In 2013 I started investing in cryptocurrencies, to be more exact on Bitcoin. It all started when one of the people I followed on Twitter posted an image of a USB with the logo of a Bitcoin. On Twitter, he commented that he had started mining his first Bitcoins. The subject in question caught my attention as on the one hand I had not the remotest idea that it was a Bitcoin, and on the other hand, the word «mine» created confusion when trying to relate it to a device with a USB connection.

I made some searches and discovered that Bitcoin was a cryptocurrency or digital currency, open-source, decentralized, whose creator was unknown and that from its origin in 2009 had gone from worth cents to about $280, only to collapse later. I found the story very interesting so I kept looking for information on the web and especially on the Bitcointalk forum which was one of the few sites where you could find valuable things. At the end of that same summer, I bought my first Bitcoins so that I could better understand firsthand everything I was learning.

That was briefly my beginning in the world of cryptocurrencies. Since then everything has evolved a lot and I have had the opportunity to go through several bullish and bass cycles in which I have made countless successes and mistakes. In this post, I will comment on which are in my opinion the most important things if you want to start investing in cryptocurrencies.

Learn Before Investing

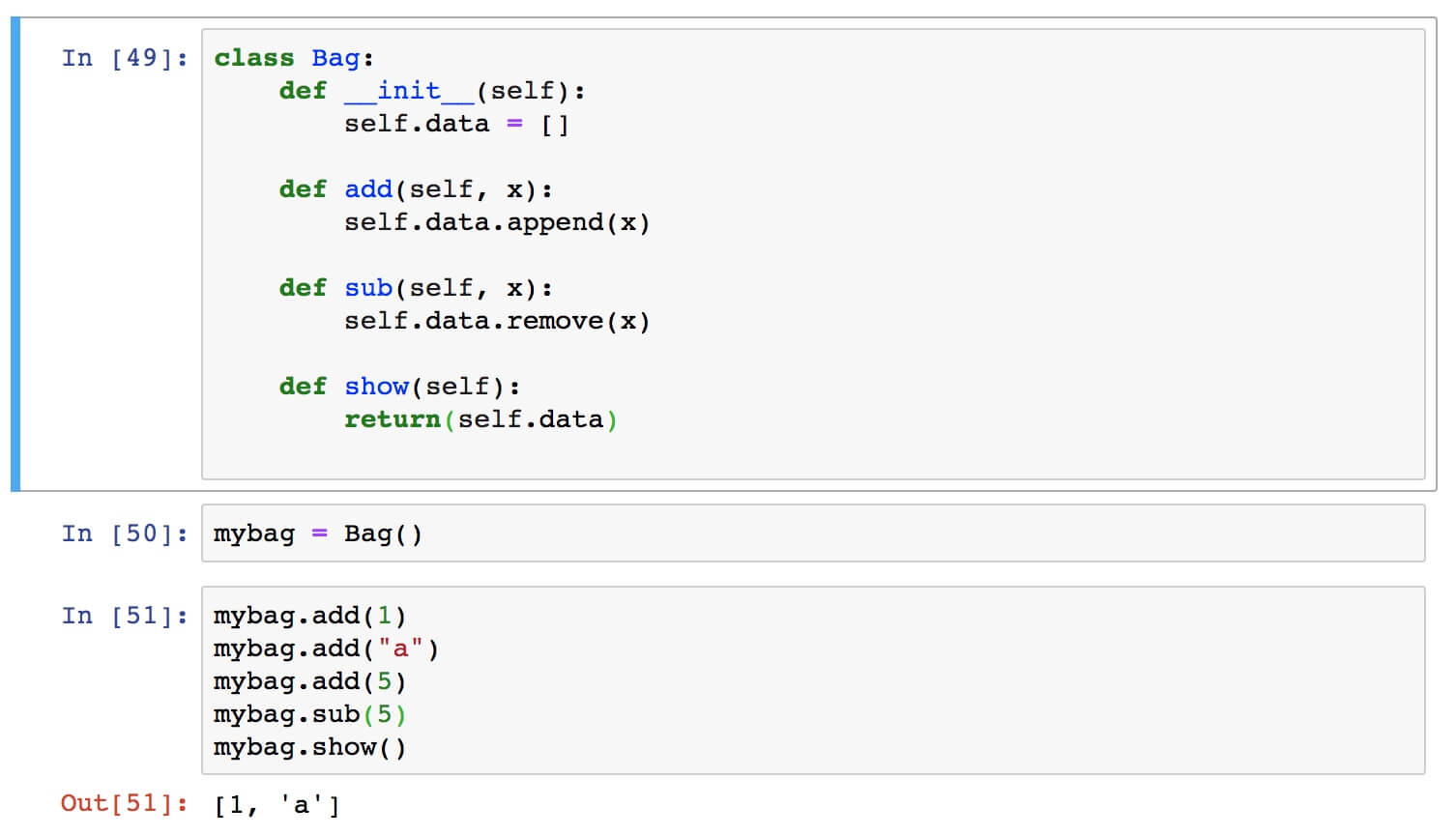

If you want to be successful by investing or trading you need to be trained and prepared for it. If we talk about cryptocurrencies we must add some additional difficulties compared to other traditional financial assets. First, it requires a learning process to understand its technology and peculiarities as well as having great volatility and less liquidity than other types of investment. Therefore, investing without any preparation can lead us to lose all our money so as a starting point I would recommend:

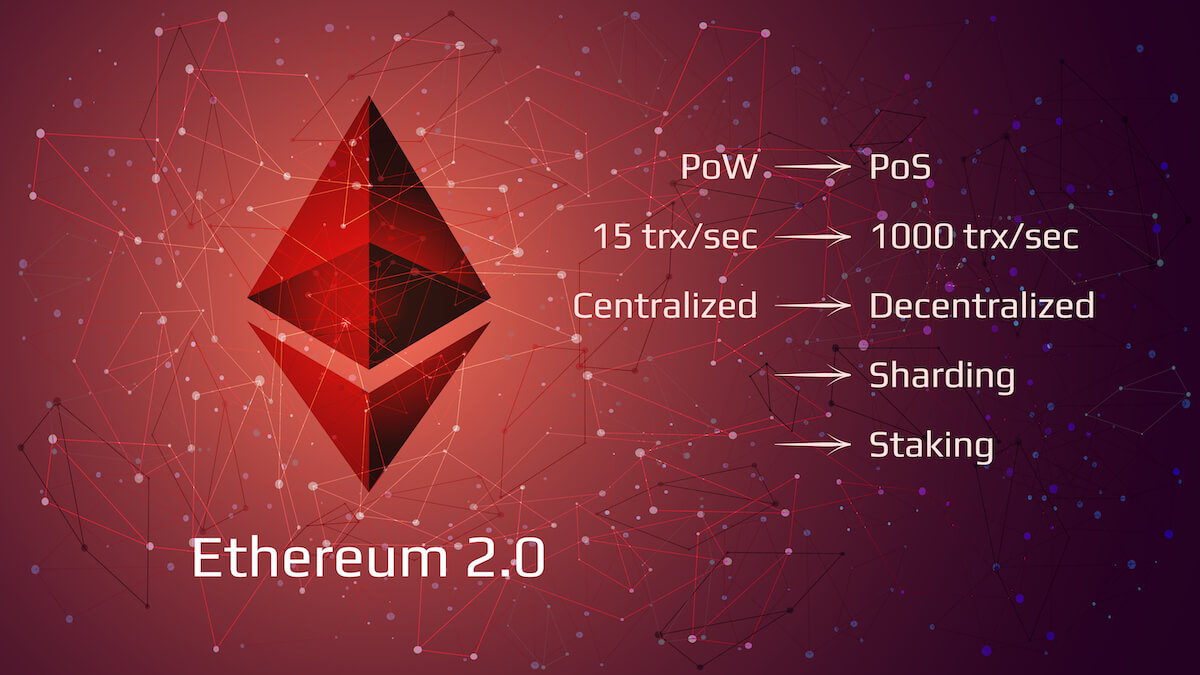

Acquire general knowledge about blockchain and cryptocurrencies: their basic operation, as a transaction occurs, where cryptocurrencies are stored and in general understand the entire ecosystem related to the blockchain.

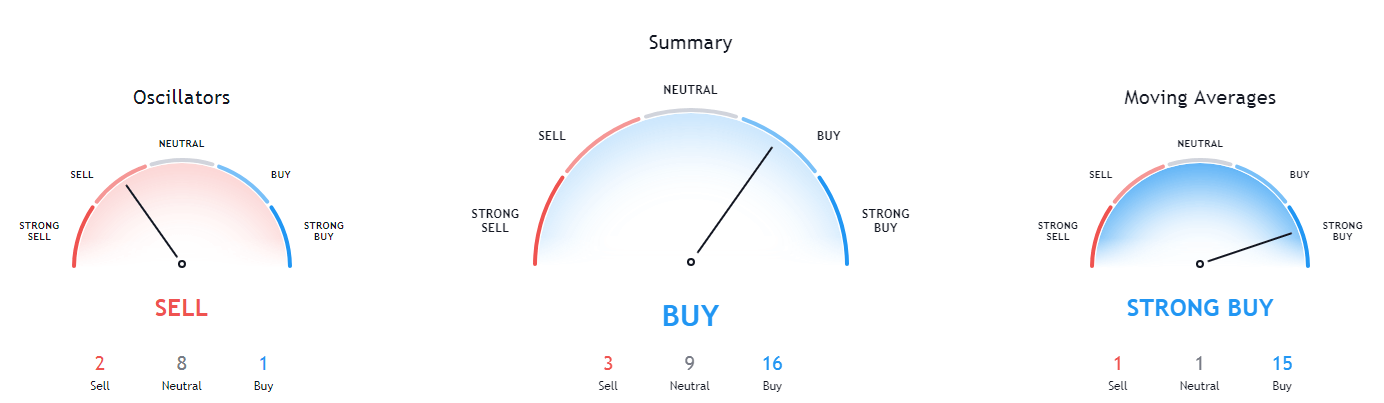

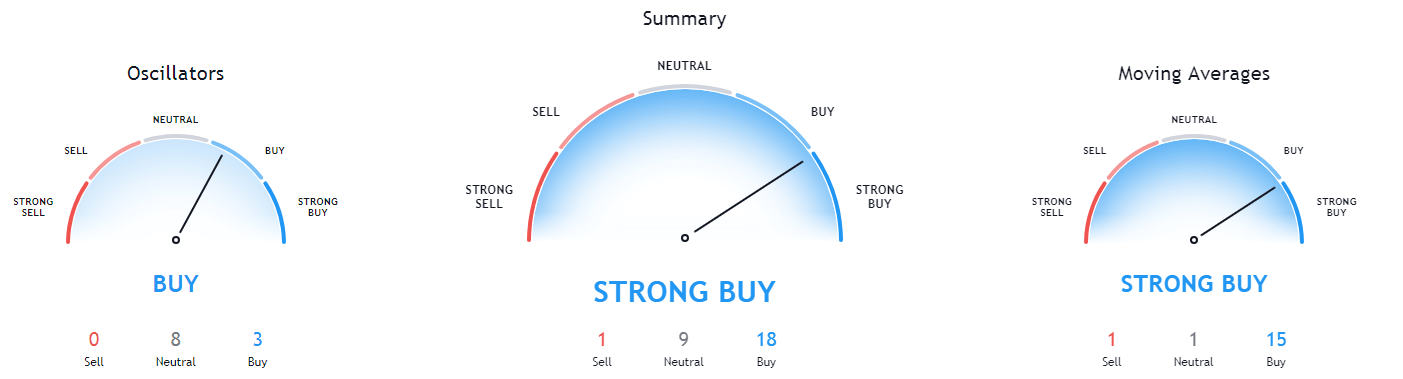

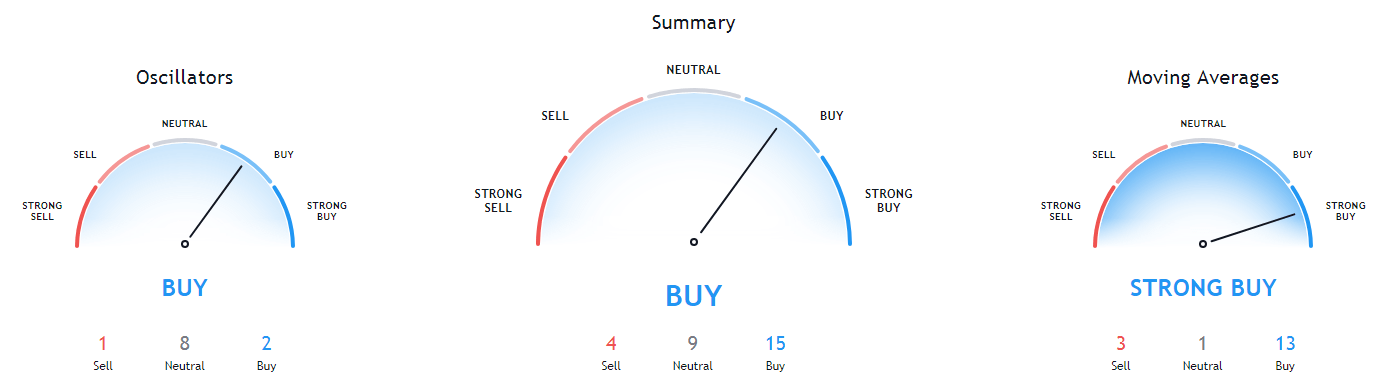

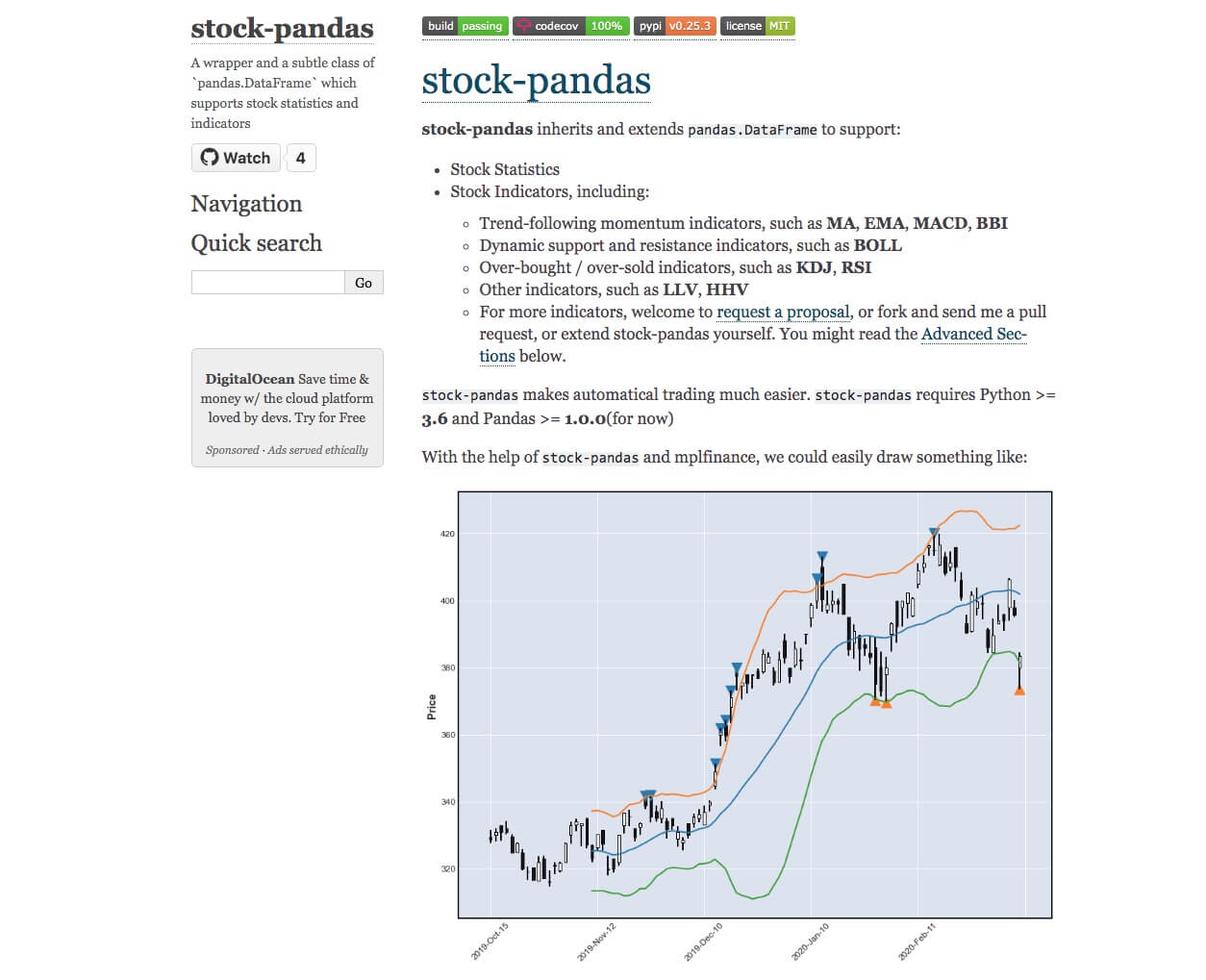

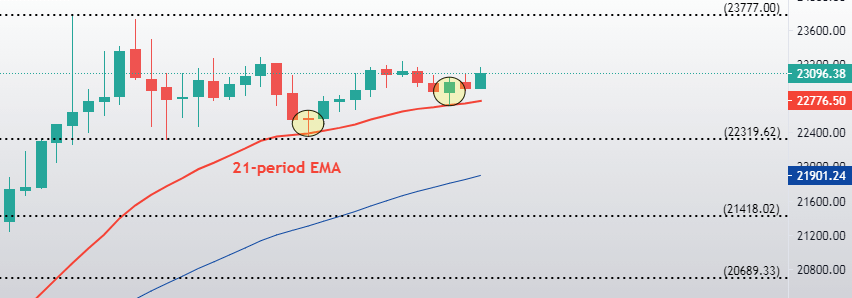

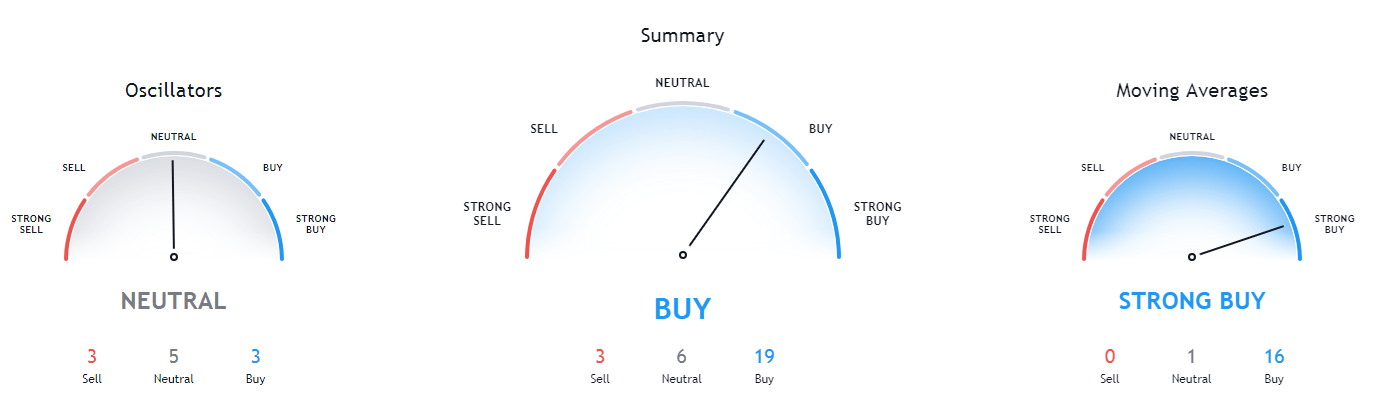

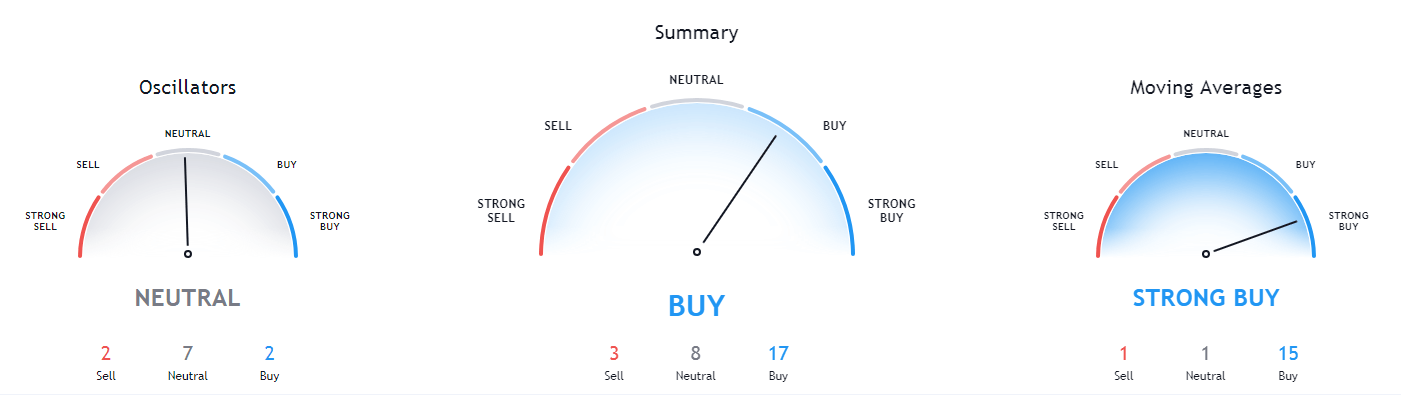

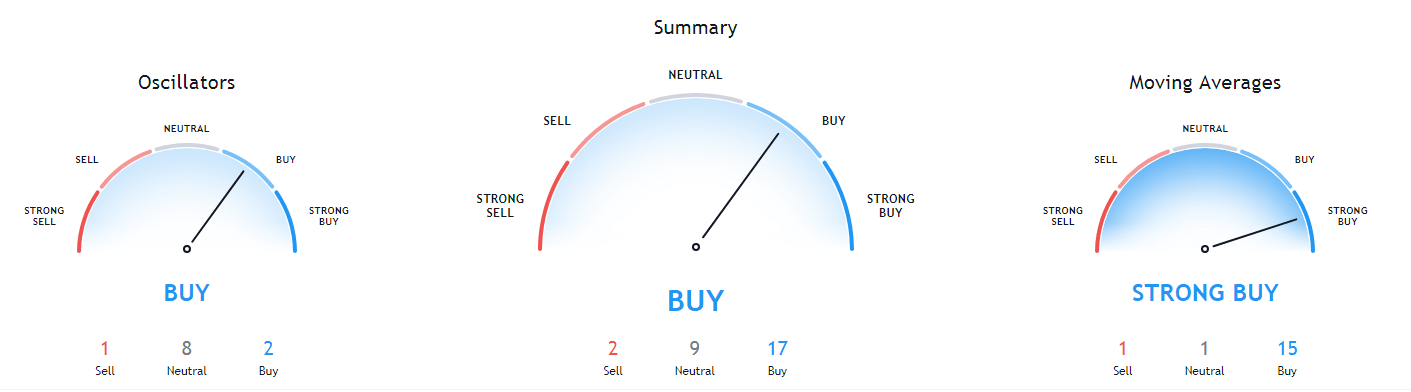

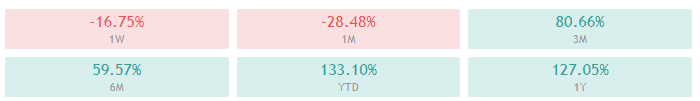

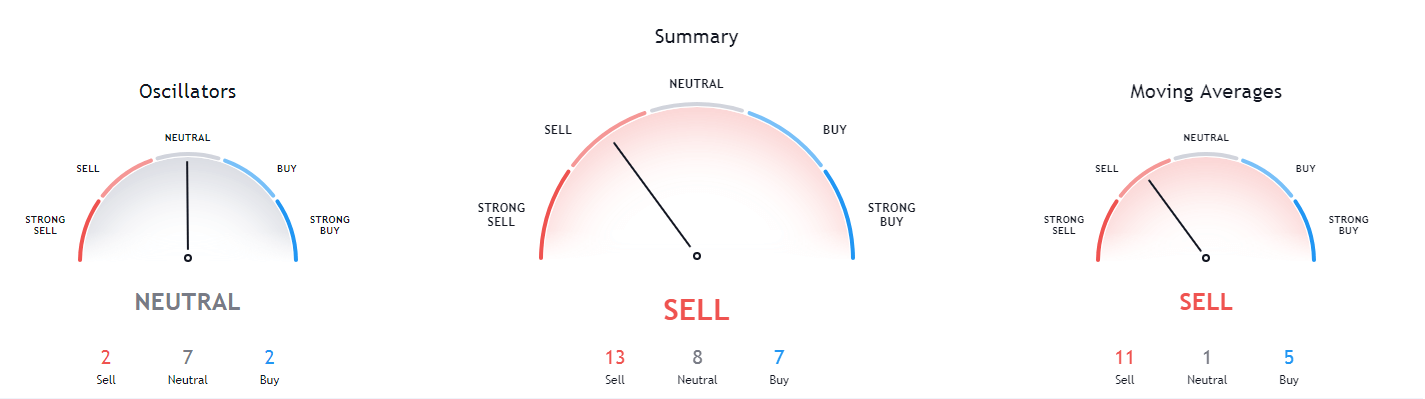

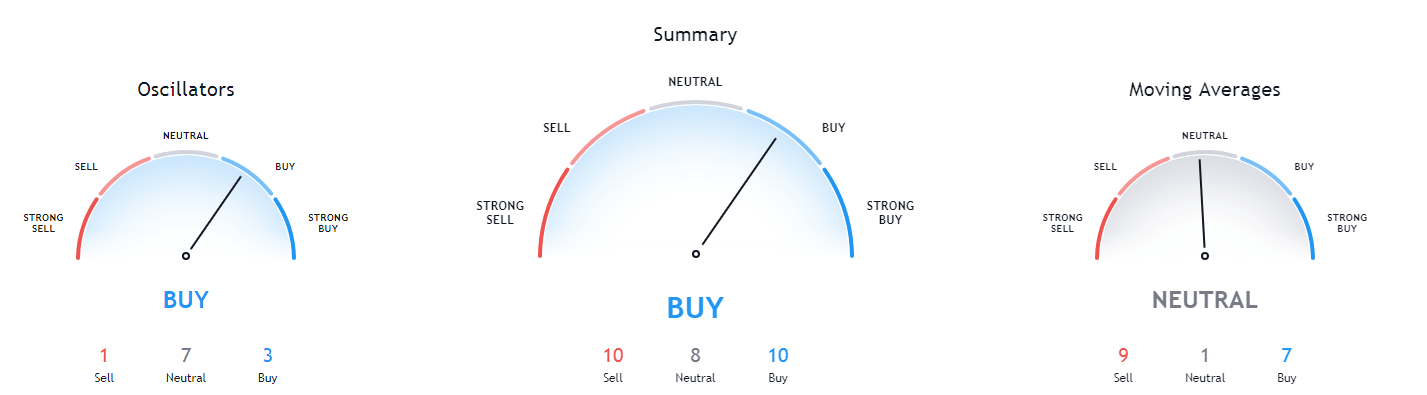

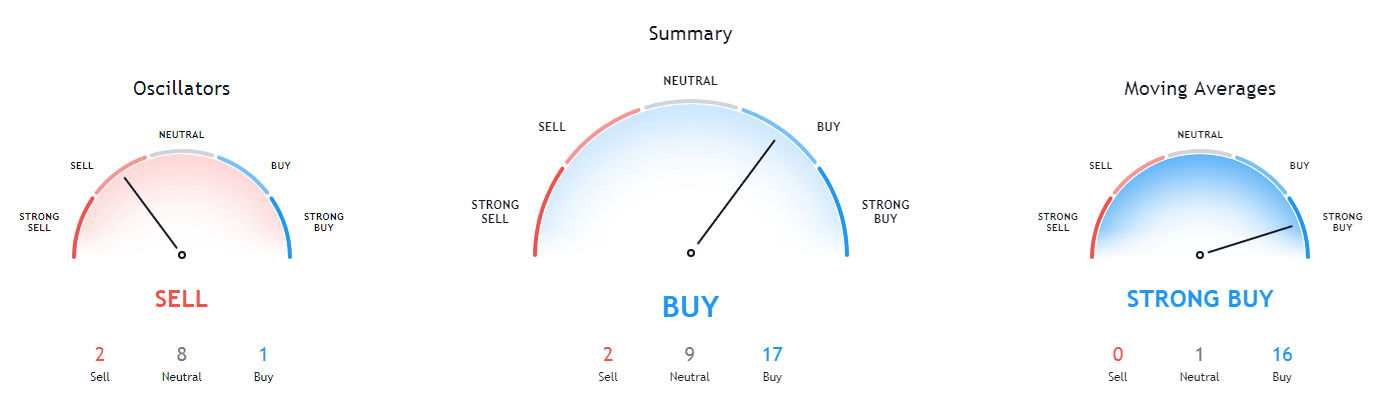

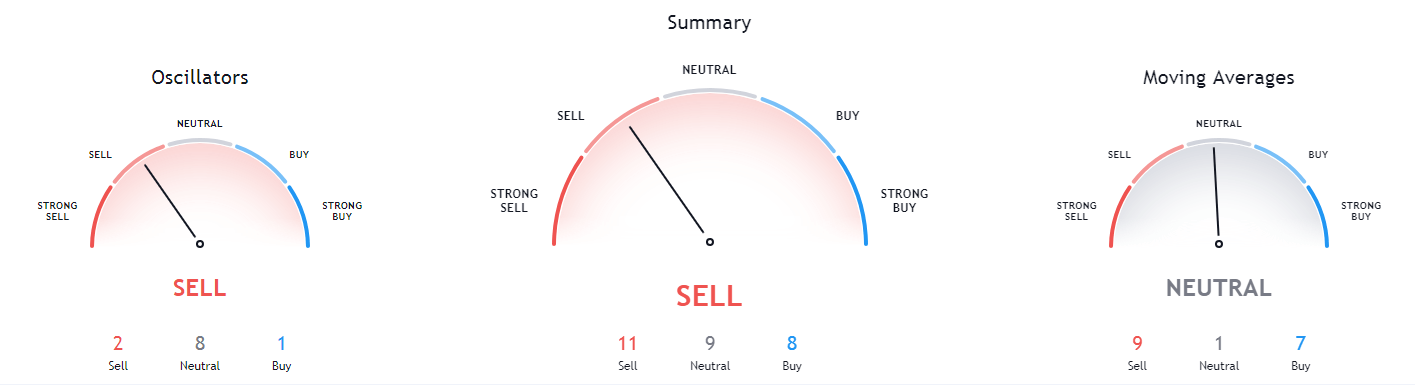

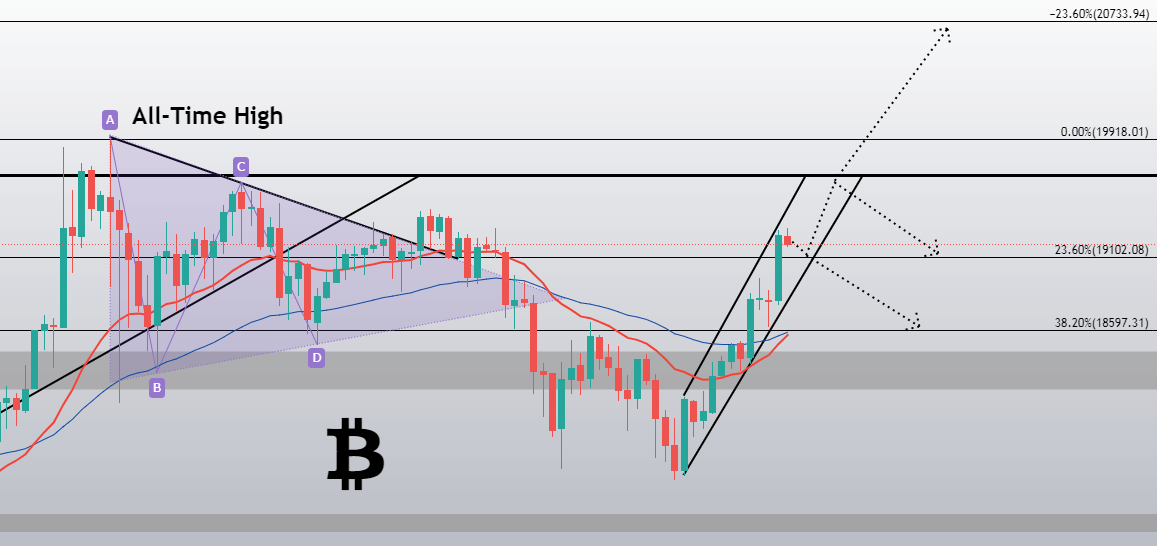

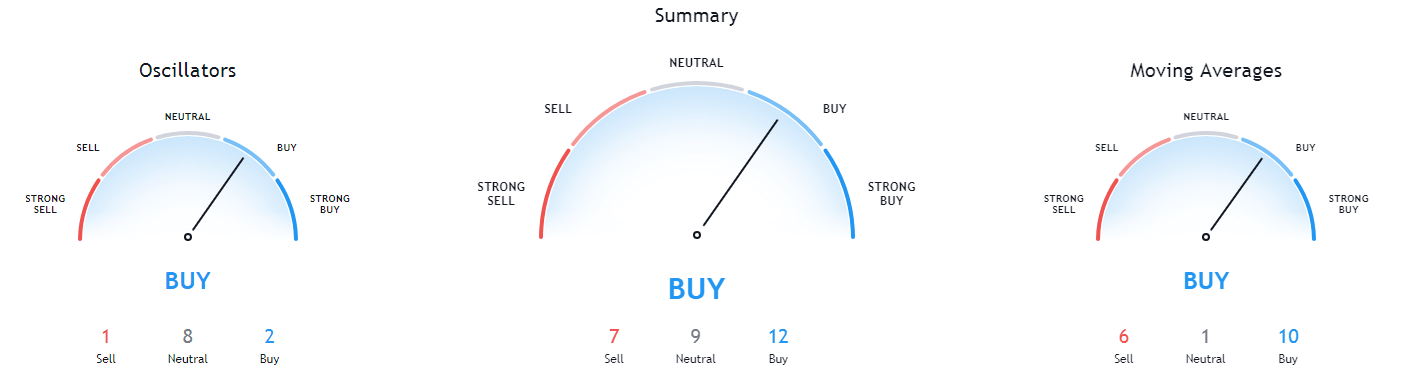

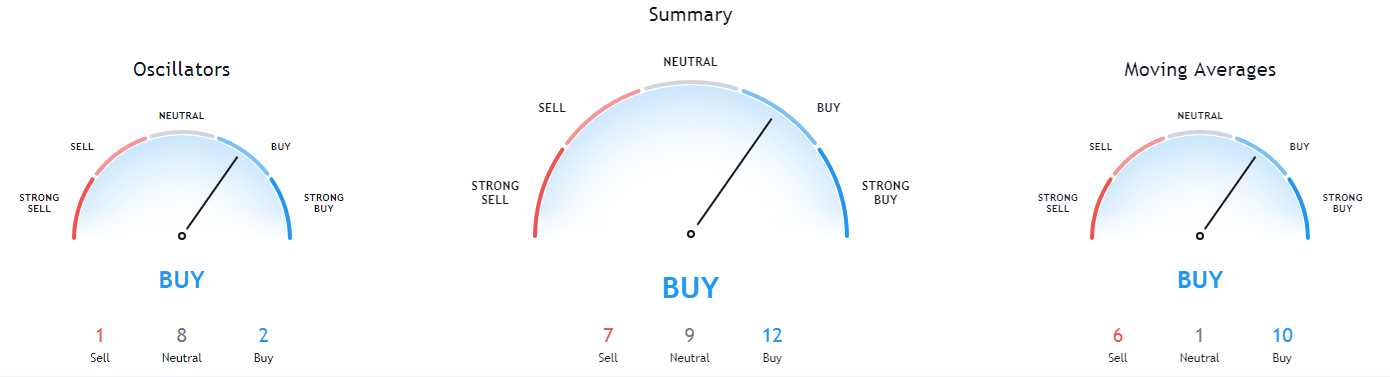

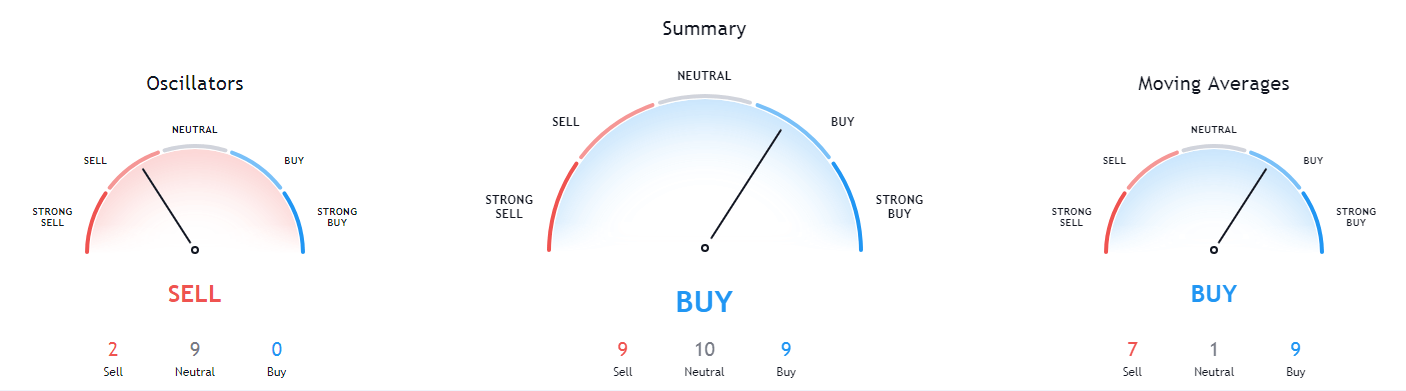

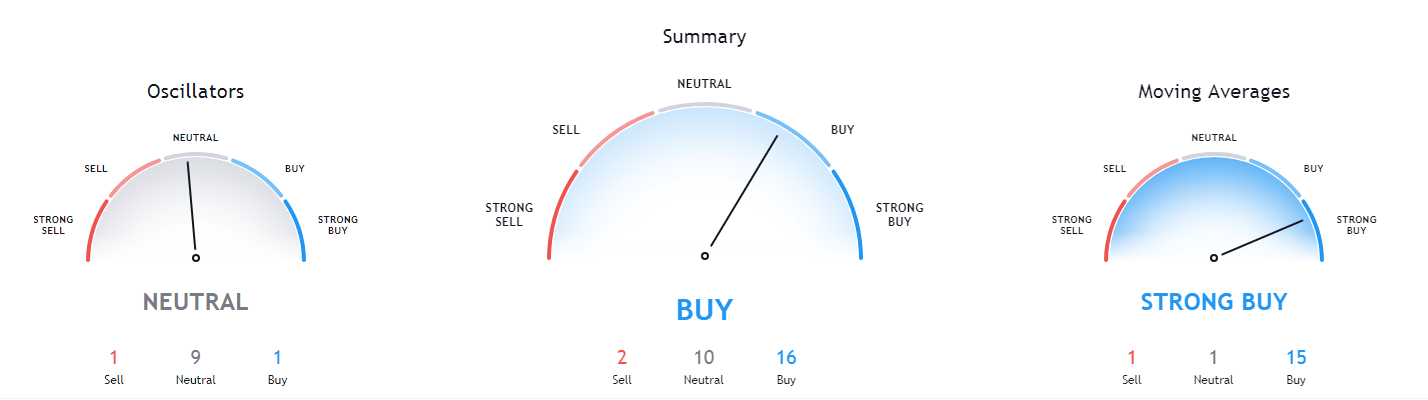

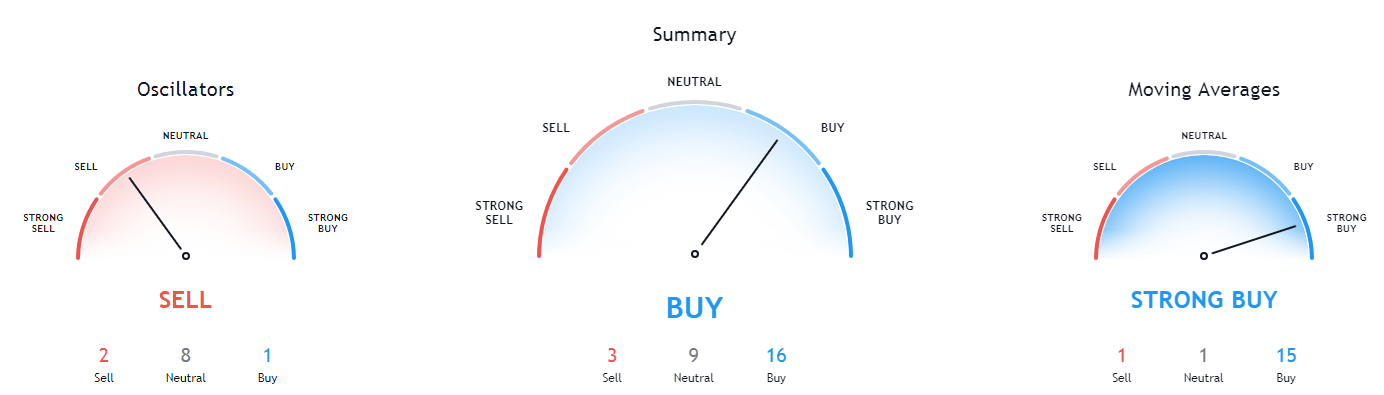

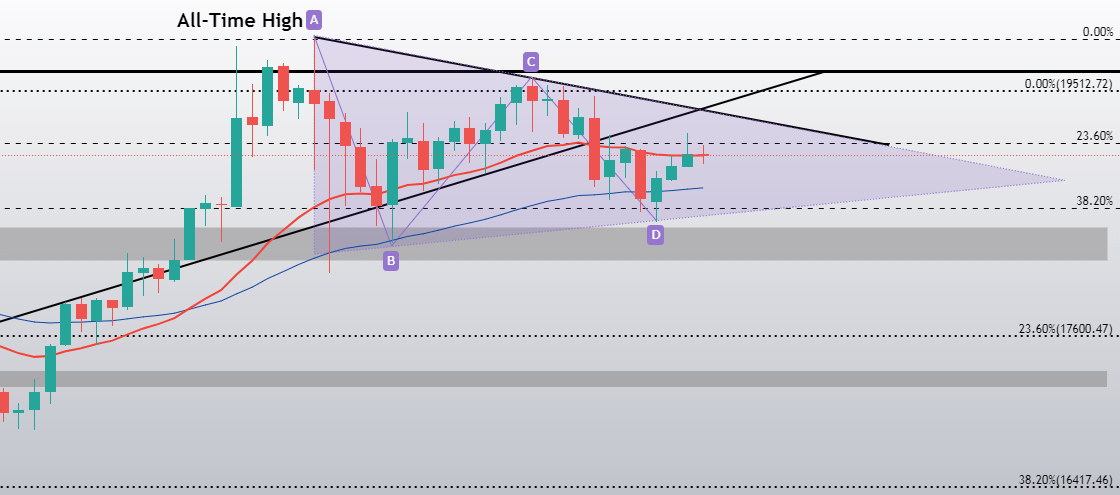

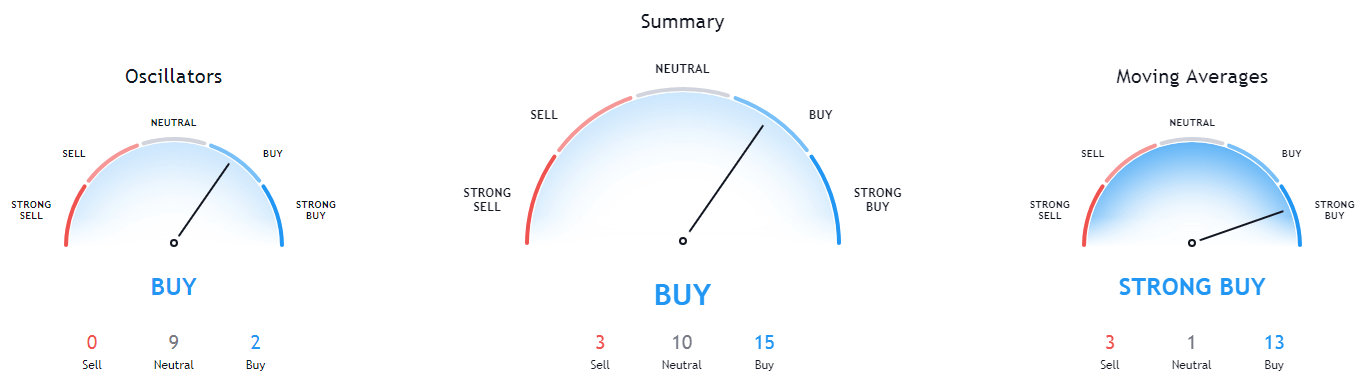

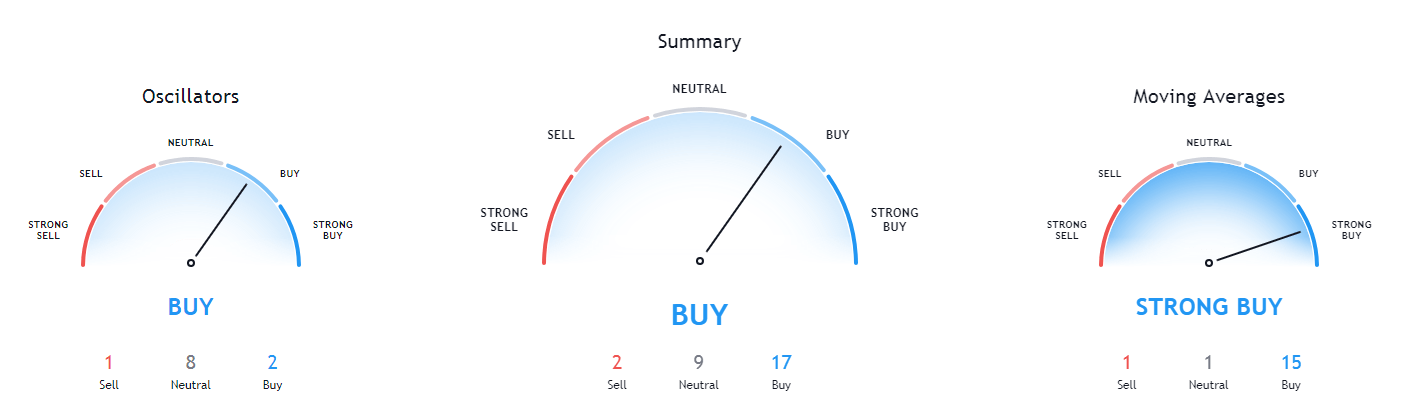

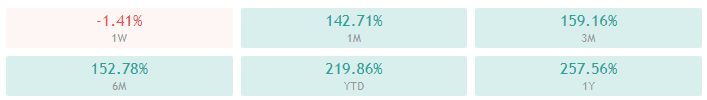

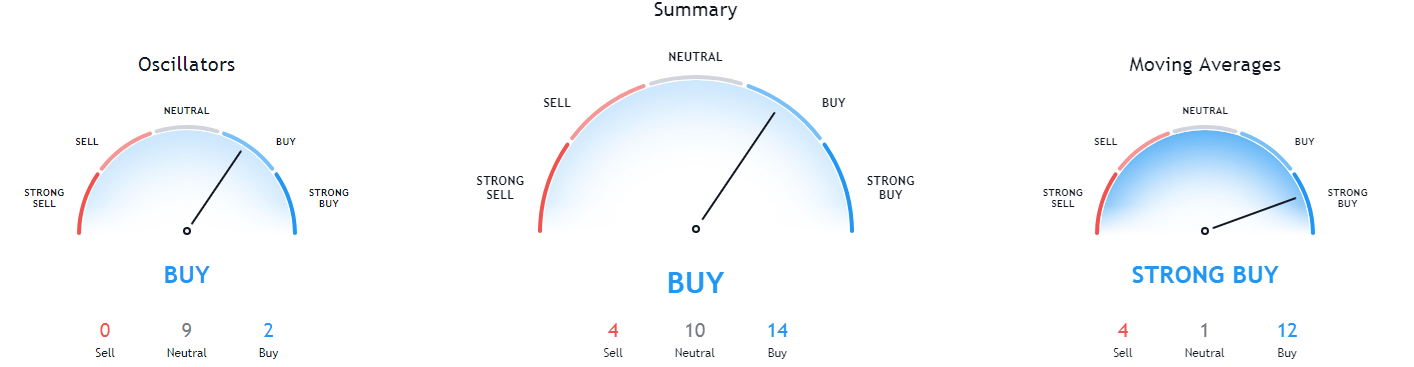

Technical Analysis: it will allow you to analyze a chart, know in which phase of the market we are, and look for points of entry as precise as possible.

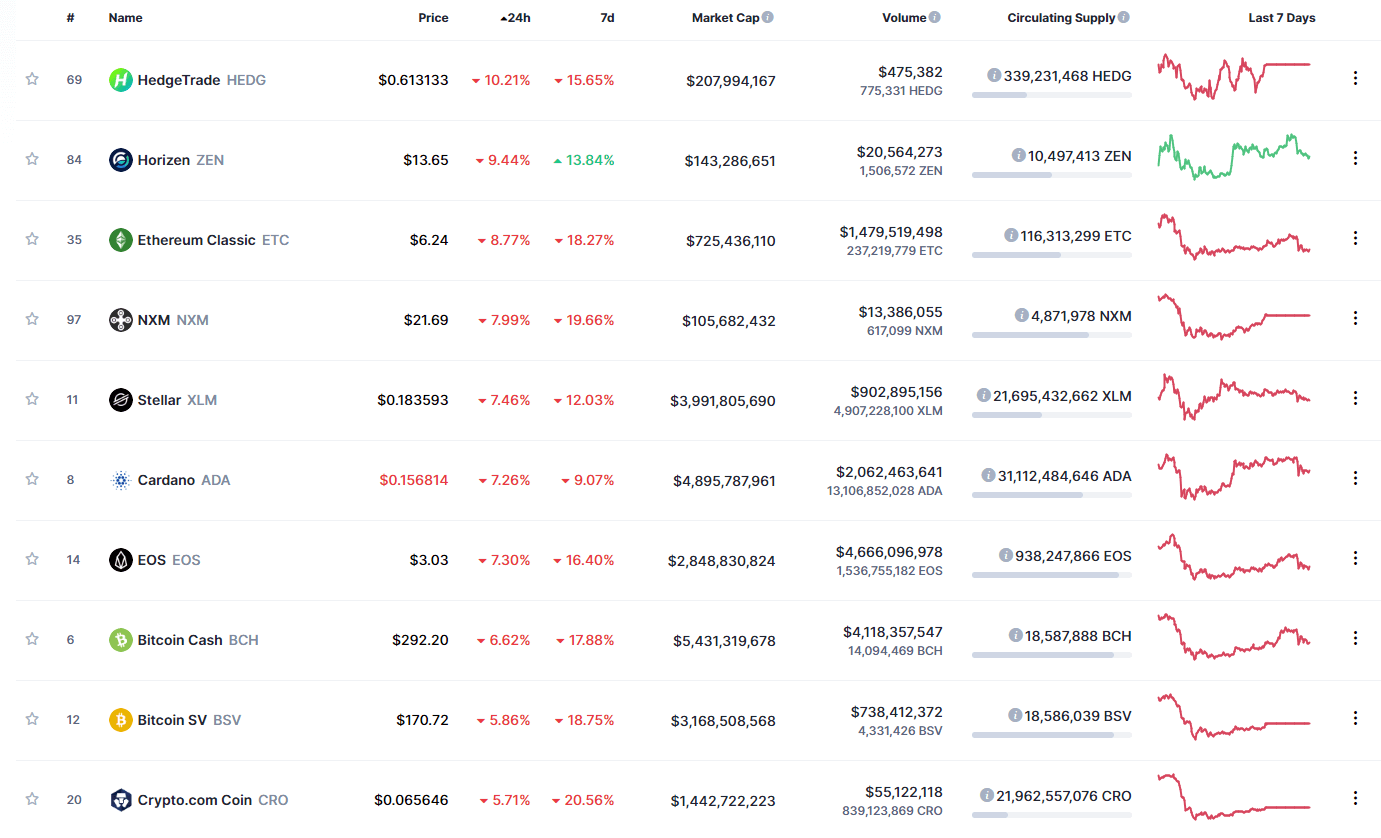

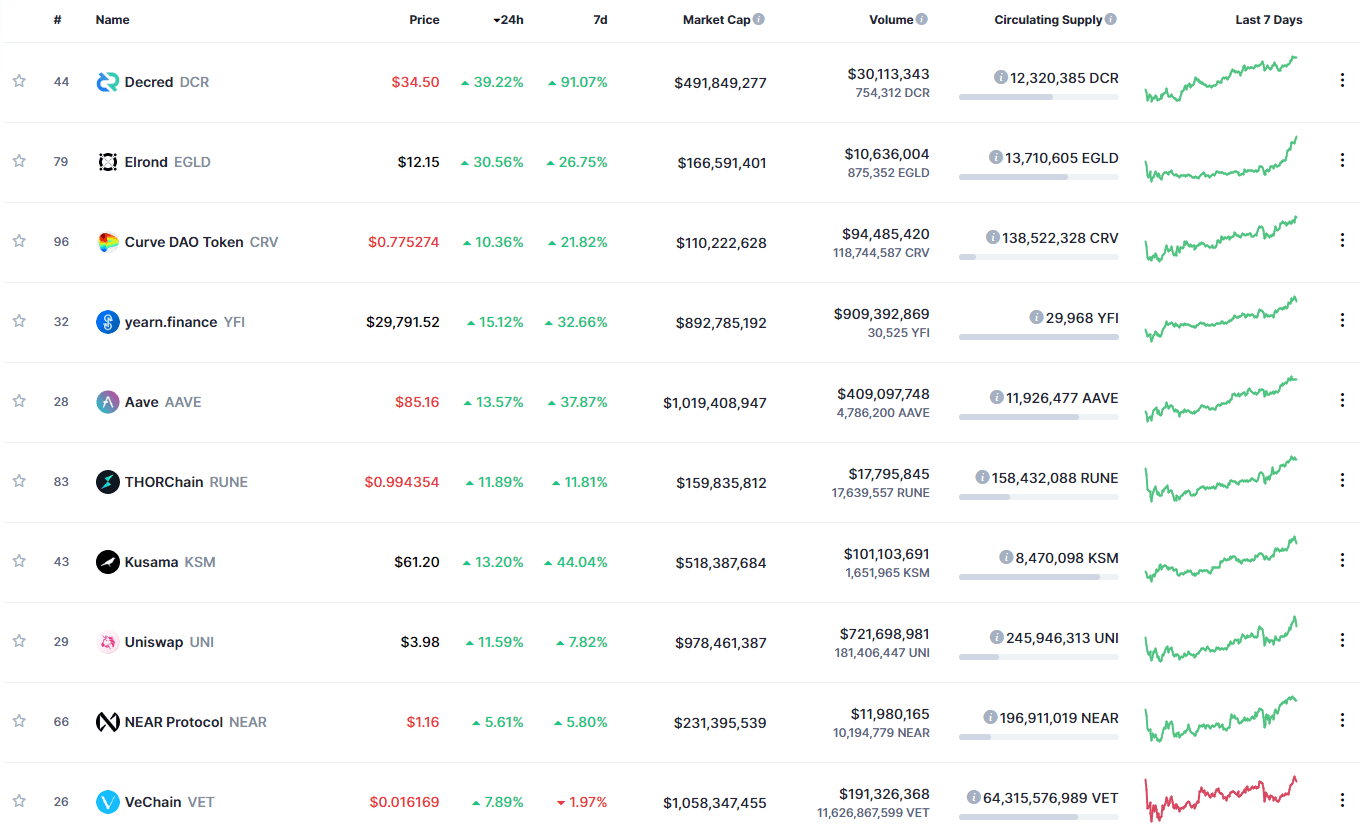

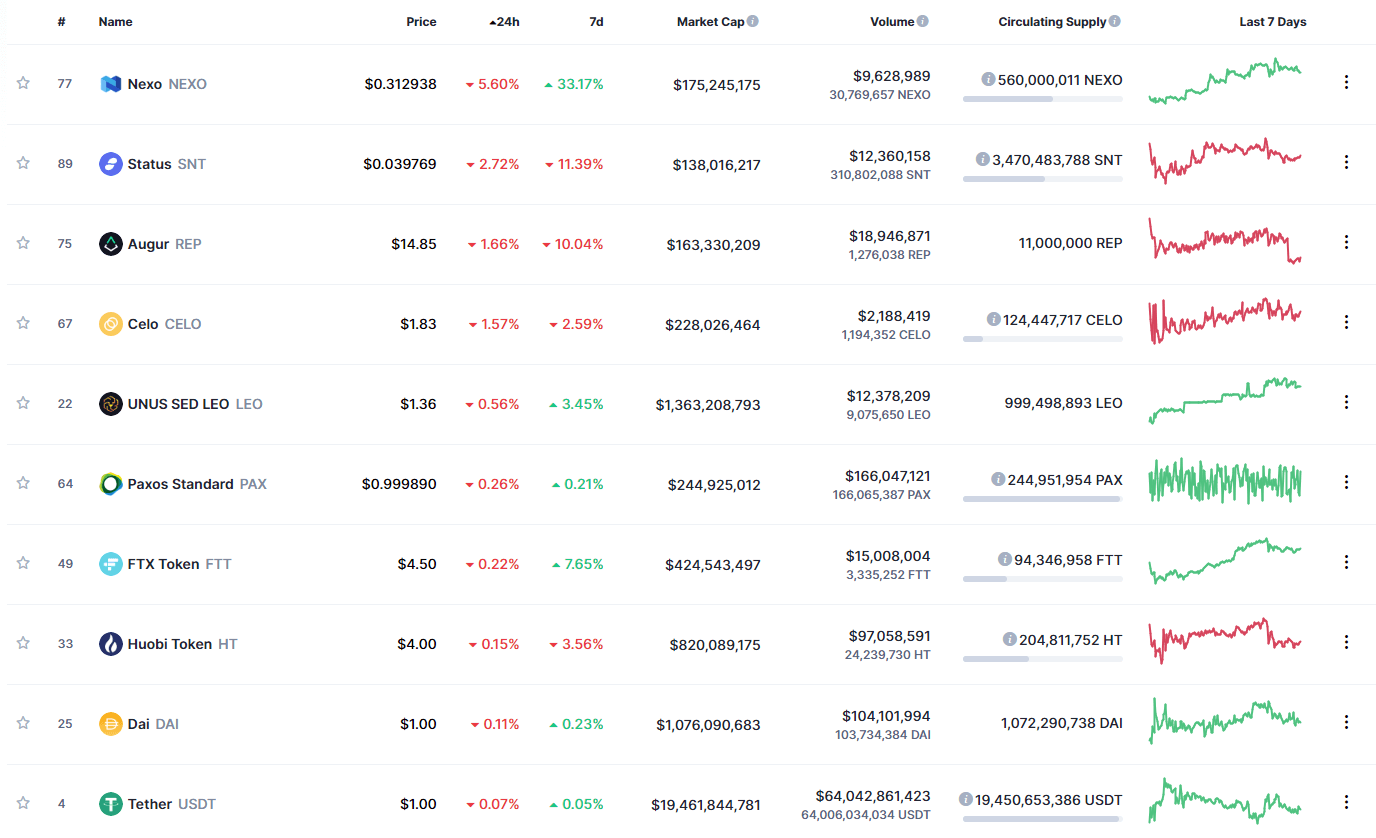

Fundamental Analysis: when we want to invest in a listed company we analyze its strengths, weaknesses, business model, certain ratios, etc. To invest in cryptocurrencies we have to do something similar so we have to familiarize ourselves with certain ratios, metrics, and factors to analyze in any project in which we are interested.

Be informed about the latest news, both those directly related to cryptocurrencies and others at the macro level that can also influence the price.

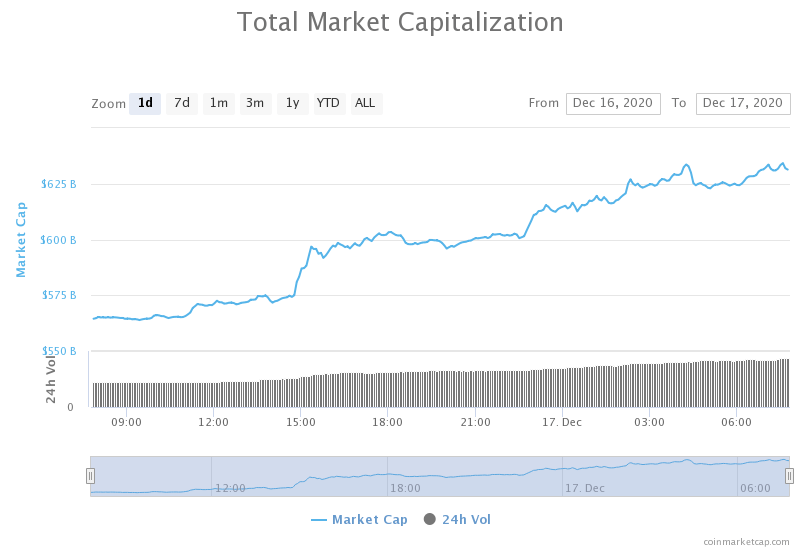

Focus on Long-Term Investment

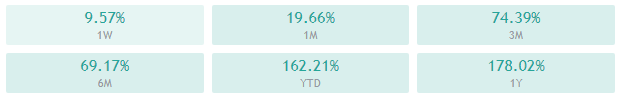

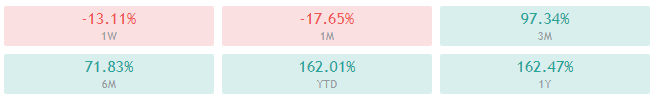

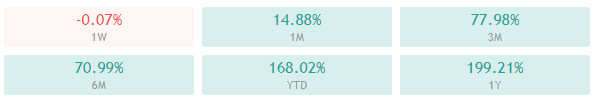

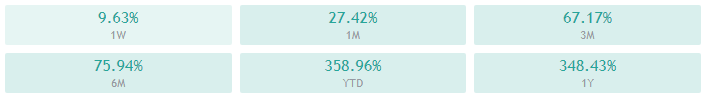

A mistake I made for quite some time was to be too attentive to the short term and not to have a broader view of the market. With few exceptions, I think we should forget about short-term trading or intraday trading and it is better to focus on the medium and long term. The idea is to try to make profits in the big phases of climbs and to get away in periods of great noise and uncertainty. We must try to follow much of the trend when a new upward cycle begins.

In addition, focusing on longer timeframes reduces emotional and irrational reactions to the short term that most people are victims of when investing in any market. To sum up the ideas a bit, it is not necessary to open operations with cryptocurrencies every day or week, as it would almost certainly lead to losses. You will probably make 80-90% of your earnings during bullish cycles so for the rest of the time a good idea is to focus on preserving capital.

Worry About Safety

Most of you may have heard stories about stolen bitcoins, hacked exchanges, lost private keys, … etc. When all there is money on the table is important to take all possible security measures. It is often claimed that we are our own bank when we use Bitcoin and cryptocurrencies, this tells us that we are the only ones responsible for protecting our capital.

Some of the things you can do to keep your investments safe are:

Activate the dual authentication factor: Enabling 2FA (dual authentication factor) is the first thing to do immediately after opening an account in an online exchange or purse where your cryptocurrencies are. All exchanges have this option and this way you make sure that if your login and passwords are compromised, theoretically no person has the possibility to enter your account unless they also enter the 6-digit code that only you have the power to access on your phone. Also, enable it in your email accounts.

If possible, avoid 2FA via SMS and use a single-use password application such as Google Authenticator that supports a multitude of exchanges and applications such as Gmail, Dropbox, Coinbase, Bitstamp, Binance, etc.

Protect your passwords: Use long, as secure as possible and different passwords on each of the pages or apps you sign up for. As it can be a bit cumbersome every time you want to access them, use a password manager. These programs allow you to store a lot of passwords in an encrypted database, so you only have to memorize one key to access all the others. Some recommended password managers are LastPass or KeePass.

Use purses or wallets for cryptocurrencies: This point and the previous one are related but are of such importance that I prefer to dedicate a single paragraph to it. A wallet (also called a wallet) is the place where we keep our cryptocurrencies and allow us to send and receive them. Although blockchain technology is very secure, exchanges or exchange houses are a very weak link within the ecosystem and the number of hacks that have occurred since the birth of Bitcoin has been countless.

Among some of the most important, we can highlight the hack of the exchange platform MT.Gox in February 2014 in which a total of approximately 744,408 BTC were stolen or the Cryptopia exchange hack in January 2019 in which approximately $16 million was stolen.

For all the above, avoid keeping your cryptocurrencies in exchanges and keep them as safe as possible using purses to keep your investments safe.

Don’t Invest Money You’re Not Willing to Lose

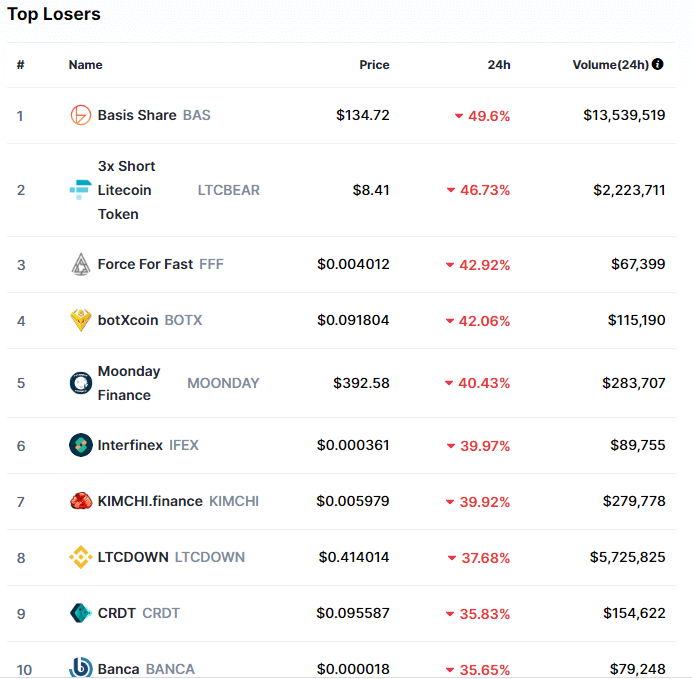

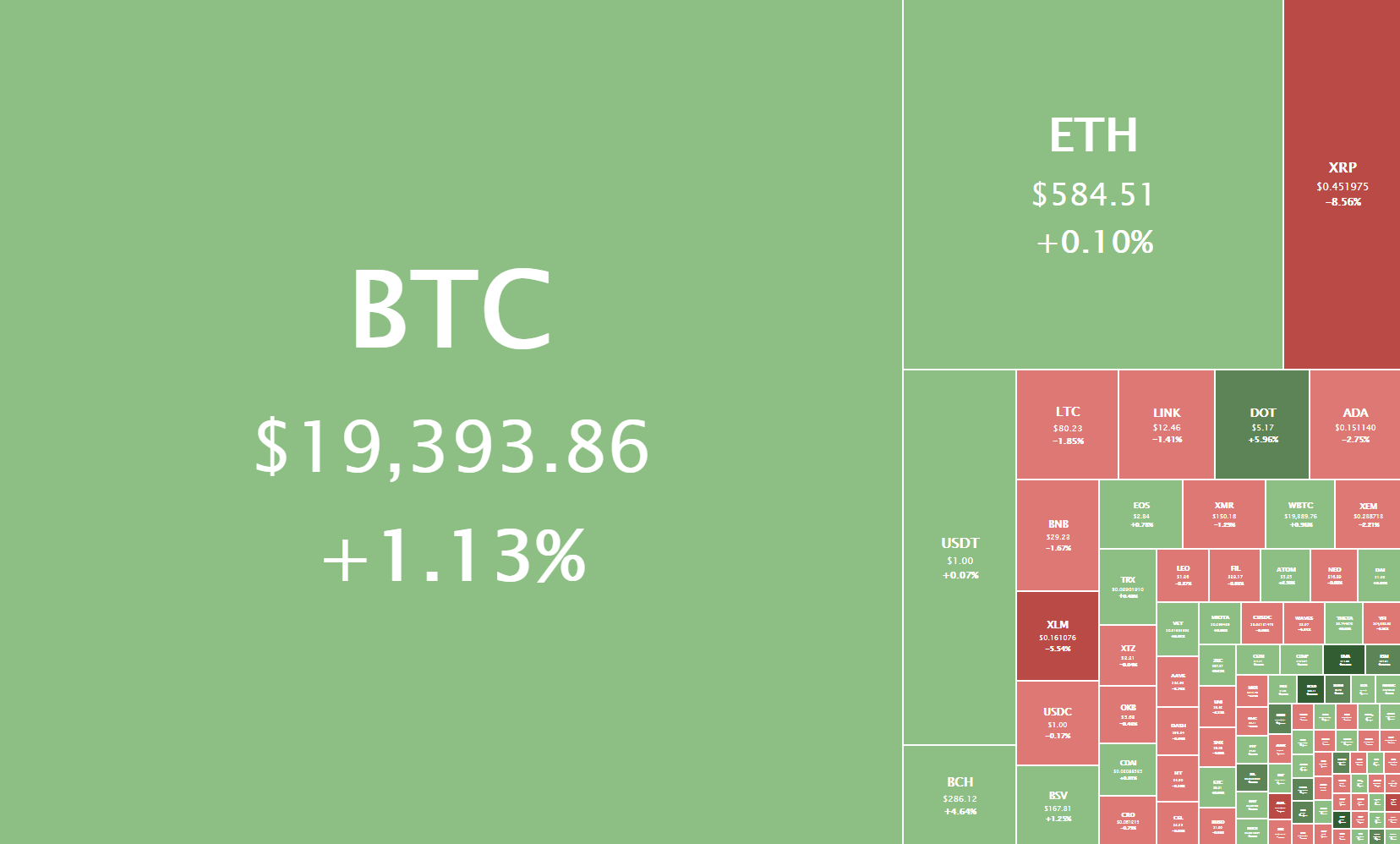

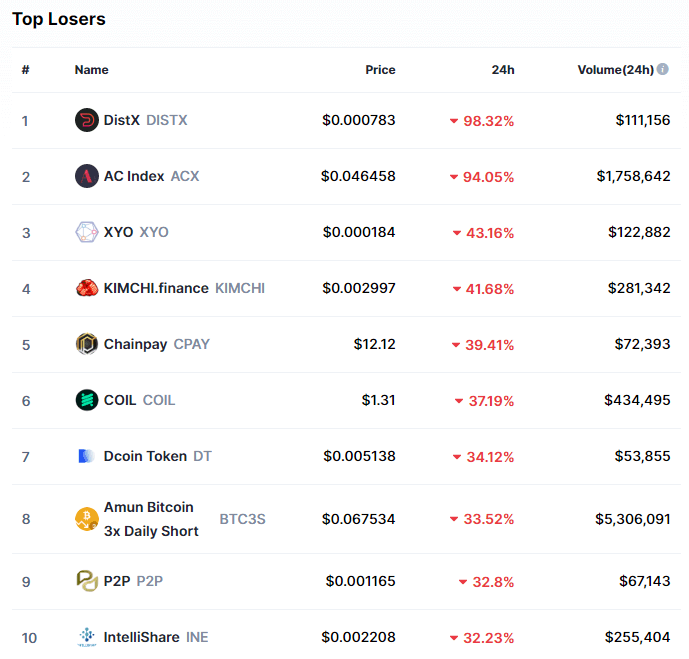

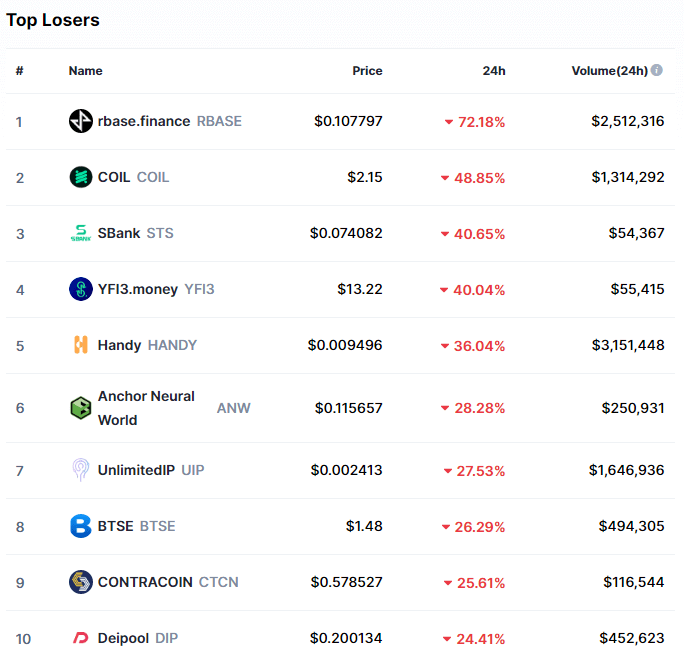

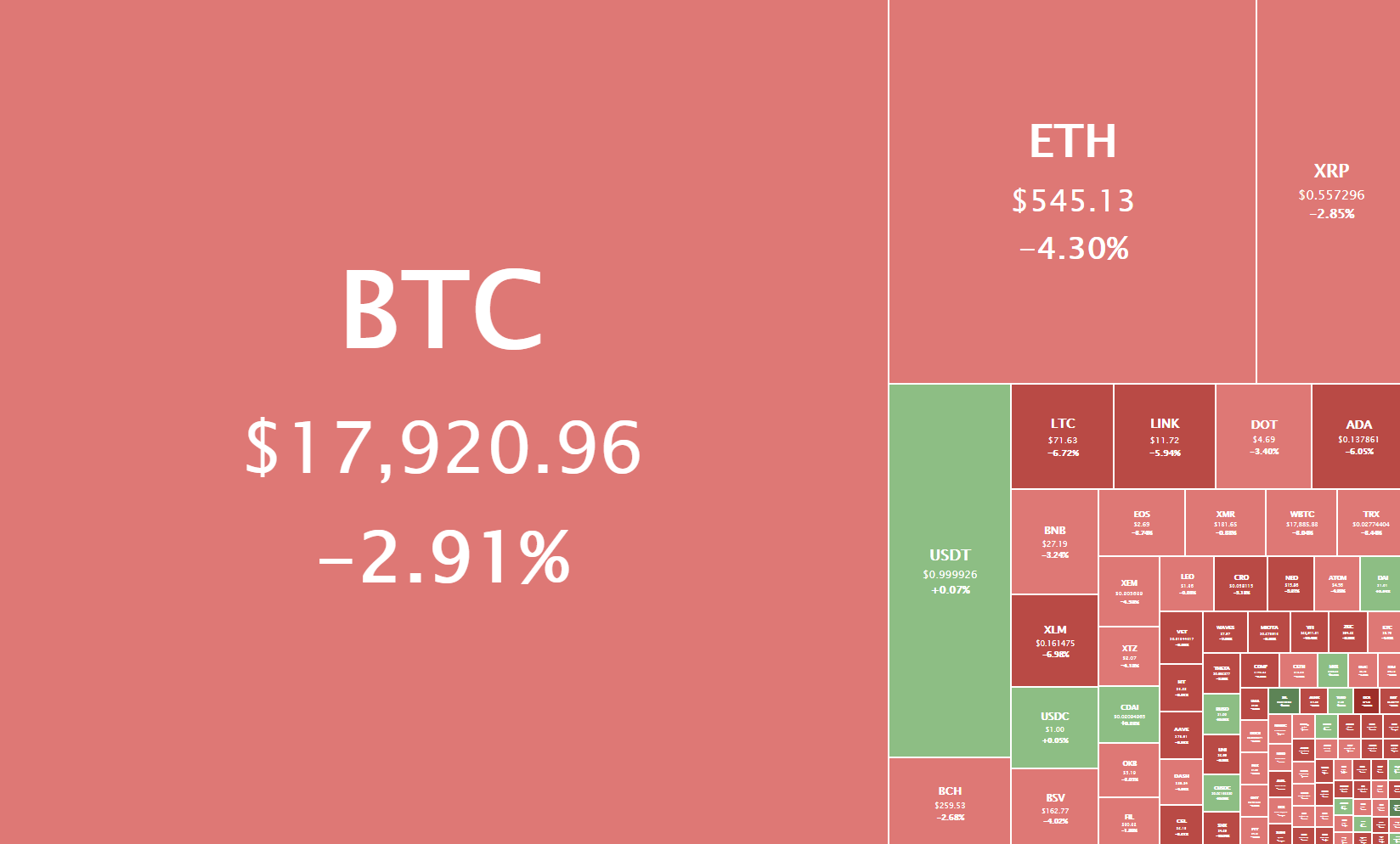

It’s a super-repeated phrase in the investment world, but it’s still a common mistake. During the last bearish cycle, Bitcoin lost approximately 84% of its value. Many other cryptocurrencies suffered much greater losses, not counting those that have disappeared along the way losing many people all the money invested.

Even if you have an investment plan, adequate risk management and you are able to manage your positions correctly, there are still other risks inherent to the investment in cryptocurrencies, such as those discussed in previous sections related to security, make you lose all your capital.

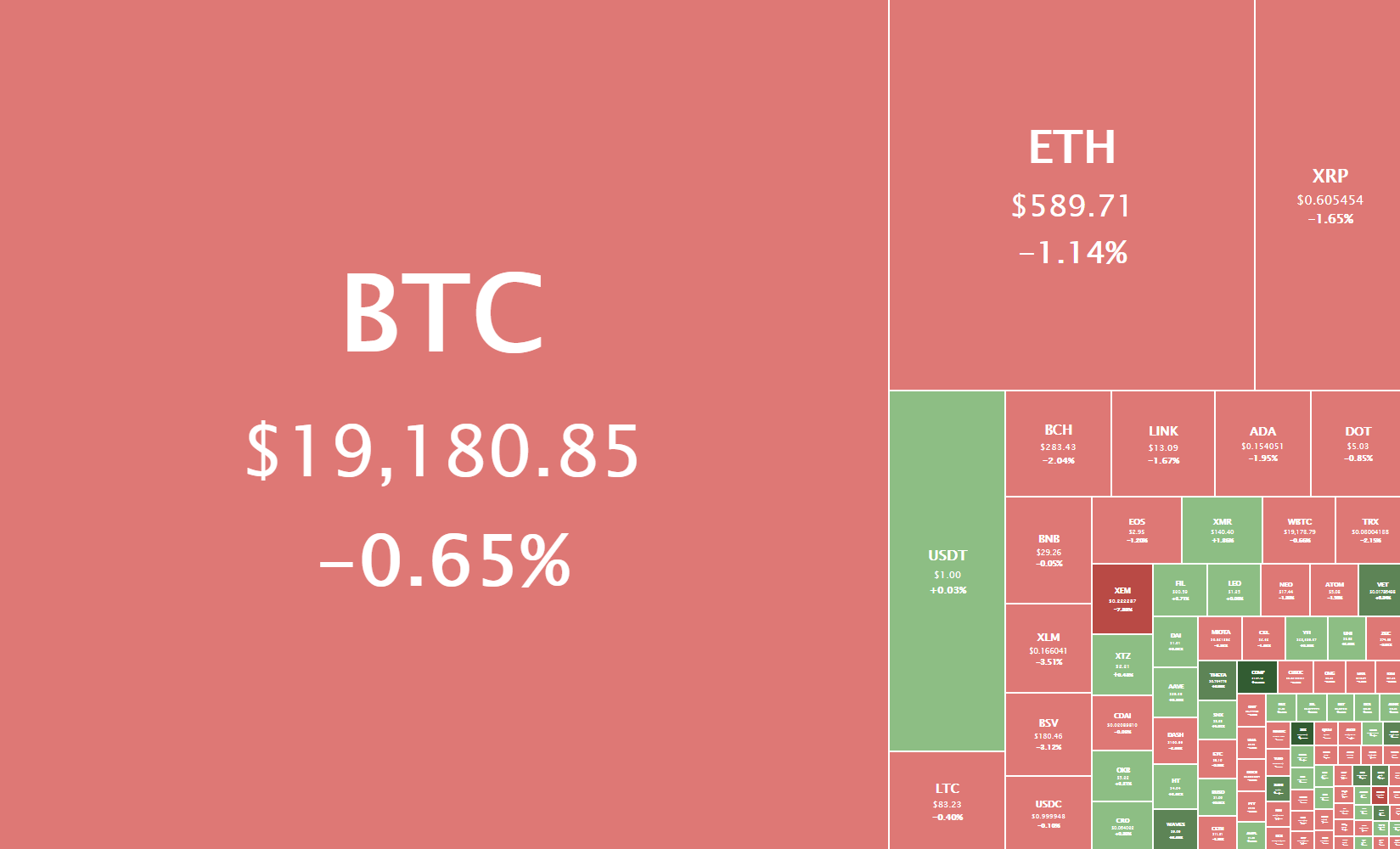

Therefore, as a starting point when investing in Bitcoin, Ethereum, Ripple, Litecoin or any other crypto is that you’re only willing to invest the capital you are willing to lose. It must be money you don’t need in your day to day so that if you lose it doesn’t affect your life.

Develop a Critical Vision

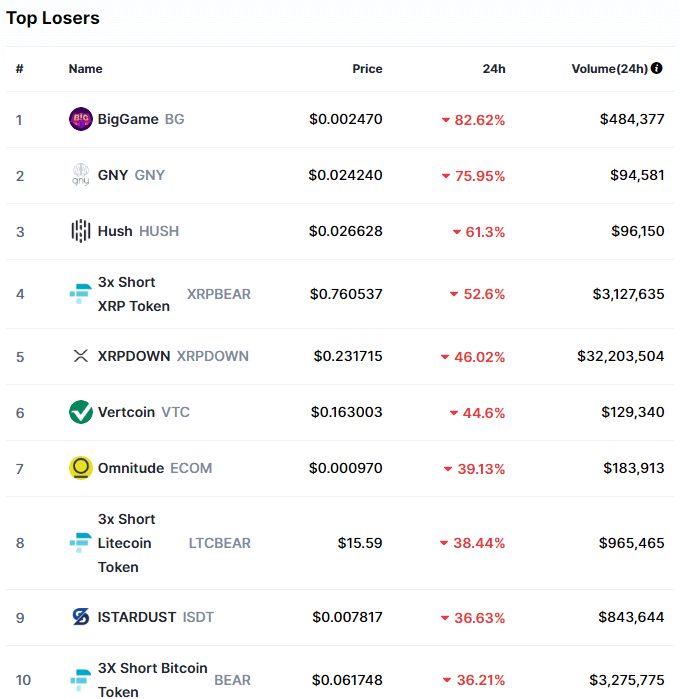

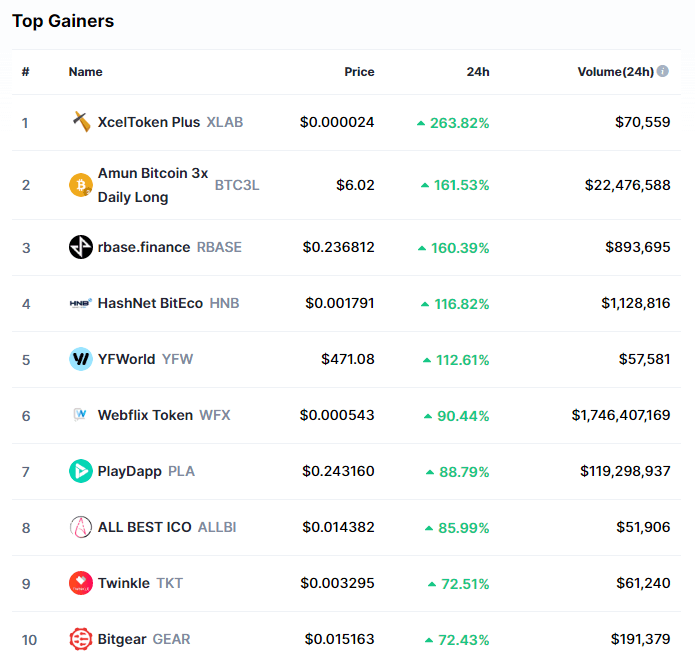

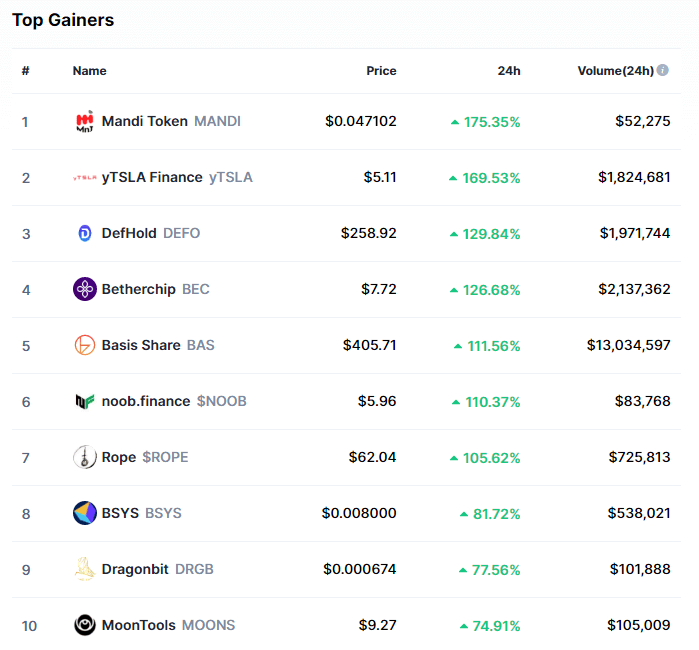

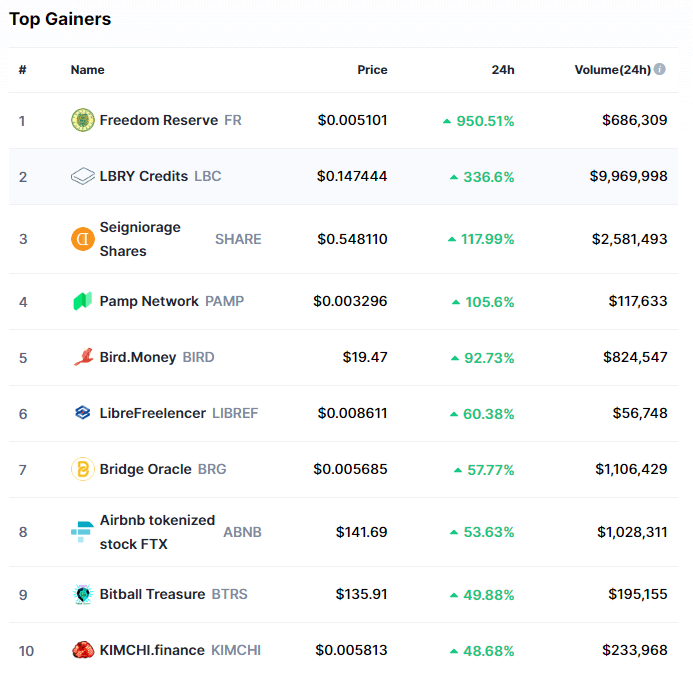

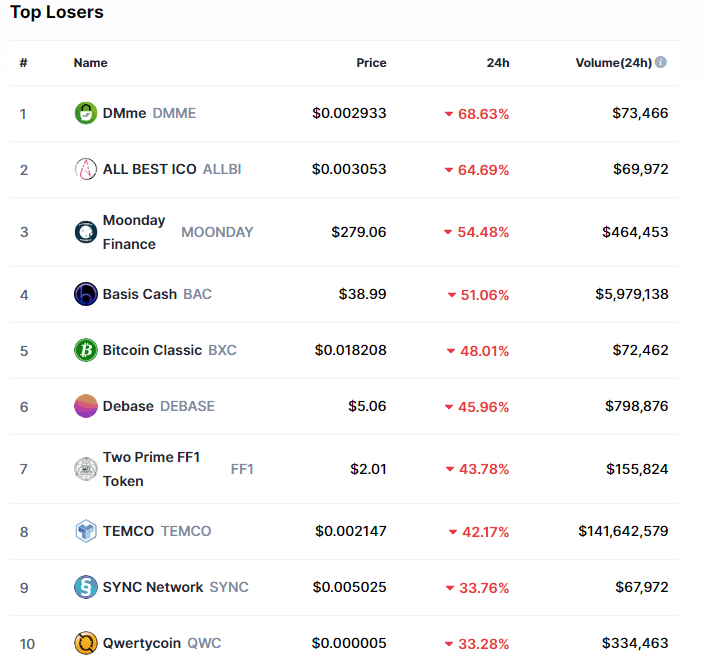

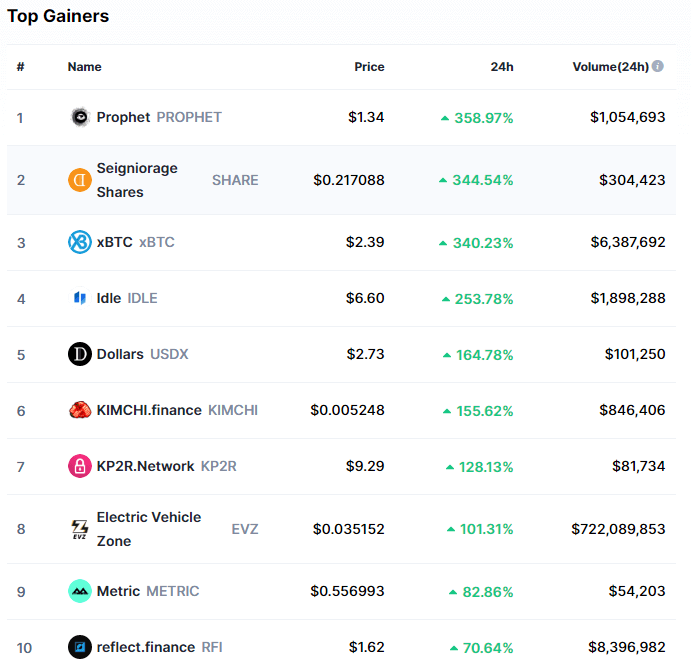

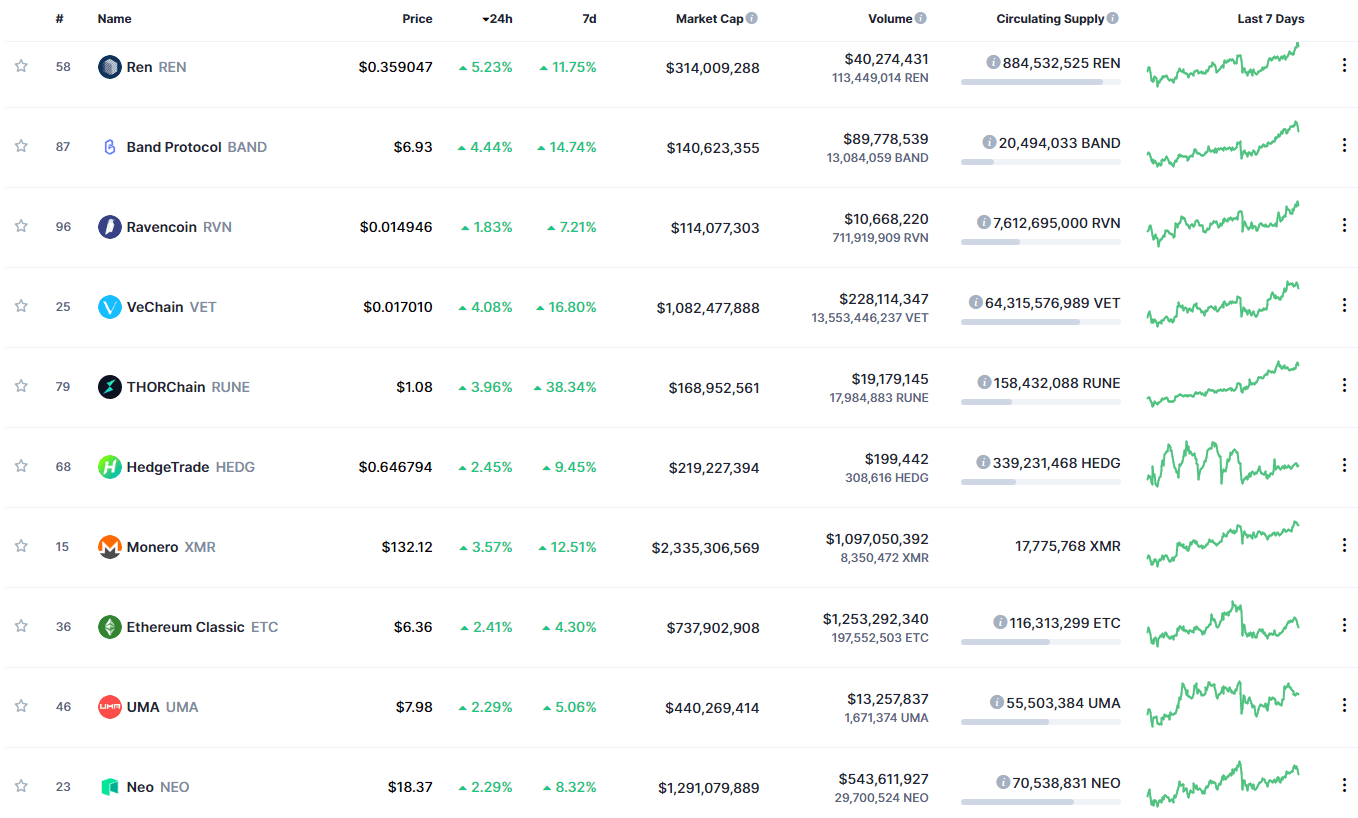

One of the most widely used abbreviations in the crypto world is DYOR, which comes from the English «Do your own research» which means that you must do your own research before investing in a project. On the date I write this article, there are more than 2,000 cryptocurrencies and tokens on the market. Some are projects with great growth potential while others are destined to disappear or are simply scams. You may also find several hundred opinions on projects or predictions about the price of Bitcoin in the future on social networks.

For all the above my recommendations are:

-Be skeptical of information you may find in media such as blogs, RRSSs, or newspapers.

-Don’t invest your money based on other people’s opinions.

-Make your own analyses that support your investment decisions. So you will be solely responsible for your successes and mistakes and will be a good starting point to improve your strategies and make better decisions in the future.

-To analyze in depth a token or cryptocurrency and form your own opinion, some of the sources you can use are:

-Web page for project information, development roadmap, work team, etc.

-Read his whitepaper.

-Telegram groups/Discord.

-Social media, blog, and other communication channels

-Perform Google searches where you will find analysis and reviews.

All this information, together with the knowledge you acquire through learning, will lead you to ideas and thoughts of your own.

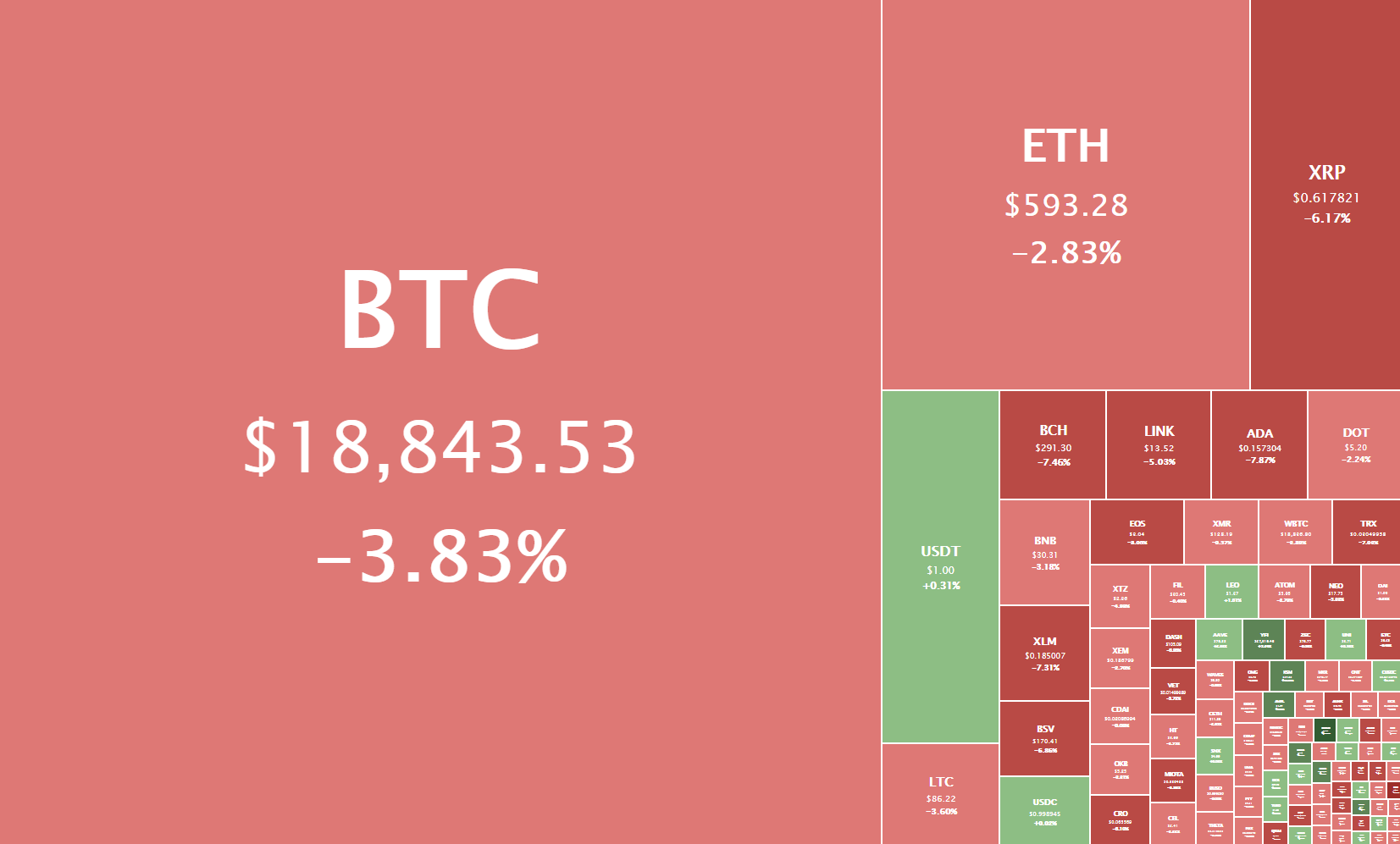

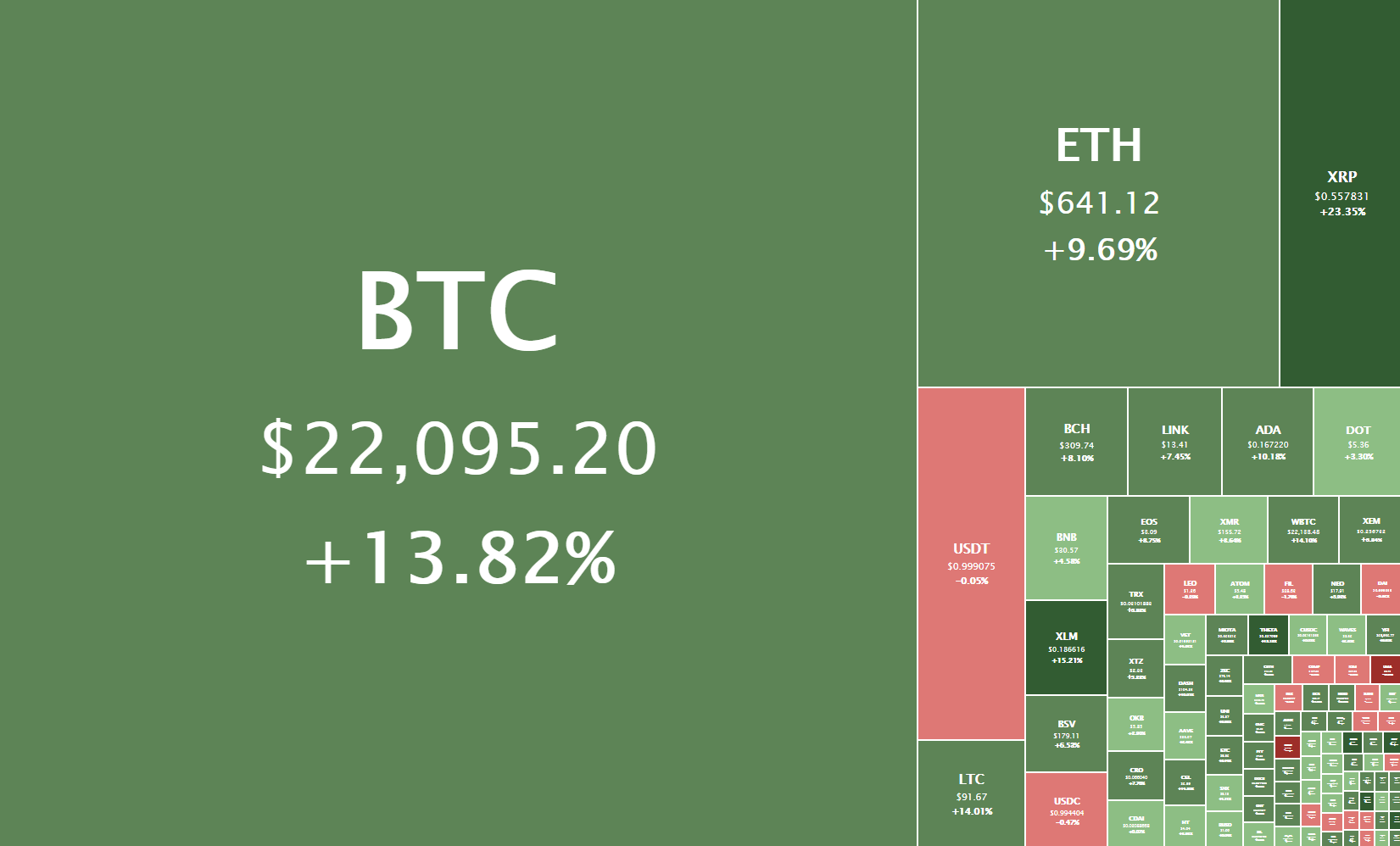

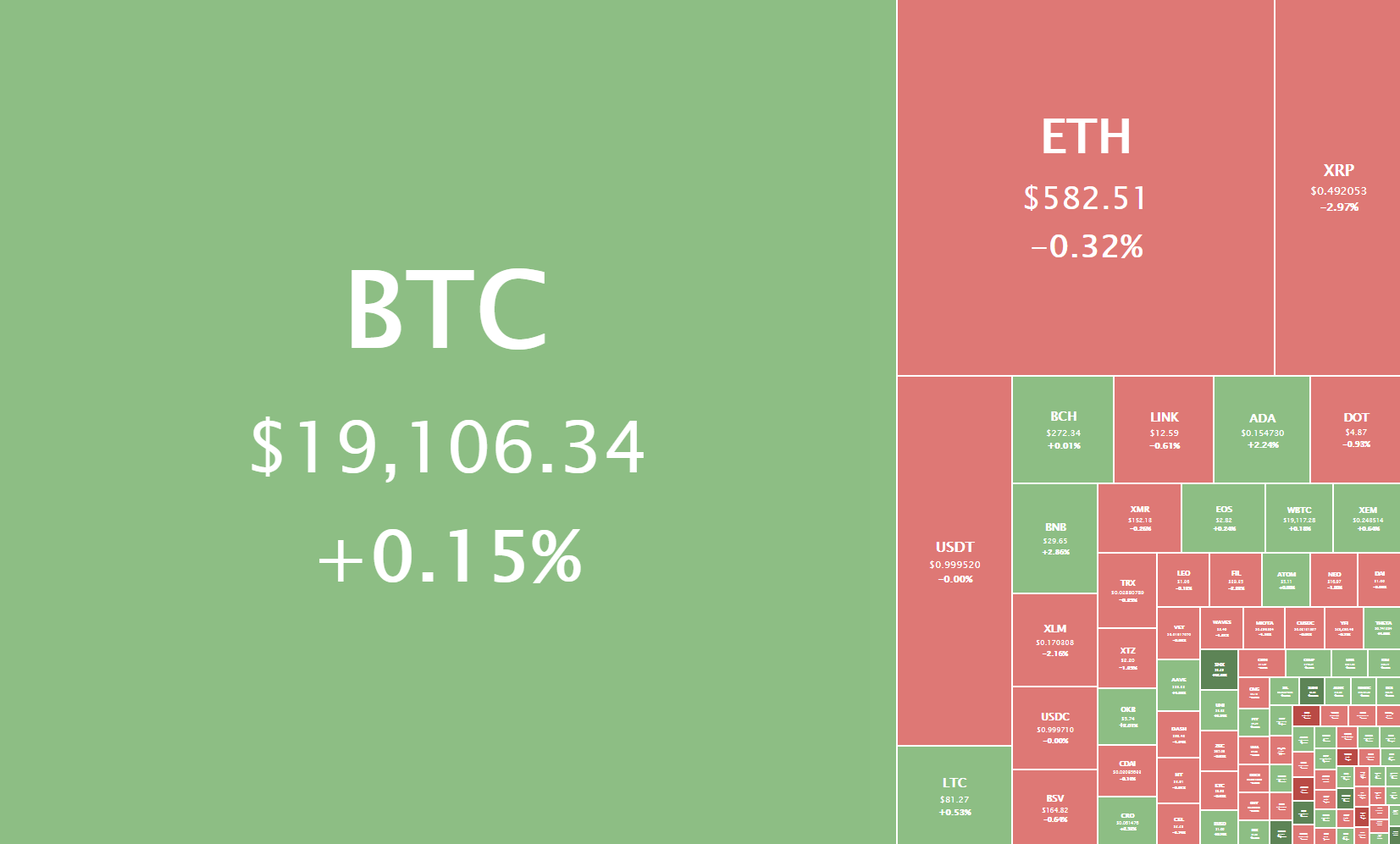

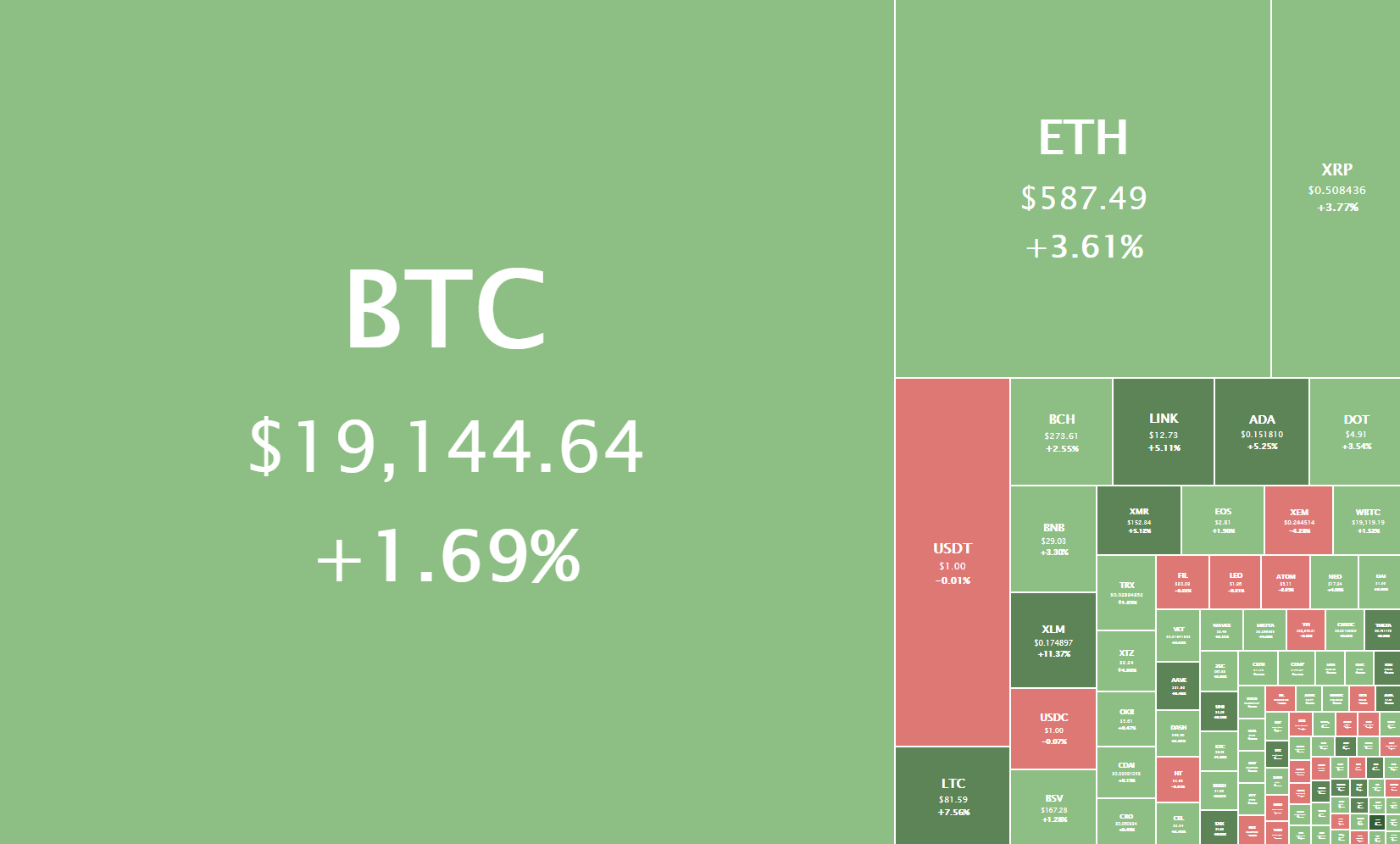

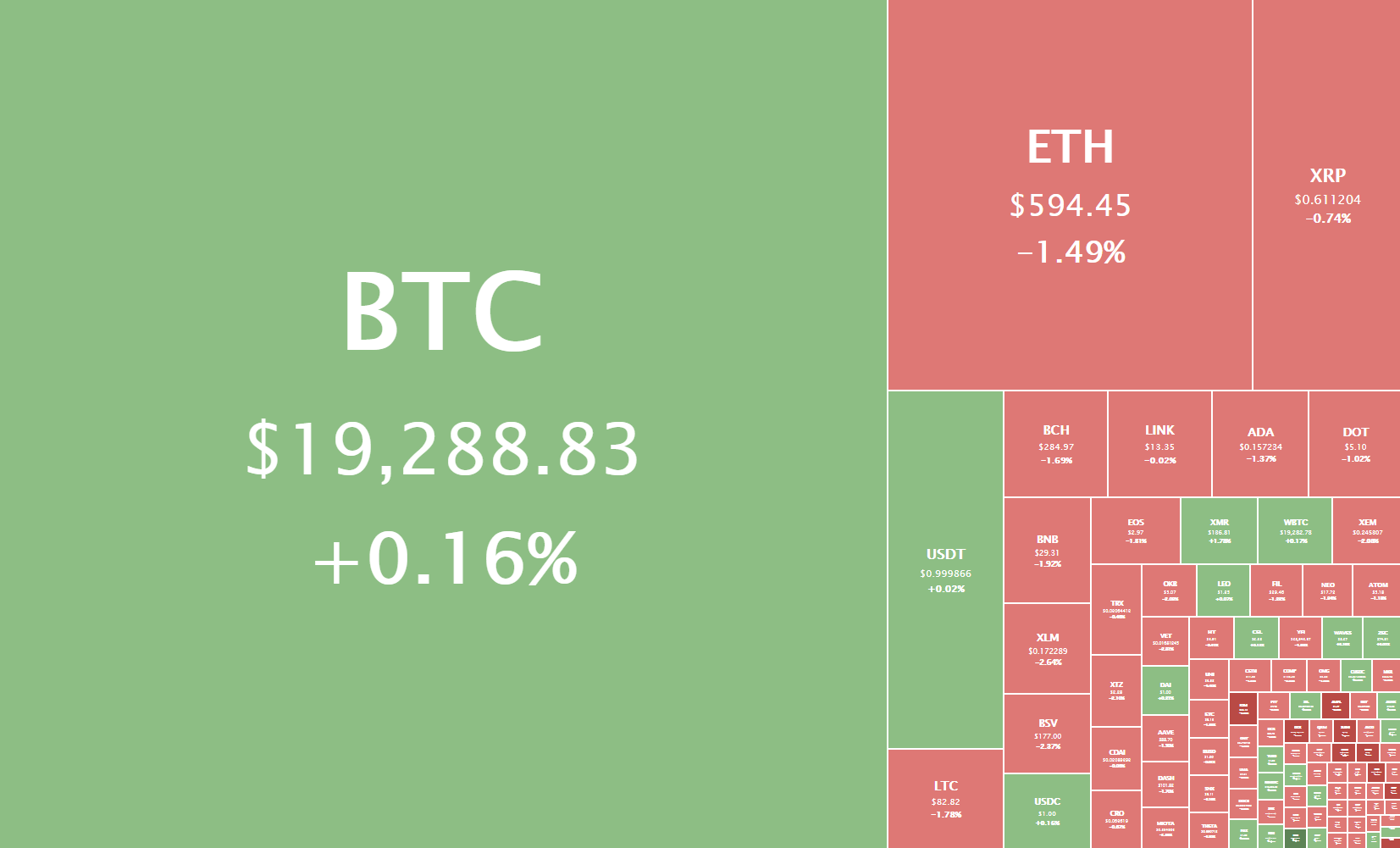

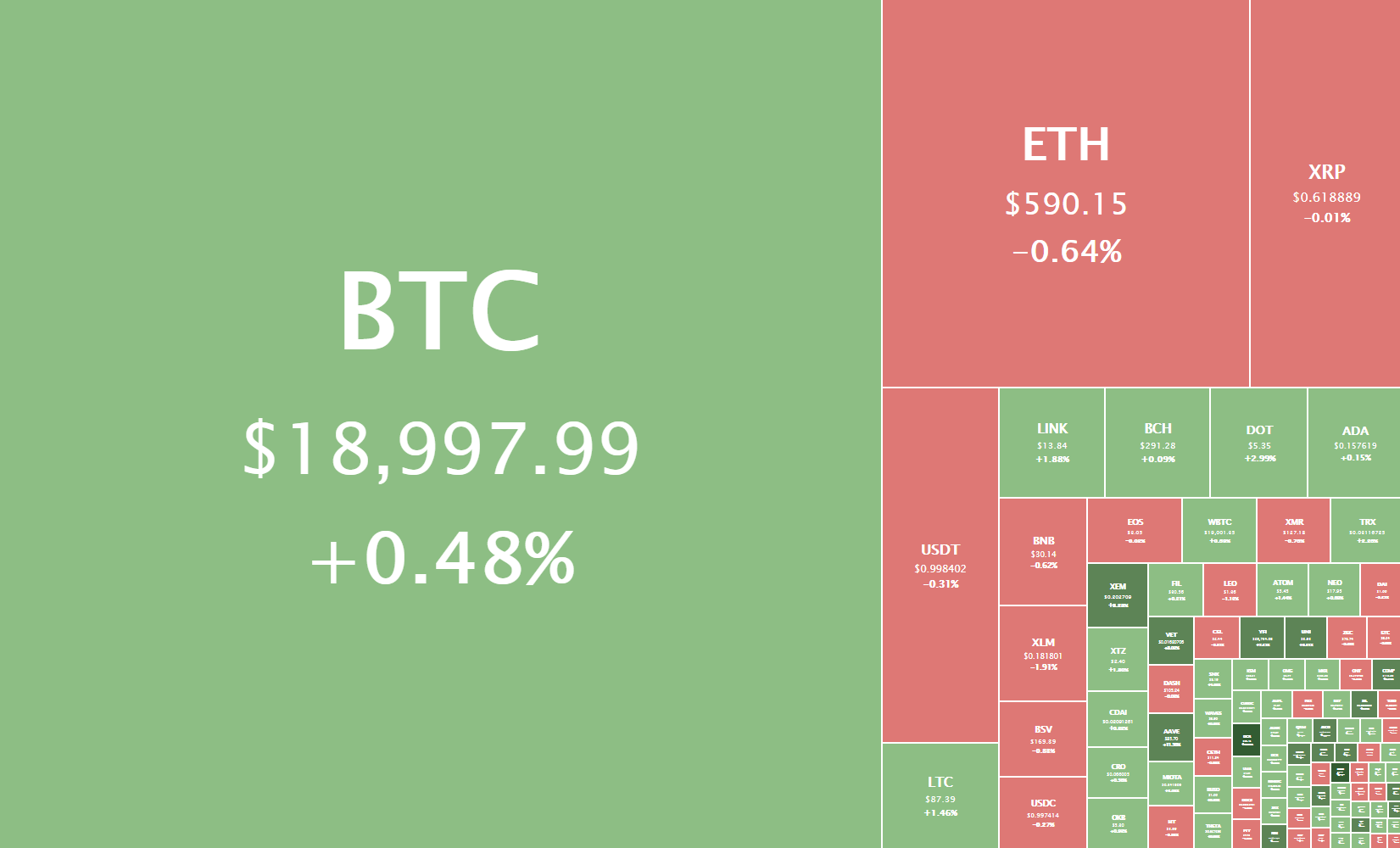

Bitcoin Is Tops

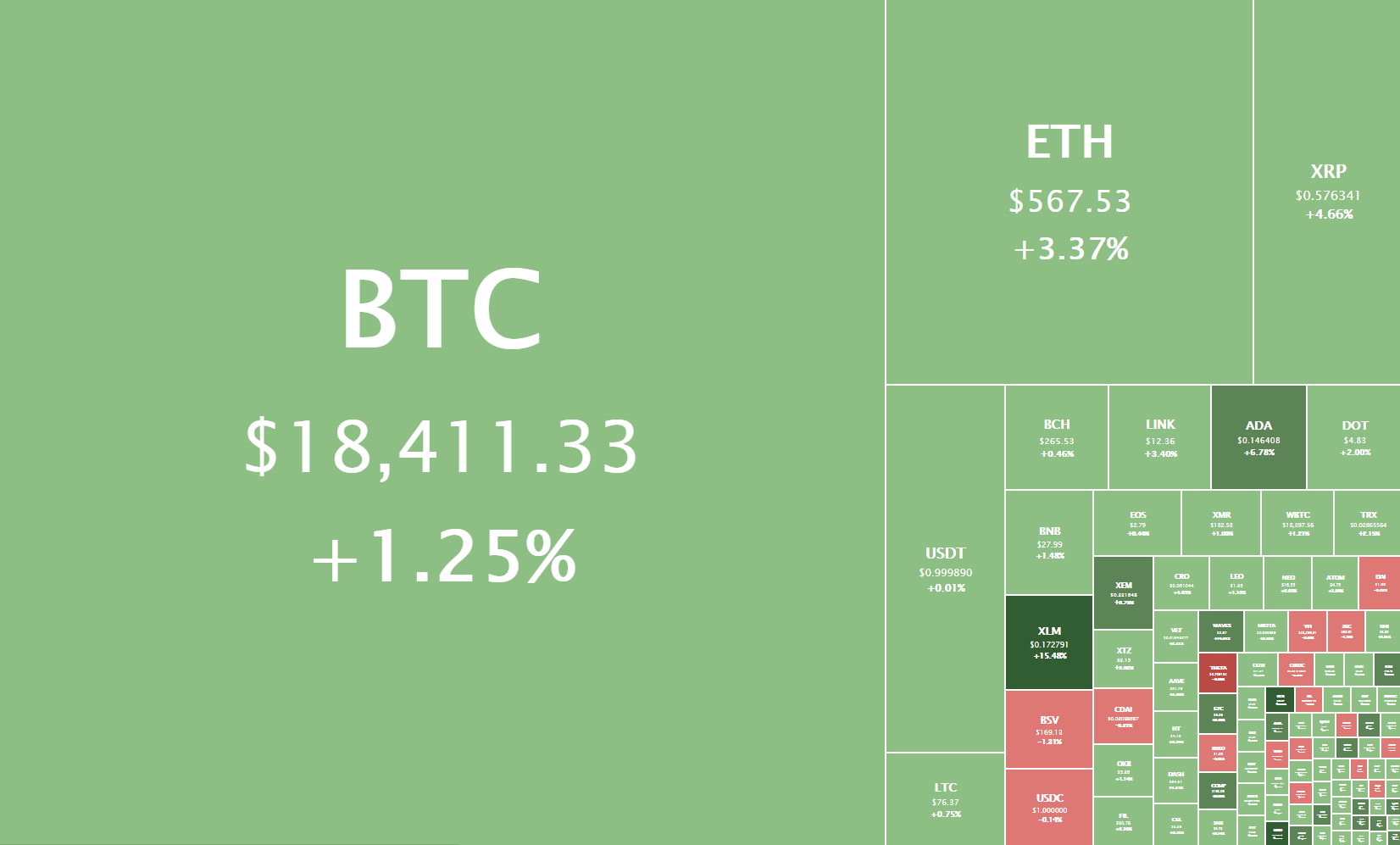

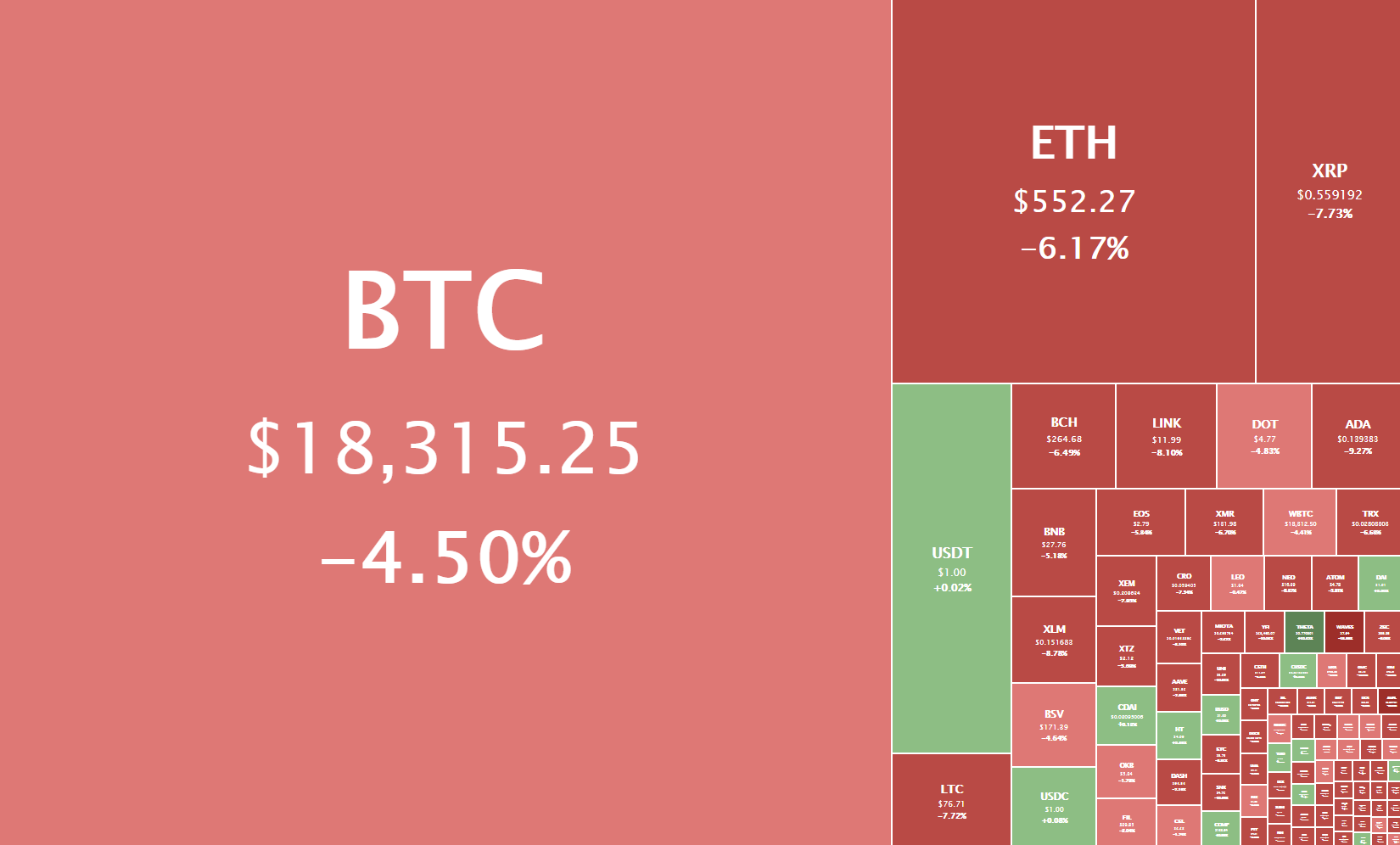

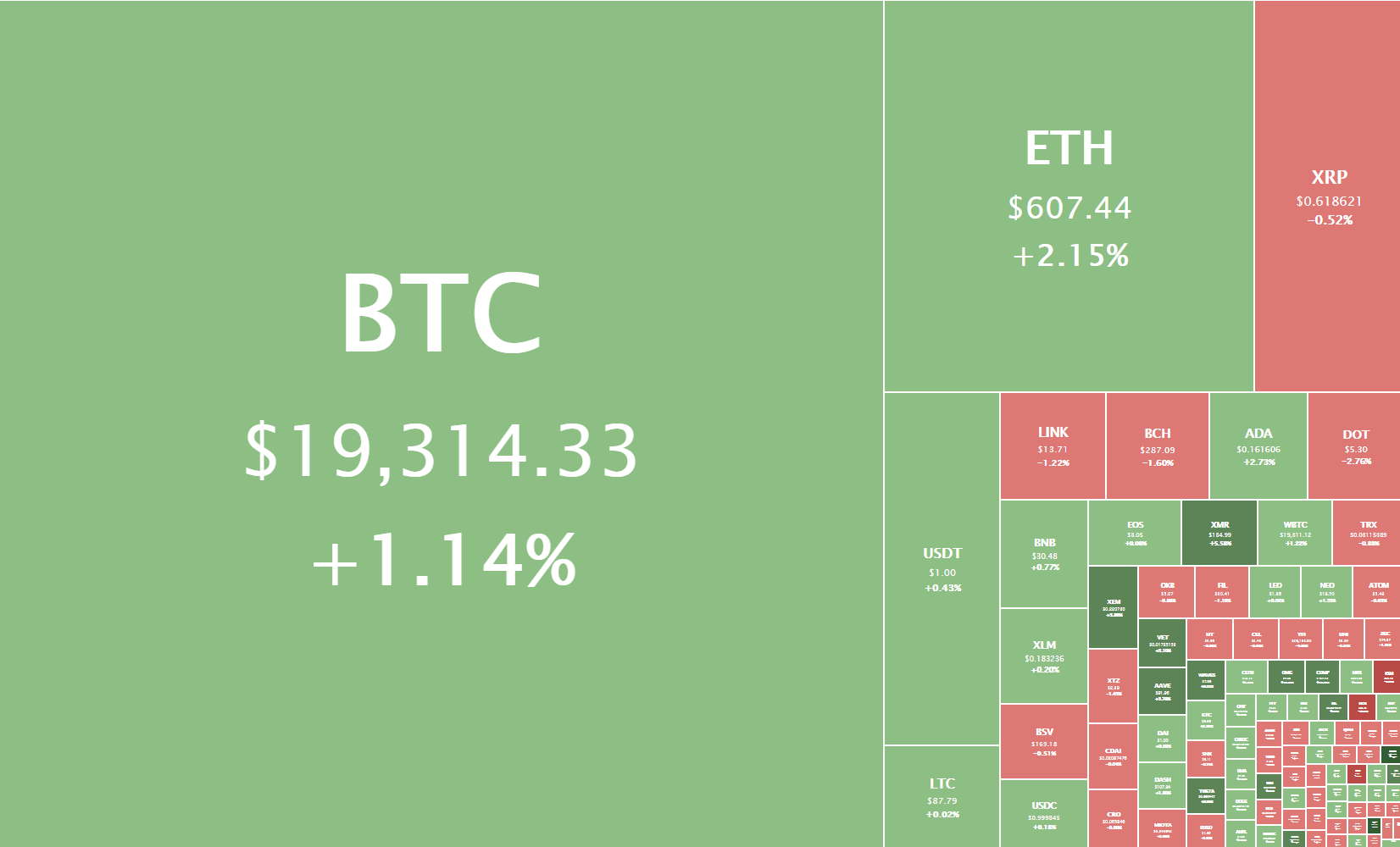

Although many competitors have emerged, Bitcoin remains the most important cryptocurrency due to:

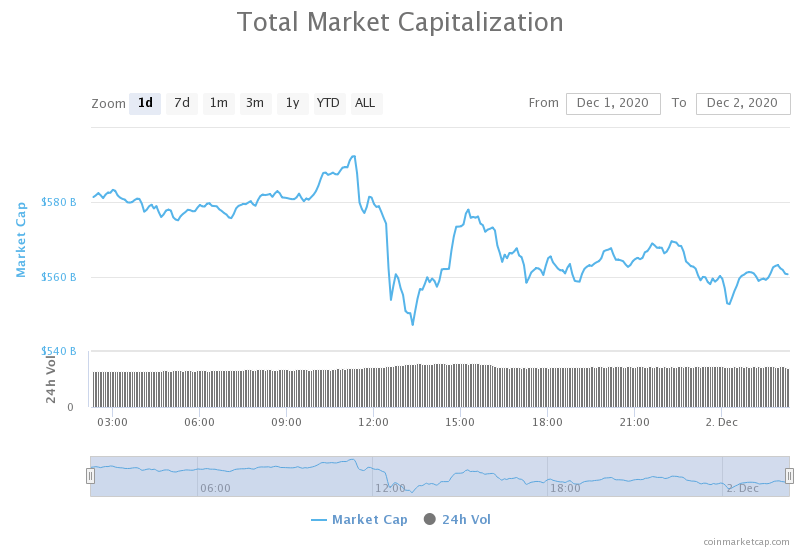

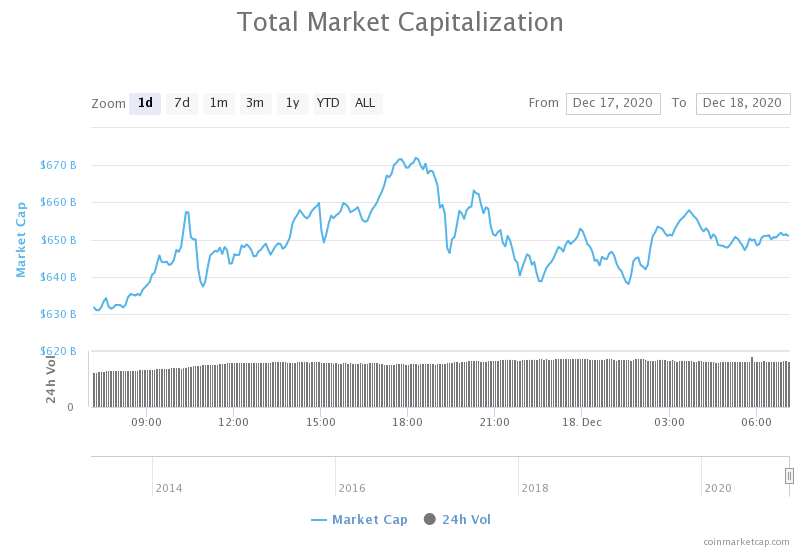

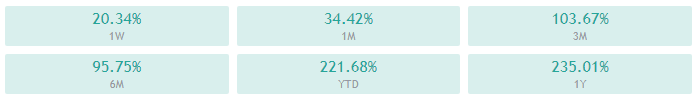

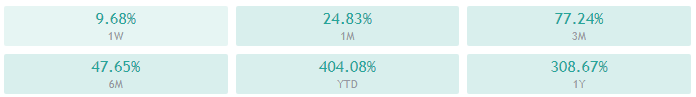

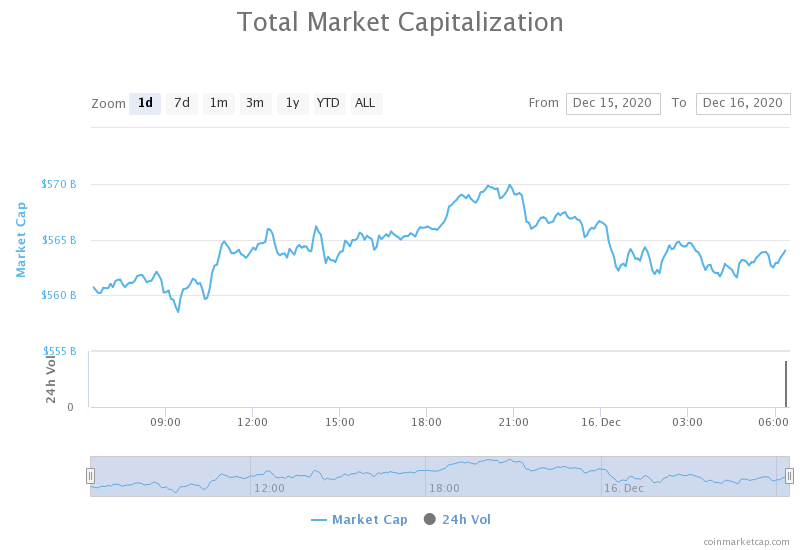

- Increased market capitalization

- Increased number of users

- Increased security of the network

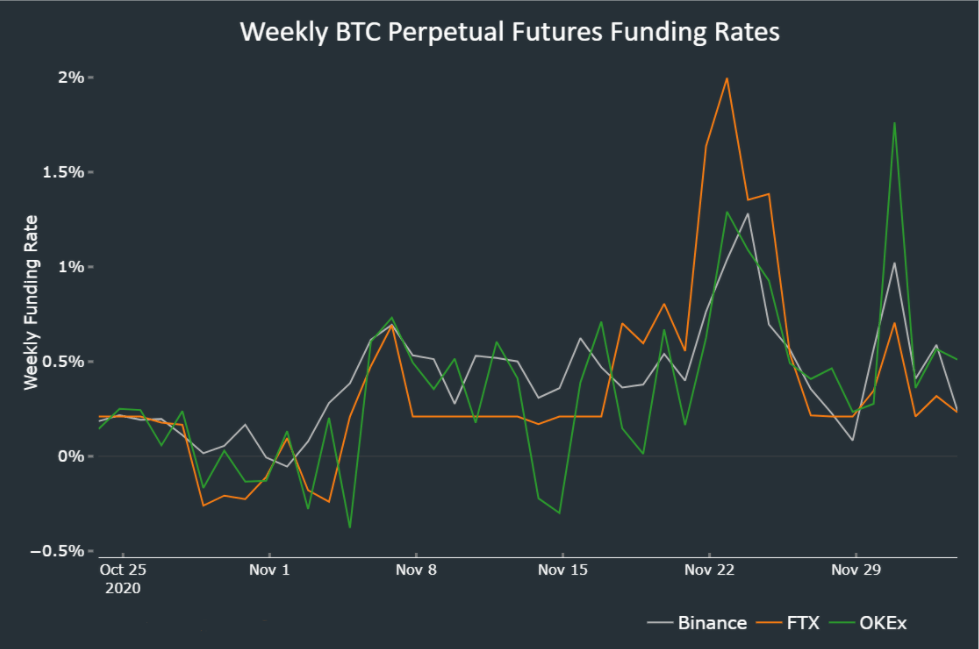

Greater liquidity: when investing, Bitcoin has more volume of trading in exchanges than the rest of cryptocurrencies and is also the first trading in the regulated futures market. In addition, it continues to await the approval of an ETF that would allow a large number of investors to invest in Bitcoin without having to worry about the purchase and storage process as we do now.

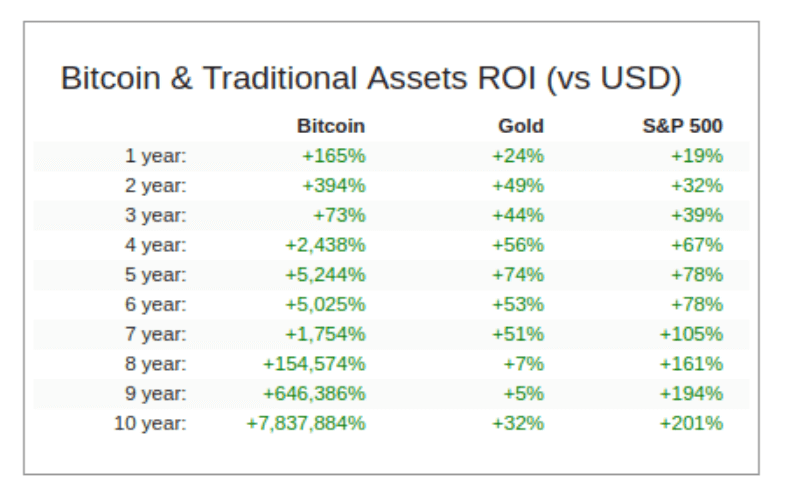

Bitcoin as a reserve of value: some characteristics such as its scarcity or that it has no correlation with any other financial asset makes it gradually start to be considered as a possible reserve of value such as GOLD. According to the words of Jerome Powell, President of the Federal Reserve of the United States on July 11 «Bitcoin is a speculative reserve of value just like Gold». Considering from whom this statement comes must be taken into account. For all these reasons, and also for others, I consider Bitcoin the cryptocurrency with the greatest projection for the future.

For this reason:

-I always have bitcoin as a reference point when analyzing the market and planning the strategy to follow.

-When I invest in cryptocurrencies, I always maintain a high percentage in BTC as it usually has a good performance even though at certain times some altcoins may have higher returns.

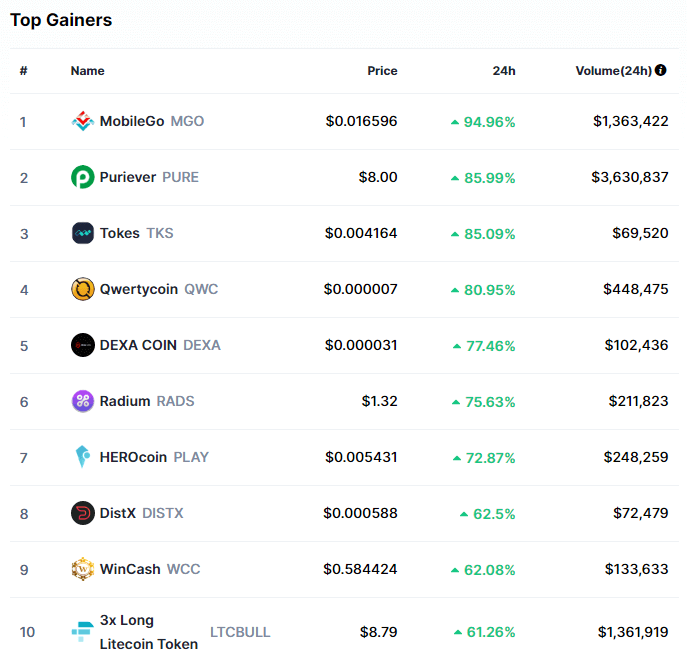

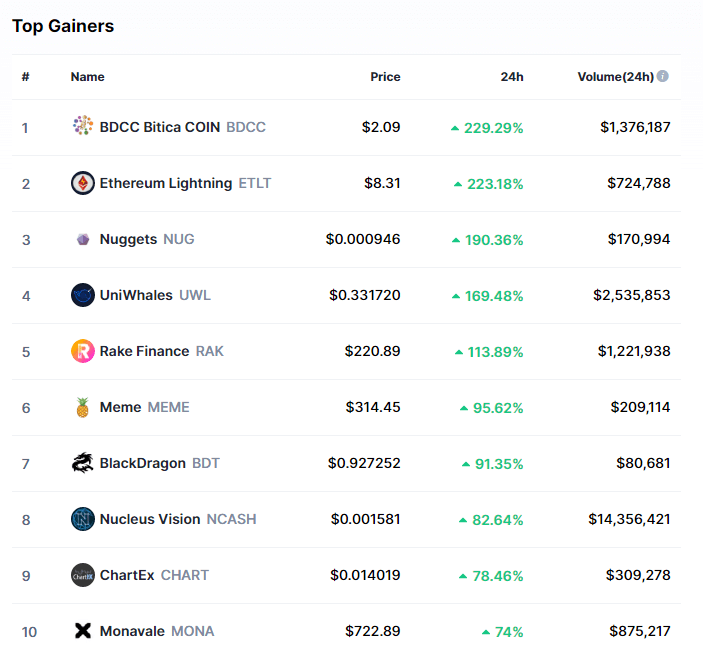

FOMO: Watch Your Emotions

Some technologies may be new, but people’s behavior is old. Markets from the beginning are largely driven by emotions and the strongest are fear and greed. The expression «FOMO» (fear of missing out) whose translation is something like fear of missing something, refers to the emotions mentioned above and that lead us to make wrong decisions.

Very often, when a cryptocurrency in which we want to invest begins to increase its price quickly, we are tempted to enter for fear of staying outside and not making money. You have to avoid buying by chasing the price in this way as many times at the time of buying, the price will start to correct and we will get caught in losses.

As a significant example, we can think of many people in December 2017 entering into Bitcoin highs around $20,000 guided by FOMO. What does this lead to? On the other hand, the big investors were selling the Bitcoins that they bought at lower prices, which later led to the price drop and the beginning of the bearish cycle in which many people were trapped.

The way to avoid being dragged by emotions is to create an investment plan and follow it. Let us not enter when the market is widespread when we should have done so earlier according to our investment plan.

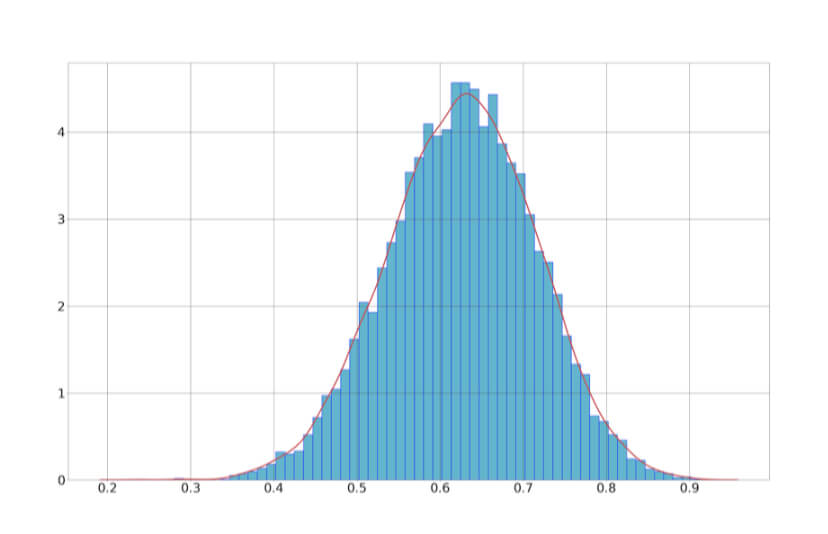

The cryptocurrency market is very unpredictable and volatile, so to start we can start with strategies such as DCA (Dollar Cost Averaging), in which we make purchases spaced in time. We will not capture the soils of the market, but we will get acceptable yields. On the other hand, being aware of our emotions and detecting in this case the feeling of thinking that we are going to stay out is a first step to correct it.

Conclusion

These have been the things that I consider most important when starting to invest in Bitcoin, Ethereum, Ripple, EOS, BNB, or any other cryptocurrency that you are interested in.

Appearing on episode 439 of the Anthony Pompliano’s Pomp

Appearing on episode 439 of the Anthony Pompliano’s Pomp

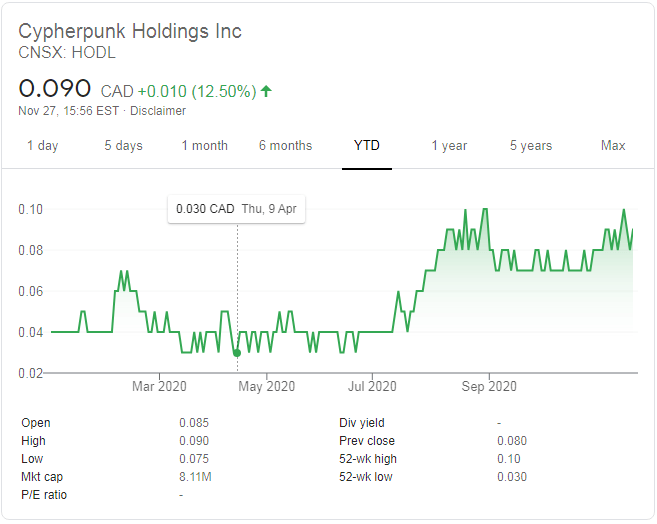

Cypherpunk Holdings is run by Antanas Guoga, also known as Tony G, a Lithuanian businessman, politician, and former professional-level poker player. He currently serves as an elected member of the Seimas, a legislative branch of the Lithuanian government. Prior to this, he served as a member of the European Parliament for Lithuania.

Cypherpunk Holdings is run by Antanas Guoga, also known as Tony G, a Lithuanian businessman, politician, and former professional-level poker player. He currently serves as an elected member of the Seimas, a legislative branch of the Lithuanian government. Prior to this, he served as a member of the European Parliament for Lithuania.