On the forex front, the U.S. Dollar Index kept trading within a tight range on Monday, closing flat on the day at 97.38. The U.S. government reversed its decision to brand China a currency manipulator. U.S. Treasury Secretary Steven Mnuchin said: “China has made enforceable commitments to refrain from competitive devaluation while promoting transparency and accountability.” China offshore yuan strengthened to the strongest level in six months, with USD/CNH dipping 0.5% to 6.8822.

Economic Events to Watch Today

EUR/USD – Daily Analysis

The euro rose 0.2% to $1.1135. Dismissals from the 1.1100-15 are aiming at higher marks. The initial point is 1.1152, supported by 1.1167. On Monday, the Euro has traded slightly bullish during the trading session but hasn’t been overly convincing. It seems as if we are yet striving to decide out where the pair is likely to go.

An unexpectedly weaker figure will likely leave a bearish impact on the greenback, and supporting the EUR/USD pair may cross the range of 1.1150. The U.S. dollar was weak on Friday after the release of the negative wage growth figures for December.

Looking forward, the speeches by FOMC’s E.Rosengren (Boston Fed) and R.Bostic (Atlanta Fed) should keep the attention on the buck later in the N.A. session. Moreover, the traders will closely observe the critical event in the upcoming days, which includes the German GDP and the ECB Accounts on Wednesday and Thursday, as well.

Daily Support and Resistance

- S3 1.1062

- S2 1.1097

- S1 1.1115

- Pivot Point 1.1131

- R1 1.115

- R2 1.1166

- R3 1.12

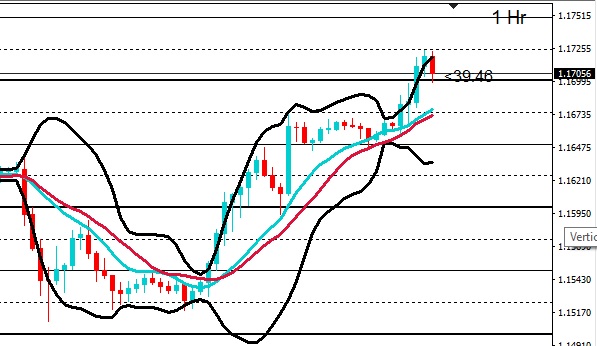

EUR/USD– Trading Tips

The EUR/USD has traded slightly higher as investors seem to price in weaker CPI sentiments ahead of the news release. The support becomes a resistance level of 1.1145 is holding the pair below this level. We may have a bullish or bearish breakout upon the release of U.S. CPI data during the U.S. session.

A bullish breakout of 1.1145 can open further room for buying until 1.1208. Conversely, the closing of bearish candles below 1.1145 can drive the selling trend until 1.1100 support. The next support is likely to be found around 1.1075 today.

GBP/USD– Daily Analysis

The British pound lost 0.4% to $1.2987. Official data showed that U.K. Gross Domestic Product (GDP) shrank 0.3% on month in November (flat estimated), and industrial production slid 1.2% (flat expected).

At the GBP front, despite the significant recovery from the 3-week low of 1.2691, the GBP currency trader remained cautious from the bearish risk-sentiment due to increased sentiments of Bank of England’s rate cut as early as this September.

The Bank Of England Governor Carney said last week that there are the chances to deliver a rate cut by 250 basis points. Besides this, the BOE policymaker Vlieghe said during the weekend that if the improvement does not come in the economic data, he will back for a reduction.

Moreover, a series of depressing U.K. key data, including the monthly GDP reduction and a significant drop in the industrial and manufacturing production data, supports the case for the dovish BOE monetary policy stance.

Looking forward, the focus now will shift towards the U.S. inflation data, which is scheduled to release later in the N.A. session at 1330 GMT. Due to the lack of any critical data from U.K. docket traders will keep their eyes on U.S. inflation data and the Sino-US phase-one trade deal.

Daily Support and Resistance

- S3 1.2845

- S2 1.292

- S1 1.2955

- Pivot Point 1.2996

- R1 1.303

- R2 1.3071

- R3 1.3147

GBP/USD– Trading Tip

On Tuesday, the GBP/USD continues to trade with bearish bias around 1.2980 after violating the 1.3045 support level. On the 4 hour timeframe, the pair has formed a strong bearish candle which is supporting the bearish trend in GBP/USD. The pair is currently trading in a bearish channel, which is extending resistance around 1.3034 along with support around 1.2906. While the MACD is still staying in the selling zone. I will be looking to take sell trades below 1.3000 today to target 1.2925 and 1.2906.

USD/JPY – Daily Analysis

The USD/JPY climbed 0.4% to 110.01, the highest level since May 22. The USD/JPY currency pair hit the bullish level above the110 handles for the first time since May, mainly due to the fresh optimism surrounding the United States and China trade deal.

As in result, the traders are selling the safe-have Japanese Yen in the wake of risk-on sentiment in the market. As of writing, the USD/JPY currency is currently trading at 110.08, having hit the high of 110.20.

During the night, the USD/JPY currency pair strengthened its Asian session gains to a high of 109.94, a high since May 2019, in line with positive risk appetite.

Meanwhile, the report came that the United States trade representative removed the currency manipulator tag for China, which also helped in increasing the risk-on market sentiment and also boosted the U.S. dollar.

The U.S. two-year Treasury yields increased to 1.585% (from 1.57% and a mild curve steepening allowed ten-year yields to test 1.85% from 1.82%. Fed funds futures indicated a modest (1bp) increase in implied yields across the curve, with the implied terminal rates up to 1.33% in early 2021.

Daily Support and Resistance

- S3 109.02

- S2 109.28

- S1 109.38

- Pivot Point 109.54

- R1 109.64

- R2 109.8

- R3 110.06

USD/JPY – Trading Tips

The USD/JPY pair has traded in line with the previous forecast as it continues to trade bullish at 110.017 after breaking above 109.600 triple top resistance level.

On the 4-hour timeframe, the candlestick pattern three while soldiers are likely to extend buying trend until the next resistance level of 110.570. Moreover, the RSI and MACD are still staying in the buying zone. Today, I will be looking for buying trades over 109.84 level with a target of 110.570.

All the best for today!