Gainsy is a foreign exchange broker that was founded in 1998 and is located in Saint Vincent and the Grenadines. Gainsy incorporates their own beliefs into the forex industry from honestly to innovation.

“GAINSY Company provides on-line trading on the Forex market on the basis of NDD (Non-Dealing Desk). All trading positions are hedged on the interbank market at the largest institutional liquidity providers. Hence, GAINSY Company is interested in clients’ profit directly, as the more profit you take – the larger your deposit becomes, and with a larger deposit, the more company is able to earn on commissions while hedging your positions. We give you the opportunity to lead a profitable, high-quality, fast and efficient trading on the Forex market using STP and ECN accounts.”

That’s the statement taken directly from the broker’s website. We will be using this review to see if they really are trying to help their clients grow and also how they stack up against the competition in regards to trading conditions.

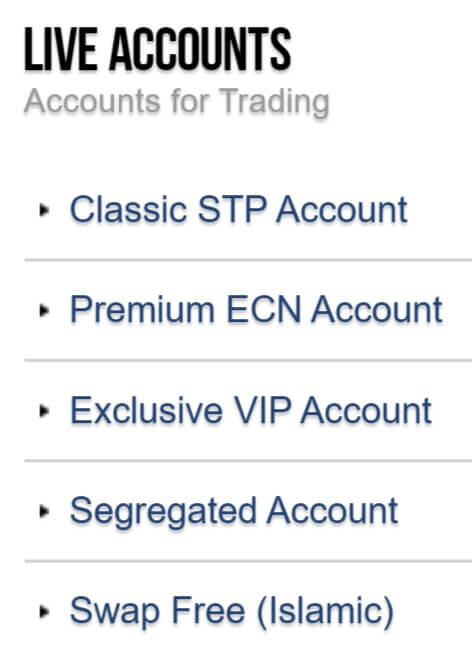

Account Types

There are multiple different account types however we will only be looking at the ones directed towards retail traders, so we won’t look at the PAMM accounts or other investment style accounts. So let’s see what is available.

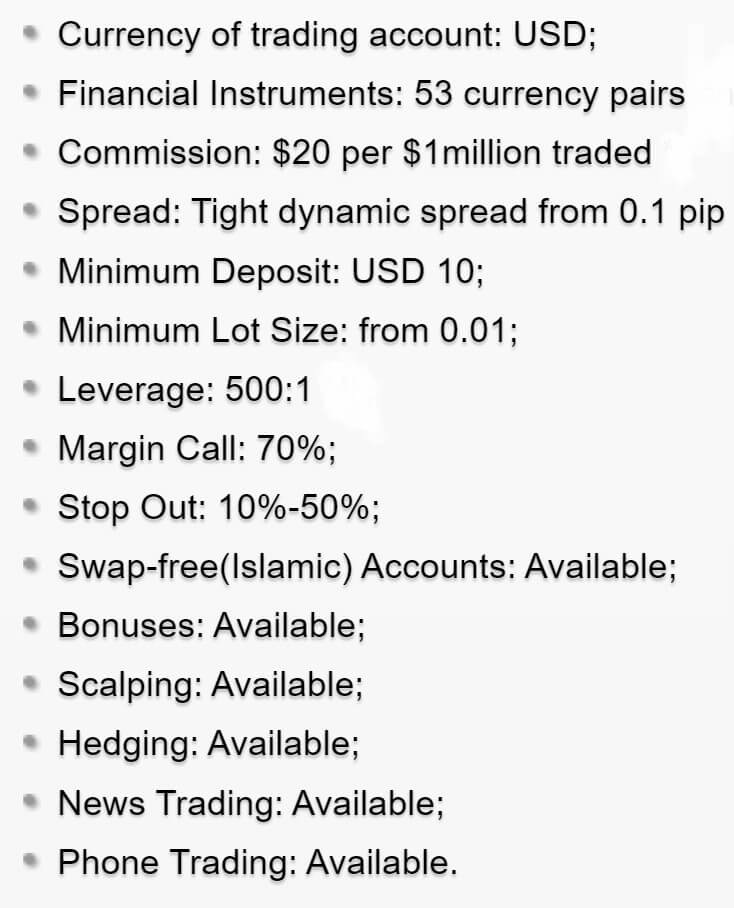

Classic STP Account:

This account has a minimum deposit requirement of $10 and comes with access to the Gainsy trading platforms, its base currency must be in USD. It has access to 53 currency pairs as well as Gold and Silver, it has an added commission of $20 per million traded and variable spreads starting as low as 0.1 pips. The minimum trade size starts at 0.01 lots and the account can be leveraged up to 1:500. The margin call level is set at 70% with the stop out being set between 10% and 50%. Bonuses, scalping, hedging, news trading, and telephone trading are all available with this account.

Premium ECN Account:

Premium ECN Account:

This account has a minimum deposit requirement of $10,000 and comes with access to the Gainsy trading platforms, its base currency must be in USD. It has access to 55 currency pairs as well as Gold and Silver, it has an added commission of $2 per lot traded and variable spreads starting as low as 0 pips. The minimum trade size starts at 0.01 lots and the account can be leveraged up to 1:100. The margin call level is set at 120% with the stop out being set at 100%. Scalping, hedging, news trading, and telephone trading are all available with this account while bonuses are not available.

Exclusive VIP Account:

This account has a minimum deposit requirement of $100,000 and comes with access to the Gainsy trading platforms, its base currency must be in USD. It has access to 53 currency pairs as well as Gold and Silver, it has an added commission of $20 per million traded and variable spreads starting as low as 0 pips. The minimum trade size can be set by the client, as can the leverage. The margin calls and stop out levels can also be set by the client. Bonuses, scalping, hedging, news trading, and telephone trading are all available with this account.

Swap-Free (Islamic) Account:

All of the above accounts can also be used as a swap-free Islamic account for those that cannot accept or pay interest charges. The trading conditions are the same just without any swap fees.

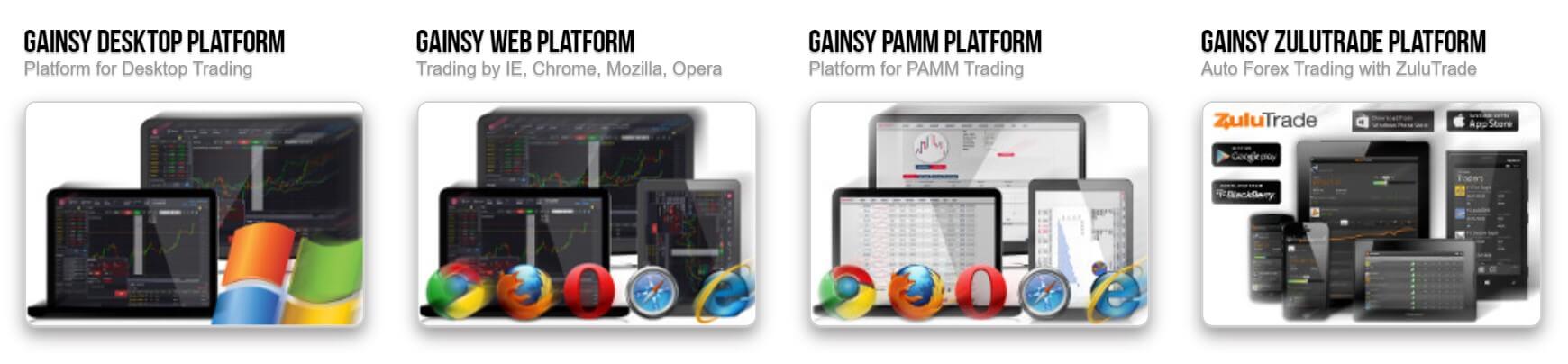

Platforms

We won’t be looking at the PAMM platform, but there are a couple of other platforms available to trade with.

Gainsy Desktop, Web and Mobile Platform:

The desktop version states that it is coming soon, however, the mobile and web versions are fully available to use. They use their own platform with some of its features including in being compatible with ECN trading accounts, high speed of application performance and orders execution, displaying of quotes in real-time data with a fully customized list of trading tools, the ability of monitoring price history with the help of graphical charts, the ability to use such order types such as Markets, Stop, Limit, OCO, Parent & Contingent for secure and professional trading, monitoring the history of trade orders for analyzing results of your trading, full access to information about the client’s trading account, direct access through the platform to the most recent and current economic news and more.

ZuluTrade:

ZuluTrade is one of the worlds most used and popular social trading platforms, using it with Gainsy offers many features including an automated service requiring almost no actions on the part of the Investor, the possibility to familiarize with the system of automatic trades copying by opening free Demo Account, utilization of NDD technology, that allows conducting Forex trading with no re-quotes having the fastest order execution, the opportunity to copy signals of several traders at the same time, as well as open multiple accounts with the same purposes, complete set of parameters that allows to select professional traders sorting them by total drawdown, Stop Loss level, level of interest risks, the period of trader’s activity, number of subscribers, profitability, invested amount, round-the-clock Forex trading even without the access to the computer, total compatibility of GTP and ZuluTrade platforms, an opportunity to copy signals of successful traders as well as conduct independent trading, the possibility to study techniques and strategies of the most successful traders while analyzing their signals, and control over the risks: the possibility of risk reduction comparing with manual trading.

Leverage

The leverage that you get depends on the account you are using. The Classic STP account holder can have a leverage up to 1:500, while the Premium ECN account can be leveraged up to 1:100, and the Exclusive VIP account holder can select what leverage they want the account to use. This can be selected when opening up an account and can be changed by contacting the customer service team with the request to change it.

The leverage that you get depends on the account you are using. The Classic STP account holder can have a leverage up to 1:500, while the Premium ECN account can be leveraged up to 1:100, and the Exclusive VIP account holder can select what leverage they want the account to use. This can be selected when opening up an account and can be changed by contacting the customer service team with the request to change it.

Trade Sizes

Trade sizes start from 0.01 lots and go up in increments of 0.01 lots. We do not currently know what the maximum trade size is but would suggest keeping under 50 lots whatever it is. We also do not know how many open trades or orders you can have at any one time.

Trading Costs

There is an added commission on all the accounts. The Classic STP account has an added commission of $20 per million traded while the Premium ECN account has an added commission of $2 per lot traded, in reality, they are the same thing, just worded differently. There are also swap charges which are interest fees for holding trades overnight, these can be viewed within the treading platform. There is a swap-free Islamic account available for those that cannot pay or receive interest charges.

Assets

There are only forex pairs and metals available, we have outlined the instruments below.

Forex: AUDCAD, AUDCHF, AUDDKK, AUDJPY, AUDNZD, AUDSGD, AUDUSD, CACCHF, CADJPY, CHFJPY, CHFSGD, EURAUD, EURCAD, EURCHF, EURDKK, EURGBP, EURHKD, EURJPY, EURNOK, EURNZD, EURSEK, EURSGD, EURTRY, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPDKK, GBPJPY, GBPNOK, GBPNZD, GBPSEK, GBPSGD, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDSGD, NZDUSD, SGDJPY, USDCAD, USDCH, USDDKK, USDHKD, USDHUF, USDJPY, USDLTL, USDLVL, USDMXN, USDNOK, USDPLN, USDSEK, USDSGD, USDTRY , USDZAR.

Metals: Gold and Silver

Spreads

The spreads on both accounts are very low due to them having an added commission. Pairs such as EUR/USD are as low as 0.1 pips while other pairs are slightly higher such as EUR/AUD starting at 0.9 pips. The spreads are variable which means they move with the markets, the more volatility there is the higher they will be.

Minimum Deposit

The minimum deposit is just $10 which gets you access to the Classic STP account. If you want the Premium ECN account you will need to deposit at least $10,000.

Deposit Methods & Costs

The following methods are available to deposit with, you can use Visa/MasterCard, QIWI Wallet, Bank Transfer, UnionPay, Perfect Money, CashU and WebMoney, there may be others but those are the ones we know of. We do not know if there are any added fees for deposits.

Withdrawal Methods & Costs

You can use the same methods to withdraw with, these are Visa/MasterCard, QIWI Wallet, Bank Transfer, UnionPay, Perfect Money, CashU and WebMoney. Once again there may be more available and we do not know if there are any added fees, but be sure to check with your own bank or processor to see if they add any fees of their own.

Withdrawal Processing & Wait Time

All withdrawal requests should be processed within 48 hours from Gainsy. After that, it will take between 1 to 5 working days for the withdrawal to fully process depending on the method used to withdraw.

Bonuses & Promotions

There are a lot of bonuses on offer. We won’t go over all of them but we will outline a few just so you can get an idea of the sort of promotions and bonuses that Gainsy offer.

Unified Bonus up to 50%:

Unified Bonus is the additional funds, which are not canceled when the equity of trading account is below the initial balance amount, therefore, Unified Bonus may be fully used in your trading, even during “drawdown”. This promotion may increase your profit generation, saving your positions in case of negative movements and when the market behaves unexpectedly.

Bonus “Easy Income” 10%:

Each company’s client after each replenishment of an account in the amount of not less than 300 USD has the right to order additional investments of 10% from the deposit. These funds can be used in trading and are also available for withdrawing if the client for 6 months does not take out money from an account. If funds are withdrawn before the specified period, the company’s investment funds are canceled automatically.

Standard +30%:

You can open an account with 10000 USD, and start trading 1 lot. As a result, in one month you can earn an extra 5000 USD approximately. Or you can order our bonus “Standard 30” after account replenishment. Then, you start trading with the amount of 13000 USD, not 10000 USD. Consequently, after a 30% bonus credit, you can open an order of 1.3 lots, instead of 1 lot. And under the same circumstances you do not earn 5000 USD, but 5000 USD +1500 USD, i.e. 6500 USD.

Educational & Trading Tools

There are a few different tools available, the firs being a toolbar, which is designed to help you look through finance related websites for news and analysis. There is also a free educational course, this is basically some pages of text about different subjects on trading, okay for beginners but nothing special. There is also a glossary of trading-related terms, a margin calculator, a pip value calculator, and an economic calendar, detailing upcoming news events and the market they may affect.

Customer Service

There is a live chat feature available with someone there to answer your question. Otherwise, you can use the single email address that has been provided, not too many ways to get in touch which is a little disappointing to see.

Email: [email protected]

Demo Account

Demo accounts are a great way to test out the markets or new strategies without any real risk so it is good to see them available from Gainsy. You can select either the STP or ECN account to mimic but we do not know if there is an expiration time or any other details about the demo account.

Countries Accepted

The following statement is present on the site: “Please, pay attention, the Company does not provide its services to the citizens of the U.S. and some other jurisdictions. Please, see Client Agreement for more information.” If you are still not sure of your eligibility you should contact the customer service team to find out.

Conclusion

There is a lot of information on the Gainsy website. The way in which this information is laid out can look very busy and can be a little difficult to navigate. There are two different account types, the STP or ECN. In practice, there isn’t too much difference between them apart from a few extra pairs to trade on the ECN account. Trading conditions are fairly cheap with the low spreads and only $2 commission, however, the spreads are a little higher than we sometimes see on ECN accounts. With only currency pairs and metals available there is a small lack of instruments to trade, there also isn’t full disclosure on the deposit and withdrawal methods, so some more information around this subject needs to be added. The other concern that we have is the lack of ways to contact the customer service team, if something goes wrong, it could take a while before you get a resolution.