Anzo Capital is a forex broker based in Belize and was founded by a group of financial industry veterans. The broker was set up with a goal to reduce and mitigate their clients’ risks. Offering secure online trading, essential trading tools, and resources and offering a dedicated customer support team are their commitments. Do they live up to them? In this review, we will dive deep into the service that Anzo Capital is really offering.

Account Types

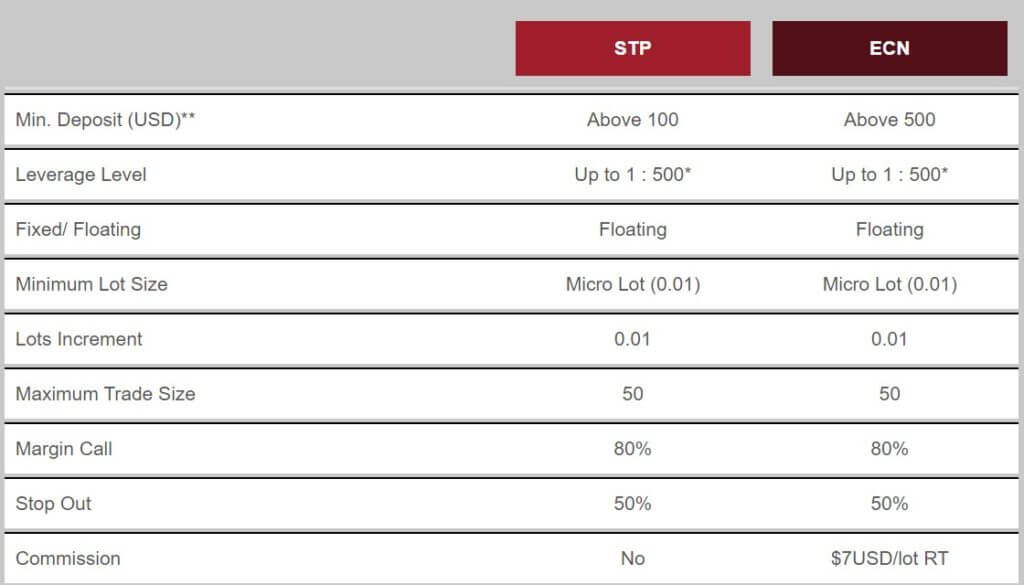

There are just two accounts on offer from Anzo Capital and they are based around different types of market execution, let’s take a look to see what is on offer.

STP Account: An STP account stands for ‘Straight Through Processing’, this means that your orders are sent directly to the markets in real-time and there is no other entity involved. This account requires a minimum deposit of $100 and can have leverage anywhere up to 1:500. It has floating spreads and the minimum trade size is 0.01 lots (micro lot) which can be increased by 0.01 increments, the maximum trade size sits at 50 lots. Margin call is set at 80% and stop out set at 50%, there are no added commissions added to this account. This account has access to MetaTrader 4 as its trading platform and has access to all trading services except for an account manager. This account type can be used as an individual or joint account only.

ECN Account: An ECN account stands for ‘Electronic Communications Network’ when you put in an order, it is sent to liquidity providers who then confirms your order, quotes are more stable with an ECN broker compared to STP. This account has a minimum deposit of $500 and retains the same leverage maximum of 1:500, spreads remain floating but are slightly reduced in size and the 0.01 lot minimum and 50 lots maximum trade sizes still stand. Margin call and stop out levels remain at 80% and 50% respectively. There is an added commission of $7 USD per lot traded. MetaTrader 4 is the only available trading platform for this account and it has access to all trading services including a dedicated 24/5 account manager, this account type can be used by individuals, joint accounts and also as corporate accounts.

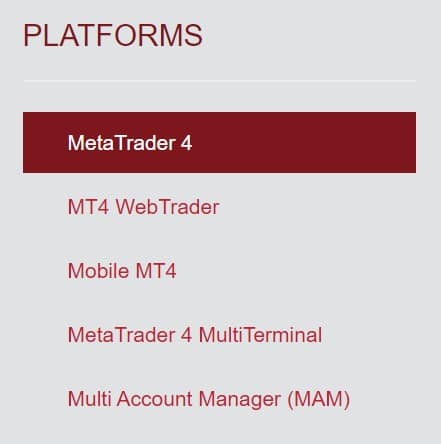

Platforms

There is just a single platform available to use the Anzo Capital, the good news is that it is MetaTrader 4 which is always a solid choice.

There is just a single platform available to use the Anzo Capital, the good news is that it is MetaTrader 4 which is always a solid choice.

MetaTrader 4 (MT4): MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. Millions of people use MT4 for its interactive charts, multiple timeframes, one-click trading, trade copying and more. In terms of accessibility, MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Leverage

The maximum leverage is set at 1:500 however not everyone can use it, maximum leverage is determined by account capital and the following conditions:

- Up to leverage of 1:500 when equity is less than USD 100,000

- Up to leverage of 1:400 when equity is between USD 100,000 to USD 200,000

- Up to leverage of 1:200 when equity is between USD 200,000 to USD500,000

- Up to leverage of 1:100 when equity is above USD 500,000

Trade Sizes

Minimum trade sizes are currently set at 0.01 lots which are also known as a micro lot and are the industry standard for forex trading. The maximum trade size is currently 50 lots which is an appropriate level, the majority of retail traders will never get this high if you do, it is recommended not to trade over 509 lots anyway as it can make it harder for the market or liquidity providers to fill the order instantly. Trading sizes can go up in increments of 0.01, for instance, 0.02, 0.03, all the way up to 50.0.

Trading Costs

Botha accounts have spreads which add to the cost of the trade, the STP account only uses spreads as their payment structure, we will be looking at spreads later in this review. The ECN account has an added commission of $7 per lot traded. This is not an unreasonable amount as it seems that $6 per lot is quickly becoming the standard commission charge. Swap fees are also present and are charged or received for holding trades overnight, these fees can be seen from directly within MetaTrader 4 (trading platform).

Assets

The assets on Anzo Capital are divided into 4 categories with multiple instruments within them, they are broken down as follows:

Forex Currency Pairs: The forex market is open 24 hours a day, 5 days a week. Anzo Capital currently offers both major, minor and exotic pairs to trade. There are 28 major and minor pairs including pairs such as EUR/USD and NZD/CHF. There are 17 exotic pairs including pairs such as USX/MXN and EUR/DKK.

Precious Metals: Only two metals on offer which is a little disappointing, there is Gold and Silver which are the main two,m but would have been nice to see others such as Platinum or Zinc.

Contract For Difference: Also known as CFDs, these are broken down into further categories, there are currently 13 CFDs on offer with an additional 2 spot oils and 11 cahs indices. Things like crude Oil, DAX30 and UK 100 Index are available for trading.

Cryptocurrencies: Cryptocurrencies are quickly becoming a major trading asset for both new and experienced traders. There are only 4 on offer from Anzo Capital which is a little disappointing, but any step in the right direction is a good one. You can currently trade ETHUSD, BTCUSD, LTCUSD, and XRPUSD. It would be nice to see more in the future.

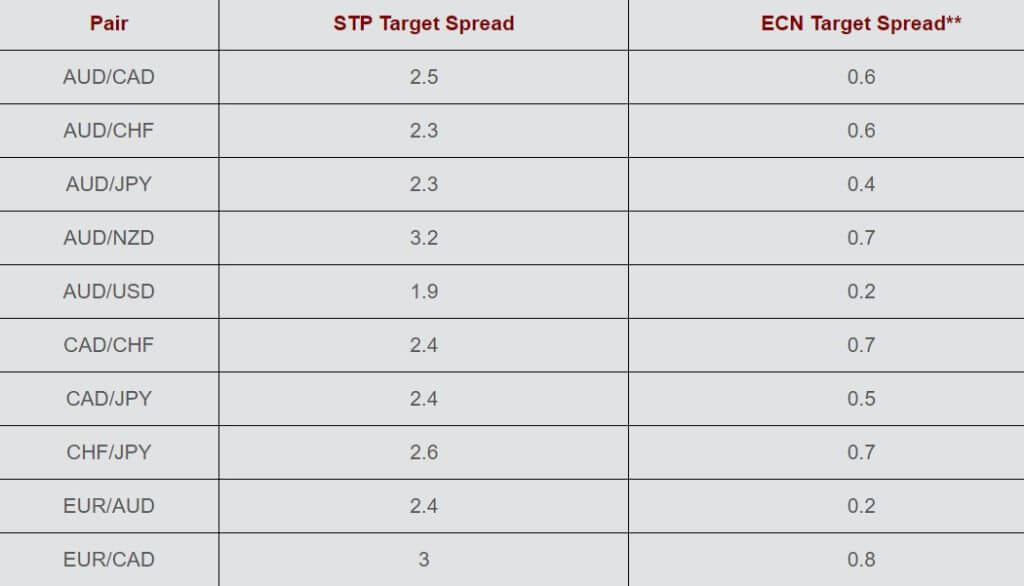

Spreads

Spreads are completely dependant on two aspects, the account you are using and the instrument that you are trading. If we take forex as an example, AUD/CAD for the STP account has a target spread of 2.5 pips, while the ECN account for the same pair has a target spread of 0.6 pips. For metals, Gold has a target spread of 0.35 for STP and 0.1 for ECN. For CFDs, ASX200 has a target spread of 3.5 for STP and 1.2 for ECN and finally, cryptocurrencies have the same target spreads for both accounts an example is Bitcoin at 50.

It is also important to note that all spreads are variable, this means that they change depending on the markets, the target spreads are what Anzo Capital want them to be, not what they will be, they will often be seen slightly higher and rarely lower.

Minimum Deposit

The minimum amount needed to open up an account is currently $100 for the STP account, however, once an account has been opened the minimum deposit reduces for future top-ups. Depending on the payment method that you use, the minimum deposit will drop down to $20 once an account has already been opened.

Deposit Methods & Costs

There are a whole host of deposit methods available, we have put them all into a convenient table below in the following format:

Method – Currencies – Min Amount

Bank Transfer – USD – $100

Visa / MasterCard – USD – $20

WebMoney – USD – $100

Skrill – USD, EUR, GBP – $20

Neteller – USD, EUR, GPB, $20

FasaPay – IDR – $100

Qiwi – USD – $100

Yandex – USD – $100

SticPay – USD – $100

There are some other additional transfer methods which are specific to certain countries, be sure to check them out to see if any specific payment methods may be relevant to you.

It should be noted that there are no fees for depositing with Anzo Capital except with bank wire transfer, Anzo Capital will cover all fees if the deposit is over $3,000 any amount under this and the client will need to cover any fees. Also, be sure to check with your own bank in case they charge any bank transfer fees themselves.

It is also a surprise that there are so many deposit methods, but no cryptocurrencies available, a lot of people are beginning to fund their account with crypto, so it is a shame that it is not available here.

Withdrawal Methods & Costs

Withdrawals are done via the same method that you used to deposit, the following information is relevant for withdrawals.

Bank Transfer – USD – $100

Visa / MasterCard – USD – $20

WebMoney – USD – $100

Skrill – USD, EUR, GBP – $20

Neteller – USD, EUR, GPB, $20

FasaPay – IDR – $100

Qiwi – USD – $100

Yandex – USD – $100

SticPay – USD – $100

It should be noted that there are no added fees except for a similar situation as the deposits, Anzo Capital will cover all fees if the deposit is over $3,000 any amount under this and the client will need to cover any fees. Also, be sure to check with your own bank in case they charge any bank transfer fees themselves.

Withdrawal Processing & Wait Time

All withdrawals are processed the same day as the request, however, any requests out of working hours will be processed on the next working day (Monday to Friday).

Bank wire transfers will take between 2 to 5 working days once they have been processed and credit or debit cards will take between 1 to 5 days once they have been processed. E-wallets should receive the funds within 2 hours of being processed.

Bonuses & Promotions

There were 2 promotions that we could find one of them was for $50 cash rebates. You are able to receive a $50 bonus for depositing $500 with an ECN account or $200 with an STP account, you can withdraw the funds once you reach the following goals:

a. Complete at least 5 trading lots for STP/ECN account

a. Complete at least 5 trading lots for STP/ECN account

b. At least 25 tickets round turn for STP/ECN Account

c. 5 standard lots round turn for STP/ECN Account of trading volume must be done within 30 calendar days from the date when the one-time deposit is made.

The second was the ability to get a free VPS, in order to get one, you need to have a daily average balance of at least $5,000 and trade at least 5 lots per month. If you do not meet this requirement you will be charged $25 per month.

Educational & Trading Tools

There are a number of different educational and trading tools available as well as some other basics to help with analysis.

There are a number of different educational and trading tools available as well as some other basics to help with analysis.

The majority of information provided is based around news, there is an economic calendar that tells you about any upcoming news events and how they may affect the markets, there are also news articles and daily insights to give you ideas of what may happen in the markets to help aid your own analysis.

In terms of education, there is a very basic video series that goes over some of the absolute basics, in terms of what forex is and different ways to do it. This may be helpful for people completely new, but if you have traded before you may not find it very helpful.

Finally there are signals, however, these are not unique to Anzo Capital as anyone can use them from MQL5.

Customer Service

Should you wish to get in contact with Anzo Capital there are two ways to do it, you can either use their email address or live chat. We tried the live chat but did not connect after 5 minutes so gave up, this wasn’t the most promising time, however, we only tried once so may have just been unlucky. It is a little disappointing that only these 2 methods ar3e available as we have grown accustomed to being able to use the phone to get in contact. Support is available 24 hours a day, 5 days a week and is closed at the same time as the markets are.

Demo Account

Demo accounts are available, just click the demo account button on the right of the page a sign up. Demo accounts can be wither STP or ECN accounts so you can test the one you think you may use, can have a deposit up to $100,000 to play with and can select leverage up to 1:500. The demo accounts work with MetaTrader 4 and last 30 days, once the 30 days are up the accounts will be closed. You can sign up for a new one once your current one ends.

Countries Accepted

The only mention of any restrictions is the fact that Anzo Capital does not accept anyone from the United States if you are unsure if you are eligible for an account, get in contact with the customer service team and find out.

Conclusion

Anzo Capital is providing a competitive trading environment, its ECN account has a commission close to the industry standard of $6 and the trading conditions are acceptable for that commission rate. Plenty of ways to deposit and withdraw without any added fees, it would have been nice to see crypto as an option though. We weren’t able to get through to the customer service team which is concerning, but we may have just been unlucky on that one. Anzo Capital seems like a competent broker and we would not look at you funny if you decided to sign up with them.

We hope you like this Anzo Capital review. If you did, be sure to check out some of the other reviews to help find the broker that is right for you.