Traders Trust is a regulated Forex Broker, compliant with MiFID II under CySEC regulation. These are not to be confused with ttcmmarkets.com which Traders Trust does give a disclaimer on, on the website, in regards to the fact that the mentioned website is fraudulently using their details under their own domain. So, word of warning, ensure you are going to the correct website, and do not be misguided. The website is rather outdated, suggesting this is a broker that has been operating for some time.

Aside from this disconcerting hiccup, this IS a CySEC regulated company, and on the whole, appear to offer amicable services to their clients in respect of trading conditions.

Account Types

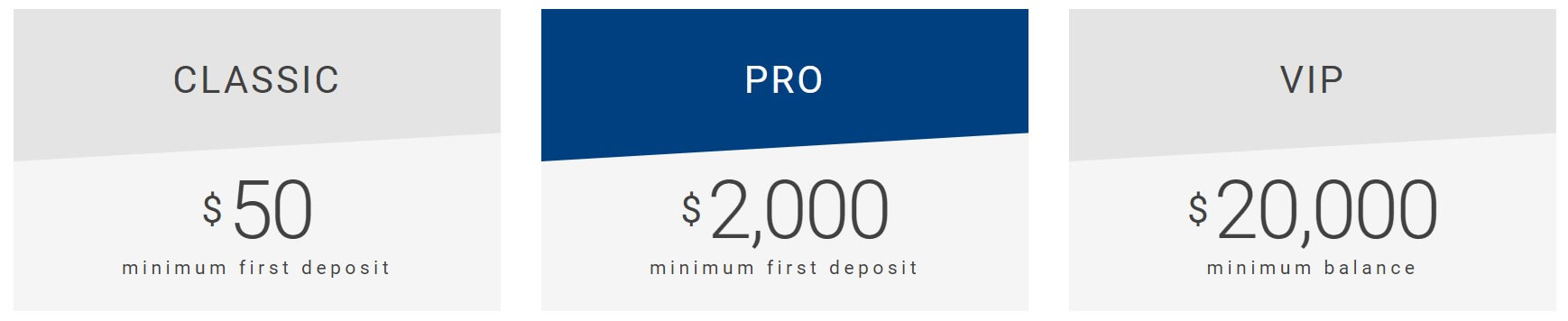

Traders Trust offers the following account types:

Classic: STP/NDD, 0 commissions and up to 1:30 leverage

Pro: STP/ECN/NDD, 3$ per lot per trade commission, and up to 1:30 leverage

VIP: STP/ECN/NDD, 1.5$/lot and up to 1:30 leverage

Platforms

Traders Trust has made its services fully compatible with the MT4 platform, which you can use via Windows Desktop, Webtrader, iOS, and Android versions meaning you can trade both at home, or on the go.

Leverage

As a result of ESMA policies, Traders Trust must comply with such regulation laws and therefore clients of this broker are restricted to using the leverage of up to 1:30 which may not be suitable for all types of trading, or indeed, desirable for all traders.

Trade Sizes

The minimum trade size is 0.01 lot, which goes for all account types (Classic/ Pro/ VIP).

Maximum trade volume allowed is set at:

- FX 100 lots

- CFDs 50 lots

- Commodities 50 lots

Trading Costs

As mentioned previously, depending on the account type you choose, you may e subject to commission charges, or you may not;

- Classic: 0 commissions

- Pro: 3$ per lot per trade commissions

- VIP: 1.5$ per lot, per trade commissions

Bear in mind that when you are not paying commission fees, chances are, the spread will be marked up, so that the broker makes a profit via the spreads instead. This means that costs for trading overall, for the client, even out, regardless of which account type you choose.

Assets

Traders Trust is not the best when it comes to variety and a wide selection of tradable assets, with only offering around 70 tradable instruments in total: Forex, Indices, and Commodities. Some traders may find this small selection satisfactory, while others may consider this limiting. We must note here that Traders Trust does not offer CFD crypto trading, which more and more brokers are not offering. This suggests that this broker is not particularly forward-thinking, and perhaps a little outdated with the provision of their trading services, in comparison to other brokers being added to the industry.

Traders Trust is not the best when it comes to variety and a wide selection of tradable assets, with only offering around 70 tradable instruments in total: Forex, Indices, and Commodities. Some traders may find this small selection satisfactory, while others may consider this limiting. We must note here that Traders Trust does not offer CFD crypto trading, which more and more brokers are not offering. This suggests that this broker is not particularly forward-thinking, and perhaps a little outdated with the provision of their trading services, in comparison to other brokers being added to the industry.

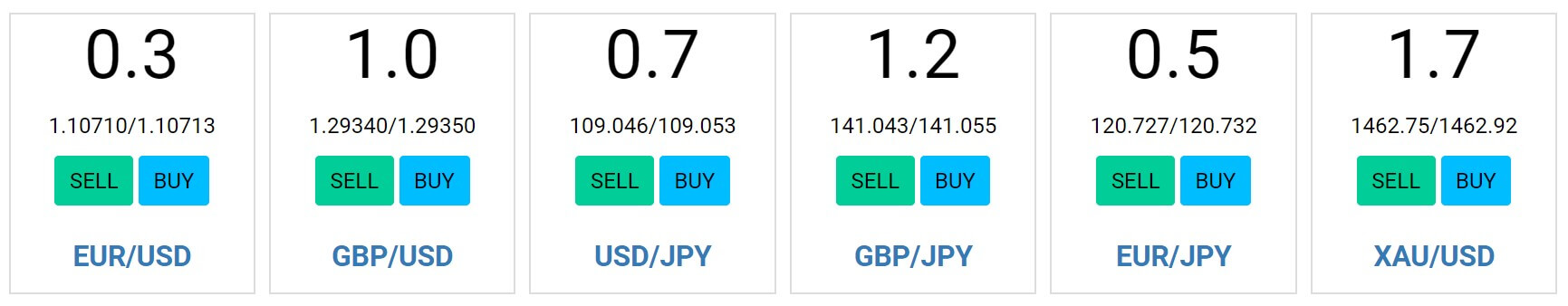

Spreads

Traders Trust offers floating spreads and you can view their live spreads on the website, on all tradable instruments available. Their Forex spreads must be commended which average out to be very competitive in comparison to other brokers. Spreads on Indices and Commodities appear to be relatively tight as well.

Minimum Deposit

The minimum deposit requirement differs from one account type to another. For the Classic account, the client must deposit a minimum of 50 USD or equivalent currency. The minimum for the Pro is 2,000 USD while the VIP account must be credited with a minimum amount of 20,000 USD or equivalent currency.

By no means are the Pro and VIP accounts ‘’affordable’’ for the majority, however, there is the Classic account option which should appeal to many traders, especially newer traders. However, of course, with the Classic account, the benefits are not as great as the other account options; with spreads starting at 1.5 pips, as opposed to 0 on the Pro account.

Deposit Methods & Costs

To deposit into a Traders Trust account, you have the following options at your disposal: Bank wire, credit/debit card, Skrill, Neteller, Bitcoin or Bit wallet. It is nice to see a rounded selection of methods to choose from to suit many clients, and also the fact they offer BTC as a deposit method is very preferable as it typically is one of the fastest methods. Traders Trust does not charge their clients any fees when making a deposit.

Withdrawal Methods & Costs

Clients may withdraw from a Traders Trust account via the following options: Bank wire, credit/debit card, Skrill, Neteller, Bitcoin or Bit wallet. Traders Trust does not charge their clients any fees when making a withdrawal however always check first with your provider to see if you may be liable for any fees applicable.

Withdrawal Processing & Wait Time

Bank card and wire transfers can take the standard between 3-5 working days but of course, depending on your banking provider, timescales to actually receive your funds could vary. Alternatively, Withdrawals by Skrill, Neteller, Bitcoin take a couple of hours only, which is far more efficient.

Bonuses & Promotions

Traders Trust does not offer any deposit bonuses nor do they offer any promotional offers advertised.

Educational & Trading Tools

The only tools that you will find from Traders Trust are the standard: Economic calendar and a trading calculator, which is handy for both new and experienced traders alike. You will not, however, find any training or educational courses. Of course, these can be found online, anyhow, and for free.

The only tools that you will find from Traders Trust are the standard: Economic calendar and a trading calculator, which is handy for both new and experienced traders alike. You will not, however, find any training or educational courses. Of course, these can be found online, anyhow, and for free.

Customer Service

Should you wish to get in touch with Traders Trust, you may contact them via Live Chat or email. For those that prefer telephone contact, unfortunately, you will be disappointed as this method of customer support is not available. Their customer support, however, operates on a 24/5 basis Monday to Friday on GMT+2 time zone. The response time is typically very prompt however the quality of response is not always consistent in reference to having to repeat oneself to get an answer.

Should you wish to get in touch with Traders Trust, you may contact them via Live Chat or email. For those that prefer telephone contact, unfortunately, you will be disappointed as this method of customer support is not available. Their customer support, however, operates on a 24/5 basis Monday to Friday on GMT+2 time zone. The response time is typically very prompt however the quality of response is not always consistent in reference to having to repeat oneself to get an answer.

Demo Account

It is standard procedure to provide a demo account access for potential clients to backtest the broker’s services before agreeing to become a client. With Traders Trust you can make use of their demo to try out their trading conditions before depositing live money into a real account.

Countries Accepted

Please be reminded that Traders Trust is a CySEC regulated FX broker, and therefore has restrictions in place on particular residents not being allowed to make use of their services. Residents of these countries include Australia, New Zealand, Canada, Iran, Iraq, North Korea, Japan, USA, Cuba, Syria, Sudan, Afghanistan, Guyana, Lao People’s Democratic Republic, Uganda, and Yemen.

Conclusion

Traders Trust overall is not a broker to shy away from, however in respect of competitors, this broker does not stand out; leverage caps are low and yes, commission fees are low, but not all spreads are tight. In addition, the minimum deposit for 2 out of 3 accounts is incredibly high compared to other brokers offering similar types of accounts with the same benefits. IN conclusion, this broker does have many positive attributes, but one must fully backtest this broker’s trading conditions in demo first, for some time, in order to make a comprehensive decision if this broker is suitable for you or not.