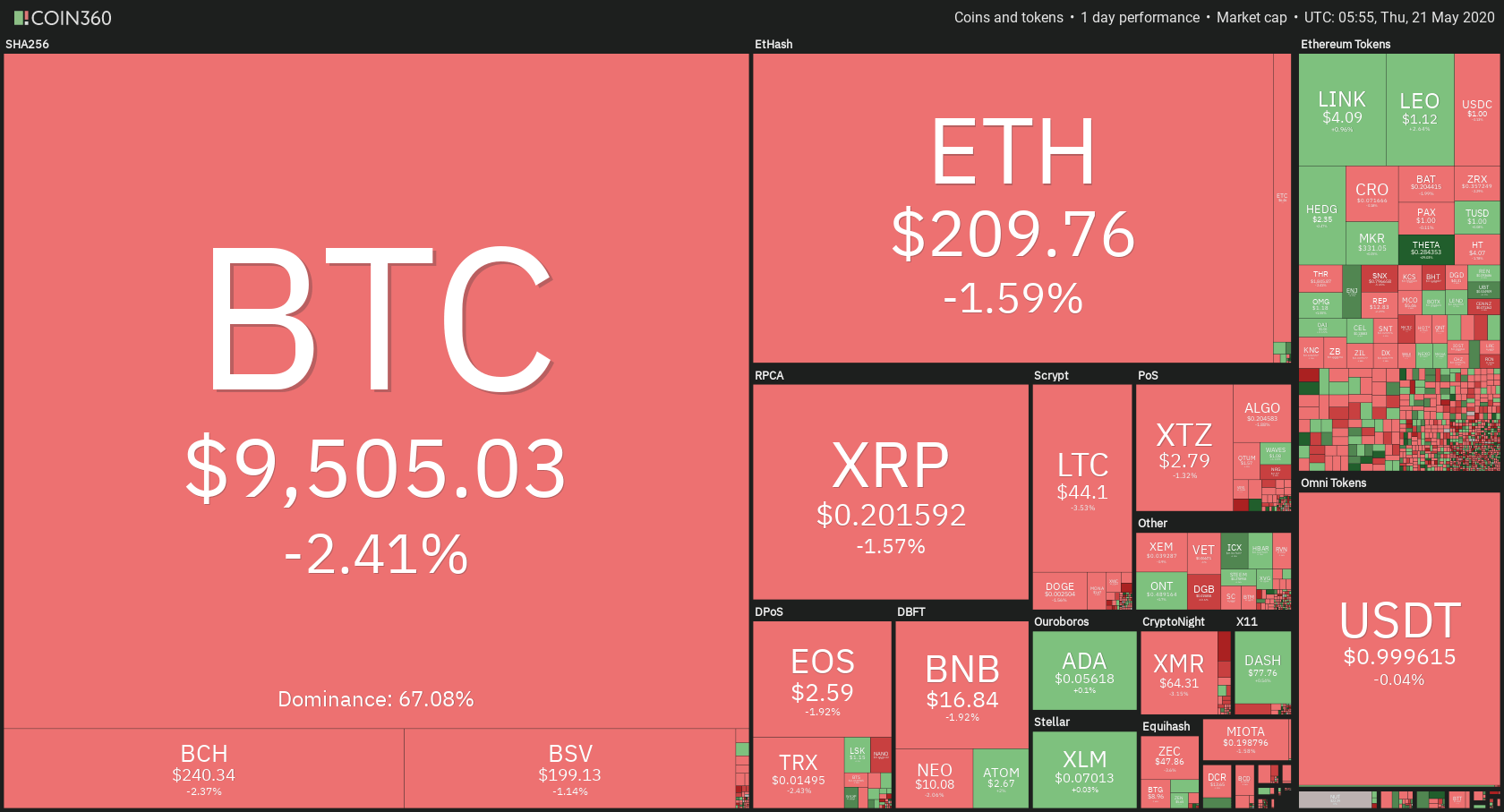

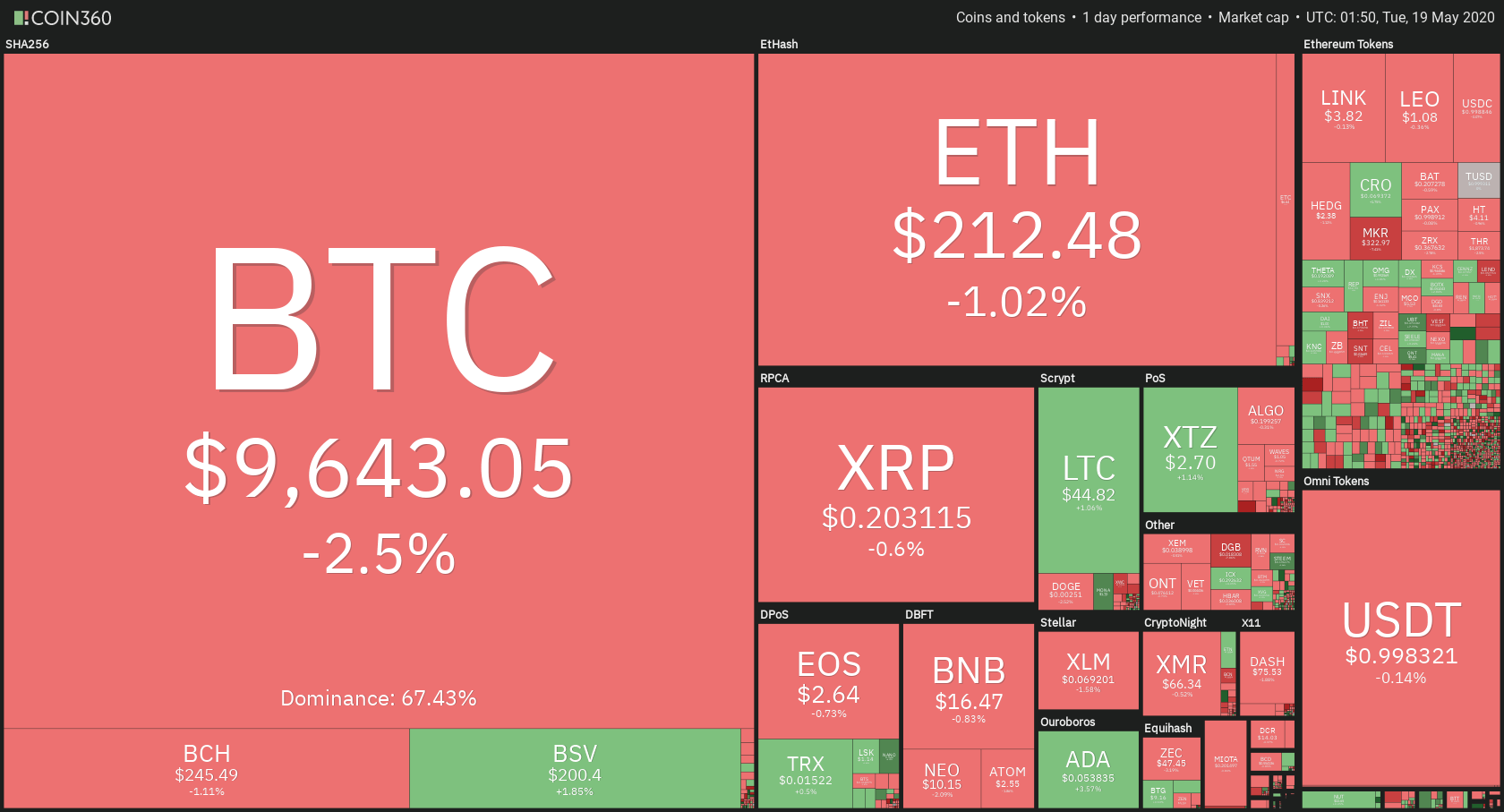

Ripple arguably is one of the most popular cryptocurrencies and the third-largest by market capitalization. The blockchain network is, however, best known for its facilitation of ultra-fast and near-instant cross-border money transfers through its real-time gross settlement system (RTGS). Here, transactions are powered by the Ripple (XRP) token, which acts as the mediator between currencies.

Apart from playing that role, what else is Ripple used for? If you hold Ripple, where else can you spend it?

It turns out, you can spend Ripple to buy goods and services from many places around the world.

For instance, Spend, a company that provides worldwide banking solutions, now allows Ripple enthusiasts to pay with XRP via its Spend Wallets in 40 million+ locations in 180 countries.

In this article, we take a look at some of the places that accept Ripple; from apparel, to technology, to automobiles, to coffee, to privacy-oriented phone companies.

1. Digitec Galaxus

Galaxus is the largest online retailer in Switzerland, selling everything between IT products and consumer electronics in beauty, gardening, toys, sports, and leisure, office, pet supplies, and more categories.

The store uses crypto payment gateway Coinify, which supports Ripple along with other cryptocurrencies such as Bitcoin, Ethereum, Bitcoin SV, Binance Coin, NEO, DASH, and NANO Litecoin. The transaction processing time is about 15 minutes, and Coinify charges a conversion rate of 1.5%. Galaxus accepts crypto for its online shop only.

2. Cryptoshopper

This is crypto-related merchandise that sells crypto-labeled items from mugs to T-shirts, shoes, stickers, and so on. The retailers’ products are reasonably priced and make great collections for the crypto enthusiast. Shoppers can pay for the merchandise with their favorite crypto. Cryptoshopper accepts over 50 cryptos that are supported by CoinGate – its payment gateway, including Ripple, Bitcoin, and Litecoin.

3. Redeem

Redeem is an online platform through which people can trade gift cards at a 10-30% discount. Customers can trade 24/7 with cards for a host of brands, including Amazon, Nordstrom, Whole Foods, Macy’s, iTunes, Starbucks, Walmart, Best Buy, Nike, eBay, Netflix, Target, and Home Depot. Users can redeem the gift cards for a myriad of products from any of these retailers.

Redeem accepts Ripple payments as well as other cryptocurrencies such as Bitcoin, Litecoin, Ethereum, Gemini Dollar, NEO, EOS, DAI, Bitcoin Cash, Tron, Tether, Steem, and several others.

4. Ledger

Ledger is a technology company that provides solutions for cryptocurrency and blockchain applications. It’s known for its reliable range of crypto wallets, including Ledger Nano S, Ledger Nano X, and Ledger Blue. The three are hardware wallets – one of the safest wallet options in the crypto space, and they each support thousands of cryptocurrencies.

Ledger also provides Ledger Vault, which provides security solutions for crypto companies with the same level of security as the wallets, but at a larger scale. Ledger Vault supports 1000+coins, and currently secures funds for the biggest names in the industry, including Bitstamp, Uphold, and Crypto.com.

Ledger allows you to pay for products using Ripple, Bitcoin, Ethereum, Litecoin, and several other cryptocurrencies.

5. StakeBox

This is an off-shoot of a small computers’ company Raspberry Pi that provides customized staking and mining hardware and such other digital products as hardware wallets and accessories.

The company sells Proof-of-stake devices for some altcoins, including Reddcoin, Neblio, Cloakcoin, and BitBay. On top of that, it provides cold storage and a myriad of other crypto-related products.

StakeBox accepts Ripple, Bitcoin, Bitcoin Cash, Litecoin, and several other cryptocurrencies.

6. Blockchain Coffee

This is a Mexican coffee grower that sells “gourmet coffee” that’s described as “an extraordinary and sensorial experience that seeks to leave a legacy…creating a unique atmosphere that leads us to always enjoy the moment and invites us to enjoy our present.” The company sells coffee beans from the “world-renowned place for being a reference in high-quality coffee for its topography, climate, and soils.”

You can pay with cryptocurrencies such as Ripple, XCash, Monero, DASH, Ethereum, Litecoin, Doge, and more.

7. Purism

Purism is a company that manufactures “laptops and phones that protect the privacy of your family and the security of your business.” Each device comes packed with a myriad security and privacy features that you wouldn’t ordinarily find somewhere else.

For example, their laptops have hardware kill switches that render it impossible for third-parties to switch on the microphone and webcam remotely. The company’s products are eye-catching too – they’re made from sturdy components and feature a sleek and black aesthetic. Purism accepts a range of cryptocurrencies as payments, including Ripple, Ethereum, Bitcoin Cash, Litecoin, NEO, and DASH.

8. BitCars

BitCars is an automobile crypto-only company that sells antique and premium new cars alongside other products such as yachts, off-road vehicles, and bicycles. The dealership accepts Bitcoin and altcoins, including Ripple, Ethereum, Litecoin, Monero, and Bitcoin Cash through its BitPay payment processor plugin.

9. Lord Underwear

Lord Underwear is an online retailer of men, women, children, and infant clothes, including swimwear, socks, t-shirts, tank tops, pajamas, and underwear. Some of the products feature a ‘micromodal’ material known to be extremely soft and breathable. The store accepts Ripple, Bitcoin Cash, and Ethereum payments.

10. bidali

This is an online store that sells all manner of gift cards from brands such as Target, Xbox, Apple Music, Chipotle, Marks and Spencer, American Airlines, Tesco, Best Buy, Amazon, Currys PC World, and hundreds more.

The site accepts tens of cryptocurrencies, including Ripple, Bitcoin, Digibyte, Ethereum, Ethereum Classic, Komodo, Tron, Bitcoin SV, Litecoin, Basic Attention Token, Tezos, and Stellar. Giftcards.bidali also accepts stablecoins, including USDC, Gemini Dollar, QCAD, Paxos Standard Token, and more.

11. TorGuard

This is a service that provides anonymous VPN, proxy, and email encryption services for individuals and businesses. TorGuard provides some of the most trusted and well-known open-source firmware, including DD-WRT router models from some of the leading brands such as Cisco, Linksys, Airlink101, D-Link, and Asus.

TorGuard has partnered with crypto payment gateway CoinPayments, which supports cryptocurrencies, including Ripple, Bitcoin, Ethereum, Beam, Bitcoin SV, DASH, Decred, Digibyte, EOS and more.

Final Words

Thanks to a number of crypto payment gateways supporting Ripple, the crypto’s fans can now use it to pay for a whole lot of services across a variety of stores and service providers. Hopefully, in the next future, we can see many more merchants adopting the currency.

Cardano’s smart contract language is Plutus, which is based on Haskell. Cardano is basically written in Haskell. Cardano is designed with the Cardano computational layer, which by default consists of two layers while one allows formally specified languages used for checking the code of the smart contract, and the other is a defined officially virtual machine and language framework. The default layers’ goal is to check the smart contracts to avoid severe vulnerabilities in smart contracts without any additional requirements.

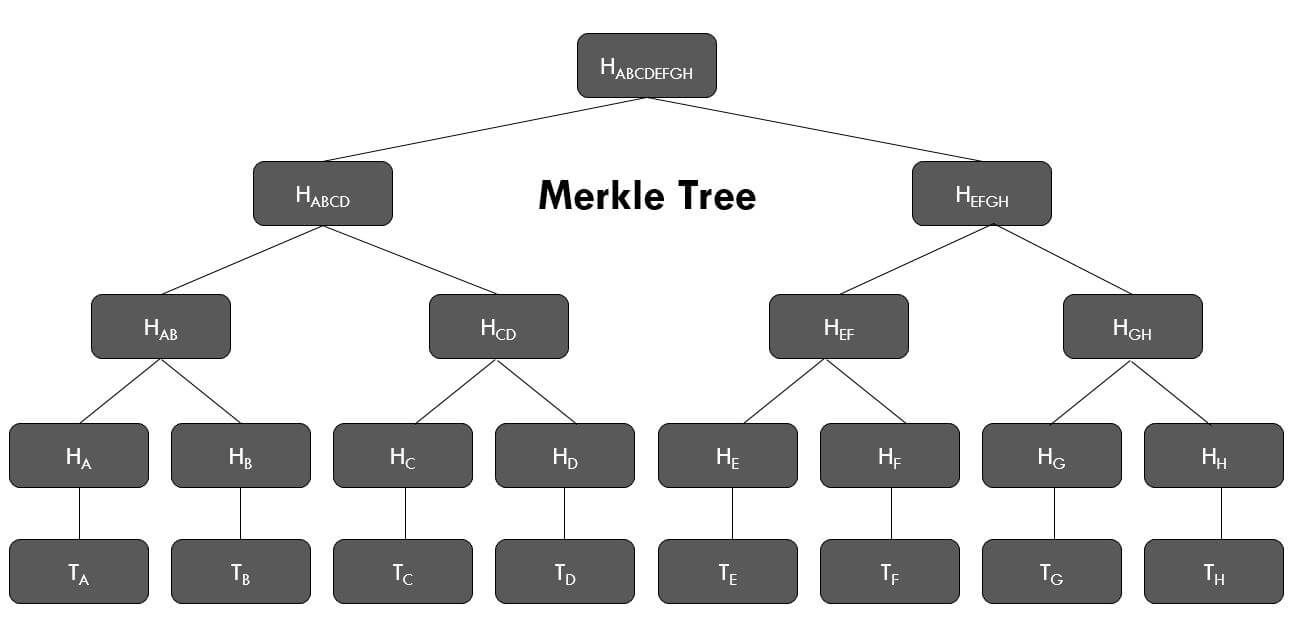

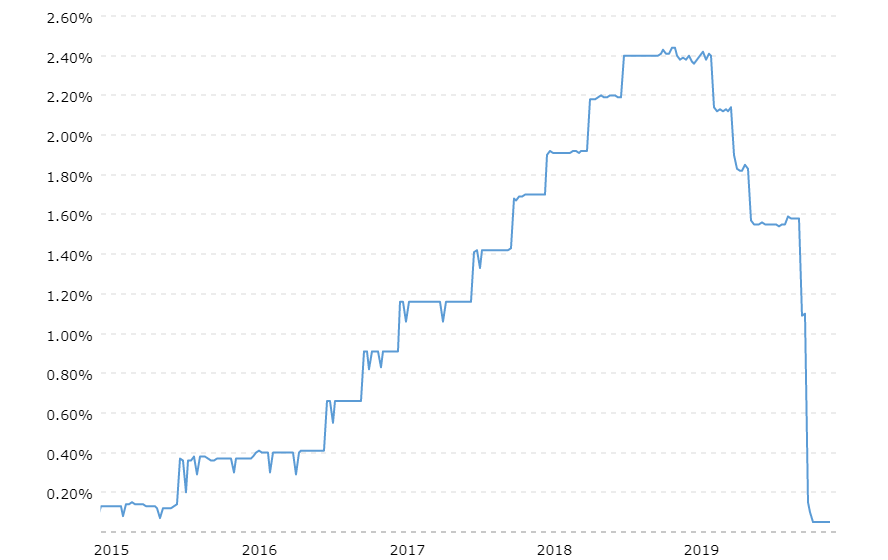

Cardano’s smart contract language is Plutus, which is based on Haskell. Cardano is basically written in Haskell. Cardano is designed with the Cardano computational layer, which by default consists of two layers while one allows formally specified languages used for checking the code of the smart contract, and the other is a defined officially virtual machine and language framework. The default layers’ goal is to check the smart contracts to avoid severe vulnerabilities in smart contracts without any additional requirements. Ethereum has been trying to incorporate formal verification for a long time now since it has many smart contracts functioning on the platforms. They have even come up with a publication called “making smart contracts smarter.” This publication focuses on smart contracts bugs and mainly focuses on ways to mitigate them. This includes the change in operational semantics of Ethereum to inbuilt formal verification.

Ethereum has been trying to incorporate formal verification for a long time now since it has many smart contracts functioning on the platforms. They have even come up with a publication called “making smart contracts smarter.” This publication focuses on smart contracts bugs and mainly focuses on ways to mitigate them. This includes the change in operational semantics of Ethereum to inbuilt formal verification.