Stock to Flow model and Bitcoin Halving

What is the Stock to Flow model?

The Stock to Flow model is a way to measure the abundance of a certain resource. The Stock to Flow ratio would then be the amount of a resource that is held in reserves divided by the amount of the resource produced annually.

While the Stock to Flow model is generally applied to natural resources, it has seen some use when predicting the cryptocurrency prices as of lately.

What does Stock to Flow show?

The S2F essentially shows a product’s supply increase each year for a given resource relative to its total supply. The higher the Stock to Flow ratio is, the less new supply enters the resource market relative to the total supply. Assets with a higher Stock to Flow ratio should, theoretically, retain its value over the long-term better than those with a lower Stock to Flow ratio.

Stock to Flow and Bitcoin

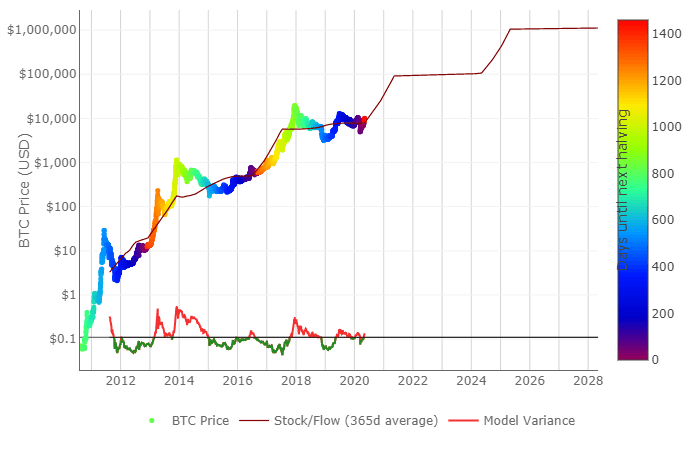

When Bitcoin’s mining and production is taken into account, it’s not difficult to see why Stock to Flow ratio would be used on calculating and predicting Bitcoin’s price. The model treats Bitcoin comparably to commodities such as gold or silver. In theory, such commodities should retain their value much better than other assets over the long term due to their low flow and relative scarcity.

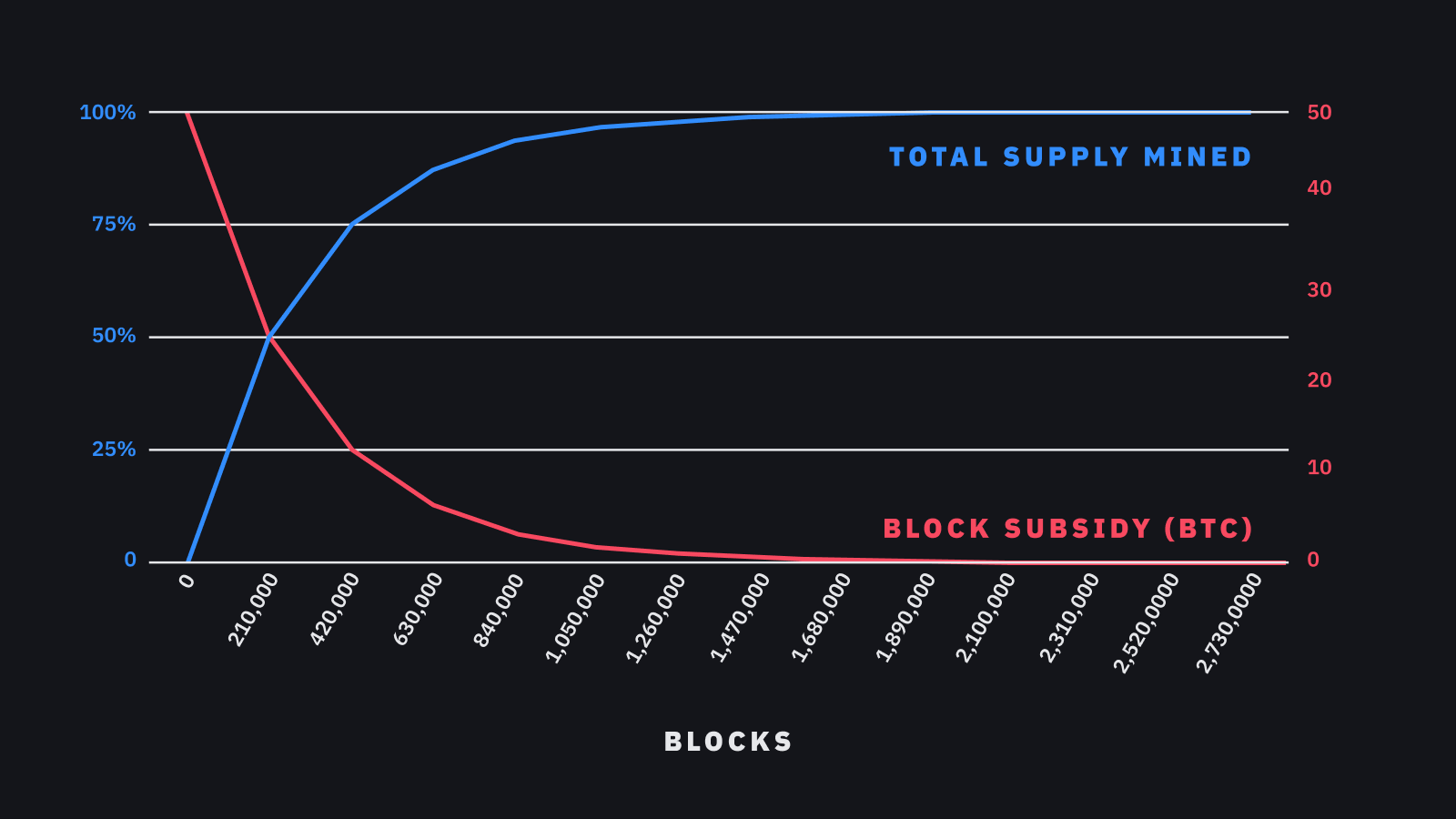

As of recently, Bitcoin is considered a very similar resource, as it is scarce, costly to produce and has a maximum supply. On top of that, its issuance is defined which makes the flow almost completely predictable, which can be extremely useful when calculating long-term price movements.

According to the “followers” of this model, the properties that Bitcoin has create a scarce resource that is expected to retain and increase its value in the long-term. The chart shows that the Stock to Flow ratio has been extremely accurate in the long-term as the price acted almost the same way after every Bitcoin halving (which reduced its daily supply by half).

Conclusion

The Stock to Flow model is a visual representation of the relationship between the available Bitcoin and its production rate. While it has so far been successful in predicting Bitcoin’s price movements, it may not be able to take into account all aspects of the Bitcoin valuation. Even so, Bitcoin’s Stock to Flow ratio is something that should be tracked and taken into account when looking for long-term trends and how Bitcoin might act in the future.