Profiting from the crypto market – Three White Soldiers pattern

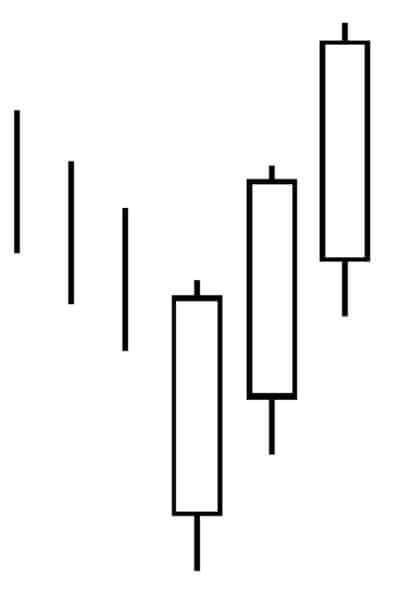

Three white soldiers is a candlestick pattern used to predict current downtrend reversals in a pricing chart. The pattern is made of three long-bodied candlesticks that open within the previous candle’s body and close over the previous candle’s high. The candlesticks should not have long shadows.

The three white soldiers pattern suggests a strong market sentiment change. If a candle is closing with small to no shadows, it suggests that bulls have taken over the price and kept it at the top of the range.

Trading the three white soldiers pattern

As the three white soldiers is a bullish visual pattern, it is mostly used as an entry or exit point. Traders wanting to short a cryptocurrency look to exit, while traders who want to go long on a crypto see three white soldiers as an entry point.

When trading the three white soldiers pattern, make sure to take into consideration that the strong move higher might create temporary overbought conditions. That’s why this pattern should be paired up with oscillators, which may confirm the market reversal.

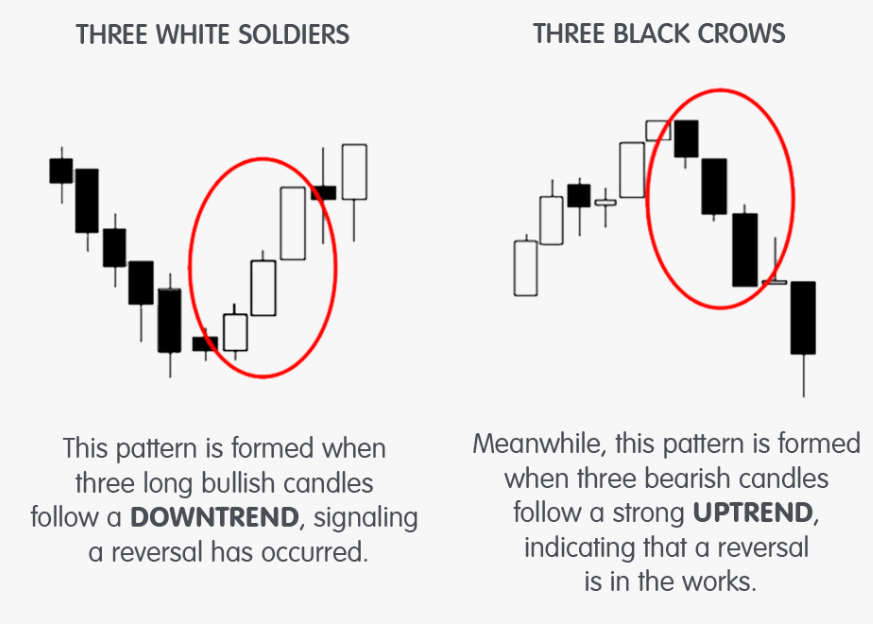

Three White Soldiers vs. Three Black Crows

The three white soldiers’ opposite pattern is the three black crows pattern. Three black crows have all the same attributes of the three white soldiers but in reverse. It consists of three consecutive candlesticks that open within the real body of the previous candle while closing lower than the previous candlestick. While three white soldiers mark a reversal from bear to the bull trend, three black crows show market reversal from bullish to bearish.

Things to consider

Three white soldiers might also appear during periods of consolidation, rather than during a trend. This is an easy way to fall into a trap, so one should take a good look at the longer time frames before trading Three white soldiers. One of the key things to take note of is the volume that supports the formation of this pattern. Any pattern is susceptible to failing in low volume conditions.