FXC Markets is a forex broker based in Bulgaria and offers its clients a variety of products and analyses to help better their trading. They don’t provide too much information about themselves which can be a little concerning but this review is intended to delve deep into the services being offered to help you decide if they are the right broker for you.

Account Types

There are three different accounts on offer from FXC Markets and they are names the Silver, Gold, and Platinum accounts, we will take a little look to see what they offer.

Silver Account: The Silver account is the entry-level account from FXC Markets, it requires a minimum deposit of $1,000 which is reasonable and you can have a choice of either fixed or variable spreads. The account is eligible for a 30% deposit bonus and has flexible leverage. It is also eligible for a free VPN which we will look at later in this review.

Gold Account: The gold account ups the minimum deposit requirement to $2,500. It also has a choice of fixed or variable spreads and is also eligible for the 30% deposit bonus. This account has flexible leverage up to 1:400 and has access to a VPN at minimum charges.

Platinum Account: The platinum account is the premier account from FXC Markets and has a minimum deposit requirement of $25,000. The choice of fixed or flexible spreads remains but it now also states “Attractive Spreads” which we will look at in more detail later in this review. There are trader rebates available along with eligibility for a 50% bonus.

Platforms

Just the single platform available on FXC Markets and that is the ever-popular MetaTrader 4.

MetaTrader 4 (MT4) is one of the world’s most popular trading platforms and for good reason. Released in 2005 by MetaQuotes Software, it has been around a while, it is stable customizable and full of features to help with your trading and analysis. MT4 is compatible with hundreds and thousands of different indicators, expert advisors, signal providers and more. Millions of people use MT4 for its interactive charts, multiple timeframes, one-click trading, trade copying and more. In terms of accessibility, MT4 is second to none, available as a desktop download, an app for Android and iOS devices and as a WebTrader where you can trade from within your internet browser. MetaTrader 4 is a great trading solution to have.

Leverage

We can see from the accounts page that the maximum leverage available is 1:400 which is a reasonable amount as it can provide a lot of profit potential while not allowing you to risk too much. Leverage can be selected when opening up an account and can be changed on an active account as long as there are no open trades.

It is important to note that not all instruments will have the same leverage as forex pairs often have higher available liability to commodities and metals.

Trade Sizes

Trade sizes start at 0.01 lots which are also known as micro-lots, we did not locate the information regarding the maximum trade size however whatever it is we do not recommend using trade sizes larger than 50 lots and it can become increasingly harder for liquidity providers and the market to execute larger trades quickly and without slippage.

While 0.01 lots may be the minimum trade size for forex currency pairs, other assets may have higher minimum trades such as 0.1 lots.

Trading Costs

There was not any information on the website in regards to any trading costs in the form of commissions, there are of course spreads which we will look at in a later section of this review.

There are also swap fees that are charged for holding trades overnight,m these can be either negative or positive and can be viewed from within the MetaTrader 4 trading platform.

Assets

It appears that there is plenty when it comes to tradable assets and instruments. There are over 65 different forex pairs that contain forex majors, forex minors and exotic pairs and include the likes of EUR/USD, CAD/CHF and EUR/SEK. Indices also make an appearance with the likes of the NASDAQ 100, FTSE 100 and S&P 500 being available to trade. If you are a precious metals trader, there are only two on offer which is the standard Gold and Silver so it would have been nice to see more such as Platinum (having looked at the commodities section, it does appear that a lot of other metals including Platinum are in fact available). You can also trade Oils and commodities, there are lots of them available with things like Brent Crude, Cocoa and Soy Beans being available. Finally, there are stocks and indexes.

With so many assets being available it would have been nice to see some cryptocurrencies there to trade as they are quickly becoming a major part of many new and experienced traders’ portfolios.

Spreads

The accounts page mentions spreads both fixed and variable as well as great value, however, there is no mention of what the spreads actually are. In terms of variable and fixed, variable spreads are spreads that move with the markets and can get bigger and smaller depending on the volatility. Fixed spreads are exactly that, they will remain the same no matter what is happening in the markets.

Minimum Deposit

The minimum deposit in order to open ana account if $1,000, this will get you a silver account. Normally once an account has been opened then the minimum deposit to top up the account is reduced however there isn’t any information on the site regarding a reduced deposit limit so we are unsure if this occurs with FXC Markets however as the minimum deposit is $1,000 we would assume that it does.

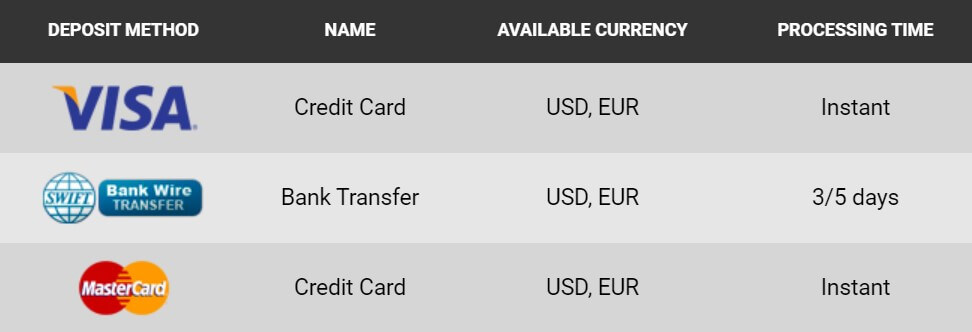

Deposit Methods & Costs

The only deposit methods mentioned on the site are credit and debit cards (Visa and MasterCard) and also bank wire transfers. Both methods allow you to deposit in both USD and EUR. There is no information regarding any added fees, but be sure to check with your own bank to see if they will add any transaction fees of their own.

The website does show an image of UnionPay but there is no mention of that in the deposit and withdrawals page so we are not sure if UnionPay is actually accepted.

Withdrawal Methods & Costs

You are able to withdraw using the same methods that you did to deposit, you must withdraw the initial deposit amount using the same method until the deposit level is balanced or negative. Once again there is no mention of any added fees so hopefully this means that FXC Markets do not add any to their withdrawals, similarly to deposits though, be sure to contact your bank to ensure they do not add any fees of their own.

Withdrawal Processing & Wait Time

FXC Markets state that they will execute a withdrawal request within 2 – 3 business days which is quite long to be processed when compared to other brokers. They also state that if withdrawing using your card, it will take up to 5 business days to receive your funds and with bank transfer, it will take between 3 to 5 days to receive your funds.

Bonuses & Promotions

The accounts page mentions the deposit bonuses however there is no mention of it on the website, we had to dive deep into the terms and conditions to find anything about it. It is not specific to any bonus but gives some general terms to any promotions. In order to convert any bonus funds into real funds, you must turnover the combined bonus and deposit amount. This makes the bonus very hard to withdraw and really not very good terms.

This is the only real information on any bonuses and there are no terms specific to any current and active promotions.

Educational & Trading Tools

There are quite a few different sections under education however the way that FXC Markets have set up their website makes it appear that there is a lot more than there actually is. There is an economic calendar that lets you know of any upcoming news events and what effect they may have on the markets you are trading. There are also some video tutorials, however, we waited for a while for the page to load but nothing did, there was just a loading symbol in the middle of the screen so we can not comment on how good the videos are or what they are based on.

Market signals are also offered but there was just some basic information on them and we could get an example of how they are. Finally, there is some fundamental and technical analysis, we wouldn’t actually see any of it so we assume you get it once you sign up, the pages we got were just some information on what fundamental and technical analysis is, we hope that this is not all the information that there is.

There is nothing here that you can’t find elsewhere on the internet in more detail.

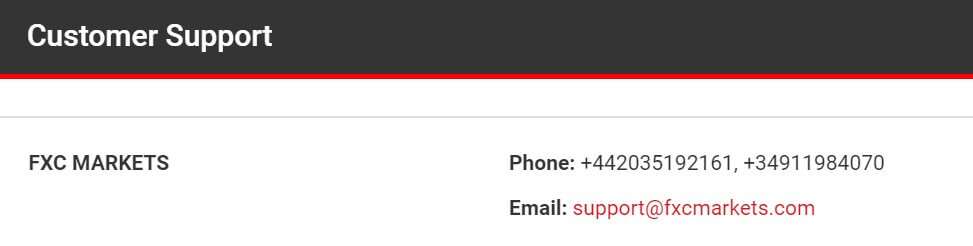

Customer Service

The contact page is pretty basic, it offers an online submission form where you can input your query and you should get a reply via email. There are also2 phone numbers available and a support email address. At this time we did not manage to test out the customer service team so we can not comment on how good and effective they were. There also want any obvious information on the opening times and if they are 24 hours or open over the weekend when the markets are closed.

Demo Account

Demo accounts or practice accounts as they are called on FXC Markets are available, there isn’t too much information regarding their conditions or features but simply state that they have unlimited practice sessions and that you can practice on an actual trading platform. It would have been nice to have information on how long the accounts last or which accounts the demo accounts are mimicking as the main accounts will differ from each other.

Countries Accepted

The following message is present on the FXC Markets website: “This information is intended for investors outside the United States who are not the US/Japanese citizens and residents. This website is intended for informational purposes only. This website is not directed at any jurisdiction and is not intended for any use that would be contrary to local law or regulation. The products described on this are not offered and may not be sold in the United States/Japan or to US/Japanese citizens and residents.”

If you are unsure whether you are eligible for an account or not, be sure to get in contact with the customer service team to find out.

Conclusion

There isn’t enough information available on the website for us to be able to fully recommend them, information such as spreads, commissions and more information on deposits and withdrawals is vital for potential clients and it is a shame that there is so little information on them, this alone can put off a lot of clients. While there are plenty of assets and instruments available to trade, there isn’t enough to get over the shortcomings.

We hope you like this FXC review. If you did, be sure to check out some of the other reviews on the site to help find the broker that is right for you.