Trade.Berry was founded with a vision to host the most transparent social trading community ever created. Founded in 2014, located in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySec). Trade Berry aims to provide a fully transparent platform and is their priority to build and maintain long term relationships with their traders by providing exceptional support and transparency of their platform. In this review, we will be looking into the services being offered to see what they really provide.

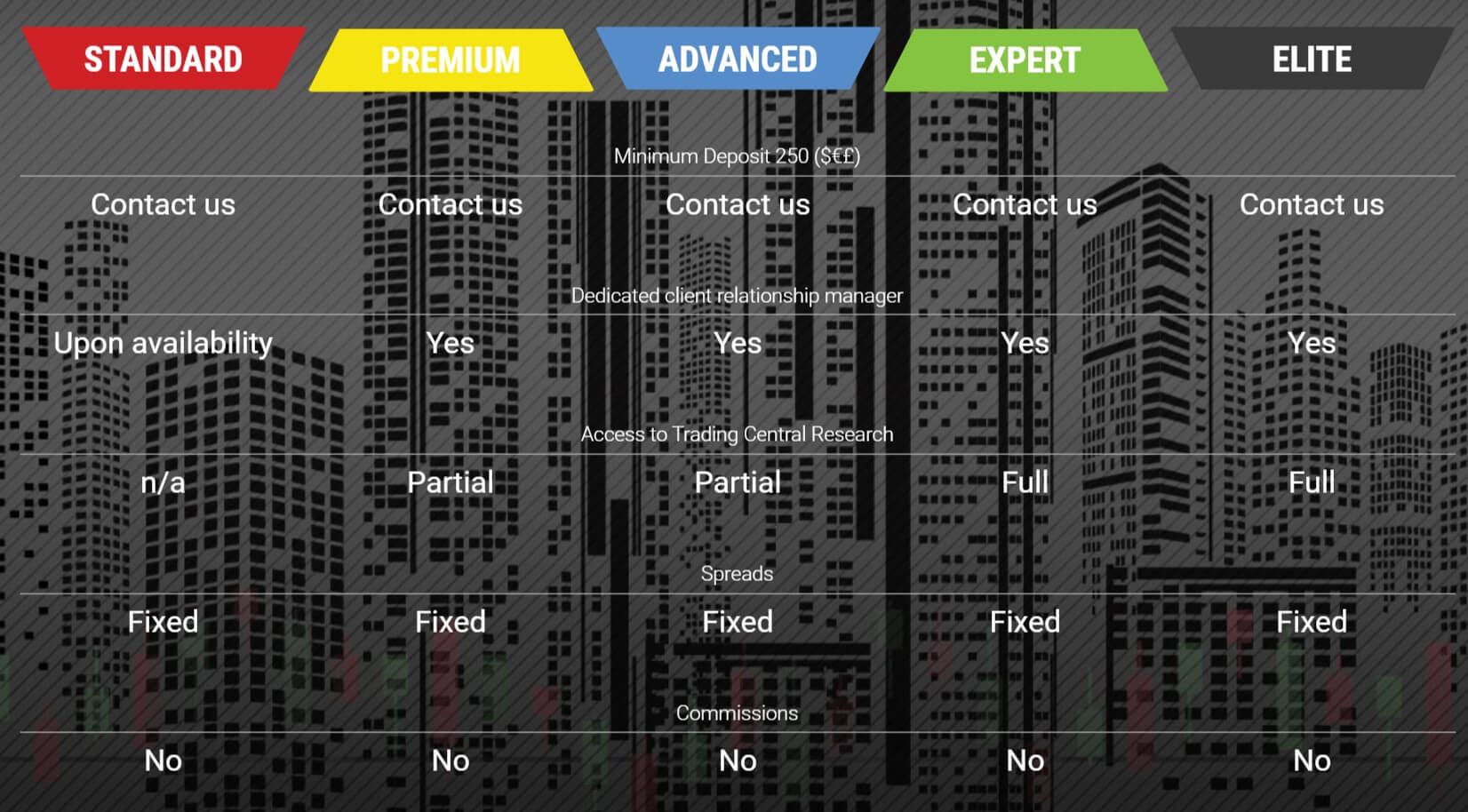

Account Types

There are 5 different accounts available to choose from when signing up, each with their own features and trading conditions, so let’s see what they are.

Standard Account:

The account requires a minimum deposit of at least $250, the account can be in EUr, USD, GBP or RON. It comes with a platform introduction and if available access to a dedicated client relationship manager. It has access to the daily market brief, no access to the trading central research and no added explanation of trading strategies. It has full access to the social sharing and community side of the broker and the minimum trade size is 0.01 lots, it has fixed spreads and no added commissions. In terms of instruments, it has Forex, Commodities, Indices, and Stocks available, leverage is 1:30 max (1:400 for professional traders) and it also comes with negative balance protection.

Premium Account:

The account requires a minimum deposit of at least $250, the account can be in EUr, USD, GBP or RON. It comes with a platform introduction and access to a dedicated client relationship manager. It has access to the daily market brief, partial access to the trading central research and if available an added explanation of trading strategies. It has full access to the social sharing and community side of the broker and the minimum trade size is 0.01 lots, it has fixed spreads and no added commissions. In terms of instruments, it has Forex, Commodities, Indices, Stocks and, Crypto available, leverage is 1:30 max (1:400 for professional traders) and it also comes with negative balance protection.

Advanced Account:

The account requires a minimum deposit of at least $250, the account can be in EUr, USD, GBP or RON. It comes with a platform introduction and access to a dedicated client relationship manager. It has access to the daily market brief, partial access to the trading central research and an added explanation of trading strategies. It has full access to the social sharing and community side of the broker and the minimum trade size is 0.01 lots, it has fixed spreads and no added commissions. In terms of instruments, it has Forex, Commodities, Indices, Stocks and, Crypto available, leverage is 1:30 max (1:400 for professional traders) and it also comes with negative balance protection.

Expert Account:

The account requires a minimum deposit of at least $250, the account can be in EUr, USD, GBP or RON. It comes with a platform introduction and access to a dedicated client relationship manager. It has access to the daily market brief, full access to the trading central research and an added explanation of trading strategies. It has full access to the social sharing and community side of the broker and the minimum trade size is 0.01 lots, it has fixed spreads and no added commissions. In terms of instruments, it has Forex, Commodities, Indices, Stocks and, Crypto available, leverage is 1:30 max (1:400 for professional traders) and it also comes with negative balance protection.

Elite Account:

The account requires a minimum deposit of at least $250, the account can be in EUr, USD, GBP or RON. It comes with a platform introduction and access to a dedicated client relationship manager. It has access to the daily market brief, full access to the trading central research and an added explanation of trading strategies. It has full access to the social sharing and community side of the broker and the minimum trade size is 0.01 lots, it has fixed spreads and no added commissions. In terms of instruments, it has Forex, Commodities, Indices, Stocks and, Crypto available, leverage is 1:30 max (1:400 for professional traders) and it also comes with negative balance protection.

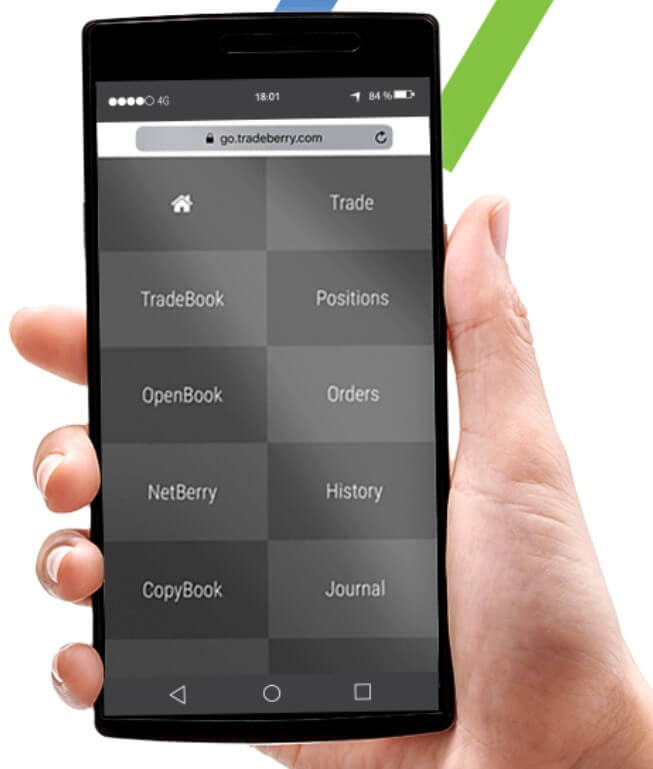

Platforms

TradeBerry uses its own trading platform that they have developed themselves. Trade.Berry’s vision is to host the most transparent social trading community ever created. That is why they joined forces with TOOMIT to create an ultra-fast platform offering the transparency they want for their community of traders. Features include execution in milliseconds, no dealing desk intervention, no delays, fast trading option, instantly tradable quotes, high liquidity, no requotes, copy trading, auto-translate chat, see analysis posted by other traders, create a blog and build your audience, provide feedback to your trader network, share your analysis, TradingView intuitive charts, variety of indicators, compare multiple instruments and position/order display.

TradeBerry uses its own trading platform that they have developed themselves. Trade.Berry’s vision is to host the most transparent social trading community ever created. That is why they joined forces with TOOMIT to create an ultra-fast platform offering the transparency they want for their community of traders. Features include execution in milliseconds, no dealing desk intervention, no delays, fast trading option, instantly tradable quotes, high liquidity, no requotes, copy trading, auto-translate chat, see analysis posted by other traders, create a blog and build your audience, provide feedback to your trader network, share your analysis, TradingView intuitive charts, variety of indicators, compare multiple instruments and position/order display.

Leverage

Trade.Berry follows the recommendations and guidelines from ESMA. Below are the levels that one can expect as a retail trader. Note that limits on the opening of a position by a retail client from 30:1 to 2:1, which vary according to the volatility of the underlying.

- 30:1 for major currency pairs

- 20:1 for non-major currency pairs, gold, and major indices

- 10:1 for commodities other than gold and non-major equity indices

- 5:1 for individual equities and other reference values

- 2:1 for cryptocurrencies

If you are considered a professional trader which means having a net worth over $500,000 and having made considerably large trades in the past year then you are eligible to have the leverage raised up to 1:400.

Trade Sizes

Trade sizes for all accounts start from 0.01 lots which are also known as micro-lots. They then go up in increments of 0.01 lots. We are not clear on the maximum trade sizes. However, whatever it is we would recommend not trading in sizes larger than 50 lots, as the bigger a trade becomes the harder it is for the markets or liquidity provider to execute the trade quickly and without any slippage.

Trading Costs

There is no added commission on any of the accounts as they all use a spread based system. There are swap charges to think about though. These are interest charges that are incurred for holding trades overnight, and they can be both negative or positive and can usually be viewed from within the trading platform of choice.

Assets

Trade.Berry has broken down its assets into 5 different categories, each with different instruments within them. They haven’t broken down their assets into each one so we will just give a little overview.

Trade.Berry has broken down its assets into 5 different categories, each with different instruments within them. They haven’t broken down their assets into each one so we will just give a little overview.

Forex:

The most accessible assets for trading fall under the FOREX category mainly due to the high liquidity and availability of a 24/5 market. This translates into the availability of prices for the traders. Trade more than 30 currency pairs to trade on.

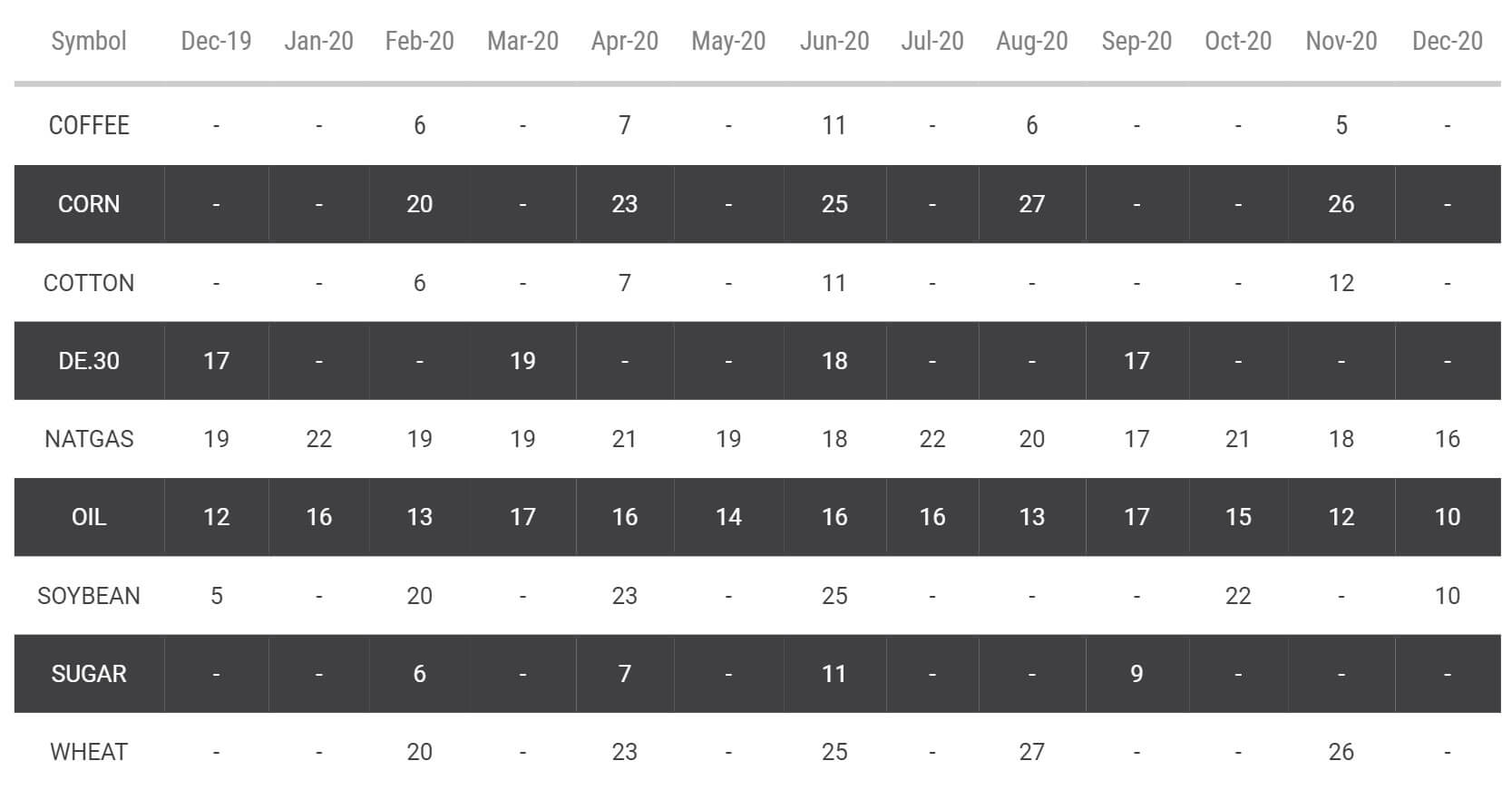

Commodities:

At TradeBerry, clients can trade CFDs on a variety of commodities from soft commodities such as coffee and sugar, precious metals such as gold and silver, and Energy commodities such as Crude Oil and Natural Gas. The price of commodities is usually moved by market supply and demand.

Indices:

A stock index is a measurement (average) of the price performance of a specific group of shares. Examples include the FTSE 100 that represents the 100 largest stocks trading on the London Stock Exchange and the NASDAQ that represents the largest stocks for technology in the US. Clients can trade CFDs on futures relating to various indices.

Stocks:

Clients are able to trade on stocks in the form of CFDs. Trading Contracts for Difference (CFD) means that traders can take advantage of price movements on their preferred stocks without the hassle or costs of ownership.

Crypto:

Unfortunately, the page for Cryptos is not working at the moment so we are unable to see any examples of what sorts of cryptocurrencies are available to trade.

Spreads

There are a few examples of spreads available on the site. There is also a little confusion, on the accounts page it states that all the account shave fixed spreads. However, when looking at the product specification, they all say variable, so we are not sure which one it is. EUR/USD seems to have a spread of 1.2 pips, other instruments will naturally have a different spread and if we look at EURGBP it has a starting spread of 1.8 pips. If the spreads are variable, it means they will move with the markets. While if they are fixed it means they will remain the same no matter what happens in the market.

There are a few examples of spreads available on the site. There is also a little confusion, on the accounts page it states that all the account shave fixed spreads. However, when looking at the product specification, they all say variable, so we are not sure which one it is. EUR/USD seems to have a spread of 1.2 pips, other instruments will naturally have a different spread and if we look at EURGBP it has a starting spread of 1.8 pips. If the spreads are variable, it means they will move with the markets. While if they are fixed it means they will remain the same no matter what happens in the market.

Minimum Deposit

The minimum deposit amount is $250. This will seemingly get you to access all the accounts which is a little strange to us as no one would sign up to the lower accounts, so we believe the figures may be wrong.

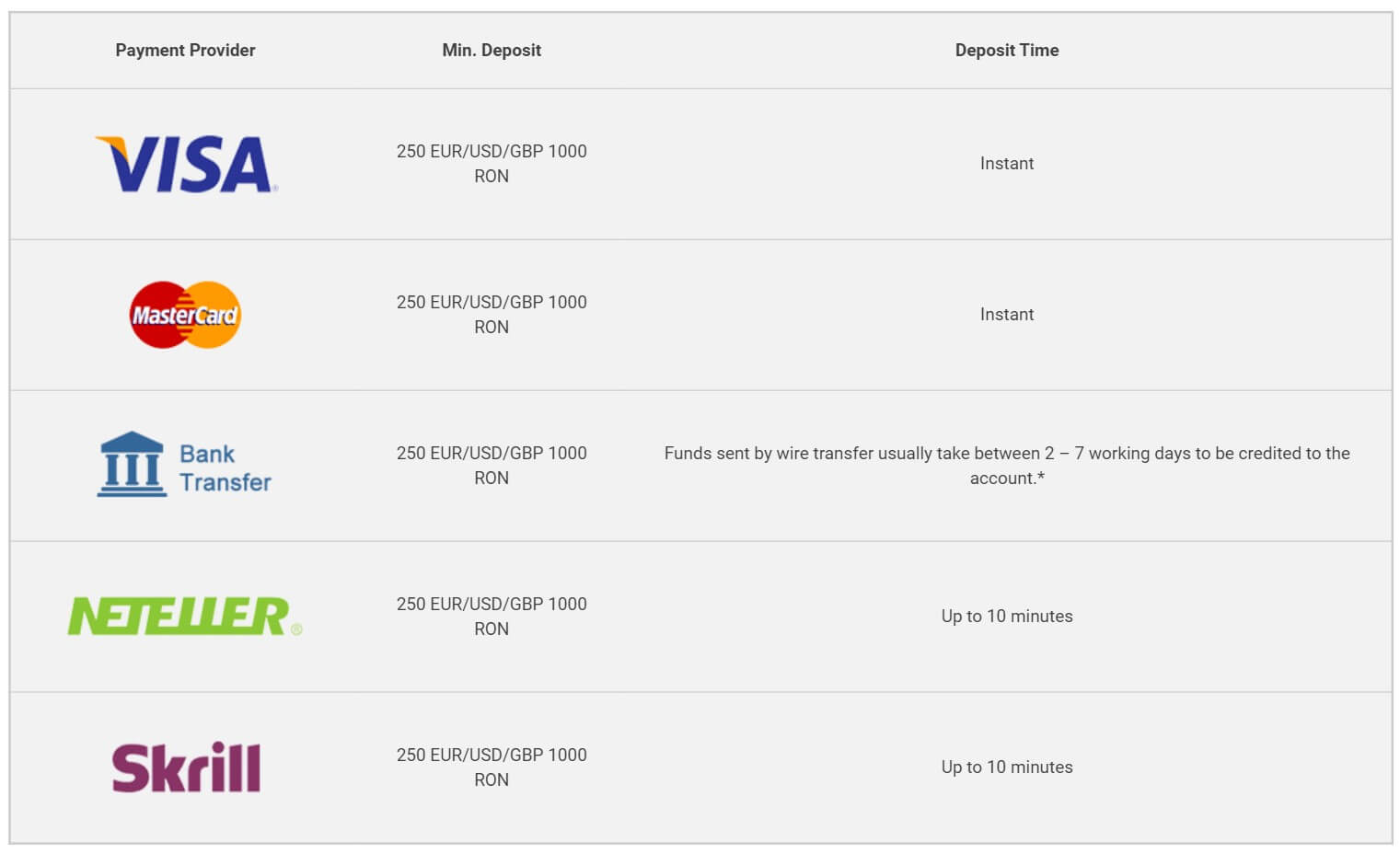

Deposit Methods & Costs

There are a few different available deposit methods, these are Visa Credit / Debit, MasterCard Credit/Debit, Bank Wire Transfer, Neteller and, Skrill. There are no added fees from Trade Berry. However, you should check with your bank or card issuer to see if they add any transfer fees of their own.

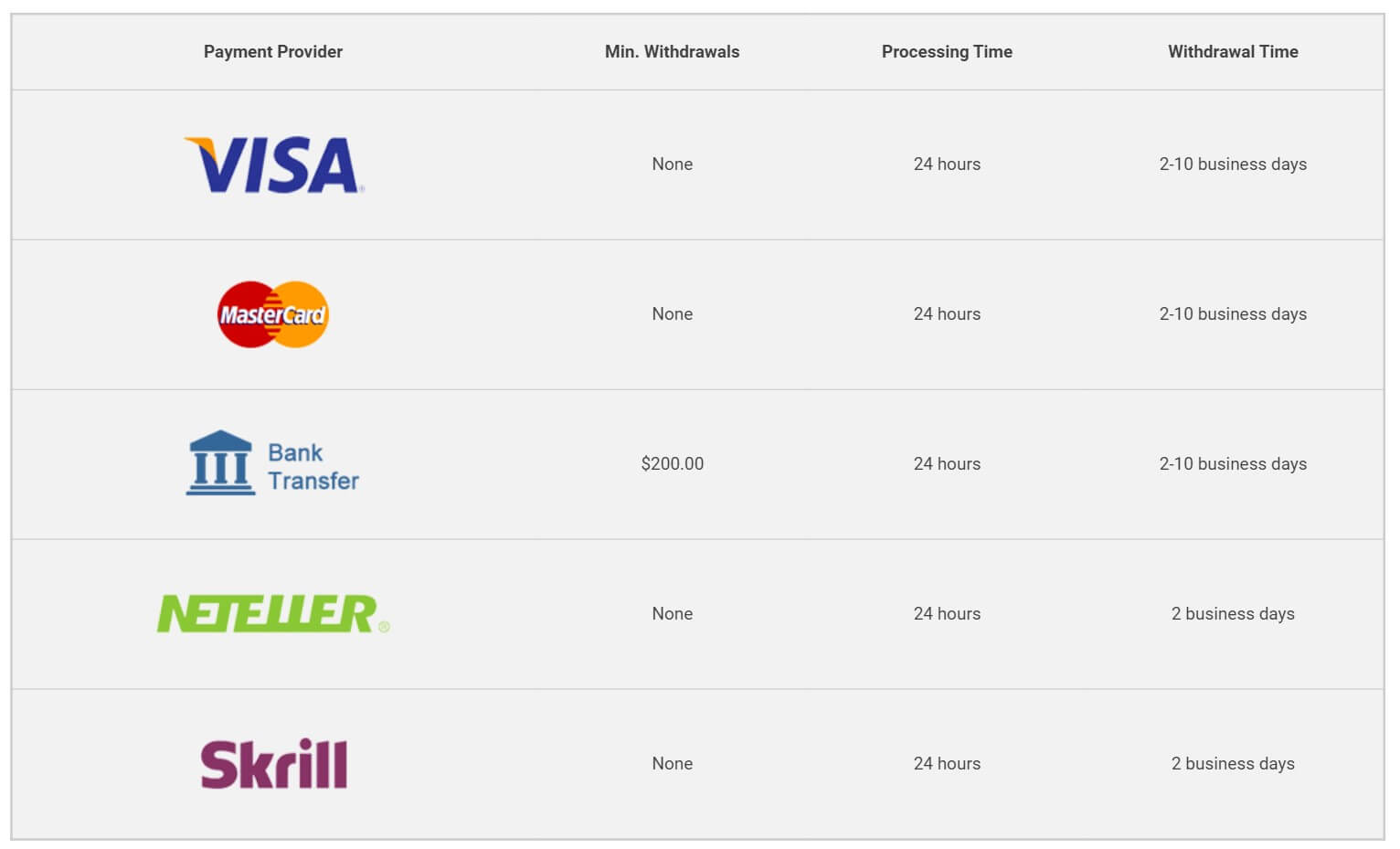

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification these are Visa Credit/Debit, MasterCard Credit / Debit, Bank Wire Transfer, Neteller and, Skrill. Just like with deposits there are no added fees but be sure to check with your own bank and card issuers to see if there are any added charges from them.

Withdrawal Processing & Wait Time

Withdrawal request processing will take up to 24 hours. Once this is complete Visa, MasterCard, and Bank Transfers will take between 2 to 10 business days to clear while Neteller and Skrill can take up to 2 business days.

Bonuses & Promotions

We could not locate any information on the website in regards to bonuses or promotions so it does not appear that there are any active ones at the time of writing this review. If you are interested in bonuses then be sure to check back regularly or get in contact with the customer service team to see if there are any upcoming bonuses or promotions.

Educational & Trading Tools

The education side of the site has a few different features, there is a video section which has over 50 different video tutorials covering various subjects such as trade different strategies, or how to analyze certain patters. The E-book section has an E-book to download titles “Basics of CFD Forex Trading”. There is also a trading calculator to help you work out the profit of a trade. The economic calendar outlines different upcoming news events and also shows which currencies they may affect. Finally, there is a Trade.Berry chat. This feature allows one to communicate with others and request help with analysis and trading.

Customer Service

The customer service team is available 24 hours a day 5 days a week and is closed at the same time as the markets over the weekend. In order to talk to the customer care team, you can use a few different phone numbers, once for the UK, one for Romania and one for Cyprus. You can also use the available email should you wish to communicate that way.

- United Kingdom: (+44) 203 150 0229

- Romania: (+40) 312 295 634

- Cyprus: (+357) 25 262020

- Email: [email protected]

You can also get in touch with Corporate should you need to using telephone, fax or email, there is also a physical address available.

Christophides House Office 201, 28 Ayias Zonis Street, Limassol 3027, Cyprus

Tel: (+357) 25 262020

Fax: (+357) 25 331522

Email: [email protected]

Demo Account

Demo accounts are available, and you need to sign up for an account to access it. As all trading conditions seem to be the same for all accounts you can use the information we have provided above to work out the trading conditions of the demo account. There is no indication of an expiration time on the accounts so hopefully, they work indefinitely. Demo accounts allow potential new clients to test out the service being offered and allows existing traders to try new strategies without risking their own capital.

Countries Accepted

The information about which countries are accepted and which are not is not present on the website. If you are interested in joining, be sure to get in contact with the customer service team to check if you are eligible for an account or not.

Conclusion

Trade.Berry confused us a little with their accounts, as they all seem to have the same entry requirements and the same trading conditions The only differences are a few educational tools, but with the entry requirement being the same, everyone will just go for the Elite account. The spreads are average. For non-commission accounts, they are in line with the rest of the industry. There are a few different ways to deposit and withdraw and each having no additional fees is a big plus. The full break down of assets and instruments is a little overwhelming as it is all on a single page rather than broken down into categories. Overall, there seems to be plenty to trade at Trade Berry and the broker seems poised to meet the needs of a wide variety of Forex traders.

Trade.Berry confused us a little with their accounts, as they all seem to have the same entry requirements and the same trading conditions The only differences are a few educational tools, but with the entry requirement being the same, everyone will just go for the Elite account. The spreads are average. For non-commission accounts, they are in line with the rest of the industry. There are a few different ways to deposit and withdraw and each having no additional fees is a big plus. The full break down of assets and instruments is a little overwhelming as it is all on a single page rather than broken down into categories. Overall, there seems to be plenty to trade at Trade Berry and the broker seems poised to meet the needs of a wide variety of Forex traders.