Double Million is a forex broker based in Saint Vincent and the Grenadines and was founded in 2011. It was formed with the goal to improve traders’ abilities and empower them to trade safely, professionally and with self-confidence. They aim to do this through advanced trading platforms and in-depth trading. We will be using this review to look into the services being offered so you can see what is on offer and decide whether they are the right broker for you.

Account Types

There are four different account son offer, each with their own requirements and trading conditions, so let’s look at what is on offer.

Mini Account:

This account needs a deposit of up to $2,500. It doe snot have robots enables and can be leveraged up to 1:200. There is an added commission on the trading and it does not have access to 24/5 support. It has access to half of the educational materials and does not have a dedicated account manager. It uses standard spreads and it does not have access to bonuses, indices or stocks.

Standard Account:

This account increases the required deposit and it is now up to $10,000. The account can not use robots and can be leveraged up to 1:300. There is an added commission to each lot traded and it has access to the 24/5 support system. The account has access to 75% of the educational material and has access to a dedicated account manager. It uses standard spreads and there is a bonus available up to 35%, it has access to indices but not stocks.

Gold Account:

The Gold requires a deposit that goes as high as $25,000. The account can use robots and can be leveraged up to 1:400. There is no added commission on this account and it has access to the 24.5 support team. It has full access to the educational material and has access to an account manager. The spreads are stated as low and there is a bonus of up to 50%, both stocks and indices are available to trade.

VIP Account:

This account requires a deposit of over $25,000. It can use robots and can be leveraged up to 1:400. There is no added commission on this account and it has access to the 24.5 support team. It has full access to the educational material and has access to an account manager. The spreads are stated as low and there is a bonus of up to 50%, both stocks and indices are available to trade.

Platforms

It is not clear to use exactly what platform is being used, we have outlined the three versions below to get an understand ing of the features.

Desktop Trader:

The desktop trader contains all relevant data that can be shown on one screen for convenience. Traders can execute one-click deals, limit orders and personalize according to preference. The desktop trader allows you to install your own Robot, with live direct quotes, advances and updated charts that are easy and friendly to use. You can also install with the trader almost any other technology or indicators that may help you’re trading. Some features include a one-click deal opening, full single screen function, Microsoft.Net technology, customized view, and advanced integrated charts.

Web Trader:

Web Trader is based on the desktop platform allowing you to use the same advanced features, charts, analytics, indicators, and tools. The web-based platform is ideal for traders who travel and need full accessibility anytime anywhere. Some feature includes over 200 tradable instruments, no download or installation required, standard browser access and, firewall access management.

Smart Phone Platform:

Stay connected at any time with the most accurate market rates at your fingertips with our new and innovative mobile platform. Some features include the ability to place trades quickly at any moment, constantly be able to monitor your positions, trade over 200 stocks, indices, currency pairs and commodities, complete access to balance sheets, equity and margin details, execution gestures such as Swipe to Close and, easy customizable easy layout for easy usage.

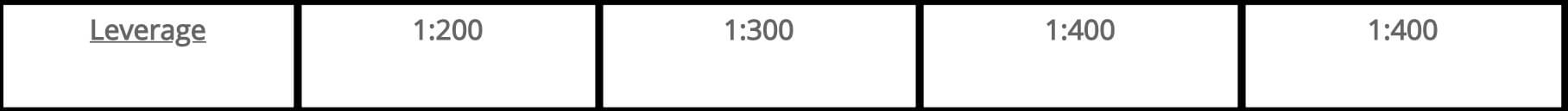

Leverage

The leverage that you can get depends on the account that you use, we have outlined them below for you.

- Mini Account: 1:200

- Standard Account: 1:300

- Gold Account: 1:400

- VIP Account: 1:400

The leverage you prefer can be selected when first opening up an account. We are not sure if you can change the leverage on an already open account, but you should contact the customer service team if you have such a request.

Trade Sizes

Trade sizes start from 0.01 lots and go up in increments of 0.01 lots. We are not sure about what the maximum trade size is or what the maximum number of open trades you can have at any one time is.

Trading Costs

The Mini and Standard accounts both have an added commission on their trading. Unfortunately, we do not know what this commission is as it is not mentioned anywhere, we know it exists, just not how much it is. The Gold and VIP accounts do not have any added commissions. Swap charges are present on all account types and these are charged for holding trades overnight. These can be viewed within the trading platform you are using.

Assets

Sadly, there is not a full breakdown of the available asset or instruments so we are not able to comment on this. It is a shame that they are not available s a lot of potential clients may look to see what is available as many people have a particular instrument that they like to trade. Not knowing if it is available could make them look for somewhere else that does have it.

Spreads

As there is no breakdown of assets, there is also no breakdown of spreads. The account page indicates standard and low spreads, but we do not really know what these mean. The spreads are, however, variable which means they move with the markets. The more volatile the market, the higher the spread swill be. Different instruments will also have different natural spreads so some will always be higher than others.

Minimum Deposit

The minimum deposit for the first deposit is $1,000. This would allow you to access the Mini account as this account can have a balance of up to $2,500. It is not known what the minimum deposit for any subsequent deposits is but it sounds like it will be reduced from the $1,000.

Deposit Methods & Costs

There doesn’t seem to be any information on deposit methods available on the site which is a big shame. It is vital for people to know how they can get their money into a broker and also how much it will cost them. This information needs to be added to the site.

Withdrawal Methods & Costs

Possibly more important than the deposit methods are the withdrawal methods. These are again not available, potential clients need to know how they can get their money back and out and if it will cost them to do so, not having this information makes it hard to build any trust with the broker.

Withdrawal Processing & Wait Time

As we do not know the withdrawal methods we also do not know the processing times for them. We would hope that any requests would be fully processed between 1 to 5 days from the request being made but we cannot say this for sure.

Bonuses & Promotions

The account comparison page indicates some bonuses of up to 50%. However, there is no relevant information about these bonuses so we do not know the terms. We can assume that they are a deposit bonus, but we do not know if they are convertible to real funds and if they are, how to do it.

Educational & Trading Tools

Just like the bonuses, there is mention of education and training on the account page, but nowhere else on the site. We assume it is accessible once you are fully signed up but this means that we are not able to comment on the usability or quality of the training available.

Customer Service

The contact us page is what you would expect of a Forex broker. There is an online submission form as well as a postal address, email address and phone number to choose your method of contact from.

The contact us page is what you would expect of a Forex broker. There is an online submission form as well as a postal address, email address and phone number to choose your method of contact from.

Address: Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown Saint Vincent

We are not sure about the opening times, but one of the perks of the upper-tier accounts is the use of a 24/5 customer service team. For people not with that account, the times may vary.

Demo Account

Demo accounts are available and it seems like you can have as many as you like. Without being fully signed in we cannot see the options available for the demo accounts such as which accounts they mimic. Demo accounts allow you to test out eh markets and trading strategies without risking any real capital.

Countries Accepted

This information is not available and so we cannot comment on it. If you are looking to sign up, we would suggest contacting the customer service team to see if you are eligible prior to creating an account.

Conclusion

There are plenty of options when it comes to accounts, but it is not fully clear what the differences between them are. Different bonus amounts, spreads, and commissions, all with no information on what any of them actually are. We have no idea what the trading costs are and even more worryingly, we have no idea how to deposit or withdraw and if it will cost us to do so. Not to mention the complete lack of information on available assets. With so much information missing, we cannot recommend Double Million as a broker to use at this point in time.

There are plenty of options when it comes to accounts, but it is not fully clear what the differences between them are. Different bonus amounts, spreads, and commissions, all with no information on what any of them actually are. We have no idea what the trading costs are and even more worryingly, we have no idea how to deposit or withdraw and if it will cost us to do so. Not to mention the complete lack of information on available assets. With so much information missing, we cannot recommend Double Million as a broker to use at this point in time.