6 different platforms when in reality they offer a single platform (MetaTrader 5) which has multiple versions for different platforms such as desktop or iOS devices. Leverage can be selected up to 1:80 as a maximum, it can range from between 1:1 as a low up to 1:80. This can be selected when opening a new account.

Leverage can be selected up to 1:80 as a maximum, it can range from between 1:1 as a low up to 1:80. This can be selected when opening a new account.

The full extent of assets and instruments available on GT247 is not apparent to us. There is mention of there being over 65 fx pairs, indices, commodities, and crypto to trade, however, there is not a breakdown of what they are.

The full extent of assets and instruments available on GT247 is not apparent to us. There is mention of there being over 65 fx pairs, indices, commodities, and crypto to trade, however, there is not a breakdown of what they are.

Customer Service

Customer Service

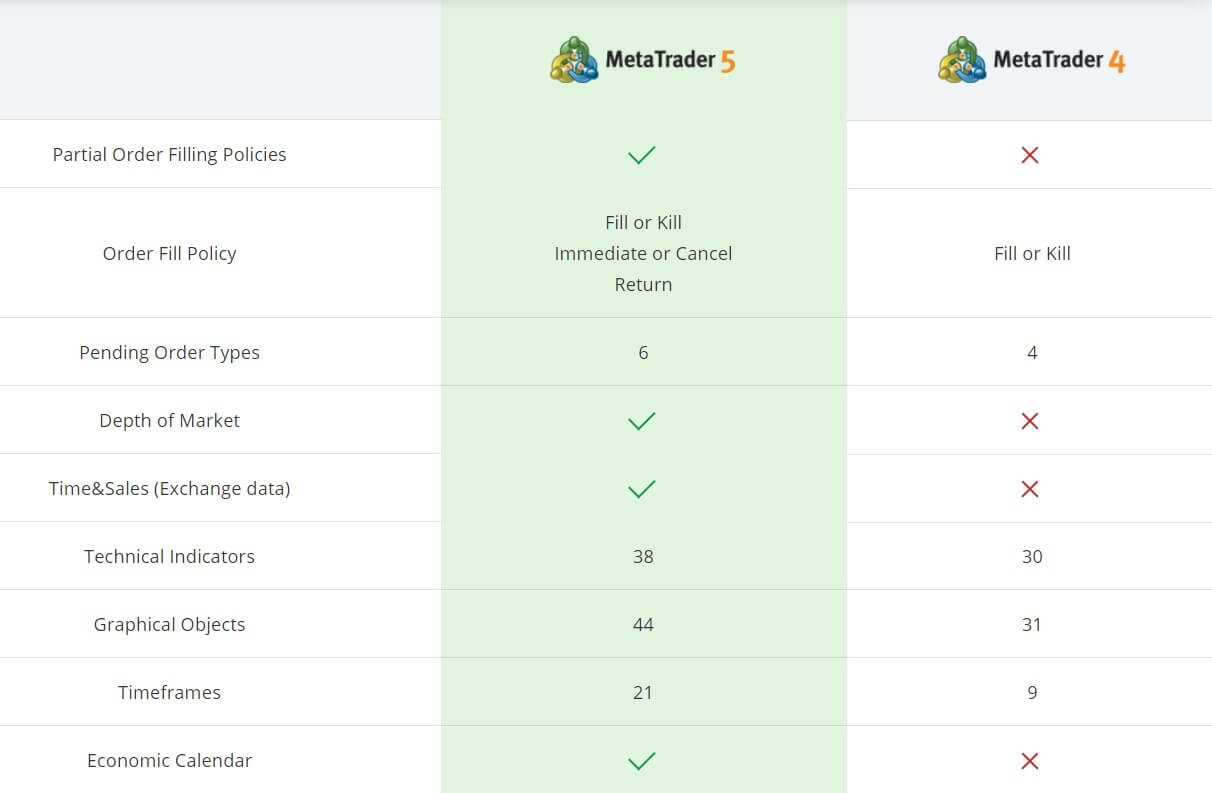

The Standard and NDD account types both support MetaTrader 4, while the ECN account supports MetaTrader 5. If you’ve used either platform before, you’ll already know just how powerful MT4/MT5 can be. Both offer advanced tools, although MT5 includes 2 more pending order types, more technical indicators, graphical objects, and timeframes than its predecessor.

The Standard and NDD account types both support MetaTrader 4, while the ECN account supports MetaTrader 5. If you’ve used either platform before, you’ll already know just how powerful MT4/MT5 can be. Both offer advanced tools, although MT5 includes 2 more pending order types, more technical indicators, graphical objects, and timeframes than its predecessor.

All accounts offer FX and CFD instruments; however, the Standard and NDD accounts offer more than 200 instruments, while the ECN account limits the number of available instruments to 100. CFDS are made up of Metals, Indices, Energies, Stocks, ETFs, and Cryptocurrencies. Beginning with FX options, we counted 66 available currency pairs on the Standard account, 60 options on the NDD account, and 57 options on the ECN account. This isn’t much of a difference, although some traders will find these numbers important.

All accounts offer FX and CFD instruments; however, the Standard and NDD accounts offer more than 200 instruments, while the ECN account limits the number of available instruments to 100. CFDS are made up of Metals, Indices, Energies, Stocks, ETFs, and Cryptocurrencies. Beginning with FX options, we counted 66 available currency pairs on the Standard account, 60 options on the NDD account, and 57 options on the ECN account. This isn’t much of a difference, although some traders will find these numbers important.

Accounts can be funded by Wire Transfer, cards, or through a few electronic payment methods. One of this broker’s disadvantages would be fees charged on deposits and withdrawals, which can really add up, especially for those making large deposits, or withdrawing through international Bank Wire. The only way to avoid these fees would be to hold an account of Gold or Platinum status.

Accounts can be funded by Wire Transfer, cards, or through a few electronic payment methods. One of this broker’s disadvantages would be fees charged on deposits and withdrawals, which can really add up, especially for those making large deposits, or withdrawing through international Bank Wire. The only way to avoid these fees would be to hold an account of Gold or Platinum status.

Assets

Assets

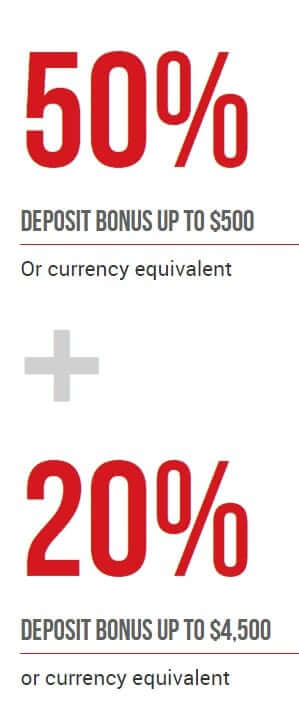

Currently, the broker is offering a few different opportunities in this category. There’s a $30 Trading Bonus, a 50% + 20% Deposit Bonus, a Loyalty Program, Free VPS Services, and Zero Fees on Deposits & Withdrawals. As usual, we took a more in-depth look at some of these offers, since terms and conditions are so important. We’ve provided a brief description and some of the most important qualifying factors below, although you’ll want to read the entire list of terms and conditions for any promotion you may be interested in on the website. Also, note that the broker mentions that new time-sensitive offers are available periodically, so be sure to keep a lookout for any additions.

Currently, the broker is offering a few different opportunities in this category. There’s a $30 Trading Bonus, a 50% + 20% Deposit Bonus, a Loyalty Program, Free VPS Services, and Zero Fees on Deposits & Withdrawals. As usual, we took a more in-depth look at some of these offers, since terms and conditions are so important. We’ve provided a brief description and some of the most important qualifying factors below, although you’ll want to read the entire list of terms and conditions for any promotion you may be interested in on the website. Also, note that the broker mentions that new time-sensitive offers are available periodically, so be sure to keep a lookout for any additions.

For Pro account holders, the smallest leverage option is 1:1. On Crypto accounts, clients can start with leverage of 1:3. Note that choosing leverage of 1:1 would simply mean that one is trading with the exact amount of funds that are available in their account. The Crypto account type allows for

For Pro account holders, the smallest leverage option is 1:1. On Crypto accounts, clients can start with leverage of 1:3. Note that choosing leverage of 1:1 would simply mean that one is trading with the exact amount of funds that are available in their account. The Crypto account type allows for  All three of the remaining account types offer the largest variety, with Forex, Metals, and Commodities being available. Now, we will look into the tradable instruments in more detail. Starting with

All three of the remaining account types offer the largest variety, with Forex, Metals, and Commodities being available. Now, we will look into the tradable instruments in more detail. Starting with

Support can be contacted through LiveChat, email, by phone, or by filling out a callback request. The company doesn’t advertise their hours on the website, so we used the opportunity to test out the website’s LiveChat feature. Sadly, support did not get back to us as quickly as we had hoped. After seven minutes with no initial response, we messaged our support agent a second time. Eventually, we gave up on the chat. This could be blamed on it being a late hour when we tested, although our support agent was active and online.

Support can be contacted through LiveChat, email, by phone, or by filling out a callback request. The company doesn’t advertise their hours on the website, so we used the opportunity to test out the website’s LiveChat feature. Sadly, support did not get back to us as quickly as we had hoped. After seven minutes with no initial response, we messaged our support agent a second time. Eventually, we gave up on the chat. This could be blamed on it being a late hour when we tested, although our support agent was active and online.

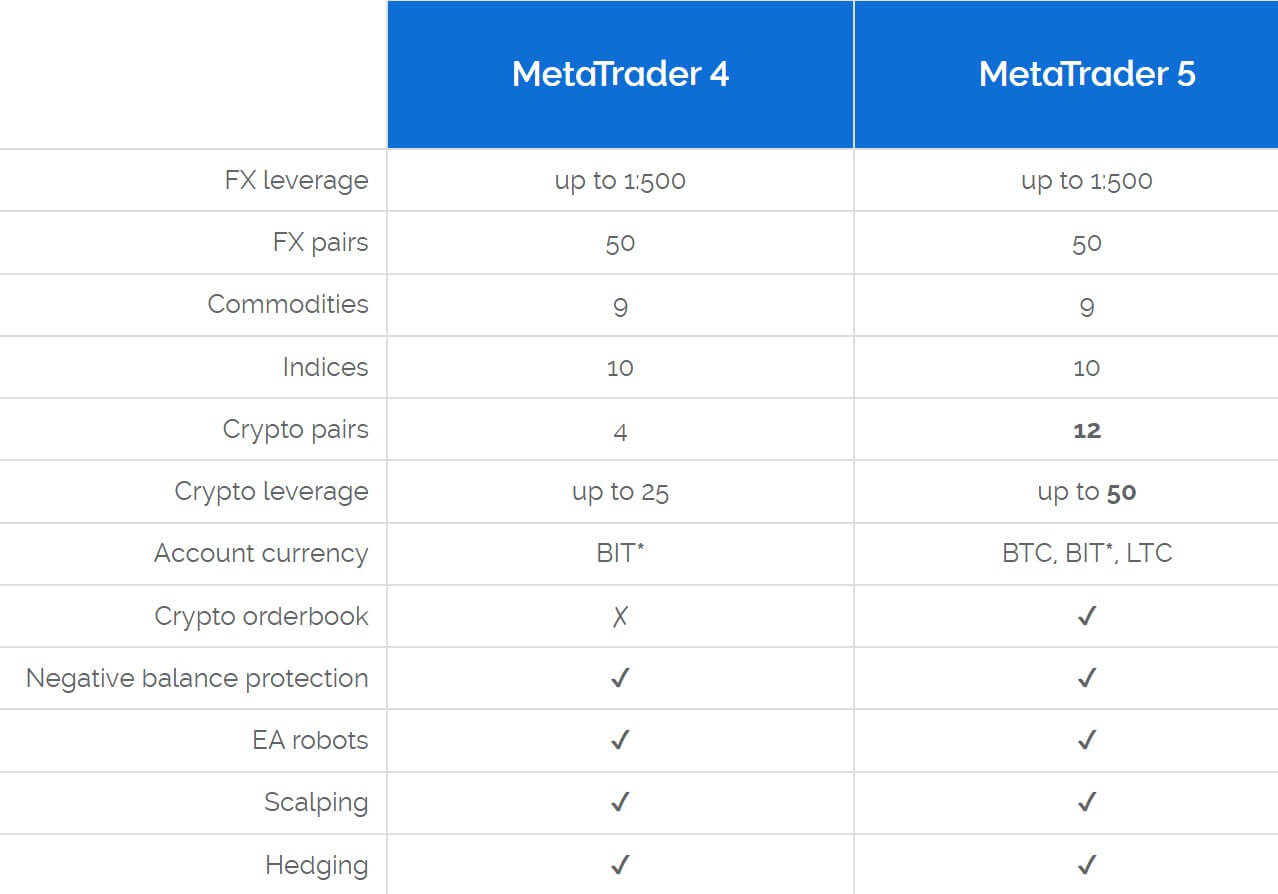

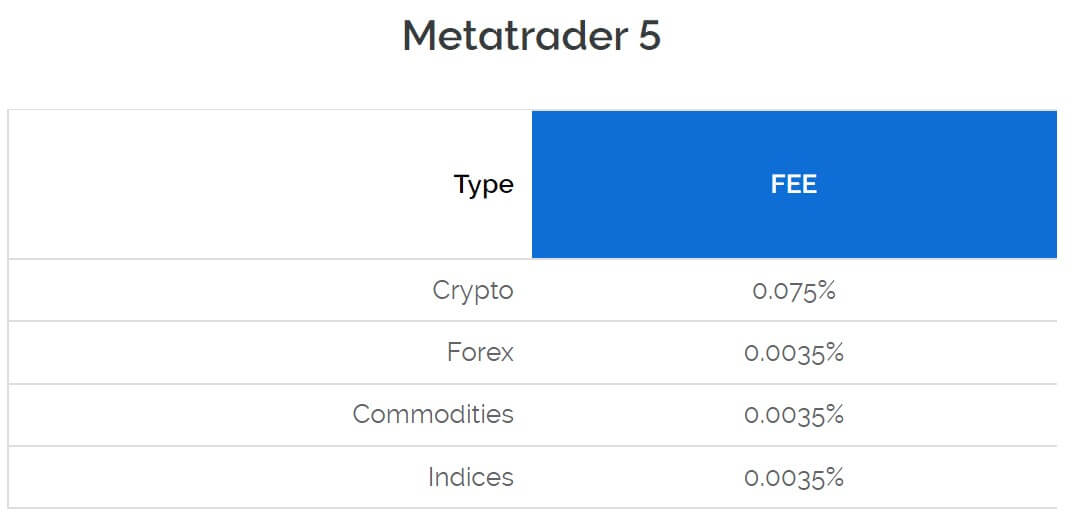

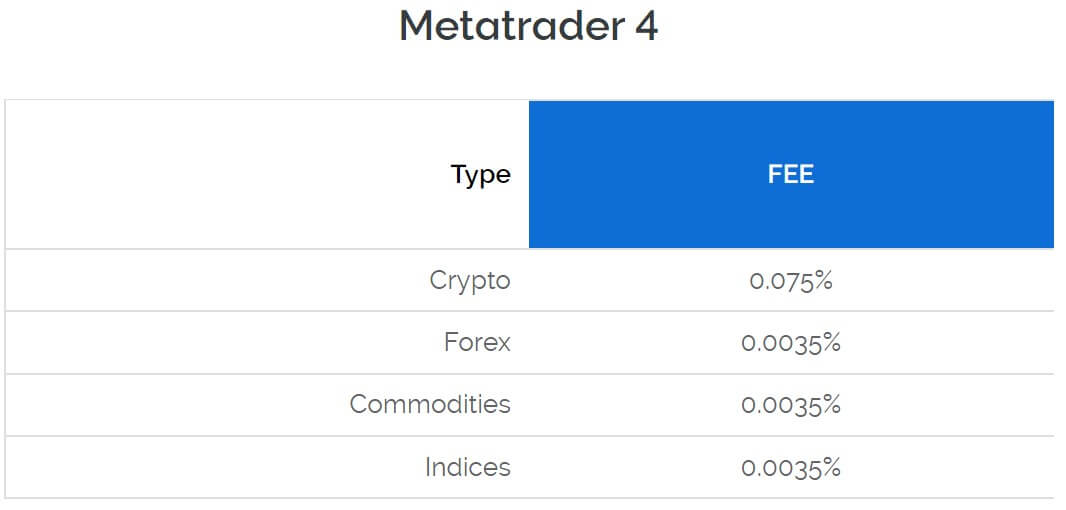

Both the MetaTrader 4 and 5 platforms are available for clients to choose from. Many brokers make the selection for their clients, so it’s nice to see options here, especially since these are the most popular trading platforms in the world today. Both offer many similarities, although MT5 offers a few additional features. The company provides the same specifications, including tradable assets, on both platforms, so the decision would really only need to be based on the platform alone. Demo accounts are available on both platforms, so consider testing out one version or the other on a demo account if you’re not sure which to choose. Both platforms can be downloaded on PC and MAC, through mobile apps, or via the WebTrader.

Both the MetaTrader 4 and 5 platforms are available for clients to choose from. Many brokers make the selection for their clients, so it’s nice to see options here, especially since these are the most popular trading platforms in the world today. Both offer many similarities, although MT5 offers a few additional features. The company provides the same specifications, including tradable assets, on both platforms, so the decision would really only need to be based on the platform alone. Demo accounts are available on both platforms, so consider testing out one version or the other on a demo account if you’re not sure which to choose. Both platforms can be downloaded on PC and MAC, through mobile apps, or via the WebTrader.

We mentioned the spreads for each account type earlier, but we will go into further detail now. Just to recap, the

We mentioned the spreads for each account type earlier, but we will go into further detail now. Just to recap, the

50% Welcome Bonus: Currently, clients can earn a 50% bonus, based on their initial deposit on MT4 Standard STP accounts. The smallest bonus is applied on deposits of at least $300, while the largest bonus tops out at $250 on deposits of $500 or more. Note that you’ll need to make a deposit that is $100 higher than the minimum requirement on this account type in order to qualify for this bonus. There are a lot of conditions for this bonus, so we will list the most important terms here and recommend that anyone interested in this bonus should take a look at the full list of terms & conditions.

50% Welcome Bonus: Currently, clients can earn a 50% bonus, based on their initial deposit on MT4 Standard STP accounts. The smallest bonus is applied on deposits of at least $300, while the largest bonus tops out at $250 on deposits of $500 or more. Note that you’ll need to make a deposit that is $100 higher than the minimum requirement on this account type in order to qualify for this bonus. There are a lot of conditions for this bonus, so we will list the most important terms here and recommend that anyone interested in this bonus should take a look at the full list of terms & conditions. Vantage FX Rebate: When you join the Vantage FX Rebate program, you can receive $2 AUD per standard FX back to your MT4 trading account in cash rebates. Rebates are calculated and added to account balances daily and can be withdrawn at any time. There are no time limits and no restrictions on trade sizes, which maximizes the potential to earn. Sadly, rebates are only available on the Standard STP account type. Also, traders must deposit at least $1,000 to participate. Note that this account has a minimum of only $200.

Vantage FX Rebate: When you join the Vantage FX Rebate program, you can receive $2 AUD per standard FX back to your MT4 trading account in cash rebates. Rebates are calculated and added to account balances daily and can be withdrawn at any time. There are no time limits and no restrictions on trade sizes, which maximizes the potential to earn. Sadly, rebates are only available on the Standard STP account type. Also, traders must deposit at least $1,000 to participate. Note that this account has a minimum of only $200. Educational resources are mostly made up of manuals and learning videos. The company has provided a breakdown of the Market Overview, Markey Analysis, and Trading Psychology under ‘Education’ > ‘Learn Forex’. Manuals are also provided that explain everything relevant to installing and

Educational resources are mostly made up of manuals and learning videos. The company has provided a breakdown of the Market Overview, Markey Analysis, and Trading Psychology under ‘Education’ > ‘Learn Forex’. Manuals are also provided that explain everything relevant to installing and

Vantage FX is a multiple award-winning, regulated Forex and CFD broker that offers three different account types with varying deposit requirements that start from $200. Trading costs can be advantageous but differ based on which account type has been chosen, with better spreads offered on the more expensive account types. Leverage options can go as high as 500:1 but those options are only available upon approval.

Vantage FX is a multiple award-winning, regulated Forex and CFD broker that offers three different account types with varying deposit requirements that start from $200. Trading costs can be advantageous but differ based on which account type has been chosen, with better spreads offered on the more expensive account types. Leverage options can go as high as 500:1 but those options are only available upon approval.

Platforms

Platforms Trade Sizes

Trade Sizes

Demo Account

Demo Account

It took a while to find, but there are a few different deposit methods available from YaMarkets, these are credit/debit cards, bank wire transfers, Neteller and Moneybookers. There are be others available but we could not locate much information about them. There is also no indication of any fees, although the promotion regarding free transfer fees states that deposits over $200 have no fees, so we can assume that there are if you are depositing a smaller amount.

It took a while to find, but there are a few different deposit methods available from YaMarkets, these are credit/debit cards, bank wire transfers, Neteller and Moneybookers. There are be others available but we could not locate much information about them. There is also no indication of any fees, although the promotion regarding free transfer fees states that deposits over $200 have no fees, so we can assume that there are if you are depositing a smaller amount.

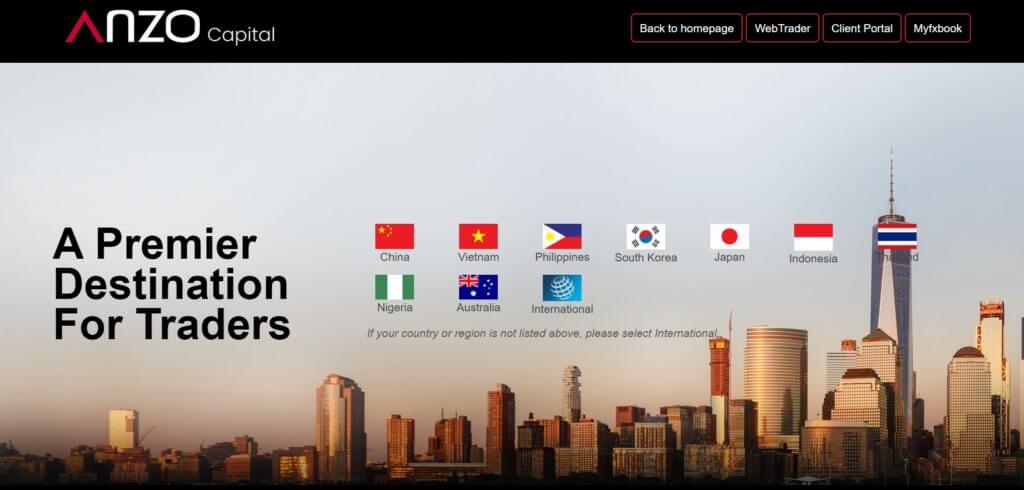

There is just a single platform available to use the Anzo Capital, the good news is that it is MetaTrader 4 which is always a solid choice.

There is just a single platform available to use the Anzo Capital, the good news is that it is MetaTrader 4 which is always a solid choice.

a. Complete at least 5

a. Complete at least 5  There are a number of different educational and trading tools available as well as some other basics to help with analysis.

There are a number of different educational and trading tools available as well as some other basics to help with analysis.

Leverage

Leverage

The FXGlobe academy is there to help you learn and earn. There are a number of different courses available which will teach you a lot of the basics when it comes to trading and how to use different software such as MetaTrader 4.

The FXGlobe academy is there to help you learn and earn. There are a number of different courses available which will teach you a lot of the basics when it comes to trading and how to use different software such as MetaTrader 4.

LBLV are offering a single trading platform, the good news is that it is MetaTrader 5 (MT5).

LBLV are offering a single trading platform, the good news is that it is MetaTrader 5 (MT5). Assets

Assets

Rebates: Ther is also a simpler rebate program where you can receive $2 per lot on a Standard STP account which technically is just lowering the overall trading cost.

Rebates: Ther is also a simpler rebate program where you can receive $2 per lot on a Standard STP account which technically is just lowering the overall trading cost.

Direct: The direct account keeps the $1 minimum deposit as well as the same leverage levels and trade sizes. It has a spread from 0.7 pips and has 117 tradable instruments including forex, crypto, and CFDs. Margin call level remains at 100% and the stop out level is at 20%. This account can use MetaTrader 5 only as its trading platform. This account also uses instant execution to make the trades.

Direct: The direct account keeps the $1 minimum deposit as well as the same leverage levels and trade sizes. It has a spread from 0.7 pips and has 117 tradable instruments including forex, crypto, and CFDs. Margin call level remains at 100% and the stop out level is at 20%. This account can use MetaTrader 5 only as its trading platform. This account also uses instant execution to make the trades.

Customer support is open from 9:00 to 21:00 Monday to Friday Moscow time rather than the usual 24 hours. You can use the online web form to send your query and receive a message back via email, or you can use the email address provided directly. There is also a phone number provided should you wish to talk with someone directly. We sent a message using the webform, it has currently been 48 hours and we are yet to receive a reply which does not fill us with confidence.

Customer support is open from 9:00 to 21:00 Monday to Friday Moscow time rather than the usual 24 hours. You can use the online web form to send your query and receive a message back via email, or you can use the email address provided directly. There is also a phone number provided should you wish to talk with someone directly. We sent a message using the webform, it has currently been 48 hours and we are yet to receive a reply which does not fill us with confidence.

Leverage

Leverage Assets

Assets

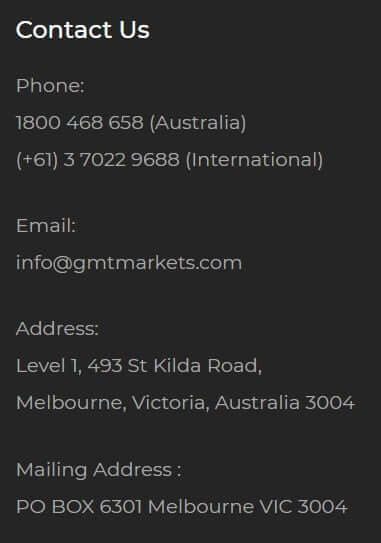

Should you wish to get in contact with GMT Markets with a question or help request, you can do it in a number of different ways. You can use the online web form to submit your query and can expect a reply back via email. There is also a physical address as well as a PO box should you wish to send a lett, also a direct email address and phone number for a more personal experience.

Should you wish to get in contact with GMT Markets with a question or help request, you can do it in a number of different ways. You can use the online web form to submit your query and can expect a reply back via email. There is also a physical address as well as a PO box should you wish to send a lett, also a direct email address and phone number for a more personal experience.

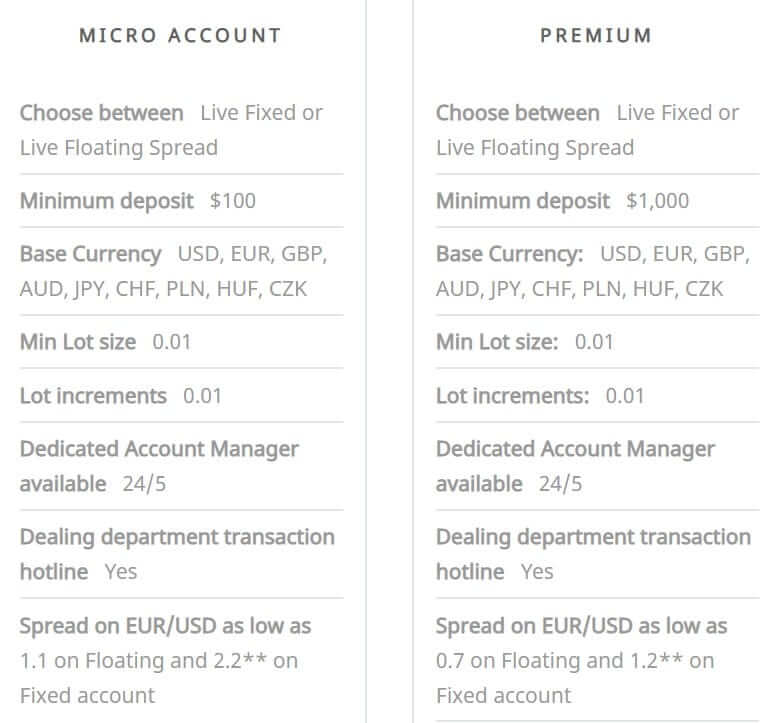

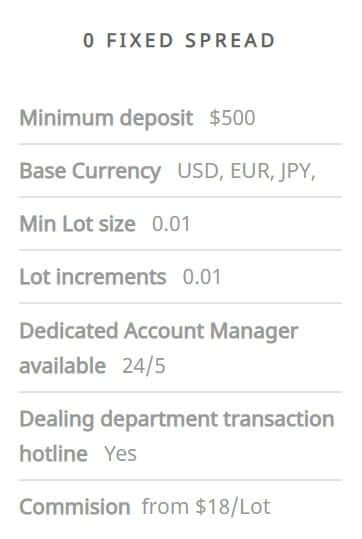

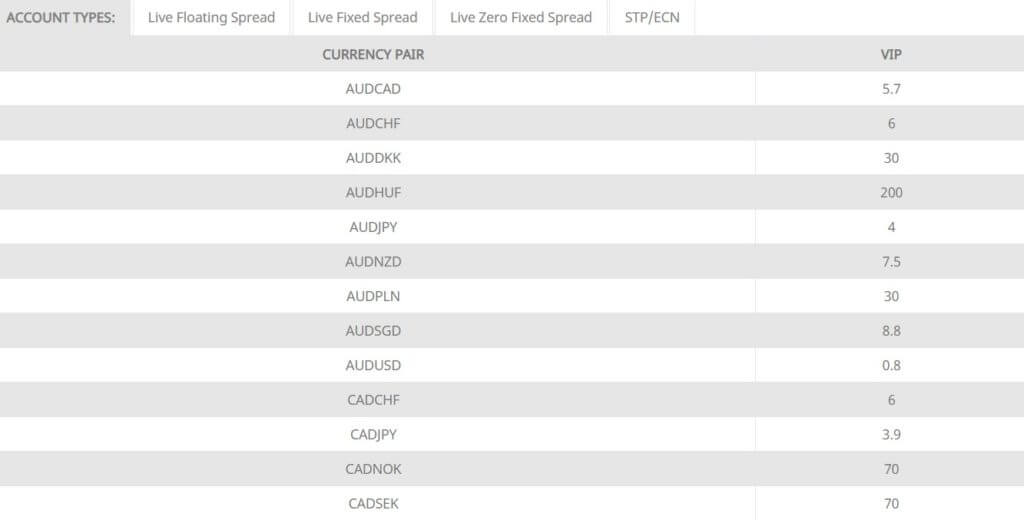

0 Fixed Spread: This account takes a slightly different approach, it has a minimum deposit of $500 but in terms of base currencies, you can only use USD, EUR or JPY. The minimum trade size remains at 0.01 (micro lot) but this time there is a commission charged for each trade, this is set at $18 per lot traded, which is extremely high. As the name suggests, spreads are set at 0 pips.

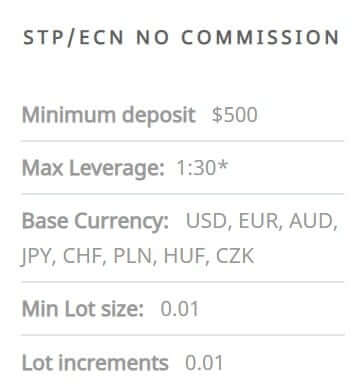

0 Fixed Spread: This account takes a slightly different approach, it has a minimum deposit of $500 but in terms of base currencies, you can only use USD, EUR or JPY. The minimum trade size remains at 0.01 (micro lot) but this time there is a commission charged for each trade, this is set at $18 per lot traded, which is extremely high. As the name suggests, spreads are set at 0 pips. Absolute Zero STP/ECN: This account requires you to contact an account manager to get set up, it has a leverage of 1:30, can be used with USD or EUR as the base currency and has no commissions, while the spreads can also be as low as 0 for pairs such as EUR/USD.

Absolute Zero STP/ECN: This account requires you to contact an account manager to get set up, it has a leverage of 1:30, can be used with USD or EUR as the base currency and has no commissions, while the spreads can also be as low as 0 for pairs such as EUR/USD.

When it comes to choosing what to trade, there is plenty on offer from FXGiants, they currently have the following instruments to trade: Shares, Forex, Metals, Indices, Commodities, Futures, and Cryptocurrencies. There is a full breakdown of

When it comes to choosing what to trade, there is plenty on offer from FXGiants, they currently have the following instruments to trade: Shares, Forex, Metals, Indices, Commodities, Futures, and Cryptocurrencies. There is a full breakdown of

Demo accounts are available, you can simply sign up and start using one, they work indefinitely as long as they are being used, if left dormant for too long they will be deleted to free up server space, however, a new one can be opened. Trading conditions are set to mimic the real markets.

Demo accounts are available, you can simply sign up and start using one, they work indefinitely as long as they are being used, if left dormant for too long they will be deleted to free up server space, however, a new one can be opened. Trading conditions are set to mimic the real markets.

Assets

Assets

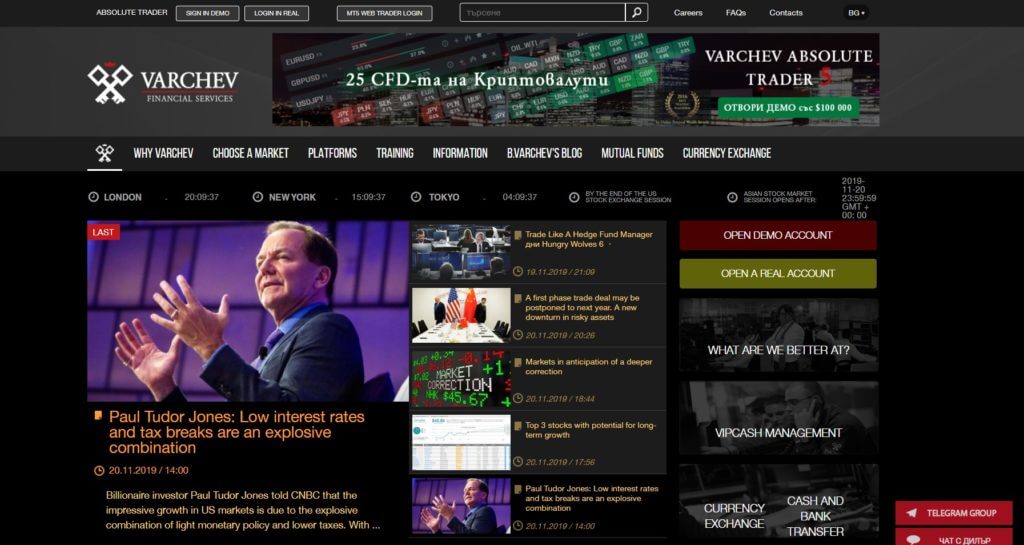

Varchev is a micro-lot broker meaning the minimal trading size is 0.01 lots. Step volume is also 0.01 lots with the minimum Stops level at 0 points. These figures make the best possible environment for precision trading for any strategy, allowing better Money Management, scaling, and Risk management. The maximum trade size is

Varchev is a micro-lot broker meaning the minimal trading size is 0.01 lots. Step volume is also 0.01 lots with the minimum Stops level at 0 points. These figures make the best possible environment for precision trading for any strategy, allowing better Money Management, scaling, and Risk management. The maximum trade size is  VAT platform has many more currencies like USD/Romanian Leu, Hungarian Forint, Chilean Peso, Brasilian Real and Czech Koruna. Overall, one of the longest list in the industry. The

VAT platform has many more currencies like USD/Romanian Leu, Hungarian Forint, Chilean Peso, Brasilian Real and Czech Koruna. Overall, one of the longest list in the industry. The

Spreads

Spreads

MetaTrader 4 (MT4):

MetaTrader 4 (MT4):

Assets

Assets

Education: There are trading Ebooks available to read online which go over different aspects of how to successfully trade with forex, CFDs, and stocks. There are also plenty of videos available that go over all aspects of trading, including the use of the trading platforms to how to analyze the market effectively. There is also a glossary available to help you understand any terms that you may not have heard before.

Education: There are trading Ebooks available to read online which go over different aspects of how to successfully trade with forex, CFDs, and stocks. There are also plenty of videos available that go over all aspects of trading, including the use of the trading platforms to how to analyze the market effectively. There is also a glossary available to help you understand any terms that you may not have heard before. Customer Service

Customer Service

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by  Leverage

Leverage Spreads

Spreads Minimum Deposit

Minimum Deposit

Spreads

Spreads Deposit Methods & Costs

Deposit Methods & Costs

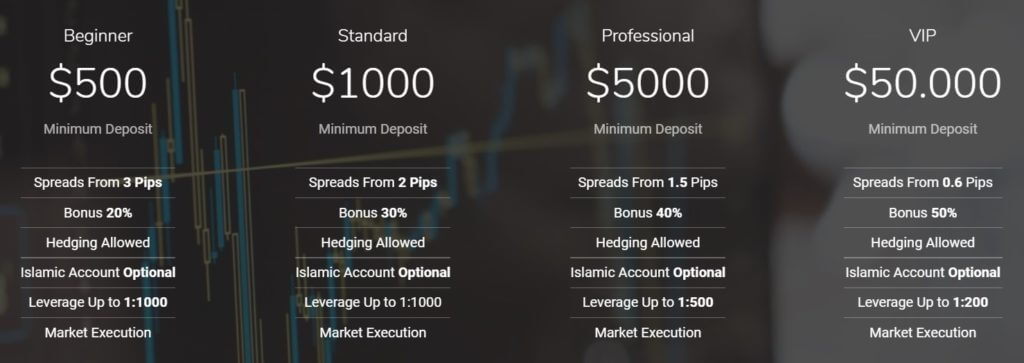

50% Tradable Bonus: Every deposit that you make can receive a tradable bonus, the amount that you receive depends on the amount that you deposit, the bonuses start from 20% for a deposit of $500 – $999 and go up to 50% for deposits over $50,000. The funds are fully tradable but can not be withdrawn until they are converted into real funds, in order to convert them to real funds the following volume of trading must be done: < Number of Lots > = < Bonus amount > / 3.

50% Tradable Bonus: Every deposit that you make can receive a tradable bonus, the amount that you receive depends on the amount that you deposit, the bonuses start from 20% for a deposit of $500 – $999 and go up to 50% for deposits over $50,000. The funds are fully tradable but can not be withdrawn until they are converted into real funds, in order to convert them to real funds the following volume of trading must be done: < Number of Lots > = < Bonus amount > / 3. Rebates: Depending on the amount that you trade, you are able to receive a certain amount of your spreads back as a rebate, starting at $1 for trading between 1 and 9 lots, up to $5 for trading 1000+ lots. Rebates are fully withdrawable funds.

Rebates: Depending on the amount that you trade, you are able to receive a certain amount of your spreads back as a rebate, starting at $1 for trading between 1 and 9 lots, up to $5 for trading 1000+ lots. Rebates are fully withdrawable funds.

All trading accounts share similar features, with a few key differences, aimed at different traders with different strategies. Those differences really just boil down to the choice between higher spreads with lack of commission fees, or lower spreads with some commissions charged.

All trading accounts share similar features, with a few key differences, aimed at different traders with different strategies. Those differences really just boil down to the choice between higher spreads with lack of commission fees, or lower spreads with some commissions charged.

Spreads

Spreads

ECN Account

ECN Account

The account with the lowest leverage cap would be the ECN account, which allows for a leverage of up to 1:500. This is still a noteworthy option, and the choices only go up from there. On the Cent account, we see a leverage cap of 1:1000, while all of the remaining accounts (Micro, Standard, and Zero Spread) allow for outstanding

The account with the lowest leverage cap would be the ECN account, which allows for a leverage of up to 1:500. This is still a noteworthy option, and the choices only go up from there. On the Cent account, we see a leverage cap of 1:1000, while all of the remaining accounts (Micro, Standard, and Zero Spread) allow for outstanding  Spreads

Spreads Minimum Deposit

Minimum Deposit This broker is currently offering a 100% deposit bonus and a Trade 100 Bonus. We also found a promotion to win a car that is not currently running, although it seems to be offered from time to time. Typically, we try to include some of the most important terms and conditions for any offers in this category, but we couldn’t access the terms and conditions for at least one of these bonuses without registering an account, which is impossible to do from our US-based offices. If you’re going to try to earn any of these rewards, we highly recommend taking a look at that section to be sure that you’re meeting all the criteria.

This broker is currently offering a 100% deposit bonus and a Trade 100 Bonus. We also found a promotion to win a car that is not currently running, although it seems to be offered from time to time. Typically, we try to include some of the most important terms and conditions for any offers in this category, but we couldn’t access the terms and conditions for at least one of these bonuses without registering an account, which is impossible to do from our US-based offices. If you’re going to try to earn any of these rewards, we highly recommend taking a look at that section to be sure that you’re meeting all the criteria.

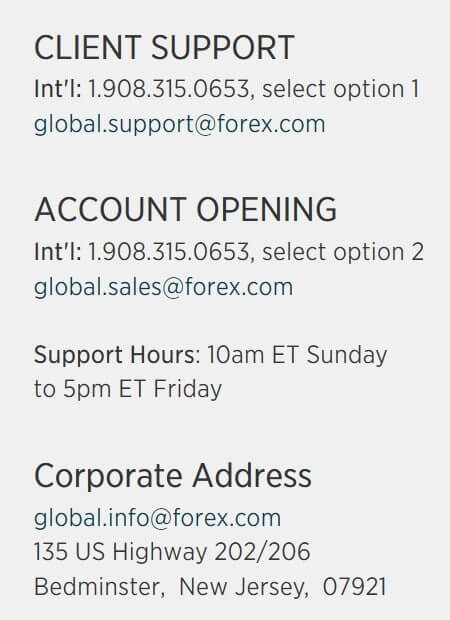

Support is available from 10 am Sunday – 5 pm Friday via LiveChat, email, or phone. We always try to take a moment to test out the LiveChat feature when it is offered. Surprisingly, we found that there was no live agent on the other side – instead, we spoke with a bot. The bot tends to provide a list of selectable options and then tries to pinpoint and answer the user’s question from there by providing links to certain sections of the website or prewritten responses. We also tried tying a keyword related to our question in the chat bar and found that the bot did manage to answer our question accurately. You can’t beat speaking with a live agent, so this is a little disappointing, although the bot does seem fairly capable. Moving on, we found that the company is also active on Facebook, Twitter, and YouTube. All contact information has been listed below.

Support is available from 10 am Sunday – 5 pm Friday via LiveChat, email, or phone. We always try to take a moment to test out the LiveChat feature when it is offered. Surprisingly, we found that there was no live agent on the other side – instead, we spoke with a bot. The bot tends to provide a list of selectable options and then tries to pinpoint and answer the user’s question from there by providing links to certain sections of the website or prewritten responses. We also tried tying a keyword related to our question in the chat bar and found that the bot did manage to answer our question accurately. You can’t beat speaking with a live agent, so this is a little disappointing, although the bot does seem fairly capable. Moving on, we found that the company is also active on Facebook, Twitter, and YouTube. All contact information has been listed below.

This broker offers leverage options from 1:1 to 1:400 on all assets, except for Gold and Silver, which has a limit of 1:100. Choosing leverage of 1:1 would simply mean that you’re trading with the funds that are already available in your trading account while using higher leverage would allow one to trade with up to 400 times the funds available in the trading account. If you’re a beginner, you may want to stick with lower leverage, especially considering that this broker is offering higher than average options. This allows more opportunity to profit, but it can also lead to failure if the trader doesn’t have enough experience.

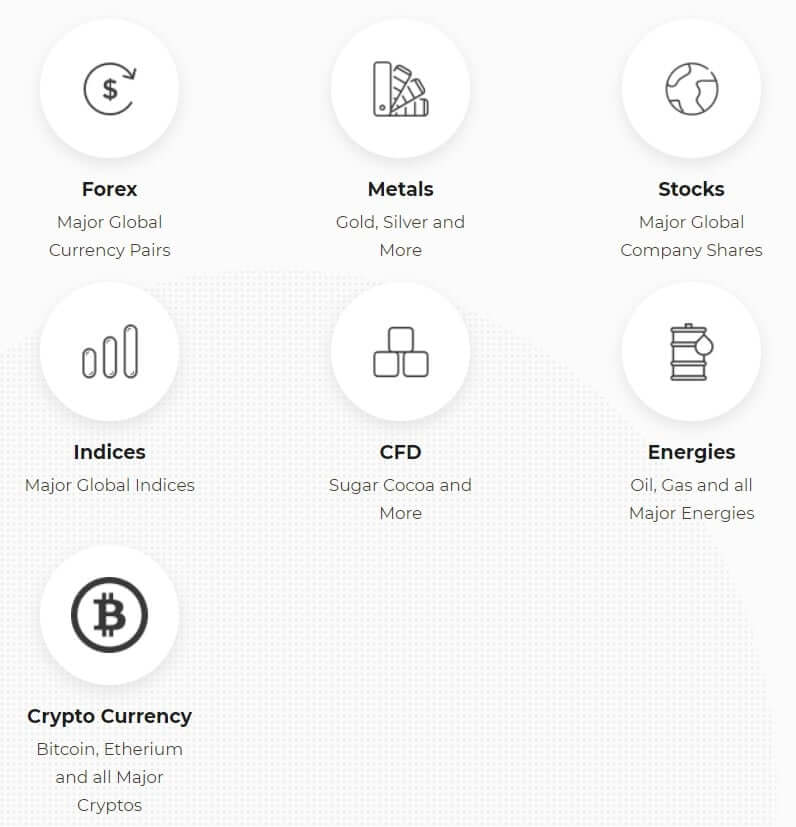

This broker offers leverage options from 1:1 to 1:400 on all assets, except for Gold and Silver, which has a limit of 1:100. Choosing leverage of 1:1 would simply mean that you’re trading with the funds that are already available in your trading account while using higher leverage would allow one to trade with up to 400 times the funds available in the trading account. If you’re a beginner, you may want to stick with lower leverage, especially considering that this broker is offering higher than average options. This allows more opportunity to profit, but it can also lead to failure if the trader doesn’t have enough experience. FXLinked offers more than 200 instruments for trading, 60 plus of which are made up of currency pairs. In addition, you’ll find 130 stocks available from big companies, like Amazon, Disney, and Ford, just to name a few. CFDs are offered on eight options, you’ll find five options under energies, more than 15 indices, Gold and Silver, and a few cryptocurrencies. It’s great to see so many different categories included here, especially considering that cryptocurrencies are available. This should provide enough variety for all traders.

FXLinked offers more than 200 instruments for trading, 60 plus of which are made up of currency pairs. In addition, you’ll find 130 stocks available from big companies, like Amazon, Disney, and Ford, just to name a few. CFDs are offered on eight options, you’ll find five options under energies, more than 15 indices, Gold and Silver, and a few cryptocurrencies. It’s great to see so many different categories included here, especially considering that cryptocurrencies are available. This should provide enough variety for all traders.

Spreads are variable and also vary based on the type of instrument that is being traded. Spreads can be as low as 0 pips on all major instruments and start much lower than

Spreads are variable and also vary based on the type of instrument that is being traded. Spreads can be as low as 0 pips on all major instruments and start much lower than

Under the ‘Education’ section of the website, you’ll find ‘Insights’ and a ‘Learning Center’. The insights section covers trending news, which is really more of a tool than it is for education. The Learning Center is divided into three sections: E-books, Tutorials, and Webinars.

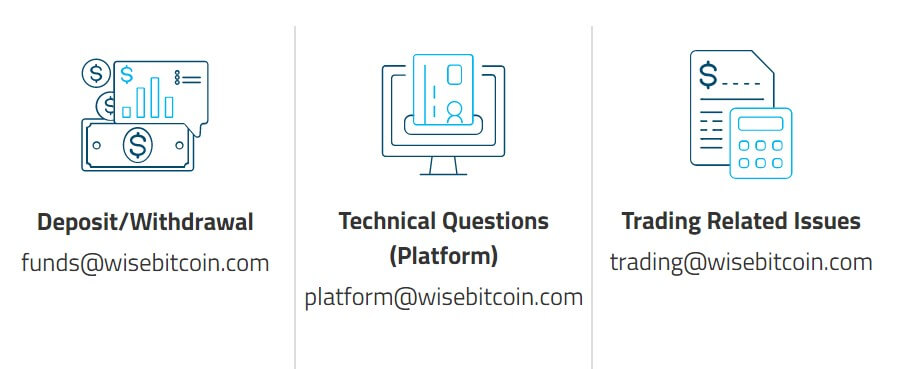

Under the ‘Education’ section of the website, you’ll find ‘Insights’ and a ‘Learning Center’. The insights section covers trending news, which is really more of a tool than it is for education. The Learning Center is divided into three sections: E-books, Tutorials, and Webinars. Support is available 24 hours a day in multiple languages through email, LiveChat, phone, or by booking a meeting. The website provides multiple email addresses, so be sure you are using the contact info for the department that is relevant to your inquiry. We’re sure that the broker would get back to you if you were to email the wrong department, but doubling checking that your email is going to the relevant department could simply help to avoid any delays. The company’s phone number is universal, so feel free to contact them by email for any type of inquiry. You can also fill out a form on the website if you’d like to book a meeting, which is a contact option that isn’t commonly available. All contact information has been listed below.

Support is available 24 hours a day in multiple languages through email, LiveChat, phone, or by booking a meeting. The website provides multiple email addresses, so be sure you are using the contact info for the department that is relevant to your inquiry. We’re sure that the broker would get back to you if you were to email the wrong department, but doubling checking that your email is going to the relevant department could simply help to avoid any delays. The company’s phone number is universal, so feel free to contact them by email for any type of inquiry. You can also fill out a form on the website if you’d like to book a meeting, which is a contact option that isn’t commonly available. All contact information has been listed below.

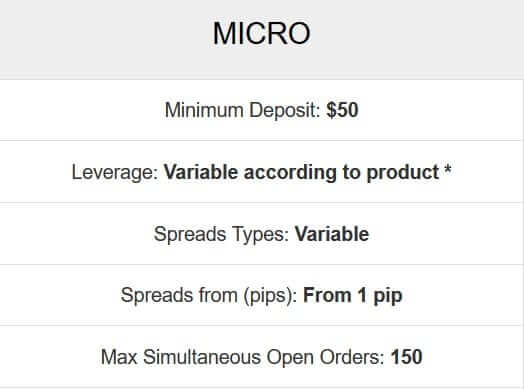

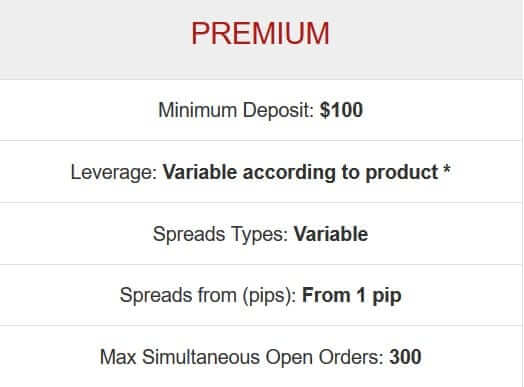

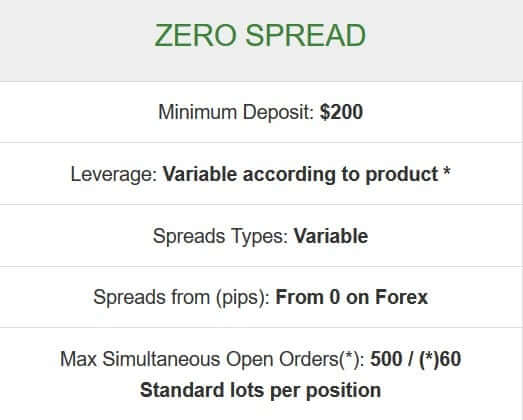

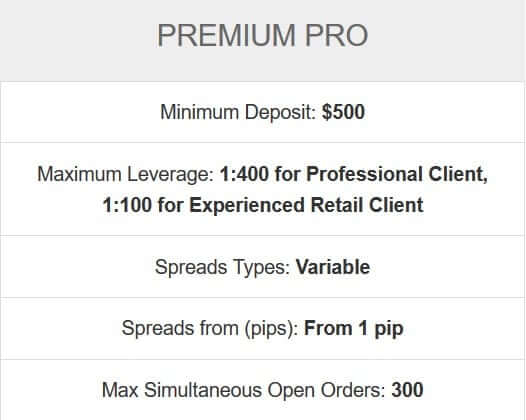

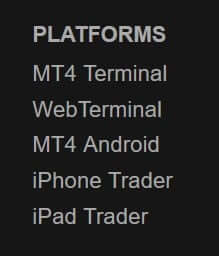

This broker features both the MetaTrader 4 and MetaTrader 5 platforms, but the chosen account type can limit one’s options. Micro and Premium account holders are able to choose between either platform, while Auto, Zero Spread, PAMM, and HFCopy account holders can only trade from MT4. MetaTrader 4 has been highly praised for its user-friendly interface and variety of tools and resources. The platform provides everything a professional trader could need, including 9 different timeframes, support for Expert Advisors, 50+ built-in indicators and tools, and more.

This broker features both the MetaTrader 4 and MetaTrader 5 platforms, but the chosen account type can limit one’s options. Micro and Premium account holders are able to choose between either platform, while Auto, Zero Spread, PAMM, and HFCopy account holders can only trade from MT4. MetaTrader 4 has been highly praised for its user-friendly interface and variety of tools and resources. The platform provides everything a professional trader could need, including 9 different timeframes, support for Expert Advisors, 50+ built-in indicators and tools, and more. Trade Sizes

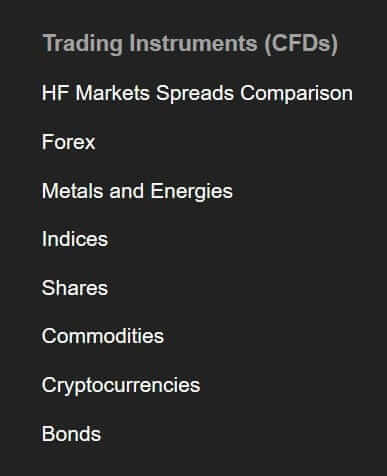

Trade Sizes This broker offers Forex, Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, and Bonds as tradable instruments. This selection certainly provides a larger variety of assets to choose from, although those operating HFCopy accounts will be limited to

This broker offers Forex, Metals, Energies, Indices, Shares, Commodities, Cryptocurrencies, and Bonds as tradable instruments. This selection certainly provides a larger variety of assets to choose from, although those operating HFCopy accounts will be limited to

100% Credit Bonus (Micro, Premium, and Islamic Accounts): The bonus only applied to new deposits or internal transfers of $100 or more and can be withdrawn if volume requirements are met. Once those requirements are met, clients will need to email support at

100% Credit Bonus (Micro, Premium, and Islamic Accounts): The bonus only applied to new deposits or internal transfers of $100 or more and can be withdrawn if volume requirements are met. Once those requirements are met, clients will need to email support at  -HF App

-HF App

IC Markets blog is the core of the educational material. It is very well developed with a clean design without overwhelming content. The education for beginners but also experienced is comprised of“101” trading categories. The first one, Forex

IC Markets blog is the core of the educational material. It is very well developed with a clean design without overwhelming content. The education for beginners but also experienced is comprised of“101” trading categories. The first one, Forex