Blockchain is one of the most disruptive technologies of the last decade, from powering cryptocurrencies to dizzying heights of success to industry after industry racing to incorporate it into their processes.

It would be ideal if blockchain was a problem-free technology providing problem-free solutions. But this is not the case.

These are the core five issues that are the bane of blockchain’s current existence: unsatisfactory privacy and security; and regulatory, legal, and ethical issues.

1. Security Issues

One of the defining features of public blockchains is their decentralization. This means that they are not controlled, nor can they be shut down by anyone. Decentralization helps keep the blockchain secure since thousands of computers from the globe are participating in maintaining and securing the network. Even if someone managed to shut down some of the computers, the rest would carry on operating the network.

But it is still this decentralization that’s potentially an Achilles heel for the blockchain. While it’s safer than a centralized network, which has a single point of control – and hence a single point of attack, the decentralized model is not perfectly secure. A public blockchain is vulnerable to a 51% attack.

A 51% attack describes an occasion when an entity or a group of people manages to take control of over 50% of a blockchain’s computing power. This would allow them to tilt the blockchain’s operations in their favor. For instance, they could double-spend coins, block transactions, or stop miners.

Smaller blockchains, in particular, are more susceptible to attacks. This is because they have fewer miners securing the blockchain, making it easier for an entity to take control of a bigger percentage of the network’s computing power. For instance, for the IOTA blockchain, a bad actor would only need to take control of 34% of the total network’s hash power.

Luckily, such an attack is extremely rare and unlikely. It is prohibitively expensive for someone to attempt to take control of over 51% of a blockchain network. The sheer financial and time resources needed to pull it off are enough to make one perish the thought.

2. Privacy Issues

Transparency is another defining feature of public blockchains. The history of transactions is available for everyone to see. While your personal credentials are not made public (or even required for you to conduct a transaction), your public address can be used to link back to you. This state is known as pseudonymity.

In an era of ubiquitous internet when privacy is highly valued, pseudonymous transactions do not exactly fly with many users. To address this problem, several privacy-oriented blockchains have sprung up to fill the gap. Examples include Monero, ZCash, Komodo, and DASH.

3. Legal Issues

While blockchain technology has increased in popularity and is being embraced across industries, its legal standing is still very much grey. Some of the legal issues are as follows:

- Decentralized Autonomous Organizations (DAOs): these are organizations that are much like traditional organizations in terms of function, except they are governed by computer code, and commands are executed by computers without the intervention of humans or central authorities. But let’s say, for example, in the event of a conflict, how will it be resolved? Who bears responsibility?

- Smart contracts: Blockchain-based smart contracts are a new kind of contract that is self-verifying and self-executing. This removes the need for costly intermediaries and saves time. Given that smart contracts are pure lines of code, it’s debatable whether they can really be considered as complete contracts, at least in the traditional sense. It’s all well and good if all parties meet their end of the bargain. But in the event of a dispute, would a smart contract be legitimate in the eyes of the law? At the very least, ensure that you have a conflict resolution procedure encoded in the smart contract.

- Leaving a blockchain: Let’s imagine you’ve been using a blockchain to record sensitive data such as your company’s financial records or employee data. What happens if you stop using the service, and you do not possess copies of the ledger? Before you sign up for a blockchain service, ensure there are provisions in place to ensure that a blockchain service provider surrenders your records back to you at the end of the contract.

4. Regulatory issues

Cryptocurrencies were the first application of blockchain. They are defined by features such as decentralization, distributed, and immutability. This decentralized feature does not particularly fly with the majority of governments and regulators all over the world. This creates a state of regulatory uncertainty.

Governments have taken different approaches to this. Some governments such as Bolivia, Colombia, Iran, Algeria, Pakistan, Bangladesh, and Ecuador have entirely banned cryptocurrencies. Other countries, such as the United States, the UK, Canada, Slovenia, and South Africa, have accepted them. Acceptance can mean anything from cryptocurrencies being accepted as means of payment but not as legal tender, to them actually being used as legal tender – like is the case in the Marshall Islands.

Too strict regulation can stifle innovation. On the other hand, a total lack of regulation could create undesirable circumstances such as market manipulation and unlawful use.

5. Ethical Issues

Blockchain gives rise to some ethical issues, with the most problematic ones being 1) its environmental impact and 2) criminals taking advantage of it.

Blockchain networks utilize cryptography to maintain security and process transactions. The amount of power that goes into this is jaw-droppingly enormous.

Check out the statistics:

- If bitcoin was a country, it would be the 41st highest electricity-consuming country in the world.

- Every year bitcoin produces 34.76 megatonnes of carbon dioxide, similar to that of Denmark.

- Just one bitcoin transaction consumes more energy than 100, 000 Visa transactions, and as much as a US household consumes in 22 days.

- The estimated global mining costs for Bitcoin is $1.5 billion.

- Bitcoin mining uses more power than 12 states (Alaska, Hawaii, Idaho, Maine, Montana, New Hampshire, New Mexico, North Dakota, Rhode Island, South Dakota, Vermont, and Wyoming).

In an era when environmental concerns are more relevant than ever, the staggering use of energy is alarming. For this reason, crypto developers need to come up with more environmentally friendly ways of releasing new coins and processing transactions.

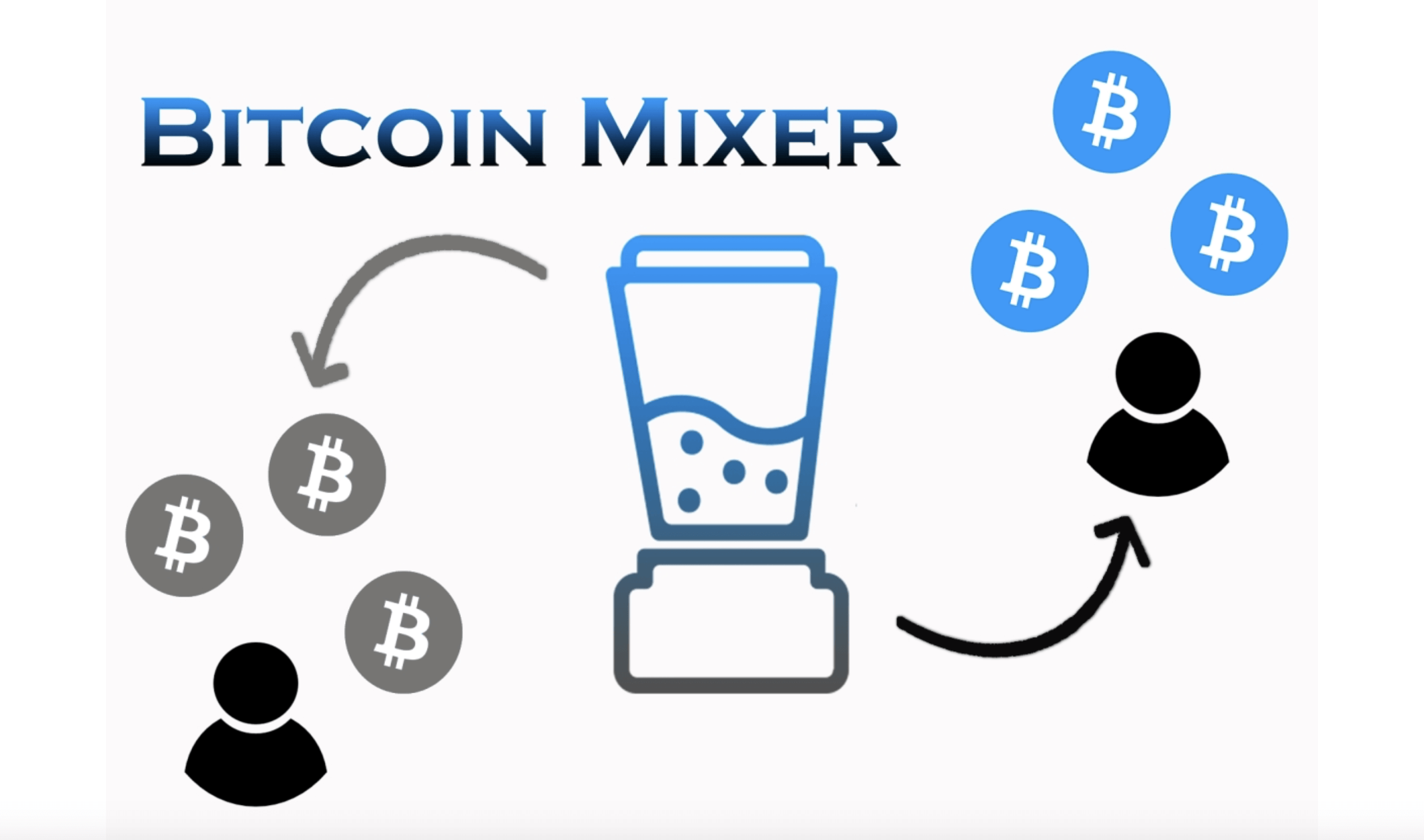

Then there is the issue of blockchain enabling criminal activities such as drug peddling, child trafficking, sex trafficking, tax evasion, money laundering, and so on. Cybercriminals take advantage of the pseudonymous and anonymous nature of cryptocurrencies to engage in such activities. Even cyber attackers want to be paid in cryptocurrency and not other types of money.

Final Words

Blockchain is a powerful technology that has revolutionized certain facets of our society. However, at this stage, the world has to contend with its less-than-perfect implications. While some of the issues require a shift in attitude, others are inherently blockchain’s own. Whether any of these is set to change in the future is anyone’s guess.