LQDFX has been providing Forex trading services out of the Marshall Islands since 2015, acting as an STP broker. Their strongest selling points include spreads from 0.0 pips, 70+ assets within their MT4 platform, and commission-free trading. The LQDFX review that follows will tell you exactly what else to expect from this broker with regard to the platform, trading conditions, customer service, costs, and much more.

Account Types

LQDFX offers several account types and these are:

- Micro

- Gold

- ECN

- VIP

- Islamic

Each of these accounts is actually quite similar, but there are a few key differences. It should also be noted that there are commission charges on the ECN and VIP accounts. Those are 3.50USD/EUR per 100,000 and 2.50USD/EUR per 100,000, respectively. The smallest accepted deposit is $20, which applies to both the Micro and Islamic accounts. Spreads range from 0.1 to 1, based on account type. The Islamic account is essentially the same as the Micro account but without the need to pay swap fees, which as not compliant with Shariah Law.

Platforms

As we so often see, LQDFX offers the MetaTrader 4 platform for all account types. The platform can be downloaded for Windows computers, as well as for Android and Apple devices. There currently is no dedicated download for Mac-based systems. Benefits of the platform include the following:

- Ultra-Fast Execution

- One-Click Trading

- Depth Of Market

- Advanced Technical Analysis

- Advanced Charts

- Negative Balance Protection

Leverage

Leverage does vary by account type, so we’ve broken it down for you below.

- Micro – 1:500

- Gold – 1:300

- ECN – 1:300

- VIP – 1:100

- Islamic – 1:300

Note that the leverage ratios listed above are the maximum allowed. You can opt to trade with less or even no leverage at all. The maximum leverage, 1:500 is on par with what most offshore Forex brokers offer. You will find a few that are offering 1:1000 or even 1:2000, but obviously, that is considered by most to be dangerous territory.

Trade Sizes

With the exception of VIP clients, all traders are allowed to trade in micro-lots (0.01). VIP clients, on the other hand, cannot enter into positions that are smaller than 0.1 lot. As for maximum trade sizes, Gold, ECN, and Islamic accounts have a limit of 40 lots. The Micro account has a limit of 5 lots and there is no limit at all on the VIP account.

Trading Costs

The Micro, Gold, and Islamic accounts all offer commission-free trading. There are commission charges on the other two accounts, as follows:

- ECN – 3.50USD/EUR per 100,000

- VIP – 2.50USD/EUR per 100,000

While neither of these charges is exorbitant, it is a tad perplexing as to why LQDFX would charge a commission on the VIP account. VIP account holders are already asked to submit a large deposit and trade in larger than average lot sizes. Yes, the spreads are tightest for the VIP account, but it still seems strange to charge the top clientele a commission.

Assets

As mentioned in the opening of this LQDFX review, the firm does offer over seventy total assets for its clients to trade with. Currency pairs make up the bulk of the asset index and after that, there are a few indices and commodities to select from. If you’re looking for metals, there are a few, and those are included with currencies. It would appear that there are no cryptocurrencies, which could be problematic for some.

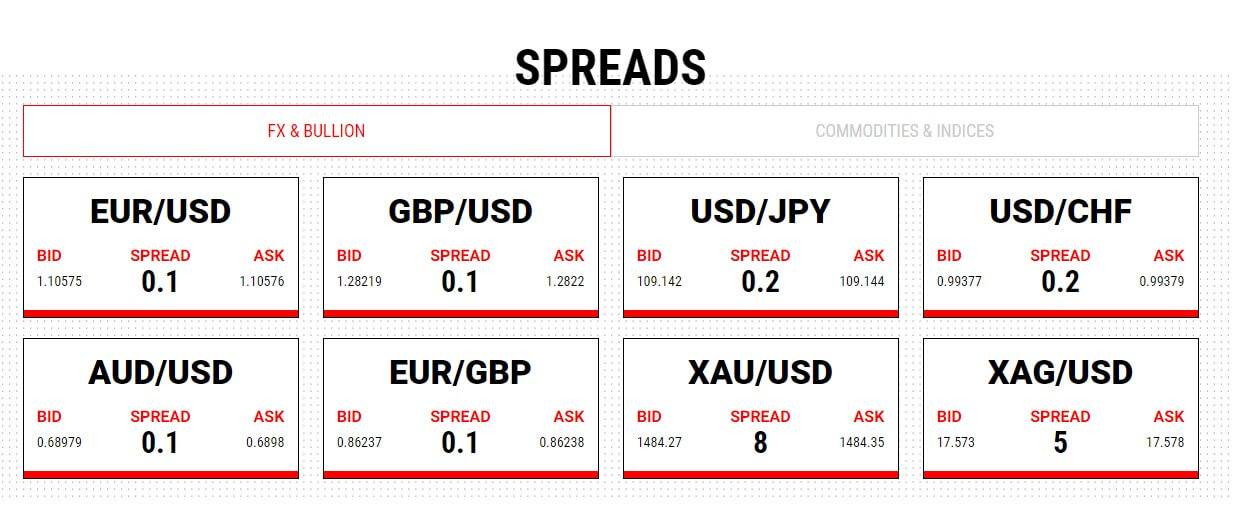

Spreads

This brokerage does offer variable spreads on all account types, with the best spreads going to the VIP account holders. The lowest possible spread is 0.1, which is offered to those who have ECN and VIP accounts. LQDFX does offer live spreads on a total of sixteen assets on their website homepage, although it is not known exactly which account type those spreads relate to. Overall, the spreads seem to be reasonable on all but the Micro account, which starts at 1 lot. Then again, we must keep in mind that there is no commission charge on that account level.

Minimum Deposit

If you want to start out with a deposit as low as $20, you’ll need to opt for either a Micro or Islamic account. The Gold and ECN accounts require a minimum and from there, the VIP account jumps much higher, climbing to $25,000. Staring out with a Micro account may be the way to go if you simply want to test the broker out. However, if you plan to trade with LQDFX over a much longer period, it would be sensible to climb to a higher account tier in exchange for better trading conditions.

Bonuses & Promotions

Bonuses & Promotions

At this time LQDFX is offering a deposit bonus that offers a 100% match on any first-time deposit of $20,000 or less. In order to claim this bonus, one must deposit at least $250. It would appear that existing customers may also claim the bonus, as the website had the following to say, “Existing customers must create a new trading account in order to receive the 100% bonus. You can do so by logging in to your LQDFX Client Area.” There are, of course, requirements which must be met in order to cash out the entire bonus and those can be viewed on the broker’s bonus page: https://www.lqdfx.com/en/promotions/bonus

Deposit Methods & Costs

LQDFX accepts several different payment methods, including:

- Wire transfer

- Credit/Debit card

- Neteller

- Skrill

- China UnionPay

- FasaPay

- Bitcoin Cash

- Bitcoin (+ other cryptos)

- UPayCard

- VLoad

Of the available payment options, only wire transfers are subject to a deposit fee and even that can be avoided by depositing $500 or more. The brokerage deserves credit here, as many brokers now struggle to accept even a few payment methods. The fact that for the most part, deposit fees are completely avoidable, is just a bonus.

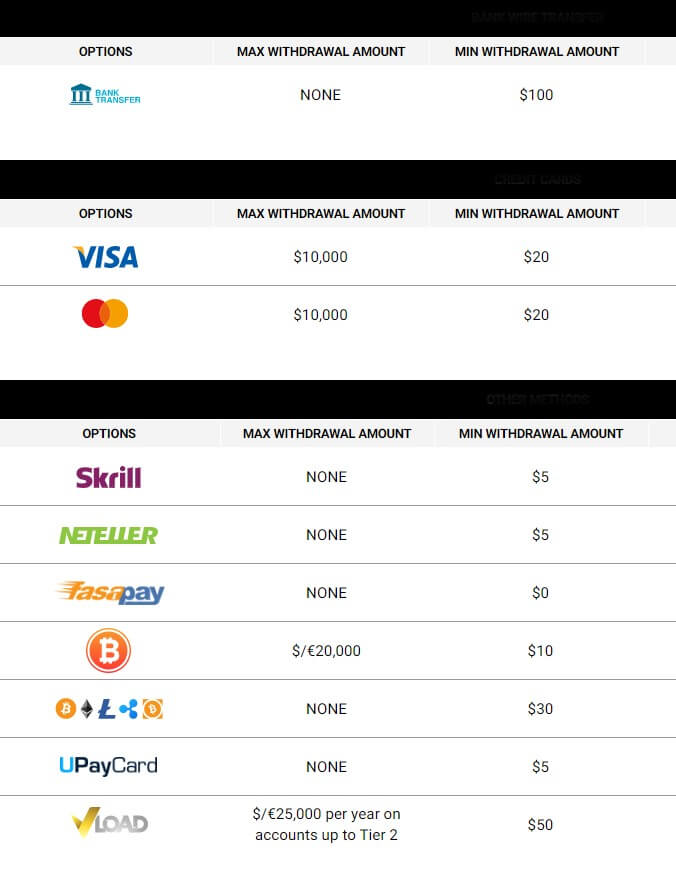

Withdrawal Methods & Costs

There are no withdrawal costs on e-payments and cryptocurrency payments. On credit and debit withdrawals, a $10 withdrawal fee is charged. On bank wires, the costs vary from bank to bank. There are minimum withdrawal amount requirements in place for each of the available methods and those are shown below.

- Wire transfer – $100

- Credit/Debit card – $20

- Neteller – $5

- Skrill – $5

- China UnionPay – $5

- FasaPay – $0

- Bitcoin Cash – $10

- Bitcoin (+ other cryptos) – $30

- UPayCard – $5

- VLoad – $50

Withdrawal Processing & Wait Time

LQDFX processes withdrawal requests in two business days or less. As usual, the wait time after that is completely dependent upon the chosen withdrawal method. Wire transfers take the longest, with a wait time of 2 to 10 business days. Card payments take up to two business days to arrive and eWallet payments typically arrive within one business day. The processing and wait times are on par with those of regulated brokers and there are no problems to report here.

Educational & Trading Tools

Educational & Trading Tools

LQDFX does offer a number of educational courses and tutorials for novice and experienced Forex traders alike An Economic Calendar is provided, along with FX chart analysis tools. Forex calculators such as Pivot, Fibonacci and Deal Size are provided on the website also. An e-book is provided for new traders, as are trading strategies. On the whole, LQDFX has gone above and beyond what many brokers offer in this area and should be commended.

Customer Service

Telephone, live chat, and email are the primary contact options, although the firm can be found on social media websites such as Twitter, Facebook, LinkedIn, and Instagram. Support is available 24-hours a day, 5-days a week. The primary LQDFX contact number is +44 2035988261, and the primary email address is [email protected]. A callback request form is provided for those who wish to avoid outgoing call charges. Additional departmental email addresses are listed below.

- Trading Department – [email protected]

- Partners Department – [email protected]

- Deposits & Withdrawals – [email protected]

Demo Account

Free demo accounts are available to those who want them. The site’s demo account registration form asks for only some basic information, after which, you’ll be able to select a currency and starting balance. Demo accounts remain active indefinitely, provided that they are actually being used. To open an LQDFX demo account, simply click on the demo tab from the site header on any page.

Countries Accepted

The broker’s website does not provide any listing of country exclusions. Instead, it says the following, “This website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation.” We did go one step further to speak with a support member regarding this topic and were told that residents of Belarus are not allowed to create an account. All others, including residents of the United States, are welcome to join.

Conclusion

A search for LQDFX scam information turned up little more than the average complaints. These are common with Forex brokers in general, as those who enter into trading without being properly educated and then losing money as a result, tend to later complain that the broker “stole” their money. The truth regarding broker liability is strongly linked to the amount of time that they have been in business. LQDFX has been providing services for several years now and shows no signs of slowing down. This, combined with their reasonable trading conditions and trusted platform, make this FX broker a viable option for those looking to trade the markets.