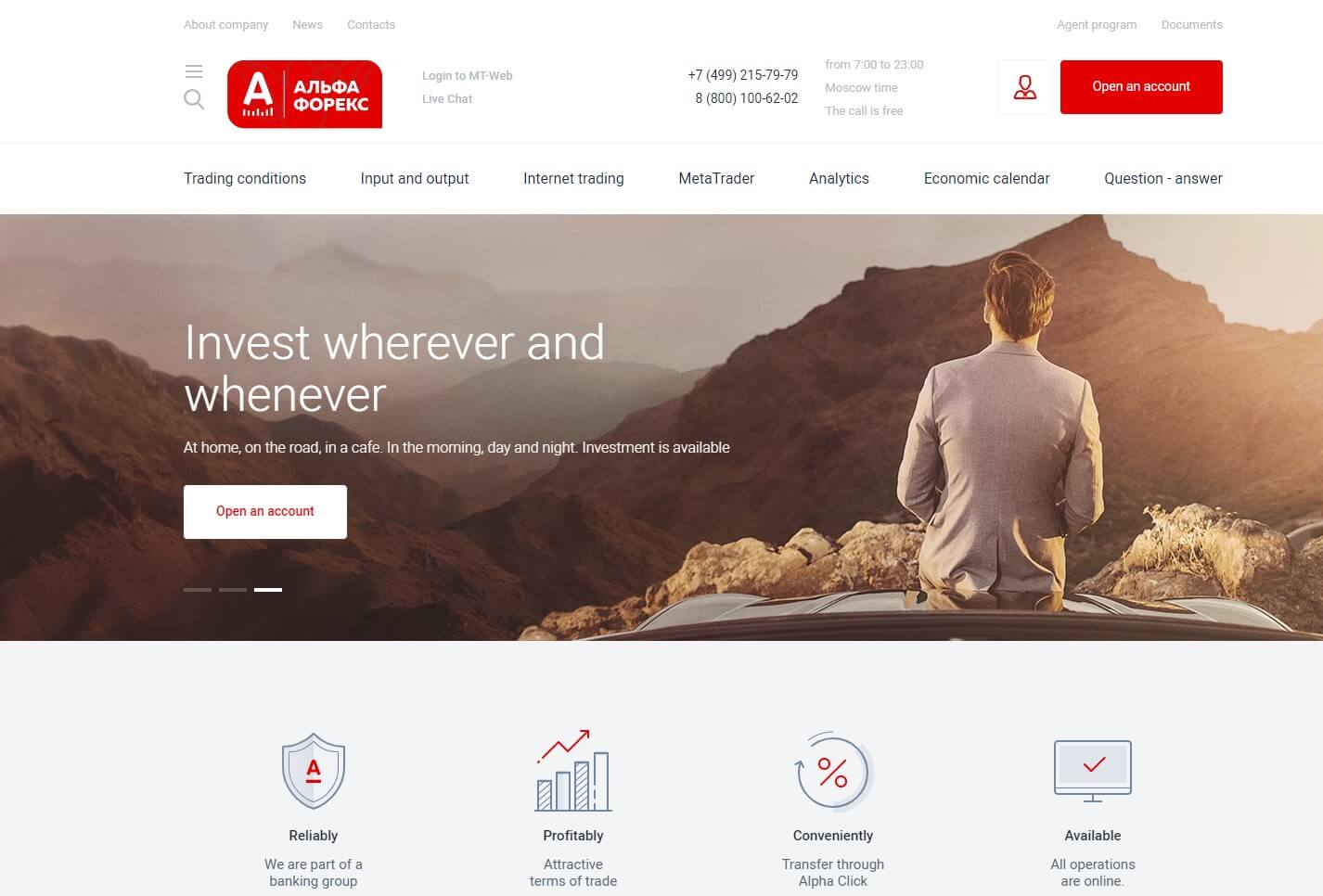

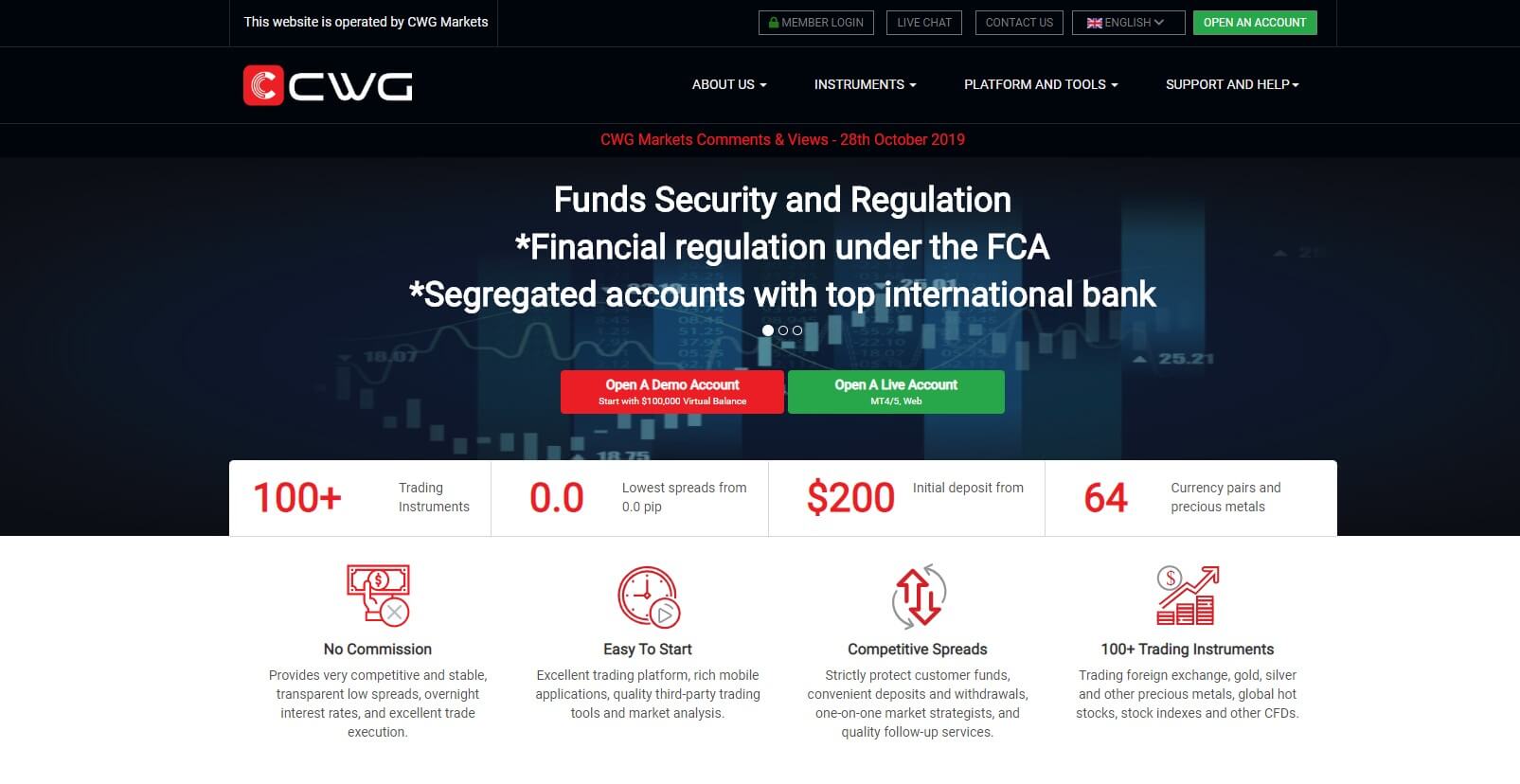

Open Broker is not a typical broker experienced traders know about. This is a Market Maker model broker with a different approach to customers, offering plenty of options and products. Open Broker is based in the Russian Federation, oriented towards Russian clients. Since establishment in 1995, it was a part of the Open Group that emerged as the largest privately-owned financial institution in Russia. Having a sustained business to be one of the leading brokerage services today.

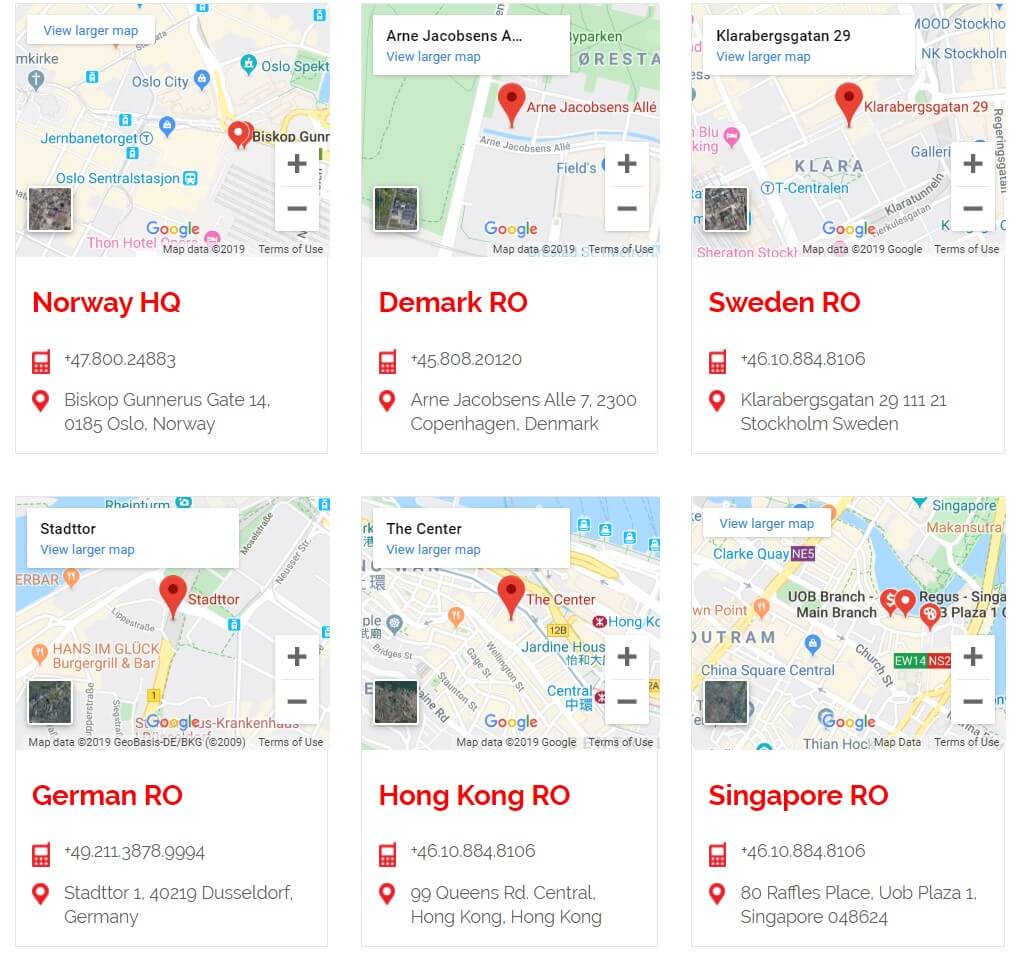

Open Broker received many awards and is frequently mentioned in the press. The management structure is heavy, structured and organized to cope with extensive products and services. Completely specialized for the Russian market- Moscow exchange, Open Broker received good ratings from their local traders. Being a part of the Open group, it allows coverage to effectively serve customers almost anywhere in Russia, as well as in London, Frankfurt, and Cyprus (bank clients). On June 28, 2002, the licenses set was obtained from the Federal Securities Commission of Russia for a complete range of brokerage services, also requiring 500 Million rubles base capital ($7,87 M). This regulator is extreme in some areas and specific to Russian laws.

According to the Moscow Exchange, in 2016, the broker takes 5th place for the number of registered customers, active customers, 1st place for the volume of client transactions. Today, Open Broker has more than 3 million customers across Russia. In the following section, we will evaluate why this broker has this success and what makes it so specific.

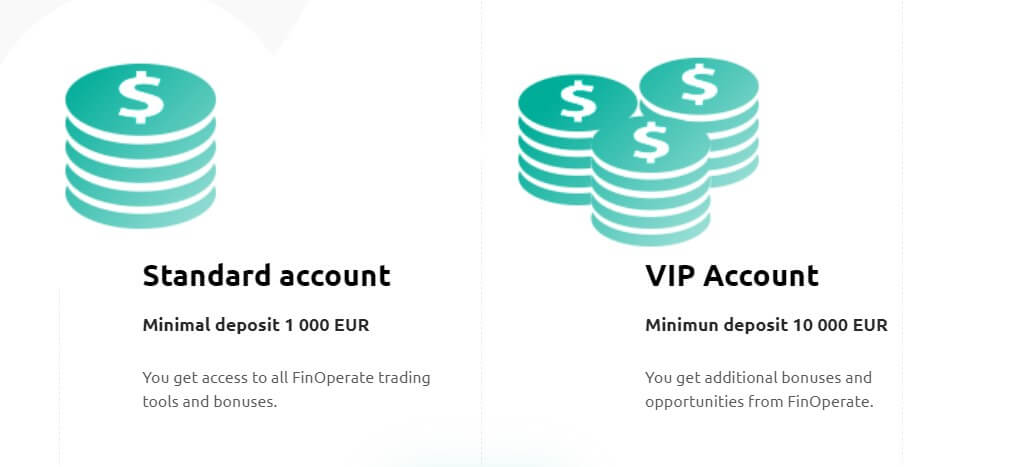

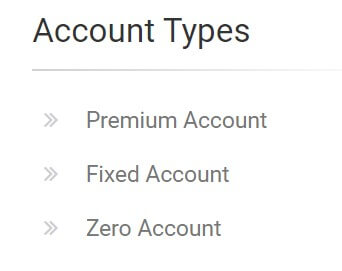

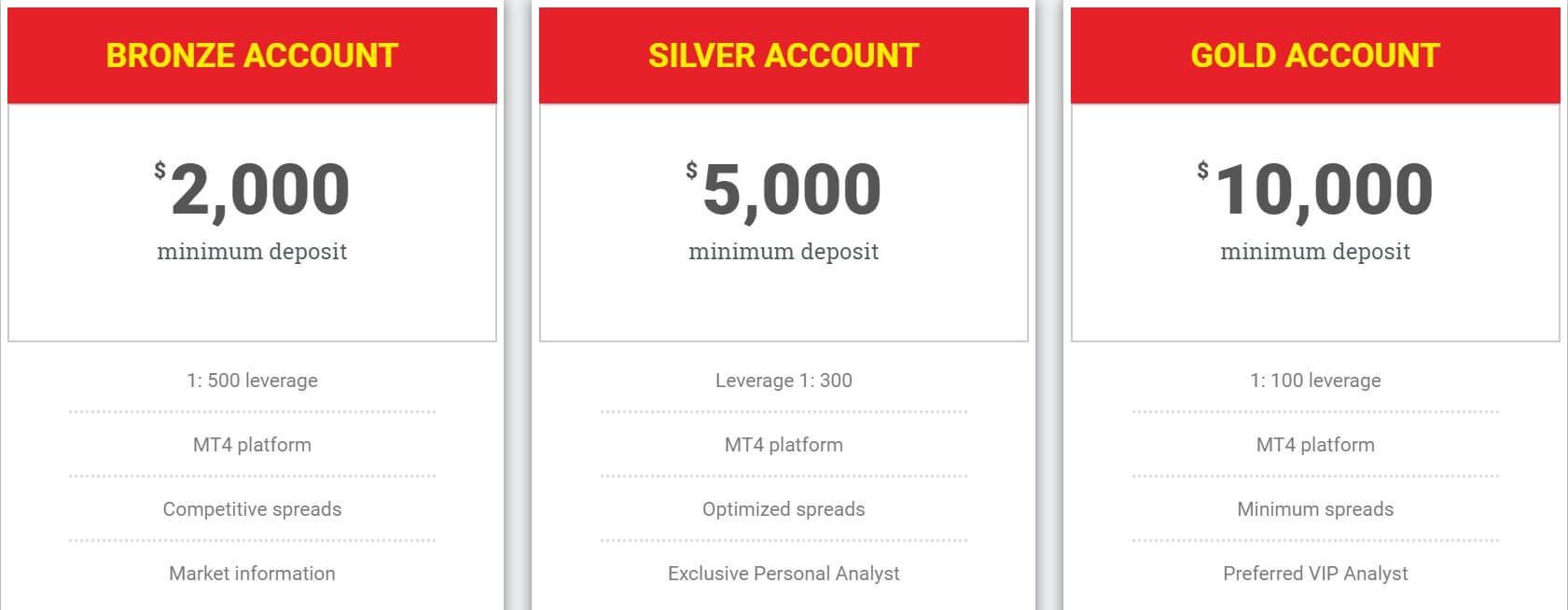

Account Types

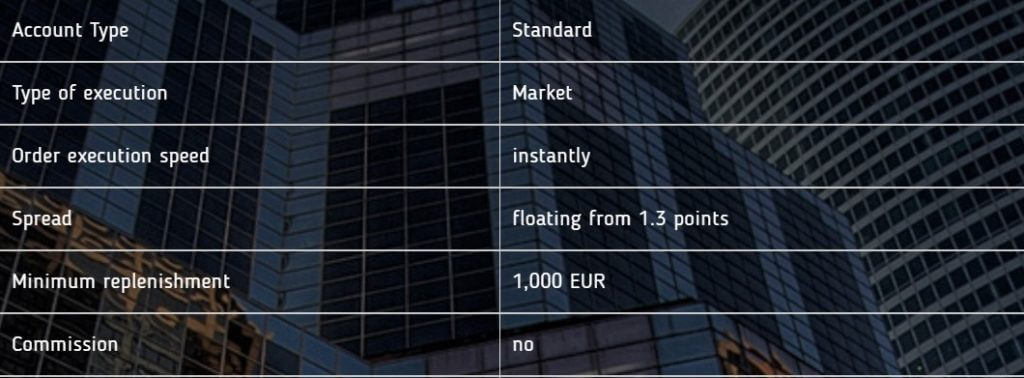

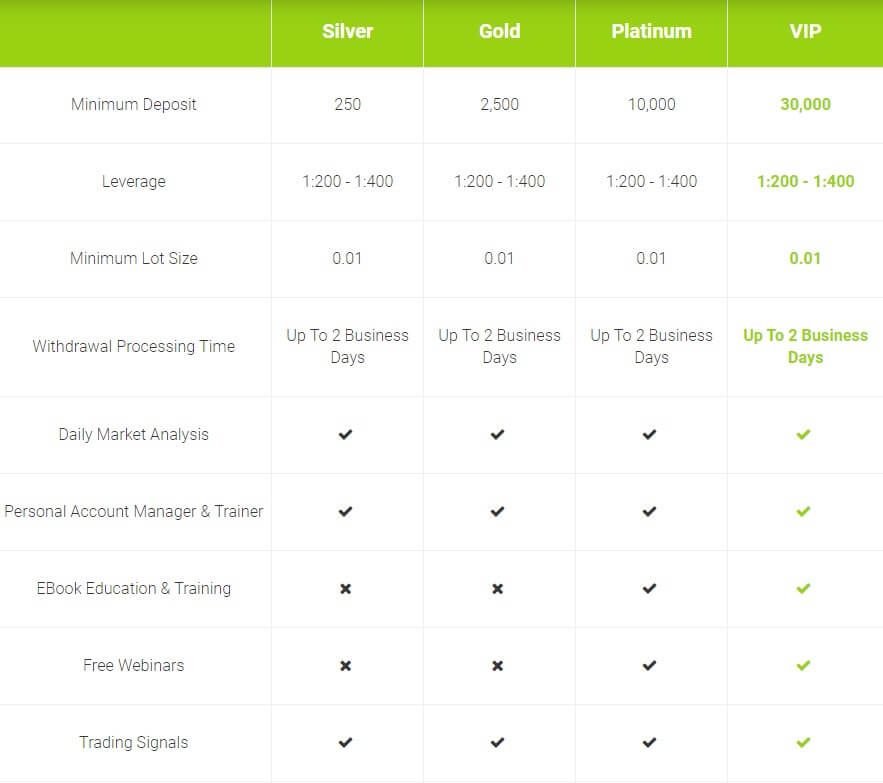

Open Brokers does not have the usual number of accounts. A total of 16 types are classified into 3 groups. Do-it-Yourself accounts, Investments accounts, and Ready-made Investments account. Since most independent traders would go with the self-managed trading accounts we will provide more details for those. The tariffs for each account is very detailed, many of the administration costs are transferred to the client. For example, there is a cost for using the leverage, reporting, different commissions for OTC, Stocks, Currencies, maintenance, etc.

Currency Exchange service is a simple conversion tool that enables clients to exchange currencies directly from the market. It works by opening an account, topping it with the currency and then exchange it to another with better rates compared to the banks. Then, these funds can be transferred to the card or a bank account. The service has no fees but has a commission that is included in the rate. The Conversion Account does not have a minimum deposit although has a fee if it is less than 50.000 rubles.

Currency Exchange service is a simple conversion tool that enables clients to exchange currencies directly from the market. It works by opening an account, topping it with the currency and then exchange it to another with better rates compared to the banks. Then, these funds can be transferred to the card or a bank account. The service has no fees but has a commission that is included in the rate. The Conversion Account does not have a minimum deposit although has a fee if it is less than 50.000 rubles.

Russian Market Account gives the ability to trade Stocks, Currencies, Bonds, Metals, and Commodities on the Russian market. This account has a flexible Universal tariff that enables traders to try different trading strategies. The Account features a cashback for transactions on the Moscow Exchange, 0.057% commission, and account maintenance of 175 rubles per month if there is trading activity.

International Markets Account Trader is open to stocks, bonds and ETFs around the world on leading international exchanges, like Nasdaq. AMEX, TSX, FTSE and also OTC market trading. This account has 3 tariffs, All-Inclusive, US PRO, and Standard ITP. All-inclusive is optimal for beginners and experienced traders who trade small volumes and mainly use market orders. The commission is $1 per 100 shares and up to a 4% annual fee for the leverage use. US PRO tariff is for scalpers and high volume traders (from 10,000 shares per day). Limit orders have the Rebates mechanism useful for scalpers. Standard ITP tariff is for investors, long term traders. Leverage for this tariff is not available.

International Markets Account Trader is open to stocks, bonds and ETFs around the world on leading international exchanges, like Nasdaq. AMEX, TSX, FTSE and also OTC market trading. This account has 3 tariffs, All-Inclusive, US PRO, and Standard ITP. All-inclusive is optimal for beginners and experienced traders who trade small volumes and mainly use market orders. The commission is $1 per 100 shares and up to a 4% annual fee for the leverage use. US PRO tariff is for scalpers and high volume traders (from 10,000 shares per day). Limit orders have the Rebates mechanism useful for scalpers. Standard ITP tariff is for investors, long term traders. Leverage for this tariff is not available.

Probably the best what Open Brokers have is the Individual Investment Account. This account has a tax benefit and the ability to connect the investment with finished products, or strategies. This way you are into a kind of PAM account. It is affordable for entry, provides full control over your account and full support. Historical ROI for this account is 31.84%

The accounts structure is not simple, and even experienced traders will lose amid all the information and costs. This is also a sign of transparency and professionalism on the other side. Open Broker has a consultation agent form at every page so visitors can be introduced to what is the best for them.

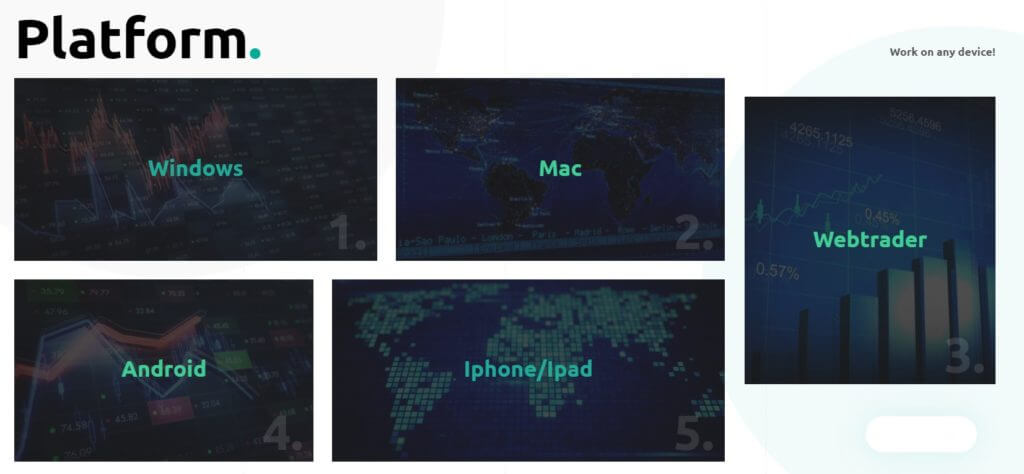

Platforms

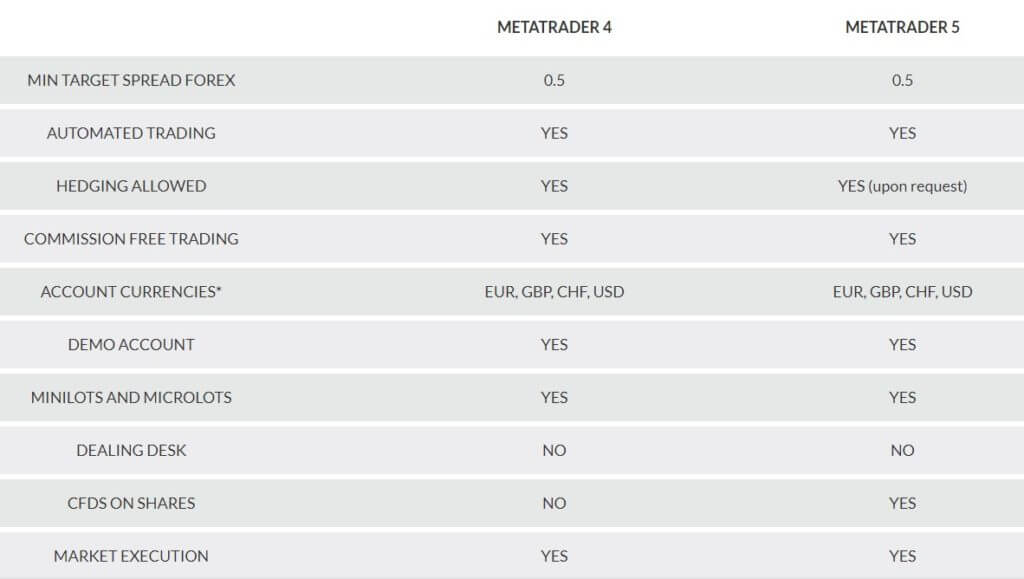

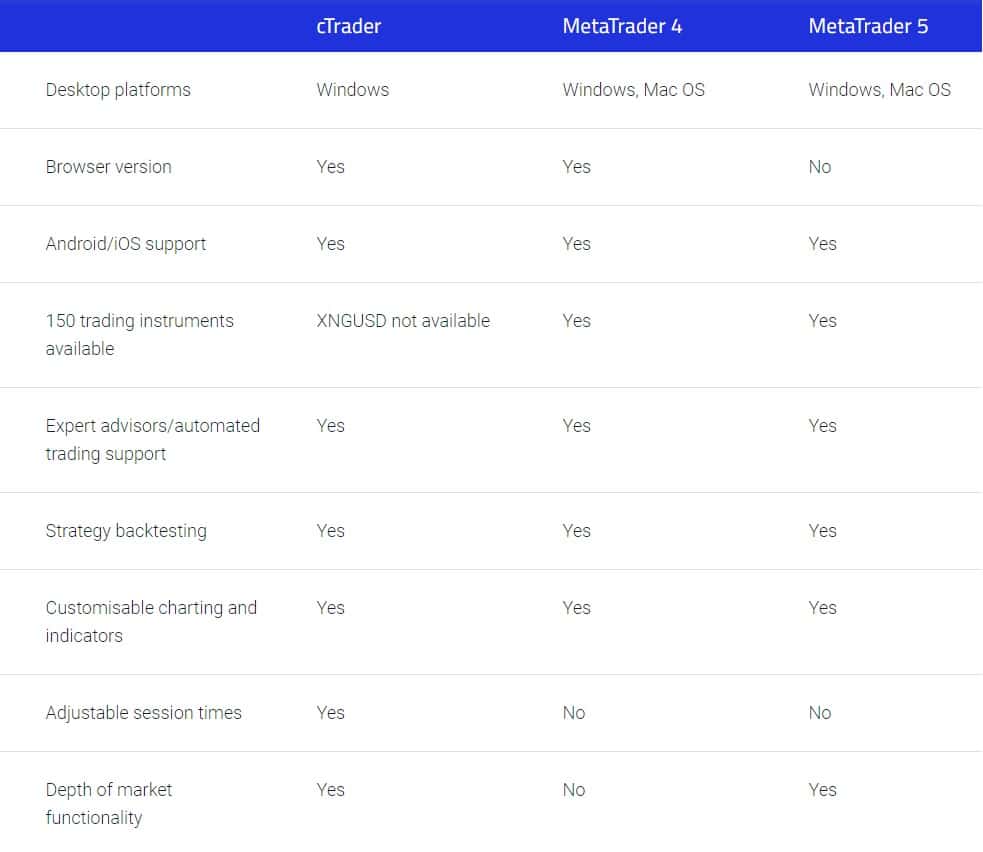

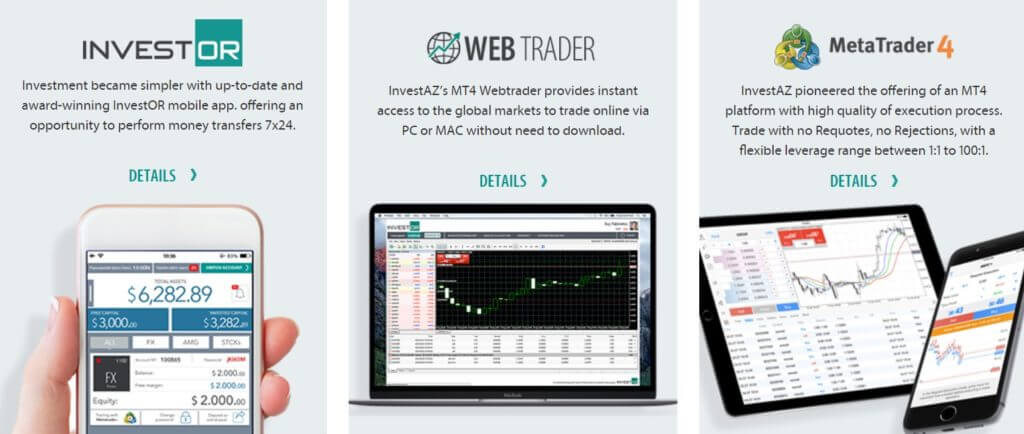

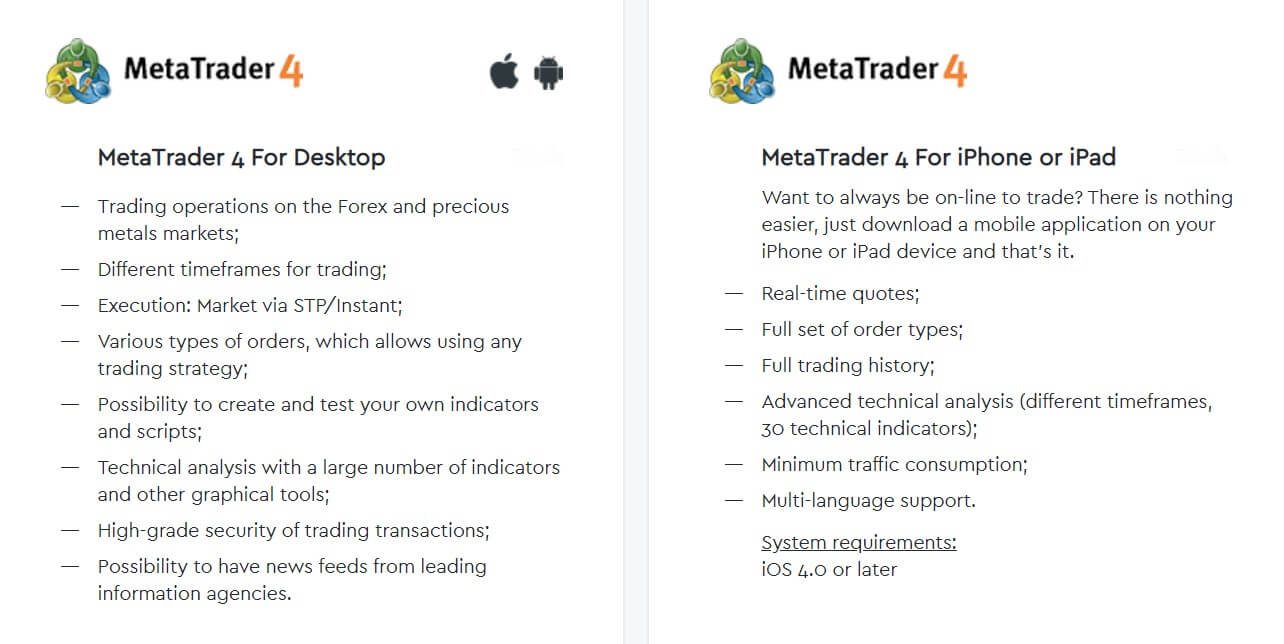

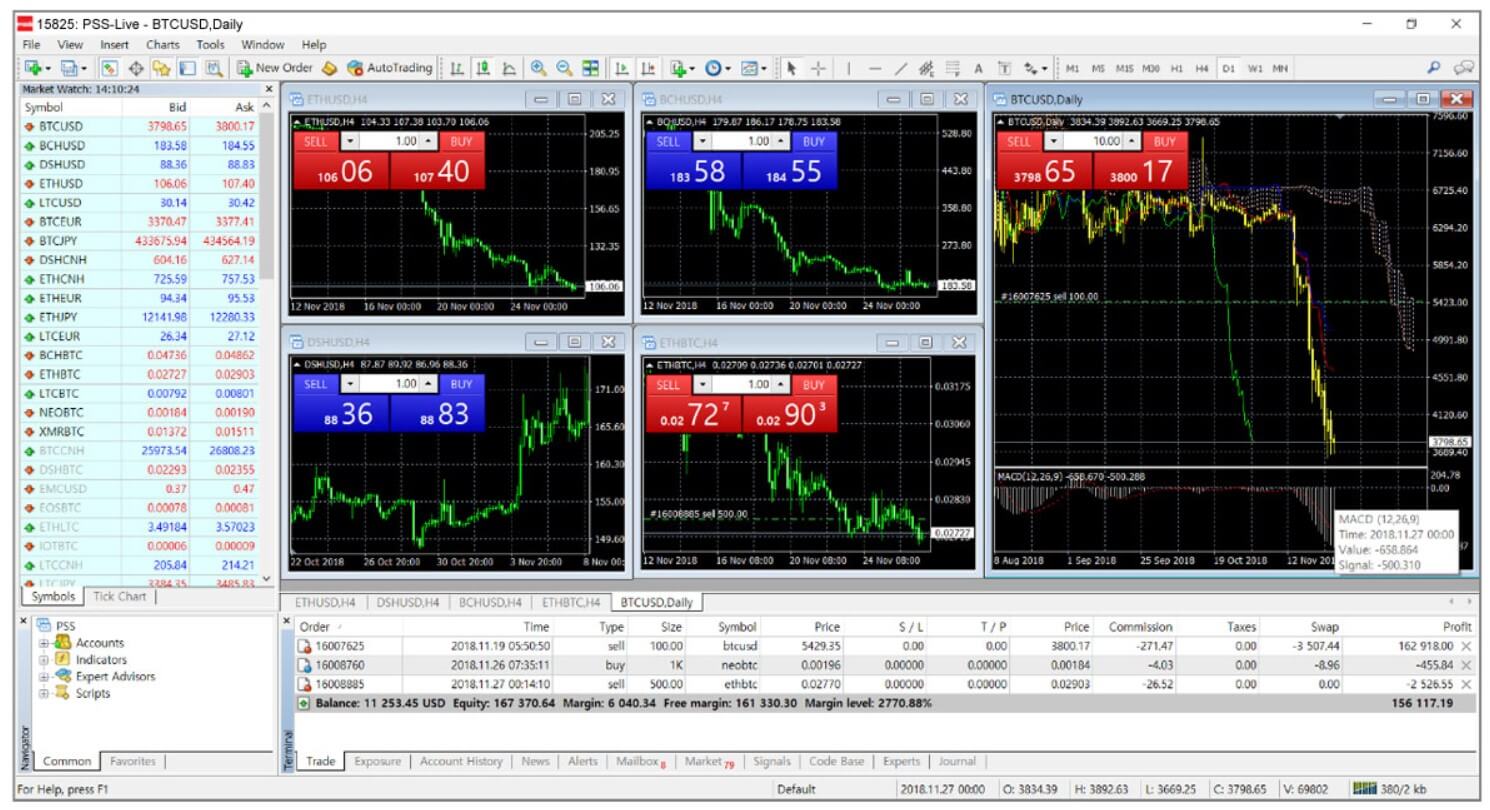

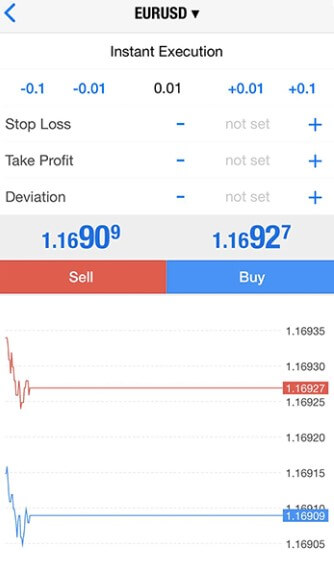

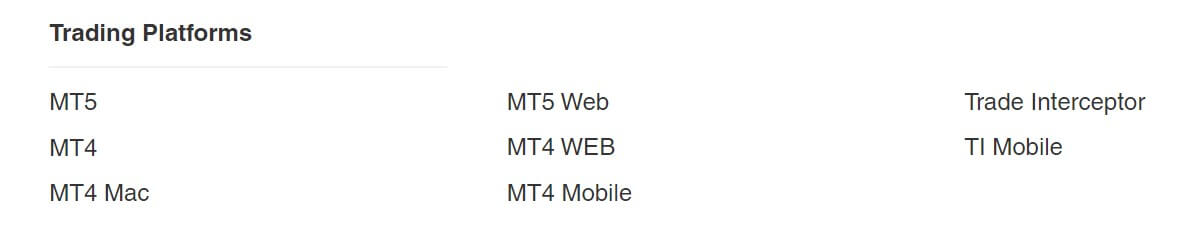

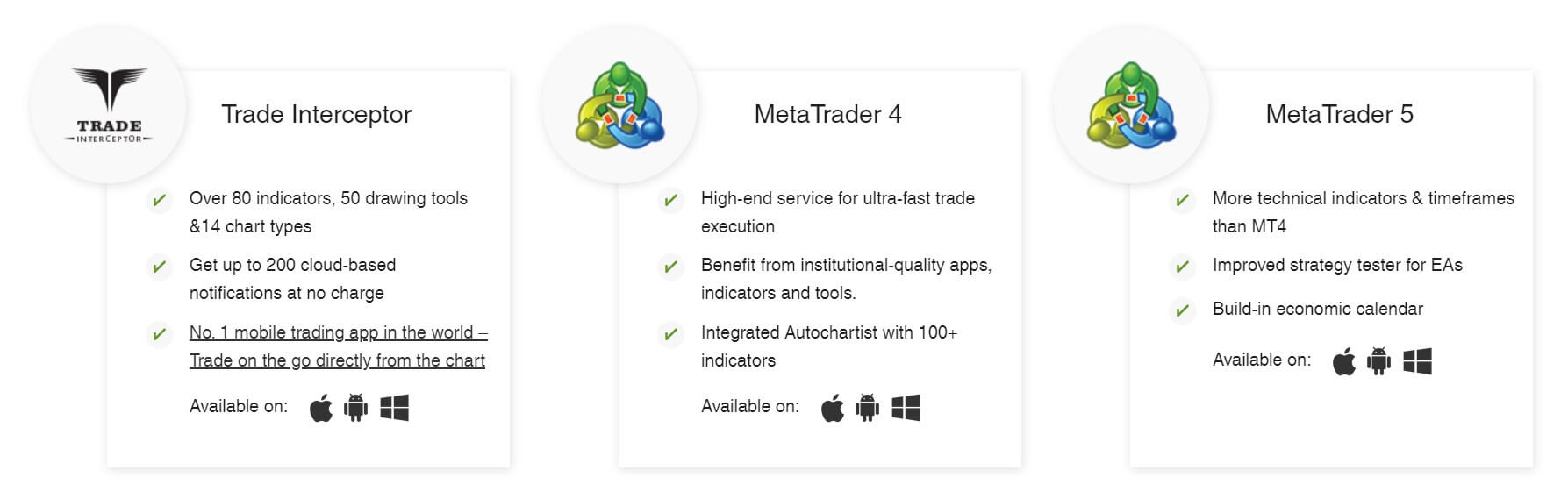

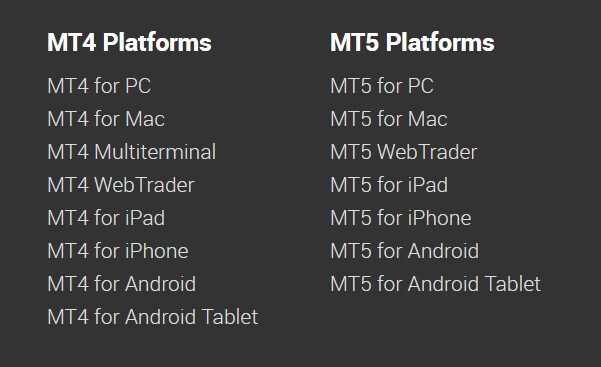

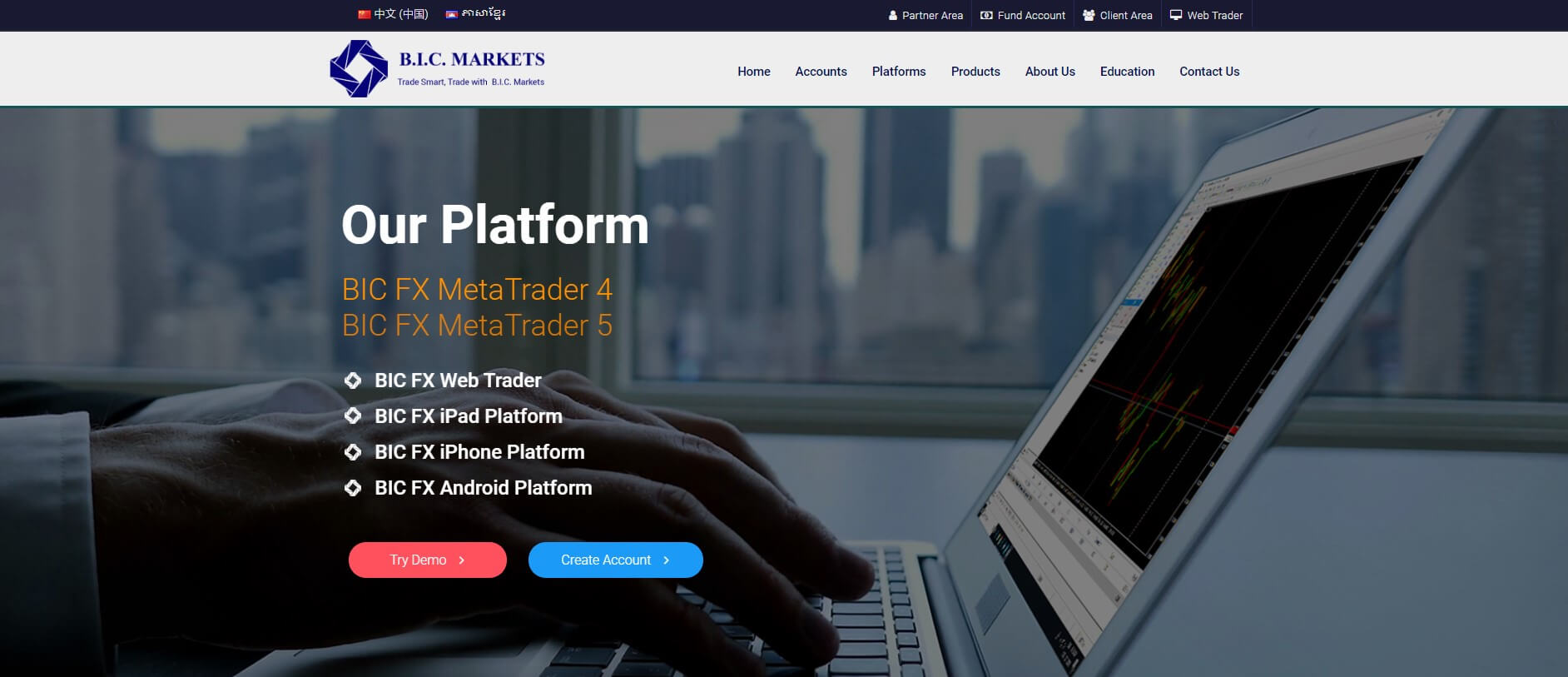

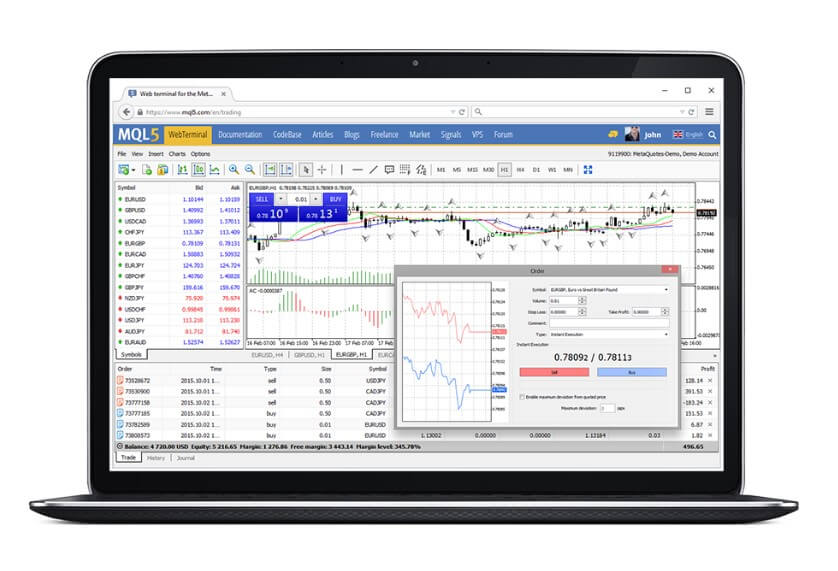

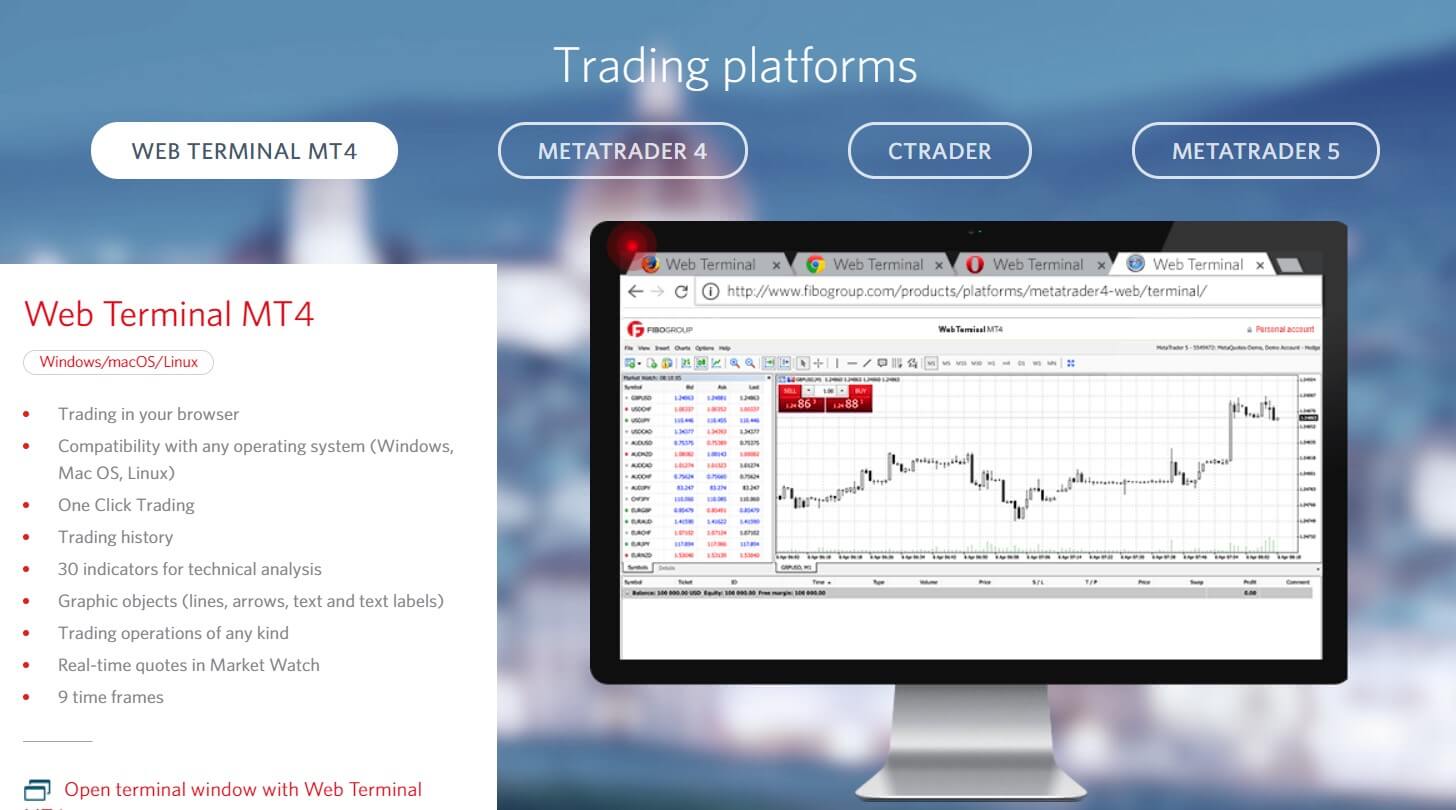

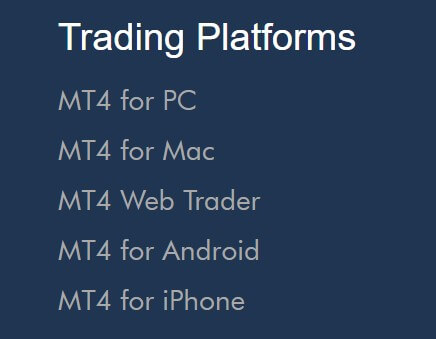

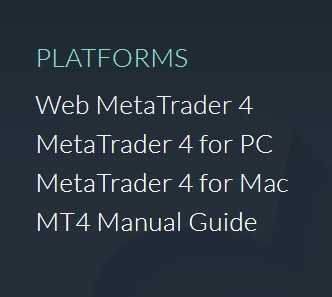

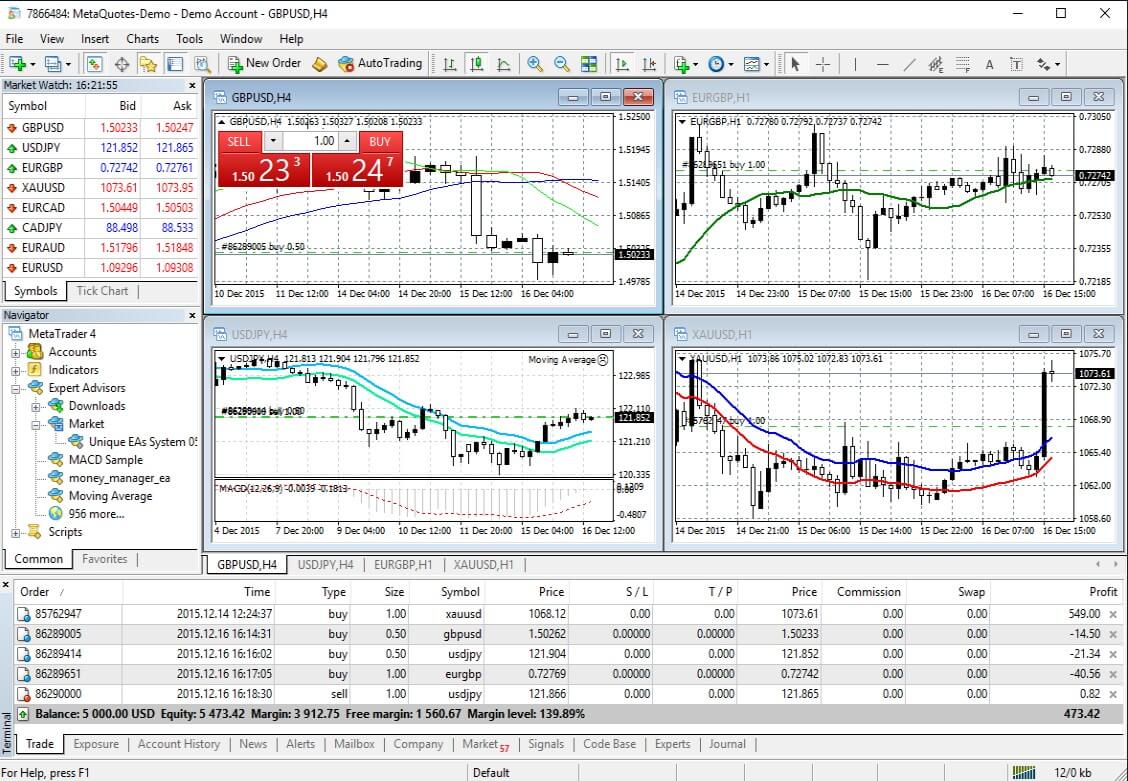

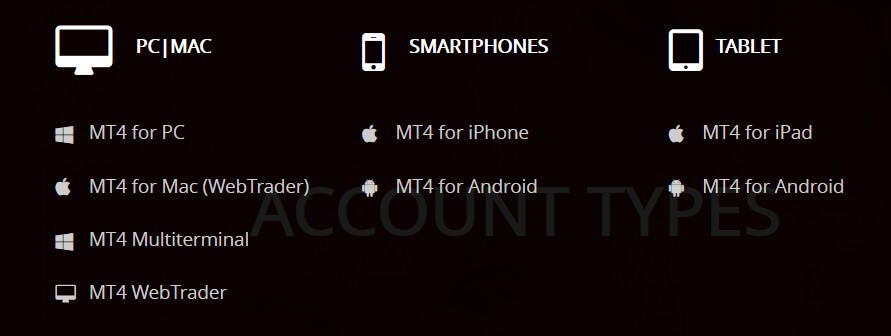

Open Broker has two platforms and one of them is not so widely known. Metatrader 5 is adopted and most traders are familiar with the software from Meta Quotes. The other one is QUIK from ARQA Technologies.

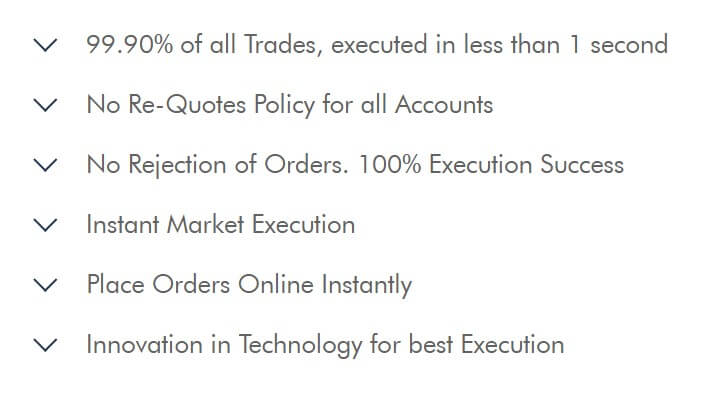

The MT5 is not set to the defaults and has 4 chart panels opened. The information lines in the journal and almost every tab of the terminal are extended and not common to see. For example, the Trade tab will show additional Margin segments like Initial Margin, Maintenance Margin, Commission and more, all grouped for all positions. When making an order, traders can select how the order will be executed too. The instrument specification panel is also extended and full of information that may seem overwhelming. Still, the trading has limitations like unusual trading sessions that cause chart gaps. The connection to the server is very quick and the execution times are a bit above 100ms on average, which is great for a dealing desk broker type.

The QUIK platform will certainly require some adaptation even if traders have trading knowledge. Windows arrangement can be linked and will display a real-time feed from the exchange. Level 2 quotes are also displayed which is very useful to some traders. The news feed is available from the broker or other agencies. Over 30 technical analysis indicators can be plotted, Fibonacci lines, angles, arcs, trend drawing, horizontal and vertical lines, text marks, etc.

The platform support pending orders, stop-limit, take profit, if-done orders, but also execute orders and import of transactions prepared in other programs. Scalper’s Level2Quotes (quotes window view) are standard, allowing quick orders by using buttons or with drag-and-drop. Import and export of data are available for MS Excel including the Level2Quotes table. The platform is adapted for the Moscow Exchange but is very rich in features. The drawback is the lack of support and abundance of addons the MT4/5 has. Open Broker does allow all trading styles, including EAs on both platforms. Algorithmic trading is also supported by the VPS service. All platforms are available for Android and iOS.

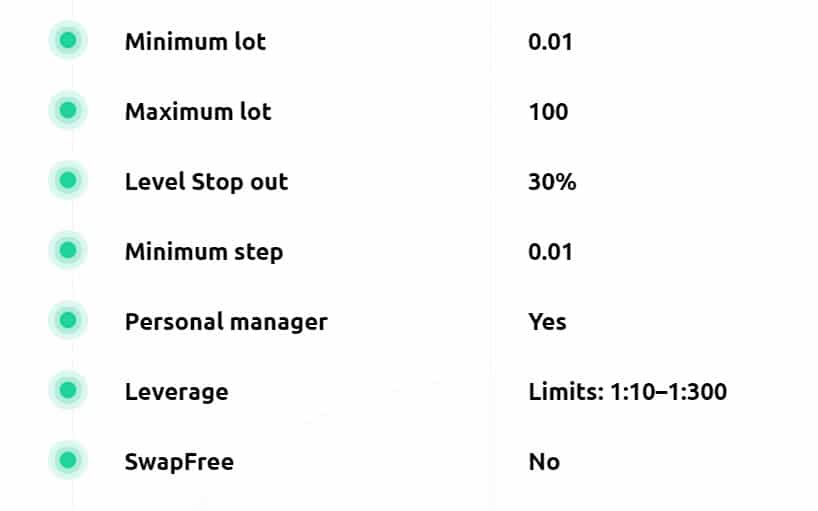

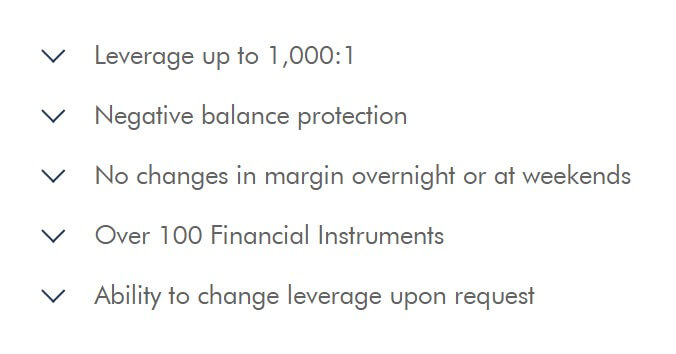

Leverage

The leverage is available to some accounts and it will come with a different fee that depends on the tariff. The exact leverage level can be arranged but traders need to consult with the Open Broker staff. For Investors type account leverage is not available.

Trade Sizes

There are many kinds of assets with varying trade sizes. Open Brokers is not simple and not typical like the other where trades sizes are clear for each asset. Here this is scaled to the account type and also to the tariff. So, for example, Investors will have bigger minimum trade sizes than scalpers. What is good is that all the information is transparent and a bit of study is required to find what is optimal for each trader or investor.

Trading Costs

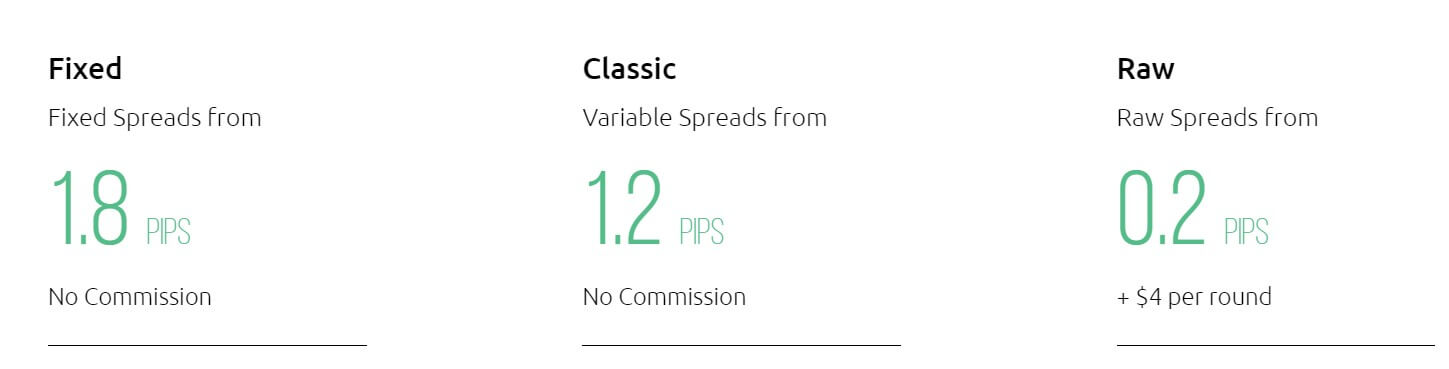

Open Broker has multiple tariffs and account types combinations. This split tariff selection and account types opens a plethora of combinations, therefore different costs. Open Broker puts a lot of administration costs to the trader so, for example, account maintenance, leverage, reports and so on, all have a fee. If traders select the International Markets Account, the commission will be 1 cent for the stock market per lot, but not less than $7 if the stock is worth more than $1.01. For stocks worth less than $1 a commission of 0.0257% but not less than $7, even for partial position closing. For the EU stocks, the commission is 0.07% but not less than 13 EUR/USD/GBP. The leverage used will cost 7% annually for stocks (long positions only).

Open Broker has multiple tariffs and account types combinations. This split tariff selection and account types opens a plethora of combinations, therefore different costs. Open Broker puts a lot of administration costs to the trader so, for example, account maintenance, leverage, reports and so on, all have a fee. If traders select the International Markets Account, the commission will be 1 cent for the stock market per lot, but not less than $7 if the stock is worth more than $1.01. For stocks worth less than $1 a commission of 0.0257% but not less than $7, even for partial position closing. For the EU stocks, the commission is 0.07% but not less than 13 EUR/USD/GBP. The leverage used will cost 7% annually for stocks (long positions only).

OTC market has another set of fees. The commission is 0.35% for trades of up to $100.000, above that value is 0.25% and above $300.000 is 0.15%. The minimum is $59 regardless of the transaction size. OTC market leverage has a fee of 3.75% per anum for Eurobonds. Reporting on the client’s securities and movements will also cost $3. For other accounts, there are similar tariffs sheets but do not differ too much.

Assets

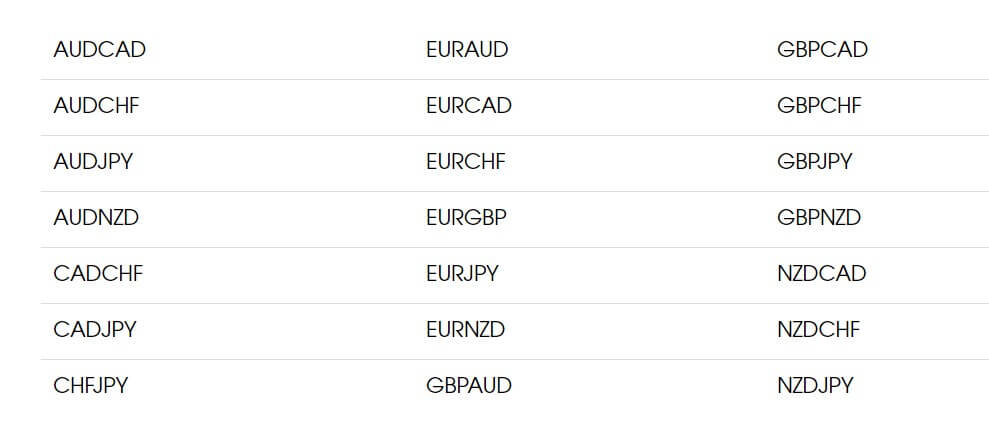

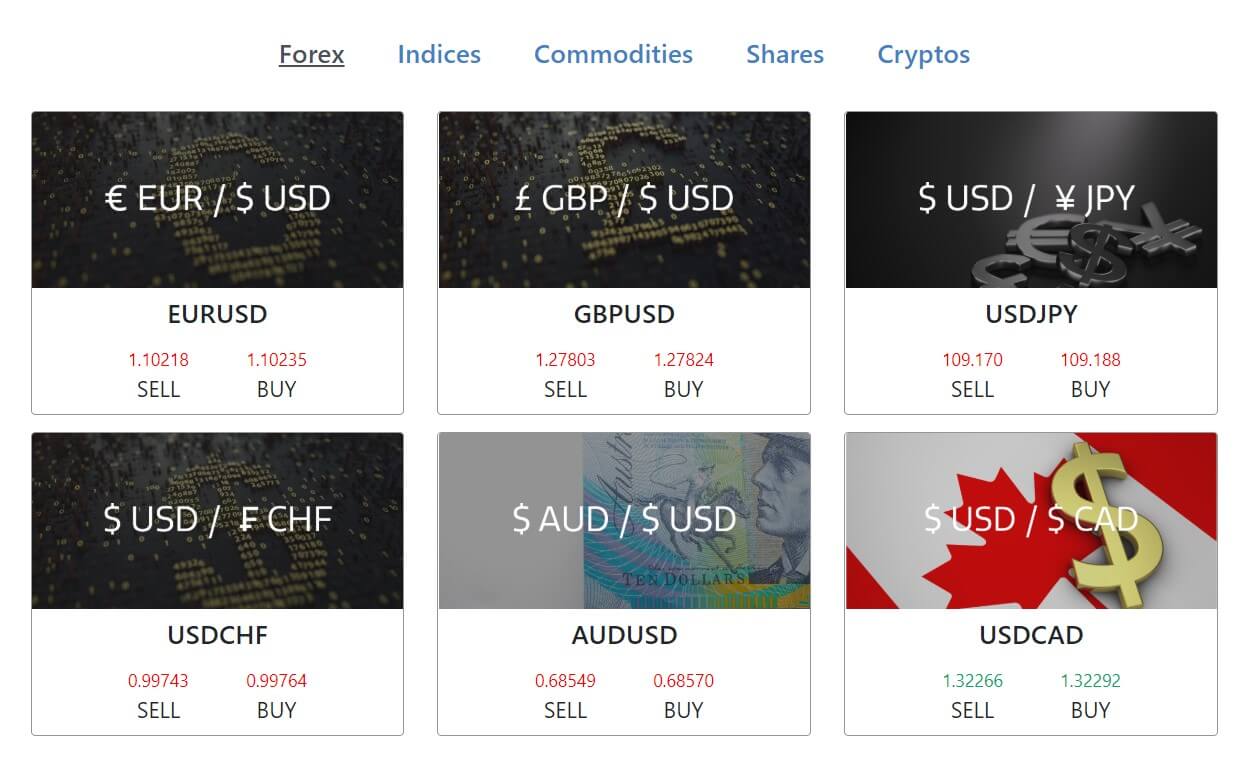

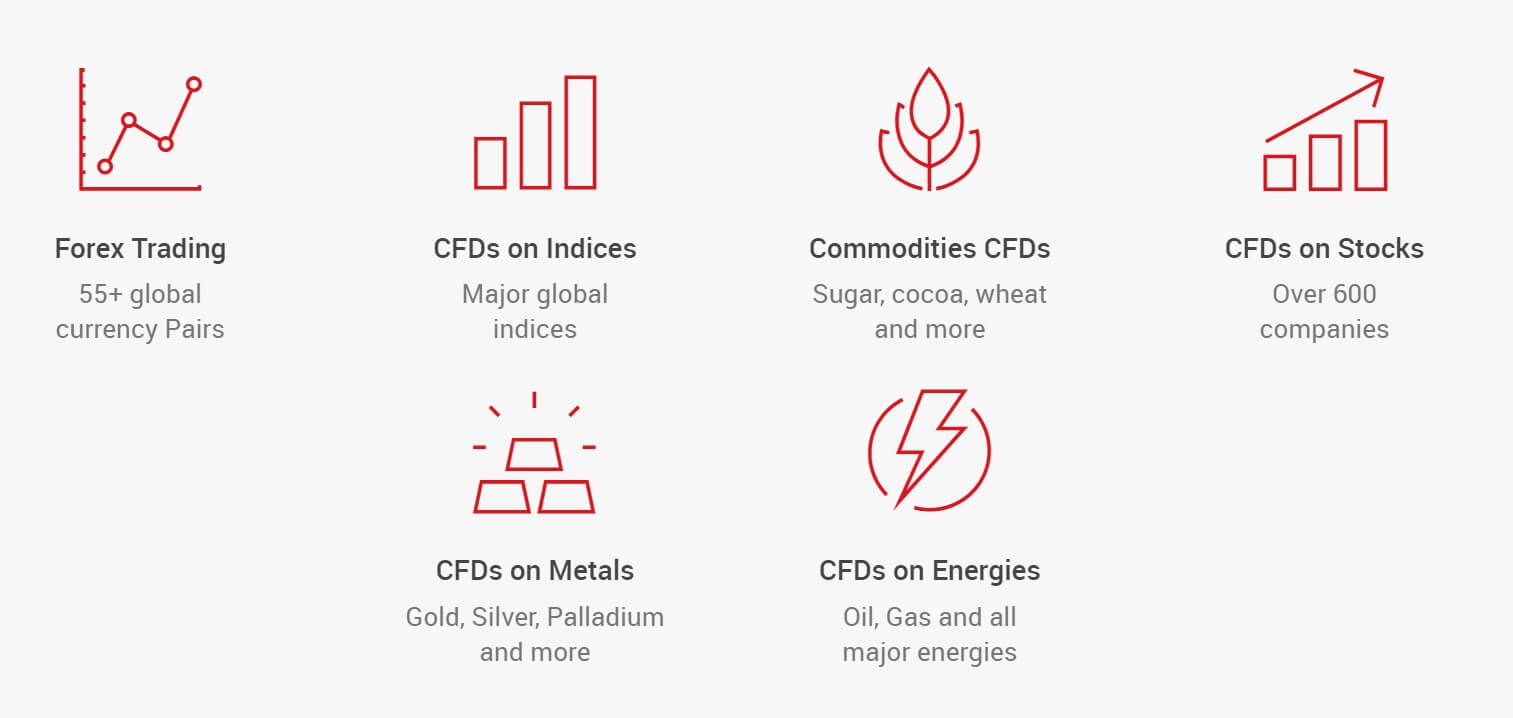

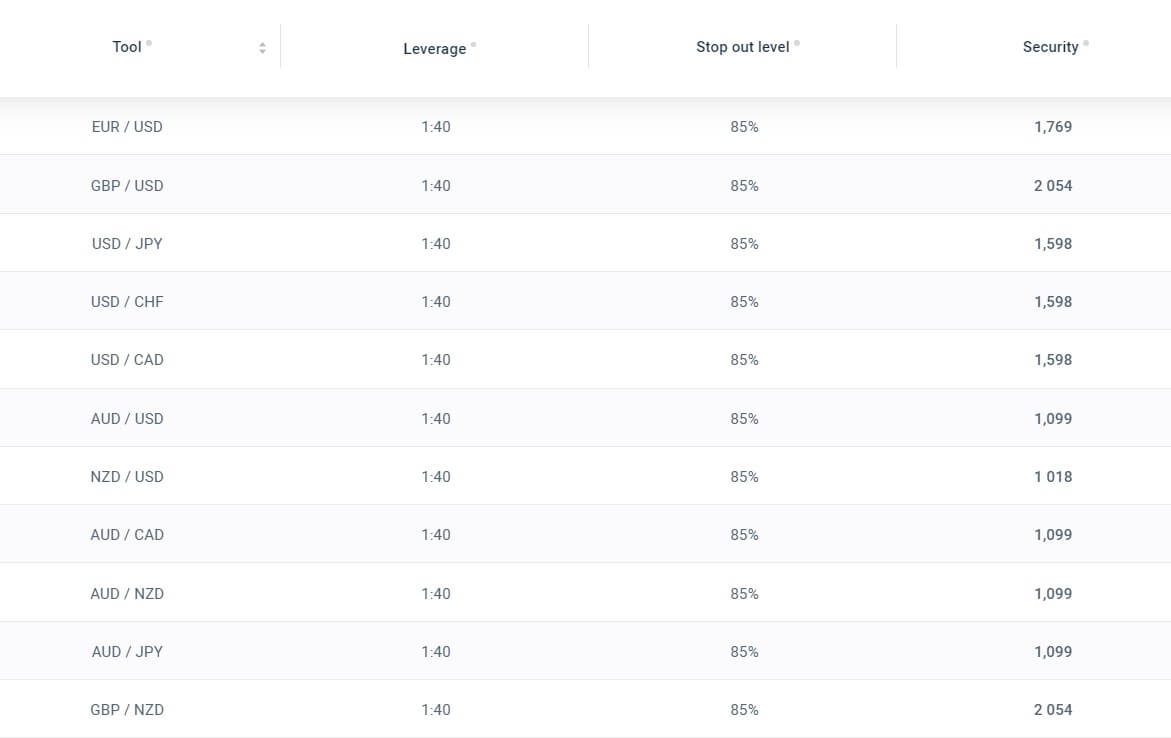

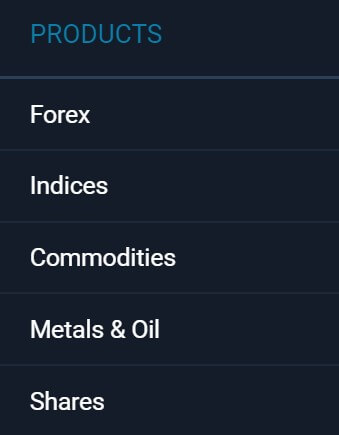

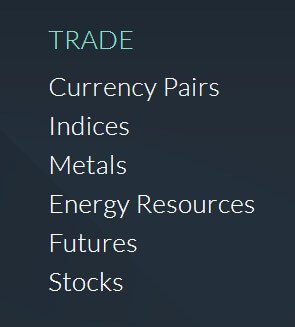

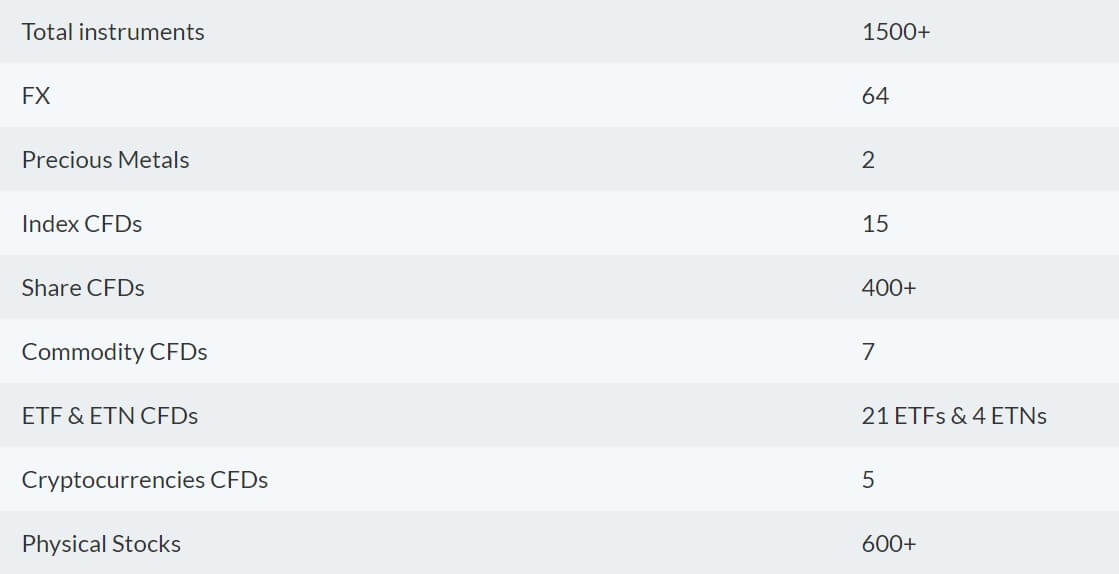

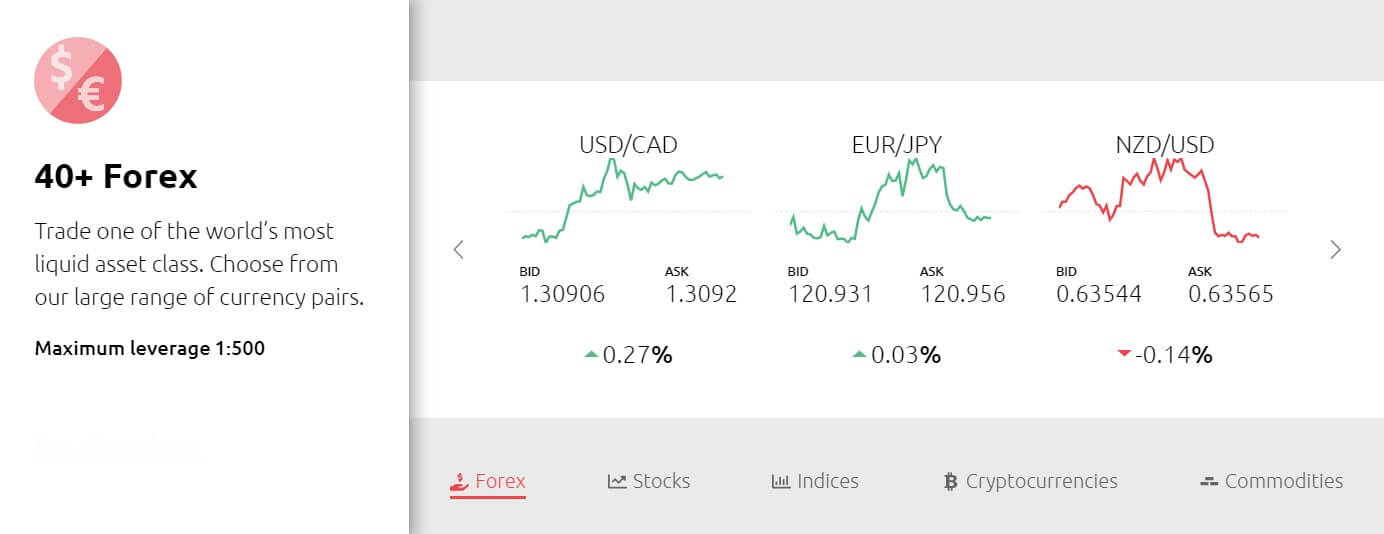

Open Broker falls into the specialized class for the Russian market. A full range of major companies and financial institutions are listed, thus making a huge list of over 10.000 assets. The US and EU stocks market are not so extensive but all the major companies are listed. The currency market is different and revolves around the Russian Ruble. Currency pairs like EUR/USD are not present. If you seek to trade all combinations with the RUB, Open Broker will have all the exotics like CNY/RUB, HKD/RUB, CHF/RUB and so on. Open Broker also features Precious metals, Bonds, EFTs, Options, and Futures.

Aside from this, Open Broker also has a Structured Product. This is a structured portfolio designed to maximize the return of a particular idea. It is based on different assets, from stocks to currencies. Once this package is acquired, no management is needed. In essence, it is like a deposit or an investment with scalable levels of risk and ROI. Periods for these investments can be from 1 month to 3 years. Open Broker markets this product as an alternative to a bank deposit. Of course, the yield is higher. Structural products can be customized and optimized according to the investor’s plans.

Mutual Funds Investment is familiar to investors as an optimal risk solution. Riskier than bonds but safer than stocks trading. Open Brokers also offers to invest with mutual funds. A total of 10 funds are available to select across multiple global regions. For this kind of asset investment, a minimum of 5000 rubles is required, which is a very low figure and suitable for anyone without experience in trading.

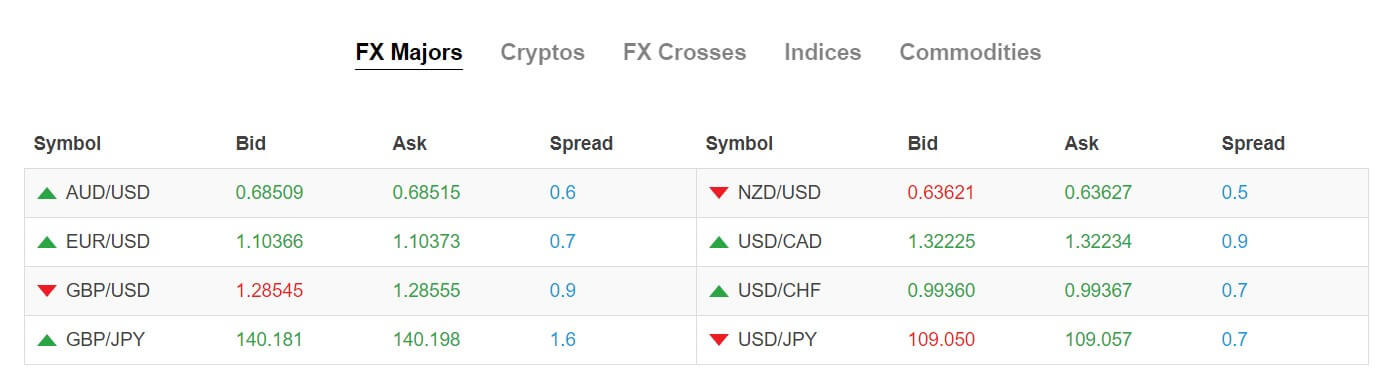

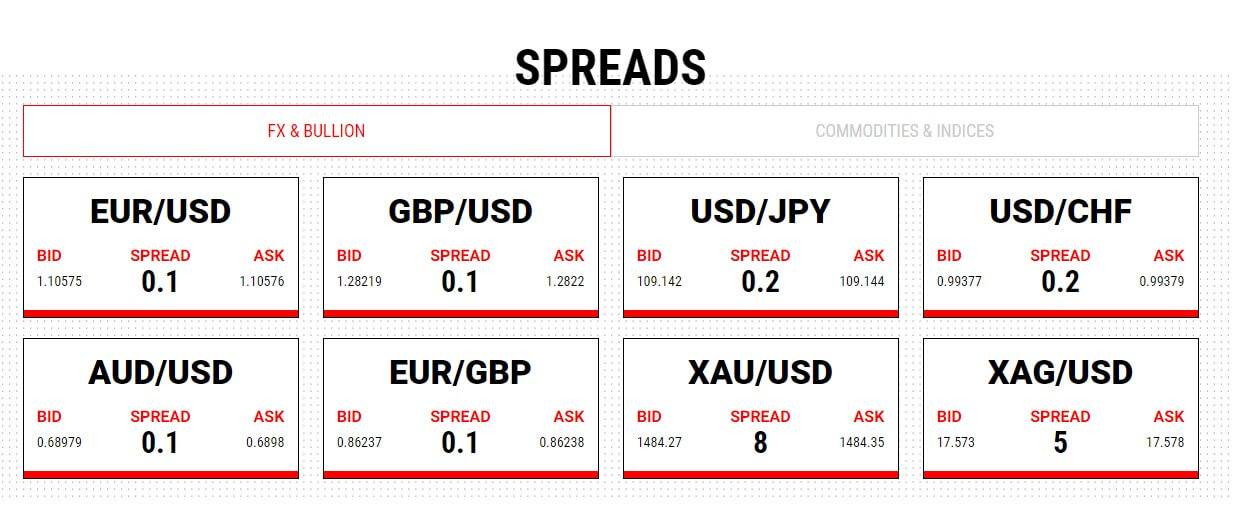

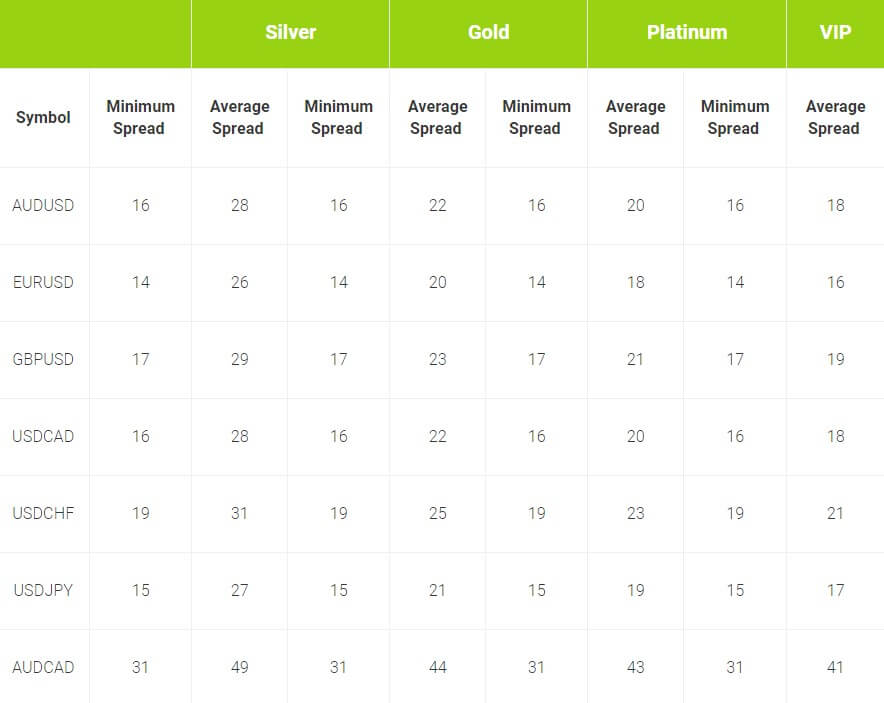

Spreads

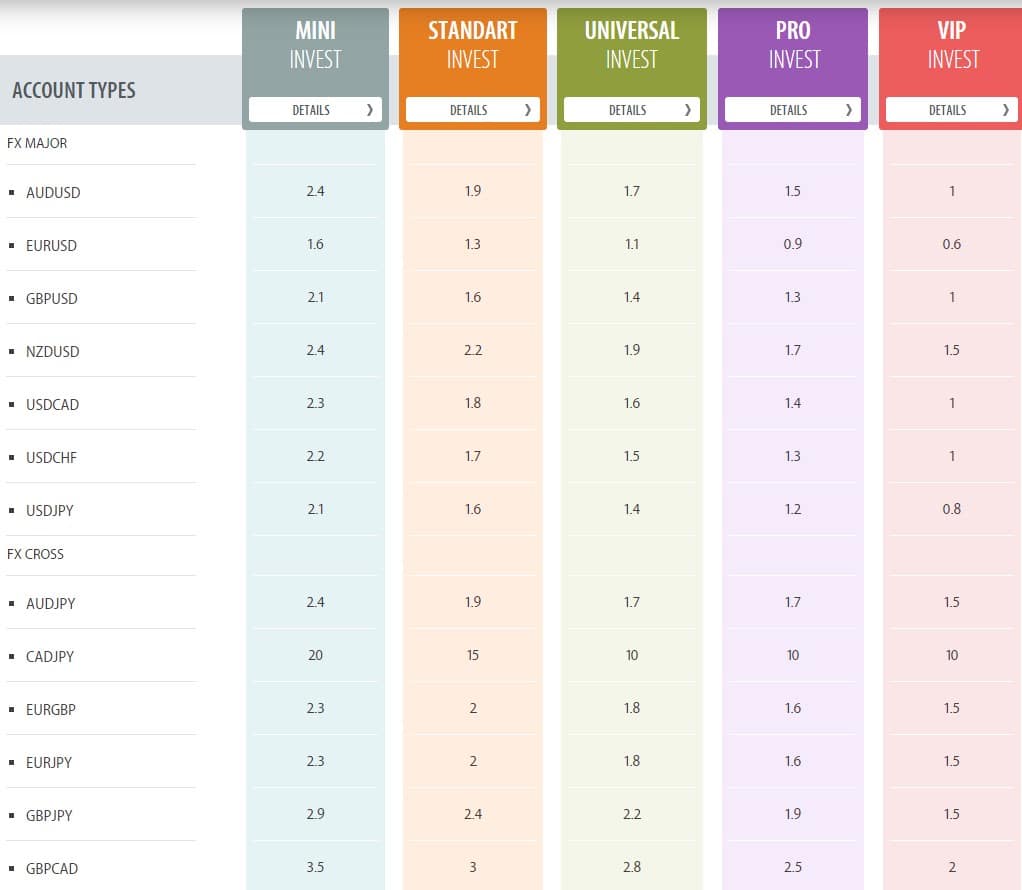

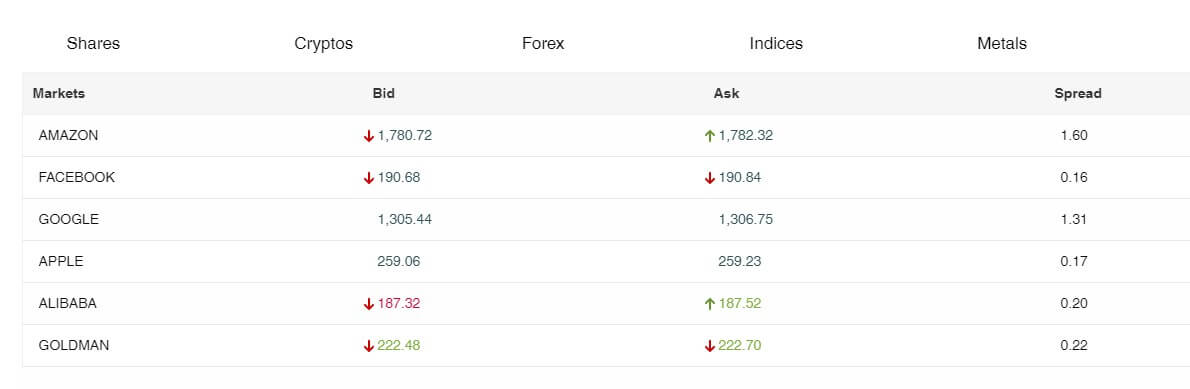

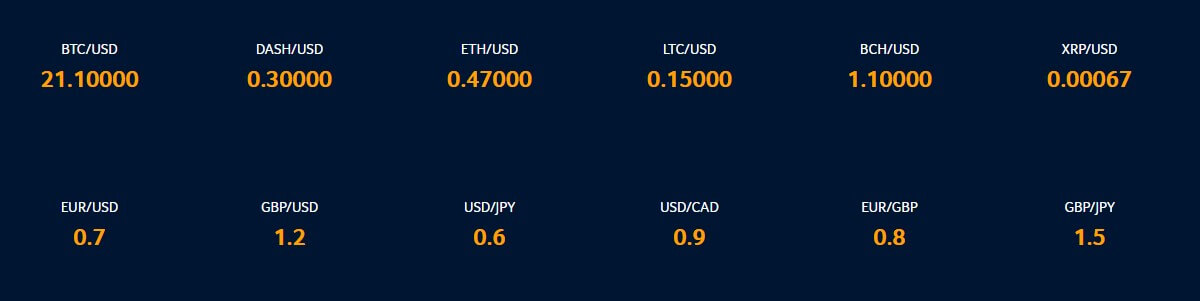

Open Broker relies on commission and the spreads vary across instruments but also many accounts types. The spreads cannot be compared to other brokers since typical currency pairs are not listed with them. What we have measured is that all are under normal values. All the information is transparent for all the account types and customizations.

Minimum Deposit

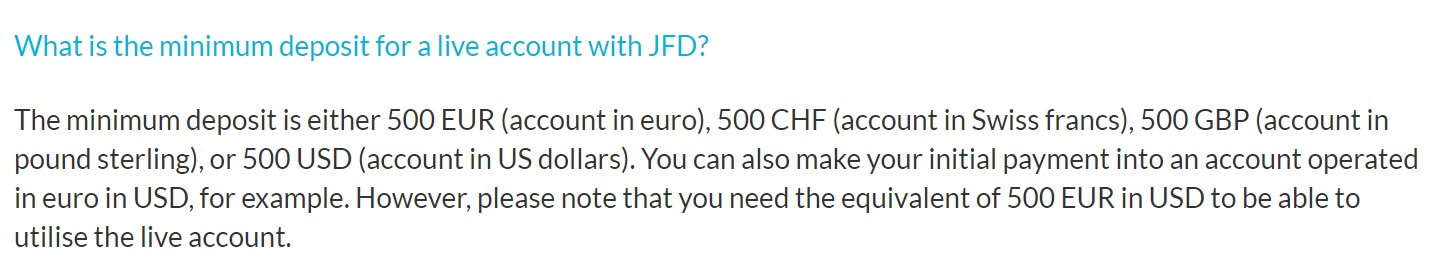

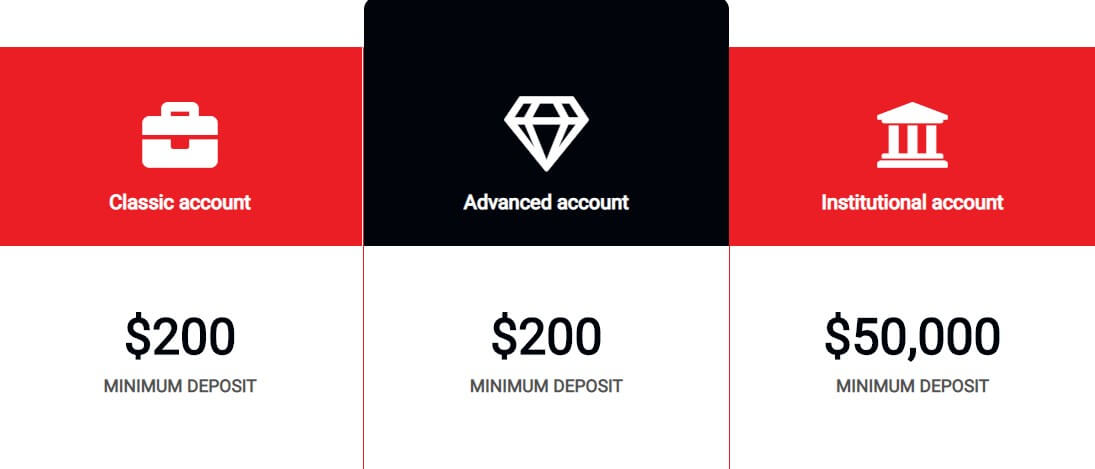

The minimum deposit is measured for every account type. For Individual Investment Account the minimum deposit is customized according to the client’s ability, but no more than 1M rubles per year. Ready-made portfolios do not have a minimum but 300.000 rubles per year is recommended. The signals service also does not require any minimum. For investment solutions, 5000 rubles is the minimum and for managed investments is 250.000 rubles. Other accounts do not require any minimum deposits.

The minimum deposit is measured for every account type. For Individual Investment Account the minimum deposit is customized according to the client’s ability, but no more than 1M rubles per year. Ready-made portfolios do not have a minimum but 300.000 rubles per year is recommended. The signals service also does not require any minimum. For investment solutions, 5000 rubles is the minimum and for managed investments is 250.000 rubles. Other accounts do not require any minimum deposits.

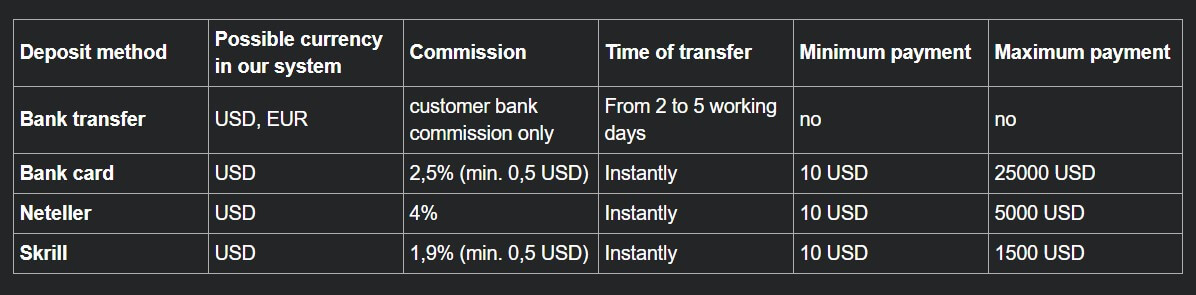

Deposit Methods & Costs

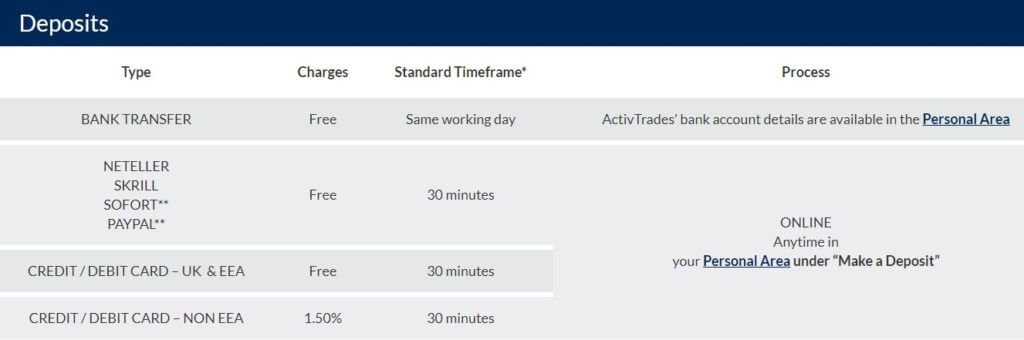

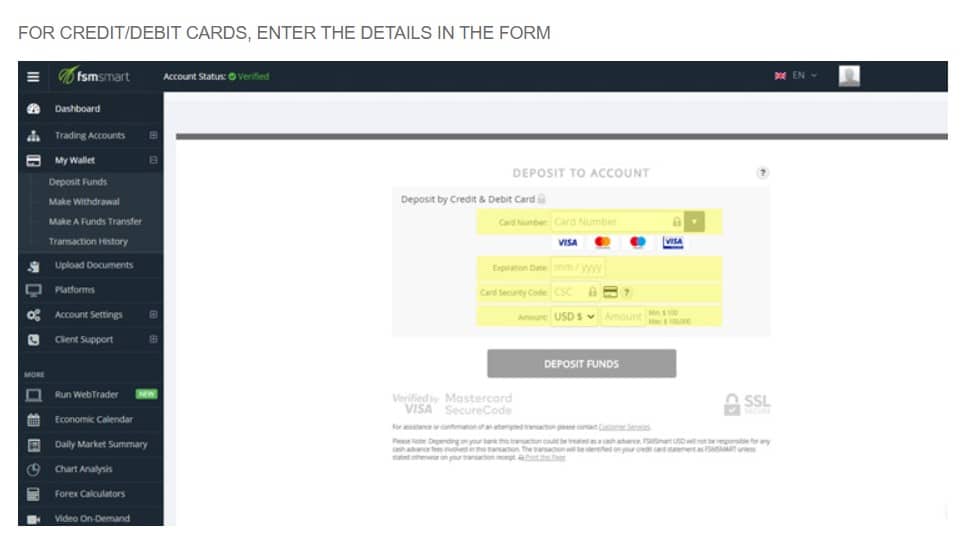

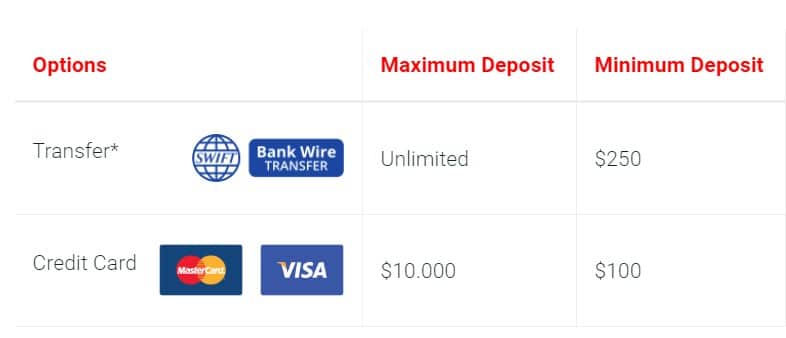

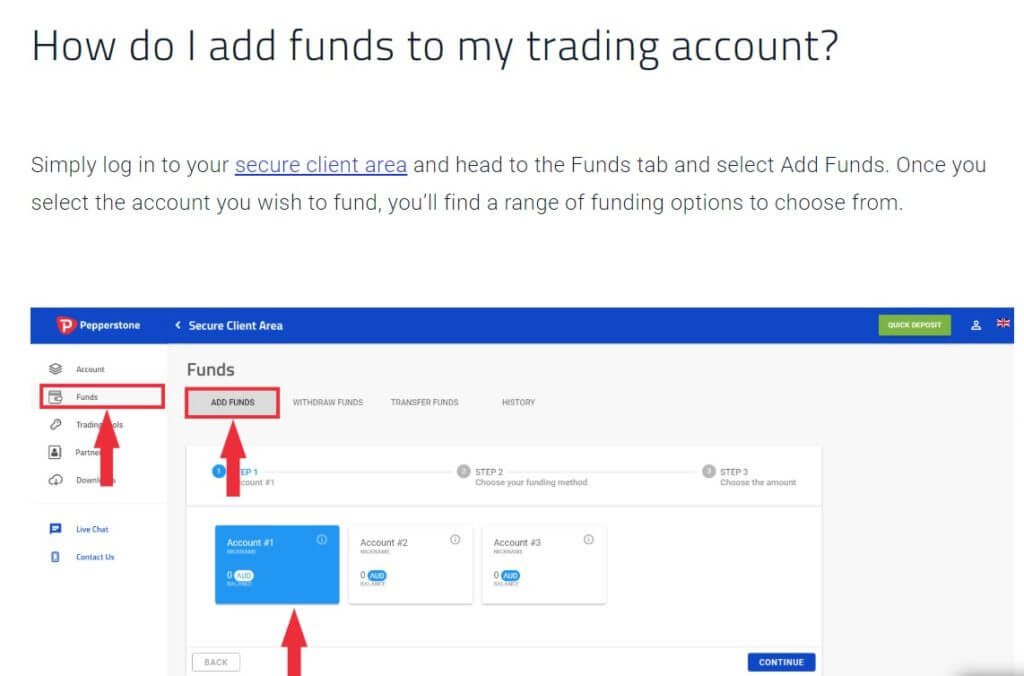

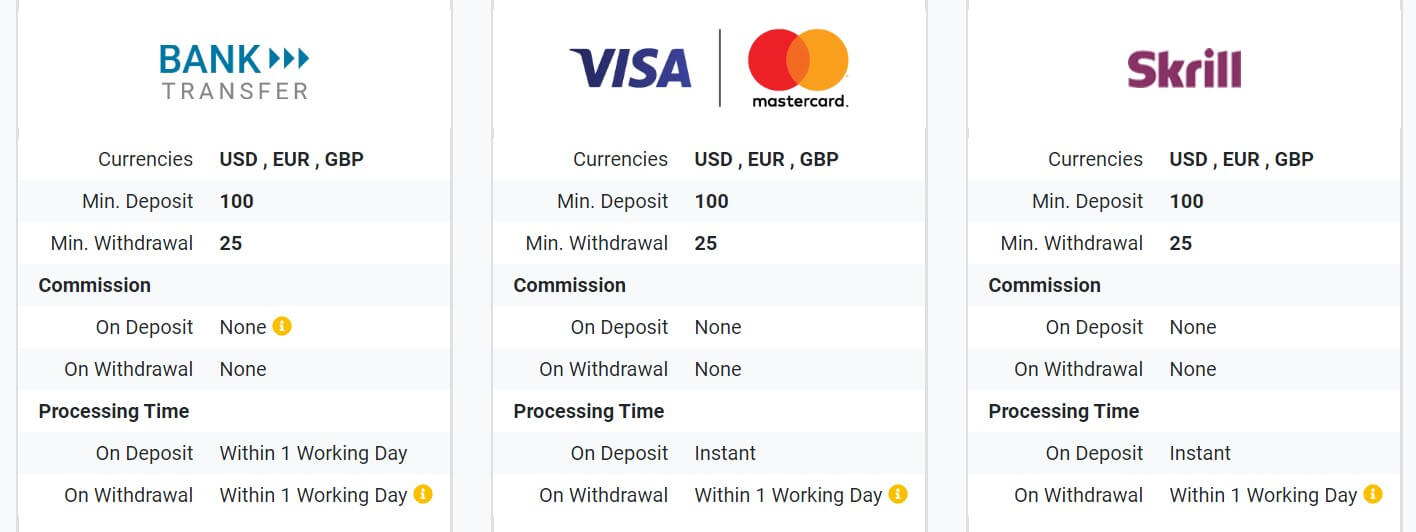

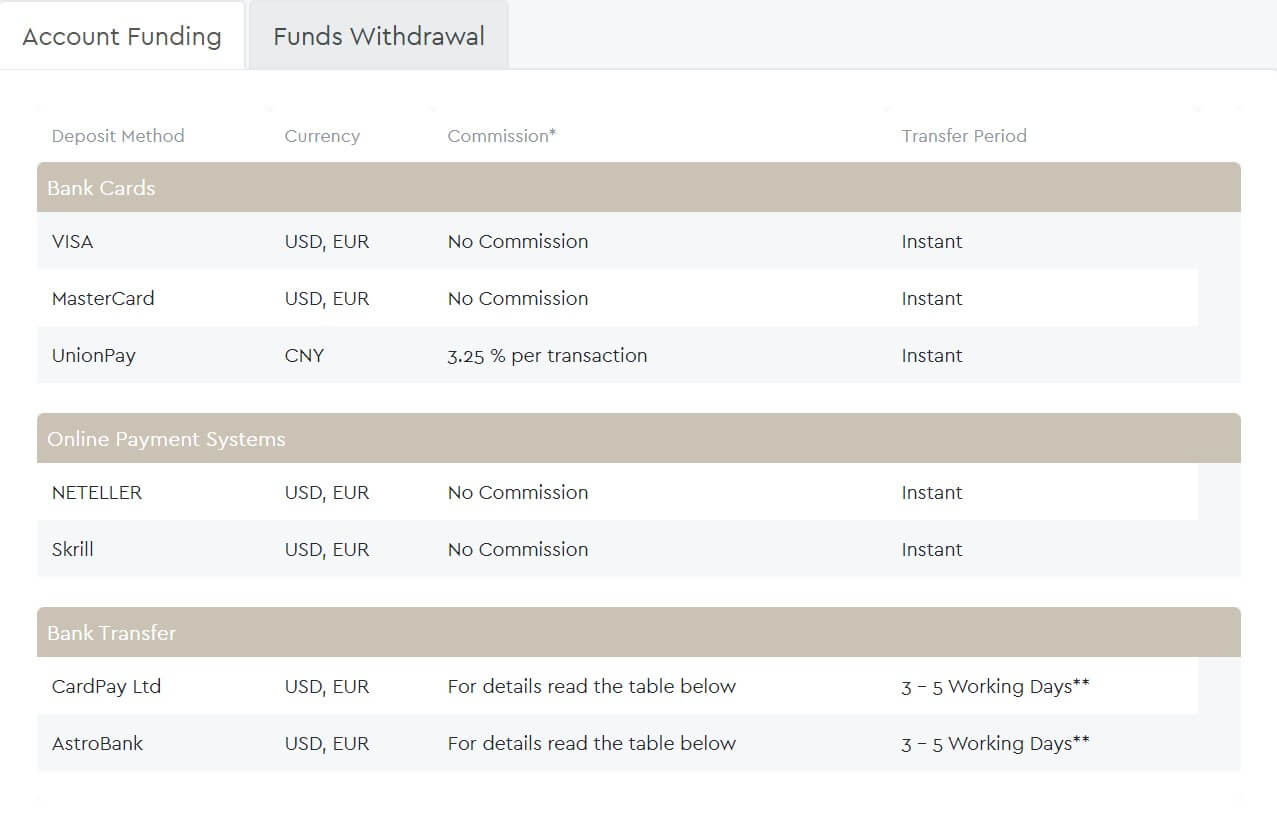

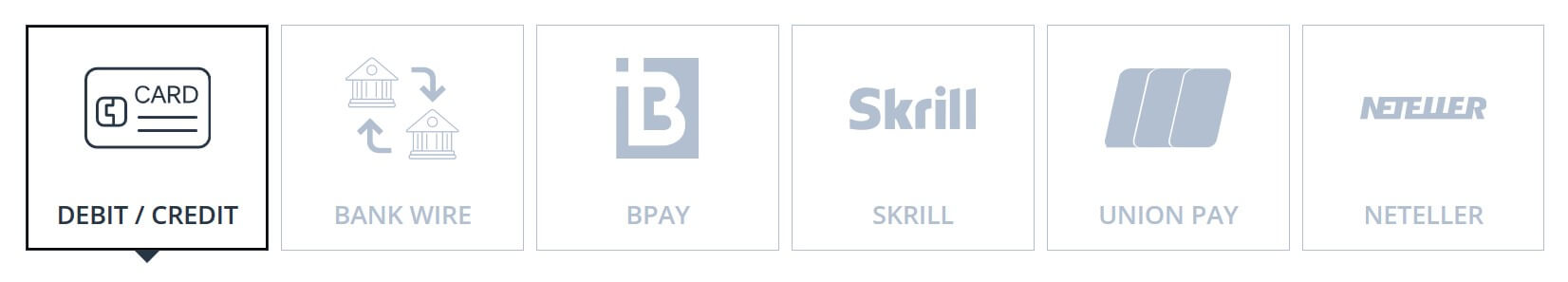

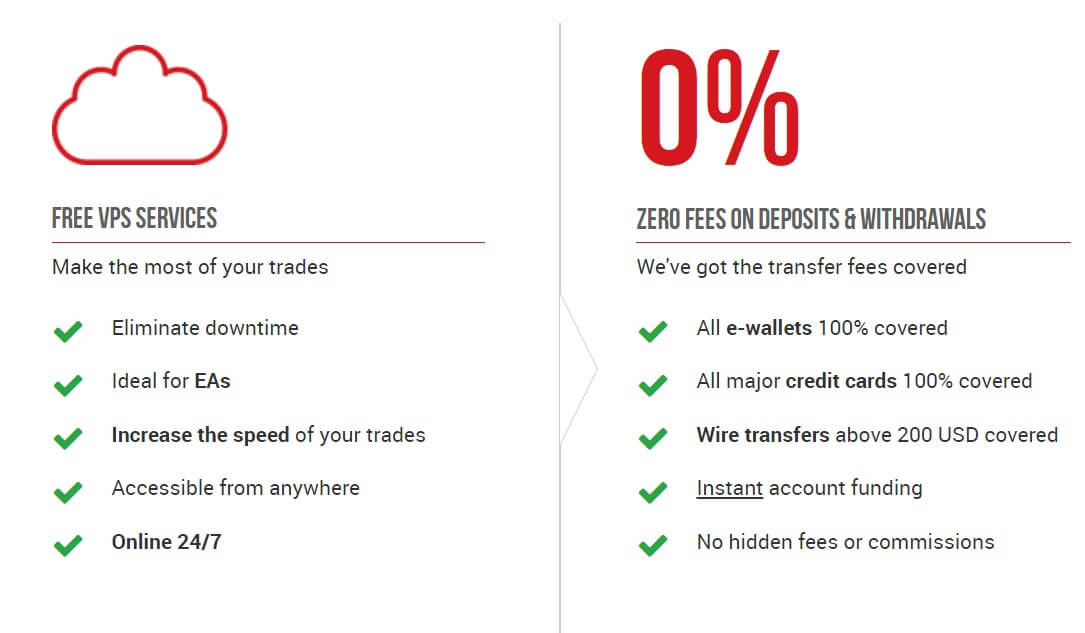

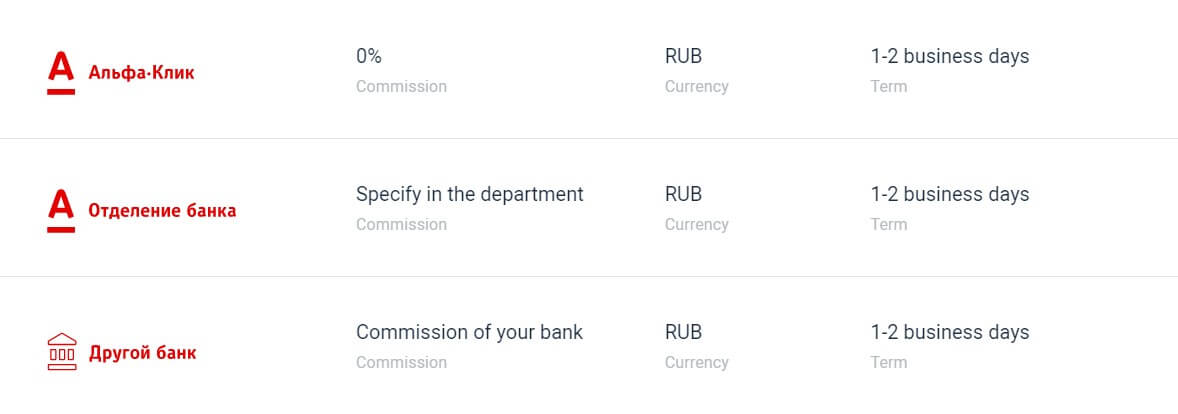

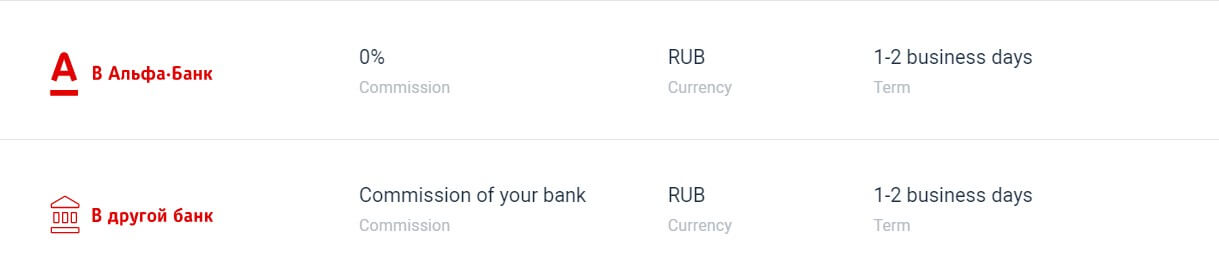

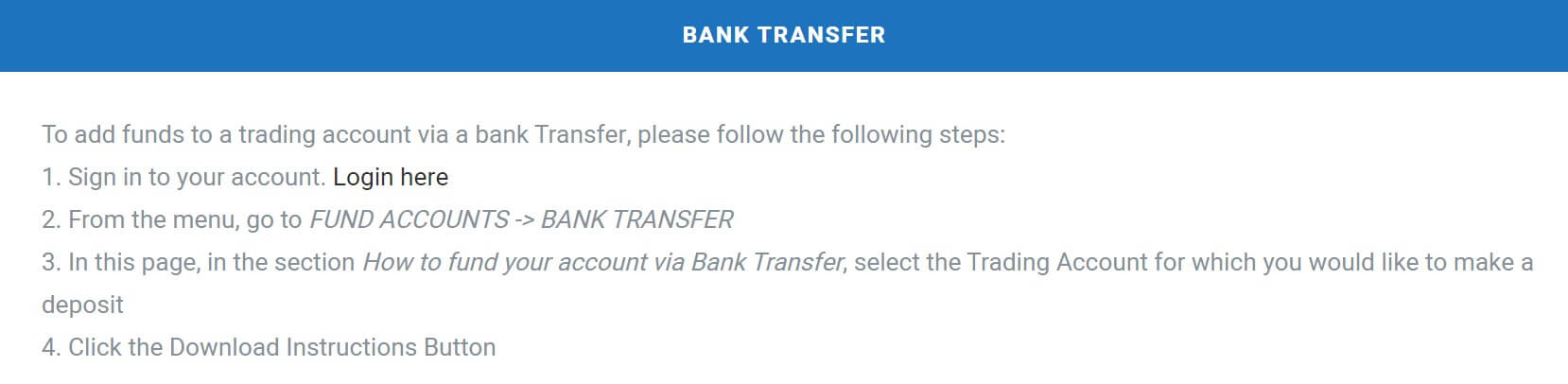

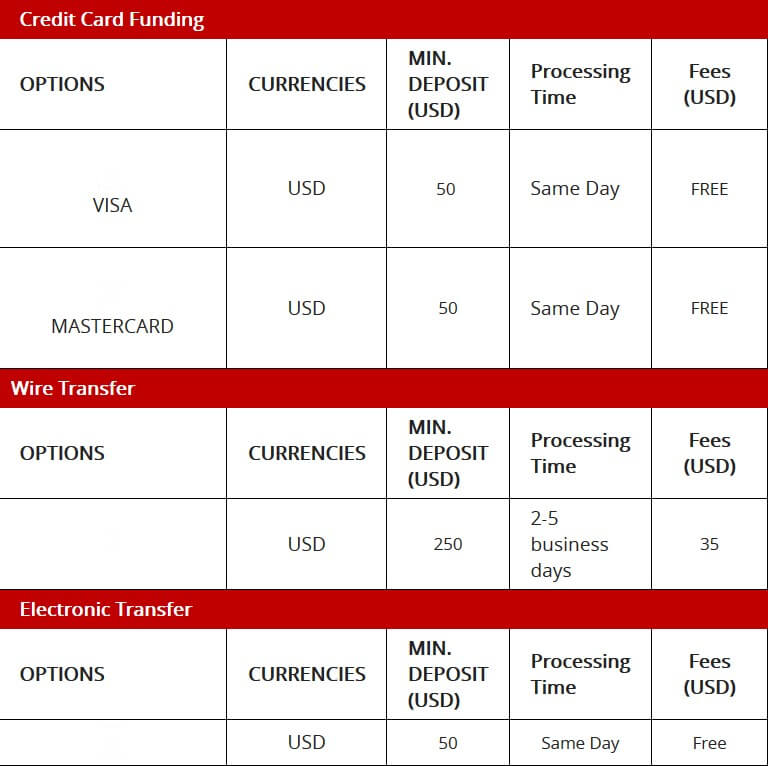

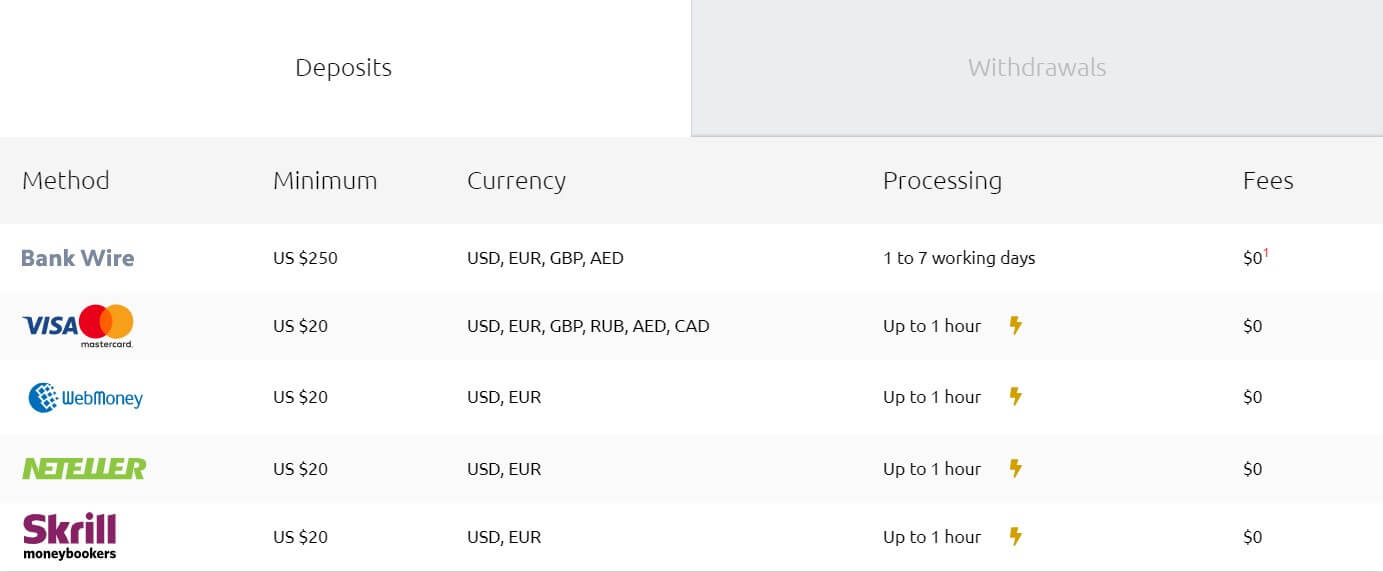

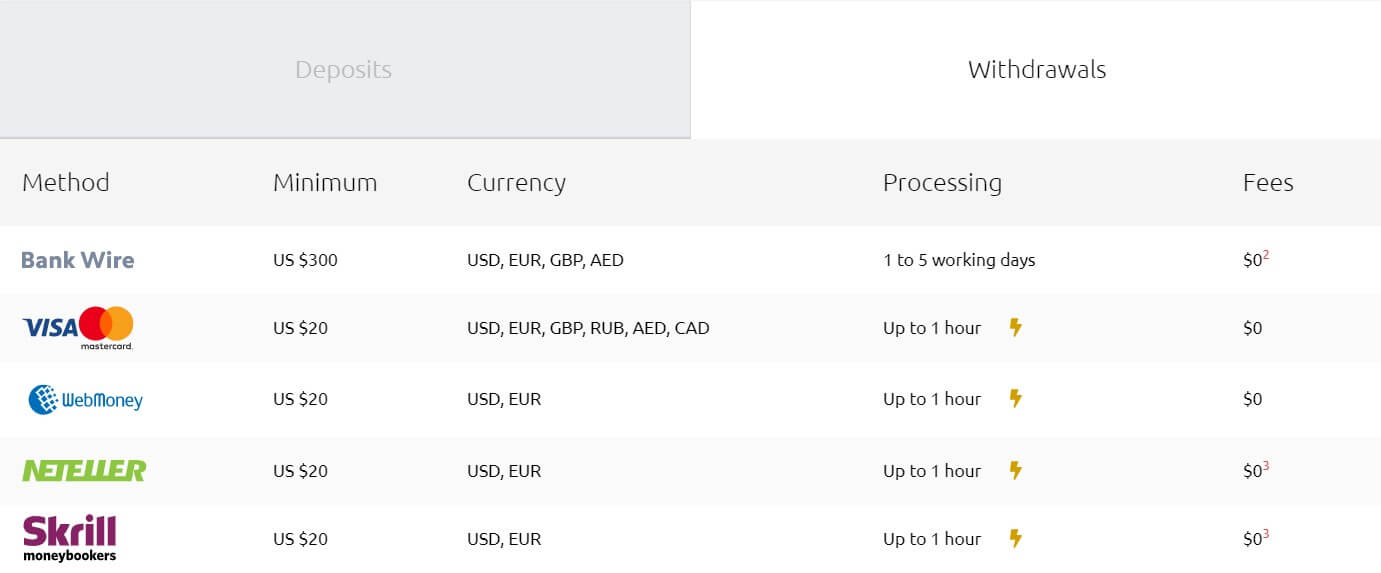

The methods will be listed once your application is completed. It can be done only by the assigned agent after a phone call. Generally, Open Brokers accept Bank transfers and Visa / MasterCard. Deposits are all without fees.

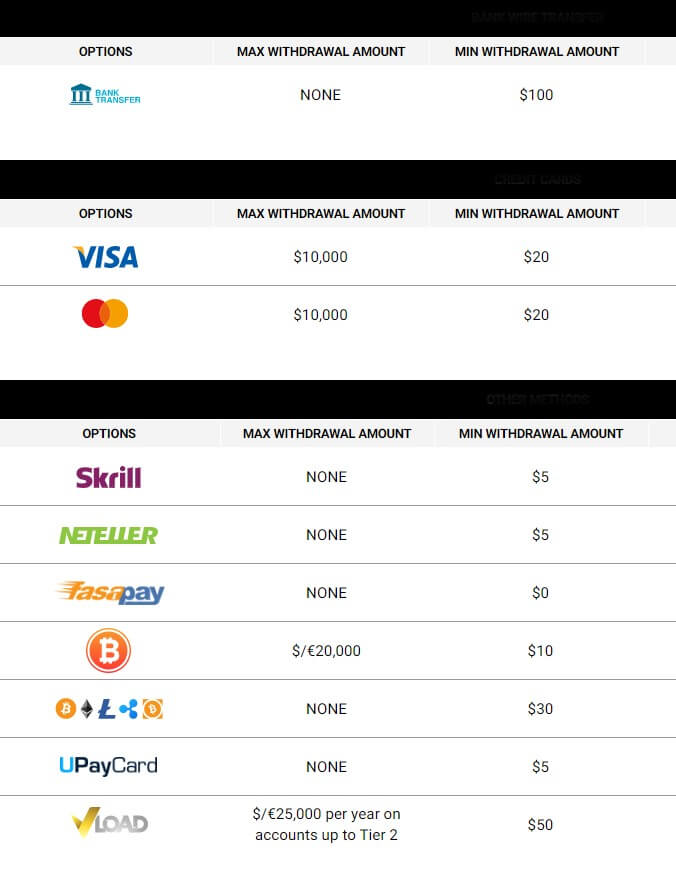

Withdrawal Methods & Costs

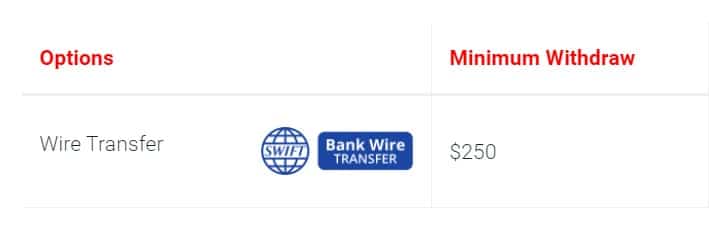

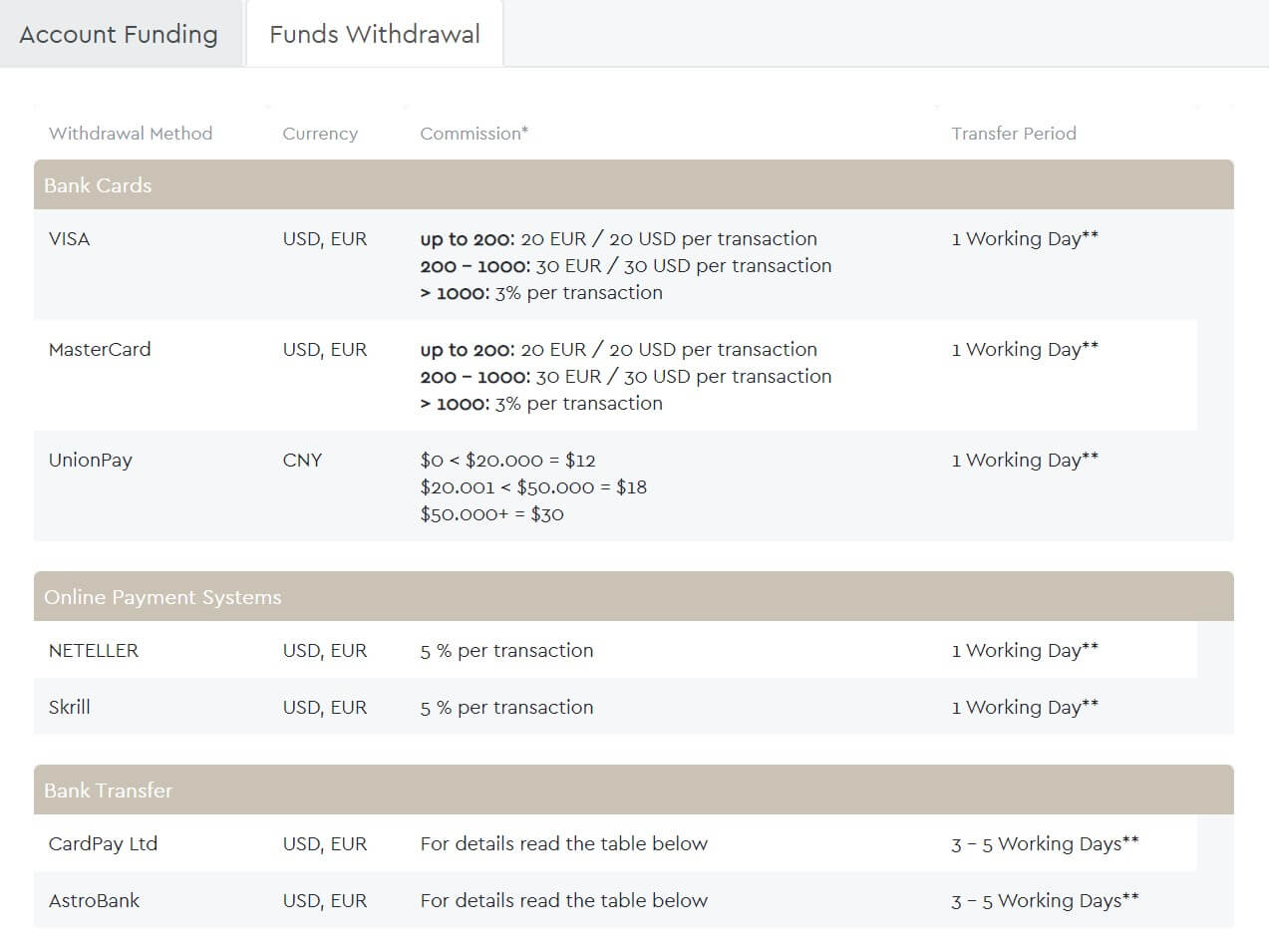

For the Standard Do-It-Yourself account, a fixed withdrawal fee is $35. No fee is charged when withdrawing funds to another personal account opened under any other agreement concluded with a broker. Such an agreement is if a client uses the Open Bank account within the Open Group. Similar fees follow for other international markets tariffs.

Ready-made portfolios account for the Russian market have 10 rubles fee or 0.02% if the withdrawal is in foreign currency. Outside the Open Group withdrawal in foreign currency is $25, 25EUR/CHF/GBP.

The withdrawal methods are the same as with deposits, Open Brokers accept Bank transfers and Visa / MasterCard.

Withdrawal Processing & Wait Time

The withdrawal processing is within a day and should reflect instantly on Visa/MasterCards. Bank transfers within the Open Group are also within the same day and for international transfers, it could take up to 7 days.

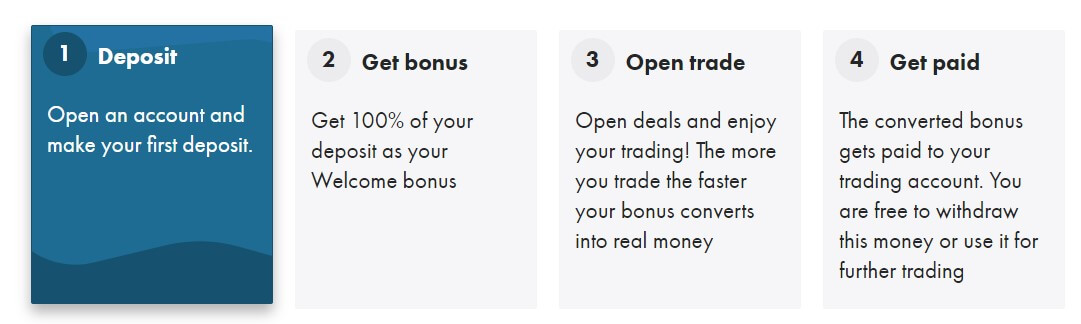

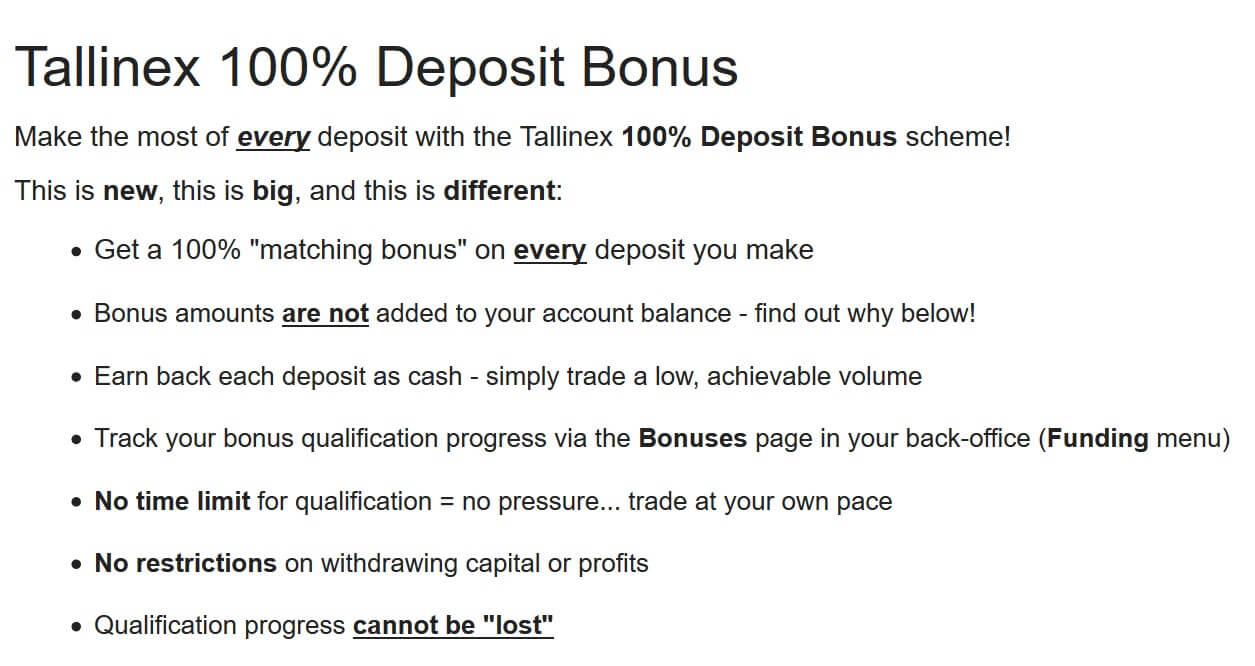

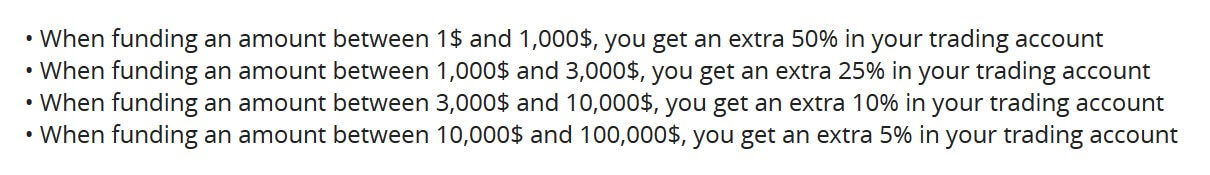

Bonuses & Promotions

O. InveStore! TM is a form of Open Broker loyalty program that rewards contributors with bonus points. Each bonus point is worth 1 rouble. Transaction volume with up to 5% cashback, points awarded for referrals, each year of having an account with Open Broker, and for participation in promotions and events. Since March 2019, there are over 10.000 products redeemable for the points collected by this program, shipped across Russia. The products range from electronics, software, books, music, cosmetics and so on.

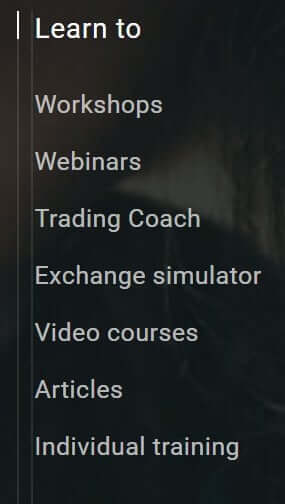

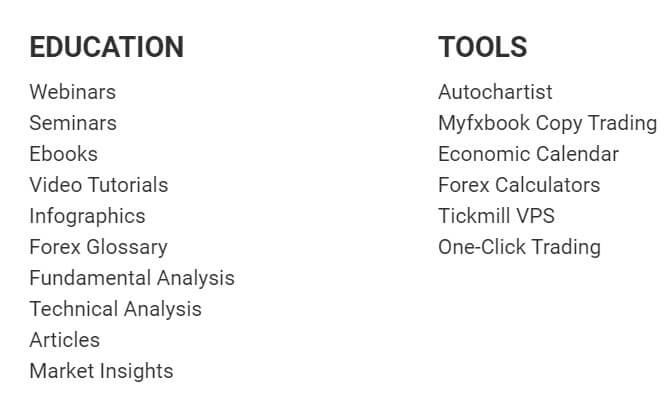

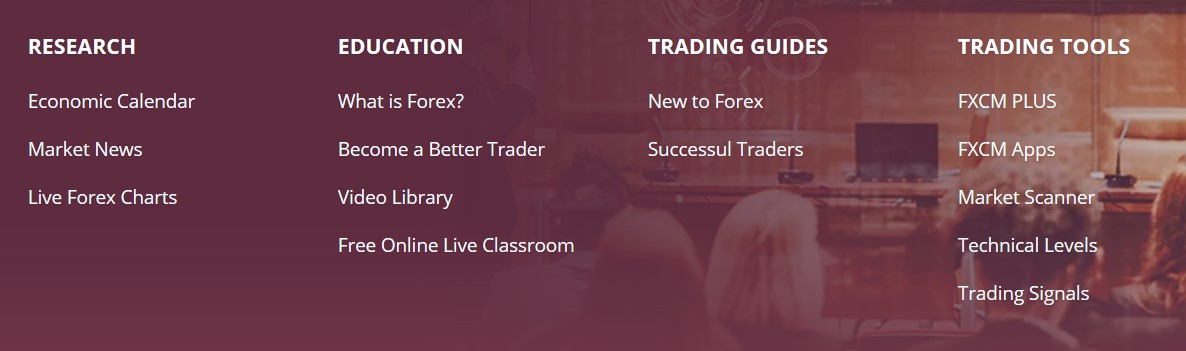

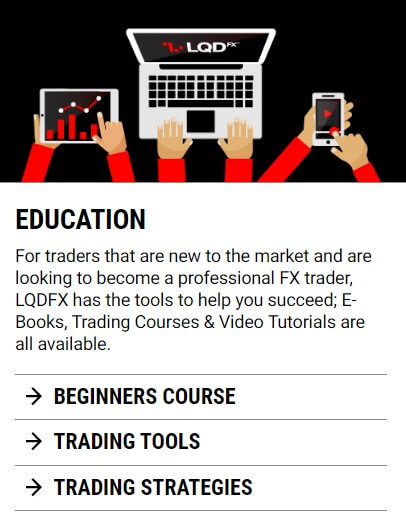

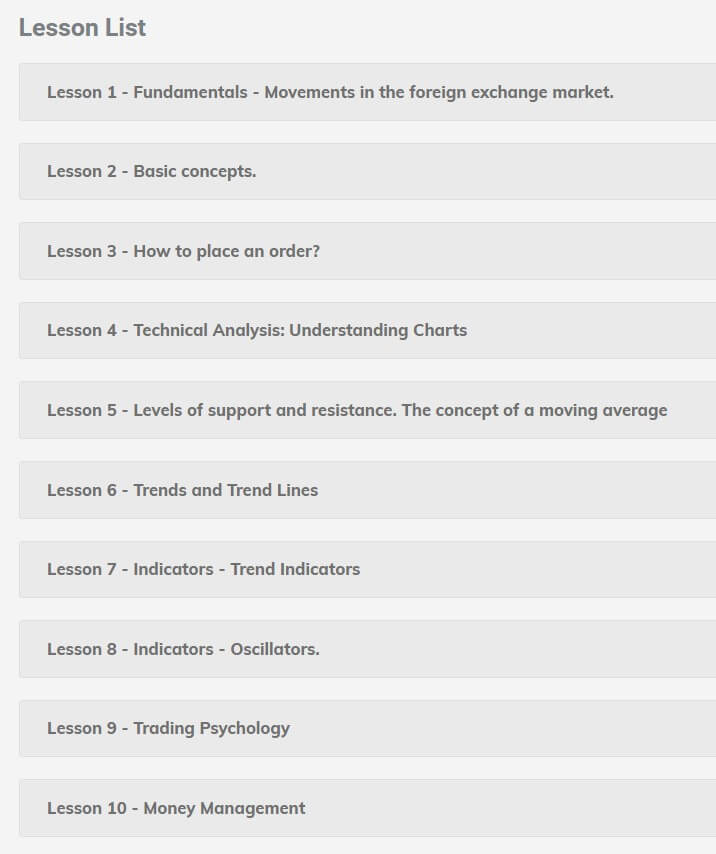

Educational & Trading Tools

Open Brokers gives an impression of academic level education to visitors. This section contains an admirable level of educational material, tools, coaching, workshops, webinars, articles, courses, and individual training.

Workshops are a kind of class that is scheduled and for free. These are local and held in Open Broker classrooms. For example, ISS accounts will introduce the conditions for obtaining a tax deduction and the class will explain in more detail how to get full benefits. This is very specific to Russia and the broker.

Webinars selection is extensive and professional. Visitors can select a range of free or paid webinars. 4 paid webinars cover the subjects like How to make money during a crisis, Fundamentals Investing, FORTS speculation methods, Risk and Money Management.

Webinars selection is extensive and professional. Visitors can select a range of free or paid webinars. 4 paid webinars cover the subjects like How to make money during a crisis, Fundamentals Investing, FORTS speculation methods, Risk and Money Management.

These cost from 4500 ($70) to 6500 rubles. Free webinars are numerous very interesting and have supreme quality. Options Trading, Oil Trading, Individual Account Intro, All about Dividends, How to make your trading system and more webinars could be found. If a topic is not covered traders can recommend a subject to Open Broker.

Trading Coach service is free for deposits of 300.000 rubles. Training will cover the platform, Fundamenta and Technical analysis and Risk management System. Coaching will be remote and traders will have all the information they need with the goal to improve trading skills. The duration will depend on the levels of skills.

Exchange Simulator is an interactive simulation app that aims to bring the elementals and strategies to beginners. It is based on Adobe Flash Player and is used in conjunction with webinars and seminars.

Video Courses are similar in quality like webinars. A total of 18 videos will cover basics but also much more and advanced topics like trading with Options, Futures, ETFs, Structured Products, Trading Academy, and so much more. Some can last up to 240 minutes and not all are free. For example, Academy Training 2.0 costs 299 rubles ($4.7) and lasts 4 hours.

Articles range is admirable and close to a library level. The articles are categorized to subject tags like indicators, psychology, MT5, QUIK, Stocks and so on. There is also a search line that is useful considering the number of articles. The content quality is very good, going into details but also keeps simple language to be understandable to beginners. For example, the TRIX indicator has its own article, explaining all the inner works, usability, application and more. The only drawback is that the educational section is all in the Russian language and everything has to be translated manually.

The individual Training Program is a customized service according to the client’s wishes. Clients can choose what to learn, when and how. Clients need to register, compose a program with the specialist, pay for the program and receive personal training on any location, time and without redundant information that you might not need. The cost of these programs is not disclosed.

Trading Ideas is a signal service developed in various forms. Investment ideas are an example of ideas of what to trade and why. These are updated and contain an analysis. Market Pulse is another form if a signal service where the markets are analyzed deeply for that day, review style. These are a few pages long but do not contain any visual presentations. Top Lis is a quick prediction of what may happen and these are very basic without much value. Strategies are a set of instructions for a certain asset, written in a professionally looking, comprehensive article with figures, charts, and tables. Depository News contains very techy news about what market entities are doing with the equities.

Dividend Calendar displays dividend distribution dates and events. The calendar is very well designed with filters and good sorting options.

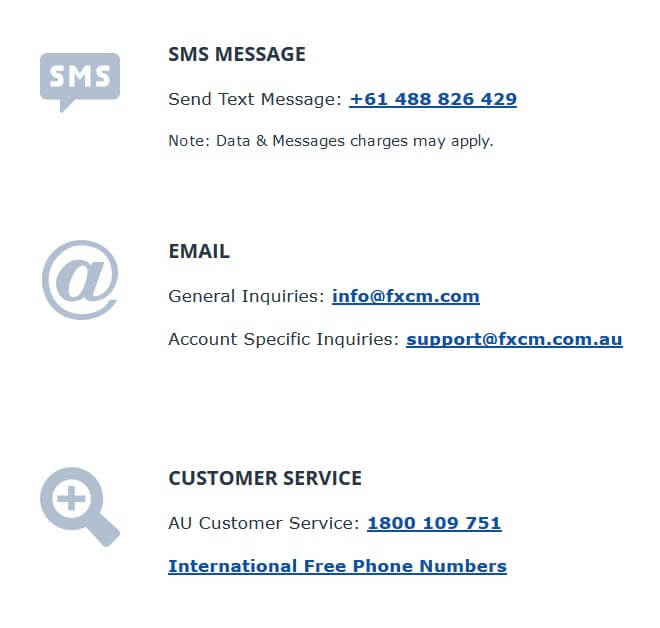

Customer Service

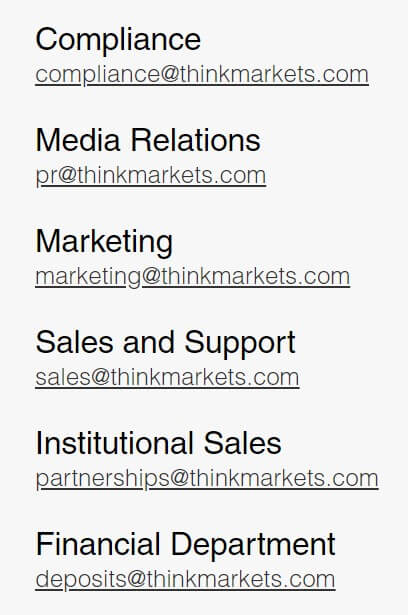

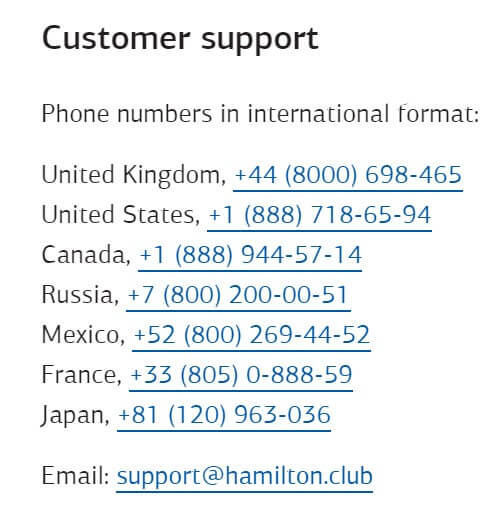

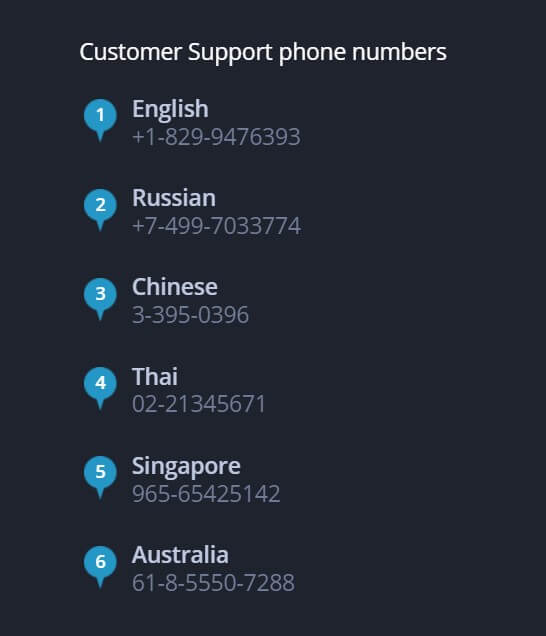

Open Broker does not have a chat service. Only email and a phone line. Social networks are well managed so you can also use Facebook for a chat. We have used the English language and received an automated response in Russian. The agents are not available 24/7. From what we could see, the support level is comparable to the rest of the services and expresses a professional and ethical approach.

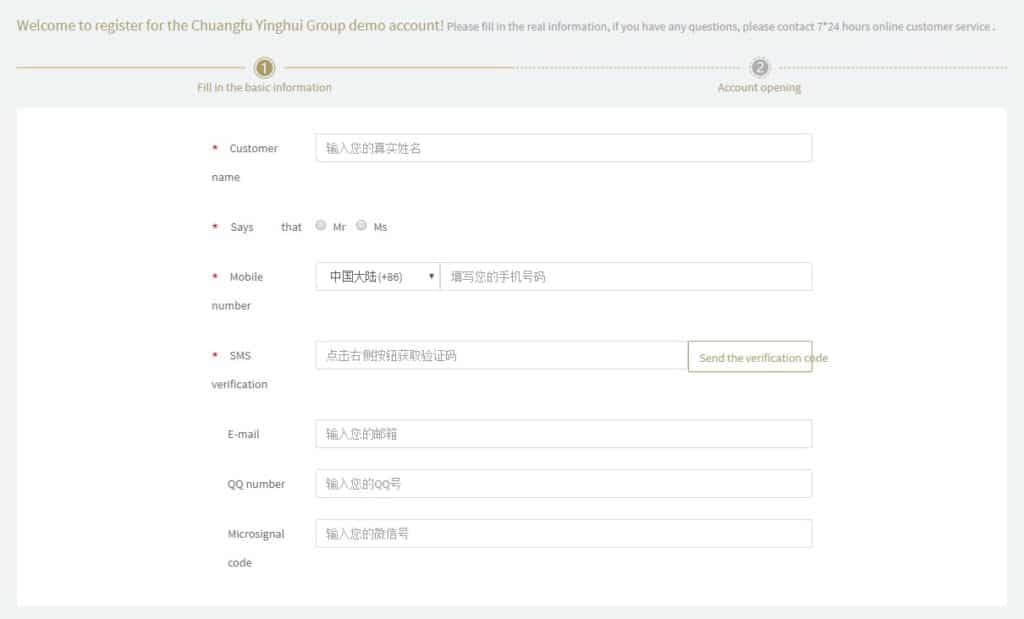

Demo Account

The Demo account is available but will not reflect all Open Brokers have to offer. The registration requires an SMS validation, not just the email. Once you type in the OTP code, the demo account credential will be sent to the email. Traders will receive two account login details. One is for currencies, the other ID is for equities. The demo is available for both QUIK and Metatrader 5.

Countries Accepted

Since the website is only in Russian, visitors may think this is for Russian citizens only.

Information for foreign citizens is not disclosed on the Open Broker website or in legal documents. Although, for legal entities, there is a form with several requirements like a transliteration of the name to the Russian language in full, shortened form, English name form the company establishment documents, English shortened form and so on. There are no prohibited countries, so even traders from the United States can register if they own a company. The biggest drawback to all this is the lack of English interface or guidance.

Conclusion

Open Broker has a good rating form the benchmark websites in Russia since English websites do not list this broker. This broker shows professionalism in every aspect of their services. The complexity of features compares only to the best and the biggest that can afford the scale of the business required for so many services provided. Any chance of unethical behavior is close to none. In terms of costs, fees are present at every step, and in return, this broker provides premium support through the product range, education, platforms, tools, and additional services. Regulation for this broker seems unnecessary just by looking at the approach to the trader from all aspects. Russian clients surely respect this and stimulate Open Broker to advance. Others can only hope that this broker plans to expand and accept international clients.

Customer Service

Customer Service

Assets

Assets

Educational & Trading Tools

Educational & Trading Tools

Minimum Deposit

Minimum Deposit

Bonuses & Promotions

Bonuses & Promotions

Demo Account

Demo Account

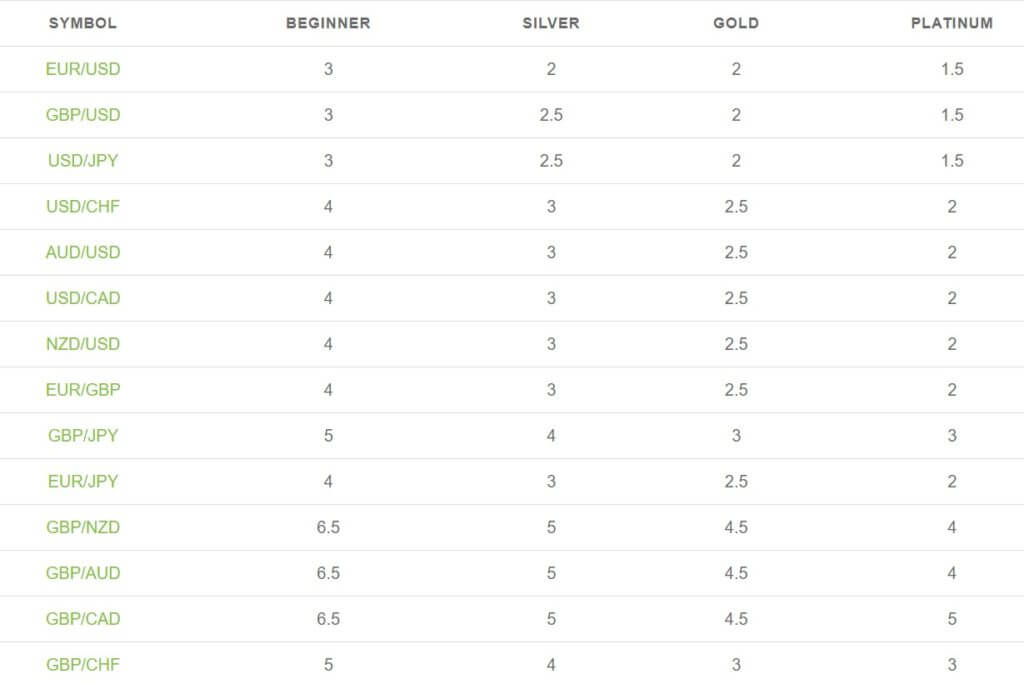

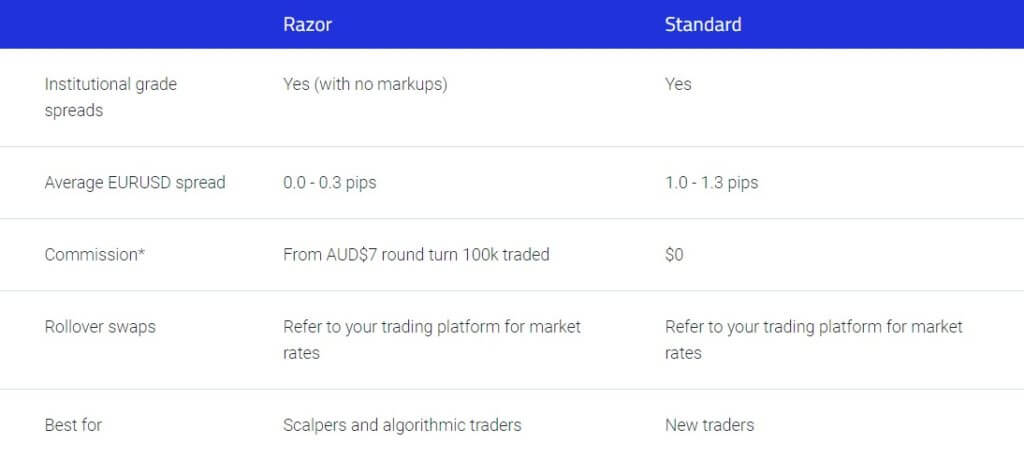

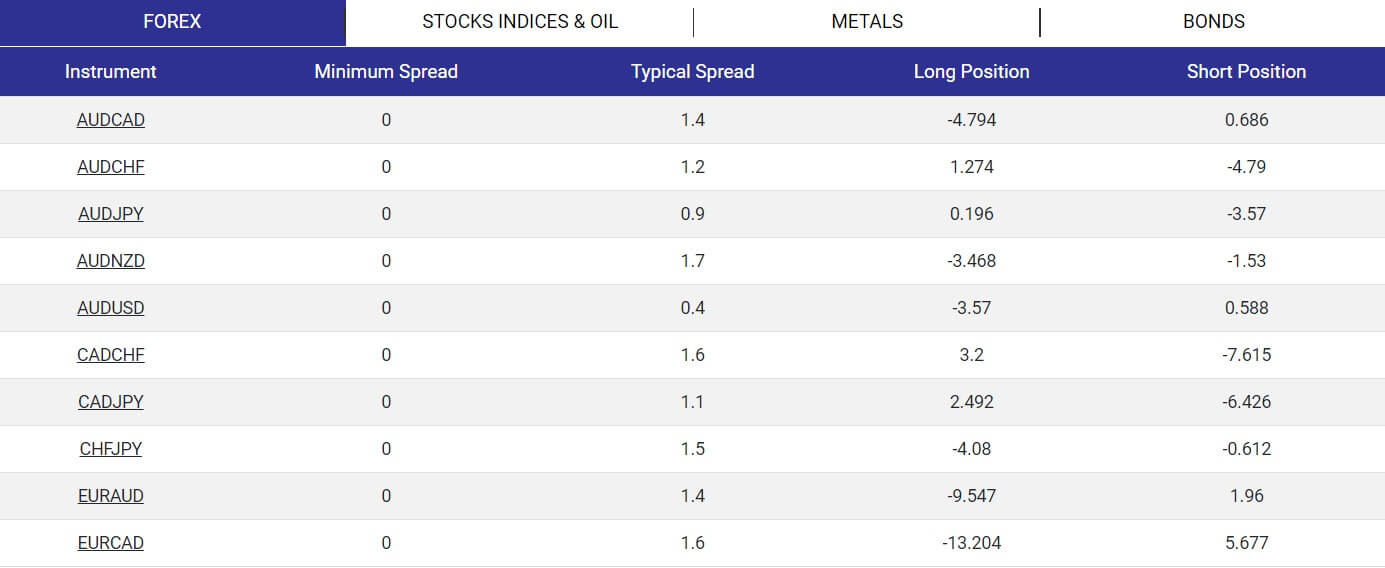

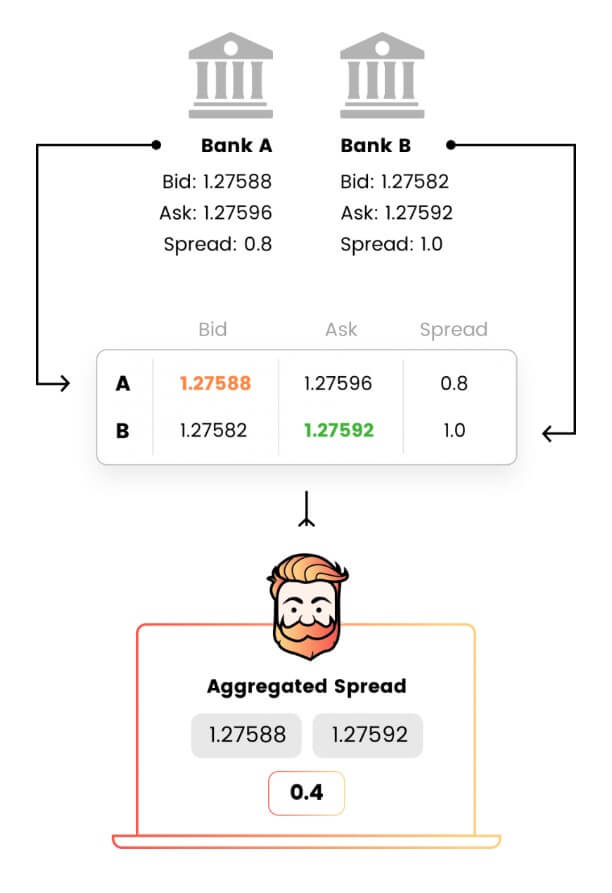

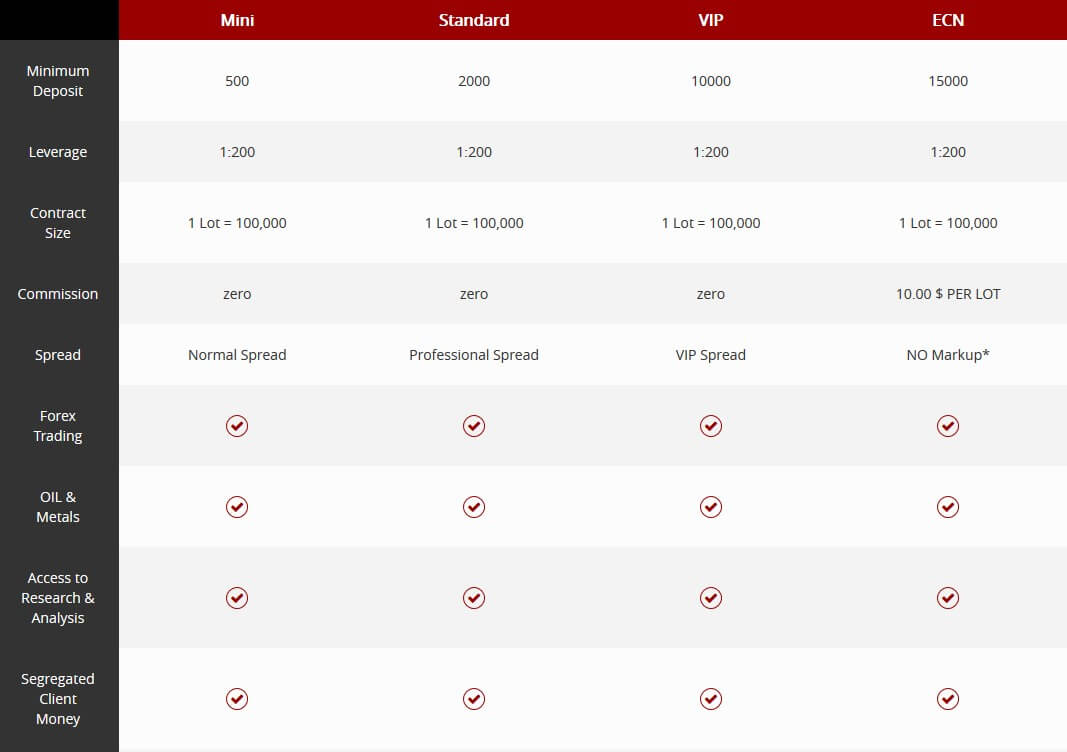

If you have an ECN account, then there is a commission charged on each trade, this is currently set at $4.5 AUD however may be different depending on the currency pair or asset that you are trading so be sure to check out the listing on the site to see what your currency pairs will charge.

If you have an ECN account, then there is a commission charged on each trade, this is currently set at $4.5 AUD however may be different depending on the currency pair or asset that you are trading so be sure to check out the listing on the site to see what your currency pairs will charge.

Customer Service

Customer Service

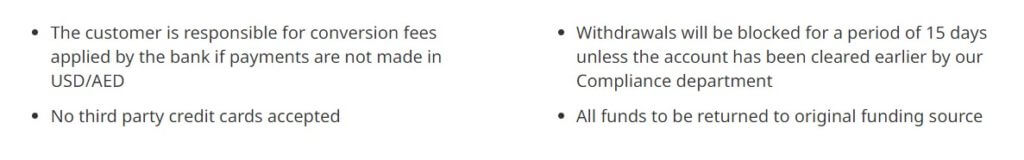

Withdrawal Methods & Costs

Withdrawal Methods & Costs

Currency Exchange service is a simple conversion tool that enables clients to exchange currencies directly from the market. It works by opening an account, topping it with the currency and then exchange it to another with better rates compared to the banks. Then, these funds can be transferred to the card or a bank account. The service has no fees but has a commission that is included in the rate. The Conversion Account does not have a minimum deposit although has a fee if it is less than 50.000 rubles.

Currency Exchange service is a simple conversion tool that enables clients to exchange currencies directly from the market. It works by opening an account, topping it with the currency and then exchange it to another with better rates compared to the banks. Then, these funds can be transferred to the card or a bank account. The service has no fees but has a commission that is included in the rate. The Conversion Account does not have a minimum deposit although has a fee if it is less than 50.000 rubles. International Markets Account Trader is open to stocks, bonds and ETFs around the world on leading international exchanges, like Nasdaq. AMEX, TSX, FTSE and also OTC market trading. This account has 3 tariffs, All-Inclusive, US PRO, and Standard ITP. All-inclusive is optimal for beginners and experienced traders who trade small volumes and mainly use market orders. The commission is $1 per 100 shares and up to a 4% annual fee for the leverage use. US PRO tariff is for scalpers and high volume traders (from 10,000 shares per day). Limit orders have the Rebates mechanism useful for scalpers. Standard ITP tariff is for investors, long term traders. Leverage for this tariff is not available.

International Markets Account Trader is open to stocks, bonds and ETFs around the world on leading international exchanges, like Nasdaq. AMEX, TSX, FTSE and also OTC market trading. This account has 3 tariffs, All-Inclusive, US PRO, and Standard ITP. All-inclusive is optimal for beginners and experienced traders who trade small volumes and mainly use market orders. The commission is $1 per 100 shares and up to a 4% annual fee for the leverage use. US PRO tariff is for scalpers and high volume traders (from 10,000 shares per day). Limit orders have the Rebates mechanism useful for scalpers. Standard ITP tariff is for investors, long term traders. Leverage for this tariff is not available.

Open Broker has multiple tariffs and account types combinations. This split tariff selection and account types opens a plethora of combinations, therefore different costs. Open Broker puts a lot of administration costs to the trader so, for example, account maintenance, leverage, reports and so on, all have a fee. If traders select the International Markets Account, the commission will be 1 cent for the stock market per lot, but not less than $7 if the stock is worth more than $1.01. For stocks worth less than $1 a commission of 0.0257% but not less than $7, even for partial

Open Broker has multiple tariffs and account types combinations. This split tariff selection and account types opens a plethora of combinations, therefore different costs. Open Broker puts a lot of administration costs to the trader so, for example, account maintenance, leverage, reports and so on, all have a fee. If traders select the International Markets Account, the commission will be 1 cent for the stock market per lot, but not less than $7 if the stock is worth more than $1.01. For stocks worth less than $1 a commission of 0.0257% but not less than $7, even for partial  The minimum deposit is measured for every account type. For Individual Investment Account the minimum deposit is customized according to the client’s ability, but no more than 1M rubles per year. Ready-made portfolios do not have a minimum but 300.000 rubles per year is recommended. The signals service also does not require any minimum. For investment solutions, 5000 rubles is the minimum and for managed investments is 250.000 rubles. Other accounts do not require any minimum deposits.

The minimum deposit is measured for every account type. For Individual Investment Account the minimum deposit is customized according to the client’s ability, but no more than 1M rubles per year. Ready-made portfolios do not have a minimum but 300.000 rubles per year is recommended. The signals service also does not require any minimum. For investment solutions, 5000 rubles is the minimum and for managed investments is 250.000 rubles. Other accounts do not require any minimum deposits.

Webinars selection is extensive and professional. Visitors can select a range of free or paid webinars. 4 paid webinars cover the subjects like How to make money during a crisis, Fundamentals Investing, FORTS speculation methods, Risk and Money Management.

Webinars selection is extensive and professional. Visitors can select a range of free or paid webinars. 4 paid webinars cover the subjects like How to make money during a crisis, Fundamentals Investing, FORTS speculation methods, Risk and Money Management.

Deposit Methods & Costs

Deposit Methods & Costs

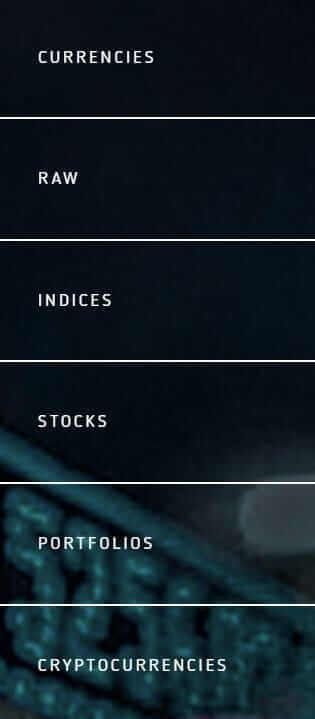

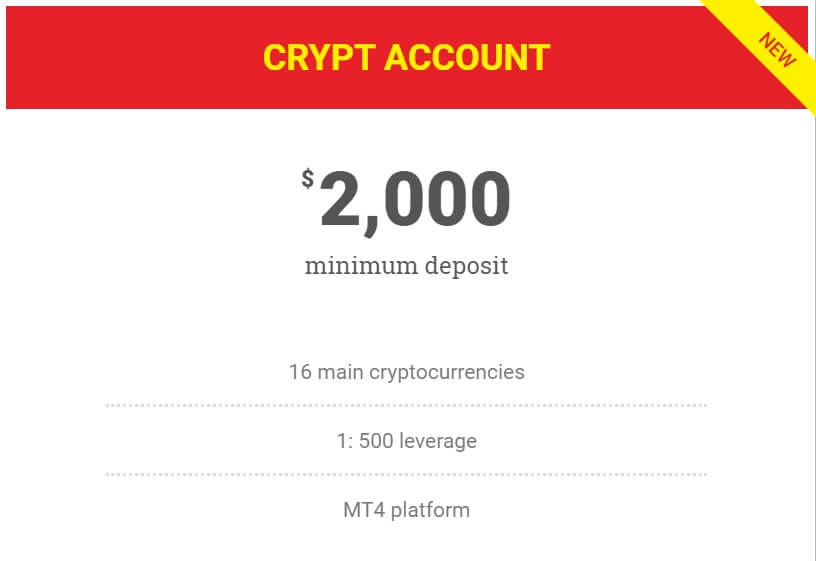

The crypto range is above average for sure. Of course, major coins like BTC and XRP are listed, but also a lot of altcoins. Monero is available in 3 combinations, Monero/Ethereum, Monero/USD and Monero/Bitcoin. Ethereum Classic can be found against Ethereum, USD, and Bitcoin. Bitcoin itself has an amazing list of combinations. How many times can you see BTC/CNY or BTC/RUB? Other Bitcoin variants like Mili Bitcoin and Bitcoin Gold are rare to see too. A total of 46 crypto combinations are found in the MT4 platform. From the exotics not mentioned, we found QTUM, OmiseGO, NEO, IOTA and Zcash, It looks like a crypto enthusiast heaven.

The crypto range is above average for sure. Of course, major coins like BTC and XRP are listed, but also a lot of altcoins. Monero is available in 3 combinations, Monero/Ethereum, Monero/USD and Monero/Bitcoin. Ethereum Classic can be found against Ethereum, USD, and Bitcoin. Bitcoin itself has an amazing list of combinations. How many times can you see BTC/CNY or BTC/RUB? Other Bitcoin variants like Mili Bitcoin and Bitcoin Gold are rare to see too. A total of 46 crypto combinations are found in the MT4 platform. From the exotics not mentioned, we found QTUM, OmiseGO, NEO, IOTA and Zcash, It looks like a crypto enthusiast heaven.

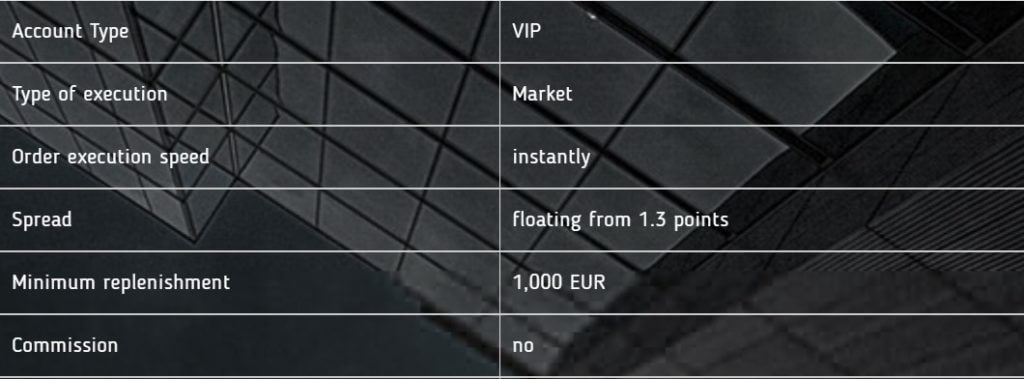

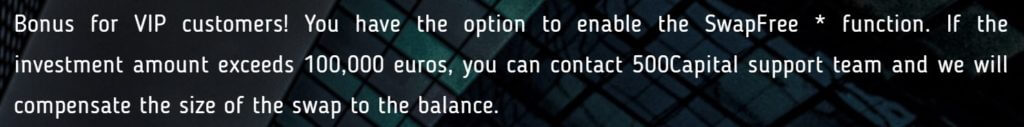

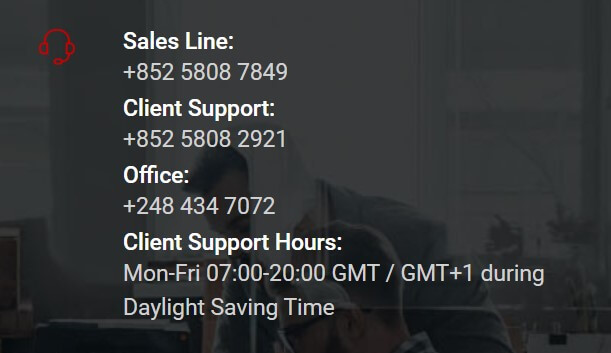

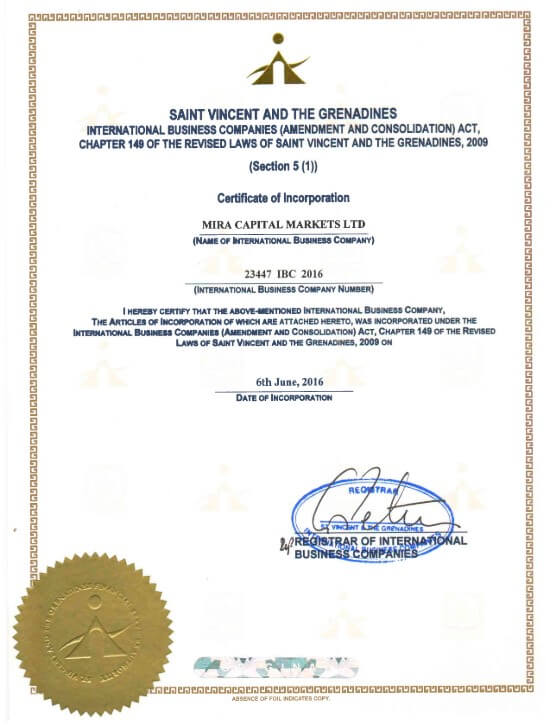

Furthermore, using an IP phone, the lines are also virtual. Private Genesys Fund is a previous brand name of 500 Capital that got exposed as many scam reports arose before March 2018. Of course, 500 Capital has scam reports although the company is still not easy to find for the search engines. Finally, the company documents reveal a few discouraging key points, as if they hold any value given to the above mentioned. Terms and Conditions under point 10 enable this company to restrict trader’s orders, 11.1.10 does not allow scalping, 11.2.7 does not allow EAs and some more under point 17.

Furthermore, using an IP phone, the lines are also virtual. Private Genesys Fund is a previous brand name of 500 Capital that got exposed as many scam reports arose before March 2018. Of course, 500 Capital has scam reports although the company is still not easy to find for the search engines. Finally, the company documents reveal a few discouraging key points, as if they hold any value given to the above mentioned. Terms and Conditions under point 10 enable this company to restrict trader’s orders, 11.1.10 does not allow scalping, 11.2.7 does not allow EAs and some more under point 17.

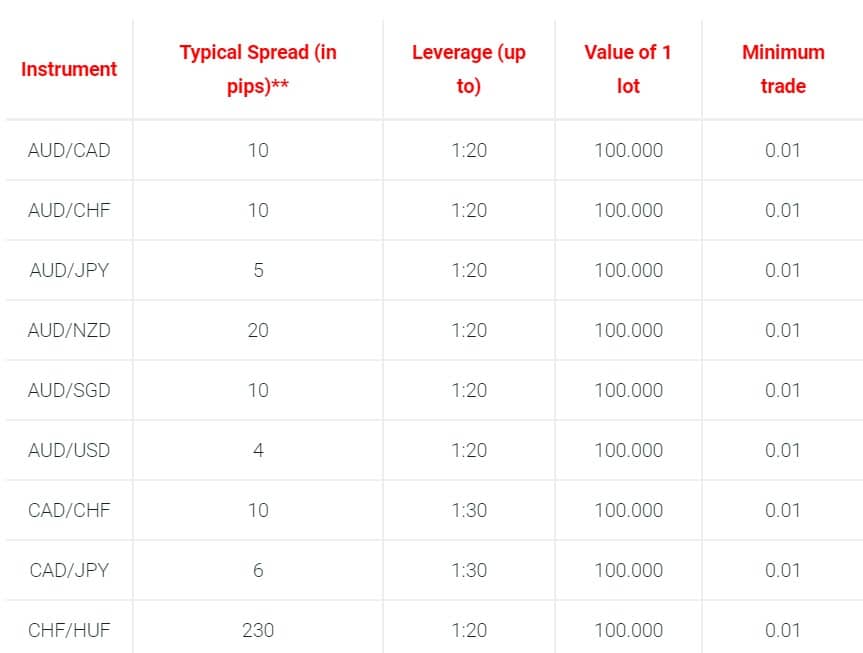

Windsor Brokers has a great asset range. Each category is well developed except Cryptocurrencies are not on the list. Starting with Forex, 15 major and 30 minor pairs are available. The exotics range is not particularly extended, PLN, Scandinavian currencies, HKD, SGD, TRY and HUF are the ones worth mentioning. So if you would like to play with the China-US trade war CNY, in not the currency you can balance to. What makes this broker different is the currency CFD for AUD, JPY, CAD, CHF, EUR, and GBP. These instruments have a very correlated price movement with their USD denominated counterparts making them less useful.

Windsor Brokers has a great asset range. Each category is well developed except Cryptocurrencies are not on the list. Starting with Forex, 15 major and 30 minor pairs are available. The exotics range is not particularly extended, PLN, Scandinavian currencies, HKD, SGD, TRY and HUF are the ones worth mentioning. So if you would like to play with the China-US trade war CNY, in not the currency you can balance to. What makes this broker different is the currency CFD for AUD, JPY, CAD, CHF, EUR, and GBP. These instruments have a very correlated price movement with their USD denominated counterparts making them less useful.

Bonuses & Promotions

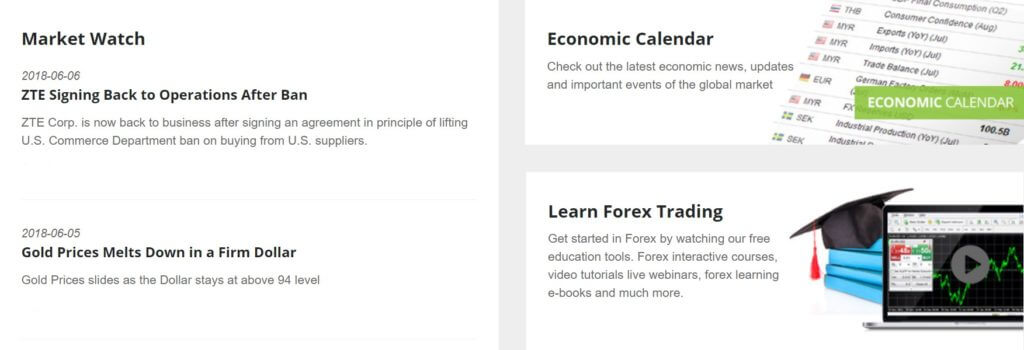

Bonuses & Promotions Education is distributed in two places, on the web site and the Client’s Portal. The home panel of the Client’s Portal contains 8 video packages that cover the basics of trading but also some interesting modern trading methods like social trading, various strategies, etc. The videos are not long and also very neutral, giving traders different aspects of trading. For beginners, these videos will give great insight into what the Forex is.

Education is distributed in two places, on the web site and the Client’s Portal. The home panel of the Client’s Portal contains 8 video packages that cover the basics of trading but also some interesting modern trading methods like social trading, various strategies, etc. The videos are not long and also very neutral, giving traders different aspects of trading. For beginners, these videos will give great insight into what the Forex is.

Assets

Assets

Educational & Trading Tools

Educational & Trading Tools

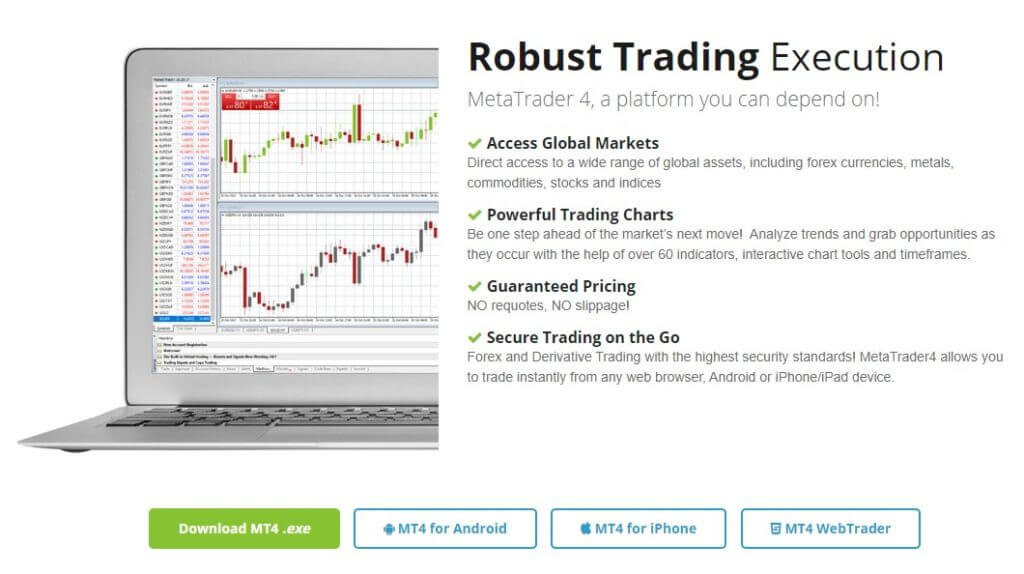

MetaTrader 4 (MT4)

MetaTrader 4 (MT4)

Demo Account

Demo Account

Trading Costs

Trading Costs

Platforms

Platforms

Withdrawal Processing & Wait Time

Withdrawal Processing & Wait Time

Platforms

Platforms

Educational & Trading Tools

Educational & Trading Tools There are more than enough ways to get in touch with Scope Markets should you have any questions or require help. There is a live chat option, where you can chat with a support team member, however, we tried this approach and unfortunately no one was around, we may have just chosen a bad time to try, but it did not leave us with much confidence.

There are more than enough ways to get in touch with Scope Markets should you have any questions or require help. There is a live chat option, where you can chat with a support team member, however, we tried this approach and unfortunately no one was around, we may have just chosen a bad time to try, but it did not leave us with much confidence.

Customer Service

Customer Service

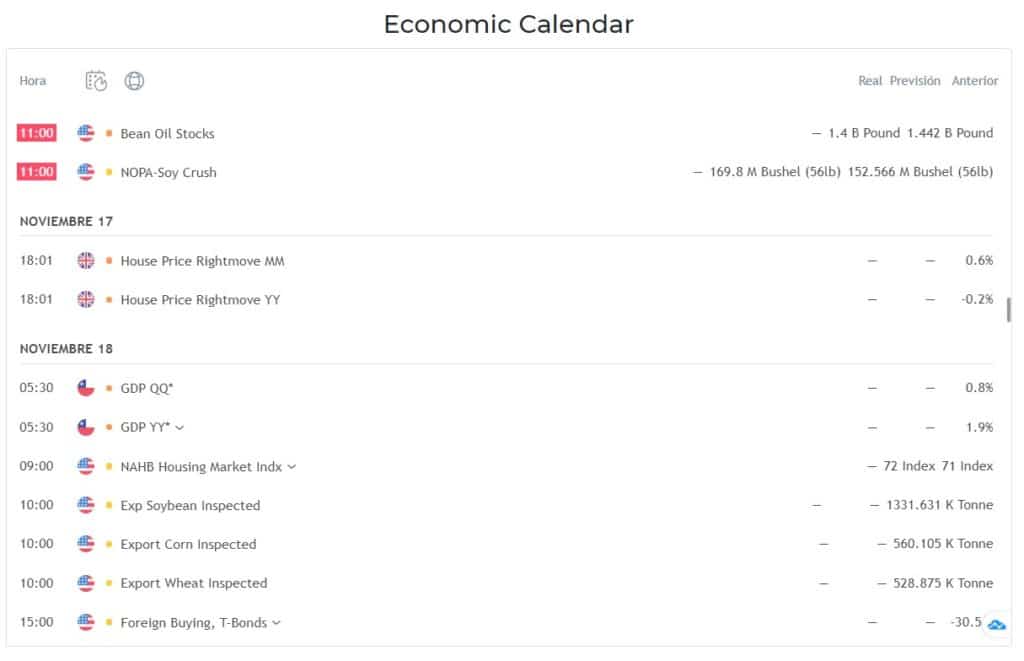

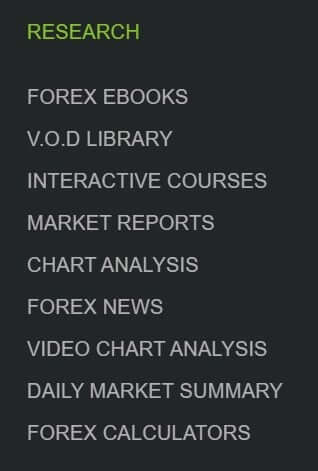

Research: Research offers a number of different sections to help you become a better trader, they offer market news and events to help you understand what is going on in the world, technical summaries as well as technical analysis to help give you a better idea of certain trading setups. There is an economic calendar and some videos that offer daily analysis to help you trade and understand certain

Research: Research offers a number of different sections to help you become a better trader, they offer market news and events to help you understand what is going on in the world, technical summaries as well as technical analysis to help give you a better idea of certain trading setups. There is an economic calendar and some videos that offer daily analysis to help you trade and understand certain

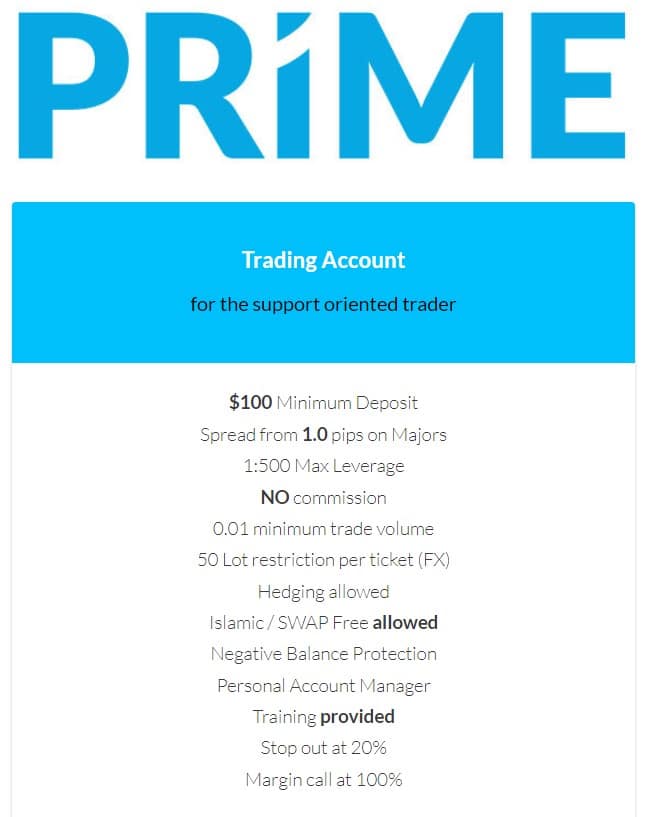

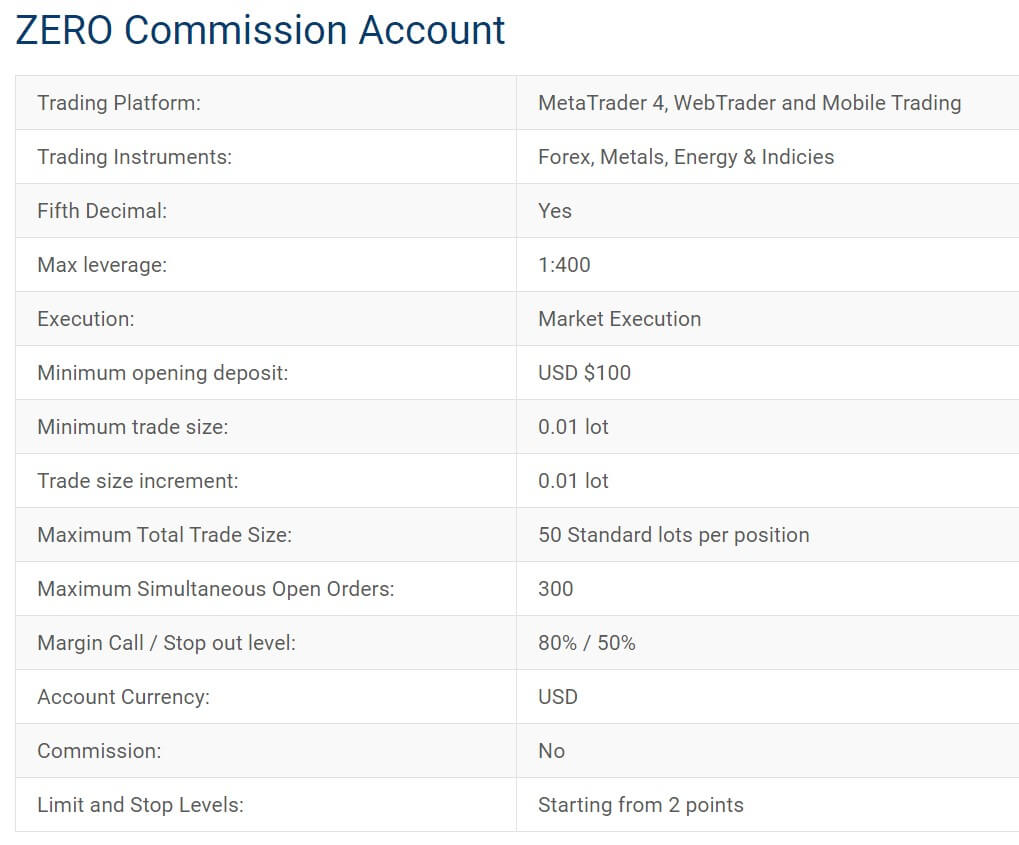

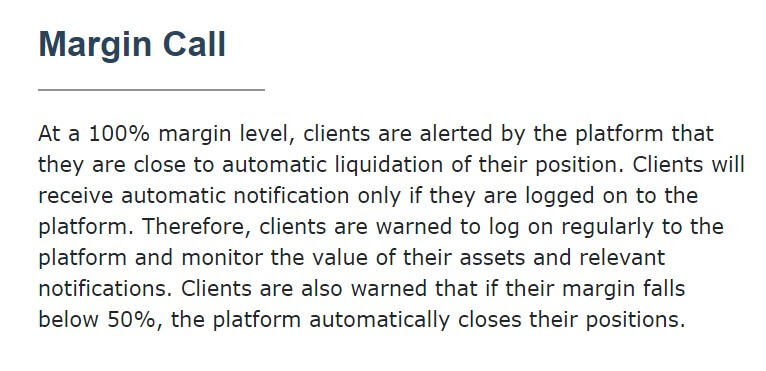

In the end, we found that the positives of BIC Markets’s offerings outweigh the cons. The main downsides to using the broker are the limited amount of currency pairs that you can access. Similarly, if transfer fees and processing times are important to you, contact BIC Markets’s customer service team because their website has a lot of missing information about this topic. Otherwise, there are 2 great account types for you to choose from, none of them charges any commission fees while the leverage rates are relatively flexible. Additionally, your funds will be protected against hefty losses through BIC Markets’s restrictive margin call and stop-out levels.

In the end, we found that the positives of BIC Markets’s offerings outweigh the cons. The main downsides to using the broker are the limited amount of currency pairs that you can access. Similarly, if transfer fees and processing times are important to you, contact BIC Markets’s customer service team because their website has a lot of missing information about this topic. Otherwise, there are 2 great account types for you to choose from, none of them charges any commission fees while the leverage rates are relatively flexible. Additionally, your funds will be protected against hefty losses through BIC Markets’s restrictive margin call and stop-out levels.

Bonuses & Promotions

Bonuses & Promotions

Educational & Trading Tools

Educational & Trading Tools

Fixed: This account is named such due to the fact that it provides the account holder with access to fixed spreads. The same as the Premium, Fixed is not associated with any commission charges. A Fixed account can be opened with a deposit in the amount of $250, with all subsequent deposits needing to be only $50 or more. The

Fixed: This account is named such due to the fact that it provides the account holder with access to fixed spreads. The same as the Premium, Fixed is not associated with any commission charges. A Fixed account can be opened with a deposit in the amount of $250, with all subsequent deposits needing to be only $50 or more. The

Assets

Assets

Educational & Trading Tools

Educational & Trading Tools

MT4 Cent:

MT4 Cent:

Assets

Assets

Educational & Trading Tools

Educational & Trading Tools

Platforms

Platforms

Educational & Trading Tools

Educational & Trading Tools

Swissquote remains to be a very popular choice among traders, due to their strong quality of service they provide as well as the fact they are regulated. We believe this broker may be more suitable for those who have more experience and for those wishing to trade with higher capital since the minimum deposit requirement is rather high compared to the majority of

Swissquote remains to be a very popular choice among traders, due to their strong quality of service they provide as well as the fact they are regulated. We believe this broker may be more suitable for those who have more experience and for those wishing to trade with higher capital since the minimum deposit requirement is rather high compared to the majority of

Assets

Assets

Genetrade is focused only on the MetaTrader 4 platform. MT4 is available as a direct web browser version without any installation which looks like the ordinary desktop MT4 variant. Mobile versions are supported for Andriod and iOS and desktop for PC and Mac. Once launched, the MT4 Platform will log in with blazing speed. The communication lag to the server was a very fast 40ms on average.

Genetrade is focused only on the MetaTrader 4 platform. MT4 is available as a direct web browser version without any installation which looks like the ordinary desktop MT4 variant. Mobile versions are supported for Andriod and iOS and desktop for PC and Mac. Once launched, the MT4 Platform will log in with blazing speed. The communication lag to the server was a very fast 40ms on average.

Precious metals range is different than what is announced on the VT Markets website. Namely, Palladium and Platinum are not listed in the MT4 platform. Spot Gold, Silver and Copper are available though, but taking into account that Silver and Gold move almost in sync, metal traders will not have another asset to diversify.

Precious metals range is different than what is announced on the VT Markets website. Namely, Palladium and Platinum are not listed in the MT4 platform. Spot Gold, Silver and Copper are available though, but taking into account that Silver and Gold move almost in sync, metal traders will not have another asset to diversify.

Platforms

Platforms Go Capital FX does not stop there and goes wide with the Commodities too. A total of 12 assets including the WTI and Brent Oil. Big attention to metals is given so traders can find Zinc, Aluminium, Nickel, Silver, and Gold. Only Copper, Platinum, and Palladium are missing for the most complete list. Furthermore, Cocoa, Sugar, and more commodities are available.

Go Capital FX does not stop there and goes wide with the Commodities too. A total of 12 assets including the WTI and Brent Oil. Big attention to metals is given so traders can find Zinc, Aluminium, Nickel, Silver, and Gold. Only Copper, Platinum, and Palladium are missing for the most complete list. Furthermore, Cocoa, Sugar, and more commodities are available.

Deposit Methods & Costs

Deposit Methods & Costs Educational & Trading Tools

Educational & Trading Tools

The Classic account type only allows for trading on forex, Gold, and Silver instruments. Both the Standard and Classic account types offer access to the company’s entire portfolio, including forex, metals, shares, commodities, indices, and bonds.

The Classic account type only allows for trading on forex, Gold, and Silver instruments. Both the Standard and Classic account types offer access to the company’s entire portfolio, including forex, metals, shares, commodities, indices, and bonds.

Bonuses & Promotions

Bonuses & Promotions

Assets

Assets Spreads

Spreads

Educational & Trading Tools

Educational & Trading Tools

Conclusion

Conclusion

DTT Global allows you to trade spot gold, spot silver, and energy commodities (namely crude oil and natural gas). There are also CFDs of 12 market indices from around the world, including the Dow Jones Industrial Average, S&P 500, Nasdaq 100, Hong Kong’s Hang Seng Index, Japan’s Nikkei 225, the UK’s FTSE 100, Germany’s DAX, and others. You can trade 10 US company stocks that are listed on the Nasdaq.

DTT Global allows you to trade spot gold, spot silver, and energy commodities (namely crude oil and natural gas). There are also CFDs of 12 market indices from around the world, including the Dow Jones Industrial Average, S&P 500, Nasdaq 100, Hong Kong’s Hang Seng Index, Japan’s Nikkei 225, the UK’s FTSE 100, Germany’s DAX, and others. You can trade 10 US company stocks that are listed on the Nasdaq.

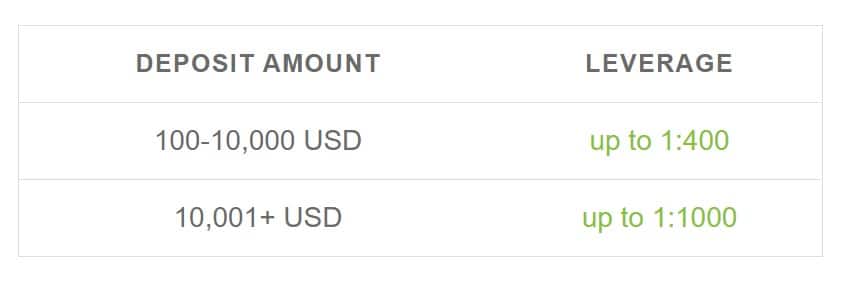

CryptoRocket offers a generous maximum leverage ratio of 1:500. There are, of course, some offshore brokers that offer higher leverage (1:2000 is the highest that we’ve ever seen), but the ability to trade with 500 times your capital should be more than sufficient. The leverage setting can be changed and can be set to as low as 1:1 if you are someone who prefers to trade without leverage. There are actually several increments to choose from and the setting can be changed at any time, provided that you have no open trades.

CryptoRocket offers a generous maximum leverage ratio of 1:500. There are, of course, some offshore brokers that offer higher leverage (1:2000 is the highest that we’ve ever seen), but the ability to trade with 500 times your capital should be more than sufficient. The leverage setting can be changed and can be set to as low as 1:1 if you are someone who prefers to trade without leverage. There are actually several increments to choose from and the setting can be changed at any time, provided that you have no open trades.

Deposit Methods & Costs

Deposit Methods & Costs

If you’d like to try something different, Libertex also offers its own trading platform. The company describes its platform as being aimed towards those that prefer simpler and convenient features with the ability to quickly manage capital. Traders can make deposits and withdrawals, access market news, and easily switch between their real and demo accounts on the platform. The platform can be accessed through the web browser or downloaded for Apple or Android. Note that the available account types depend on which platform has been chosen and that trading costs and other specifics differ based on which platform you choose to trade through.

If you’d like to try something different, Libertex also offers its own trading platform. The company describes its platform as being aimed towards those that prefer simpler and convenient features with the ability to quickly manage capital. Traders can make deposits and withdrawals, access market news, and easily switch between their real and demo accounts on the platform. The platform can be accessed through the web browser or downloaded for Apple or Android. Note that the available account types depend on which platform has been chosen and that trading costs and other specifics differ based on which platform you choose to trade through.

Assets

Assets