On the Infinito Wallet website, their mobile app is described as the “Best Crypto Wallet & DAPP Browser.” It is created and run by Infinito Blockchain Labs, a technology company registered in The Isle of Man, the U.K. The multi-asset crypto mobile app was launched in 2017 and has leveraged technology to come up with one of the most innovative crypto mobile apps today. The app takes pride in three of its primary features; the support for the widest range of cryptocoins and tokens, a built-in exchange, and support for EOS functions.

These play a key role in giving it an edge over the competition. But how safe and reliable is the mobile app considering that it is an unregulated broker? We thoroughly analyzed the app and its parent company and came up with this review that answers every question you have about the Infinito wallet.

Infinito Key features:

Pure mobile wallet: Infinito crypto wallet is mobile-based and only available to Android and iOS device users. Unlike most other apps that have either a desktop or Webtrader platform alongside the mobile app, Infinito was specially designed for mobile devices.

Built-in exchange: Infinito wallet app is one of the few all-rounded crypto apps. It recently introduced a built-in exchange in partnership with Changelly, where its members can seamlessly exchange cryptocurrencies.

Support for EOS apps: Infinito crypto wallet users can also access the EOS platform and take advantage of its features using the app. The support for EOS functions means you can sell RAM, stake CPU, and even create an EOS account and DAPPs without leaving the wallet app.

Price tracking and newsroom: You can track and receive notification about the price changes of your favorite assets using the app. And as part of the wallet roadmap, you will soon have access to one of the most comprehensive crypto newsrooms within the app.

Crypto lending: The crypto mobile wallet further maintains a secondary market where you can lend out your digital assets and earn interests in their use.

Infinito DAPP square: The Infinito crypto wallet app recently introduced the Infinito DAPP square that gives you access to leading DApps on the crypto space. In addition, they are integrated with the wallet for ease of payments.

Security features:

Password protected: The Infinito crypto wallet app is passcode protected. You get to set the password during the app installation and setup.

Biometric security: In addition to the passcode, the Infinito crypto mobile app supports several other Biometric security features, including Facial recognition and fingerprint.

Hierarchically deterministic: Infinito is also a hierarchically deterministic wallet, and this means you can create multiple wallet addresses to mask your public key and throw off trackers.

Open-sourced platform: Infinito crypto wallet is built on an open-sourced platform that has been vetted and audited by some of the most experienced crypto technologists in the world.

Risk management tools: Some of the risk management tools employed by the Infinito crypto wallet app include a profile check and detailed risk report about every wallet user. Always check this before engaging a trader on the platform.

The wallet doesn’t store any sensitive data: Infinito doesn’t store any sensitive information about their clients on their servers. It is non-custodial, and thus the private keys are under your control and stored within the mobile wallet.

Ease of use:

The Infinito crypto wallet app maintains a friendly user interface that’s easy to use for both crypto beginners and veteran traders. It is highly customizable, allowing users to tweak such aspects of the app as its background (light and dark themes), and change the size and color of texts and icons.

Infinito crypto wallet app is also multilingual and currently supports up to 12 international languages (English, Chinese, German, Thai, Russian, Japanese, Vietnamese, Korean, Italian, French, Hindi, and Portuguese). The app installation, as well as the process of sending and receiving digital currencies, are also easy and straightforward.

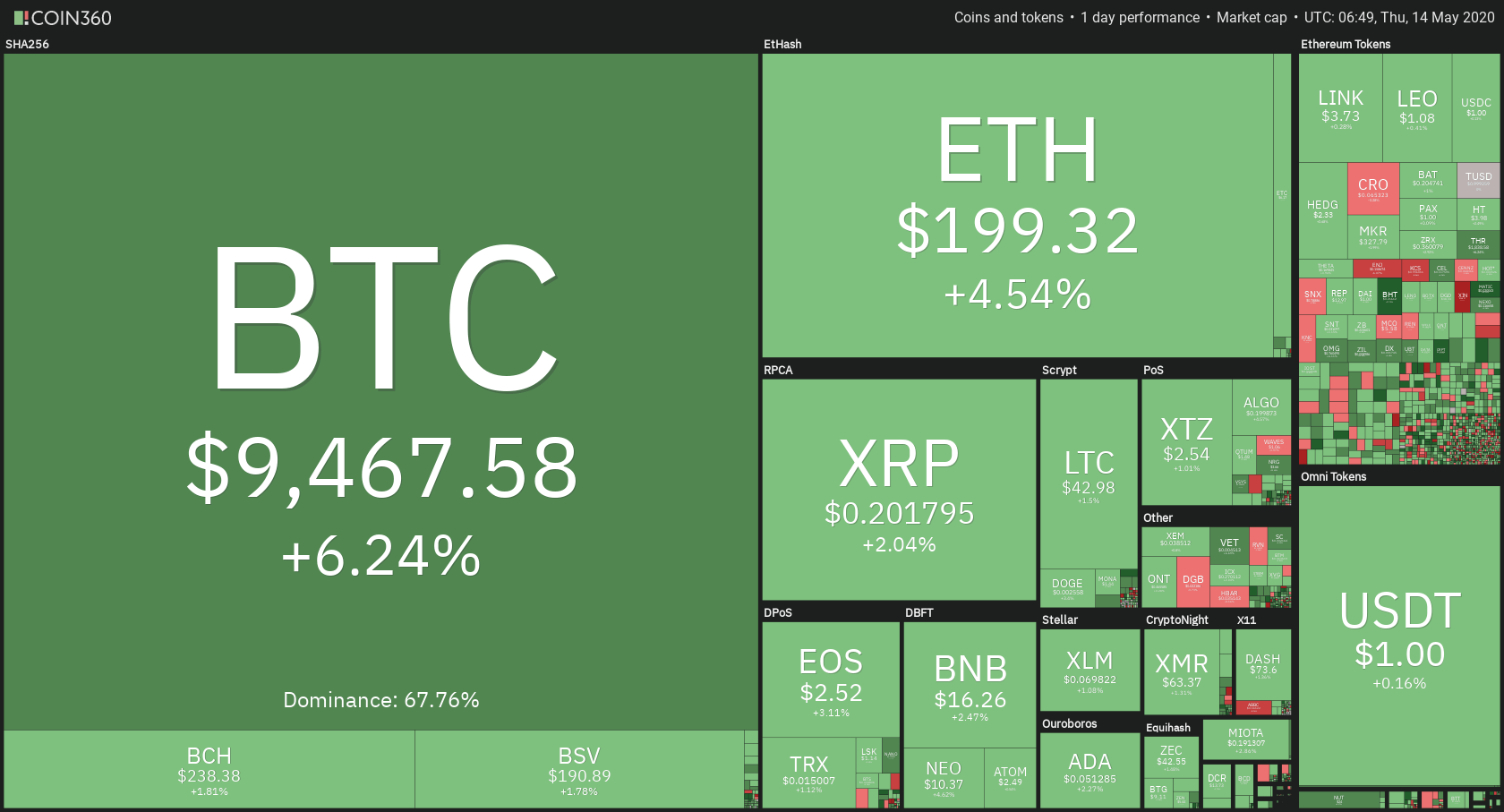

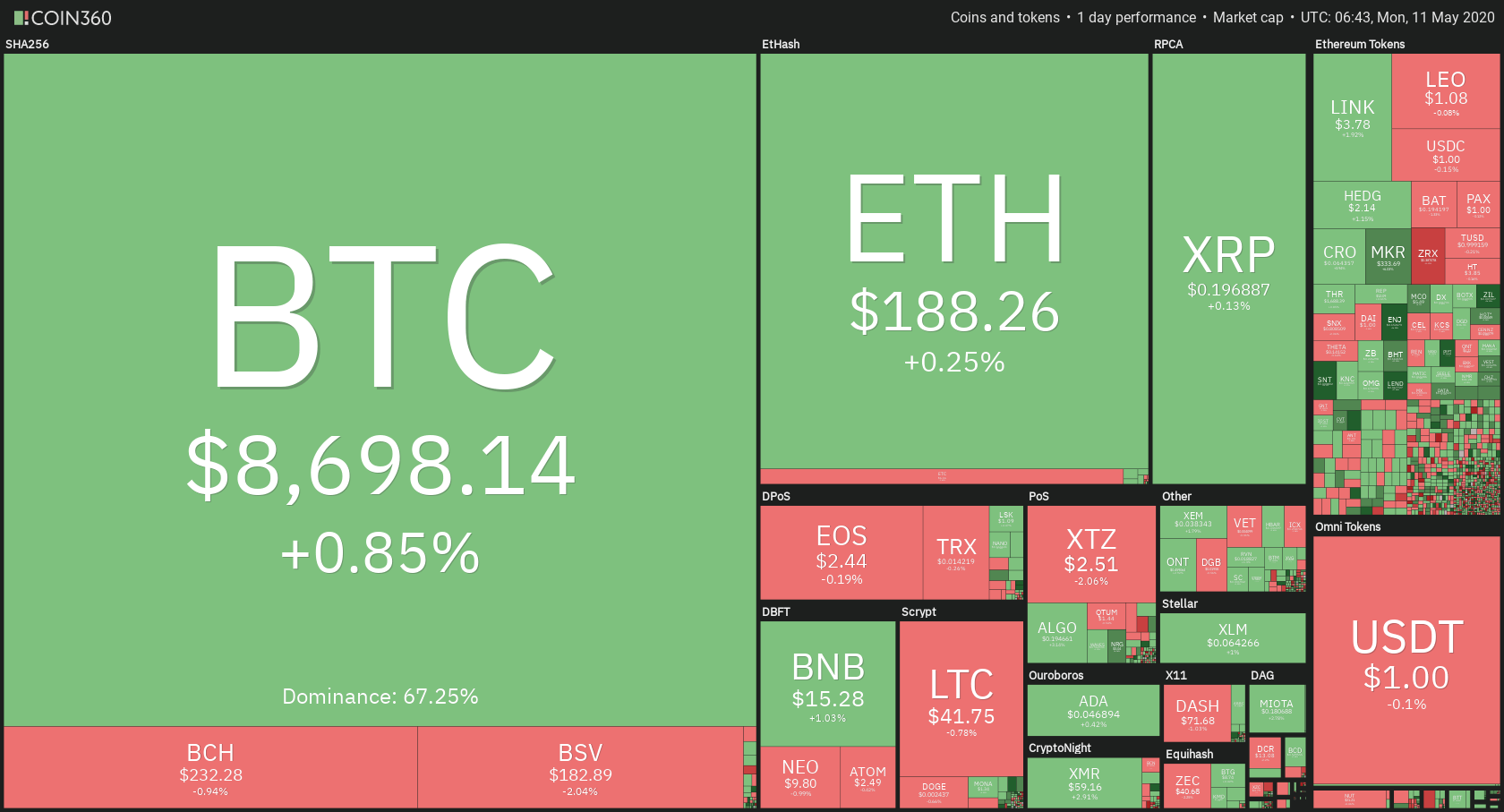

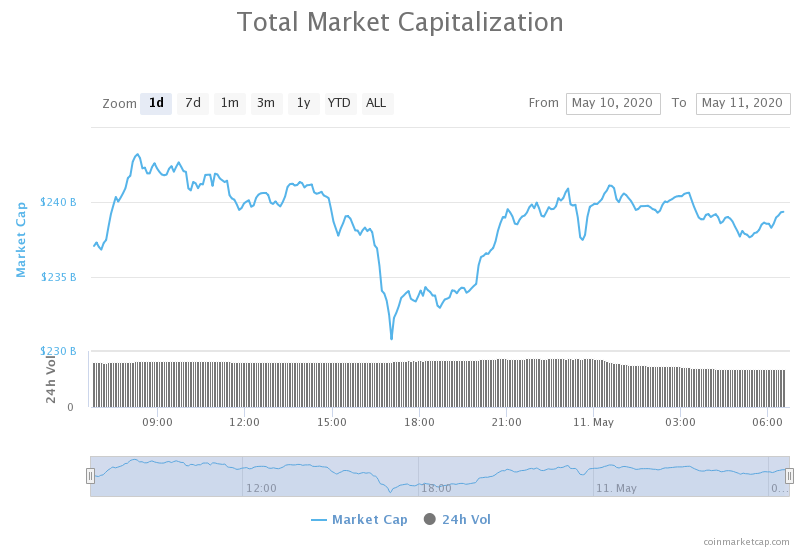

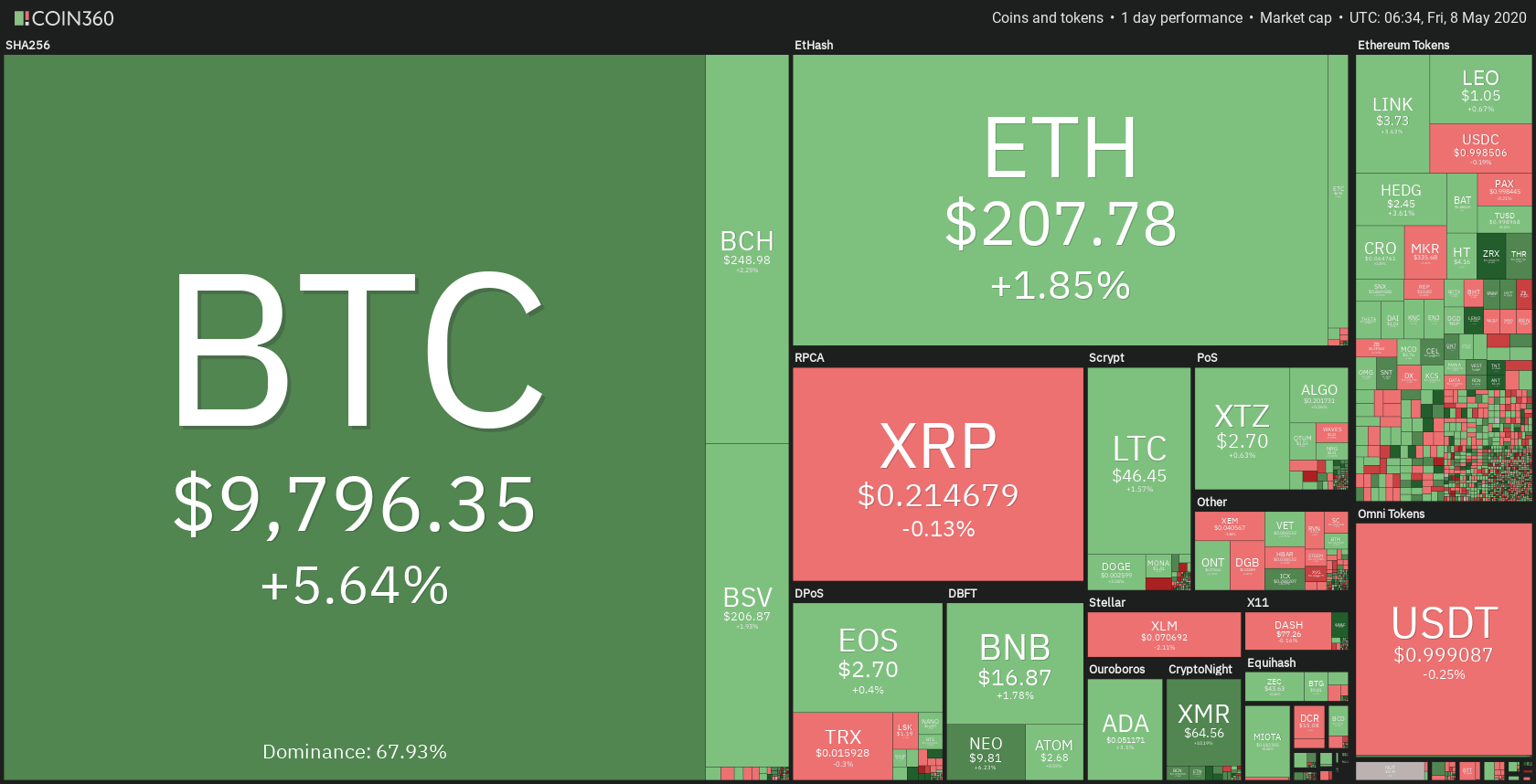

Currencies supported

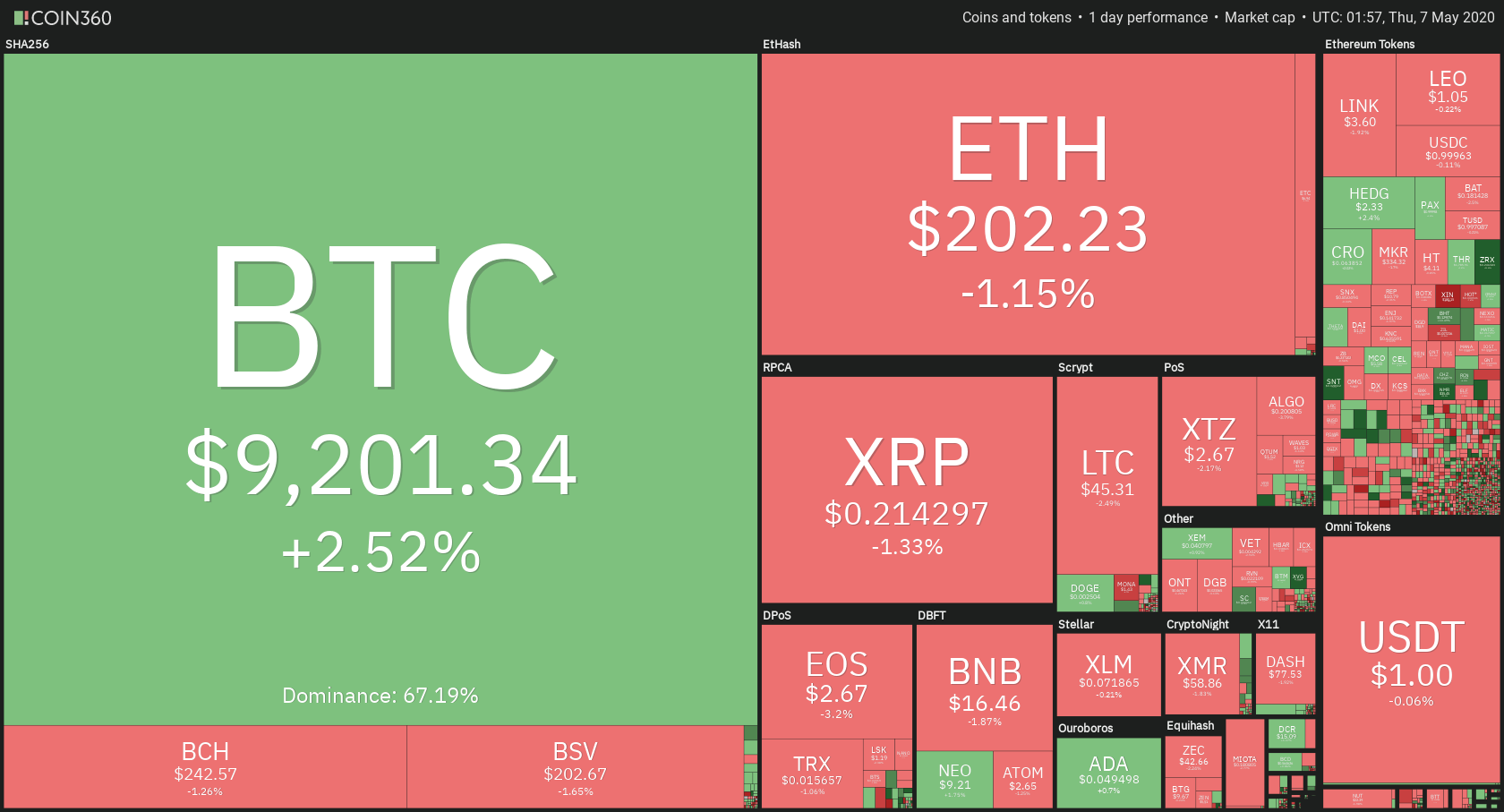

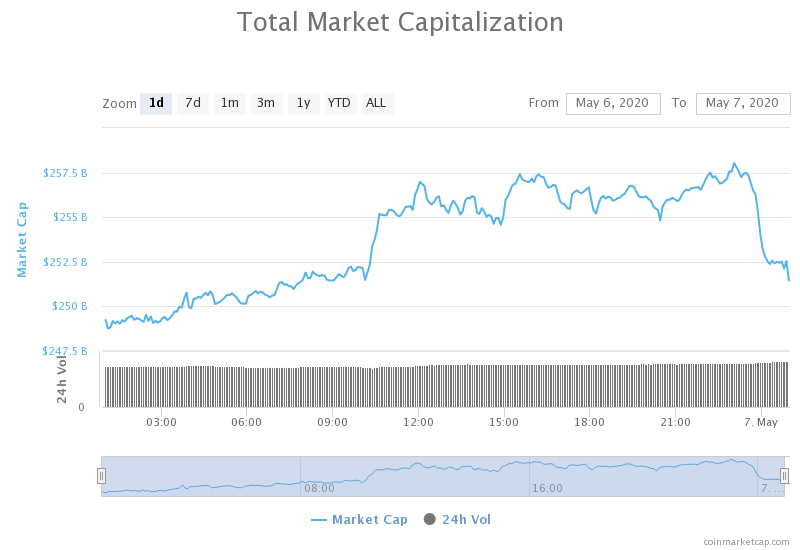

According to the Infinito crypto wallet website, you can send, receive, and exchange 2000+ cryptocurrencies and tokens on the app.

Some of the popular cryptocurrencies supported on the platform include Bitcoin, Bitcoin Cash, Ethereum, Dash. Litecoin, Dogecoin, ETC, EOS, NEO, and GAS.

The crypto wallet app also supports all the ERC 20 and NEP-5 tokens and will soon start supporting EOS and other tokens, as described on their road map.

Infinito wallet cost and other fees

Acquiring the Infinito crypto wallet app is free. You also won’t be charged to store your coins on the wallet.

Crypto transactions on the exchange and the EOS main net, however, attract variable charges depending on the transaction volumes and exchange network. These fees go to the system Infinito Blockchain network miners who confirm and validate transactions.

The crypto wallet app also has a price optimization feature that lets you set the transaction fees based on the speed with which you want the transaction confirmed. Here, high paying users will have their transactions confirmed in the shortest time possible.

Setting up the Infinito wallet:

How to install Infinito wallet:

Step 1: Download and install the Infinito Crypto wallet app: Google Play Store for Android OS users and Apple App Store for iOS users.

Step 2: Select the ‘Create a New Account’ option and agree to the app’s terms and Conditions.

Step 3: Next is the backup page where the app presents you with 12 phrases, also known as recovery seed, which serve as your account backup. Write it down on a piece of paper and store it in a highly secure place.

Step 4: Next is the passphrase verification step where you chose the correct order of seed words.

Step 5: Set up a strong password and finish the setup process.

Step 6: The app will direct you to the user dashboard, after which you can add, send, or receive coins to your wallet.

Note: You may first want to head over to the settings page to add more security layers to your accounts, such as fingerprint or facial recognition.

Sending and receiving coins:

To receive funds into your Infinito Wallet:

Step 1: Click on the coins/tokens you wish to add to your wallet and tap ‘receive.’

Note: The Infinito crypto wallet app has default addresses for Bitcoin, Ethereum, NEO, and GAS coins. If you want to add another address, click on the coins/tokens tabs and tap the coin, you wish to add. The wallet will create an address automatically.

Step 2: You will have the option of a QR code or wallet address. You can send either to the individual sending you the coins.

Step 3: Wait to receive the coins.

To send payments from your Infinito Wallet:

Step 1: On your user dashboard, click on the token/coin you wish to send.

Step 2: Select the “Send” option and enter the recipient’s wallet address and the amounts you wish to send.

Step 3: Chose the transaction fees (either Premium. Economy or Regular) and tap next.

Step 4: Confirm the wallet address, amount details, and send.

Infinito hardware wallet pros and cons:

Pros:

- Maintains a multi-layered security fence around the user account with a combination of passwords and biometrics.

- Supports one of the widest range of crypto coins and tokens.

- Easy and straightforward registration, coin-sending, and receiving processes.

- Has a built-in exchange and highly optimized transaction fees.

- It is one of the few crypto mobile apps that support the EOS main net and most functions, including the creation and use of EOS DApps.

Cons:

- Infinito Crypto wallet app is a hot wallet and, therefore, susceptible to more risks than the average hard wallet.

- It is relatively new and unregulated.

- It doesn’t have a web trader platform or desktop app.

Infinito wallet compared to competitors:

Comparing infinito with Hit wallets:

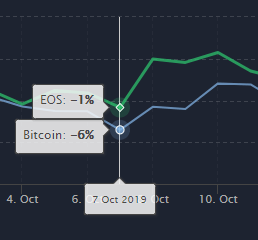

When compared to such other hot wallets as eToro, Infinito carries the day when it comes to the number of supported cryptocoins and tokens. Also, it has more integrated features like the support for the EOS main net, the creation of EOS account, and ease of interaction with the EOS DApps. It can, however, be said to be less secure than eToro, which stores its clients’ digital assets in cold storage and supports the trade of the not-so-risky CFDs.

Comparing infinito with hardware wallets:

When gauged against hardware wallets like the Ledger Nano S, the Infinito crypto wallet app takes the day for a more versatile and more technologically innovative platform. But its security features, including the integration of biometric systems, though innovative, aren’t as hardy. For instance, the hot wallet is susceptible to remote hacks that may authorize crypto transactions using the wallet. The Ledger Nano S is, on the other hand, insulated from such, as it stores private keys offline, and its transactions must be authorized by a button on the hardware crypto storage device.

Customer support:

Infinito Wallet has a relatively responsive customer support team. It is multilingual and accessible via the live chat on the wallet’s website. Alternatively, you can rely on their elaborate FAQ page, send them an email, open a support ticket via the ‘Contact Us’ icon on the website, or through the different social media platforms.

Note that Infinito doesn’t offer phone support.

Verdict: Is the Infinito wallet safe?

The Infinito crypto mobile app has several impressive operational and security features that make it one of the most technologically advanced mobile wallet. It carries out identity verification by following the KYC protocol, has open-sourced its blockchain for vetting and auditing by the global internet security community, and incorporated biometric account safety features. Since its debut in 2017, it has never suffered a security breach. All these are a clear indication of a highly secure platform, save for the fact that it is unregulated.

In the case of cryptos, there exists a computer program that emails you at specific intervals and waits for your reply. If the program does not receive any reply from the sent email, it then automatically checks for death certificates of the account holder. If it finds such a record and does not receive any email, the program will transfer the coins in the wallet to the specified wallet mentioned by the account holder during the time of set up.

In the case of cryptos, there exists a computer program that emails you at specific intervals and waits for your reply. If the program does not receive any reply from the sent email, it then automatically checks for death certificates of the account holder. If it finds such a record and does not receive any email, the program will transfer the coins in the wallet to the specified wallet mentioned by the account holder during the time of set up.

I am starting the article with budgetary use case as this is very close to my heart to achieve a corruption-free world. Every government around the world has its budgetary sessions for every financial year. As per the allocations, the amount is released to each department as required. Based on the amount announced for the department, they have to design a blueprint on how the funds will be utilized for the year and all the minor details like contractors, vendors; payments should be finalized to incorporate the same in a smart contract.

I am starting the article with budgetary use case as this is very close to my heart to achieve a corruption-free world. Every government around the world has its budgetary sessions for every financial year. As per the allocations, the amount is released to each department as required. Based on the amount announced for the department, they have to design a blueprint on how the funds will be utilized for the year and all the minor details like contractors, vendors; payments should be finalized to incorporate the same in a smart contract. Every government has many departments often divided between state and central. Most of the governments are digitizing the records as of now. It will be an excellent use case of blockchain if the digitized materials are stored in the blockchain. Often the documents should be shared amongst immigration authorities, defense, homeland security, many more departments. A lot of paperwork and permissions should be sorted out to get adequate information, which is very time-consuming.

Every government has many departments often divided between state and central. Most of the governments are digitizing the records as of now. It will be an excellent use case of blockchain if the digitized materials are stored in the blockchain. Often the documents should be shared amongst immigration authorities, defense, homeland security, many more departments. A lot of paperwork and permissions should be sorted out to get adequate information, which is very time-consuming. Voting is crucial for any democratic country to run smoothly at predefined intervals of time. There are huge limitations when it comes to conducting voting securely without any fraud. If blockchain is implemented for voting, that can be changed. Each vote can be converted into a smart contract and display the transactions publicly for everyone to view. Moscow has its voting platform on Ethereum.

Voting is crucial for any democratic country to run smoothly at predefined intervals of time. There are huge limitations when it comes to conducting voting securely without any fraud. If blockchain is implemented for voting, that can be changed. Each vote can be converted into a smart contract and display the transactions publicly for everyone to view. Moscow has its voting platform on Ethereum. Almost all the governments around the globe have some unique identification numbers for their citizens. Social security numbers for Americans and Aadhar numbers for Indians are some examples. These identification numbers contain the most sensitive information of the citizens of a country like tax returns, income details, retina scans, fingerprints, and so much more.

Almost all the governments around the globe have some unique identification numbers for their citizens. Social security numbers for Americans and Aadhar numbers for Indians are some examples. These identification numbers contain the most sensitive information of the citizens of a country like tax returns, income details, retina scans, fingerprints, and so much more.

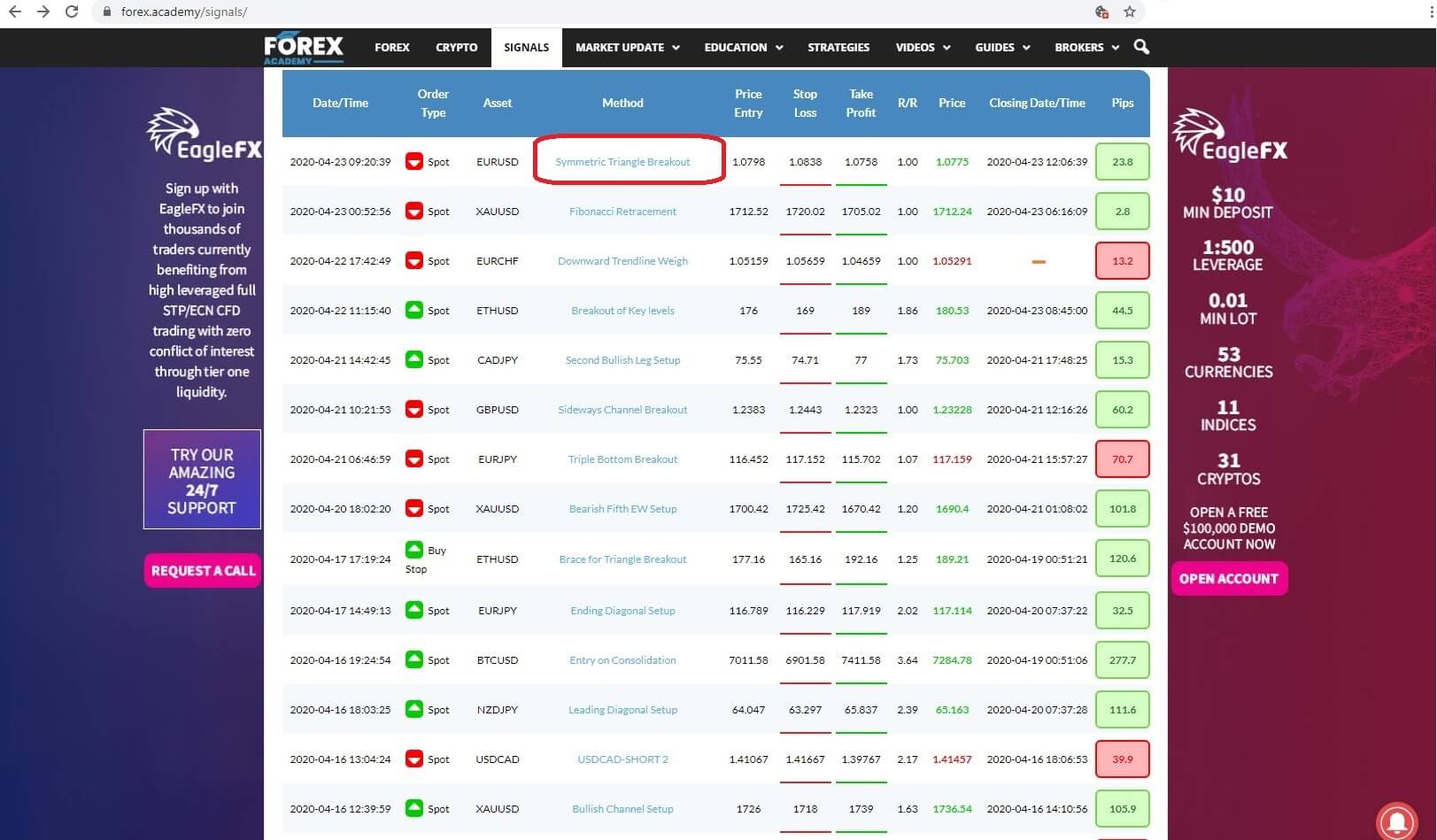

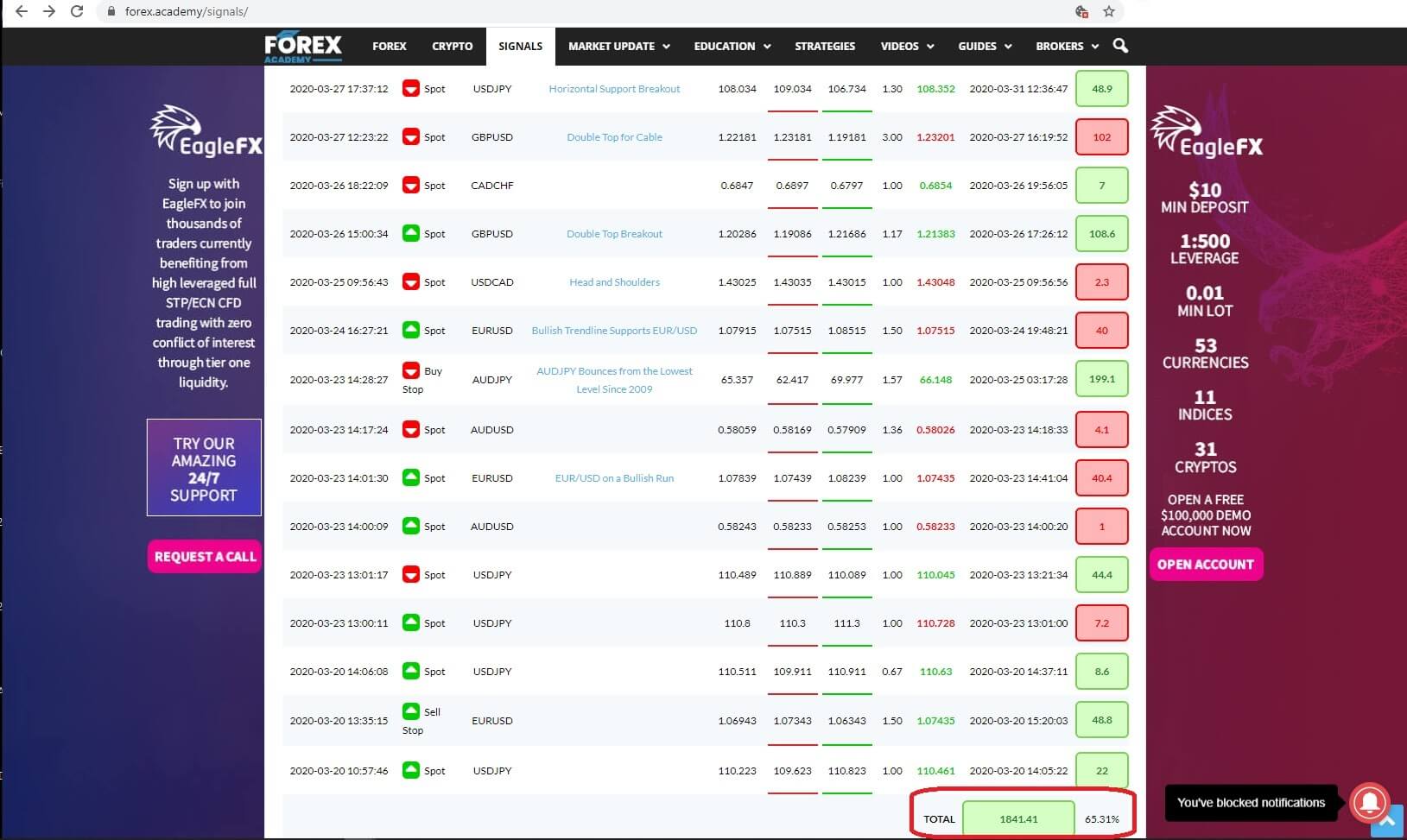

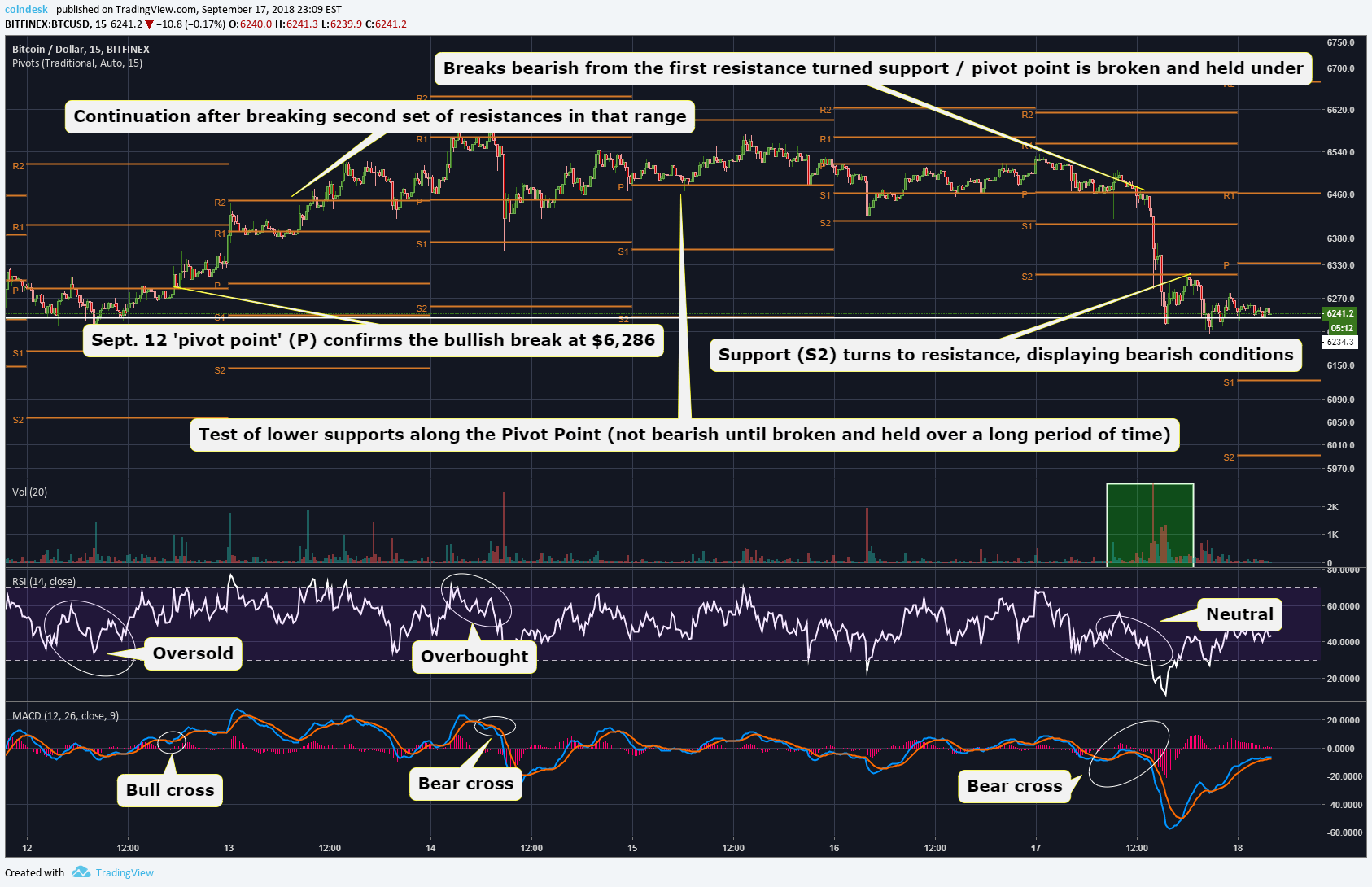

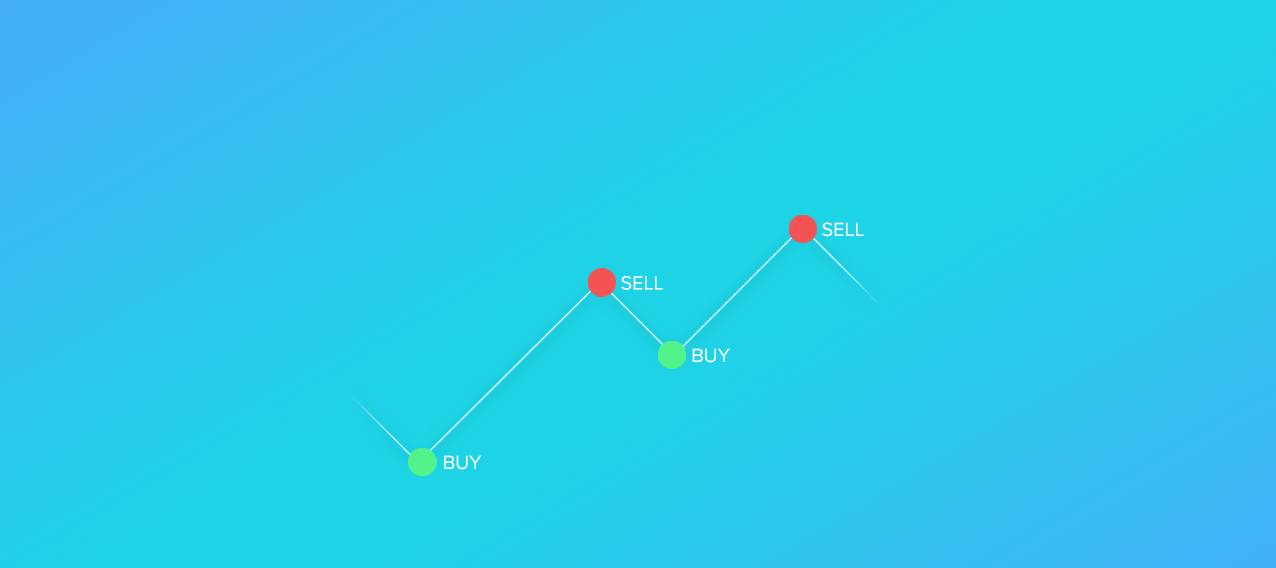

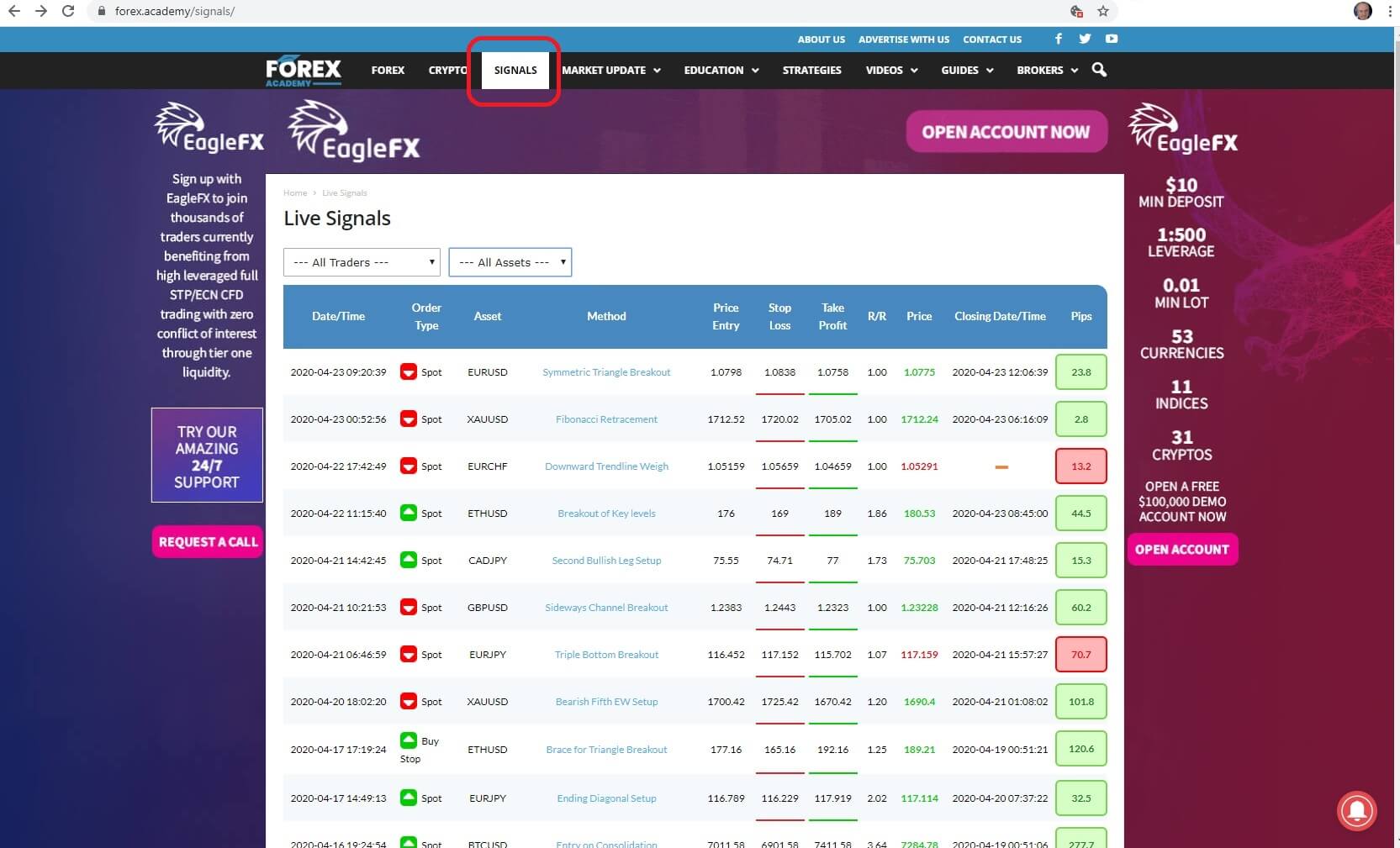

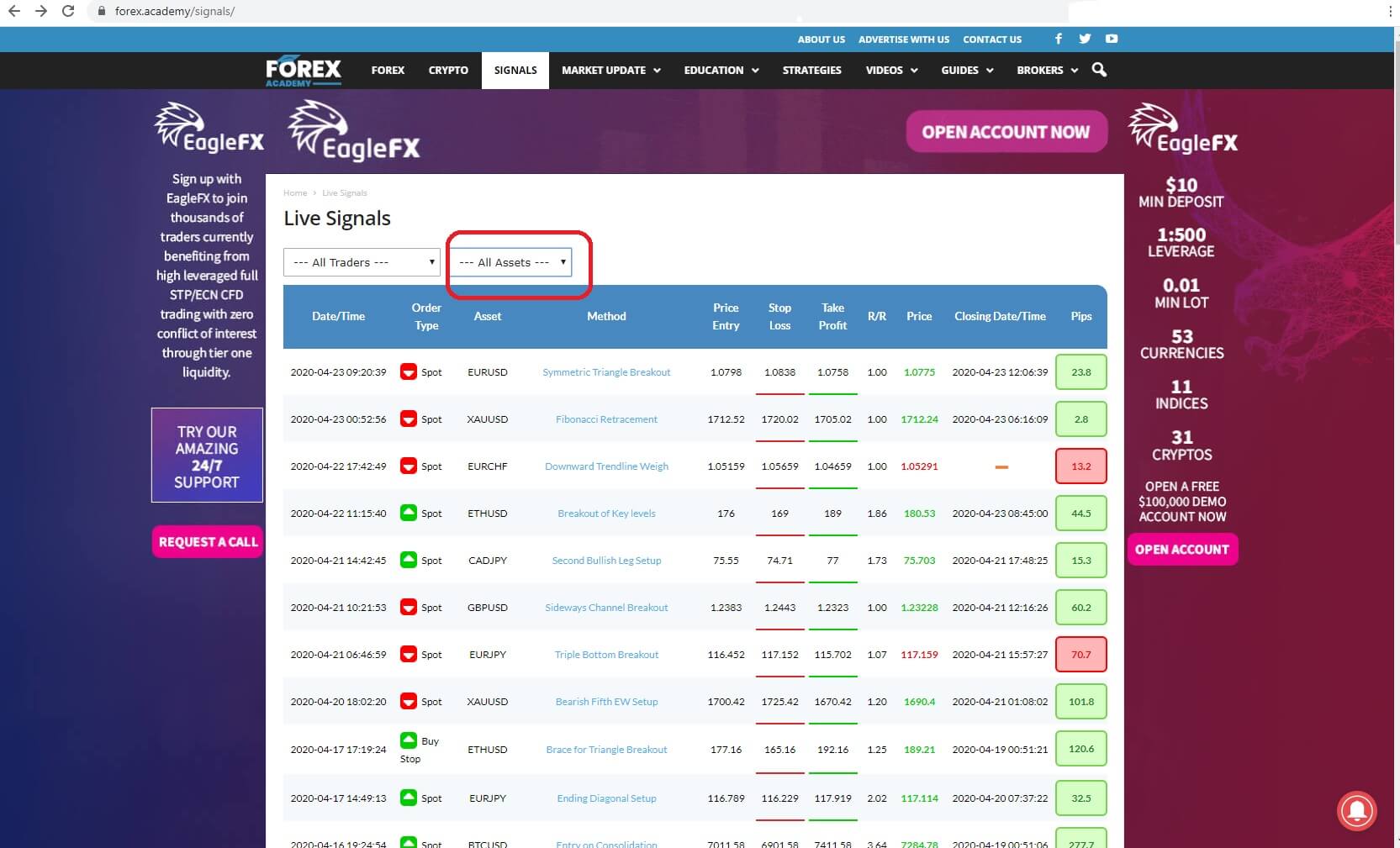

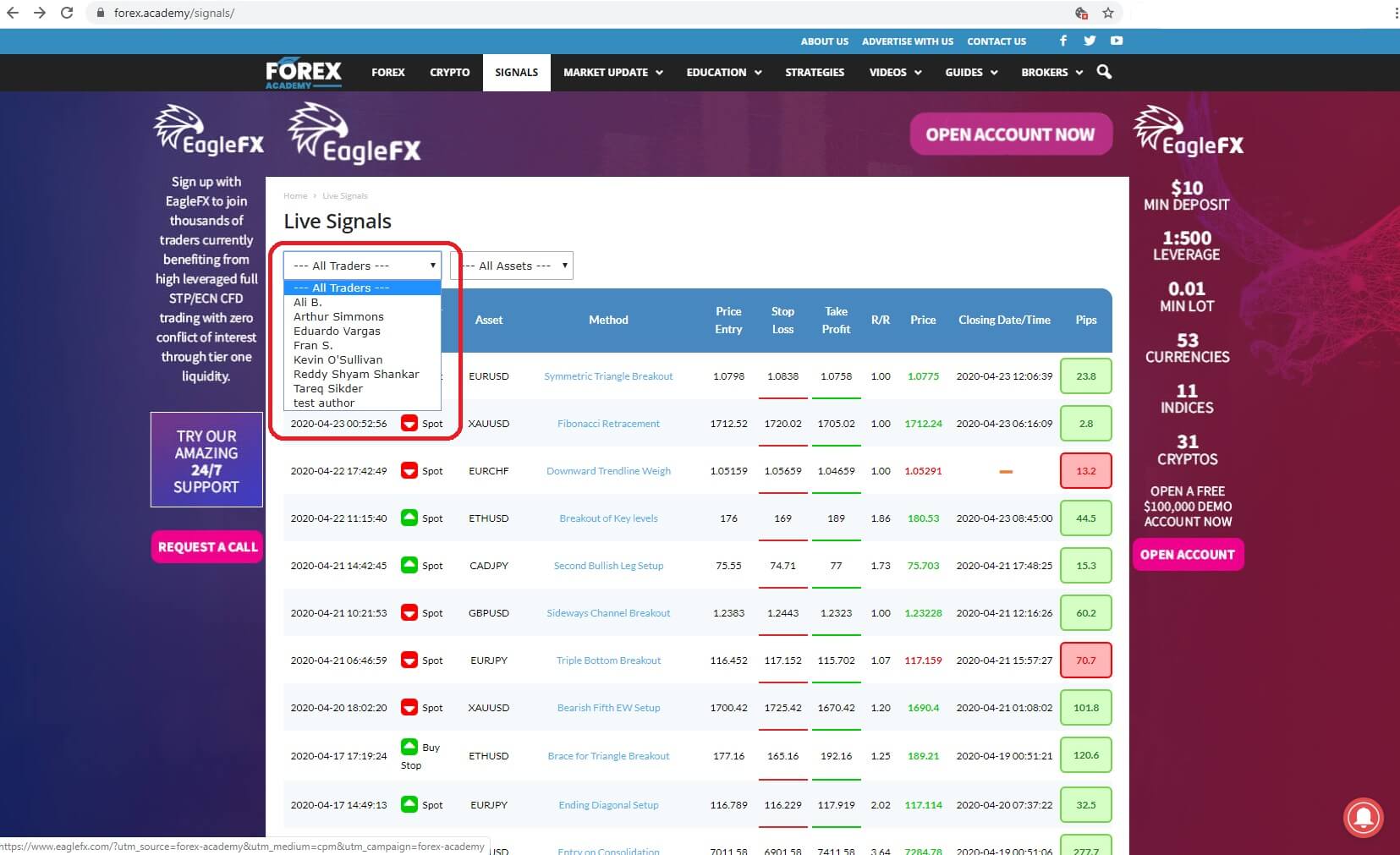

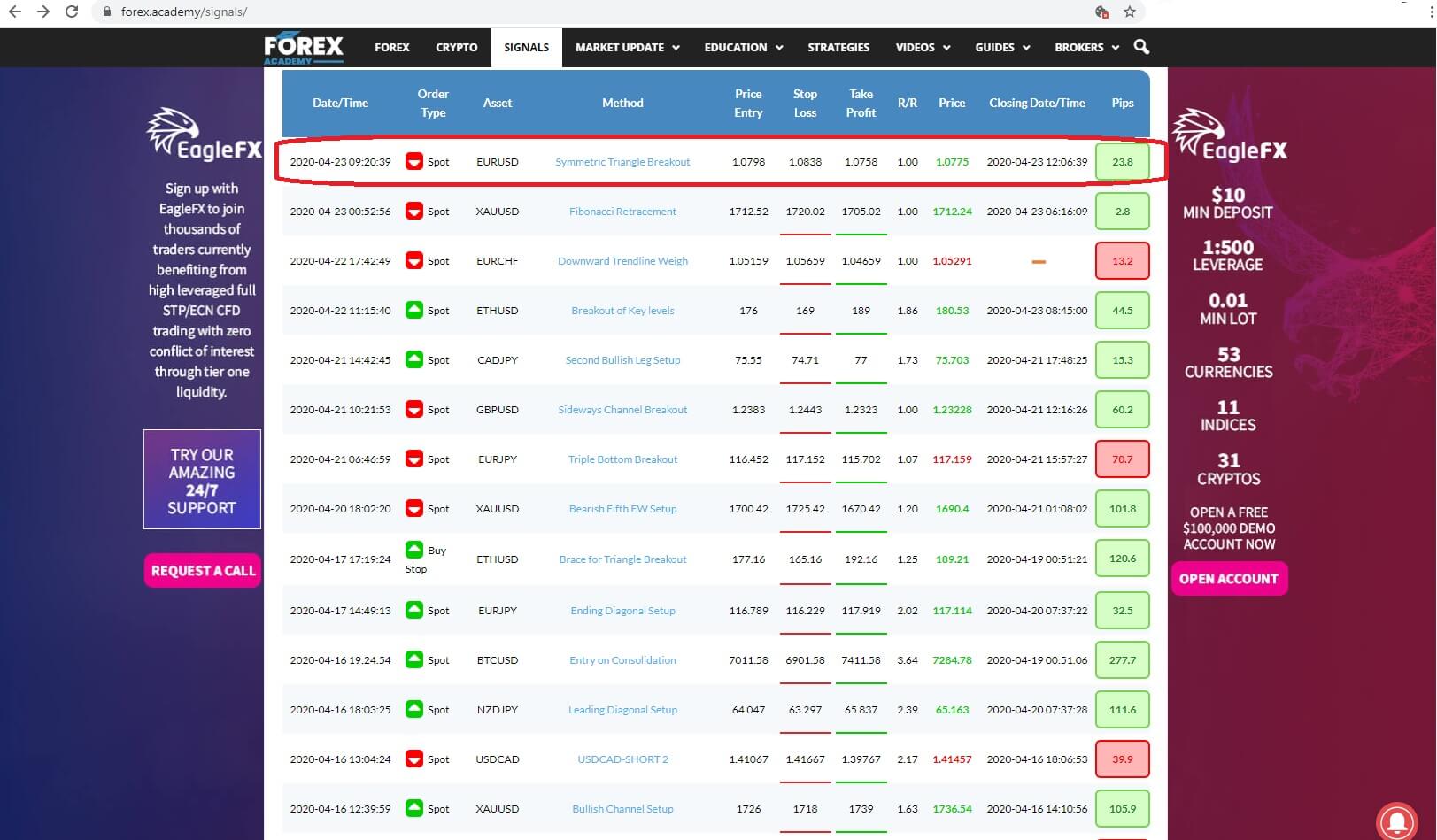

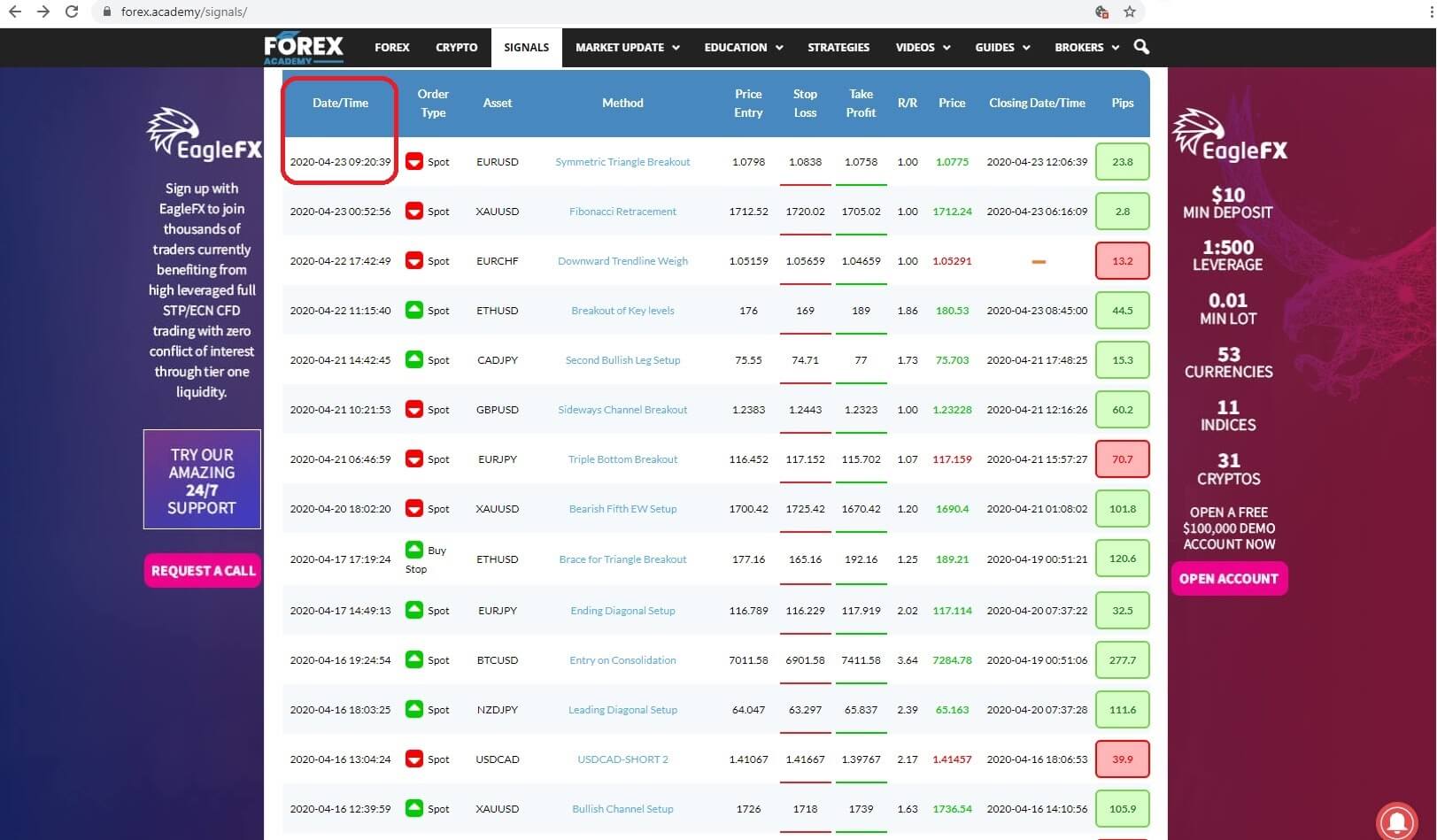

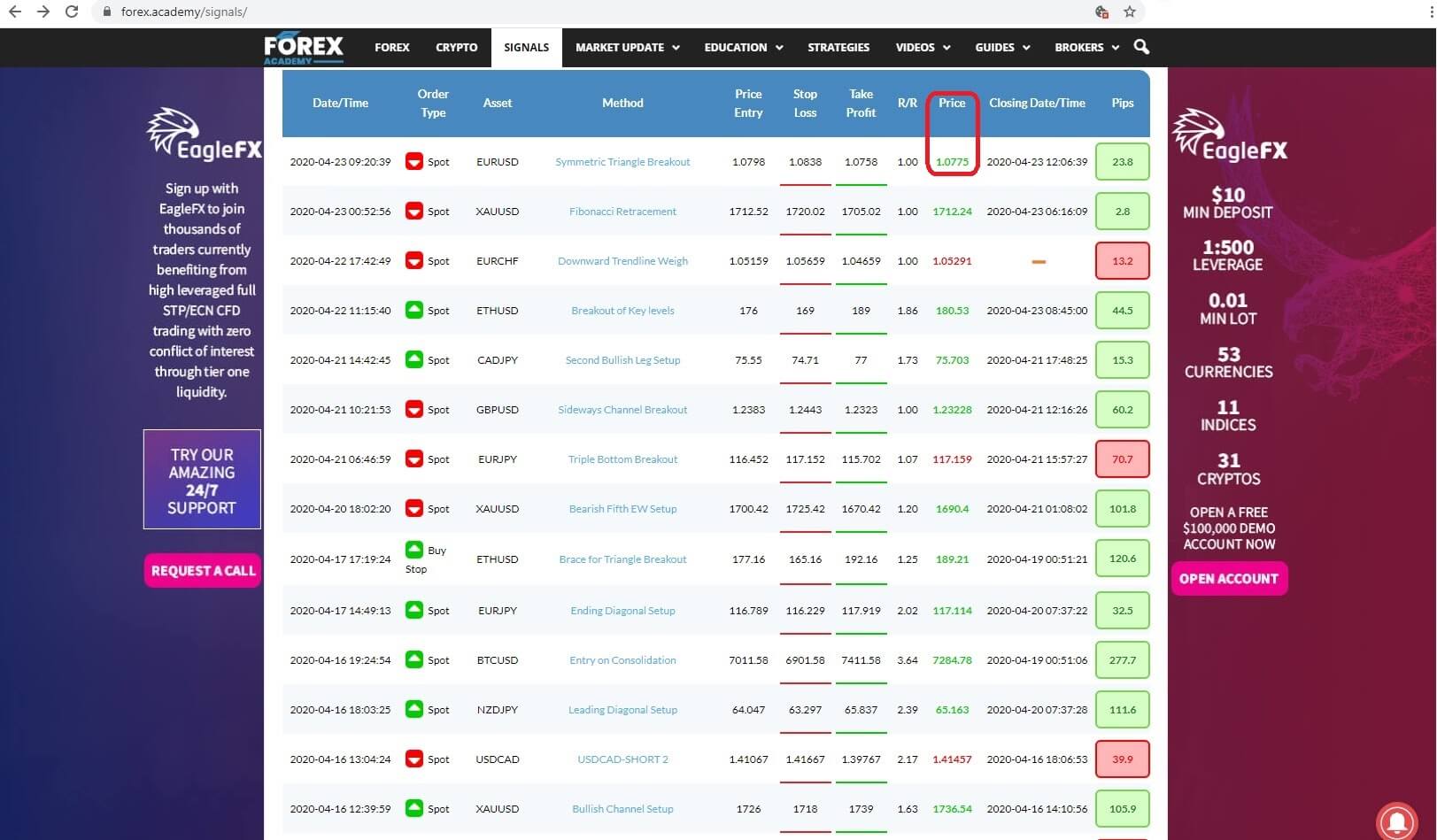

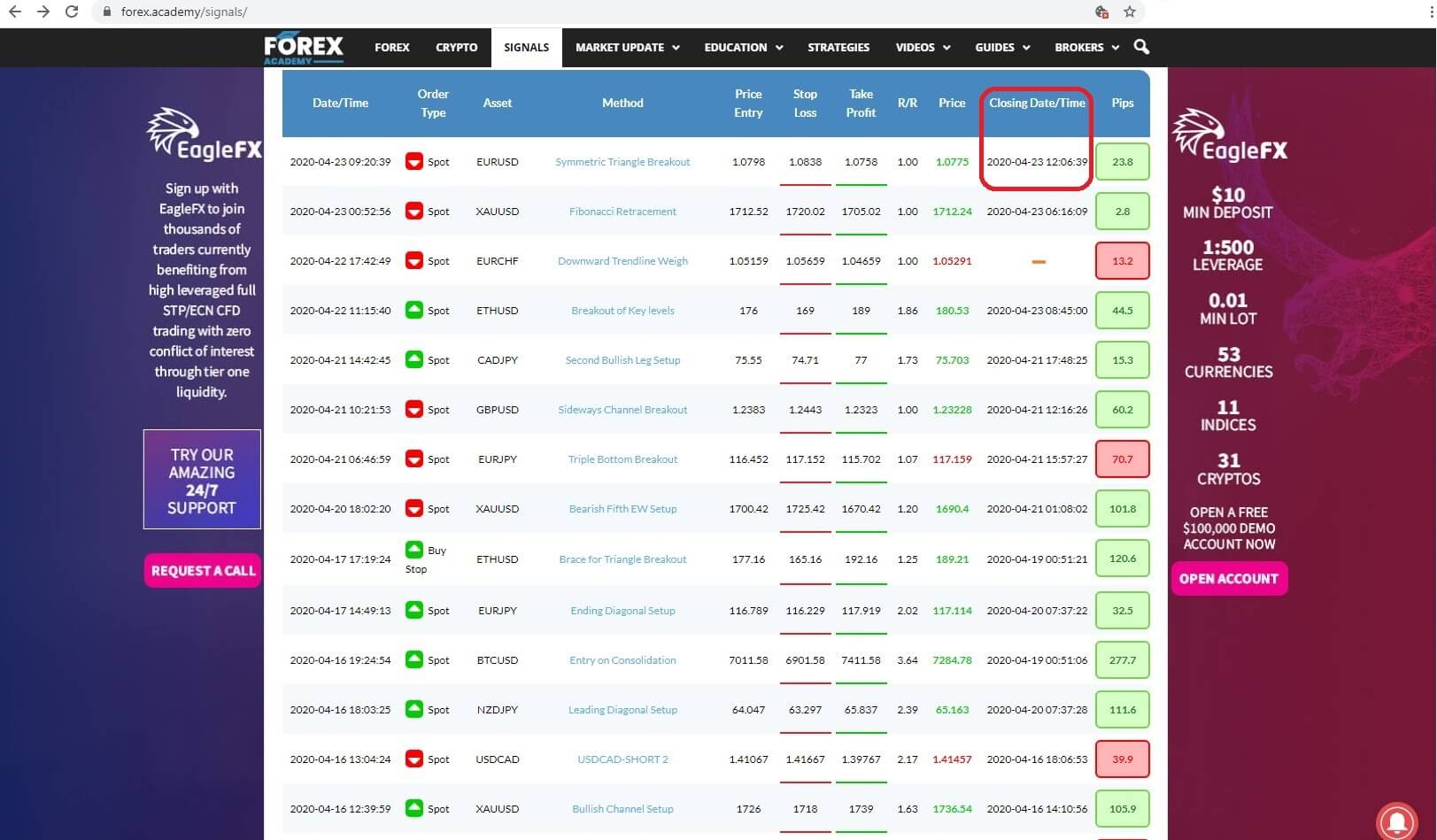

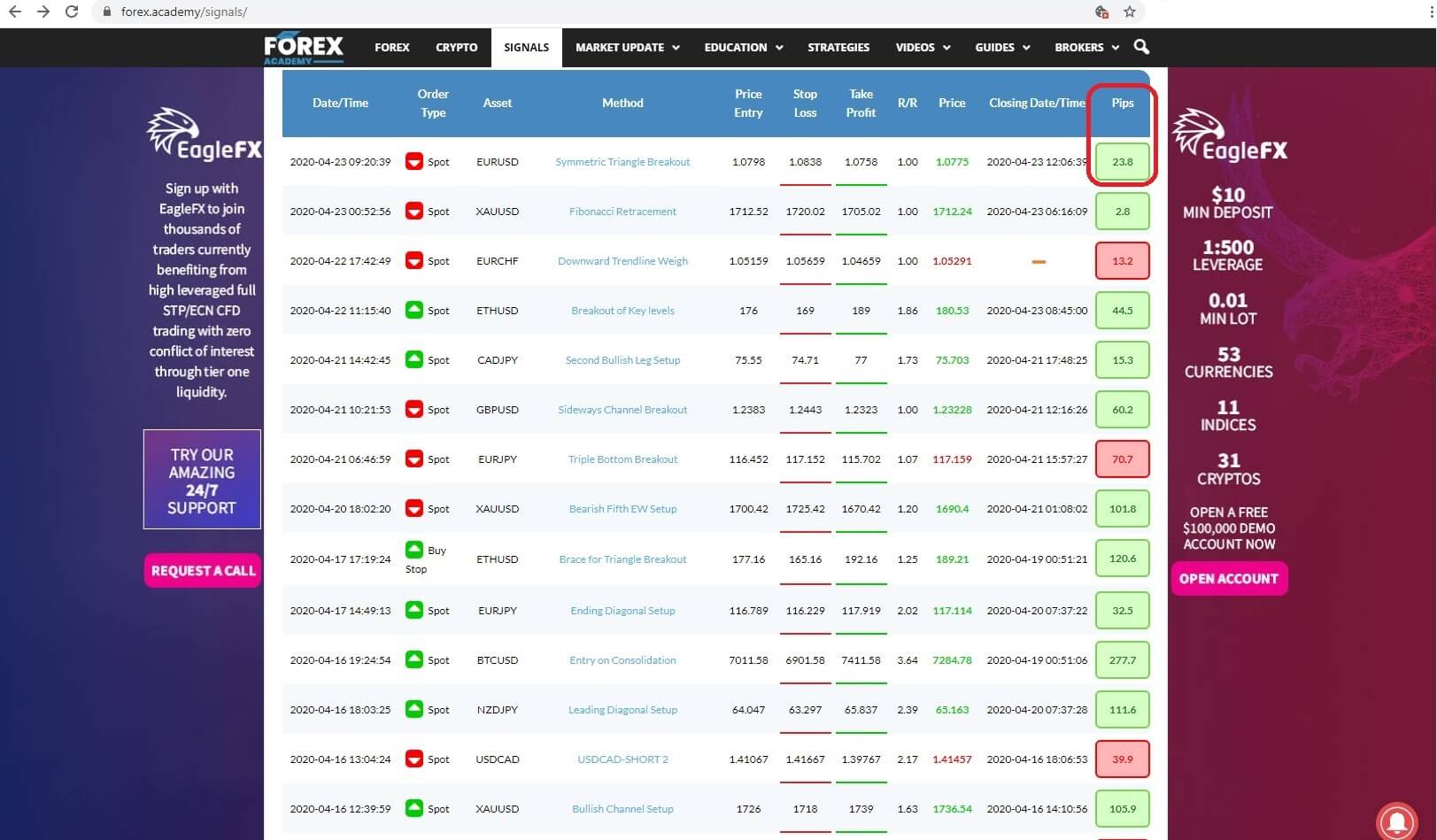

The date the trade was listed: Insert 2:

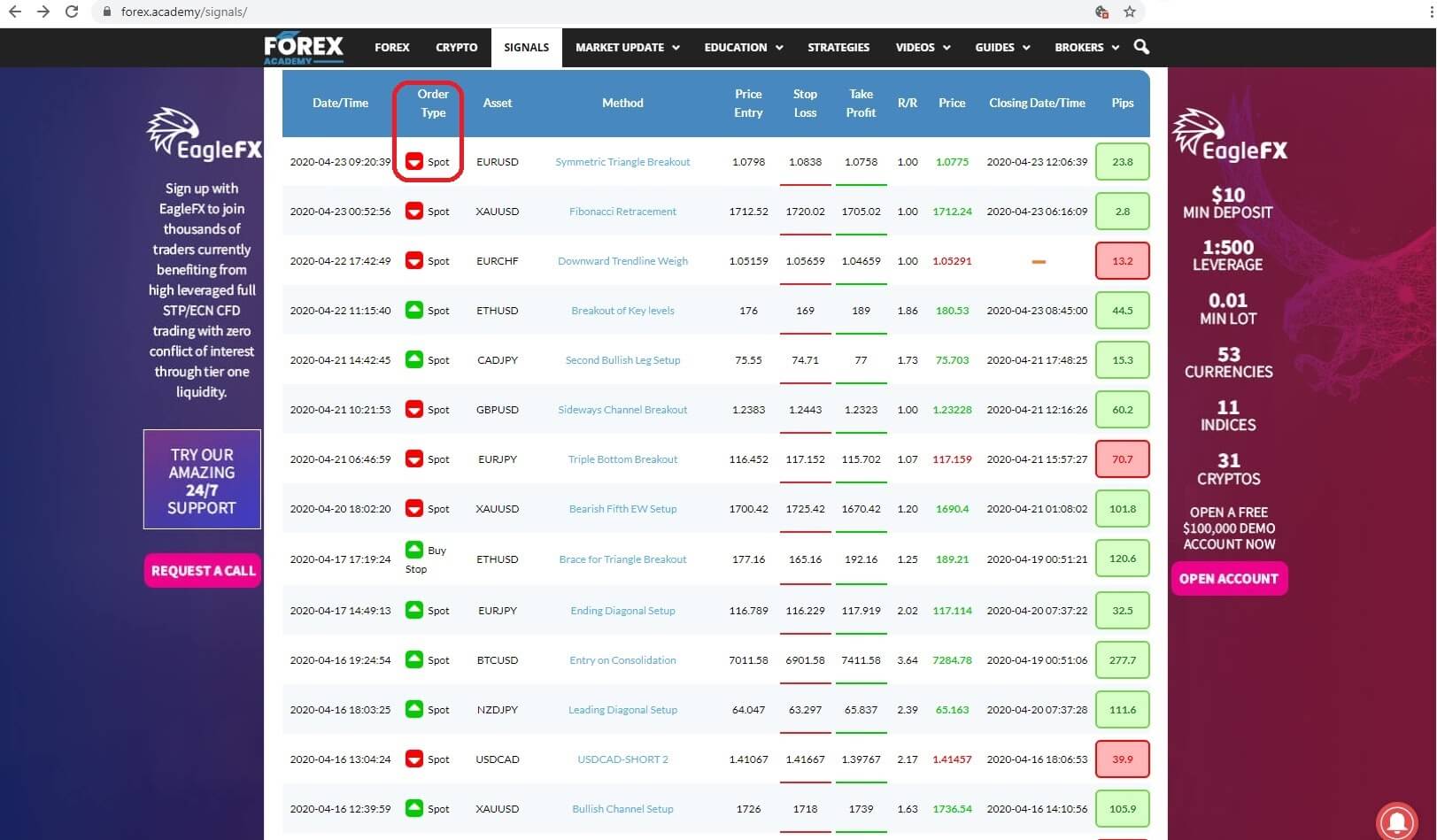

The date the trade was listed: Insert 2:  The type of order, which could be an instant execution, or spot trade, or a limit order including a buy limit or stop buy order or a sell limit or stop sell order, Insert 3:

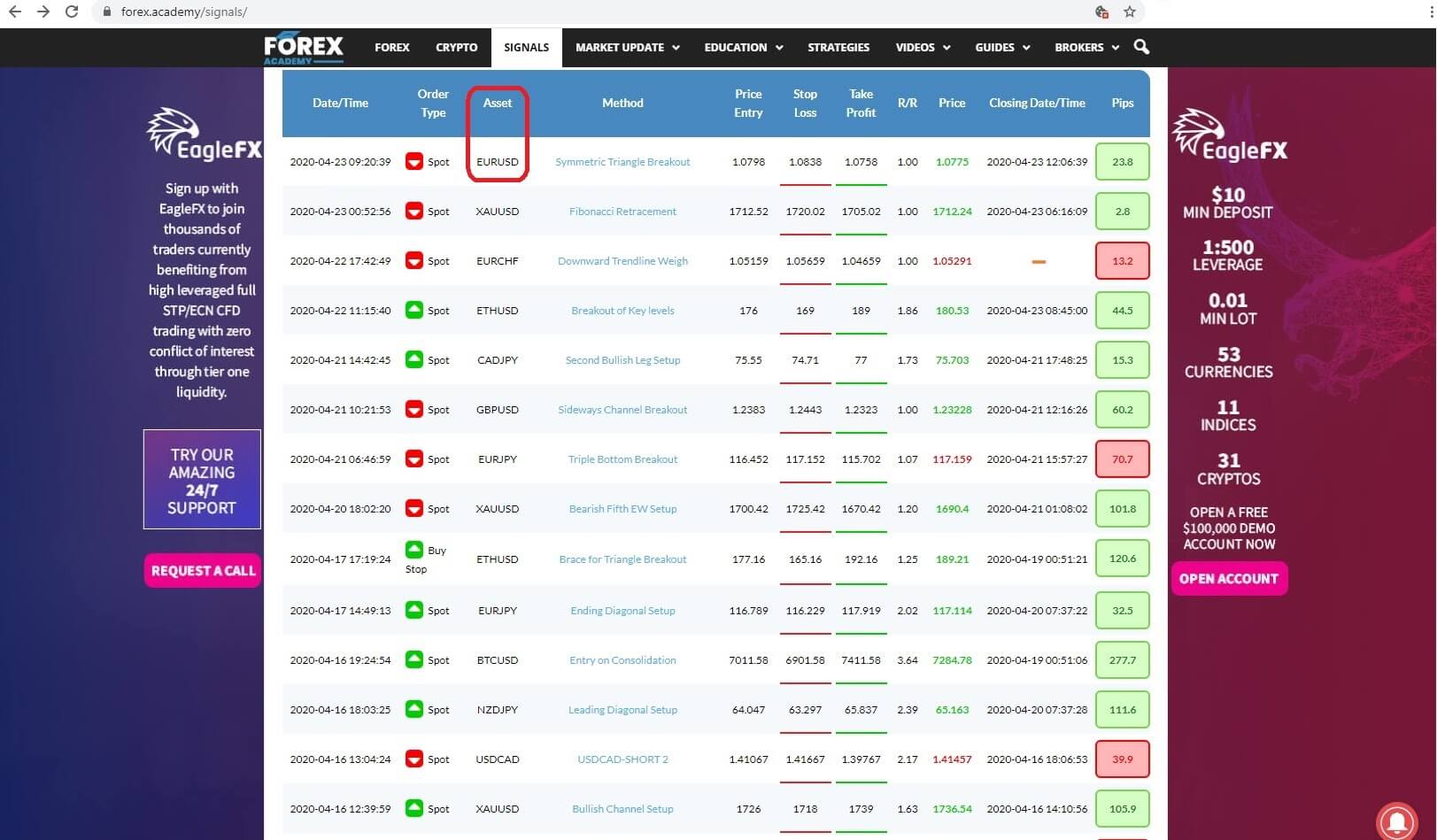

The type of order, which could be an instant execution, or spot trade, or a limit order including a buy limit or stop buy order or a sell limit or stop sell order, Insert 3:  the type of asset, which could be a number of major or cross FX pairs and gold and bitcoin. Insert 4:

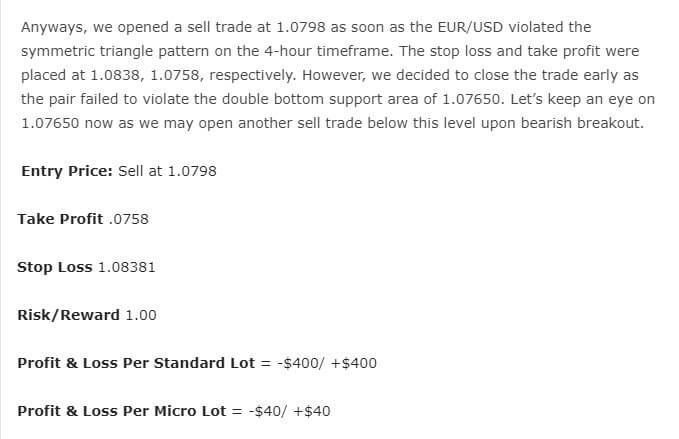

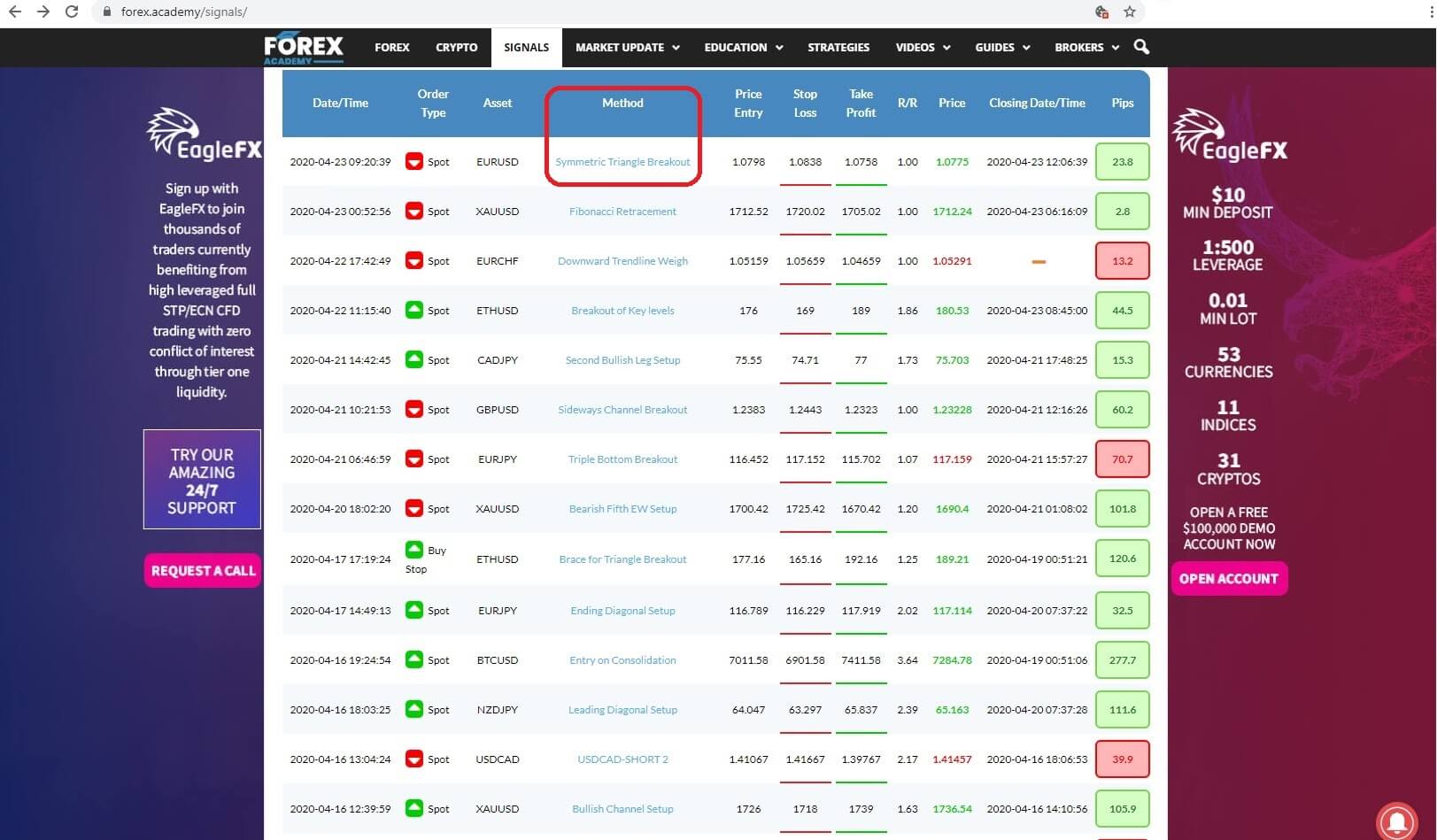

the type of asset, which could be a number of major or cross FX pairs and gold and bitcoin. Insert 4:  the method where the each trader gives a detailed analysis of the thinking behind each trade, which, incidentally, most other signal providers do not offer, and where we will come back later in this video to take a more detailed look, Insert 5:

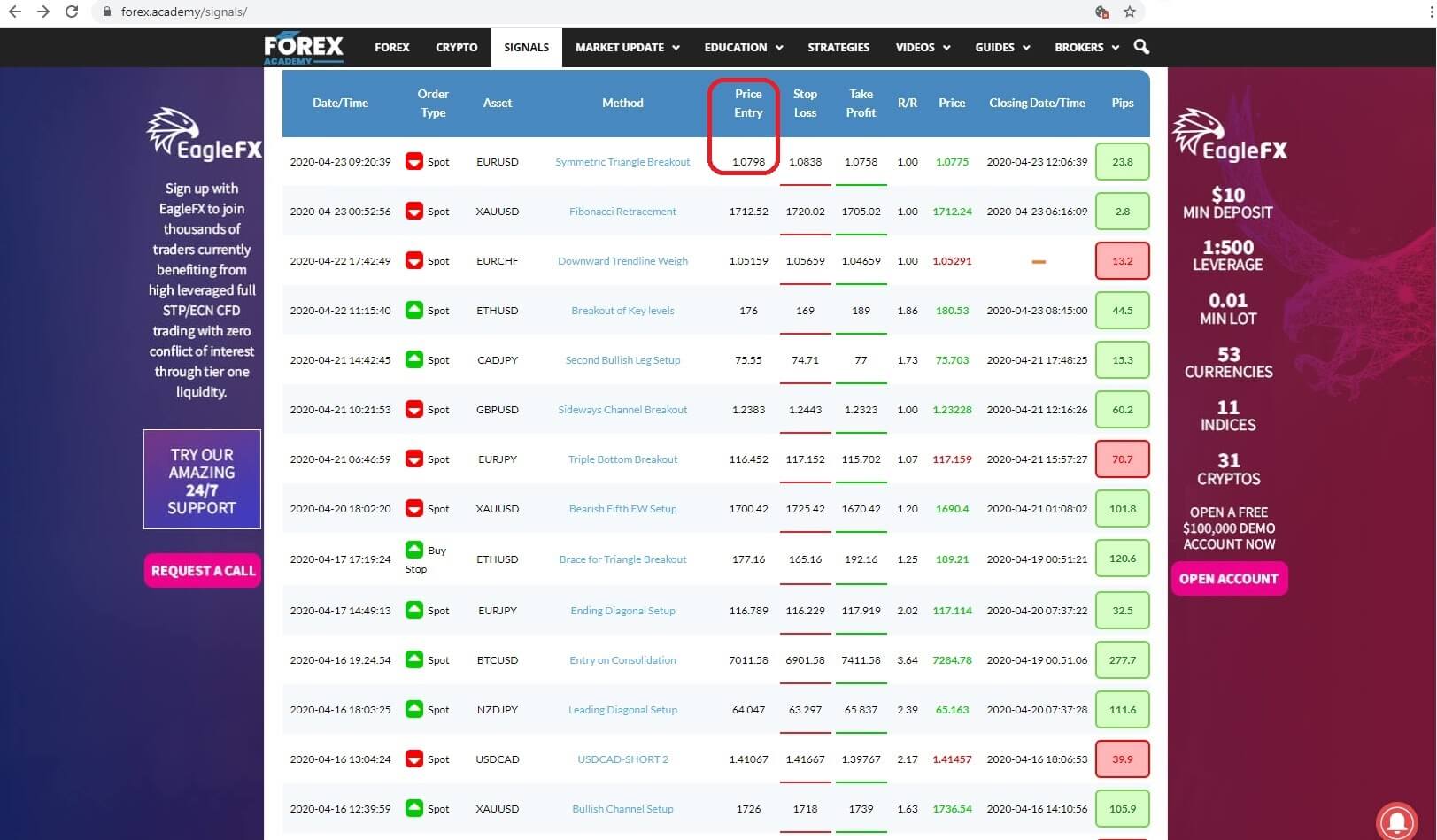

the method where the each trader gives a detailed analysis of the thinking behind each trade, which, incidentally, most other signal providers do not offer, and where we will come back later in this video to take a more detailed look, Insert 5:  the entry price for the trade, Insert 6:

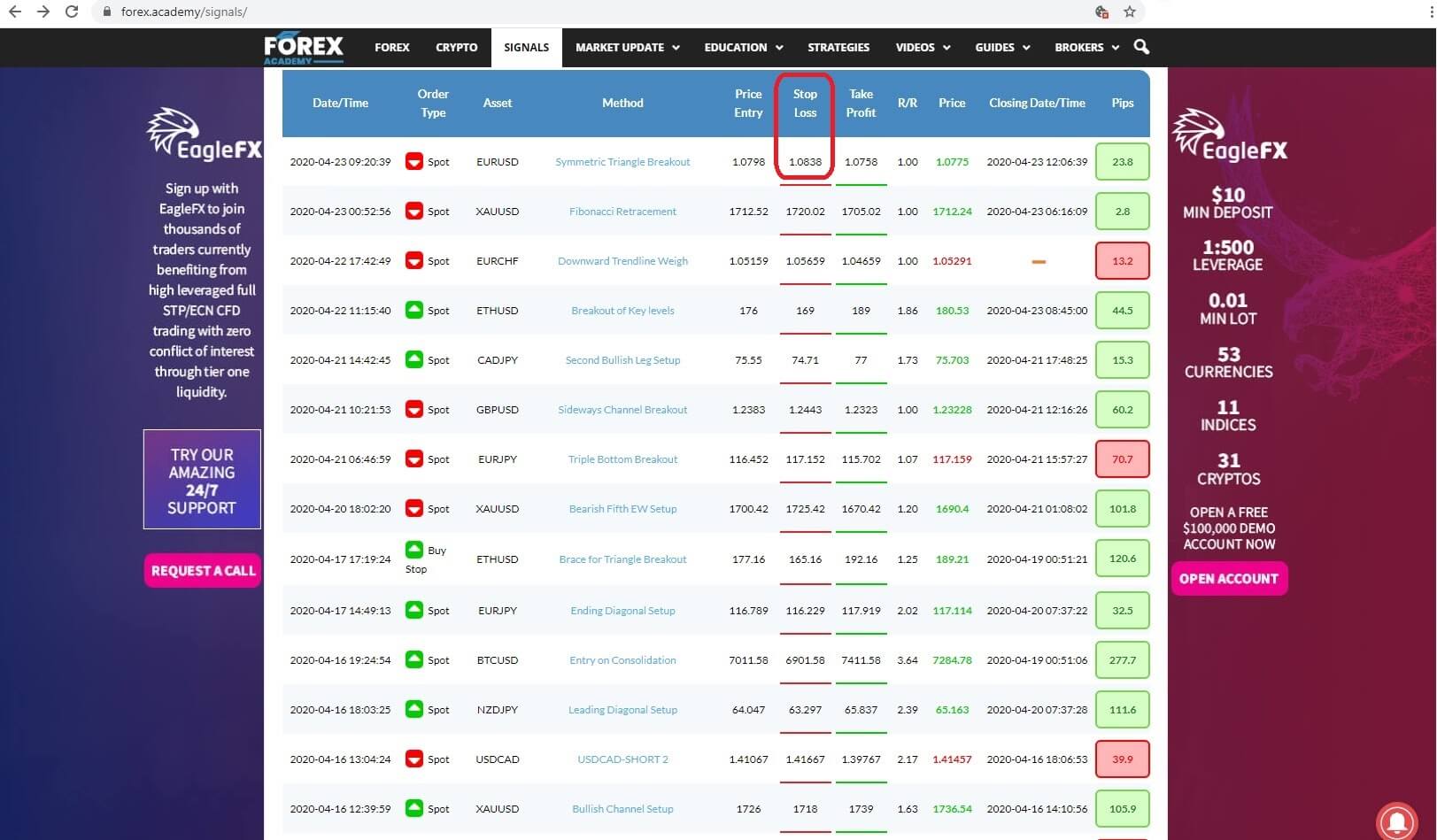

the entry price for the trade, Insert 6: the stop loss for the trade, Insert 7 :

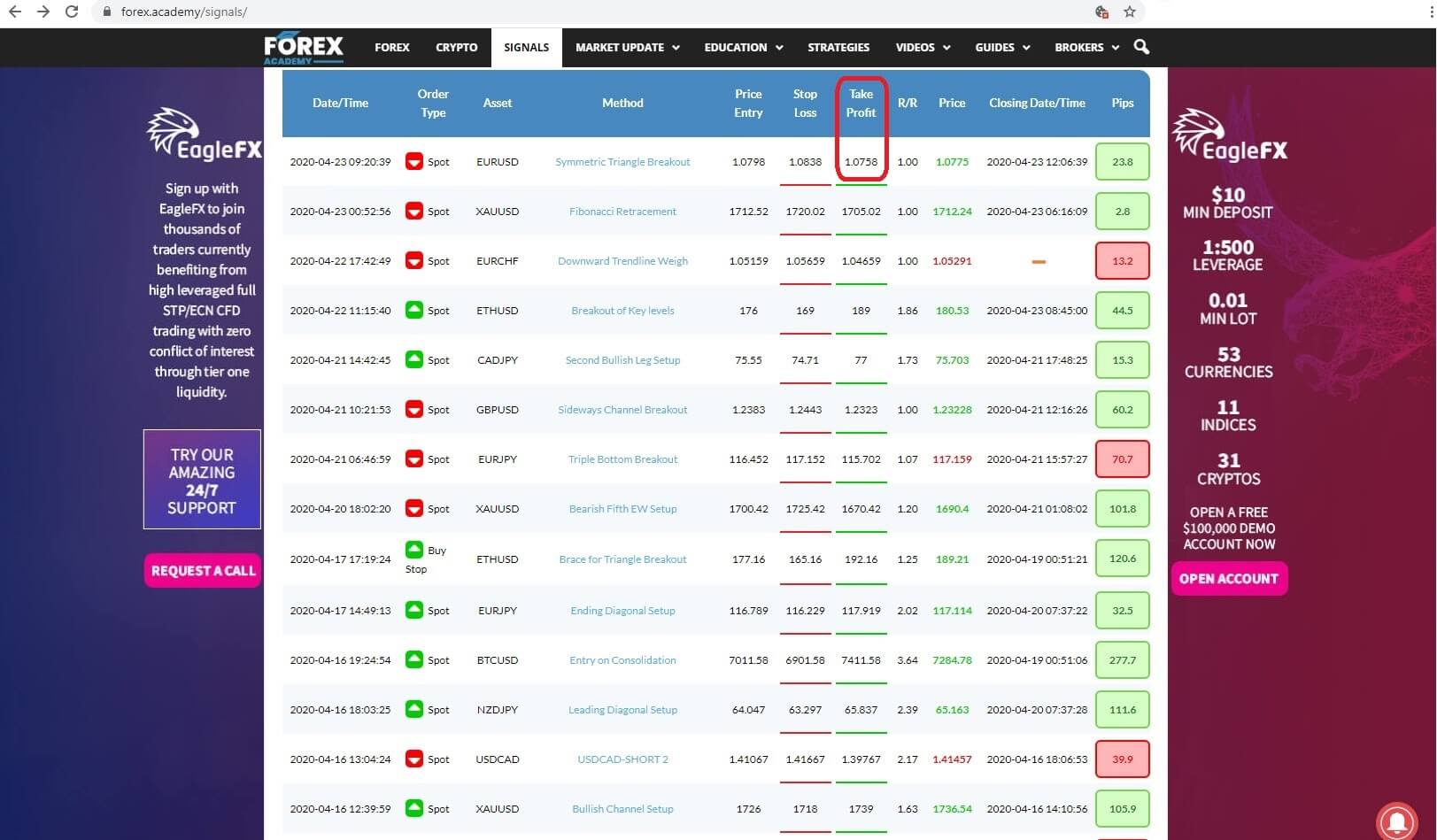

the stop loss for the trade, Insert 7 :  the take profit level, Insert 8,

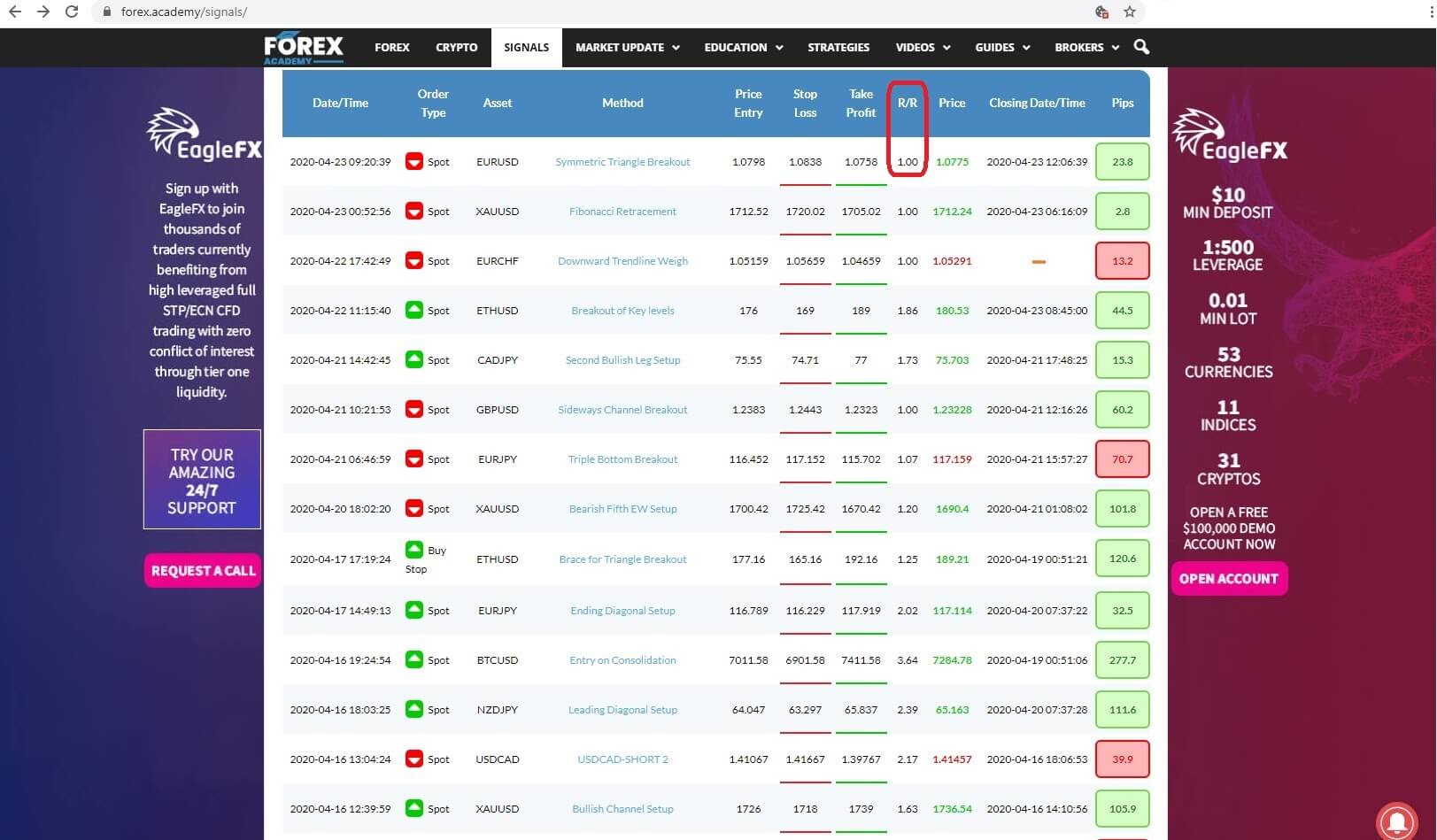

the take profit level, Insert 8,  The risk to reward level, Insert 9:

The risk to reward level, Insert 9:  the price level at close; Insert 10:

the price level at close; Insert 10:

the amount of pips won or lost or in the event of an open trade the fluctuating level of pips in play.

the amount of pips won or lost or in the event of an open trade the fluctuating level of pips in play.