Klimex offers plenty of advantageous features, including a wide variety of educational tools and lucrative bonuses. However, traders who follow certain styles might prefer to examine certain offerings in more detail. To find out if this broker is suitable for you, read this article and make a determination.

Account Types

This broker offers two account types. However, apart from the spreads, almost no other details are mentioned about the differences between the two types. In some cases, one of them may act as added-on features instead of a separate account altogether.

Standard:

Minimum Deposit: $100

Spreads: From 1.6 pips

Commission: Unspecified

Raw:

Minimum Deposit: NA

Spreads: From 0.4 pips

Commission: Unspecified

Platforms

You can trade through MetaTrader 4 (MT4) from any location and on any device (including MacBooks, Windows desktops, iPhones, and Android). The platform provides you with sophisticated graphing features, detailed charts, and tools to code your own automated trading algorithm. Users can download the phone app to enter/exit trades, manage the portfolio, and access the same features that are available on the desktop software. Lastly, Klimex’s account holders look at other people’s trades and copy the positions of their most profitable peers through the MyFXBook platform.

Leverage

The maximum leverage that Klimex gives account holders is 500:1. However, the more funds that you deposit, the lower your bower power becomes. Brokers do this to control risk. For example, a trader that has $100,000 in their account could access up to $50 million in capital with a 500:1. leverage. Losing just 3% of it would equal $1.5 million (or the account balance times 15). In many cases, people can’t afford to bring back a -$1.5 million portfolio to a positive balance and the broker incurs these costs. Therefore, many of them will limit your buying power when your account’s capital goes up.

Klimex will lower leverage to 400:1 after a trader’s balance reaches $10,000. Similarly, it goes down to 300:1 when the account size is $50,000. This is followed by another decrease to 200:1 in leverage if your balance is $100,000 or more. At times, it can even be as low as 1:1. In some cases, though, Klimex may increase your leverage. New users would fill out an application when they first open an account and existing clients can submit the same request. To access the initial leverage of 500:1, traders must fund their account with $500 or more in capital.

Trade Sizes

First, when the margin call level is reached, Klimex will send you a warning or notification through your account’s dashboard. After that, if the balance hits the 50% stop-out point, the broker will automatically start closing your positions, starting with the trade that incurred the biggest losses and up until your account has enough funds to satisfy the margin requirements.

Margin Call: 80%

Stop-Out: 50%

One unique thing about this approach is that, in general, brokerage firms may start liquidating losing positions at the margin call. At stop-out, meanwhile, all trades are closed, regardless of how much losses/profits were accumulated. What makes Klimex stand out is that they only liquidate what’s needed to bring your account back above the stop-out, as opposed to entirely closing every trade.

Trading Costs

Klimex’s website doesn’t mention anything about how much the commissions are and how swap/interest fees are charged on overnight fees. Their spreads, however, are minimal.

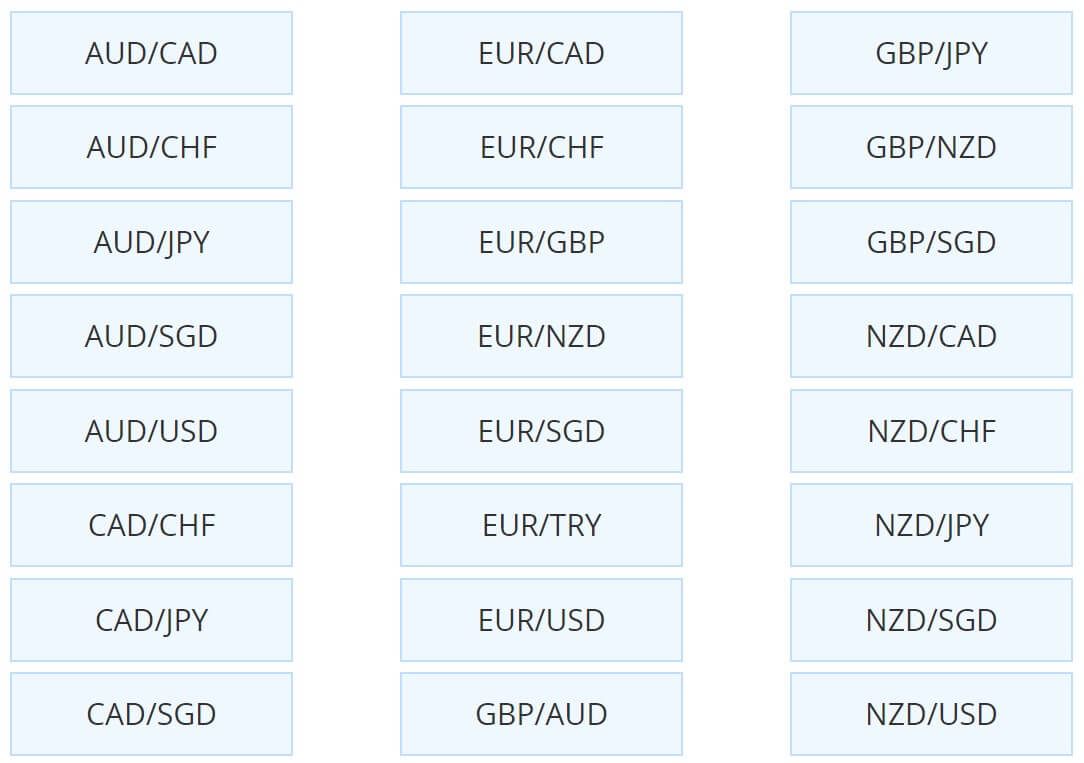

Assets

Alongside currencies, Klimex account holders can trade commodities and stock indexes. Altogether, the broker offers access to 36 forex pairs, 7 commodities, and 7 indices. The currencies include majors and exotics, with examples of the latter being the Chinese Yuan (CNH, offshore), Singapore Dollar (SGD), and Swedish Krona (SEK). Amongst the indices, only 2 of the major 3 (the Dow Jones and S&P 500) are included in Klimex’s list.

However, you can trade the USD Index (which tracks the value of the greenback), alongside the Australian (S&P/ASX 200), British (FTSE 100), German (DAX 30), and Japanese (Nikkei 225) market indices. The indexes are traded as CFD contracts, so is Crude Oil. Other commodities, however, are available on the forex exchanges. Gold and Silver contracts are traded against each of the US dollar (XAU.USD/XAG.USD) and the Australian Dollar (XAU.AUD/XAG.AUD). Platinum contracts are only tied to the USD, though.

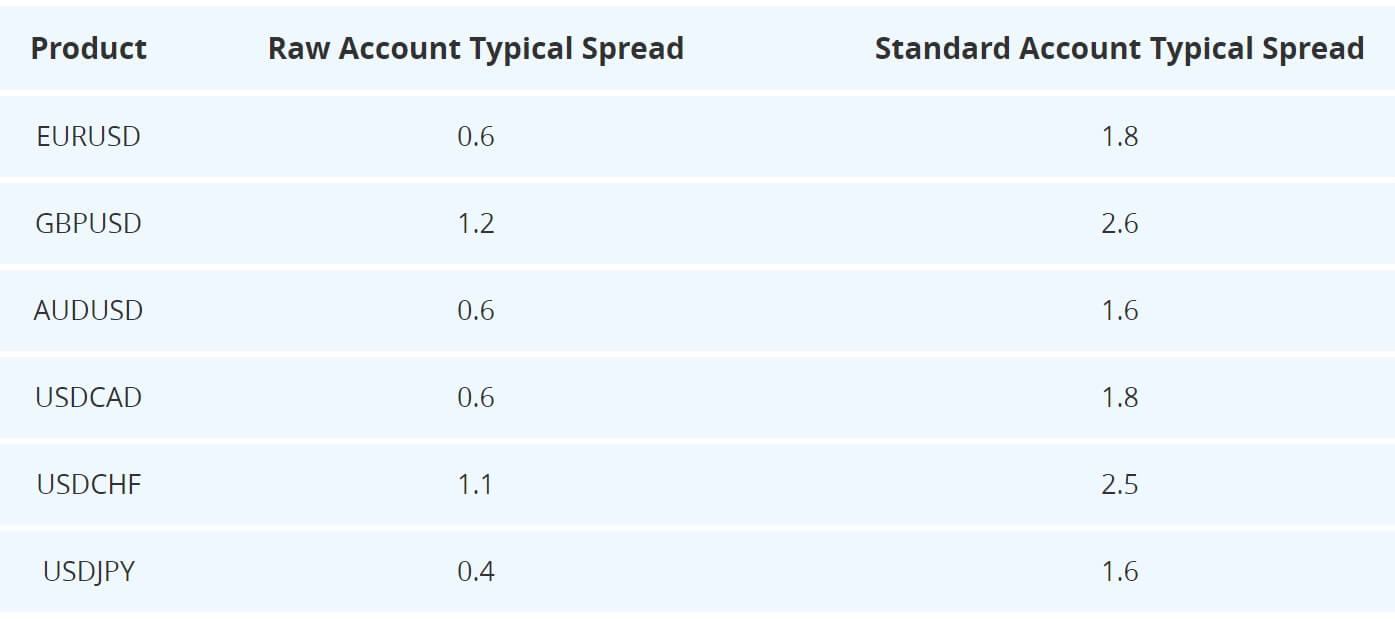

Spreads

The most popular forex majors have a spread of between 0.4 to 0.6 pips. In certain cases, it can be as low as 0 pips, but some majors have a larger than 1-pip spread.

Minimum Deposit

To open an account, traders have to deposit $100 or more. However, to access leverage, their balance must be above $500.

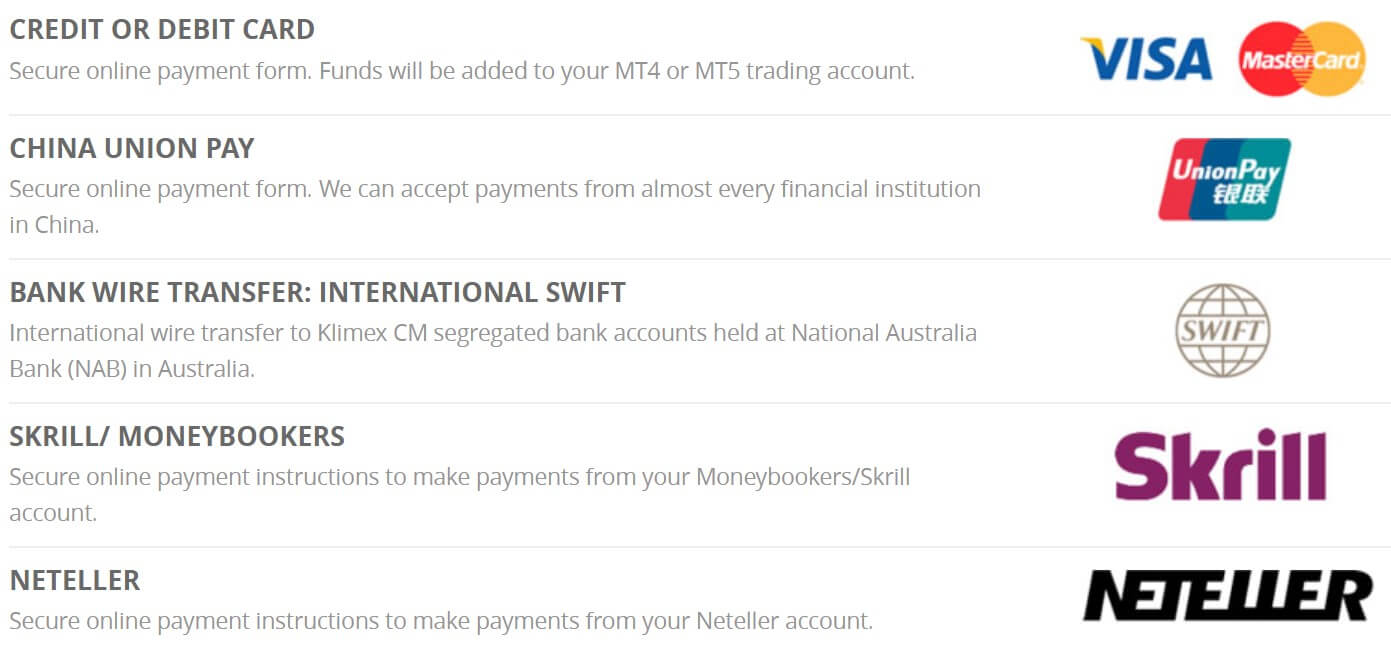

Deposit Methods & Costs

Klimex accepts credit/debit cards, bank transfers, and digital payment methods. You can deposit funds via Visa, MasterCard, and wire/SWIFT transfers. Additionally, the broker serves China UnionPay users and works with banks all across China. The other two deposit methods are Neteller and Skrill. Most transfers take 1 to 2 days to process. Klimex’s website doesn’t mention anything about fees.

Withdrawal Methods & Costs

Unfortunately, nothing is said about withdrawals or related fees, either.

Withdrawal Processing & Wait Time

The broker’s website boasts its fast withdrawal of funds, but without going into any details. Clicking on the ‘Withdraw’ link only redirects one to the login page. As such, we assume that only existing clients are privy to withdrawal details.

Bonuses & Promotions

Klimex will give you a 10% bonus on your deposit, regardless of whether you are a new user or an existing account holder. To receive this bonus, traders must deposit a minimum of A$1,000 (Australian dollars) into their account (which qualifies them for a 10% trading credit of A$100). However, the maximum credit/bonus is A$20,000, which is applicable to A$200,000 balances. Initially, the bonus is added to your account as a trading credit only. After that, A$2 of that credit is converted to cash (which you can withdraw) for every traded lot as a rebate.

For example, a trader deposits A$10,000 and receives A$1,000 in credits, which they can put towards buying or selling forex pairs. The next day, the trader opened and closed a position with 10 lots. In turn, they receive A$20 (A$2 per lot) rebate in cash, which may be withdrawn from the account. The remaining A$980 credit can only be used for buying/selling activity, but each traded lot converts another A$2 into actual cash.

This promotion has plenty of positive sides to it. The most obvious one is that Klimex will pay the rebate immediately after the position or lot is closed. Traders don’t have to wait until it becomes available for withdrawal. Just as importantly, the A$2 per lot rebate offer doesn’t expire. You can take advantage of it right after you make the minimum deposit or, conversely, wait a few months or a year before doing so.

Similarly, the broker doesn’t set a required trade size that is tied to the bonus. In other words, whether they buy/sell 1 lot or 50, account holders still receive the same A$2 a lot rebate. Similarly, the cash may be withdrawn once it becomes available (when the trade is closed). You don’t have to wait for the position to settle and there is no holding period on the funds.

Apart from the bonus and rebates, Klimex has two other promotional programs for affiliates and partners. The Introducing Broker (IB) Rebate Program is for account holders who work for an investment firm or manage the FX portfolios of their clients. Through opening a company or client account on Klimex, an Introducing Broker receives a commission every time their referral or firm’s customers make a trade. The reward is paid in the form of a rebate.

Meanwhile, the Affiliates CPA Program is for any user that wants to market the broker’s services and incentivize friends or family to open an account. Affiliates are also paid a commission on each trade that their contact/referral makes. Klimex doesn’t specify the per trade commission or rebate that Introducing Brokers and Affiliates receive. Instead, the broker encourages those who are interested in their partnership programs to contact their consultants and discuss the offerings with them.

Educational & Trading Tools

Just as with most brokers, Klimex provides traders with an economic calendar, which highlights important events from around the world that have an impact on specific currencies’ prices and the larger forex market. However, this broker’s website only gives an overview of what the calendar entails and how traders can use it when they make decisions. This helps beginners understand the role and importance of economic calendars. Nonetheless, the tool itself is not displayed on Kilmex’s ‘Economic Calendar’ page. Most likely, existing account holders will be able to view it through their MT4 accounts.

In fact, alongside the calendar, the MetaTrader platform enables you to use several other tools, such as a variety of technical indicators, account history datasets, and automated trading robots. Meanwhile, the Multi-Account Manager Solution (MAM or PAMM) is especially beneficial for account holders that manage other people’s forex portfolio. In fact, when combined with the IB promotion, financial firms and advisors are well served by this broker. When it comes to retail and professional traders, most (if not all) of Klimex’s tools can be accessed on MT4.

Beginners, however, may not find them to be that resourceful, especially since Klimex doesn’t offer any educational material or content. Yet, the MT4 platform is still rich with tutorials, forex introductory programs, and other educational content. Novice traders who are interested in this broker should inquire about the type and scope of MT4 studying/learning courses that they can utilize after opening an account with Klimex.

Customer Service

The broker has an office in George Town, the capital city of Cayman Islands (located in the Caribbean Sea between Cuba and Nicaragua). They also have a physical presence in Sydney, Australia. However, Klimex’s website and social media accounts are unclear as to which of the two locations is their primary one or the headquarters. Either way, the broker has a universal email address that traders can contact them through, regardless of where they live. Their phone number, on the other hand, is Australian.

Phone: +61 2 8235 2788

Email: [email protected]

Another way to get in touch with Klimex is through completing the form on their ‘Contact Us’ website page. The customer service team is available 24 hours during weekdays, making it ideal for traders from across the world who live in different timezones. Additionally, support is available in English, Filipino, Mandarin, Spanish, and Thai.

Demo Account

You can test your strategy or learn how to use MT4’s different tools through the demo account. In turn, this allows you to familiarize yourself with the markets or MetaTrader (depending on your level of experience) before putting your real money at risk. Signing up for the demo is easy and the registration form is very simple and straightforward. After that, users can start trading with paper money under the same market conditions, quotes, and spreads as live account holders.

Countries Accepted

Despite that Klimex is only 400 miles south of Miami, Florida, traders in the United States cannot open an account with this broker. Similarly, the firm has an office in Australia and mainly uses the AUD as its main currency, but, strangely enough, traders in that country also can’t register an account with them. Residents of Afghanistan, Burma, Egypt, and North Korea can’t use this broker, either.

Conclusion

From its multiple promotional programs to the educational content and trading tools, Klimex truly encompasses different users’ needs. Having said that, we found the main downside about this broker is how unclear certain information is. if you make frequent transfers or prefer to retain large leverage alongside a sizable portfolio, you may want to contact customer support for inquiries about transfer fees, processing times, and buying power limitations.