How to read an Order Book – Cryptocurrency edition

An order book is a tool that visualizes the real-time list of orders for a particular asset, including buyers and sellers. By properly reading an order book, one has the option to assess the supply and demand.

While all order books have the same purpose, they can vary in appearance slightly from exchange to exchange. However, they all have the same features and functions.

Order Book – essentials

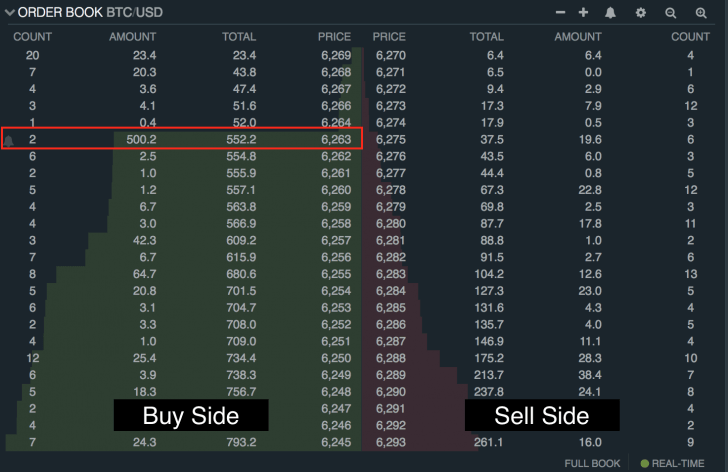

Every trader that strives to be profitable has to become comfortable with reading order books. In order to do that, they have to understand the concepts of bid, ask, price, and amount. This information is displayed for both the buy-side and the sell-side.

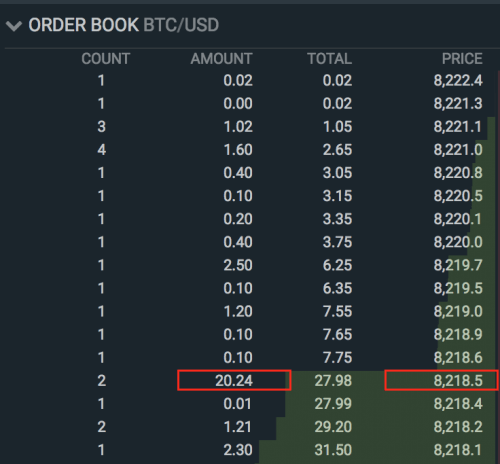

Price and Amount

Although the buy and sell sides display opposing information, the sheer concept of amount and price are relevant to both sides. The amount and price per order are displaying total units of a cryptocurrency at certain prices.

The example below shows an open buy order at the amount of 20.24 and a price of $8218.50.

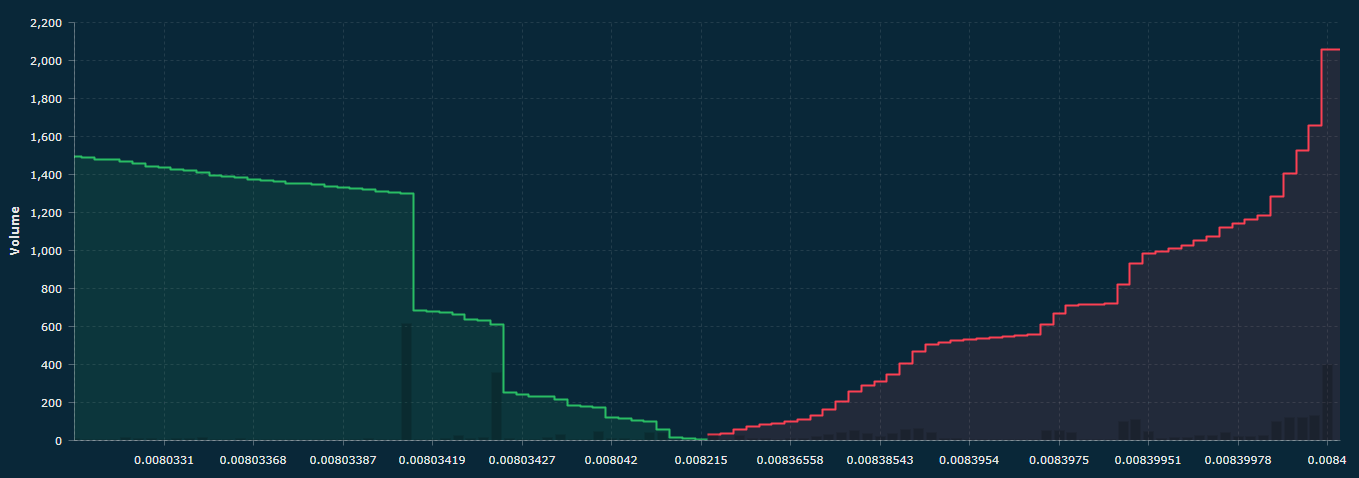

Looking at the cumulative orders can improve trading, as you can see the total amount of cryptocurrency orders, as well as their prices.

The Buy-Side

The buy-side represents all open buy orders that are listed below the last traded price. The last traded price is also known as the “bid.” It shows the trader’s interest in a certain amount of cryptocurrency at a certain price.

Once the bid matches with an appropriate sell order, the trade happens.

When a high concentration of buy orders form at a specific price level, traders recognize it as the buy wall.

Buy walls affect the price of a cryptocurrency because the price cannot go lower due to the high demand at a higher price. Buy walls act as short-term support levels.

The Sell-Side

On the other side, we have the sell-side that contains all open sell orders that are above the last traded price. This price is also known as the “ask.” The sell wall is formed when there is a concentration of sell orders at a specific price level. The sell wall acts as a short-term resistance level.

Conclusion

The order book gives a trader a great opportunity of making more informed decisions that are based on the buy and sell interest for a particular cryptocurrency.

It provides a deep outlook into the live-action supply and demand, therefore revealing order imbalances, market manipulation as well as support/resistance zones.