With blockchain technology taking space in all manner of industries, we will inevitably talk about blockchain application in one of the most crucial sectors – healthcare. If there ever was an industry that could benefit from blockchain’s immutability, transparency, and centralization, it is healthcare.

However, currently, there is not much to write home about – as far as healthcare and blockchain are concerned.

In this guide, we are going to take a look at the ways in which blockchain would disrupt the healthcare space. We’ll also look at what the situation is like right now, as well as projections for the future.

Healthcare and Innovation

To put it mildly, the healthcare industry has been slow with innovation. That may sound controversial – given the incredible advancements in healthcare and medicine over the years. But when you look at different industries, the healthcare ecosystem still seems to be operating the same way it did years ago.

So what do we mean by saying innovation has been slow in this sector?

When it comes to vertical innovation, there’s no arguing that the space has done excellently well. But the same cannot be said about horizontal innovation.

Let’s demystify this below.

Vertical Innovation vs. Horizontal Innovation

Vertical innovation refers to industry-specific innovation, while horizontal innovation means innovation that can be adopted by any industry.

When we think of advances in diagnoses and treatment of different conditions, it is very clear the healthcare industry has done so well in vertical innovation, but it sorely lacks in horizontal innovation.

Things like APIs and cloud computing are examples of horizontal innovation that any multiple fields can adopt to make their processes more efficient. The healthcare industry isn’t big on that – considering most hospitals still employ files and papers to document information.

Blockchain as a Horizontal Innovation

A blockchain is a distributed ledger that is managed by multiple computers and with no single authority overseeing its transactions. It has blocks of data linked to each other through state-of-the-art encryption, and any information entered in it cannot be deleted by anyone. Blockchain has become such as an important technology due to these reasons:

- It is decentralized – no single authority or entity calls the shots

- Data is cryptographically secured

- No one can delete the information after it goes on the blockchain

- It is completely transparent, meaning anyone in the network can confirm information whenever they want to.

Public and Private Blockchains

There are two main types of blockchains: public and private blockchains. Both types of blockchains provide a peer-to-peer, decentralized, and immutable ecosystem.

Now, on public blockchains, everyone who has access can participate in the network. Public blockchains also have storage and scalability issues that impede them from storing large volumes of data or cause them to have high latency – e.g., Bitcoin has a latency of 10 minutes. This latency is potentially life-threatening in the context of healthcare.

Also, public blockchains require immense energy to solve computational puzzles. It is inconceivable that healthcare institutions would spend huge sums of money to foot such massive power bills. Also, public blockchains, by virtue of being public are open, are accessible to anyone. This is obviously a no-no in healthcare since sensitive patient data is involved.

As you can see, public blockchains are impractical for application in healthcare.

Enter private blockchains, which have the following features:

- Fast transactions

- Privacy of patient healthcare records

- Tight security

Courtesy of these features, private blockchains are more fit – and practical, for the healthcare industry.

What Can Blockchain Do For the Healthcare Space?

1. A New Catalyst for Interoperability in Healthcare

The importance of interoperability in healthcare cannot be overstated. It could, for instance, solve the problem of mismatched patience Electronic Health Records, which has led to detrimental mistakes on patient care in the past.

With blockchain, healthcare personnel will be able to benefit from secure access to electronic healthcare record information sans the time-consuming involvement of intermediaries.

2. Cost-effective and Seamless Exchange and Access of Information

Blockchain would support the near real-time processing of requests, as well as enable the faster and more secure exchange of patient health records between and among concerned parties. It would also reduce overhead costs and, in the process, provide an economic incentive for healthcare organizations.

3. Smart contracts

The current healthcare system is riddled with bureaucracy and third-party intermediaries that contribute to expensive costs. Transactions are also fraught with inconsistency and manipulation. Blockchain-based smart contracts would solve this by removing costly intermediaries, as well as inconsistent rules which reduce trust. By providing immutable, transparent records, smart contracts would inject much-needed transparency in the healthcare ecosystem.

Other Advantages of the Healthcare Blockchain

Apart from these use cases, there are other advantages the healthcare ecosystem could obtain from integrating blockchain.

i) Thanks to the immutability of blockchain records, patients can give access to their health records to healthcare personnel without the fear of it being altered or tampered with. The integrity of patient records will remain intact, no matter how many people get access to it.

ii) Medical records added on the blockchain will remain completely secure

iii) Patients have control over who gets access to their medical data. Any party who wishes to get access to the data has to ask permission from the patient.

iv) The blockchain can be used creatively to incentivize patients to stay healthy, to follow a certain healthcare plan, or to participate in healthcare research. They can be rewarded with tokens if they do so.

v) Blockchain can help pharmacy companies track drugs from the point of origin. This would help stamp out the common stealing of drugs from the supply chain that is done so as to be sold to illegal consumers. It would also eliminate fraud, such as falsified medication.

vi) A blockchain could help various medical research institutes around the world to consolidate their research in one place for easier management and reference.

vii) Blockchain could help stamp out insurance fraud that is so prevalent in the healthcare industry. This happens when patients and unscrupulous providers provide falsified claims to receive payable benefits.

Challenges and Considerations

For blockchain to be integrated fully in blockchain, it needs to support the following:

- A ubiquitous and secure infrastructure

- A verifiable and authentic identity database for participants

- Consistent and reliable authorization of access to health information

However, the current blockchain set up cannot adequately support these requirements because of limitations in security, privacy, storage, speed, and interoperability.

Blockchain presents numerous opportunities for healthcare, but it simply hasn’t yet reached the desirable scale in which it can be applied. For this reason, several technical challenges need to be first addressed before we can harness blockchain for the benefit of healthcare.

The Future

While the healthcare industry is far from adopting blockchain full-scale, it looks like the signs are pointing a future where that will be.

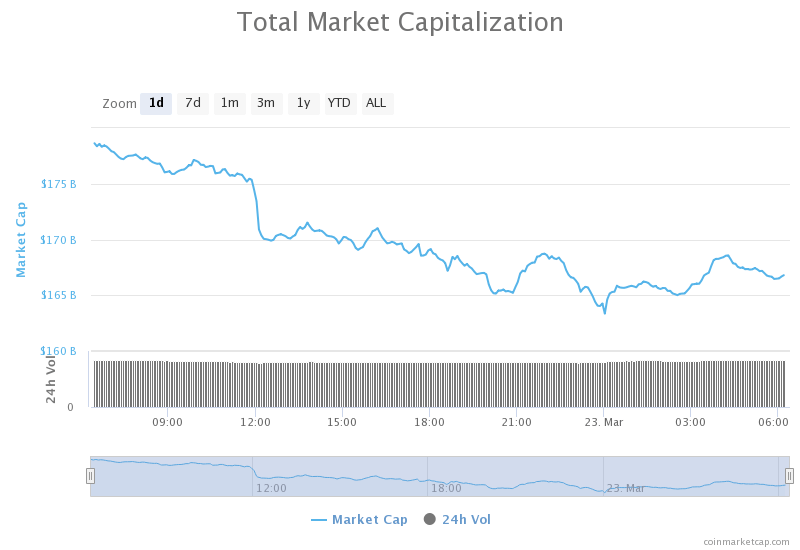

For instance, a report by BIS research shows that if the healthcare industry incorporates blockchain, it can save up to $100 billion per year by 2025. Blockchain technology would save the industry in costs related to data breaches, IT, operations, support functions, personnel, and counterfeit and insurance

The report also stated that “a global blockchain in the healthcare market is expected to grow at a compound annual growth rate of 63.85% from 2018 to 2025. The use of blockchain for healthcare will contribute to the largest market share throughout the forecast period, reaching a value of $1.89 billion by 2025…”

According to the report and the rate at which blockchain is currently being recruited for all types of industries, it makes sense to be optimistic about the future of blockchain in healthcare.

Conclusion

There is no doubt that blockchain promises unique opportunities and a transformative future for healthcare. It can help reduce complexities, streamline processes, enable secure information keeping, enable trustless coordination among various parties, and reduce costs. It’s time for the healthcare ecosystem to adopt this technology that will help it realize much-needed horizontal innovation.

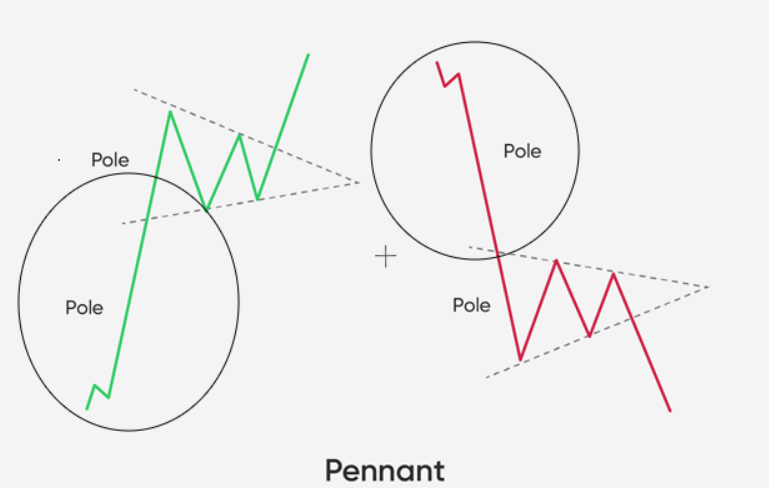

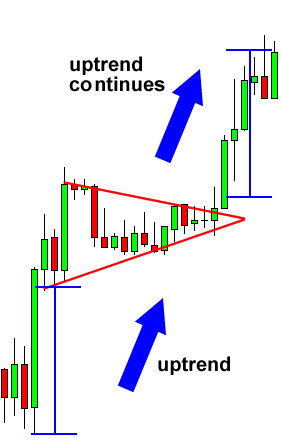

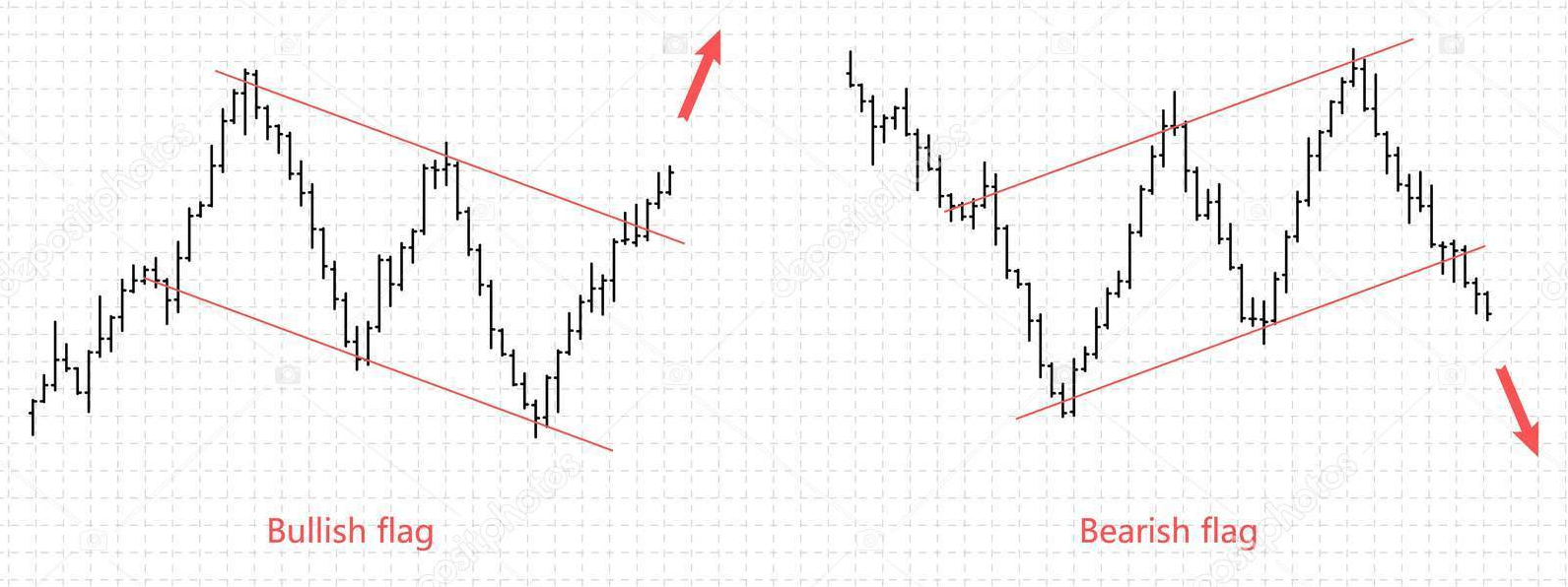

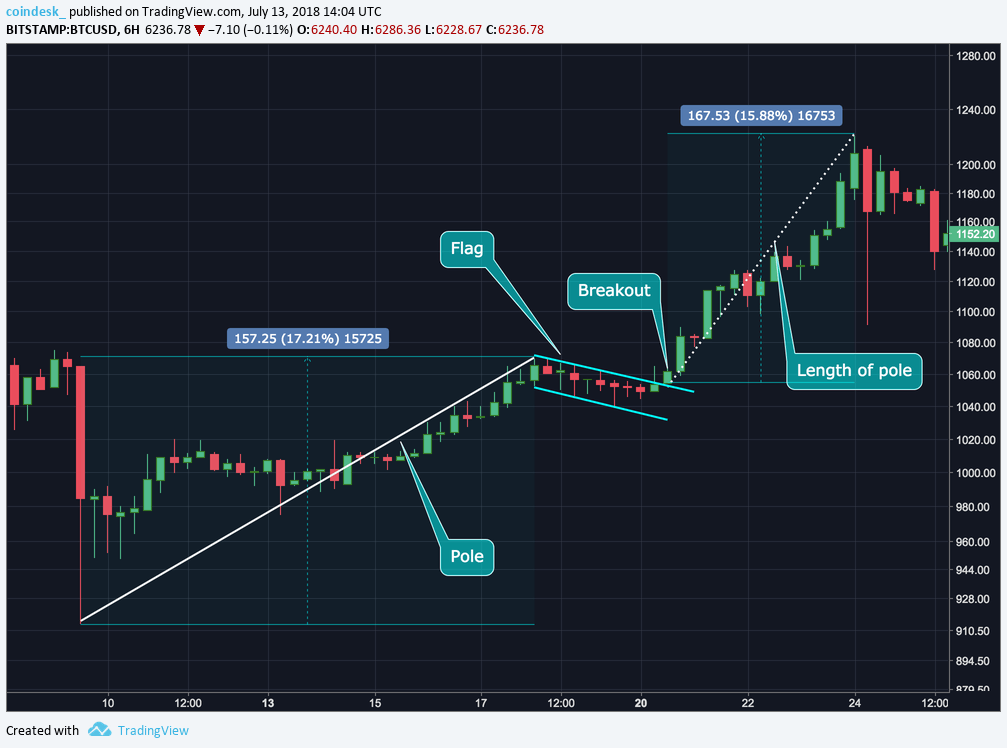

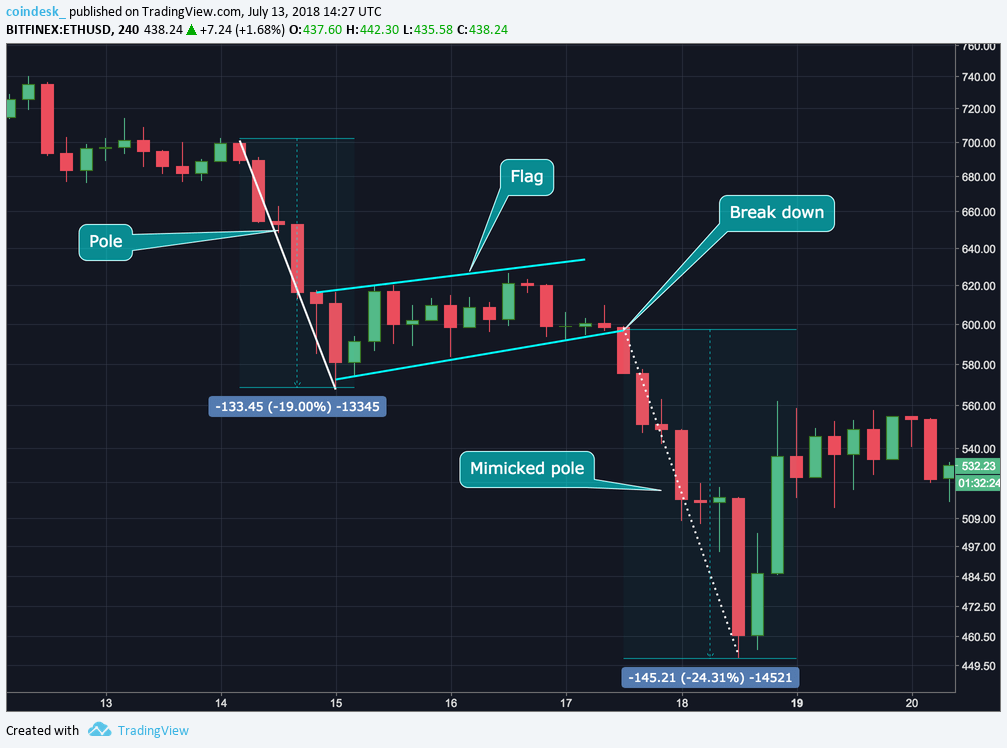

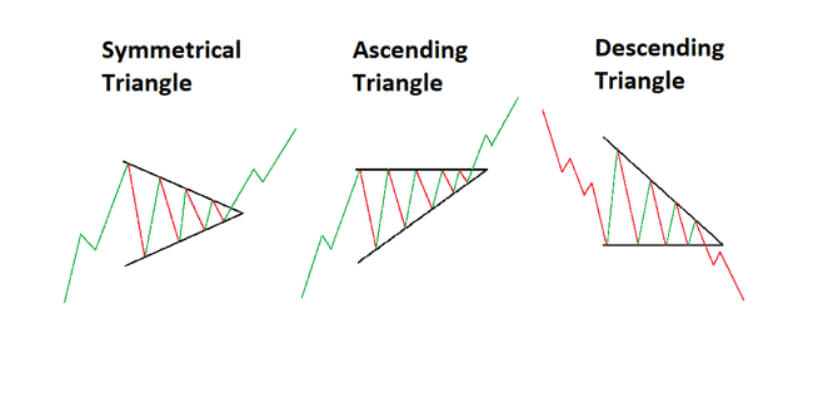

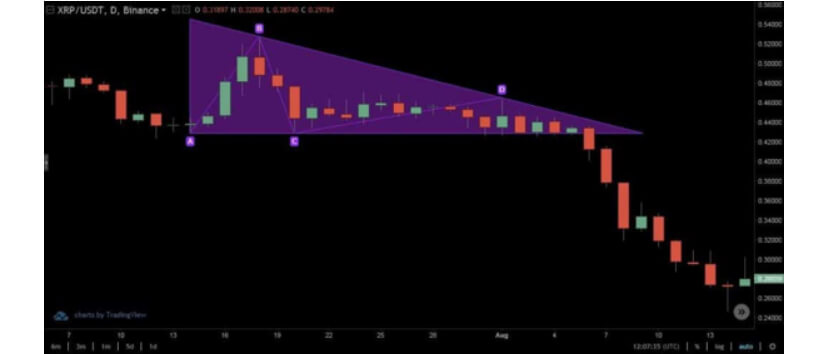

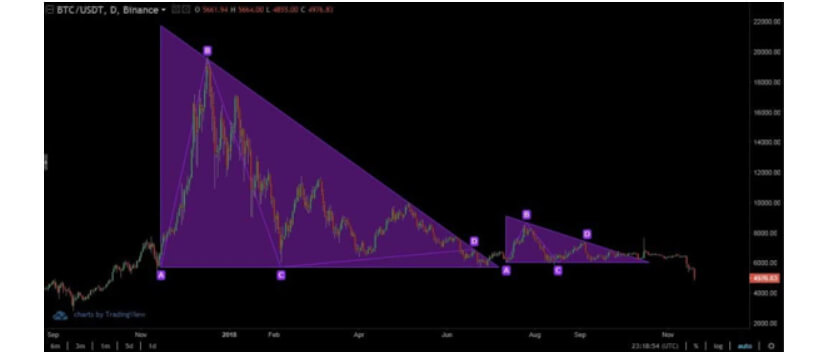

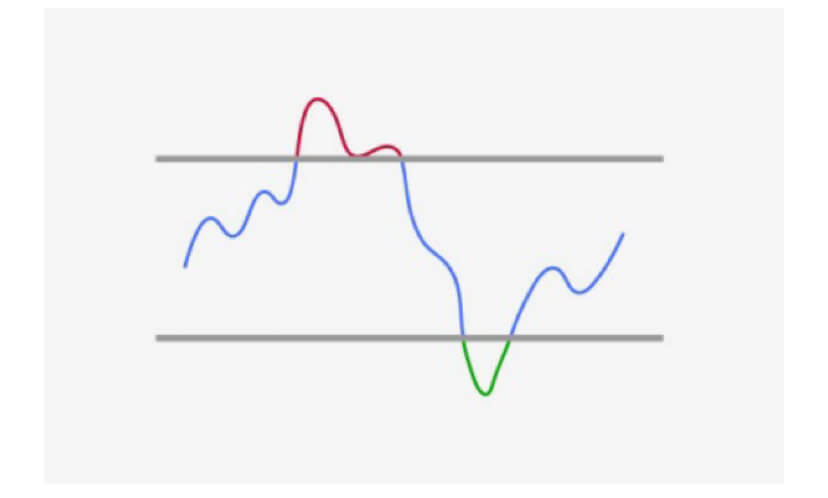

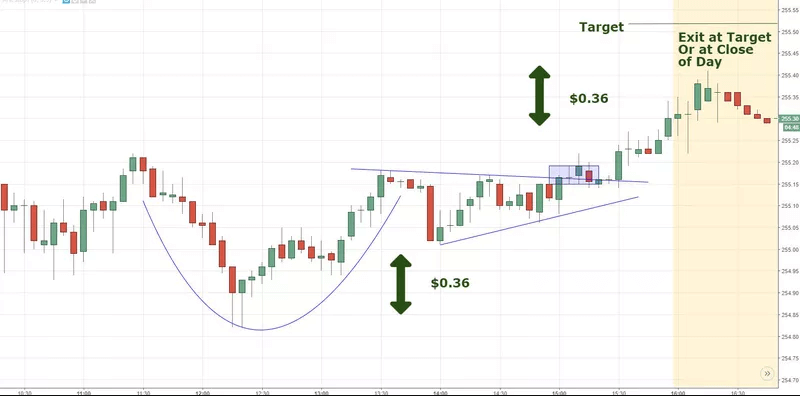

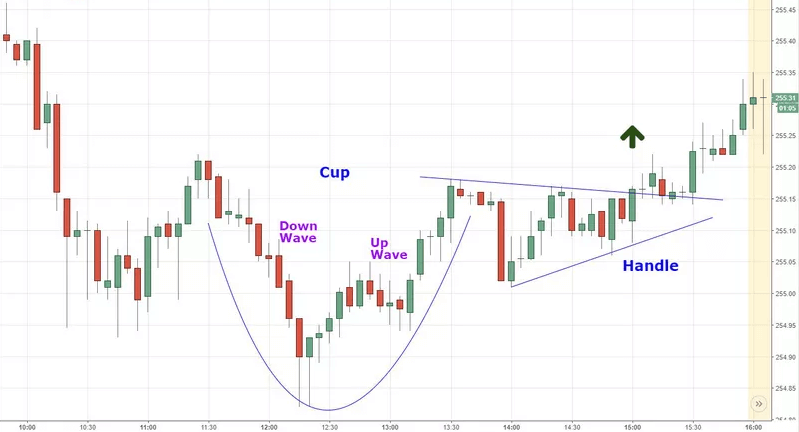

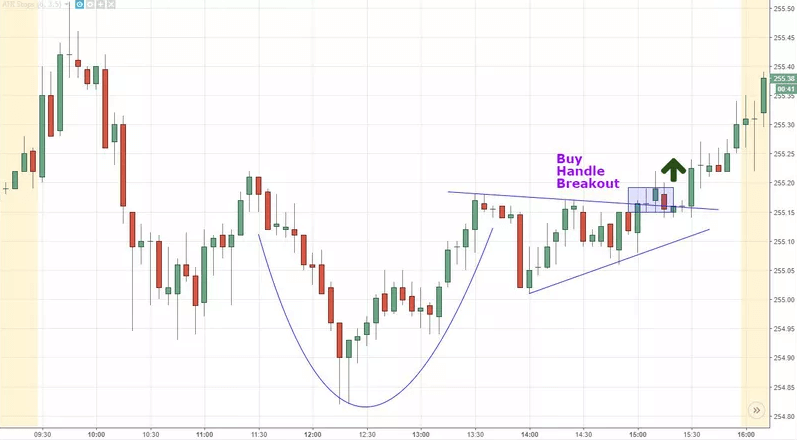

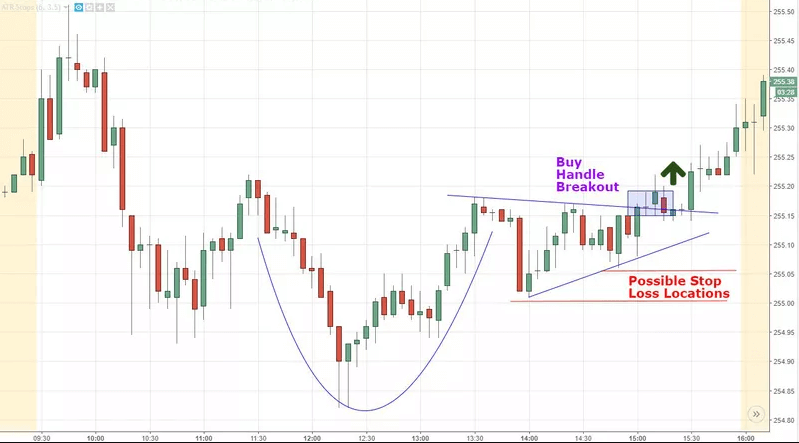

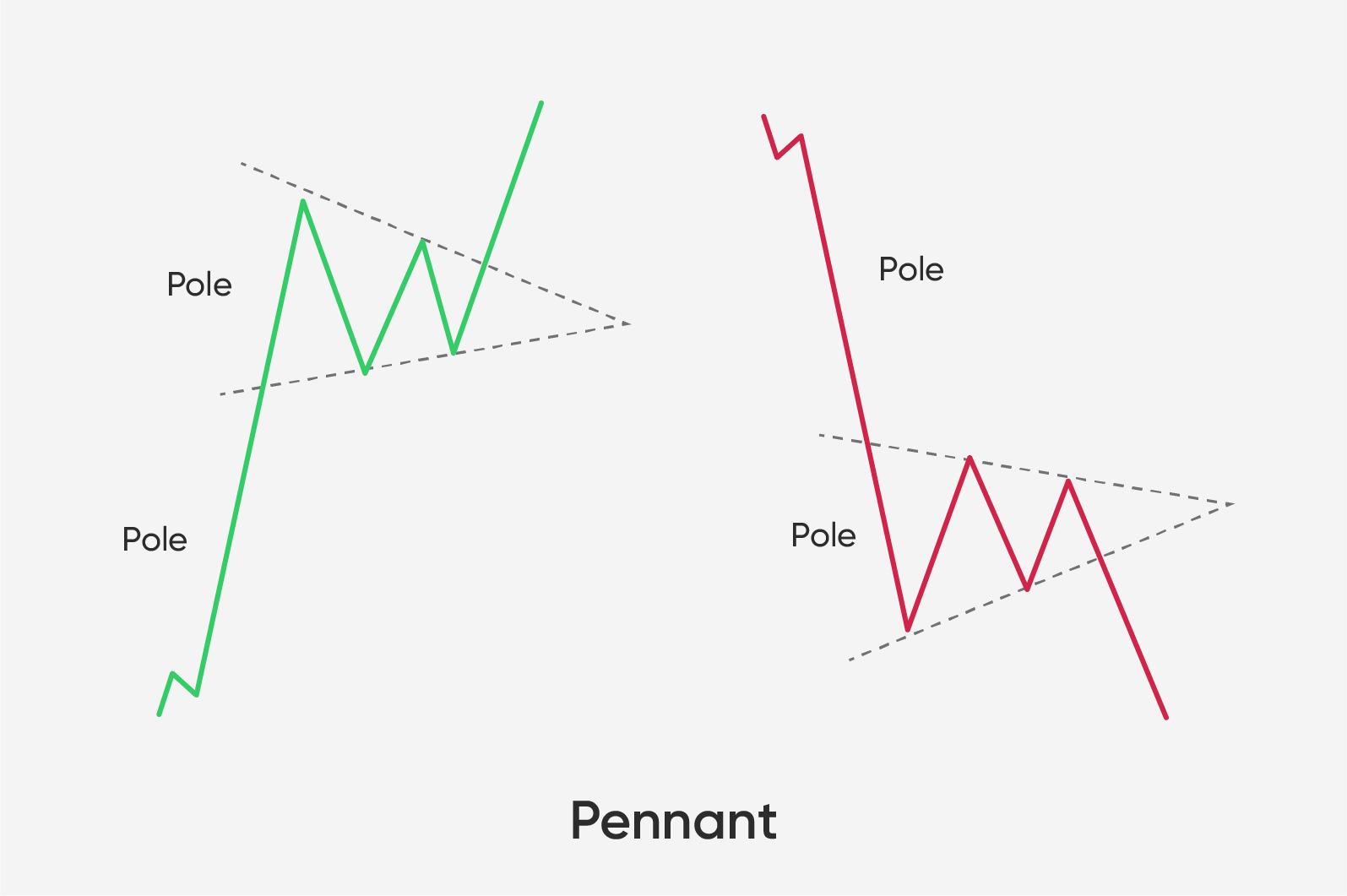

The pennant formation is a formation that looks much like a flag pattern but is triangular in shape. These formations tend to appear at the halfway mark of a trend. When a pennant forms, the trading volume tends to contract, while increasing only after the breakout. To simplify it even further, pennants look like a small triangle sitting on a long pole.

The pennant formation is a formation that looks much like a flag pattern but is triangular in shape. These formations tend to appear at the halfway mark of a trend. When a pennant forms, the trading volume tends to contract, while increasing only after the breakout. To simplify it even further, pennants look like a small triangle sitting on a long pole.