Scalping in Cryptocurrencies – Become a Trader

Scalping in Traditional Trading

Scalping is a way of trading most often used by Forex traders. It involves seemingly low-risk profiles but requires a lot of discipline as well as intensive and quick trade processing.

Scalping is trading without holding positions overnight, but rather trading on extremely short time frames to utilize short-term emotion-drive price movements.

Two common approaches to scalping are arbitrage and spread scalping. While arbitrage finds a discrepancy between the bid and ask prices between two brokers and buys from one to sell to the other, spread scalping involves the price differences with the same broker.

Scalping in Crypto Trading

A scalper in the crypto market has to take advantage of small price discrepancies between exchanges or small price fluctuations on a single exchange to lock in small gains multiple times.

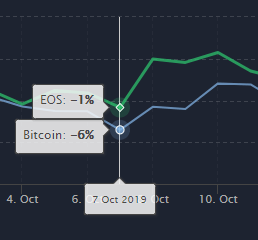

Big bull run fills the crypto market with optimism, and investing often turns to altcoins, which lead to choppy markets that can be utilized. While an investor might spot the upward trend in a given alt to make a profit, a scalper would have to spot the upward trend, long the Altcoin and short BTC to create a hedge, as well as to have an exit strategy of going back to Bitcoin as soon as the trade is made.

Scalp traders need to be quick on their feet and enter as well as close their positions in a timely manner. Discipline is key when performing these actions.

Is Scalping for You?

Even when run correctly, scalping is a strategy that is more time-consuming and much more intensive than other strategies. You will need to monitor the prices of many crypto assets if you want to use the strategy fully. On top of that, you need to execute trades quickly and to manage your bankroll well. As this requires much technical knowledge and a lot of multitasking, many scalp traders try to trade only one or a couple of pairs and look for their breakouts or retracements in order to make a profit.

While this strategy seems the most appealing, it is not for everyone. Only traders with high enough risk tolerance can utilize this strategy without it impacting them mentally.

If you, however, do decide to use this trading method, backtest your trading strategies, use keybinds to quickly enter and exit positions and calculate your trading fees beforehand to avoid any unnecessary losses.