Cryptocurrency Fractal Trading Guide

Bullish and Bearish Fractals

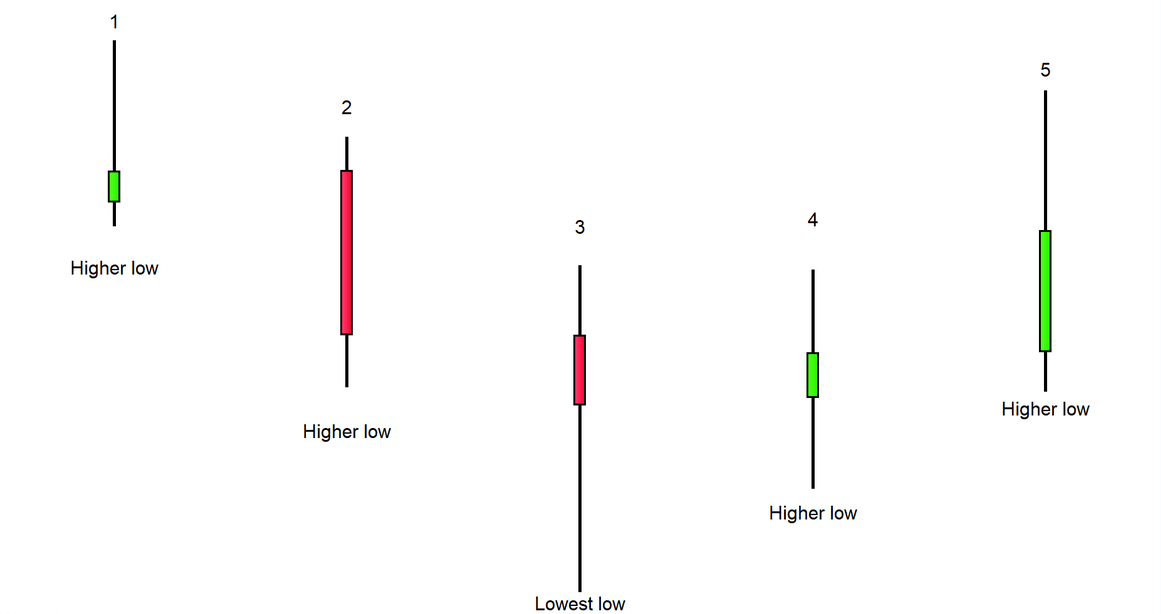

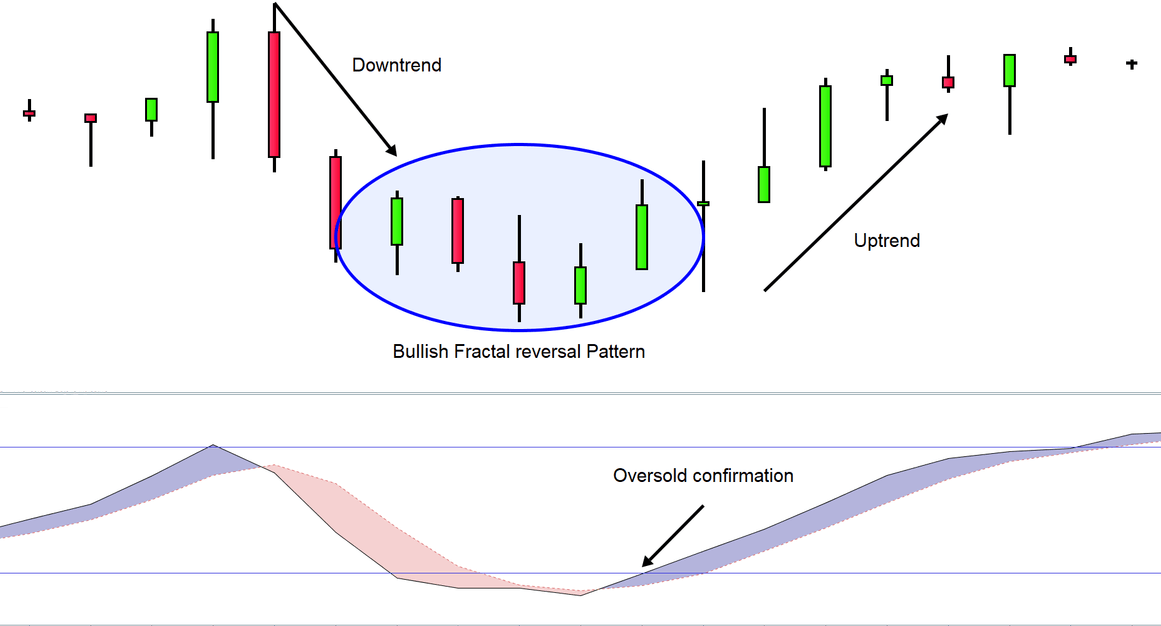

A fractal is a recurring pattern that occurs in larger price moves in technical analysis. In this case, it is a five candle trend reversal pattern, and there are bullish and bearish fractal versions. A bullish fractal reversal pattern has:

The third candle in a five-candle series has the lowest low

The first two candles have higher lows than the middle candle

The last two candles have higher lows than the middle candle

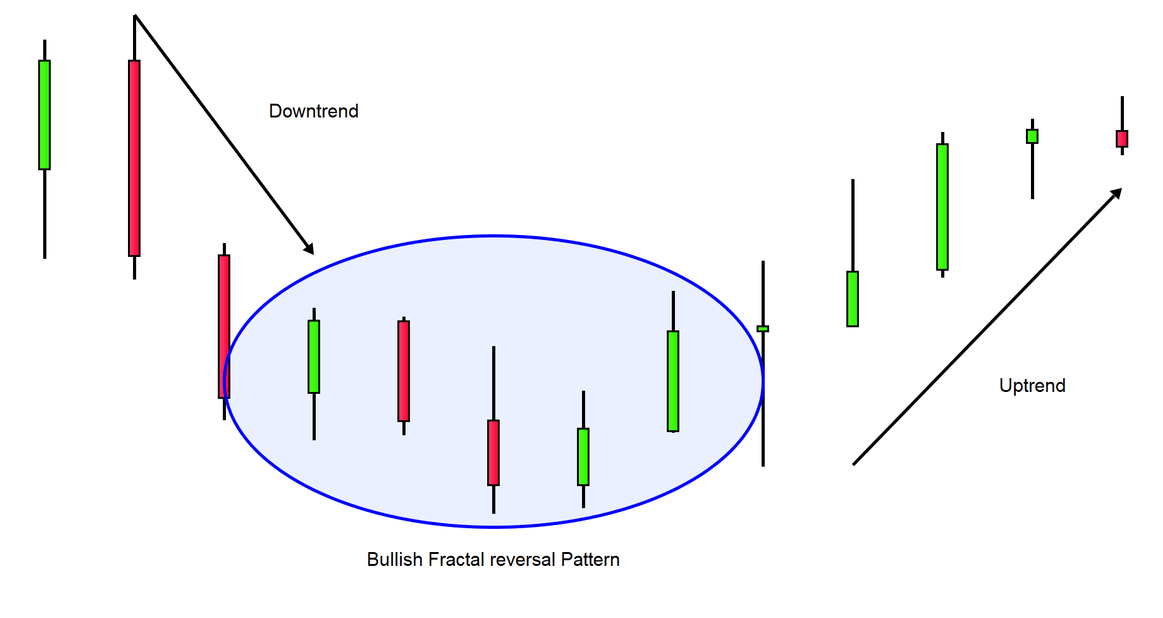

A bullish fractal reversal pattern signifies the end of a downtrend and the beginning of a new uptrend. Traders can use this pattern in two ways:

as a long entry signal or

as a signal to exit an existing short position

Many traders will use fractal signals alongside oscillators such as the stochastic or RSI for a confirmation of a bullish signal.

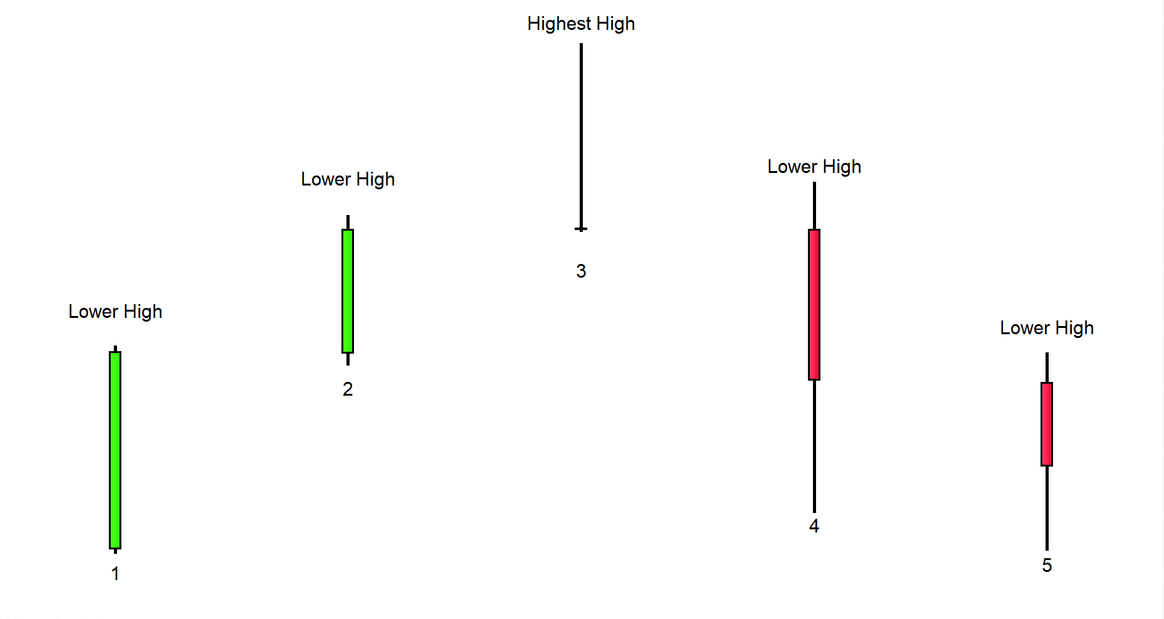

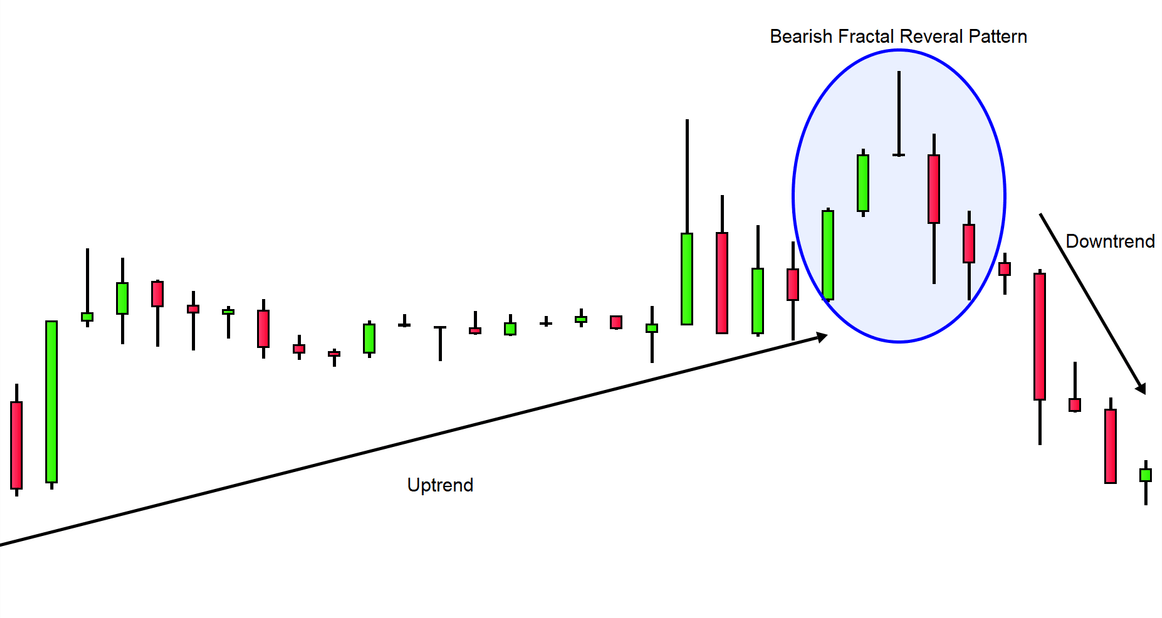

On the other hand, a bearish fractal reversal pattern has:

The third candle in a five-candle series has the highest high

The first two candles have lower highs than the middle candle

The last two candles have lower highs than the middle candle

A bearish fractal reversal pattern signifies the end of an uptrend and the beginning of a new downtrend. Traders use this pattern in two ways:

as a short entry signal or

as a signal to exit any existing long position

Fractals – multiple time frame analysis

Fractals are also very useful when it comes to multiple time frame analysis. Traders may use fractionalized times frames to create trading ideas.

As an example, a trader may use a daily or weekly time frame to get a better view of the overall market stance. However, they should decide their entry and exit points by looking at smaller time frames such as 1-hour or 15-minute charts.

A simple fractal trading strategy may look like this:

A trader identifies a major trend direction on a daily chart

They then use a 1-hour chart to identify their entry and exit points

Entry signals on the smaller time frame are considered only if they align with, the larger time frame trend

Signals against the larger trend are not considered trading signals but rather a suggestion to exit current positions

Conclusion

Using fractals as a trading tool can be beneficial in terms of analyzing daily randomness. Fractals can be used in many ways, so each trader needs to find the variation that suits them. While some traders may like using fractals, others may not. That being said, fractals are certainly a useful addition to any traders’ toolkit.