3 Key Indicators to Watch When Trading Bitcoin

For the past week, Bitcoin’s price has been dancing around the $20,000 mark, which has led many traders to lose their patience. In the eyes of those traders, the current lack of bullish momentum is problematic, especially when considering that Bitcoin tested the $16,200 level roughly two weeks ago.

Experienced traders tend to look at several key indicators that serve as telling signs of a major trend reversal. These key indicators are:

- The futures premium

- Volumes, and

- Top traders’ positions at major exchanges

While a handful of negative indicators do not precede every dip, there are some signs of weakness that show a trend reversal more often than not.

Monitoring the futures contracts premium

The open interest of perpetual contract buyers and sellers is matched at all times in any futures contract. Simply put, there is no way an imbalance of any form can happen, as every trade requires both a buyer and a seller.

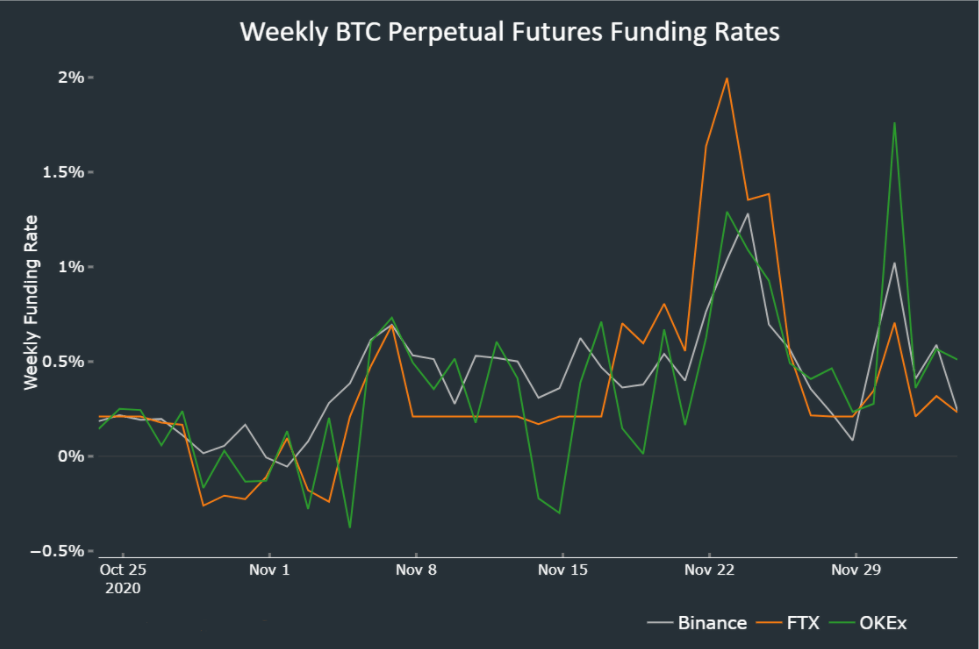

Funding rates ensure that there are no exchange risk imbalances. When sellers are the ones demanding more leverage, the funding rate goes negative. Therefore, the traders who want to be on the short side will be the ones paying the fees. The opposite is true, as well.

Sudden shifts to the negative funding rates indicate a strong interest in keeping short positions open. Ideally, investors would monitor a couple of exchanges at the same time to avoid eventual anomalies, no matter how rare they are.

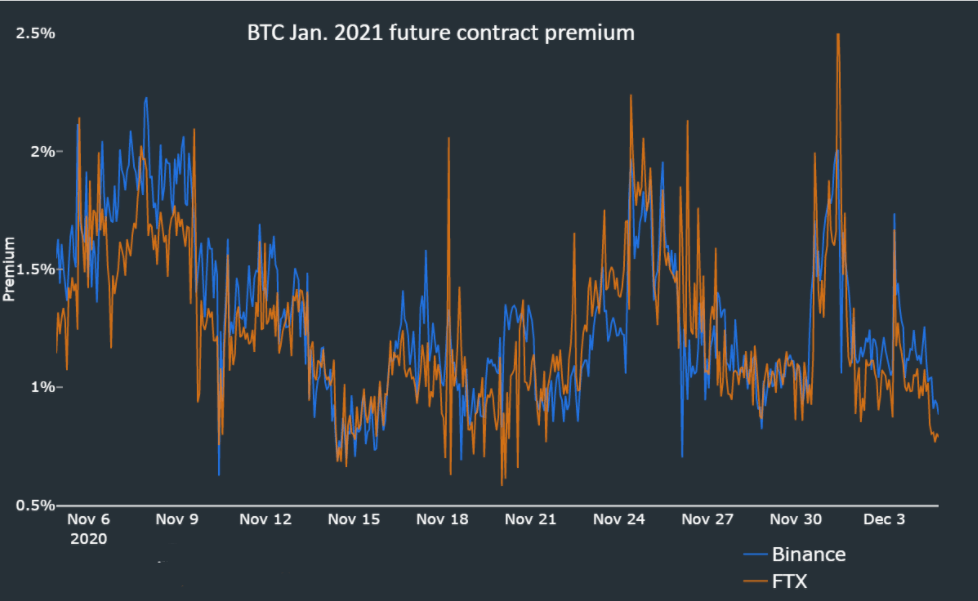

By measuring how much more expensive futures contracts are versus the regular spot market, traders can gauge the bullishness level of the market.

The fixed-calendar futures usually trade with a 0.5% or higher premium when compared to regular spot exchanges. Whenever this premium decreases or turns negative, traders can consider this a red flag. Such a situation, also called backwardation, indicates strong bearishness.

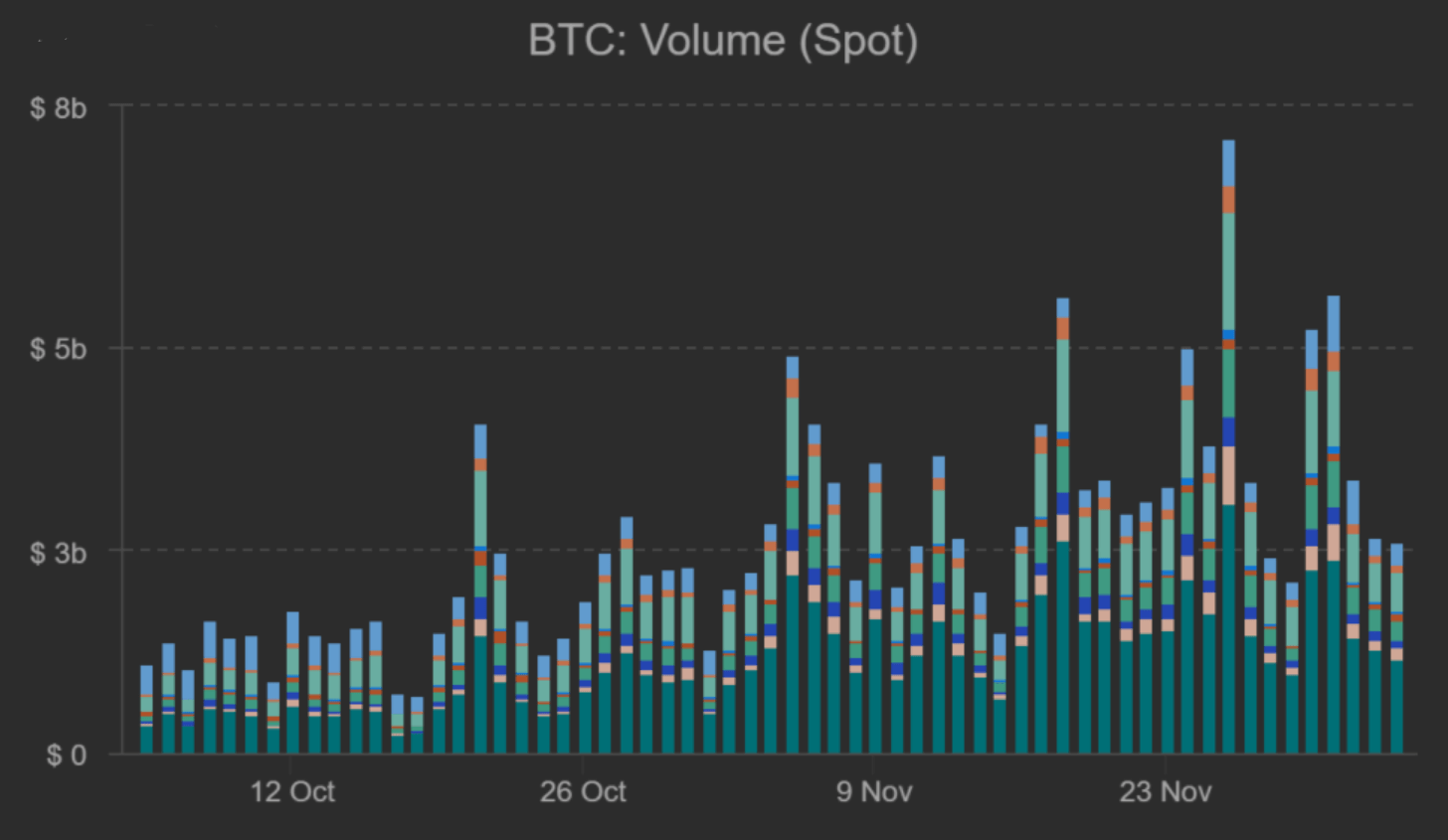

Monitoring volume

In addition to constantly checking futures contracts, good traders also track the spot market volumes. Breaking important resistance levels while simultaneously showing low volumes is somehow intriguing. Typically, low volumes show a lack of confidence. Therefore, any significant price change should be accompanied by an increase in trading volume.

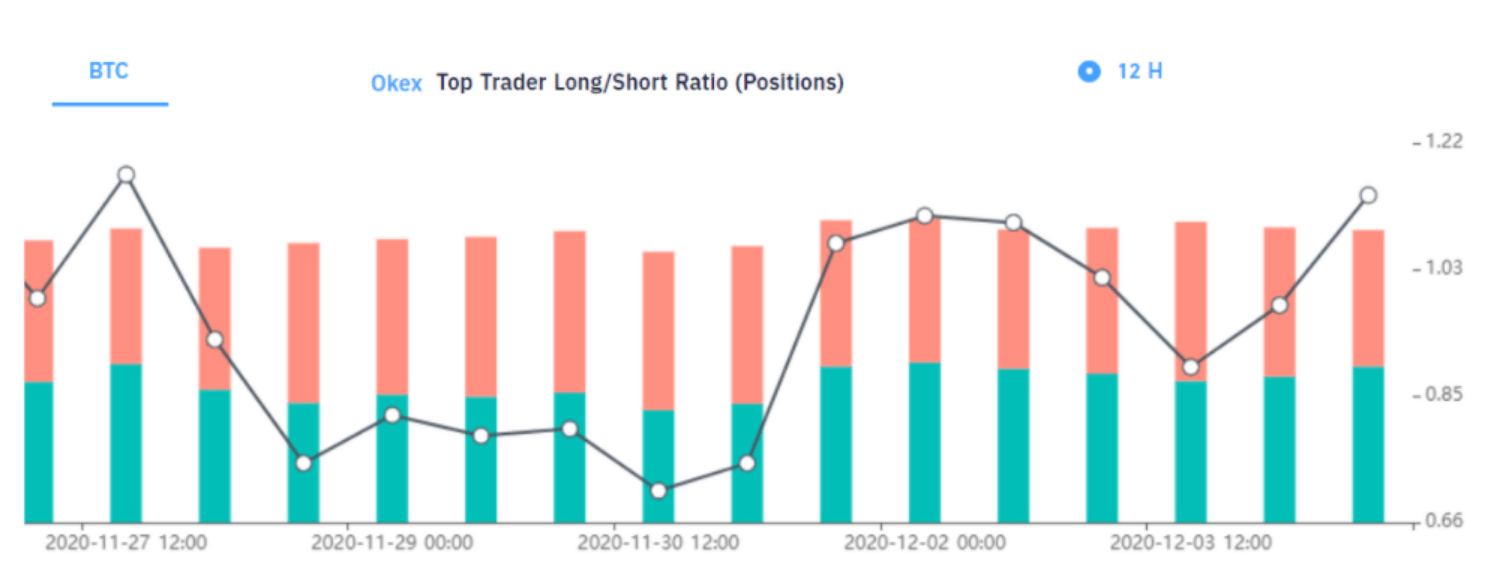

Top traders long-to-short ratio

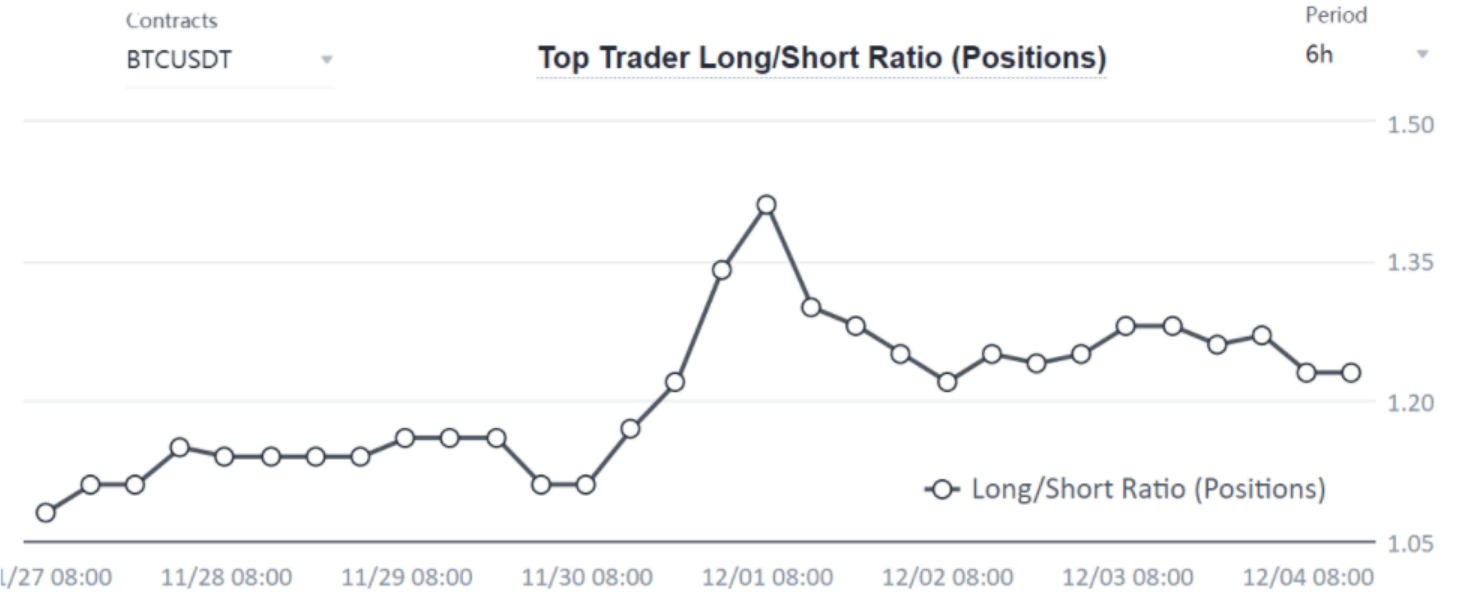

Another key metric that can be used is the top traders’ long-to-short ratio. This metric can be found at many leading crypto exchanges.

Traders should pay attention to changes in this metric rather than absolute figures as there are often discrepancies between exchanges’ methodologies.

As an example, a sudden move below the 1.00 long-to-short ratio should be a troubling signal. This is because the historical 30-day data, as well as the current 1.23 figure, favor longs.

As we mentioned before, the ratio can differ significantly between exchanges, but traders should watch changes in ratios rather than the absolute numbers themselves.

Unlike our previous example from Binance, it is common for OKEx top traders to hold levels below 1.00, all while not necessarily indicating bearishness. According to the 30-day data on this exchange, numbers below 0.75 should be cause for worry.

Conclusion

No set rule or method could predict every single spike or dip, but certainly, there are ways to improve your chances of improving your profitability when trading.

Monitoring the funding rate, spot volumes, as well as the top traders’ long-to-short ratio provides a much clearer view of the Bitcoin market as a whole, rather than simply reading candlestick patterns and monitoring general oscillators like the RSI and MACD.

This is mostly because the aforementioned metrics provide a direct gauge of professional traders’ sentiment, rather than just retail sector sentiment, and it is crucial to take them into account as Bitcoin tries to break $20,000.