When we first visited the CedarFX website, we were instantly greeted with a message stating that the broker is offering 0% commissions and ultra-low spreads. With two different account types, a wide range of instruments to choose from, and high leverage options, this broker seemed to be offering something special from the very beginning. We also noticed a cool note on the website is that the broker plants 10 trees for every lot that is traded if you open an Eco Account. Still, you can’t judge a broker by its homepage, so we decided to do some investigative work to find out if these claims are true, or if there are hidden disadvantages beneath the surface.

Account Types

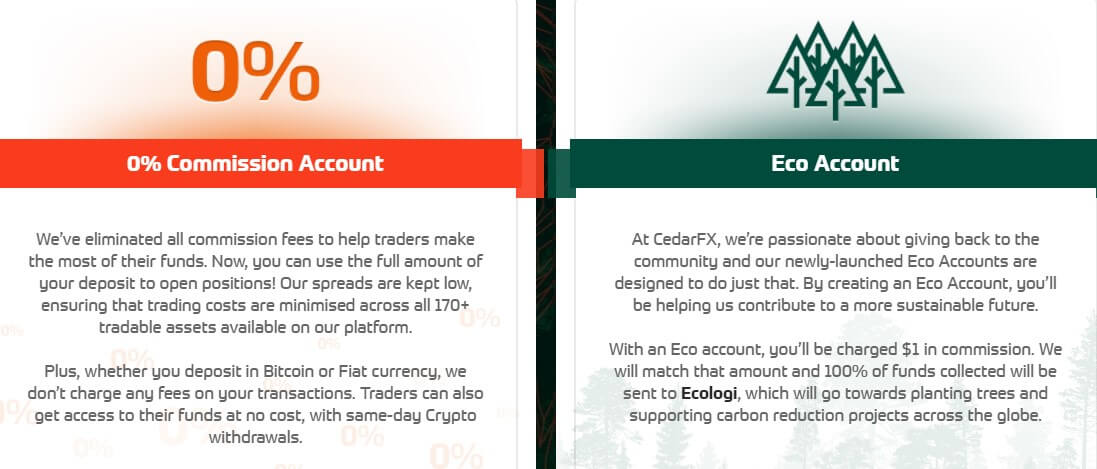

CedarFX offers two live account types: The 0% Commission Account and the Eco Account. Both accounts offer low entry-level deposit requirements, flexible leverage options, access to the same trading platform, and the same spreads. If you take a look at the following details, you’ll find that both accounts are identical, aside from commission costs.

The 0% Commission Account

- Minimum Deposit: $10 through Bitcoin or $50 through other methods

- Platform: MT4

- Leverage: (1:500 maximum depending on the instrument)

- Spread: From around 0.7 pips

- Commission: $0

Eco Account

- Minimum Deposit: $10 through Bitcoin or $50 through other methods

- Platform: MT4

- Leverage: 1:500 maximum (depending on the instrument)

- Spread: From around 0.7 pips

- Commission: $1 commission per lot

The main difference seems to be related to the commission rate, with 0% commissions being charged on the (you guessed it) 0% Commission Account, while $1 per lot is charged when trading on an Eco Account. All of the proceeds earned from paid commissions on the second account type are used to support environmental causes, which is an interesting option that we haven’t seen before. Of course, if you prefer not to participate, you can simply stick with the 0% Commission Account with no issues.

Platform

CedarFX offers the ability to trade on one of the most popular trading platforms in the world, MetaTrader 4. Several perks have helped to skyrocket MT4 to popularity, including quick and easy setup, a customizable interface that consists of a toolbar, Market Watch, Navigator, Terminal, and Charts Window, and multiple built-in tools and indicators. We’ve highlighted a few of MT4’s main features below:

- Highly accessible through desktop download, WebTrader, and mobile apps

- Supports hedging, scalping, robots, EAs, etc.

- 9 different timeframes

- 30 built-in indicators, 2000+ free custom indicators, 700 paid indicators

- Four Pending order types: buy stop, buy limit, sell limit, and sell stop

In a nutshell, MT4 is a simple to use platform that won’t frustrate beginners, yet it’s versatile enough to offer multiple tools and features that will satisfy more advanced trader needs. In our opinion, this is the only platform you’ll ever need, from the start of your trading career to the peak of it.

Leverage

CedarFX offers a maximum leverage cap of 1:500 for forex and metal options, with other options varying based on the type of instrument that is being traded. Here’s a quick summary of the broker’s leverage caps:

- Forex and metals: 1:500

- Indices and commodities: 1:200

- Cryptocurrency pairs: 1:100

- Stocks: 1:20

Overall, the leverage options are highly flexible for most of the available assets. The 1:500 leverage cap offered for forex and metals is insanely high compared to the 1:30 cap that is set by some regulators, however, we will advise traders to proceed with caution when using such a high leverage option. If you’re a beginner, it’s better to start lower and work your way up once you’re comfortable with the risks associated with using a higher leverage. Some professionals even choose to stick with a 1:100 leverage.

Trade Sizes

Supported position sizes range from 0.01 lots to 1,000 lots, meaning that the smallest supported position size is one micro lot up to a standard lot size of 1,000 lots. Novice traders should be satisfied with the option to trade micro-lots, which offers lower financial risk. Margin call and stop out levels are as follows:

- Margin Call: 100%

- Stop Out: At or below 70%

CedarFX is also very flexible when it comes to supported trading techniques, as hedging, scalping, auto traders, Expert Advisors, and trading robots are all allowed.

Trading Costs

CedarFX offers traders an advantage by offering a 0% commission free account, although the Eco account does charge $1 per lot in commissions for environmental causes. Both accounts charge the same amount for spreads (see “Spreads for more information), making the account cost comparison about as simple as it can be. Of course, traders should also keep overnight swap fees in mind when leaving trades open over the weekend. Swap values can be viewed within MT4 by right-clicking an instrument in Market Watch, selecting the currency pair through the Symbols menu, and clicking “properties” for the selected pair. If you’d like to help the environmental cause to some degree, we suggest opening one of each account type and making trades on both. This way, you can take advantage of the broker’s 0% commission rate while also giving back to the environment whenever you do choose to trade on the Eco Account. If you’d like to know more about where that money goes, you can visit this link: https://ecologi.com/projects.

Assets

One of CedarFX’s main advantages comes in the form of an impressive 170+ catalog of instruments to choose from in categories like forex, cryptocurrencies, metals, commodities, stocks, and indices. Traders will find that the broker offers 55 currency pairs in total, including majors, minors, and even rare exotic options. If you’re interested in cryptocurrencies, you’ll be happy to know that 35 options are available. These include familiar options like Bitcoin, Ethereum, and Ripple, plus many more choices that include newer companies. Metals offerings include Gold, Silver, and Platinum. Commodity options are made up of Natural Gas, UK Oil, and US Oil, while the only futures option is the US Dollar. When it comes to stock offerings, there are 64 choices available in popular companies like Apple, Amazon, and Facebook, along with some smaller companies as well. In total, there are 11 indices available for trading.

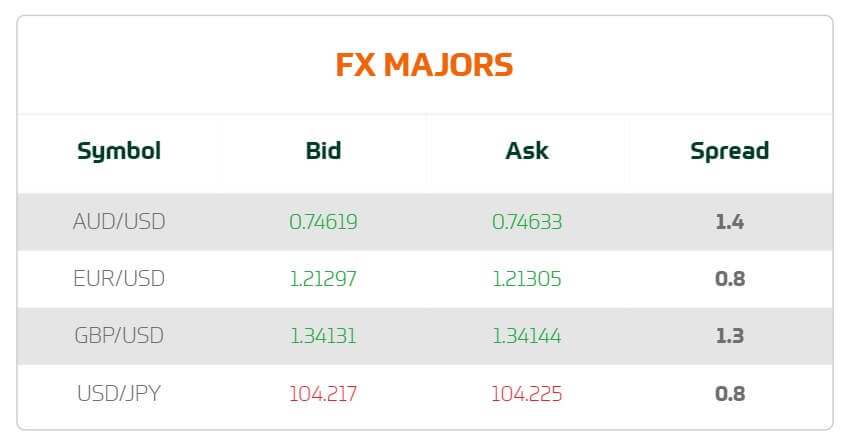

Spreads

Although CedarFX doesn’t exactly advertise their average spreads, they do offer a glimpse of their spreads on the website’s homepage. When we checked, we saw the lowest spread of 0.7 pips on EURUSD and the highest listed spread of 1.5 pips on AUDUSD. These options seem to be very low considering that the broker offers commission-free accounts, especially considering that an average spread of around 1.5 pips is usually charged in conjunction with commission costs. We do wish that more than four currency pairs were included with the live spreads and that assets from more categories were listed as well, but this seems to be a good sign that the broker’s fees remain highly competitive.

Minimum Deposit

CedarFX asks for two different minimum deposits, depending on the method being used to fund the account. For Bitcoin-based deposits, only $10 is required, while the minimum requirement is raised to $50 for all other deposits. CedarFX requires Bitcoin deposits to be no less than $10 due to the fact that blockchain charges a fee of 0.0005BTC per transaction, meaning that a lesser amount may not show up once fees have been charged.

Deposit Methods & Costs

CedarFX doesn’t charge any fees for depositing from their side, however, those choosing to deposit via Bitcoin will have to pay the 0.0005 BTC fee for each deposit, regardless of the size of the transaction. If you want to make the most of your money, we suggest making larger deposits whenever possible so that you’ll wind up paying less in BTC fees over time. These deposits will appear in your account within 5 minutes to five hours, with the exact time depending on current blockchain traffic. If you choose the credit/debit option for making a deposit, you’ll be directed to another website where you’ll create an account and use your card to purchase Bitcoin that will then be deposited to your CedarFX account instantly.

Withdrawal Methods & Costs

This broker only offers withdrawals through Bitcoin and recommends that traders choose a reliable wallet provider. Coinbase is one of the best choices in this situation, although they aren’t the only choice. Note that there is a minimum $10 withdrawal amount and no maximum limit on the amount that can be withdrawn at any given time.

Withdrawal Processing & Wait Times

CedarFX reviews and processes all withdrawals within a speedy 24 hours, however, the exact amount of time that it takes to receive your money will depend on blockchain traffic. If network traffic is normal, your withdrawal could be finished within just a few minutes or within the first hour after being sent to the blockchain, depending on the number of confirmations needed. Whenever Bitcoin’s value rises, you’ll need to anticipate network congestion and slightly longer wait times. Still, all traders can expect to receive their withdrawal within 1-3 days, which is a fairly competitive timeframe for broker withdrawals, especially when compared to the long wait times we usually see with bank wire and credit card providers.

Bonuses & Promotions

There doesn’t seem to be any sign of special bonuses or promotional opportunities from the broker at this time, however, it’s possible that this could be added in the future. In the meantime, it seems as though CedarFX has chosen to focus their extra efforts on environmental issues, so they deserve some bonus points on that note.

Educational & Trading Tools

The broker’s website does mention that informational material is provided to help traders get started, but it seems as though they haven’t added any tools or resources to their website just yet. It’s worth noting that demo accounts are available for all traders to take advantage of for now, but you shouldn’t let the lack of resources stop you from learning. Fortunately, the internet is filled with (free) resources that will help you learn everything you need to know before opening a trading account.

Demo Account

Demo Account

Like most forex brokers, CedarFX offers free demo accounts to their potential clients with no sign-up required. The demo account mimics the same exact market conditions that you’ll see on the broker’s live account, making it a great option for beginners that want to practice, anyone that wants to test the platform and conditions before making an investment, and for traders that need to test out different trading plans or strategies. Traders shouldn’t take this opportunity for granted, considering that demo accounts are one of the best hands-on tools with zero financial risk or obligation. To open your demo account, simply scroll towards the bottom of the website and click the “Open a Demo Account” button that is located under “Free Demo and Live Accounts”. The website will then start the download for the demo account setup automatically.

Customer Service

CedarFX offers a few different options to those that need to get in touch with a support agent. The fastest method would be through LiveChat, but you can also fill out an email form at the bottom of the broker’s website or request a callback if you aren’t in a rush. Traders will find the LiveChat option conveniently located at the bottom right-hand corner of the broker’s website labeled “write a message”. Once you enter your message, you’ll be prompted to enter your name and email address to start the chat before being connected to a live agent. In our case, we were connected with Penelope less than 20 seconds after entering our information and all of our questions were answered quickly. In addition to offering an instant contact method, we have more good news about this broker – customer service is available 24 hours per day, 7 days per week, so you’ll never have to wait long to speak to someone.

Countries Accepted

In some cases, it can be tricky to determine whether US-based citizens are allowed to open an account with certain brokers. When we asked customer support outright, we received this answer “CedarFX accepts client globally, however, do check to make sure that registration is not contrary to your local law or regulation.” This is an average answer, but it doesn’t answer the question directly, so we had to do a bit of investigative work. Fortunately, we found that country isn’t a required input during the account registration process and we didn’t get blocked by the website’s server when we registered an account from a US-based IP address. This suggests that traders from virtually every country should be able to open an account here without an issue.

Conclusion

After performing an extensive review of the CedarFX website, there were a few highlights that jumped out at us, including 0% commission accounts, high leverage caps, a wide range of tradable instruments, and highly competitive spreads. When it comes to funding, traders are limited to Bitcoin, although there is also an easy option to purchase Bitcoin using your card and have it instantly added to your account. Some traders may feel that the requirement to withdraw via Bitcoin is a downside, but there are some perks there, including faster withdrawal times than those that would be available through other methods and the potential to make money if Bitcoin’s value goes up.

CedarFX does fall a little short when it comes to education options, although demo accounts are available, and they don’t seem to be focused on adding any bonuses or special opportunities in the meantime. This wasn’t much of a dealbreaker, considering that the actual live account terms are positive, but it would be nice to see these details added to the website in the future. Overall, CedarFX left us with the impression that they are a broker worth investing in that will leave more money in their client’s pockets, thanks to their highly competitive trading charges and other unique advantages.