TrioMarkets are a CySEC regulated ECN/STP Forex broker and on the surface, appear to offer a very wholesome and thorough service including educational material, MT4 platform, Social Trading and of course, for those that consider it of necessity, this broker offers the security of complying with a regulating body.

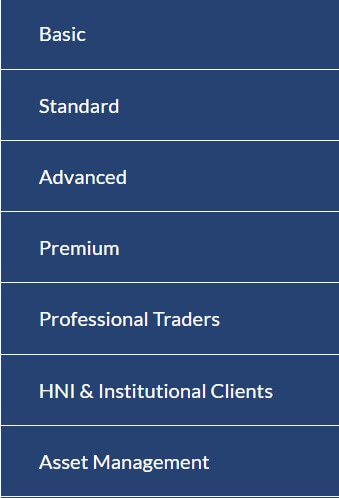

Account Types

TrioMarkets offer a variety of trading accounts, from small accounts targeted at the newer traders, and alternative account options for perhaps the more experienced, and then professional traders. There is the option to hold a ‘Professional’ traders account, which would entitle you to higher leverage options than what the regulation body policies allow on the other accounts. However, this usually means your minimum deposit requirement is much higher than the other accounts. The 4 accounts aside from the professional option, are as follows:

Basic: leverage of 1:30, minimum spread from 2.4 Pips and No commission charged

Basic: leverage of 1:30, minimum spread from 2.4 Pips and No commission charged

Standard: leverage of 1:30, minimum spread from 1.4 Pips and No commissions

Advanced: leverage of 1:30 and the choice between a raw or low markup spreads

Premium: leverage of 1:30 and a raw spread of 0.0. Priority access to the customer support team and low commission charges

TrioMarkets also offers Islamic accounts, which are shariah compliant.

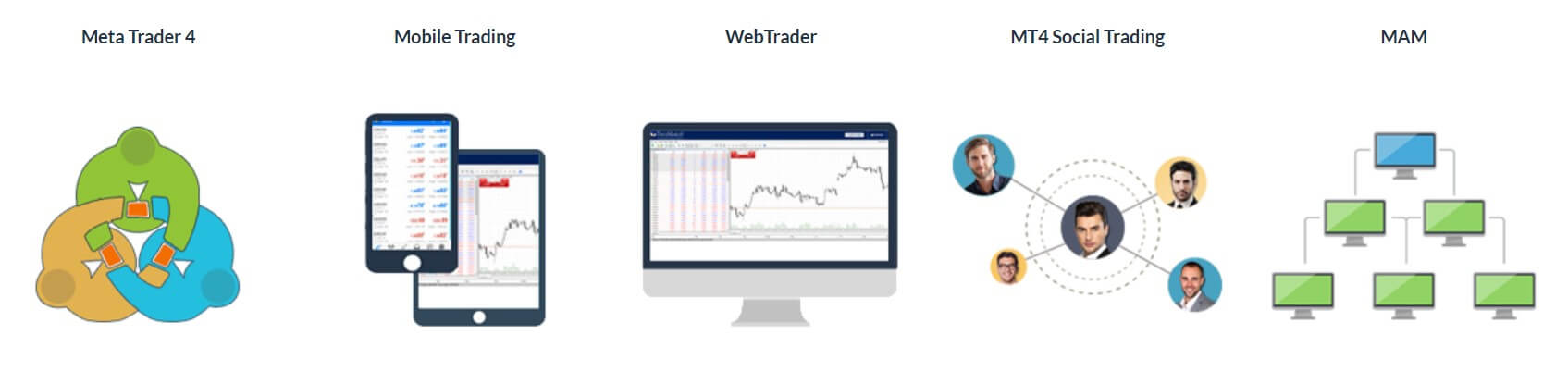

Platforms

TrioMarkets offer the trusted and reliable MetaTrader4 (MT4) platform as well as their very own tailor-made version of MT4, which they have so named MT4 TrioXtend. If you are not already aware, customized platforms have been tailored for a reason; usually to mark up spreads and to ensure/maximize profits from clients. It is wise to always try out the demo version prior to opening the live account, to ensure this platform is ideal for you and your style of trading. Windows/ Mac Desktop, as well as mobile options, are available.

Leverage

For all accounts (Basic, Standard, Advanced and Premium), clients can trade with a maximum leverage of 1:30, which is not particularly amicable for the majority of traders, but this is, of course, a result of regulatory policies that the broker must comply with. However, should you consider yourself a ‘professional’ trader, you can apply for the professional account, which entitles you to higher leverage, depending on how much you deposit. This information is not particularly clear until you submit the request for such an account.

For all accounts (Basic, Standard, Advanced and Premium), clients can trade with a maximum leverage of 1:30, which is not particularly amicable for the majority of traders, but this is, of course, a result of regulatory policies that the broker must comply with. However, should you consider yourself a ‘professional’ trader, you can apply for the professional account, which entitles you to higher leverage, depending on how much you deposit. This information is not particularly clear until you submit the request for such an account.

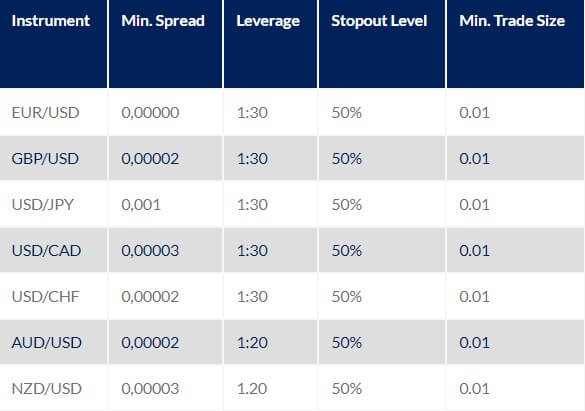

Trade Sizes

TrioMarkets minimum trade size is 0.01 lot, and this goes for all account types. There is no maximum trade size.

Trading Costs

Commission charges vary from account type:

- Basic: 2.4 pips – $24 per lot, per trade

- Standard: 1.4 pips – $14 per lot, per trade

- Advanced 1.1 pips – $11 per lot, per trade

- Premium 0.8 pips – $8 per lot, per trade

Swap fees are calculated depending on trade size and asset and also according to the exchange rate at the time. This can be calculated manually with assistance from the customer support team.

Assets

With TrioMarkets, you may trade a variety of CFD assets: Forex (60+ currencies) Metals, Indices, Stocks and Commodities. A full list of all available tradable assets can be found on the website, along with their specifications in regards to trading conditions. The selection of assets on offer is more than satisfactory, although some may argue not so since there are no cryptocurrencies available by this broker.

Spreads

Spreads by TrioMarkets are variable, and this goes for all account types. Unfortunately, the live floating spreads cannot be found on the website, so you would need to install MT4 and take a look at their demo version to see what the spreads actually are. However, minimum spreads for some pairs are displayed on the website. When speaking to a live chat agent, they were unable to provide even an average spread on any pair. In this case, one would need to check the demo for the live spreads to get a full overview of the spreads offered by TrioMarkets.

Minimum Deposit

The minimum deposit requirements depending on the account type you opt for, which are as follows:

- Basic $500

- Standard $5,000

- Advanced $10,000

- Premium $25,000

The minimum deposit required for each account is a clear indication of the level of trader experience clients should have before entering into a live account, which is good to know so you can establish what level of experience you have and what deposit you are willing to make, when choosing the most appropriate account type for you.

Deposit Methods & Costs

TrioMarkets accept Card deposit, Bank wire transfers, Neteller and Skrill. TrioMarkets do not charge any deposit fees.

Withdrawal Methods & Costs

TrioMarkets allow clients to withdraw via Card, Bank Wire Transfer, Neteller, and Skrill. Note that there is a 1.5% fee applied to all withdrawals and a minimum charge for bank wires is $25 but a max $50 charge.

Withdrawal Processing & Wait Time

Withdrawal processing with TrioMArkets can take between 2-5 working days, but this can also vary and depends on the banking providers you use, so be sure to check with your own individual provider before making any withdrawals to avoid any delays or disappointment.

Bonuses & Promotions

TrioMarkets do not offer any promotional schemes or deposit bonuses, which is a positive attribute since this means that clients are not made to deposit and trade with eagerness supported by a false sense of extra margin.

Educational & Trading Tools

TrioMarkets have their very own trading education program, called TrioAcademy, which you can sign up to, to access a variety of tools: e-books, videos, and courses. In addition to this free education, TrioMarkets also offers Market News on the website, along with an economic calendar, so that even once you have started trading, you still have access to guides to assist in your everyday trading.

Customer Service

Customer support and assistance is available on a 24/5 basis between Monday and Friday during the hours of 9 AM and 9 PM (GMT +1). You may request assistance or have queries answered by Live Chat, Ticket form, and Telephone. The telephone agents operate 6 different language desks as well which is an added bonus for clients.

Overall the quality of customer service is prompt with response rate and the response overall is friendly, polite and adequately helpful.

Demo Account

TrioMarkets offer a demo account to practice with, should you require trading practice and/or wish to backtest their trading services to ensure they are in line with your expectations. It seems, however, that TrioMarkets only offer a demo account for the standard MT4 platform, but not for their own tailor-made version of it (MT4 TrioXtend), as this is nowhere to be found on the website.

Countries Accepted

TrioMarkets, since they are regulated (CySEC), cannot accept residents of the following countries to become clients: the United States of America, the State of Israel. The Islamic Republic of Iran and the Democratic People’s Republic of Korea (DPRK).

Conclusion

TrioMarkets offer a fair range of tradable assets and, for their regulation status, a fair service in terms of trading conditions, although some may argue that the low leverage restriction can be limiting, depending on what type of trading you are conducting. It must be noted also that withdrawals are not lengthly, and the customer service team are helpful and efficient with heir responses. The only need to be cautious is perhaps when it comes to the customized platform; all should be wary that a tailor-made platform is made to differ and tailored in a way that profits can be made easier for the broker, from the clients. Taking all elements discussed on this broker into account, TrioMarkets is seemingly targeted at the more well-established and experienced traders.