GMT Markets is a forex broker based out of Melbourne, Australia. GMT Markets want to be your number 1 choice for online forex and CFD trading. Regulated by the Australian Securities and Investments Commission offering competitive trading environments and modern technology, that is what is being claimed, so let’s take a little look to see what is really on offer.

Account Types

GMT Markets try to keep things simple for their clients with just the single account type. This account has a minimum deposit of $500 and a minimum trade size of 0.01 lots (micro lot). Spreads are fixed, meaning that they always remain the same, they vary by currency but start at 1.5 pips. Leverage on this account has a top of 1:200. Base currencies can be in either USD or AUD.

Platforms

Just one trading platform is on offer from GMT Markets and that is MetaTrader 4 (MT4) while having just one platform available can seem to limit, the fact that it is MetaTrader 4 gives us some comfort. MT4 is a hugely popular trading platform and has a whole host of features to help with your analysis and trading. It has high levels of customizability and is compatible with hundreds and thousands of indicators, expert advisers and signals. It is also accessible in a number of ways such as a desktop download, app for iOS and Android devices and as a WebTrader to use within your internet browser, this helps ensure that wherever you are you have access to the markets.

Leverage

Leverage

Leverage can be chosen by the client when opening up an account, the current maximum leverage is 1:200 but alternatives are available in increments to chose from.

Trade Sizes

Trade sizes start at 0.01 lots which are also known as micro-lots. The maximum trade size is not mentioned but these normally sit between 50 lots and 100 lots which is more than enough for the majority of retail clients.

Trading Costs

We do not believe that there are any commissions charged on trades with GMT Markets, instead, they use a spread based system, this means that he spreads are slightly higher and that is where the broker makes its money. As spreads are starting at 1.5 this is not a major issue. Swaps are also charged for holding trades overnight, these figures can be seen from within the MT4 platform directly.

Assets

Assets

GMT Markets offers a number of different instruments to trade with including forex pairs, CFDs, commodities, metals, energies and Cryptocurrencies. We could only find info that there are 32 forex currency pairs, we could not get many details into the specifics of things such as the cryptocurrencies, however, it is good to know that they are available.

Spreads

GMT Markets uses a fixed spread system, this means that they do not change with the markets. Spreads start at 1.5 pips for pairs such as EUR/USD however rise depending on the pair being traded, some can be seen as high as 5 pips or 7 pips.

Minimum Deposit

The minimum deposit needed to open an account is $500 AUD. After the initial deposit, there is no further limit so any amounts can be used to top up your account.

Deposit Methods & Costs

The following methods are available to deposit with Visa / Mastercard, Bank Wire Transfer, Bpay and Poli. There are no added fees for deposits, however, please check with your bank if using bank transfers in case they charge any fees themselves. GMT Markets do not accept third party deposits so all deposits must come from accounts in your own name.

It would have been nice to see some additional e-wallets such as Skrill and Neteller. There is also no option to deposit via cryptocurrencies which are fast becoming a popular way of transferring money.

Withdrawal Methods & Costs

The same methods are available to withdraw with, we are unable to tell if there are any fees added, but for Bank Wire transfers you must check with your bank to see if any fees will be charged by them. GMT Markets do not accept third party withdrawals so all withdrawals must come to accounts in your own name.

Withdrawal Processing & Wait Time

GMT Markets aim to process all withdrawals within 48 business hours. Local transfers will normally take around 1 – 2 business days while international transfers will take between 3 – 5 business days.

Bonuses & Promotions

We could not locate any information on the website in regards to any promotions and bonuses so we do not believe that there are any active at the moment, this does not mean that there won’t be any in the future though,

Educational & Trading Tools

There are a few resources available for clients to use, these include daily market analysis, an economic calendar, news feed, exclusive articles and then there are also online webinars and free seminars to attend. These are aimed at getting you the basics rather than becoming an expert.

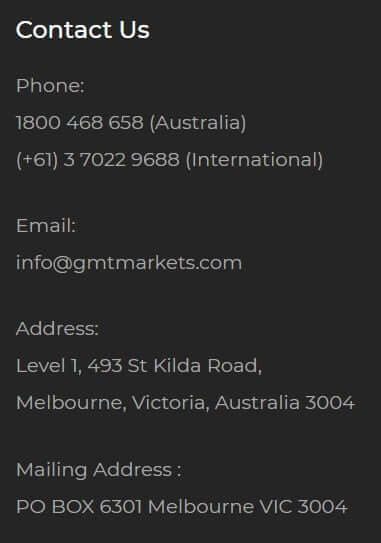

Customer Service

Should you wish to get in contact with GMT Markets with a question or help request, you can do it in a number of different ways. You can use the online web form to submit your query and can expect a reply back via email. There is also a physical address as well as a PO box should you wish to send a lett, also a direct email address and phone number for a more personal experience.

Should you wish to get in contact with GMT Markets with a question or help request, you can do it in a number of different ways. You can use the online web form to submit your query and can expect a reply back via email. There is also a physical address as well as a PO box should you wish to send a lett, also a direct email address and phone number for a more personal experience.

We tried contacting the customer service team and got a response back after about 29 hours which is not too long, the customer service department claims to be open 24 hours a day 5 days a week and only closes when the markets are closed.

Demo Account

Demo accounts are available on request, simply sign up and select a demo account. The demo accounts last as long as you need them, however, if left dormant for too long they will be closed to help free up server space if this happens a new one can then be opened.

Countries Accepted

All information and services are aimed at residents of Australia, if you are from any other country then you may struggle to open an account.

Conclusion

GMT Markets are clearly aiming at an all Australian client base, they make things simple by having one account type and one trading platform. It can be a little struggle to find some of the required information on their site though. Customer services responded to the query in an acceptable timeframe, it would have been nice to of had more information regarding depositing and withdrawing and to have more methods to do so. If you are from Australia, there are seemingly better brokers out there, but if you chose to go with GMT Markets, you should be ok.

We hope you like this GMT Markets review. If you did, be sure to check out some more reviews to help find the broker that is right for you.