XMTRADING is a product of Tradexfin Limited that is regulated by the Financial Services Authority (FSA) and located in Cyprus. The broker offers high-leverage trading on FX, Commodities, Equity Indices, Precious Metals, and Energies. If you’re interested in signing up, you’ll need to know more about the three account types offered by the broker and their conditions.

Account Types

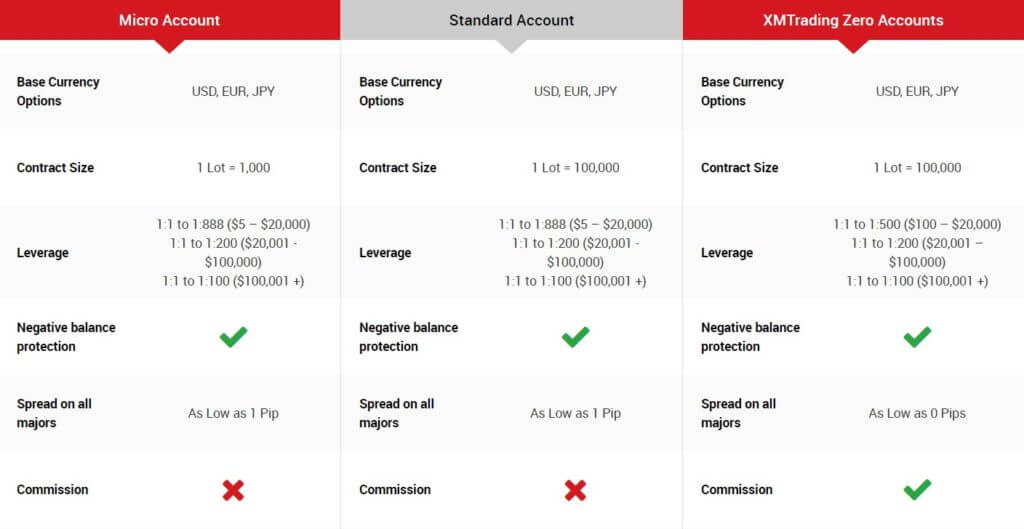

This broker offers three different account types; Micro, Standard, and Zero accounts. All accounts are affordable, with minimum deposit requirements ranging from $5 to $100. Leverage options and spreads are shared on the Micro and Standard account types, while the leverage cap is set lower on the Zero account. The Zero account also comes with lower spreads and is the only account type to charge commissions. We’ve included a quick summary of each account type below.

Micro Account

Minimum Deposit: $5

Leverage: 1:1 Up to 1:888*

Spread: From 1 pip

Commission: Zero

Standard Account

Minimum Deposit: $5

Leverage: 1:1 Up to 1:888*

Spread: From 1 pip

Commission: Zero

ZMTRADING Zero Account

Minimum Deposit: $100

Leverage: 1:1 Up to 1:500*

Spread: From 0 pips

Commission: $5 per $100,000 traded

The broker requires a color copy of a valid passport or other official identity document and a utility bill dated within the last 6 months for account verification. Note that your address must be verified before withdrawals can be made, so you may want to complete this process before making a deposit. The broker doesn’t mention how long verification can take.

*These are the highest options available and limitations are set based on the account’s balance. See ‘Leverage’ for more details.

Platform

One of this broker’s advantages would be the inclusion of the two most popular trading platforms on the market – MetaTrader 4 and MetaTrader 5. You’ll be able to trade on either platform with no requotes or rejections. Trading on MT4 with this broker grants access to more than 1000 trading instruments, including Forex, CFDs, and Futures, full EA functionality, 1 click trading, technical analysis tools with 50 indicators and charting objects, 3 chart types, VPS functionality, and more.

MT5 offers many of the same advantages, however, traders would have access to FX, Gold, Oil, and Equity Indices through this platform. Many may have a preferred platform already, although it’s important to consider which asset classed one would prefer to have access to if this broker is chosen. On another note, there should be no issue accessing the platform, whichever is chosen. Both MT4 and MT5 are available on PC, Mac, and Mobile devices. The platforms can also be accessed through the browser-based WebTrader.

Leverage

The highest leverage option available would depend both on the account type and the amount of funds in the account. There are also some limitations on certain instruments. On Standard and Zero accounts, the maximum leverage cap of up to 1:888 is available with an account balance between $5 and $2,000. Anything between $20,000 and $100,000 qualifies for leverage of up to 1:200. Anything over that amount would only qualify for leverage as high as 1:100.

Options differ on Zero accounts, with the maximum leverage cap of 1:500 available with an account balance between $100 and $20,000, a leverage of 1:200 available on balances between $20,001 and $100,000, and a leverage of up to 1:100 available on any amount that tops $100,000. The broker has likely based their leverage options around the account balance in order to set limitations that would decrease the amount of funds one might lose. Taking a look at the instrument limitations, we see a leverage cap of 1:50 for some currency pairs, 1:100 for a few others, and a leverage cap of 1:400 on CHF currencies.

Trade Sizes

On MT5, the minimum trade size on the Micro account is 0.1 lots. On MT4, the minimum trade size is 0.01 lots, otherwise known as one micro lot, on the Micro account and both of the other account types. All accounts allow for 200 open and pending positions at one time. The Micro account has a lot restriction per ticket of 100 lots, while the other account types have a restriction of 50 lots. The maximum trade size on Precious Metals is 50 lots.

The margin in your trading account needs to be equal or above 100% in order for you to open new trades unless the new trades will result in your account being fully hedged. As soon as the margin level drops below 50% the broker will provide a warning that you do not have enough equity to support open positions. The stop-out level is reached when the client falls 20% below the required margin.

Trading Costs

This broker profits through commissions, spreads, swaps, and inactivity fees. Micro and Standard account holders will not have to pay any commissions. The commission on the Zero account is $5 per $100,000 traded. The commission fee for the MT4 platform is deducted from the transaction for both positions at once (opening and closing), and the commission on the MT5 platform is deducted from the account separately during the opening and closing of the position.

Positions held open overnight may be charged rollover interest. In the case of forex instruments, the amount credited or charged depends on both the position taken (i.e. long or short) and the rate differentials between the two currencies traded.

In the case of stocks and stock indices, the amount credited or charged depends on whether a short or a long position has been taken. Rollover interest is only applied to cash instruments. In the case of futures products, which have an expiry date, there are no overnight charges. Any account that is dormant for 90 calendar days will be considered inactive and a monthly $5 fee will be charged.

Assets

Assets

Earlier, we mentioned that certain asset classes are available on each platform, so we will quickly recap. If you’ve chosen MT4, you’ll have access to FX, CFDs, and Futures. Meanwhile, trading on MT5 grants access to FX, Oil, Gold, and Equity Indices. Those FX options are shared by all accounts and include more than 55 currency pairs, including majors, minors, crosses, and exotics. Commodities are made up of Cocoa, Coffee, Corn, Cotton, High-Grade Copper, US Soybeans, Sugar, and Wheat. Equity indices include 18 options. Precious Metals include Gold, Silver, Platinum, and Pallidum. Note that options are limited to Gold and Silver on Micro accounts. Five Energies are available, including Brent Crude Oil, Natural Gas, and more. All of the available instruments can be viewed under the ‘Trading’ section of the website.

Spreads

Spreads on all majors start as low as 1 pip on Standard and Micro accounts and are from 0 pips on Zero accounts. These options are obviously advantageous, but we were also concerned about the typical spreads on other instruments. While the website does not mention these specifically, it is possible to compare the average spreads under the ‘Trading’ category on the website. Since spreads can vary so widely on all assets and account types, we would definitely recommend taking a look at this section yourself.

Minimum Deposit

The Micro and Standard account types allow traders to open an account with as little as $5. Traders may want to deposit a larger amount in order to gain more bonus credit and to be able to support more trading activity, however, this amount is excellent for beginners and it also provides the ability to test out some of the available funding methods before making a larger deposit.

The Zero account type is also offering a low deposit requirement of $100. Fortunately, traders should be able to open any of the available accounts with this broker without being restricted based on capital. If you’re on the fence about making a deposit, you could also take advantage of this brokers $30 Trading Bonus promotion, which allows one to open an account without making an initial deposit.

Deposit Methods & Costs

We found the FAQ to be vague when it comes to the available funding methods. While the broker did mention that they support multiple cards, electronic payment methods, Bank Wire Transfer, and other methods, we felt that the broker should understand how important it is to list these options in detail. After opening an account, we found the options to be much more limited than they were initially made out to be, with options being limited to Visa, MasterCard, SticPay, and Wire Transfer. Aside from Wire Transfer, all deposits are processed instantly. No fees are charged on the broker’s behalf on incoming deposits.

Withdrawal Methods & Costs

Funds are processed back to the originating payment source as refunds. Any profits on Visa or MasterCard withdrawals must be processed back via Wire Transfer. The broker offers fee-free withdrawals on all methods and covers banking fees on Wire Transfer withdrawals of $200 or more. If you withdraw any amount lower than $200, you’ll be charged by the company’s bank. While the broker does not detail how much the charge would be, one could expect to see a charge anywhere from $25 to $50 dollars.

Withdrawal Processing & Wait Time

This broker processes withdrawal requests within 24 hours. SticPay withdrawals are received the same business day. It typically takes 2-5 business days to receive card withdrawals. The wait time for Wire Transfer withdrawals depends on the client’s country. Standard wire within Europe should be received within 3 business days, while it can take up to 5 business days to receive wires back to some locations.

Bonuses & Promotions

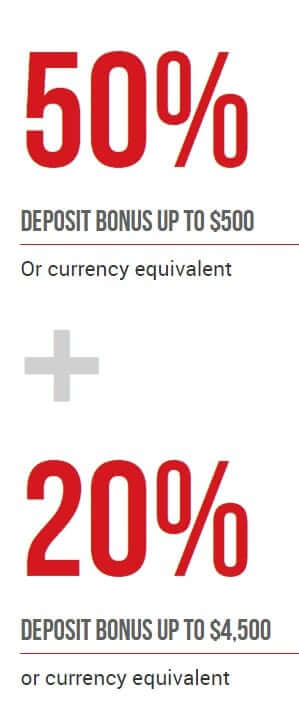

Currently, the broker is offering a few different opportunities in this category. There’s a $30 Trading Bonus, a 50% + 20% Deposit Bonus, a Loyalty Program, Free VPS Services, and Zero Fees on Deposits & Withdrawals. As usual, we took a more in-depth look at some of these offers, since terms and conditions are so important. We’ve provided a brief description and some of the most important qualifying factors below, although you’ll want to read the entire list of terms and conditions for any promotion you may be interested in on the website. Also, note that the broker mentions that new time-sensitive offers are available periodically, so be sure to keep a lookout for any additions.

Currently, the broker is offering a few different opportunities in this category. There’s a $30 Trading Bonus, a 50% + 20% Deposit Bonus, a Loyalty Program, Free VPS Services, and Zero Fees on Deposits & Withdrawals. As usual, we took a more in-depth look at some of these offers, since terms and conditions are so important. We’ve provided a brief description and some of the most important qualifying factors below, although you’ll want to read the entire list of terms and conditions for any promotion you may be interested in on the website. Also, note that the broker mentions that new time-sensitive offers are available periodically, so be sure to keep a lookout for any additions.

$30 Trading Bonus (No-Deposit Bonus): The broker offers a $30 non-withdrawable credit to any clients that open a real account. The promotion makes it possible for said client to open an account and test the broker’s products and services with no initial deposit. Any profits earned are fully withdrawable.

50% +20% Deposit Bonus (Micro and Standard Accounts): This is a two-tier bonus that can earn traders a maximum of $5,000. The first tier applies a bonus of up to 50% on deposits of $5 or more. The second tier is applied to deposits of $2,000 or more. Therefore, a client could earn a total bonus of $700 on a $2,000 deposit, and so on, up to $5,000. Profits can be withdrawn but doing so may result in partial removal of bonus funds.

Loyalty Program (Micro and Standard Accounts): All account holders begin at the Executive level and work their way up with trading activity. With each loyalty status upgrade, the amount of points that are earned increases. The more points one has, the more they will be able to redeem for credit rewards. Executive level earns 7 points per lot, Gold earns 10 per lot, Diamond earns 13 points per lot, and Elite earns 16 points per lot.

Educational & Trading Tools

Judging by the wide range of promotions and the detailed information on this broker’s website, we were expecting to see a wide range of features in this category. Sadly, the broker just isn’t offering much in the ways of education. At first, we didn’t find any educational options, but we did find a link to some educational videos on the FAQ (https://www.xmtrading.com/tutorials). Demo accounts are also available, although one would need some prior knowledge in order to use one. Trading tools are limited to Forex calculators and VPS options.

Demo Account

Traders are allowed to operate up to five demo accounts at once through this broker and demo accounts do not have expiration dates; however, if one does not login to their demo account for 90 days, the system will close the account. We highly recommend opening a demo account if you could use the practice since these accounts allow one to trade under the conditions of the broker, become acquainted with the trading platform, test out strategies, and more, all while using virtual currency. Demo accounts are an excellent practice tool because they carry no risks.

Customer Service

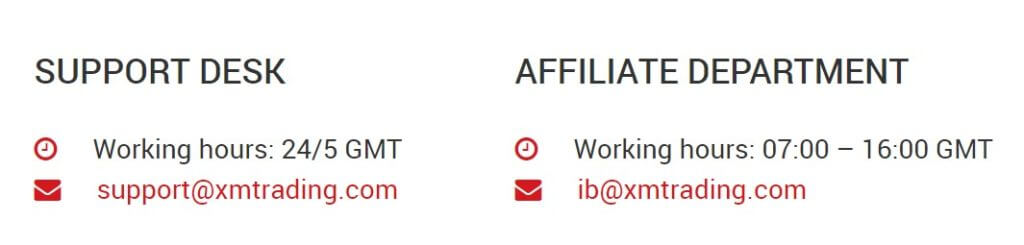

Support is available 24 hours a day, five days a week via LiveChat or email. It could also be worth taking a moment to check the website’s FAQ since many frequently asked questions about accounts and funding are answered there. We were a little disappointed that the company isn’t offering a direct phone number, so we decided to test out their LiveChat feature in order to see if the service was up to our standards. Fortunately, an agent responded right away, proving that the website is offering at least one instant contact option. The broker’s email and mailing address have been listed below.

Email: [email protected]

Address: F20, 1st Floor, Eden Plaza, Eden Island, Seychelles

Countries Accepted

At the bottom of their website, the broker quickly mentions that the website is not aimed towards residents of Japan. On the FAQ, the broker also mentions that US residents are no longer accepted, due to a recent act passed by the US Congress. We were determined to find out whether these restrictions are enforced, so we attempted to open an account from our US-based offices. Sadly, the broker was sure to exclude to the US and all similar options from the list, so there’s no way around that restriction. However, we did find Japan to be an option and found it to be possible to open an account from that location.

Conclusion

XMTRADING is an FX and CFD broker that offers high-leverage trading from three different account types on the MetaTrader 4 and 5 platforms. This broker is highly affordable and the most expensive account only requires a deposit of $100. Trading costs can be advantageous, with spreads starting from between 0 and 1 pips on all account types and commissions are only charged on Zero accounts.

On a negative note, the broker isn’t totally transparent about funding options and only offers a few options, although Visa/MasterCard is accepted. Fortunately, the broker covers all funding fees, aside from bank charges on withdrawals less than $200 USD. There are also opportunities to make extra money, including several ongoing bonuses and promotions.

Surprisingly, the website is a bit barren when it comes to educational resources, although demo accounts and a few educational videos are available. Customer support can be reached anytime during weekdays, but contact methods are limited to LiveChat or phone.