Introduction

We have learned a lot of concepts related to technical analysis in the past few course lessons. Starting from Moving Averages, we have extended our discussion to Fibonacci Trading, Candlestick Patterns, and Indicator based analysis. We have also gone through some of the advanced technical trading concepts like Pivot Trading and Elliot Wave Theory.

We hope you have understood these concepts and started to apply them in a demo account. If you have any queries, please post them in the respective lesson comments so that we can address them in the right place. However, this is not the end of the technical analysis basics. We must go through one most crucial concept before going further. And that is to learn the trading of Forex Chart Patterns.

What are Forex Chart Patterns?

Do not mistake these Forex chart patterns with the Candlestick Patterns that we have learned before. Two or more candlesticks form candlestick patterns. And the maximum number of candlesticks in a single candlestick pattern is not more than four. But when it comes to Forex Chart Patterns, there are more candlesticks involved. The number can range from 50 to 500 and beyond.

To explain in simple terms, we know the price action moves in three different stages – Trends, Channels, and Ranges. When moving in these stages, the candlesticks follow specific patterns at times. Primarily, these patterns are formed by a group of candlesticks, and they look similar to the shapes that we see in real life. For instance, below is the snapshot of one of the very well known Forex chart patterns known as Cup & Handle Pattern.

(Image Taken From – Forex Academy)

In the above image, we can see how candlesticks combined to form a Cup & Handle Pattern.

Why is it important to know them?

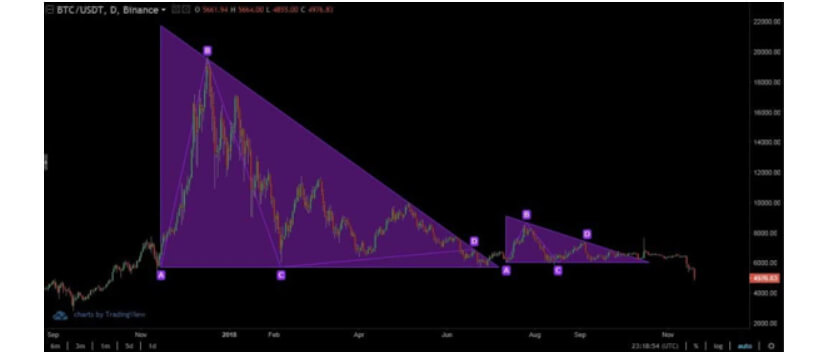

We can consider these Forex Chart Patterns as land mine detectors. Because, when mastered, we will be able to detect the market explosions before even they occur. Hence any technical trader needs to learn to identify and trade these chart patterns. Forex chart patterns are given the highest importance because of one simple reason – high probability performing trades.

For technical analysts and price action traders, these chart patterns offer reliable clues to make their moves in the direction in which the price might go in the future. The reason behind this is that these patterns have the potential to push the price in a specific direction. There is a logical reason behind the formation of every single chart pattern, and why the price will go in a particular direction after the formation of these patterns.

Types of Forex Chart Patterns

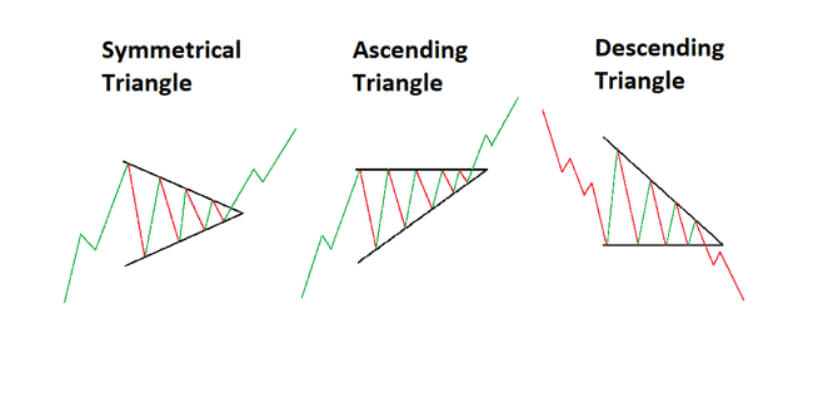

Just like what we have learned in the Candlestick pattern lessons, there are three different types of Forex Chart Patterns.

Continuation Patterns – The appearance of these patterns indicates that the underlying trend will continue, and the price will continue moving in the direction that it is currently moving.

Examples – Pennant Chart Pattern and Rectangular Chart Pattern

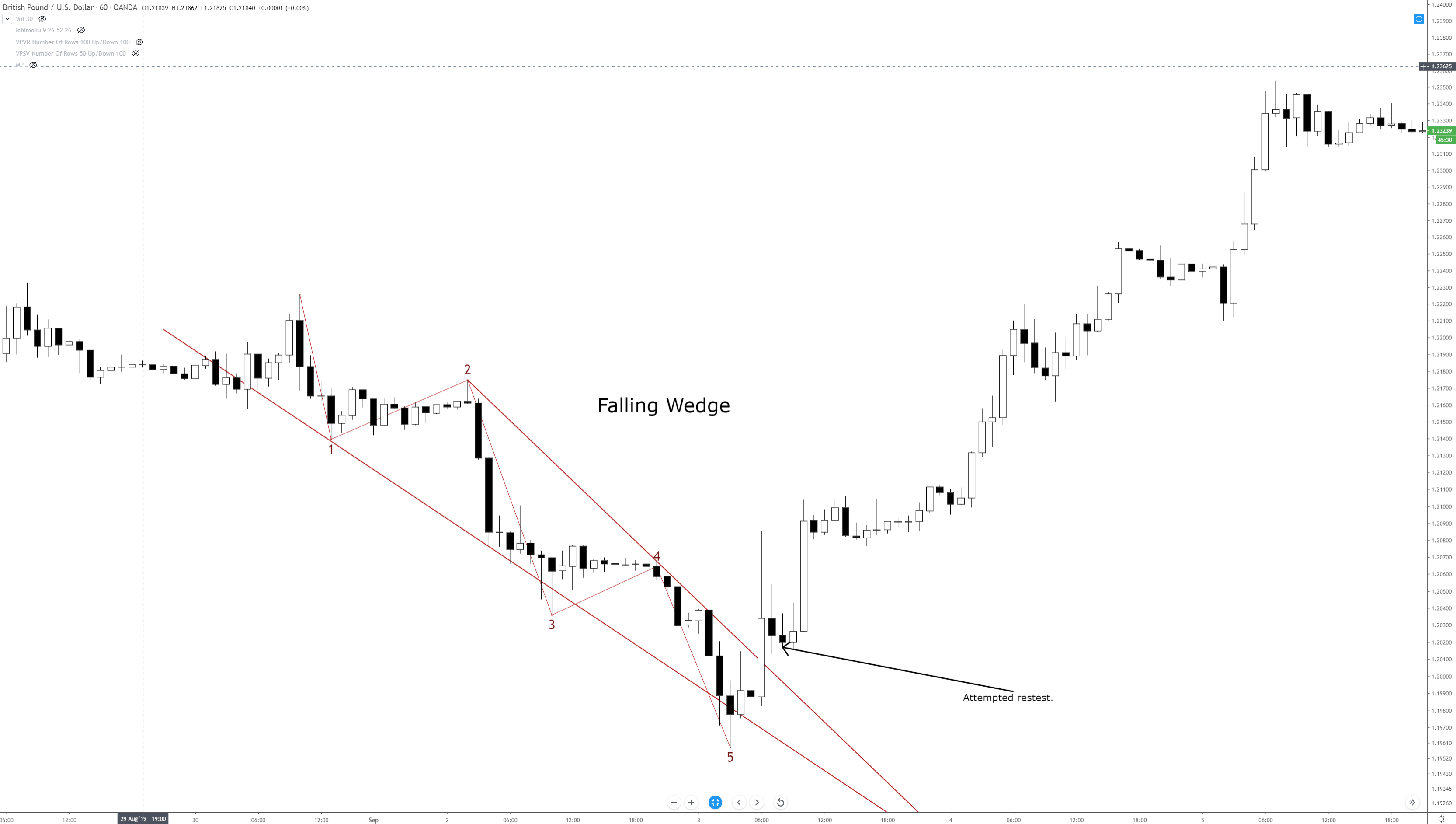

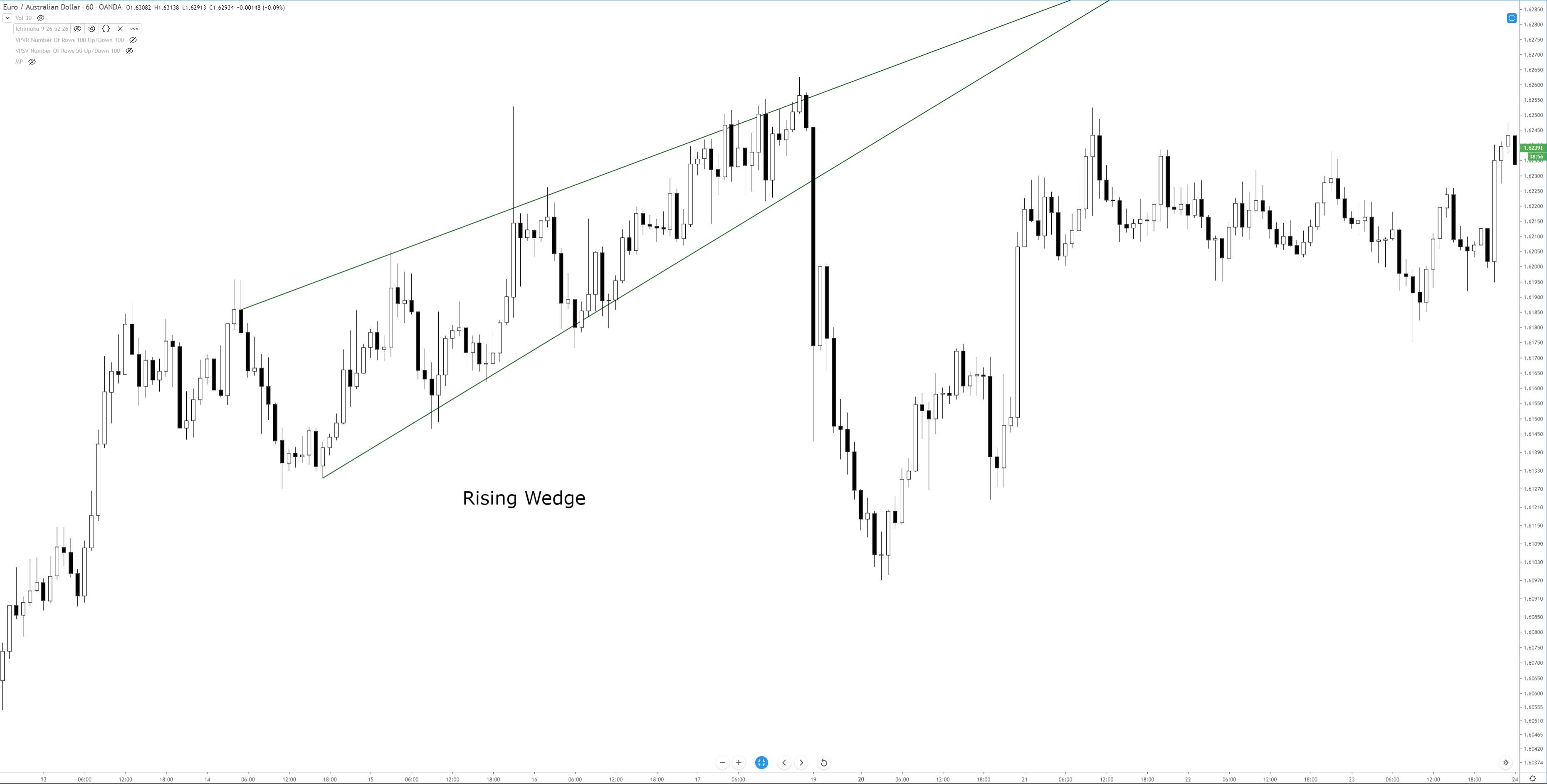

Reversal Patterns – If we have identified these kinds of patterns on the price chart, it is an indication that the market is about to reverse its direction. Hence the name – Reversal Patterns.

Examples – Wedge Pattern, Head & Sholders Pattern, and Double Tops & Bottoms.

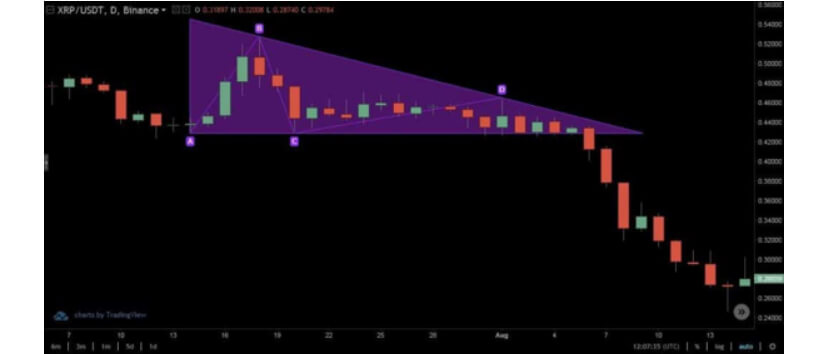

Neutral Patterns – These patterns are termed neutral because the price can move in either of the directions after the formation of these patterns. So we must be careful while trading these kinds of patterns.

Example – Symmetric Triangle Pattern

We will be covering a combination of these in the upcoming articles so you will get a holistic knowledge of trading Forex patterns. Stay Tuned!